|

市场调查报告书

商品编码

1851750

汽车点火器线圈:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automotive Ignition Coil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

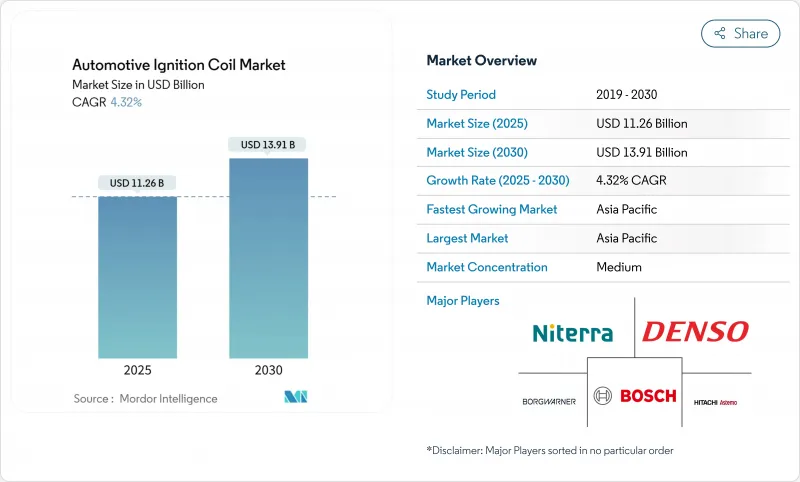

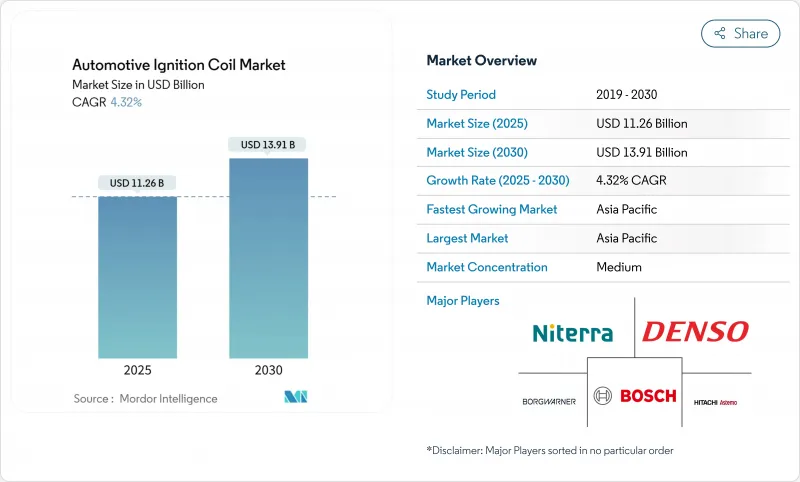

预计到 2025 年汽车点火器线圈市场规模将达到 112.6 亿美元,到 2030 年将达到 139.1 亿美元,年复合成长率为 4.32%。

亚太地区轻型汽车产量不断增长、点火线圈(COP)技术的持续主导地位以及旧款车型灵活的换代週期,都在支撑着汽车点火线圈市场的成长。汽车製造商正在针对小型化涡轮增压引擎优化点火系统设计。同时,铜价上涨和稀土磁体供应风险挤压了供应商的利润空间,而纯电动车(BEV)的普及则凸显了长期需求的上限。这些相互矛盾的因素使得汽车点火器线圈市场处于传统内燃机需求与快速电气化未来发展之间的战略十字路口。

全球汽车点火器线圈市场趋势及洞察

全球乘用车和轻型商用车产量增加

全球汽车生产持续从低迷中復苏,尤其是在亚太地区,预计2024年上半年产业销售额将成长7%。由于轻型商用车的电气化进程比乘用车落后约五年,汽车点火器线圈市场受益于产量的增加。汽车製造商也正在推出保留内燃机(ICE)的48V轻度混合动力平台,这在降低排放的同时增加了对点火线圈的需求。为满足欧7排放标准,对精确点火正时的重视也为支援单缸控制的COP组件提供了发展动力。这些因素共同推动了点火线圈市场的稳定成长。

老旧公园的维修需求

到2024年,美国的平均车龄将达到12.5年。老旧车辆需要更频繁的保养,这催生了蓬勃发展的点火线圈售后市场。 Standard Motor Products公司已提供800种SKU,覆盖率高达99%;而NGK的欧洲产品涵盖420个零件编号,适用于87%的车型。独立研讨会依赖广泛的兼容性,这使得售后市场成为一个利润日益丰厚的管道。老旧车型报废前的这段时间,至少在一个车型週期内,为售后市场提供了稳定的收入来源。

纯电动车的普及将淘汰传统的点火系统。

电动车省去了整个火花点火器装置,维护成本最多可降低 40%。Denso预测,到 2035 年,纯电动车将占据全球产量的大部分,供应商的重心将转向电池、逆变器和热感管理模组。乘用车领域最初将出现最严重的下滑,而由于续航里程和负载容量的限制,重型商用车可能会落后。然而,这种发展方向的转变将限制未来点火线圈的产量。

细分市场分析

缸内点火线圈系统被认为是汽车点火器线圈市场的主要成长引擎,预计到2024年将占据51.33%的市场份额,复合年增长率(CAGR)为6.32%。这种设计无需高压导线,降低了电磁损耗,并支援涡轮增压引擎所需的先进爆震控制策略。缸体点火线圈和油轨组件在对成本敏感的车型中仍然具有竞争力,尤其是在新兴国家的入门市场。

OEM厂商的案例研究也印证了这一转变:博世在宝马车型中引入了弹簧触点式点火线圈(COP),以提高火星塞连接的可靠性;Denso的产品蓝图则将无分电器解决方案列为核心产品线。结合48V马达和内燃机的混合动力传动系统将需要每个汽缸配备一个点火线圈,这将使COP点火线圈在2030年之前保持领先地位。价格优势、安装简单以及改进的引擎管理意味着COP点火线圈将继续处于汽车点火器线圈市场的前沿。

由于製造流程成熟、可靠性高且成本低,单一火星塞设计预计在2024年将占总销售量的62.41%。然而,随着高端汽车製造商追求更高的燃烧效率,双火星塞装置预计将实现5.97%的复合年增长率。鑑于巴西灵活燃料汽车中乙醇含量各不相同,多个点火点有利于火焰的稳定传播。

博格华纳的多火花点火系统展示了供应商如何透过延长点火持续时间或提供顺序脉衝来优化燃烧。随着监管机构收紧颗粒物排放限制,双火花点火系统的价值将日益凸显。然而,单火星点火系统庞大的装置量以及与多种引擎混合气的兼容性,将确保在整个预测期内,采用这种配置的汽车点火器线圈的市场规模仍将保持可观。

区域分析

汽车点火器线圈市场由亚太地区主导,市占率高达46.21%,年复合成长率达6.97%。预计到2024年,中国汽车产业销售额将达到10兆元人民币,其中国产品牌占比高达61.9%,将推动强劲的线圈需求。日本製造商如NGK绝缘体正向全球出口先进的产品,而印度低成本的市场环境也吸引了大量投资,用于OEM供应和售后市场出口。北美市场虽然成熟,但盈利。平均车龄12.5年确保了售后市场的稳定需求,而美国环保署(EPA)严格的法规也保证了高端线圈在现有内燃机平台上的市场地位。

欧洲正努力在积极的纯电动车政策和暂定的欧7排放标准之间寻求平衡。在电池平台规模化之前,汽车製造商必须安装高功率点火线圈以满足颗粒物排放法规的要求。 NGK 87%的售后市场覆盖率使其能够为老旧的汽油车和轻度混合动力车提供零件。南美洲的发展主要得益于巴西的灵活燃料生态系统,该国82%的轻型车辆使用乙醇混合燃料,这增加了点火线圈的应力,也对耐腐蚀设计提出了更高的要求。巴西的乙醇产量在2023年达到了353亿公升。

中东和非洲的贡献目前仍然较小,但随着汽车普及率的提高,其份额将逐步成长。政治不稳定和货币波动使物流变得复杂,但日本和中国品牌在奈及利亚、埃及和南非的本地组装正在创造线圈市场机会。整体而言,地理多样性能够缓衝单一地区市场衝击对汽车点火器线圈市场的影响。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球乘用车和轻型商用车产量增加

- 老化雪橇的售后市场更换需求

- 严格的废气排放法规推动了高性能线圈的发展

- 小型涡轮增压汽油引擎需要COP线圈

- 新兴市场的灵活燃料计划需要坚固耐用的线圈

- 智慧诊断线圈在连网汽车中的应用现状

- 市场限制

- 纯电动车的普及将取代传统的点火系统。

- 铜和稀土元素磁铁的价格波动

- 48V混合动力架构减少了每辆车的线圈数量。

- 低压等离子点火技术的出现

- 价值/供应链分析

- 技术展望

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 点火器线圈

- 缸内点火线圈(COP)

- 点火器线圈导轨

- 运行原理

- 单火花技术

- 双火花技术

- 透过分销管道

- OEM

- 售后市场

- 按车辆类型

- 搭乘用车

- 商用车辆

- 按地区

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 埃及

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NGK Spark Plug Co. Ltd(Niterra)

- Denso Corporation

- Robert Bosch GmbH

- Hitachi Astemo Ltd

- Diamond Electric Holdings Co. Ltd

- Taiwan Ignition System Co. Ltd

- BorgWarner Inc.(incl. Delphi Technologies)

- Eldor Corporation

- Valeo SA

- Continental AG

- Mitsubishi Electric Corporation

- Standard Motor Products Inc.

- Federal-Mogul(Tenneco)

- Mahle GmbH

- Walker Products Inc.

第七章 市场机会与未来展望

The automotive ignition coil market size is sized at USD 11.26 billion in 2025 and is forecast to touch USD 13.91 billion by 2030, advancing at a 4.32% CAGR.

Rising light-vehicle output in Asia Pacific, continued dominance of coil-on-plug (COP) technology, and a resilient replacement cycle in mature fleets collectively underpin growth. OEMs are fine-tuning ignition designs for turbocharged downsized engines that must comply with near-term Euro 7 limits, while the aftermarket benefits from the 12.5-year average vehicle age in the United States. At the same time, elevated copper prices and supply risks for rare-earth magnets are compressing supplier margins, and battery-electric-vehicle (BEV) penetration sets a clear upper bound on long-term demand. These crosscurrents place the automotive ignition coil market at a strategic pivot between legacy combustion needs and a rapidly electrifying future.

Global Automotive Ignition Coil Market Trends and Insights

Rising Global Production of Passenger and Light Commercial Vehicles

Vehicle volumes continue to rebound from pandemic lows, especially in Asia Pacific, where industry revenue climbed 7% in 1H 2024. Production upswings favor the automotive ignition coil market because light commercial electrification trails passenger adoption by roughly five years. Automakers are also rolling out 48V mild-hybrid platforms that keep internal-combustion engines (ICE) in play, extending coil demand while cutting emissions. The emphasis on precise ignition timing to satisfy Euro 7 creates tailwinds for COP assemblies that support individual-cylinder control. Together, these forces add a moderate uplift to the growth trajectory.

Aftermarket Replacement Demand From Ageing Parc

Average fleet age reached 12.5 years in the United States during 2024. Older vehicles require more frequent service, which supports a vibrant aftermarket for coils. Standard Motor Products already fields 800 SKUs with 99% coverage, while NGK's European range covers 420-part numbers that fit 87% of vehicles on the road. Independent workshops rely on broad compatibility, making the aftermarket an increasingly lucrative channel. The time buffer before legacy vehicles retire creates a durable revenue stream for at least one model cycle.

BEV Penetration Eliminates Conventional Ignition Systems

Electric cars remove the entire spark-ignition assembly, cutting maintenance costs by up to 40%. DENSO projects BEVs will dominate global production by 2035, prompting suppliers to pivot toward battery, inverter, and thermal-management modules . Passenger segments will see the sharpest drop first, while heavier commercial classes will transition later due to range and payload limits. Nonetheless, the directional shift places a ceiling on future coil volumes.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Emission Norms Pushing High-Performance Coils

- Turbo-Charged Downsized Gasoline Engines Need COP Coils

- Price Volatility of Copper and Rare-Earth Magnets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coil-on-plug systems accounted for 51.33% of 2024 revenue, and their 6.32% CAGR positions them as the clear growth engine for the automotive ignition coil market. The design removes high-voltage leads, reduces electromagnetic loss, and supports advanced knock-control strategies demanded by turbocharged engines. Block coils and rail assemblies stay competitive in cost-sensitive models, especially in entry-level segments across emerging economies.

OEM case studies reinforce the shift: Bosch introduced a spring-contact COP for BMW models to improve spark-plug connection reliability, while DENSO's portfolio roadmap highlights distributor-less solutions as a core product line. Hybrid powertrains, which blend a 48 V e-motor with an ICE, still require one coil per cylinder, securing volume for COP units through 2030. Competitive pricing, simplified installation, and incremental engine-management gains will keep COP at the center of the automotive ignition coil market narrative.

Single-spark designs owned 62.41% of sales in 2024, reflecting mature manufacturing, proven reliability, and lower cost. Yet dual-spark units are tracking a 5.97% CAGR as premium OEMs chase further combustion efficiency. In Brazil's flex-fuel fleet, variable ethanol content makes multiple ignition points advantageous for stable flame propagation.

BorgWarner's multi-spark line illustrates how suppliers extend dwell time or deliver sequential pulses to optimize burn time. Dual-spark value scales when regulators tighten particulate limits. Even so, single-spark's sizeable installed base and compatibility with a broad engine mix mean that the automotive ignition coil market size for this configuration will remain substantial through the forecast horizon.

The Automotive Ignition Coil Market Report is Segmented by Type (Block Ignition Coils, Coil On Plug, and More), Operating Principle (Single Spark Technology and Dual Spark Technology), Distribution Channel (OEM and Aftermarket), Vehicle Type (Passenger Cars and Commercial Vehicles), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific leads the automotive ignition coil market with 46.21% share and is on pace for 6.97% CAGR. China recorded auto-industry revenue of 10 trillion yuan in 2024, and domestic brands accounted for 61.9% of sales, driving strong local coil demand. Japanese manufacturers such as NGK ship advanced units worldwide, while India's low-cost base draws investment for OEM supply and aftermarket export. North America is a mature but profitable arena; the 12.5-year average fleet age secures steady aftermarket pull, and strict U.S. EPA rules keep premium coils relevant for remaining ICE platforms.

Europe balances aggressive BEV policy with interim Euro 7 compliance. Automakers must fit high-output coils to meet particulate limits until battery platforms scale, and NGK's 87% aftermarket coverage ensures part availability for aging gasoline and mild-hybrid fleets. South America is driven by Brazil's flex-fuel ecosystem, where 82% of the light-vehicle park runs on ethanol blends, a scenario that raises coil stress and boosts demand for corrosion-resistant designs; Brazil's ethanol output reached 35.3 billion liters in 2023 .

The Middle East and Africa remain smaller contributors yet record incremental gains as motorization rates climb. Political instability and currency volatility complicate logistics, but localized assembly by Japanese and Chinese brands is opening coil opportunities in Nigeria, Egypt, and South Africa. Overall, geographic diversity cushions the automotive ignition coil market against single-region shocks.

- NGK Spark Plug Co. Ltd (Niterra)

- Denso Corporation

- Robert Bosch GmbH

- Hitachi Astemo Ltd

- Diamond Electric Holdings Co. Ltd

- Taiwan Ignition System Co. Ltd

- BorgWarner Inc. (incl. Delphi Technologies)

- Eldor Corporation

- Valeo SA

- Continental AG

- Mitsubishi Electric Corporation

- Standard Motor Products Inc.

- Federal-Mogul (Tenneco)

- Mahle GmbH

- Walker Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Global Production of Passenger and Light Commercial Vehicles

- 4.2.2 Aftermarket Replacement Demand From Ageing Parc

- 4.2.3 Stringent Emission Norms Pushing High-Performance Coils

- 4.2.4 Turbo-Charged Downsized Gasoline Engines Need COP Coils

- 4.2.5 Flex-Fuel Programs in Emerging Markets Require Robust Coils

- 4.2.6 Connected-Vehicle Smart-Diagnostic Coils Adoption

- 4.3 Market Restraints

- 4.3.1 BEV Penetration Eliminates Conventional Ignition Systems

- 4.3.2 Price Volatility of Copper and Rare-Earth Magnets

- 4.3.3 48 V Hybrid Architectures Cutting Coil Count per Vehicle

- 4.3.4 Emergence of Low-Tension Plasma Ignition Techs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Type

- 5.1.1 Block Ignition Coils

- 5.1.2 Coil-on-Plug (COP)

- 5.1.3 Ignition Coil Rail

- 5.2 By Operating Principle

- 5.2.1 Single Spark Technology

- 5.2.2 Dual Spark Technology

- 5.3 By Distribution Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 By Vehicle Type

- 5.4.1 Passenger Cars

- 5.4.2 Commercial Vehicles

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Egypt

- 5.5.5.4 Turkey

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 NGK Spark Plug Co. Ltd (Niterra)

- 6.4.2 Denso Corporation

- 6.4.3 Robert Bosch GmbH

- 6.4.4 Hitachi Astemo Ltd

- 6.4.5 Diamond Electric Holdings Co. Ltd

- 6.4.6 Taiwan Ignition System Co. Ltd

- 6.4.7 BorgWarner Inc. (incl. Delphi Technologies)

- 6.4.8 Eldor Corporation

- 6.4.9 Valeo SA

- 6.4.10 Continental AG

- 6.4.11 Mitsubishi Electric Corporation

- 6.4.12 Standard Motor Products Inc.

- 6.4.13 Federal-Mogul (Tenneco)

- 6.4.14 Mahle GmbH

- 6.4.15 Walker Products Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment