|

市场调查报告书

商品编码

1851743

照明控制系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Lighting Control System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

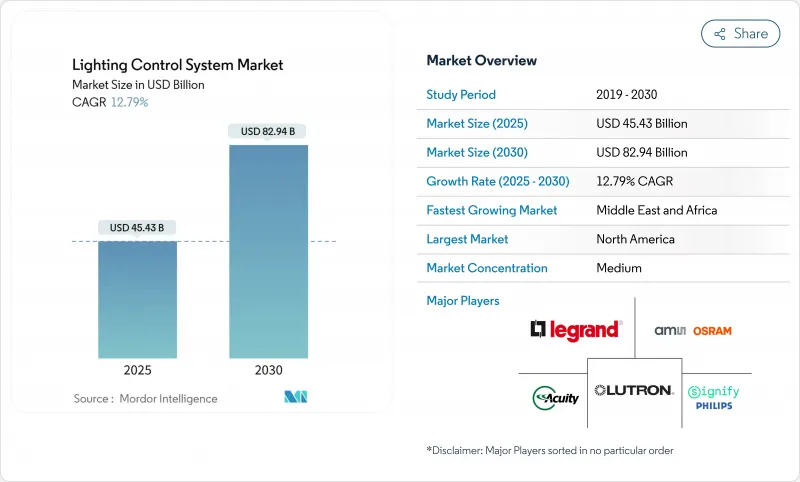

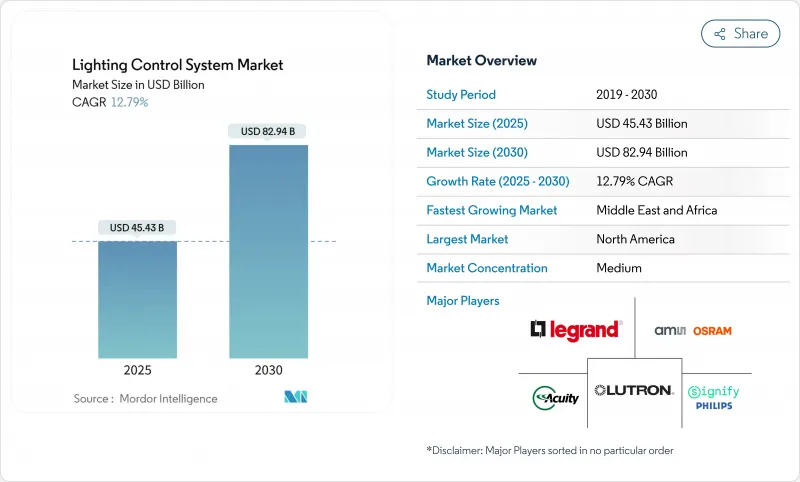

预计到 2025 年,照明控制系统市场规模将达到 454.3 亿美元,到 2030 年将扩大到 829.4 亿美元,年复合成长率为 12.79%。

加速成长反映了强制性的能源效率要求、智慧城市计画的普及以及物联网赋能的楼宇自动化技术的广泛应用,这些技术将照明设备转化为资料来源。各国政府目前在建筑规范中强制要求自动关闭、日光回应调光和人员感应功能,从而催生了不可或缺的需求。 LED组件价格的下降缩短了投资回收期,使得即使对于规模较小的设施,全面控制系统也能在经济上可行。无线网状网路通讯协定降低了安装的复杂性,为2020年之前建造的设备提供了改装的机会。同时,日益严峻的网路安全威胁和半导体供应长期短缺给供应商和设施业主带来了直接的营运风险。

全球照明控制系统市场趋势与洞察

节能照明系统的需求日益增长

与传统萤光具相比,LED 灯具结合智慧控制系统,可节能高达 80%,帮助全球各地的设施降低营运成本和碳排放。工业计划在短短 12 个月内就实现了 87% 的照明节能,即使对于大型工厂而言,也能迅速收回成本。人员感应、日间行车灯采集和定时功能可实现持续优化,而不会影响工作流程。业主们欣喜地看到,许多计划如今都能在一年内收回成本,这在其他建筑支出受到严格审查的当下,为市场需求注入了强劲动力。

更严格的建筑能源效率标准和绿色认证要求

2021 年国际节能规范强制要求商业空间采用自动关闭和日光响应控制,将可选升级变为强制性要求。加州第 24 号法规(2022 年)推动了 4kW 以上计划采用需求响应调光控制,确保几乎所有大型建筑都能实施该技术。 LEED 认证体系对先进的照明控制系统给予加分,使资本市场和监管机构的压力趋于一致,从而优先考虑符合 ESG 标准的资产。由于合规性不容妥协,照明控制系统市场获得了一个防御性成长支柱,可以缓衝宏观经济波动的影响。

较高的初始实施和整合成本

全面的控制维修所需的资金是更换基本LED灯的两到三倍,这使得中小企业难以负担。复杂的计划需要熟练的性能验证工程师,而这类工程师数量有限,推高了人事费用,尤其是在成熟地区以外的地区。即使是目前每年可节省100,831美元的知名饭店维修,也需要大量资金,且投资回收期长达1.62年,这凸显了中小企业面临的资金筹措难题。新兴市场的资金筹措缺口最大,因为这些地区的能源贷款十分稀少。

细分市场分析

驱动程式、感测器和网关构成了智慧升级的核心,硬体将在2024年占总收入的57.4%。服务业务将以12.9%的复合年增长率成为成长最快的业务,因为大规模部署始终需要设计咨询、现场试运行和定期优化。随着基于人工智慧的分析需要持续调整,照明控制系统服务市场规模预计将持续成长。例如,能源管理协作组织(Energy Management Collaborative)的蓝牙Mesh计划,该项目在全球43个地区部署了3685个控制器,充分展现了服务的复杂性及其带来的持续收入潜力。

专业服务能够确保长期合约的签订,从而将一次性资本计划转化为可预测的现金流。韧体更新、故障分析、能源报告等服务越来越多地被纳入企业外包的託管服务合约中。因此,硬体供应商正在将生命週期合约打包出售,推动照明控制系统市场从组件销售转向解决方案生态系统。这种策略转变为缺乏设计和支援资源的公司设定了准入门槛。

到2024年,有线通讯协定将维持64.2%的市场份额,这主要得益于关键任务型工厂对抗电磁干扰能力和稳定延迟的要求。医院和资料中心等无法容忍网路中断的场所,其照明控制系统市场规模依然庞大,而与有线DALI-2系统相关的照明控制系统市场也占据了重要地位。工程师更青睐专用线所固有的确定性性能和实体安全性。

无线部署正以15.3%的复合年增长率迅速缩小差距。蓝牙Mesh提供自癒功能和基于智慧型手机的性能验证,从而降低人事费用。整合到Matter生态系统中,透过将住宅和商业设备整合到通用的管理平台下,将加速设计人员的采用。计划于2026年推出的Thread 1.4升级将增加边界路由器的灵活性,使设施团队能够在不重新布线的情况下扩展网路。对于停工时间有限的传统零售店和正在营业的零售店而言,减少中断至关重要。

照明控制系统市场按产品类型(硬体、软体、服务)、通讯协定(有线、无线)、安装类型(新建、维修)、应用(室外、室内)和地区进行细分。市场预测以美元计价。

区域分析

受严格的能源法规和智慧城市早期应用的推动,北美地区预计到2024年将占全球销售额的34.5%。照明控制系统市场正受益于联邦政府的节能计画和税收优惠政策,这些政策提高了投资报酬率。公用事业公司对感测器组件的补贴进一步改善了商业维修的经济效益。加拿大各省正在效仿美国标准,而墨西哥的工业走廊则将照明控制系统整合到加工厂的扩建项目中,以最大限度地降低营运成本。

欧洲已设定2030年脱碳目标,并维持推进动能。德国、法国和英国已将智慧照明纳入公共部门采购规则。欧盟税务资讯揭露要求业主证明其能源强度降低,从而引导资金流向配备大量感测器的升级改造专案。透过DALI-2和ETSI EN 303 645安全框架进行的标准化工作降低了多供应商部署的风险,并加强了单一市场内的采用。

到2030年,中东和非洲将以12.8%的复合年增长率成为成长最快的地区。沙乌地阿拉伯和阿联酋正在建造的特大城市从一开始就将可控照明系统纳入总体规划。政府拨给智慧基础设施的预算确保了计划储备充足,即使面临石油收入波动也能持续推进。在撒哈拉以南非洲,不稳定的电网促使人们采用感测器来降低电压骤降期间的负荷,保护设备并延长照明设备的使用寿命。开发银行支持的融资有助于克服初期成本障碍,并确保销售持续成长。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 节能照明系统的需求日益增长

- 严格的建筑能源法规和强制性绿色认证

- LED价格快速下降,提升投资报酬率

- 智慧城市计画中的自适应路灯

- ESG挂钩融资加速智慧维修

- Li-Fi相容性创造了新的收入来源

- 市场限制

- 初始部署和整合成本高昂

- 多厂商生态系中的互通性问题

- 网路安全与资料隐私风险

- 合格试运行专业人员短缺

- 供应链分析

- 监管环境

- 技术展望(物联网边缘控制、人工智慧、Li-Fi)

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 报价

- 硬体

- LED驱动器

- 感应器

- 开关和调光器

- 继电器单元

- 网关和控制面板

- 软体

- 服务

- 硬体

- 透过通讯协定

- 有线

- 无线的

- 按安装类型

- 新建设

- 改装

- 透过使用

- 室内的

- 商业办公

- 工业和仓储

- 住房

- 饭店及休閒

- 其他的

- 户外

- 道路和公路

- 建筑与建筑幕墙

- 体育场馆

- 其他的

- 室内的

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 策略趋势

- 公司简介

- Signify(Philips Lighting)

- Acuity Brands

- Legrand

- Lutron Electronics

- ams OSRAM

- Schneider Electric

- Eaton(Cooper Lighting)

- Hubbell Lighting

- Honeywell

- Cisco Systems

- Siemens(Enlighted)

- Delta Electronics

- Panasonic

- Zumtobel Group

- Helvar

- Synapse Wireless

- WAGO

- Cree Lighting

- Leviton Manufacturing

- Digital Lumens

- ABB

第七章 市场机会与未来展望

The lighting control system market size reached USD 45.43 billion in 2025 and is forecast to advance to USD 82.94 billion by 2030, translating into a solid 12.79% CAGR.

Accelerated growth reflects mandated energy-efficiency requirements, the spread of smart city programs, and wider use of IoT-enabled building automation that turns luminaires into data sources. Governments now anchor automatic shut-off, daylight-responsive dimming, and occupancy sensing in building standards, which creates non-discretionary demand. Price erosion in LED components has shortened payback periods, making comprehensive controls economically viable even for smaller facilities. Wireless mesh protocols have reduced installation complexity, opening retrofit opportunities in stock built before 2020. At the same time, escalating cybersecurity threats and lingering semiconductor supply bottlenecks present near-term operational risks for suppliers and facility owners.

Global Lighting Control System Market Trends and Insights

Growing Demand for Energy-Efficient Lighting Systems

Facilities worldwide pursue lower operating costs and carbon footprints by pairing LEDs with intelligent controls that trim lighting energy as much as 80% compared with legacy fluorescent installations. Documented industrial projects have reached 87% lighting-energy savings in the first twelve months, underscoring quick payback even in large plants. Occupancy sensing, daylight harvesting, and scheduling allow continuous optimisation without impacting workflow, which makes capital approval easier when utility prices keep rising. Building owners value that many projects now return cash within a single fiscal year, creating momentum that sustains demand when other construction outlays are under scrutiny.

Stringent Building-Energy Codes and Green Certification Mandates

The International Energy Conservation Code 2021 requires automatic shut-off and daylight-responsive controls in commercial spaces, converting optional upgrades into mandatory scope. California Title 24 (2022) pushes demand-responsive dimming on projects above 4 kW, guaranteeing control deployment in virtually every large build. LEED rating systems award points for advanced lighting controls, aligning regulatory pressure with capital markets that now prioritise ESG-ready assets. Because compliance is non-negotiable, the lighting control system market gains a defensive growth pillar that softens macro-economic swings.

High Upfront Installation and Integration Cost

Comprehensive control retrofits still command two- to three-times the capital of basic LED lamp swaps, which discourages smaller businesses. Complex projects rely on skilled commissioning engineers whose limited availability inflates labour fees, especially outside mature regions.Even high-profile hotel retrofits that now yield USD 100,831 annual savings required sizeable capital and a 1.62-year payback, highlighting the cash hurdle that smaller enterprises face. Financing gaps remain widest in emerging markets where energy loans are scarce.

Other drivers and restraints analyzed in the detailed report include:

- Rapid LED Price Erosion Expanding ROI

- Smart-City Programs Using Adaptive Street Lighting

- Interoperability Issues Across Multi-Vendor Ecosystems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware captured 57.4% revenue in 2024 as drivers, sensors, and gateways form the backbone of any intelligent upgrade. Services are poised for the fastest 12.9% CAGR because every significant deployment requires design consultation, site commissioning, and periodic optimisation. The lighting control system market size for services is projected to gain momentum as AI-based analytics demand continuous tuning. Global roll-outs such as Energy Management Collaborative's Bluetooth Mesh project, which involved 3,685 controllers in 43 areas, illustrate service-heavy complexity and recurring revenue potential.

Professional services secure long-term contracts that convert one-time capital projects into predictable cash flows. Firmware updates, fault analytics, and energy reporting increasingly fall under managed-service agreements that enterprises outsource. As a result, hardware vendors bundle lifecycle contracts, pushing the lighting control system market toward solution ecosystems rather than component sales. This strategic shift raises entry barriers for firms that lack design and support resources.

Wired protocols preserved 64.2% share in 2024, valued for EMI immunity and stable latency that mission-critical factories demand. The lighting control system market size tied to wired DALI-2 installations remains considerable among hospitals and data centres where network downtime is unacceptable. Engineers favour deterministic performance and inherent physical security of dedicated cabling.

Wireless deployments are closing the gap at a 15.3% CAGR. Bluetooth Mesh offers self-healing paths and smartphone-based commissioning that slash labour costs. Integration into the Matter ecosystem aligns residential and commercial devices under common management shells, which accelerates specifier acceptance. Thread 1.4 upgrades planned by 2026 will add border-router flexibility, allowing facility teams to scale networks without rewiring. Reduced disruption is compelling for heritage sites and live retail stores where shutdown time is limited.

Lighting Control System Market is Segmented by Offering (Hardware, Software, Services), Communication Protocol (Wired, Wireless), Installation Type (New Construction, Retrofit), Application (Outdoor, Indoor) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 34.5% revenue in 2024 due to strict energy codes and early smart-city adoption. The lighting control system market benefits from federal efficiency programmes and tax incentives that improve investment payback. Utility rebate schemes covering sensor packages further sweeten economics for commercial retrofits. Canadian provinces mirror United States standards, while Mexico's industrial corridors integrate lighting controls into maquiladora expansions to minimise operational spend.

Europe maintains momentum with firm decarbonisation targets set for 2030. Germany, France, and the United Kingdom embed intelligent lighting in public-sector procurement rules. EU taxonomy disclosures oblige property owners to prove energy intensity reductions, which steers capital toward sensor-rich upgrades. Standardisation efforts through DALI-2 and the emerging ETSI EN 303 645 security framework make multi-vendor deployments less risky, reinforcing uptake across the single market.

The Middle East and Africa post the fastest 12.8% CAGR through 2030. Mega-cities under construction in Saudi Arabia and the UAE incorporate control-ready luminaires into master plans from the start. Government budgets earmarked for smart infrastructure keep project pipelines robust even when oil revenues fluctuate. In sub-Saharan Africa, grid instability motivates adoption of sensors that dim loads during voltage dips, protecting equipment and extending luminaire life. Financing backed by development banks helps bridge initial cost hurdles, ensuring sustained volume growth.

- Signify (Philips Lighting)

- Acuity Brands

- Legrand

- Lutron Electronics

- ams OSRAM

- Schneider Electric

- Eaton (Cooper Lighting)

- Hubbell Lighting

- Honeywell

- Cisco Systems

- Siemens (Enlighted)

- Delta Electronics

- Panasonic

- Zumtobel Group

- Helvar

- Synapse Wireless

- WAGO

- Cree Lighting

- Leviton Manufacturing

- Digital Lumens

- ABB

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for energy-efficient lighting systems

- 4.2.2 Stringent building-energy codes and green certification mandates

- 4.2.3 Rapid LED price erosion expanding ROI

- 4.2.4 Smart-city programs using adaptive street lighting

- 4.2.5 ESG-linked finance accelerating smart retrofits

- 4.2.6 Li-Fi readiness unlocking new revenue streams

- 4.3 Market Restraints

- 4.3.1 High upfront installation and integration cost

- 4.3.2 Interoperability issues across multi-vendor ecosystems

- 4.3.3 Cyber-security and data-privacy risks

- 4.3.4 Shortage of qualified commissioning professionals

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (IoT-edge controls, AI, Li-Fi)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.1.1 LED Drivers

- 5.1.1.2 Sensors

- 5.1.1.3 Switches and Dimmers

- 5.1.1.4 Relay Units

- 5.1.1.5 Gateways and Control Panels

- 5.1.2 Software

- 5.1.3 Services

- 5.1.1 Hardware

- 5.2 By Communication Protocol

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By Installation Type

- 5.3.1 New Construction

- 5.3.2 Retrofit

- 5.4 By Application

- 5.4.1 Indoor

- 5.4.1.1 Commercial Offices

- 5.4.1.2 Industrial and Warehousing

- 5.4.1.3 Residential

- 5.4.1.4 Hospitality and Leisure

- 5.4.1.5 Others

- 5.4.2 Outdoor

- 5.4.2.1 Roadway and Street

- 5.4.2.2 Architectural and Facade

- 5.4.2.3 Sports and Stadium

- 5.4.2.4 Others

- 5.4.1 Indoor

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.2.5 Egypt

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Strategic Moves

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Signify (Philips Lighting)

- 6.4.2 Acuity Brands

- 6.4.3 Legrand

- 6.4.4 Lutron Electronics

- 6.4.5 ams OSRAM

- 6.4.6 Schneider Electric

- 6.4.7 Eaton (Cooper Lighting)

- 6.4.8 Hubbell Lighting

- 6.4.9 Honeywell

- 6.4.10 Cisco Systems

- 6.4.11 Siemens (Enlighted)

- 6.4.12 Delta Electronics

- 6.4.13 Panasonic

- 6.4.14 Zumtobel Group

- 6.4.15 Helvar

- 6.4.16 Synapse Wireless

- 6.4.17 WAGO

- 6.4.18 Cree Lighting

- 6.4.19 Leviton Manufacturing

- 6.4.20 Digital Lumens

- 6.4.21 ABB

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment