|

市场调查报告书

商品编码

1851728

LED驱动器:市场占有率分析、产业趋势及驱动因素、成长预测(2025-2030年)LED Driver - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

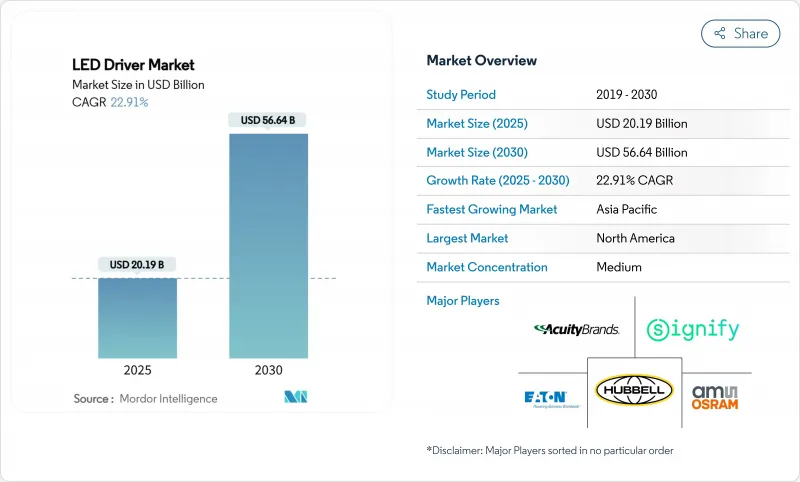

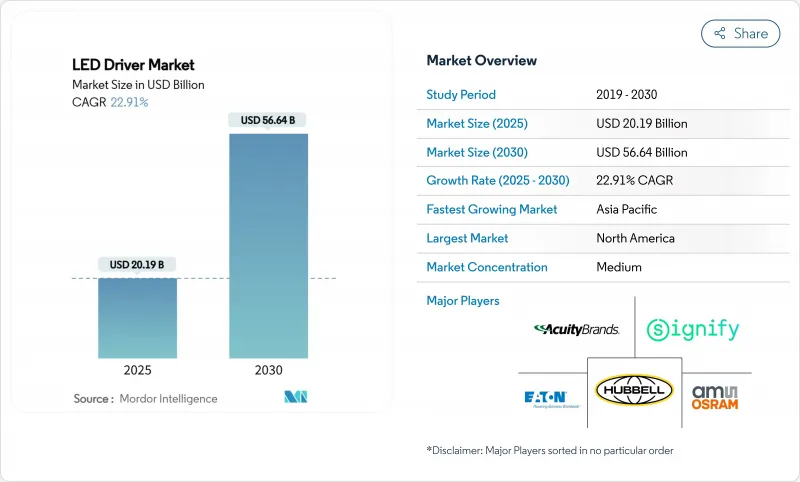

预计到 2025 年,LED 驱动器市场规模将达到 201.9 亿美元,到 2030 年将成长至 566.4 亿美元,复合年增长率为 22.91%。

这项扩张得益于各国能源效率标准的统一、无线控制技术的加速普及,以及碳化硅和氮化镓半导体的应用——这些半导体能够提高转换效率并缩小驱动器尺寸。尤其是在亚太地区,政府资助的维修项目与净零排放承诺相辅相成,推动了大规模的更换需求;同时,北美和欧洲的新建筑标准正在推动智慧照明的整合规范。车辆电气化扩大了小型化、耐高温驱动器的应用范围,而Matter/Thread标准化则消除了长期存在的互通性障碍。总而言之,这些转变正在将LED驱动器市场从组件供应商提升为互联建筑平台和能源管理服务的策略推动者。

全球LED驱动器市场趋势及驱动因素

补贴型LED改装计画有助于加速市场发展

印度的UJALA倡议表明,大规模推广高效节能灯具每年可减少20吉瓦的电力需求,并避免8,000万吨二氧化碳排放。与以往的折扣计划不同,该计划的市场驱动因素维持了供应商的净利率,并鼓励产品持续升级,重点关注具备能量监控功能的高级驱动器。中国、马来西亚和欧盟的类似计画正在从灯泡更换转向整套灯具更换,从而推动了对支援无线控制、功率因数达到0.9或更高、并符合IEC防闪烁标准的驱动器的需求。随着第一批LED灯具于2015年左右投入使用,第二轮58亿台的更换週期将在2025年至2028年间达到高峰。这些计划将确保在整个预测期内拥有可预测的、大批量的采购管道,从而为LED驱动器市场注入新的动力。

氮化镓硅基驱动积体电路价格的快速下降使其得以大规模应用。

德克萨斯(TI) 从 6 吋到 8 吋 GaN 晶圆的过渡降低了晶粒成本,同时提高了产量比率,将功率转换效率提升至 92% 以上,并缩小了散热预算。英飞凌的 300 毫米试验线预计 2025 年与硅晶片价格持平,从而开拓零售轨道照明和家电照明等主流通路。 GaN 更高的开关频率可将磁铁尺寸缩小高达 40%,从而实现更薄的灯具和更低的机壳温度,这对于板载晶片 ) 模组至关重要。汽车头灯系统受益于 GaN 对高结温的耐受性,支援电动车的自我调整光束架构。这些经济优势促进了良性循环的整合:随着产量增加,成本进一步下降,从而进一步扩大 LED 驱动器市场。

硅供应限制导致驱动晶片生产出现瓶颈

Wolfspeed的流动性压力威胁到其用于高功率照明和电动车应用的碳化硅晶圆供应。代工厂优先生产先进的3nm逻辑晶片,导致用于LED驱动器的16-90nm混合讯号製程产能短缺。典型MOSFET的前置作业时间超过40週,而专用PMIC的交货週期则长达一年,迫使厂商重新设计并采用多供应商策略。这些限制导致价格波动,挤压了中端OEM厂商的利润空间,并削弱了户外照明计划等竞标上限明确的领域的近期出货前景。在东南亚产能扩张启动之前,硅短缺问题可能会持续阻碍LED驱动器市场的发展。

细分市场分析

2024年,恆定电流装置占据了LED驱动器市场61.2%的比重。然而,转换效率高达92%且无需更改设计即可适应可变电压LED负载的恒定功率驱动器,预计在2025年至2030年间将以23.1%的复合年增长率成长。在汽车头灯这一细分市场,英飞凌的Litix Power Flex系列代表了性能的飞跃:SPI控制的调光和多串保护功能使其能够在不增加散热负担的情况下扩展功能。

自我调整照明场景的兴起强化了这一转变。建筑建筑幕墙、体育场馆和可调白光办公灯具等,如果能够动态调节输出,同时将电流保持在二极管的容差范围内,则可从中受益。这种多功能性减少了产品型号的繁多,并增强了灯具製造商的现场升级途径。随着无线通讯协定的日益普及,韧体可选的输出曲线使得恒定功率设计成为不断发展的LED驱动器市场中的首选平台。

以DALI和0-10V为主导的有线系统将在2024年占据LED驱动器市场规模的65.4%。然而,无线技术的普及速度更快,预计到2030年将以24.3%的复合年增长率成长。罗格朗获得Matter认证的墙盒调光器表明,消费者对基于应用程式的性能验证充满热情。

从总成本角度来看,取消控制线可节省商业维修预算的15%至25%的人力成本,而且在许多情况下,LED加控制系统的投资报酬率更高。 Thread的IPv6基础架构便于楼宇管理系统集成,而BLE网状网路则为紧急照明检查提供低功耗备用方案。随着空中韧体更新的普及,无线韧体透过相容未来功能来延长使用寿命。这些优势已使无线技术稳固地成为LED驱动器市场的支柱。

区域分析

北美地区在2024年销售额中占据32.3%的份额,这主要得益于更严格的灯具能源效率标准,将标准提高到83-195流明/瓦,引导设计者选择高效驱动器。企业改造项目,例如可口可乐公司对其六家工厂的维修,每年可节省97,063美元,凸显了快速的投资回报。 CHIPS法案拨款2000亿美元用于国内工厂,以提高类比和电源组件的可靠性。加拿大和墨西哥利用一体化的供应链共用技术标准和认证实验室,促进跨境运输。

亚太地区将呈现最快的结构性成长,预计到2030年复合年增长率将达到24.2%。中国製造业的深度将降低零件成本,而政府的智慧城市津贴将刺激当地对配备NB-IoT和LoRa网关的驾驶者的需求。印度创纪录的UJALA计画将补充二手灯具库存,并启动第二波灯具升级週期。日本、韩国和台湾将把电动车头灯的创新转化为可出口的自我调整光束驱动器。东协市场将吸收供应链多元化,而越南将成为北美品牌的精加工和组装中心。

欧洲将透过「生态设计2019/2020」计画保持发展势头,该计画的目标是到2030年实现每年96太瓦时(TWh)的节能。德国復兴信贷银行(KfW Bank)的拨款将优惠利率与智慧照明的部署挂钩,以加快物流仓库驱动器的更新换代。东欧的维修计画得到了凝聚基金的支持,英国的建筑法规L部分也提及了动态照明指南,该指南鼓励使用支持开放通讯协定通讯的驱动器。中东和非洲地区,尤其是沙乌地阿拉伯,其「2030愿景」计画预测LED采用率将以10%的复合年增长率成长,这为全球LED驱动器市场提供了补充,并得到了当地组装企业的支持。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 补贴型LED维修计画(2025年及以后)

- 氮化镓硅基驱动积体电路价格快速下降

- 新建筑标准中强制要求智慧照明

- Matter/Thread无线控制的主流应用

- 电动车头灯LED驱动器的需求激增

- 企业净零排放目标加速产业升级

- 市场限制

- 驱动积体电路硅供应持续受限

- 传统有线通讯协定的互通性有限。

- 非隔离式驱动器设计的复杂性

- 对中国製造的恆流模组征收高额进口关税

- 供应链分析

- 技术展望

- 监管环境

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 依产品类型

- 恆定电流LED驱动器

- 恆压LED驱动器

- 恒定功率LED驱动器

- 透过控制功能

- 用电线

- 0-10 V

- DALI

- DMX

- PLC

- Trailing-Edge

- 无线的

- Wi-Fi

- Bluetooth/BLE

- Zigbee

- Thread /Matter

- Li-Fi

- 用电线

- 透过输出

- 小于25瓦

- 25-65 W

- 65-150 W

- 150瓦或以上

- 按外形规格

- 外部独立

- 整合/入职

- 线性驱动器

- 紧凑/模组驱动程式

- 按最终用途

- 住房

- 商业和办公

- 零售和酒店

- 户外和街道照明

- 产业

- 医疗保健和教育

- 汽车照明系统

- 园艺和农业

- 消费性电子产品背光

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 卡达

- 其他中东地区

- 非洲

- 南非

- 埃及

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Signify

- ams OSRAM

- Acuity Brands Lighting

- Hubbell Incorporated

- Eaton(Cooper Lighting)

- Lutron Electronics

- Cree LED(SGH)

- MEAN WELL Enterprises

- Inventronics

- Tridonic(Zumtobel)

- Delta Electronics

- Shenzhen Done Power

- ERP Power

- Lifud Technology

- Helvar

- Murata Manufacturing

- Texas Instruments

- ON Semi

- Allegro MicroSystems

- ROHM Semiconductor

- Macroblock Inc.

- TCI Srl

- MOSO Power

- Current(GE)

第七章 市场机会与未来展望

第八章 投资分析

The LED driver market is valued at USD 20.19 billion in 2025 and is forecast to grow to USD 56.64 billion by 2030, reflecting a CAGR of 22.91%.

This expansion is underpinned by the alignment of national energy-efficiency mandates, accelerating wireless-control adoption and the deployment of silicon-carbide and gallium-nitride semiconductors that raise conversion efficiency and shrink driver footprints. Government-funded retrofit programs, particularly in Asia-Pacific, intersect with net-zero commitments to lift large-scale replacement demand, while new-build codes in North America and Europe push integrated intelligent-lighting specifications. Automotive electrification further widens the addressable base for compact, high-temperature drivers, and Matter/Thread standardization dismantles long-standing interoperability barriers. Collectively, these shifts elevate the LED driver market from a component-supply business to a strategic enabler of connected-building platforms and energy-management services.

Global LED Driver Market Trends and Insights

Subsidy-fuelled LED Retrofit Programs Drive Market Acceleration

India's UJALA initiative illustrates how large-scale distribution of efficient lamps can slash electricity demand by 20 GW and avoid 80 million t of CO2 annually. Unlike earlier discount schemes, the program's market-based approach sustained vendor margins, encouraging continual product upgrades that now emphasize advanced drivers with energy-monitoring functions. Similar schemes in China, Malaysia and the European Union are moving from bulb replacements toward holistic luminaire swaps, triggering demand for drivers that support wireless controls, target power factors above 0.9 and meet IEC flicker criteria. Because early LED waves entered service around 2015, a secondary replacement cycle of 5.8 billion units begins peaking between 2025 and 2028. These programs collectively add momentum to the LED driver market by ensuring predictable, large-volume procurement pipelines over the forecast period.

Rapid Price Declines in GaN-on-Si Driver ICs Enable Mass Adoption

Texas Instruments' migration from 6-inch to 8-inch GaN wafers cuts die cost while improving yield consistency, pushing power-conversion efficiency beyond 92% and shrinking thermal budgets.Infineon's 300 mm pilot line is expected to reach silicon-parity pricing in 2025, opening mainstream channels such as retail track lighting and appliance illumination. GaN's higher switching frequencies reduce magnetics size by up to 40%, enabling slimmer luminaire profiles and lowering enclosure temperatures, a critical factor for chip-on-board modules. Automotive headlamp systems benefit from GaN's resilience at high junction temperatures, supporting adaptive-beam architectures in electric vehicles. These economics support a virtuous cycle of integration: as volumes climb, cost drops deepen, broadening the LED driver market even further.

Persistent Silicon Supply Constraints Create Bottlenecks in Driver IC Production

Wolfspeed's liquidity pressures threaten silicon-carbide wafer availability for high-power lighting and EV applications. Foundries prioritize advanced 3-nm logic, leaving 16-90 nm capacity thin for the mixed-signal processes used in LED drivers. Lead times exceed 40 weeks for common MOSFETs; speciality PMICs stretch beyond a year, forcing design pivots and multi-sourcing strategies. The constraint drives price volatility that squeezes mid-tier OEM margins, dampening near-term shipment potential in segments such as outdoor lighting projects with firm bid ceilings. Until capacity additions in Southeast Asia come online, silicon shortfalls remain a measurable drag on the LED driver market.

Other drivers and restraints analyzed in the detailed report include:

- Smart-Lighting Mandates in New-Build Codes Create Compliance-Driven Demand

- Mainstream Adoption of Matter/Thread Wireless Controls Standardizes Connectivity

- Limited Interoperability Across Legacy Wired Protocols Fragments Market Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Constant current devices held 61.2% LED driver market share in 2024, driven by decades of design familiarity in high-lumen applications. However, constant power drivers deliver up to 92% conversion efficiency and accommodate variable-voltage LED loads without redesign, supporting a projected 23.1% CAGR between 2025 and 2030. In the automotive front-lighting niche, Infineon's Litix Power Flex series illustrates the performance jump: SPI-controlled dimming and multi-string protection broaden functionality without thermal penalty.

The rise of adaptive lighting scenarios reinforces the shift. Architectural facades, sports arenas and tunable-white office fixtures benefit when output can adjust dynamically while current remains within diode tolerances. This versatility lowers SKU proliferation for luminaire makers and enhances field-upgrade paths. As wireless protocols proliferate, firmware-selectable power curves make constant power designs the preferred platform in the evolving LED driver market.

Wired systems, led by DALI and 0-10 V, accounted for 65.4% of the LED driver market size in 2024 because existing-bearing structures embed control cabling. Yet wireless features head into the steep part of the adoption curve, with a 24.3% CAGR through 2030. Legrand's Matter-approved wall-box dimmers demonstrate consumer enthusiasm for app-based commissioning.

From a total-cost lens, eliminating control wires trims labour 15-25% in commercial retrofit budgets, often swinging ROI in favour of LED plus controls. Thread's IPv6 foundation eases building-management integration, and BLE mesh provides low-energy fallback for emergency lighting checks. With over-the-air firmware updates now mainstream, wireless drivers extend operating lifetimes by accommodating future features. These advantages cement wireless as a pillar of the LED driver market.

LED Driver Market Report is Segmented by Product Type (Constant Current LED Drivers, and More), Control Feature (Wired, Wireless), Power Output (Less Than25W, 25-65W, and More), Form Factor (External Stand-Alone, Integrated/On-Board, and More), End-Use Application (Residential, Commercial and Office, Retail and Hospitality, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America's 32.3% revenue share in 2024 derives from rigorous lamp-efficacy rules that raise the bar to 83-195 lm/W, steering specifiers toward high-efficiency drivers. Corporate retrofits such as Coca-Cola Consolidated's six-facility upgrade realize USD 97,063 annual savings and underline the quick payback narrative. The CHIPS Act allocates USD 200 billion for domestic fabs, improving resilience for analog and power components. Canada and Mexico leverage integrated supply chains to share technical standards and qualification labs, smoothing cross-border shipments.

Asia-Pacific exhibits the fastest structural rise, projecting a 24.2% CAGR through 2030. China's manufacturing depth slashes BOM costs, and its municipal smart-city grants stimulate local demand for drivers with NB-IoT or LoRa gateways. India's record-scale UJALA program replenishes lamp inventories at end-of-life, kick-starting a second-wave luminaire upgrade cycle. Japan, South Korea and Taiwan channel EV-led headlamp innovations into exportable adaptive-beam drivers. ASEAN markets absorb supply-chain diversification, with Vietnam emerging as a finish-and-assembly hub for North American brands.

Europe sustains momentum through Ecodesign 2019/2020, which targets 96 TWh savings annually by 2030. Germany's KfW-bank subsidies tie preferential interest rates to intelligent-lighting deployment, accelerating driver replacements in logistics warehouses. Eastern European retrofit pipelines receive cohesion-fund backing, while the United Kingdom's Building Regulations Part L references dynamic-lighting guidance that favours drivers capable of open-protocol communication. The Middle East and Africa supplement the global LED driver market with Vision 2030 programs, typified by Saudi Arabia's 10% CAGR LED adoption outlook underpinned by local assembly ventures.

- Signify

- ams OSRAM

- Acuity Brands Lighting

- Hubbell Incorporated

- Eaton (Cooper Lighting)

- Lutron Electronics

- Cree LED (SGH)

- MEAN WELL Enterprises

- Inventronics

- Tridonic (Zumtobel)

- Delta Electronics

- Shenzhen Done Power

- ERP Power

- Lifud Technology

- Helvar

- Murata Manufacturing

- Texas Instruments

- ON Semi

- Allegro MicroSystems

- ROHM Semiconductor

- Macroblock Inc.

- TCI Srl

- MOSO Power

- Current (GE)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Subsidy-fuelled LED retrofit programs (post-2025 roll-outs)

- 4.2.2 Rapid price declines in GaN-on-Si driver ICs

- 4.2.3 Smart-lighting mandates in new-build codes

- 4.2.4 Mainstream adoption of Matter/Thread wireless controls

- 4.2.5 Surge in EV headlamp LED driver demand

- 4.2.6 Corporate net-zero targets accelerating industrial upgrades

- 4.3 Market Restraints

- 4.3.1 Persistent silicon supply constraints for driver ICs

- 4.3.2 Limited interoperability across legacy wired protocols

- 4.3.3 Design-in complexity for non-isolated drivers

- 4.3.4 High import tariffs on Chinese constant-current modules

- 4.4 Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Constant Current LED Drivers

- 5.1.2 Constant Voltage LED Drivers

- 5.1.3 Constant Power LED Drivers

- 5.2 By Control Feature

- 5.2.1 Wired

- 5.2.1.1 0-10 V

- 5.2.1.2 DALI

- 5.2.1.3 DMX

- 5.2.1.4 PLC

- 5.2.1.5 Trailing-Edge

- 5.2.2 Wireless

- 5.2.2.1 Wi-Fi

- 5.2.2.2 Bluetooth/BLE

- 5.2.2.3 Zigbee

- 5.2.2.4 Thread / Matter

- 5.2.2.5 Li-Fi

- 5.2.1 Wired

- 5.3 By Power Output

- 5.3.1 Less than 25 W

- 5.3.2 25 - 65 W

- 5.3.3 65 -150 W

- 5.3.4 Greater than 150 W

- 5.4 By Form Factor

- 5.4.1 External Stand-Alone

- 5.4.2 Integrated / On-Board

- 5.4.3 Linear Drivers

- 5.4.4 Compact / Module Drivers

- 5.5 By End-Use Application

- 5.5.1 Residential

- 5.5.2 Commercial and Office

- 5.5.3 Retail and Hospitality

- 5.5.4 Outdoor and Street Lighting

- 5.5.5 Industrial

- 5.5.6 Healthcare and Education

- 5.5.7 Automotive Lighting Systems

- 5.5.8 Horticulture and Agriculture

- 5.5.9 Consumer-Electronics Backlighting

- 5.5.10 Other Applications

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Qatar

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Egypt

- 5.6.5.2.3 Nigeria

- 5.6.5.2.4 Kenya

- 5.6.5.2.5 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Signify

- 6.4.2 ams OSRAM

- 6.4.3 Acuity Brands Lighting

- 6.4.4 Hubbell Incorporated

- 6.4.5 Eaton (Cooper Lighting)

- 6.4.6 Lutron Electronics

- 6.4.7 Cree LED (SGH)

- 6.4.8 MEAN WELL Enterprises

- 6.4.9 Inventronics

- 6.4.10 Tridonic (Zumtobel)

- 6.4.11 Delta Electronics

- 6.4.12 Shenzhen Done Power

- 6.4.13 ERP Power

- 6.4.14 Lifud Technology

- 6.4.15 Helvar

- 6.4.16 Murata Manufacturing

- 6.4.17 Texas Instruments

- 6.4.18 ON Semi

- 6.4.19 Allegro MicroSystems

- 6.4.20 ROHM Semiconductor

- 6.4.21 Macroblock Inc.

- 6.4.22 TCI Srl

- 6.4.23 MOSO Power

- 6.4.24 Current (GE)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Emerging Opportunities in Non-Isolated Drivers

- 7.3 Visible-Light Communication Integration

- 7.4 GaN and SiC-based Driver IC Adoption