|

市场调查报告书

商品编码

1851732

液态硅橡胶(LSR):市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Liquid Silicone Rubber (LSR) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

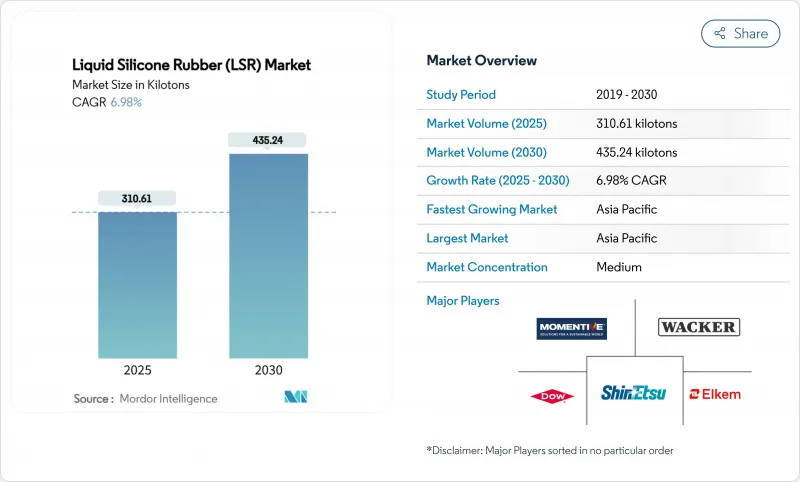

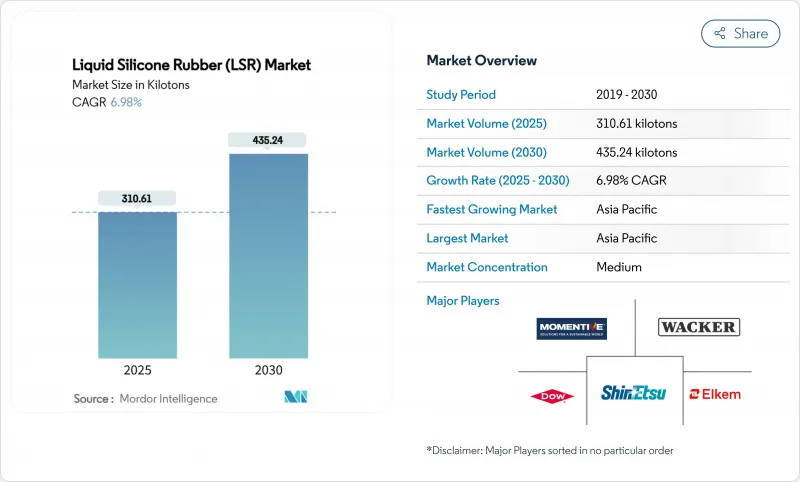

预计到 2025 年,液态硅橡胶市场规模将达到 310.61 千吨,到 2030 年将扩大到 435.24 千吨,2025 年至 2030 年的复合年增长率为 6.98%。

医疗设备、高阶婴幼儿产品和超高压电动车电池组对生物相容性材料的需求不断增长,推动了这一成长趋势。亚太地区目前主导着电子和汽车製造业带来的消费,而医疗保健领域的创新正在加速北美和欧洲的采用。液态射出成型(LIM)仍然是首选的加工技术,因为它具有公差小、飞边少和生产速度高等优点。

全球液态硅橡胶(LSR)市场趋势与洞察

来自医疗保健行业的需求增加

医院和医疗器械制造商之所以指定使用医用级配方,是因为这种材料符合 ISO 10993 细胞毒性标准和 USP VI 级标准,能够耐受伽马射线和蒸气灭菌,并可支撑带有倒角的复杂几何形状。近期的突破性技术使得单一植入能够释放多种药物,从而使医生能够根据肿瘤治疗和疼痛管理的需求定製药物释放曲线。抗压性能延长了植入的使用寿命,降低了再次手术的风险和整体医疗成本。由于 FDA 对可追溯性的要求以及更严格的颗粒物法规,用于导管接头和微型阀门的无尘室液态离子注入 (LIM) 已成为普遍做法。这些因素共同推动了全球规范化率的上升,并将液态硅橡胶市场推向了利润更为丰厚的医疗领域。

婴儿护理行业的需求增加

不含增塑剂、双酚A (BPA) 和乳胶蛋白的安抚塑化剂、磨牙环和奶瓶越来越受到青睐。液态硅橡胶即使经过数百次洗碗机和消毒循环仍能保持弹性,为品牌提供了比热塑性弹性体 (TPE) 更耐用的选择。其低致敏性和无异味特性符合严格的国际玩具安全标准,而丰富的色彩选择则有助于高端产品在零售货架上脱颖而出。生产商的创新,例如100%食品级婴儿牙刷,显示这一细分市场正持续扩展到日常卫生用品领域。这些趋势正在扩大消费群体,并提高液态硅橡胶市场的收入密度。

液态硅橡胶製品高成本

与热塑性弹性体注塑相比,专用出料泵、闭合迴路温度控制和柱塞式射出成型机增加了资本支出。诸如医用级纯度、食品接触认证和阻燃包装等附加价值,使混炼价格比普通弹性体高出25%至60%。製程整合感测器可以缩短生产週期并减少废料,但需要对工业4.0硬体进行前期投资。预算受限的细分市场,例如个人护理用品分配器,也正在转向改性热塑性弹性体,这限制了近期的成长。生产商正在透过采用更大型腔的模具、预测性维护平台和扩大区域混炼规模来降低运输成本,从而逐步缓解液态硅橡胶市场面临的成长瓶颈。

细分市场分析

预计到2024年,工业级液态硅橡胶将维持47.38%的市场份额,为各行业的密封件、垫圈和小键盘外壳提供经济高效的性能。其高撕裂强度和耐油性使其适用于汽车引擎盖部件和家用电器按钮,从而确保液态硅橡胶市场稳定的基准需求。

随着微创治疗在全球日益普及,医用/植入的年复合成长率 (CAGR) 达到 7.15%。美国FDA核准的心臟导线和神经调控植入通常采用铂金硫化液态硅橡胶 (LSR),因为其萃取物含量低且压迫永久变形稳定。这种高端价格分布正在推动整个液态硅橡胶市场的盈利,领先的供应商正在扩大符合 ISO 13485 认证的生产单元,以满足严格的可追溯性要求。食品接触级液态硅橡胶正在开闢一个不断成长的市场,主要应用于可重复使用的烘焙模具和婴儿用品领域。即使经过反覆消毒,其性能依然稳定,并被视为一次性塑胶的环保替代品。

到2024年,液态射出成型( LIM)将占据69.19%的市场份额,这得益于其全自动混合、短固化週期和极少的后处理。多组分LIM将硬质塑胶基板与柔软的液态硅橡胶(LSR)包覆成型一次成型,从而缩短了医疗阀门和智慧型手錶錶带的组装时间。这些优势对于寻求更短生产週期和更高、更稳定的产量比率的原始设备製造商(OEM)至关重要,进一步巩固了LIM在液态硅橡胶市场的地位。

对于工业隔膜等大型零件而言,转注成型和压缩模塑仍然十分重要,因为吨位而非型腔数量才是决定经济效益的关键因素。早期积层製造试验表明,3D列印的液态硅橡胶(LSR)晶格可以调节客製化义肢的缓衝性能,这预示着未来预计将在原型製作的灵活性和大规模生产的品质之间架起一座桥樑。

区域分析

到2024年,亚太地区将占全球液态硅消费量的53.96%,其中中国将占一半以上。温卡天宇和江苏天辰的扩张标誌着市场正向本地上游一体化转型,这降低了原材料成本,并确保了供应的连续性。政府对新能源汽车的扶持政策正在推动电池冷却垫片和电池模组密封垫对液态硅橡胶的需求,进一步巩固了该地区在液态硅橡胶市场的影响力。

北美则位居第二,这主要得益于明尼苏达州、加州和墨西哥巴希奥走廊的高纯度医疗设备製造群。近期新增产能,例如杜特维勒的双组分注塑生产线,缩短了美国和加拿大原始设备製造商 (OEM) 的前置作业时间,同时帮助他们抵御了运费波动的影响。华盛顿州和阿拉巴马州的航太产业正在指定使用阻燃等级的材料製造客舱和引擎密封件,并利用液态硅橡胶 (LSR) 种类繁多的隔热窗来实现其轻量化目标。

欧洲在工艺创新和永续性方面保持领先地位。德国机械製造商不断提高点胶精度以降低废品率,而义大利模具製造商则率先采用随形冷却布局来缩短生产週期。欧盟委员会对循环经济的重视推动了像新曙光硅胶公司这样的化学回收企业进行研发,预示着未来闭合迴路系统将为液态硅橡胶市场的进一步成长铺平道路。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 来自医疗保健行业的需求增加

- 高生物相容性增加了婴儿护理行业的需求

- 对超高压电动车电池密封件的需求推动了汽车级密封件的普及

- 独特的性能使其在电子行业中得到更广泛的应用。

- 受轻量化目标驱动,航太航太业正在扩大采用率

- 市场限制

- 液态硅橡胶製品高成本

- 来自新型热塑性弹性体在消费品领域的低成本竞争

- 液态硅橡胶的回收问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 工业液态硅橡胶

- 医用级液态硅橡胶

- 食品接触级液态硅橡胶

- 透过加工方法

- 液态射出成型

- 传递模塑和压缩模塑

- 透过使用

- 密封件、垫圈和O形圈

- 导管和医用管路

- 电气连接器和外壳

- 奶嘴、奶瓶和婴儿配方奶粉

- 穿戴式和植入式药物传输系统

- 按最终用途行业划分

- 医疗保健和医疗设备

- 车

- 电气和电子

- 消费品

- 美容及个人护理

- 其他终端用户产业(工业机械、密封件等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Avantor, Inc.

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- Jiangsu Tianchen New Material Co. Ltd

- KCC SILICONE CORPORATION

- Momentive

- RICO Elastomere Projecting GmbH

- RICO GROUP GmbH

- Shin-Etsu Chemical Co. Ltd

- Stockwell Elastomerics Inc.

- Trelleborg Group

- Wacker Chemie AG

- Wynca Tinyo Silicone Co., Ltd.

第七章 市场机会与未来展望

The liquid silicone rubber market size reached 310.61 kilotons in 2025 and is projected to expand to 435.24 kilotons by 2030, reflecting a 6.98% CAGR over 2025-2030.

Rising demand for biocompatible materials in medical devices, premium baby products, and ultra-high-voltage electric-vehicle (EV) battery packs sustains this growth trajectory. Asia-Pacific dominates current consumption on the back of electronics and automotive manufacturing, while healthcare innovation is accelerating adoption in North America and Europe. Liquid injection molding (LIM) remains the preferred processing technology because it delivers tight tolerances, minimal flash, and high output rates.

Global Liquid Silicone Rubber (LSR) Market Trends and Insights

Increasing Demand From the Healthcare Industry

Hospitals and device makers specify medical-grade formulations because the material meets ISO 10993 cytotoxicity and USP Class VI criteria, resists gamma and steam sterilization, and supports complex geometries with undercuts. Recent breakthroughs enable multi-drug elution from a single implant, allowing physicians to tailor release profiles for oncology and pain-management therapies. Compression-set resistance extends implant life, lowering revision-surgery risk and total cost of care. Clean-room LIM has become routine for catheter hubs and micro-valves, driven by FDA expectations for traceability and tighter particulate limits. These factors together lift global specification rates and help propel the liquid silicone rubber market toward higher-margin medical segments.

Rising Demand From the Baby Care Industry

Caregivers increasingly favor pacifiers, teething rings, and feeding bottles that contain no plasticizers, BPA, or latex proteins. Liquid silicone rubber maintains elasticity after hundreds of dishwasher or sterilization cycles, giving brands a clear durability advantage over TPE alternatives. Hypoallergenic and odor-neutral traits align with strict international toy-safety directives, while vibrant pigmentation options help premium lines stand out on retail shelves. Producer innovation-such as 100% food-grade infant toothbrushes-illustrates how this niche keeps expanding into everyday hygiene items. Together, these trends enlarge the consumer base and lift revenue density inside the liquid silicone rubber market.

High Cost of Liquid Silicone Rubber Products

Dedicated dosing pumps, closed-loop temperature control, and plunger-type injection machines inflate capital outlays relative to thermoplastic molding. Added-value features-medical purity, food-contact certification, or flame-retardancy packages-increase formulation prices by 25%-60% versus commodity elastomers. Process-integration sensors provide cycle-time savings and scrap reduction but require upfront investment in Industry 4.0 hardware. Budget-constrained segments such as personal-care dispensers sometimes switch to modified TPEs, dragging near-term growth. Producers are countering with higher cavity molds, predictive maintenance platforms, and expanded regional compounding to shrink freight costs, gradually easing this brake on the liquid silicone rubber market.

Other drivers and restraints analyzed in the detailed report include:

- Demand for EV Battery Sealing

- Growing Utilization From the Electronics Industry

- Recycling Challenges for Liquid Silicone Rubber

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Industrial grade maintained the lion's share at 47.38% in 2024, delivering cost-effective performance for seals, grommets, and keypad housings across diverse industries. High tear strength and oil resistance underpin its suitability for under-hood automotive parts and consumer-electronics buttons, ensuring stable baseline demand inside the liquid silicone rubber market.

Medical/implant grade is advancing at a 7.15% CAGR as minimally invasive therapies gain traction globally. United States FDA approvals for cardiac leads and neuromodulation implants frequently cite low extractables data and stable compression-set values made possible by platinum-cured LSR. This premium pricing tier improves overall liquid silicone rubber market size profitability, with top suppliers scaling ISO 13485-certified production cells to meet stringent traceability requirements. Food-contact grade forms a niche growth pocket anchored in reusable baking molds and baby utensils; performance parity after repeated sterilizations positions it as an eco-friendly alternative to single-use plastics.

Liquid Injection Holding held 69.19% in 2024, stemming from fully automated mixing, short cure cycles, and minimal post-processing. Multi-component LIM integrates hard-plastic substrates with soft LSR over-molds in a single shot, cutting assembly time for medical valves and smart-watch straps. These advantages are critical as OEMs chase takt-time reductions and repeatable high yields, reinforcing LIM's status in the liquid silicone rubber market.

Transfer and compression molding retain relevance for very large parts such as industrial diaphragms, where press tonnage rather than cavity count dictates economics. Early additive-manufacturing pilots demonstrate how 3D-printed LSR lattices can tune cushioning in custom prosthetics, hinting at a future bridge between prototype agility and mass-production quality.

The Liquid Silicone Rubber Market Report Segments the Industry by Type (Food-Contact Grade LSR, Industrial Grade LSR, Medical Grade LSR), Processing Method (Liquid Injection Molding, Transfer and Compression Molding), Application (Seals, Gaskets and O Rings, Catheters and Medical Tubing, and More), End-User Industry (Healthcare and Medical Devices, Automotive, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific held 53.96% of global volume in 2024, with China accounting for more than half of regional consumption. Expansions by Wynca Tinyo and Jiangsu Tianchen signal a shift toward local upstream integration that lowers feedstock costs and secures supply continuity. Government incentives for new-energy vehicles elevate LSR demand in battery cooling pads and cell-module gaskets, cementing the region's influence on the liquid silicone rubber market.

North America ranks second, anchored by high-purity medical-device production clusters in Minnesota, California, and Mexico's Bajio corridor. Recent capacity additions-such as Datwyler's two-component molding lines-shorten lead times for U.S. and Canadian OEMs while shielding them from freight volatility. Aerospace tier-ones in Washington and Alabama specify flame-retardant grades for cabin and engine seals, tapping LSR's broad thermal window to meet weight-saving goals.

Europe maintains leadership in process innovation and sustainability. German machine builders continuously refine dosing precision to shrink scrap rates, and Italian mold-makers pioneer conformal-cooling layouts that lower cycle times. The European Commission's focus on circularity spurs R&D into chemical recycling ventures like New Dawn Silicones, foreshadowing a future where closed-loop systems unlock additional growth channels for the liquid silicone rubber market.

- Avantor, Inc.

- CHT Germany GmbH

- Dow

- DuPont

- Elkem ASA

- Jiangsu Tianchen New Material Co. Ltd

- KCC SILICONE CORPORATION

- Momentive

- RICO Elastomere Projecting GmbH

- RICO GROUP GmbH

- Shin-Etsu Chemical Co. Ltd

- Stockwell Elastomerics Inc.

- Trelleborg Group

- Wacker Chemie AG

- Wynca Tinyo Silicone Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand From the Healthcare Industry

- 4.2.2 Rising Demand From the Baby Care Industry due to its High Biocompatibility

- 4.2.3 Demand for Ultra-High-Voltage EV Battery Sealing Drives Automotive Grade Adoption

- 4.2.4 Growing Utilization from the Electronics Industry due to its Unique Properties

- 4.2.5 Increasing Adoption in the Aerospace Industry Driven by Light weighting Targets

- 4.3 Market Restraints

- 4.3.1 High Cost of Liquid Silicone Rubber Products

- 4.3.2 Low-cost Competition from Novel TPEs in Consumer Goods

- 4.3.3 Recycling Challenges for Liquid Silicone Rubber

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Industrial Grade LSR

- 5.1.2 Medical Grade LSR

- 5.1.3 Food-Contact Grade LSR

- 5.2 By Processing Method

- 5.2.1 Liquid Injection Molding

- 5.2.2 Transfer and Compression Molding

- 5.3 By Application

- 5.3.1 Seals, Gaskets and O Rings

- 5.3.2 Catheters and Medical Tubing

- 5.3.3 Electrical Connectors and Housings

- 5.3.4 Teats, Soothers and Infant Feeding

- 5.3.5 Wearable and Implantable Drug Delivery Systems

- 5.4 By End-use Industry

- 5.4.1 Healthcare and Medical Devices

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Consumer Goods

- 5.4.5 Beauty and Personal Care

- 5.4.6 Other End-user Industries(Industrial Machinery and Seals, etc.)

- 5.5 By Geography

- 5.5.1 Asia Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Avantor, Inc.

- 6.4.2 CHT Germany GmbH

- 6.4.3 Dow

- 6.4.4 DuPont

- 6.4.5 Elkem ASA

- 6.4.6 Jiangsu Tianchen New Material Co. Ltd

- 6.4.7 KCC SILICONE CORPORATION

- 6.4.8 Momentive

- 6.4.9 RICO Elastomere Projecting GmbH

- 6.4.10 RICO GROUP GmbH

- 6.4.11 Shin-Etsu Chemical Co. Ltd

- 6.4.12 Stockwell Elastomerics Inc.

- 6.4.13 Trelleborg Group

- 6.4.14 Wacker Chemie AG

- 6.4.15 Wynca Tinyo Silicone Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Advancements in Miniaturization and Smart Device Integration