|

市场调查报告书

商品编码

1851740

穿戴式运算设备:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Wearable Computing Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

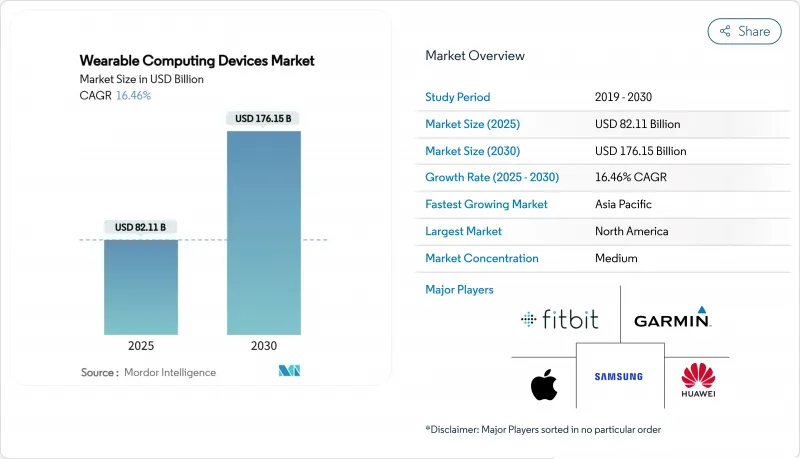

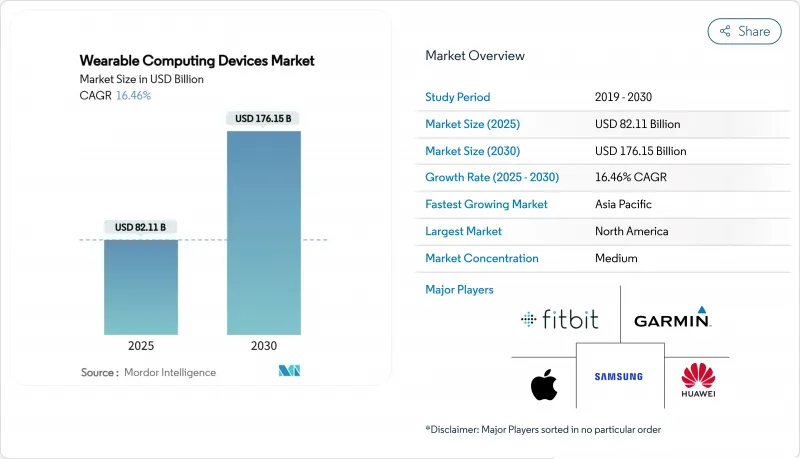

预计到 2025 年,穿戴式运算设备市场规模将达到 821.1 亿美元,到 2030 年将成长至 1,761.5 亿美元。

感测器小型化、电池高效晶片组以及与智慧型手机生态系统的紧密整合,正日益扩大其对消费者和企业的吸引力。非侵入式代谢监测和符合美国食品药物管理局 (FDA) ISO 13485:2016 标准的认证,正在改善医疗级产品的监管;而基于超宽频技术的精准定位功能,则拓展了工业安全领域的应用情境。供应链的韧性,尤其是微型LED组件的供应链韧性,仍然是一项策略性要求;随着资料共用规则的日益严格,以隐私为中心的设计概念也日益凸显。综上所述,这些因素共同作用,维持了激烈的市场竞争,并推动了以生态系统为中心的策略发展,将硬体、软体和医疗服务合约融为一体。

全球穿戴式运算设备市场趋势与洞察

更小的传感器和更节能的晶片组

TDK的固态电池能量密度高达1000Wh/L,使得穿戴式耳机和智慧手錶在小型化的同时,也能延长续航时间。晶片封装技术的进步使得多个感测器可以整合在单一基板上;苹果的专利技术能够根据用户使用情况动态调节功率和发热量,在不增加机壳厚度的情况下提高效率。清华大学研发的水系铵离子微型电池展现出更安全、更灵活的化学特性,适用于皮肤接触式设备。这些突破性进展使得始终在线的健康指示器和色彩鲜艳的微型LED显示器成为可能,同时还能最大限度地降低功耗,从而推动日常配件中持续健康监测功能的广泛应用。

消费者健康监测文化的兴起

穿戴式装置正日益成为临床级事件的侦测利器,例如,一位消费者的手錶在确诊心碎症候群(Takotsubo心肌病)后显示出心臟异常。 Galaxy AI如今提供「能量评分」分析,结合睡眠、压力和活动状况,实现个人化指导。香港大学的感测器内运算原型可在本地处理生物讯号,降低延迟,并实现敏感资料的线上共享。 MOTIVATE-T2D研究的证据表明,佩戴运动追踪器的糖尿病患者在运动方案的依从性方面有所提高,这证实了其健康益处可量化。这些进展加深了消费者的信任,并使主动自我护理成为常态。

资料隐私和网路安全问题

一项调查发现,92%的用户不清楚其穿戴式装置的数据共用的,这使得他们不愿共用敏感指标。针对消费性设备的HIPAA豁免条款造成了实施上的漏洞,而医疗保健领域的资料外洩事件在五年内增加了55%,凸显了资料外洩的风险。澳洲人权委员会警告称,儿童穿戴式装置带来的神经系统资料风险日益增加,并呼吁对隐私法进行现代化改革。区块链原型可以将未授权存取减少45%,并将检测时间缩短至10天以内,但成本和扩充性仍然是限制因素。市场发展动能取决于透明的授权流程和安全设计架构。

细分市场分析

到2024年,智慧型手錶将占据穿戴式运算设备市场46%的份额,这主要得益于其全面的健康仪錶板和丰富的第三方应用程式生态系统,确保了其日常实用性。随着生物活性感测器和其他多模态感测器能够实现除心率之外的代谢测量,智慧型手錶推动的可穿戴计算设备市场规模预计将稳定成长。耳戴式设备预计到2030年将以18.5%的复合年增长率增长,其隐藏的外形规格以及新增的温度、心率和语音控制功能将为其带来益处。工业头戴式显示器透过迭加数位指令,在造船和现场服务领域日益普及,显着提高了生产效率。智慧服饰仍处于起步阶段,但源自电子皮肤原型的柔性印刷电路和纺织嵌入式电极正在推动其在復健领域的应用。健身追踪器正面临来自入门级手錶的定价压力,这些手錶以略高的价格提供类似的测量功能。

在穿戴式运算设备产业,穿戴式摄影机和外骨骼正在为公共和製造业疲劳缓解等特定领域做出贡献。市场参与企业强调开放API,允许将视讯串流和动态资料导入企业控制面板。智慧眼镜正转向仓储和医疗保健工作流程,以减少人工扫描时间和错误率。供应商正在投资超低功耗晶片组,以确保处方镜片满足光学清晰度和电池续航目标。总体而言,产品多元化正在扩大潜在用户群体,同时又不削弱智慧型手錶的主导地位,从而支持穿戴式运算设备市场的均衡成长。

到2024年,健身和健康领域将占穿戴式运算设备市场规模的39%,主要得益于消费者对计步、睡眠分期和手錶指导等功能的广泛兴趣。与订阅式健身的整合能够增强使用者留存率。在医疗保健应用领域,预计复合年增长率将达到19.2%,随着远端患者监护计画对持续生命征象监测进行报销,设备将从健康配件转变为可报销的临床工具。慢性病患者族群,例如第2型糖尿病患者,在穿戴式装置产生的警报和远端会诊提示的指导下,血糖控制得到了显着改善。医院正在采用贴片式感测器进行术后护理,从而减少床边巡视,节省医护人员的时间。

随着身临其境型音讯技术的不断发展,资讯娱乐产业持续成长;工业企业部署环境监测器以减少危险区域的暴露事故。国防应用包括生物识别和情境察觉迭加。穿戴式运算设备产业也在拓展教育领域,注意力追踪头戴装置可用于辅助自适应课程。日益增长的需求要求供应商既要满足IEC医疗安全标准,又要达到严苛的防护等级,这进一步提高了设计和品质保证方面的专业化要求。

穿戴式运算装置市场报告按产品类型(智慧型手錶、智慧服装、外骨骼等)、最终用户(健身和健康、资讯娱乐等)、作业系统(watchOS、Harmonyos 等)、连接技术(蓝牙、蜂窝网路(LTE、5G)、Wi-Fi 等)和地区进行细分。

区域分析

预计到2024年,北美将维持34.5%的可穿戴计算设备市场份额,主要得益于保险公司将此类设备纳入健康奖励,以及临床医生积极采用远端监测註册。苹果、美国以及其他新兴医疗科技公司受益于涵盖持续生命征象监测的报销代码,这提高了消费者自费支付相关费用的意愿。对资料收集日益严格的审查促使供应商采用符合HIPAA标准的云端平台和透明的知情同意流程。医疗系统初步试验表明,配戴连网贴片的心臟病患者的再入院率有所降低,这鼓励了医院采购此类设备。

亚太地区是成长最快的地区,预计到2030年复合年增长率将达到16.8%。印度本土品牌正在推出售价低于30美元的智慧型手錶,这些手錶具备血氧饱和度和心率警报功能,扩大了其目标消费群体。中国正在推行综合健康数位化政策,该政策为慢性病远端监测提供报销,并鼓励医院采购医用级腕带。日本正在推出降温穿戴设备,使工人能够在潮湿环境中舒适工作;韩国的零件供应丛集则支持全球生产的扩充性。进口关税正促使原始设备製造商(OEM)将组装分散到越南和印尼,以降低成本波动。

欧洲在较为谨慎的推广路径上正经历着稳定成长。 GDPR的实作将增强使用者信心,但也会增加文件工作量。各国医疗保健系统正在试行为慢性疾病患者提供设备补贴,但各成员国的报销标准差异显着。在中东和非洲,撒哈拉以南非洲的基础建设面临许多挑战,但海湾地区的富裕市场潜力巨大,健身互联已成为一种身分象征。在拉丁美洲,巴西和墨西哥的需求正在增长,这主要得益于健身文化的兴起和智慧型手机普及率的提高。全部区域的穿戴式运算设备市场将继续受到医疗保健政策、可支配收入以及通讯基础设施成熟度的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 更小的传感器和更节能的晶片组

- 消费者健康监测文化的兴起

- 智慧型手机生态系统整合与超级应用

- 保险远距健康奖励

- 免手持式AR穿戴装置确保前线人员的安全

- 突破性的非侵入性代谢监测(葡萄糖等)

- 市场限制

- 资料隐私和网路安全问题

- 电池寿命和热设计限制

- 处方药相关法规含糊不清

- 尖端元件(微型LED、SiP)供应瓶颈

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 依产品类型

- 智慧型手錶

- 头戴式显示器

- 智慧服饰

- 洗脑神曲(耳虫)

- 健身追踪器

- 执法记录仪

- 外骨骼

- 智慧眼镜

- 最终用户

- 健身与健康

- 医疗保健

- 资讯娱乐

- 工业与国防

- 其他的

- 按作业系统

- watchOS

- Android/ Wear OS

- Harmony作业系统

- RTOS

- 原件/其他

- 透过连接技术

- Bluetooth

- 蜂窝网路(LTE、5G)

- Wi-Fi

- NFC

- 超宽频

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- Huawei Technologies Co. Ltd.

- Garmin Ltd.

- Fitbit LLC(Google)

- Sony Corporation

- Microsoft Corporation

- Bose Corporation

- Huami Corp.(Amazfit)

- Withings

- Medtronic PLC

- AIQ Smart Clothing Inc.

- Sensoria Inc.

- GoPro Inc.

- Transcend Information Inc.

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

- OMRON Healthcare Inc.

- Nuheara Limited

- Oppo Electronics Corp.

- Polar Electro Oy

- Vivo(BBK Electronics)

- Realme

- Zepp Health

- Motorola Mobility LLC

- Lenovo Group Ltd.

- Jabra(GN Audio)

- Valencell Inc.

第七章 市场机会与未来展望

The wearable computing devices market stands at USD 82.11 billion in 2025 and is projected to advance to USD 176.15 billion by 2030, reflecting a sturdy 16.46% CAGR through the period.

Sensor miniaturization breakthroughs, battery-efficient chipsets, and closer integration with smartphone ecosystems are widening both consumer and enterprise appeal. Non-invasive metabolic monitoring and FDA alignment with ISO 13485:2016 are improving the regulatory path for medical-grade products, while precise location capabilities built on ultra-wideband are expanding industrial safety use cases. Supply-chain resilience, especially around micro-LED components, remains a strategic requirement, and privacy-focused design is moving to the foreground as data sharing rules tighten. Collectively, these factors keep competitive pressure high and encourage ecosystem-centric strategies that blend hardware, software, and health-service subscriptions.

Global Wearable Computing Devices Market Trends and Insights

Sensor Miniaturization and Battery-Efficient Chipsets

Solid-state batteries from TDK achieve 1,000 Wh/l energy density, cutting size while extending run-time for hearables and watches. Chip packaging advances allow multiple sensors on one substrate, and Apple patents show dynamic power and thermal adjustment based on user context, boosting efficiency without thicker casings. Aqueous ammonium-ion micro batteries developed at Tsinghua University demonstrate safer and flexible chemistry suitable for skin-contact devices. These leaps enable always-on health metrics plus vivid micro-LED displays that draw minimal power. The outcome is a broader acceptance of continuous monitoring in everyday accessories.

Rising Consumer Health-Monitoring Culture

Wearables increasingly detect clinical-grade events, highlighted when a consumer's watch flagged cardiac abnormalities later diagnosed as takotsubo cardiomyopathy. Galaxy AI now delivers "Energy Score" insights that contextualize sleep, stress, and activity for personal coaching. In-sensor computing prototypes from the University of Hong Kong process bio-signals locally, lowering latency and reducing exposure of sensitive data online. Evidence from the MOTIVATE-T2D study shows enhanced adherence to exercise regimens among diabetes patients equipped with trackers, supporting quantifiable health gains. These developments deepen consumer trust and normalize proactive self-care.

Data-Privacy and Cybersecurity Concerns

A study shows 92% of users lack clarity on how wearable data is shared, fueling hesitation about sharing sensitive metrics. HIPAA exclusions for consumer devices leave enforcement gaps, and healthcare breaches rose 55% over five years, underlining exposure. The Australian Human Rights Commission warns of heightened neural-data risk in child-oriented wearables, prompting calls for privacy law modernization. Blockchain prototypes reduce unauthorized access by 45% and cut detection time to under 10 days, but cost and scalability remain barriers. Market momentum hinges on transparent consent flows and security-by-design architectures.

Other drivers and restraints analyzed in the detailed report include:

- Smartphone-Ecosystem Integration and Super-Apps

- Breakthrough Non-Invasive Metabolic Monitoring

- Battery Life and Thermal-Design Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartwatches accounted for 46% of wearable computing devices market share in 2024, anchored by comprehensive health dashboards and extensive third-party app ecosystems that secure daily relevance. The wearable computing devices market size attributed to smartwatches is poised to grow steadily as BioActive and other multi-modal sensors enable metabolic readings beyond heart rate. Ear-worn devices, advancing at 18.5% CAGR to 2030, benefit from discreet form factors and the addition of temperature, heart-rate and voice command functions. Industrial head-mounted displays gain ground in shipbuilding and field service by overlaying digital instructions, driving measurable productivity gains. Smart clothing remains nascent, though flexible printed circuits and textile-embedded electrodes from e-skin prototypes advance rehabilitation use cases. Fitness trackers feel price pressure from entry-level watches that bundle similar metrics at little premium.

The wearable computing devices industry sees body-worn cameras and exoskeletons serving specialist verticals such as public safety and manufacturing fatigue mitigation. Market entrants emphasize open APIs so video streams and biomechanical data feed into employer dashboards. Smart glasses pivot to warehouse and healthcare workflows, cutting manual scanning time and error rates. Vendors invest in ultra-low-power chipsets so prescription-lens variants meet optical clarity and battery objectives. Overall, product diversification expands the total addressable base without eroding smartwatch primacy, supporting layered growth across the wearable computing devices market.

Fitness and wellness accounted for 39% of the wearable computing devices market size in 2024, held up by broad consumer interest in step counts, sleep staging, and on-watch coaching. Integration with subscription fitness content strengthens retention. Medical and healthcare applications, forecast to grow 19.2% CAGR, transition devices from wellness accessories to reimbursable clinical tools as remote patient monitoring programs reimburse continuous vitals capture. Chronic-disease cohorts such as Type 2 diabetes show measurable blood-glucose control improvements when guided by wearable-generated alerts and tele-consultation prompts. Hospitals adopt patch-based sensors for post-operative care, reducing bedside checks and freeing staff time.

Infotainment keeps momentum through immersive audio, while industrial firms deploy environmental monitors to cut exposure incidents in hazardous zones. Defense uses include biometric authentication and situational awareness overlays. The wearable computing devices industry also touches education, where attention-tracking headsets inform adaptive curricula. Demand convergence pushes suppliers to meet both IEC medical safety norms and ruggedized ingress ratings, further professionalizing design and quality assurance obligations.

The Wearable Computing Devices Market Report is Segmented by Product Type (Smartwatches, Smart Clothing, Exoskeletons, and More), End User (Fitness and Wellness, Infotainment, and More), Operating System (watchOS, Harmonyos, and More), Connectivity Technology (Bluetooth, Cellular (LTE, 5G), Wi-Fi and More), and Geography.

Geography Analysis

North America retained 34.5% share of the wearable computing devices market in 2024 as insurers integrated devices into wellness incentives and clinicians embraced remote monitoring enrolment. Apple, Samsung and rising health-tech specialists benefit from reimbursement codes that cover continuous vitals capture, reinforcing consumer willingness to pay out-of-pocket premiums. Heightened scrutiny of data collection pushes vendors to adopt US-based HIPAA-aligned clouds and transparent consent flows. Health-system pilots demonstrate lower readmissions among cardiac patients equipped with connected patches, amplifying hospital procurement interest.

Asia Pacific is the fastest-growing region at 16.8% CAGR to 2030. Local brands in India offer sub-USD 30 smartwatches that still package blood-oxygen and heart-rate alerts, expanding addressable consumer segments. China pursues integrated health-digitization polices that reimburse remote monitoring for chronic diseases, encouraging hospital procurement of medical-grade wristbands. Japan showcases cooling wearables for workforce comfort in humid environments, while South Korea's component supply clusters underpin global production scalability. Import tariffs push OEMs to diversify assembly into Vietnam and Indonesia, mitigating cost swings.

Europe posts steady growth under a more cautious adoption curve. GDPR alignment delivers user trust yet adds documentation overhead. National health systems pilot device subsidies for chronic-care populations, but reimbursement schedules differ widely between member states. Middle East and Africa see potential in affluent Gulf markets where connected fitness is a status symbol, contrasted by infrastructure hurdles in sub-Saharan regions. Latin America records pockets of demand in Brazil and Mexico as gym culture and smartphone penetration improve. Across regions, the wearable computing devices market continues to be shaped by healthcare policy, disposable income and telecom infrastructure maturity.

- Apple Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Corp.

- Huawei Technologies Co. Ltd.

- Garmin Ltd.

- Fitbit LLC (Google)

- Sony Corporation

- Microsoft Corporation

- Bose Corporation

- Huami Corp. (Amazfit)

- Withings

- Medtronic PLC

- AIQ Smart Clothing Inc.

- Sensoria Inc.

- GoPro Inc.

- Transcend Information Inc.

- Ekso Bionics Holdings Inc.

- Cyberdyne Inc.

- OMRON Healthcare Inc.

- Nuheara Limited

- Oppo Electronics Corp.

- Polar Electro Oy

- Vivo (BBK Electronics)

- Realme

- Zepp Health

- Motorola Mobility LLC

- Lenovo Group Ltd.

- Jabra (GN Audio)

- Valencell Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sensor miniaturization and battery-efficient chipsets

- 4.2.2 Rising consumer health-monitoring culture

- 4.2.3 Smartphone-ecosystem integration and super-apps

- 4.2.4 Insurance tele-wellness incentives

- 4.2.5 Hands-free AR wearables for frontline workforce safety

- 4.2.6 Breakthrough non-invasive metabolic monitoring (e.g., glucose)

- 4.3 Market Restraints

- 4.3.1 Data-privacy and cybersecurity concerns

- 4.3.2 Battery life and thermal-design limits

- 4.3.3 Regulatory ambiguity for medical-grade claims

- 4.3.4 Advanced component supply bottlenecks (micro-LED, SiP)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Smartwatches

- 5.1.2 Head-Mounted Displays

- 5.1.3 Smart Clothing

- 5.1.4 Ear-worn (Hearables)

- 5.1.5 Fitness Trackers

- 5.1.6 Body-worn Cameras

- 5.1.7 Exoskeletons

- 5.1.8 Smart Glasses

- 5.2 By End User

- 5.2.1 Fitness and Wellness

- 5.2.2 Medical and Healthcare

- 5.2.3 Infotainment

- 5.2.4 Industrial and Defense

- 5.2.5 Others

- 5.3 By Operating System

- 5.3.1 watchOS

- 5.3.2 Android / Wear OS

- 5.3.3 HarmonyOS

- 5.3.4 RTOS

- 5.3.5 Proprietary / Other

- 5.4 By Connectivity Technology

- 5.4.1 Bluetooth

- 5.4.2 Cellular (LTE, 5G)

- 5.4.3 Wi-Fi

- 5.4.4 NFC

- 5.4.5 Ultra-Wideband

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 South-East Asia

- 5.5.4.7 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Kenya

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 Samsung Electronics Co. Ltd.

- 6.4.3 Xiaomi Corp.

- 6.4.4 Huawei Technologies Co. Ltd.

- 6.4.5 Garmin Ltd.

- 6.4.6 Fitbit LLC (Google)

- 6.4.7 Sony Corporation

- 6.4.8 Microsoft Corporation

- 6.4.9 Bose Corporation

- 6.4.10 Huami Corp. (Amazfit)

- 6.4.11 Withings

- 6.4.12 Medtronic PLC

- 6.4.13 AIQ Smart Clothing Inc.

- 6.4.14 Sensoria Inc.

- 6.4.15 GoPro Inc.

- 6.4.16 Transcend Information Inc.

- 6.4.17 Ekso Bionics Holdings Inc.

- 6.4.18 Cyberdyne Inc.

- 6.4.19 OMRON Healthcare Inc.

- 6.4.20 Nuheara Limited

- 6.4.21 Oppo Electronics Corp.

- 6.4.22 Polar Electro Oy

- 6.4.23 Vivo (BBK Electronics)

- 6.4.24 Realme

- 6.4.25 Zepp Health

- 6.4.26 Motorola Mobility LLC

- 6.4.27 Lenovo Group Ltd.

- 6.4.28 Jabra (GN Audio)

- 6.4.29 Valencell Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment