|

市场调查报告书

商品编码

1851745

行动人工智慧:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Mobile Artificial Intelligence - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

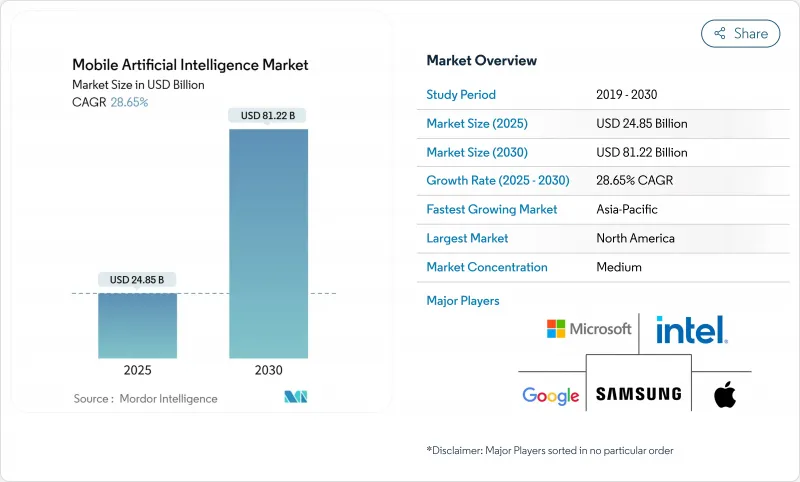

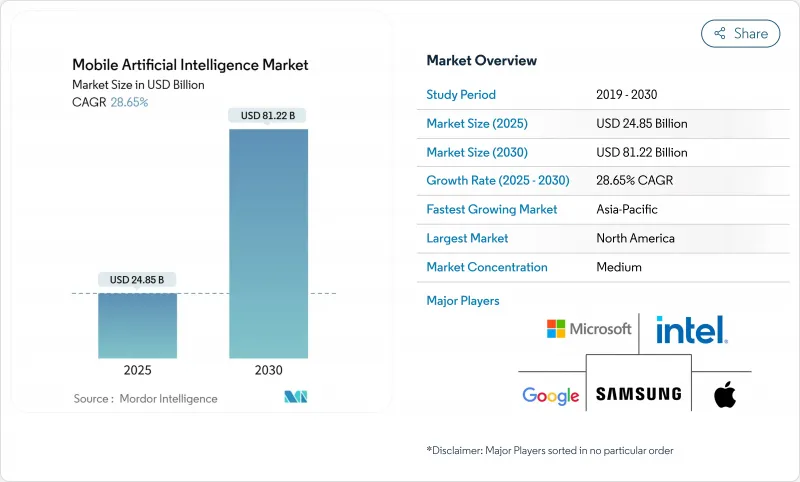

预计到 2025 年,行动人工智慧市场规模将达到 248.5 亿美元,到 2030 年将达到 812.2 亿美元,预测期(2025-2030 年)复合年增长率为 28.65%。

日益严格的资料主权法规、神经处理单元 (NPU) 的快速创新以及企业对低延迟推理的需求是关键的成长要素。高通骁龙 8 Elite 和 ARM Cortex-X925 等突破性晶片设计正在重新定义智慧型手机、汽车和工业设备的性能基准。供应商的策略现在强调垂直整合的软硬体堆迭,以加快产品上市速度并实现差异化的装置端 AI 功能。先进基板和高频宽记忆体的供应链限制仍然影响着价格和供货,但亚太地区的产能扩张表明,这种情况在 2026 年后有望得到缓解。

全球行动人工智慧市场趋势与洞察

对人工智慧处理器的需求激增

人工智慧晶片组的空前普及正在重塑设备架构。 ARM 的 3nm Cortex-X925 处理器在 3.8GHz 的主频下,吞吐量比上一代核心提升了 46%,同时保持了适用于高阶行动电话的功耗上限。像高通和英伟达这样获得长期晶圆代工厂订单的代工厂,能够降低供应风险,确保具有竞争力的成本结构。三星 Galaxy S25 的 NPU 效能提升了 40%,凸显了效能行销策略的转变,即从传统的 CPU 指标转向持续的 AI 推理能力。晶片需求也推动了固态散热技术的创新,使得手持外形规格也能实现 25 瓦的散热能力。由此带来的效能余量加速了对话式介面、即时视觉和装置端分析等过去依赖云端服务的应用。

搭载生成式人工智慧技术的智慧型手机发布

生成式人工智慧正从旗舰机型走向大众市场。 Canalys预测,到2028年,全球54%的行动电话出货量将具备人工智慧功能,这快速普及的趋势与以往LTE技术的过渡类似。苹果的神经网路引擎目前可为即时通讯提供装置端情境建模,而三星的Galaxy AI则提供即时翻译和内容创作功能。印度市场对价格的敏感度阻碍了人工智慧的普及。预计到2024年,售价低于600美元的设备仅占出货量的4-5%,将限制人工智慧的早期应用。为了弥合这一差距,联发科发布了天玑9400,这是一款专为中阶装置打造的整合式NPU晶片。 OPPO已承诺透过与Google和微软的合作,在5000万部设备中嵌入生成式人工智慧功能。

AI晶片组定价较高

入门级AI智慧型手机的售价仍在600美元左右,这限制了其在具备大规模生产能力的新兴经济体中的普及。美光和SK海力士已将产能预留至2025年,导致高频宽记忆体持续短缺,材料成本不断上涨。台积电CoWoS生产线的封装瓶颈也为行动装置製造商带来了额外的成本压力。厂商的因应策略是分层设计功能集:透过对传统晶片进行软体最佳化来实现基本的AI功能,而高阶机型则增加了先进的NPU加速功能。 2026年起,台湾和日本的新晶圆厂运作,可望逐步缩小AI晶片组和非AI晶片组之间的价格差距。

细分市场分析

智慧型手机将在2024年占据56%的收入份额,而车载应用预计到2030年将以29.40%的复合年增长率增长,因为对话式车载助手和自动驾驶功能正从高端配置走向主流功能。随着L3级高速公路自动驾驶系统成为高阶车型的标配,车载系统的行动人工智慧市场规模预计将迅速扩张。 SoundHound与腾讯的伙伴关係证明,多语言语音控制可以与现有的资讯娱乐系统整合。相机应用将继续在夜间模式和降噪流程中采用人工智慧技术,而无人机将利用边缘推理技术在无GNSS讯号覆盖区域实现避障。

汽车产业的高速成长反映了电控系统的结构性变革,人工智慧正在管理感知、意图预测和个人化使用者体验。宾士正透过其CARIAD平台整合大规模语言模型,以学习驾驶员的驾驶习惯并主动安排保养服务。工业机器人和医疗穿戴式装置代表了其他高价值的细分市场,凸显了行动人工智慧市场已从消费者通讯扩展到关键任务。

到2024年,硬体支出将占总支出的64%,这主要得益于NPU、GPU以及嵌入式毫米波感测器的普及。然而,随着企业将模型训练、微调和生命週期管理外包,业务收益预计将以27.00%的复合年增长率成长。 Verizon和SK Telecom提供的託管服务将云端GPU、边缘节点和编配软体捆绑在一起,使企业无需前期投资即可添加人工智慧功能。 ARM的Kleidi等软体库可加速通用CPU上的N维张量运算,进而提高晶片的利用率。

感测器技术的演进进一步模糊了硬体和软体之间的界限,其整合的微控制器能够本地运行初步的人工智慧程式。由此产生的数据经济为分析、更新和合规服务创造了持续的收入来源,检验了平台模式将如何再形成行动人工智慧市场。

行动装置与其他应用程式(智慧型手机、相机、无人机、机器人、汽车和其他应用)、组件(硬体、软体和服务)、技术(CPU、GPU、NPU/AI 加速器、DSP)、处理类型(设备端/边缘、云端基础和混合)、终端用户产业(消费性电子、汽车和移动出行、工业和製造业等)以及工业地区製造业等)以及工业地区製造业等)以及进行人工智慧细分。

区域分析

预计到2024年,北美将占全球营收份额的35%,这主要得益于企业快速采用私有5G和边缘节点来託管本地AI工作负载。包括OpenAI 400亿美元资金筹措在内的大规模资金筹措,进一步巩固了该地区在基础模型研究和商业性应用领域的领先地位。政府拨款和国防合约也进一步刺激了对符合严格合规标准的安全设备端解决方案的需求。

亚太地区是成长最快的地区,预计到2030年将以24.80%的复合年增长率成长,这主要得益于Softbank Corporation9.6亿美元的基础设施计画和SK集团65亿美元的资料中心建设。日本的Cristal Intelligence计画和韩国的GPU即服务将使缺乏内部专业知识的中型企业也能获得人工智慧能力。在印度,智慧型手机在农村地区的普及以及本土语言模型计划的推进表明下游需求强劲。

欧洲正受益于以德国、法国和英国主导的稳定扩张,这三个国家都将欧盟人工智慧法律下的严格隐私规则与汽车和产业政策融合。中东正将石油收入投入人工智慧中心建设,而非洲则利用行动优先的使用模式,在农业和金融科技领域试行人工智慧服务。整体而言,区域差异主要体现在基础设施成熟度、法规环境和设备价格等方面,这些因素共同影响行动人工智慧市场的部署速度。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对人工智慧处理器的需求激增

- 搭载生成式人工智慧技术的智慧型手机发布

- 提高边缘人工智慧晶片的能源效率

- 消费者隐私和低延迟需求

- 行动优化型LLM框架

- 5G通讯人工智慧功能包

- 市场限制

- AI晶片组定价较高

- 热预算和功率预算限制

- 对设备端资料的监管

- 先进基板供应短缺

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 智慧型手机

- 相机

- 无人机

- 机器人技术

- 车

- 其他用途

- 按组件

- 硬体(人工智慧晶片组、感测器)

- 软体(SDK、框架)

- 服务(整合、维护)

- 透过技术

- CPU

- GPU

- NPU/AI加速器

- DSP

- 按处理类型

- 设备端/边缘端

- 云端基础的

- 杂交种

- 按最终用户行业划分

- 消费性电子产品

- 汽车与出行

- 工业和製造业

- 医疗保健和生命科学

- 国防/航太

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Qualcomm Technologies

- Apple Inc.

- Samsung Electronics

- MediaTek Inc.

- Huawei Technologies(HiSilicon)

- Alphabet Inc.(Google)

- Nvidia Corporation

- Intel Corporation

- Microsoft Corporation

- IBM Corporation

- ARM Ltd.

- OPPO

- Xiaomi Corp.

- Vivo

- Honor Device Co.

- Baidu Inc.

- TSMC

- Synopsys

- Cadence Design Systems

- Graphcore

- Cerebras Systems

第七章 市场机会与未来展望

The Mobile Artificial Intelligence Market size is estimated at USD 24.85 billion in 2025, and is expected to reach USD 81.22 billion by 2030, at a CAGR of 28.65% during the forecast period (2025-2030).

Heightened regulatory focus on data sovereignty, rapid neural-processing-unit (NPU) innovation, and enterprise demand for low-latency inference are the primary growth catalysts. Breakthrough chip designs such as Qualcomm's Snapdragon 8 Elite and ARM's Cortex-X925 are resetting performance baselines for smartphones, vehicles, and industrial devices. Vendor strategies now emphasize vertically integrated hardware-software stacks that shorten time-to-market and enable differentiated on-device AI features. Supply-chain constraints in advanced substrates and high-bandwidth memory continue to influence pricing and availability, yet committed capacity expansions in Asia Pacific signal relief after 2026.

Global Mobile Artificial Intelligence Market Trends and Insights

AI-Capable Processor Demand Surge

Unprecedented uptake of AI-centric chipsets is reshaping device architecture. ARM's 3 nm Cortex-X925 delivers 46% higher throughput than prior cores at 3.8 GHz while holding power ceilings suitable for premium phones. Manufacturers securing long-term foundry allocation, such as Qualcomm and NVIDIA, mitigate supply risk and lock in competitive cost structures. Samsung's Galaxy S25 showcases a 40% NPU boost, underscoring how performance marketing has shifted from general CPU metrics to sustained AI inference capability. Chip demand is also driving innovation in solid-state cooling that supports 25-watt dissipation in handheld form factors. The resulting performance headroom accelerates conversational interfaces, real-time vision, and on-device analytics that previously relied on cloud services.

Generative-AI Smartphone Launches

Generative AI is moving from flagship exclusivity toward mass-market availability. Canalys projects that 54% of global handset shipments will be AI-ready by 2028, a steep adoption curve that mirrors past LTE transitions. Apple's Neural Engine now performs on-device context modeling for messaging, while Samsung's Galaxy AI offers live translation and content drafting. Price sensitivity in India illustrates adoption friction: sub-USD 600 devices represent only 4-5% of 2024 shipments, limiting early AI penetration. To bridge the gap, MediaTek introduced Dimensity 9400 with an integrated NPU tuned for mid-range handsets. Enterprise fleets also drive volume, with OPPO pledging to embed generative-AI features in 50 million units via Google and Microsoft partnerships.

Premium Pricing of AI Chipsets

Entry-level AI smartphones still debut near USD 600, limiting penetration in high-volume growth economies. High-bandwidth-memory shortages persist because Micron and SK Hynix have capacity booked out through 2025, sustaining elevated bill-of-materials costs. Packaging bottlenecks around TSMC's CoWoS lines add further cost pressure for mobile device makers. Vendors respond by tiering feature sets: essential AI functions are delivered via software optimization on legacy silicon, while premium models add advanced NPU acceleration. New fabs coming online in Taiwan and Japan after 2026 may gradually reduce the price delta between AI and non-AI chipsets.

Other drivers and restraints analyzed in the detailed report include:

- Edge-AI Chip Energy-Efficiency Gains

- Consumer Privacy and Low-Latency Need

- Thermal and Power-Budget Constraints

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartphones retained 56% of 2024 revenue, yet automotive applications are set to post a 29.40% CAGR through 2030 as conversational in-car assistants and autonomous functions transition from luxury options to mainstream features. The mobile artificial intelligence market size for automotive systems is projected to scale rapidly once Level-3 highway pilots become standard equipment in premium models. Partnerships like SoundHound-Tencent prove that multilingual voice control can be integrated with existing infotainment stacks. Camera apps continue adopting AI for night-mode and de-noise pipelines, while drones leverage edge inference for obstacle avoidance in GNSS-denied zones.

High growth in vehicles reflects structural changes in electronic control units, where AI now governs perception, intent prediction, and personalized user experience. Mercedes-Benz integrates large language models via CARIAD platforms that learn driver routines and proactively schedule servicing. Industrial robots and medical wearables represent additional high-value niches, underscoring how the mobile artificial intelligence market is broadening beyond consumer messaging to mission-critical domains.

Hardware held 64% of the 2024 spend thanks to NPUs, GPUs, and mm-wave sensors embedded across devices. Nevertheless, services revenue is forecast to climb 27.00% CAGR as enterprises outsource model training, fine-tuning, and lifecycle management. Managed offerings from Verizon and SK Telecom bundle cloud GPUs, edge nodes, and orchestration software, letting firms add AI features without upfront capex. Software libraries such as ARM's Kleidi accelerate N-dimensional tensor operations on generic CPUs, improving utilization of installed silicon.

Sensor evolution further blurs hardware-software boundaries by embedding micro-controllers that execute first-pass AI locally. The resulting data economy creates recurring revenue for analytics, updates, and compliance services, validating how platform models reshape the mobile artificial intelligence market.

The Mobile Artificial Intelligence Market Report is Segmented by Application (Smartphone, Camera, Drone, Robotics, Automotive, and Other Applications), Component (Hardware, Software, and Services), Technology (CPU, GPU, NPU/AI Accelerator, and DSP), Processing Type (On-device/Edge, Cloud-Based, and Hybrid), End-User Industry (Consumer Electronics, Automotive and Mobility, Industrial and Manufacturing, and More), and Geography.

Geography Analysis

North America held 35% revenue share in 2024 as enterprises rapidly deployed private 5G and edge nodes to host on-premises AI workloads. Large funding rounds, including OpenAI's USD 40 billion raise, reinforce the region's leadership in foundational-model research and commercial adoption. Government grants and defense contracts further stimulate demand for secure on-device solutions that meet stringent compliance standards.

Asia Pacific is the fastest-growing territory with a 24.80% CAGR through 2030, propelled by SoftBank's USD 960 million infrastructure plan and SK Group's USD 6.5 billion data-center build-out. Japan's Cristal Intelligence initiative and South Korea's GPU-as-a-Service offerings extend AI capabilities to mid-market enterprises without in-house expertise. India's smartphone expansion into rural districts and indigenous language model projects point to robust downstream demand.

Europe contributes steady expansion led by Germany, France, and the United Kingdom, each aligning automotive and industrial policy with strict privacy rules under the EU AI Act. The Middle East is channeling oil-windfall funds into AI hubs, while Africa leverages mobile-first usage patterns to pilot AI services in agriculture and fintech. Altogether, regional divergences center on infrastructure maturity, regulatory climate, and device affordability, factors that collectively shape deployment velocity in the mobile artificial intelligence market.

- Qualcomm Technologies

- Apple Inc.

- Samsung Electronics

- MediaTek Inc.

- Huawei Technologies (HiSilicon)

- Alphabet Inc. (Google)

- Nvidia Corporation

- Intel Corporation

- Microsoft Corporation

- IBM Corporation

- ARM Ltd.

- OPPO

- Xiaomi Corp.

- Vivo

- Honor Device Co.

- Baidu Inc.

- TSMC

- Synopsys

- Cadence Design Systems

- Graphcore

- Cerebras Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-capable processor demand surge

- 4.2.2 Generative-AI smartphone launches

- 4.2.3 Edge-AI chip energy-efficiency gains

- 4.2.4 Consumer privacy and low-latency need

- 4.2.5 Mobile-optimised LLM frameworks

- 4.2.6 5G-telco AI-feature bundles

- 4.3 Market Restraints

- 4.3.1 Premium pricing of AI chipsets

- 4.3.2 Thermal and power-budget constraints

- 4.3.3 Regulatory scrutiny on on-device data

- 4.3.4 Advanced substrate supply crunch

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphone

- 5.1.2 Camera

- 5.1.3 Drone

- 5.1.4 Robotics

- 5.1.5 Automotive

- 5.1.6 Other Applications

- 5.2 By Component

- 5.2.1 Hardware (AI Chipsets, Sensors)

- 5.2.2 Software (SDKs, Frameworks)

- 5.2.3 Services (Integration, Maintenance)

- 5.3 By Technology

- 5.3.1 CPU

- 5.3.2 GPU

- 5.3.3 NPU/AI Accelerator

- 5.3.4 DSP

- 5.4 By Processing Type

- 5.4.1 On-device/Edge

- 5.4.2 Cloud-based

- 5.4.3 Hybrid

- 5.5 By End-user Industry

- 5.5.1 Consumer Electronics

- 5.5.2 Automotive and Mobility

- 5.5.3 Industrial and Manufacturing

- 5.5.4 Healthcare and Life-Sciences

- 5.5.5 Defense and Aerospace

- 5.5.6 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Qualcomm Technologies

- 6.4.2 Apple Inc.

- 6.4.3 Samsung Electronics

- 6.4.4 MediaTek Inc.

- 6.4.5 Huawei Technologies (HiSilicon)

- 6.4.6 Alphabet Inc. (Google)

- 6.4.7 Nvidia Corporation

- 6.4.8 Intel Corporation

- 6.4.9 Microsoft Corporation

- 6.4.10 IBM Corporation

- 6.4.11 ARM Ltd.

- 6.4.12 OPPO

- 6.4.13 Xiaomi Corp.

- 6.4.14 Vivo

- 6.4.15 Honor Device Co.

- 6.4.16 Baidu Inc.

- 6.4.17 TSMC

- 6.4.18 Synopsys

- 6.4.19 Cadence Design Systems

- 6.4.20 Graphcore

- 6.4.21 Cerebras Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment