|

市场调查报告书

商品编码

1851760

柔性管道:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Flexible Pipe - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

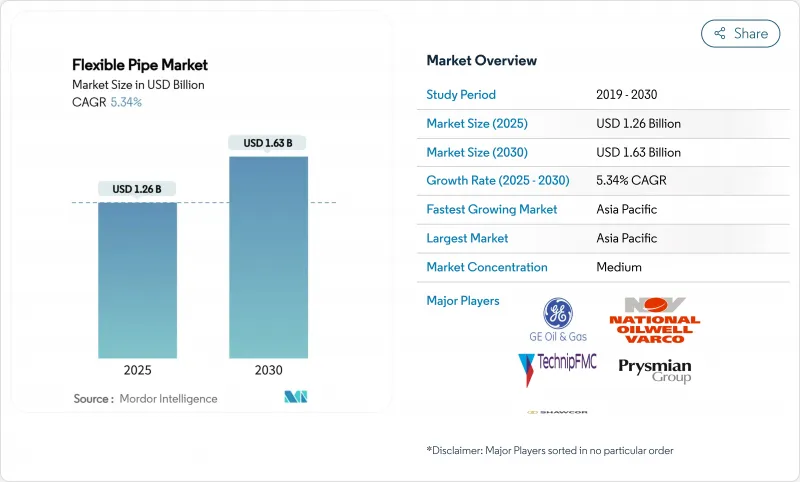

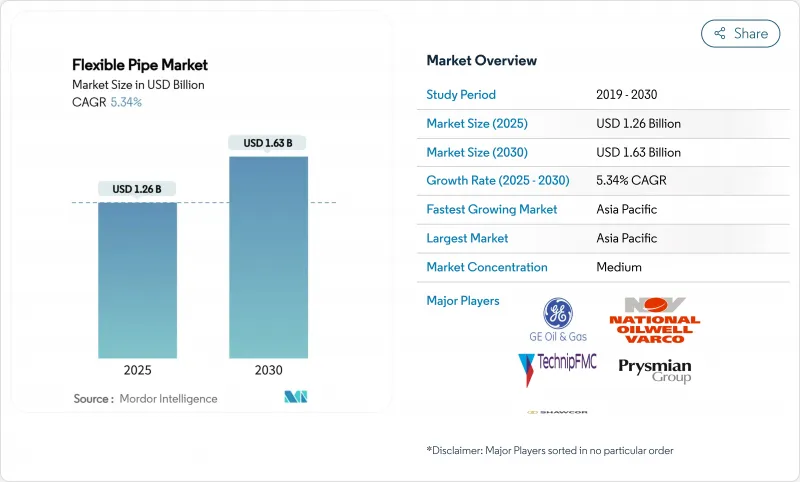

预计到 2025 年,柔性管道市场规模将达到 12.6 亿美元,到 2030 年将达到 16.3 亿美元,预测期内复合年增长率为 5.34%。

这一成长归功于深水和超深水探勘计画、用于缓解腐蚀的快速材料创新,以及巴西和圭亚那盐层下开发的扩张。行业领导者正在嵌入光纤感测器,以提供即时完整性数据,从而减少停机时间并延长资产寿命。亚太地区占据重要地位,这主要得益于中国、印度和澳洲的近海项目,以及降低物流成本的本土製造业的支持。在材料方面,高密度聚苯乙烯(HDPE) 仍然是营运商的首选,但对轻量化需求的不断增长促使碳纤维和其他复合材料解决方案获得青睐。加速的垂直整合策略,例如 Saipem 和 Subsea7 的拟议合併,透过将工程、采购、施工和安装 (EPCI) 能力整合到同一家公司旗下,正在重塑竞争格局。

全球柔性管道市场趋势与洞察

深海与超深海开发扩张

复杂的海底地形使得刚性钢管系统成本过高,促使操作员批准长度超过1500公尺的计划。雪佛龙公司的安克油田已运作20 ksi的海底硬件,为柔性管道市场树立了新的性能标竿。在巴西的盐层下地层中,二氧化碳引起的腐蚀应力出现在水深2900公尺处,使得拥有成熟复合材料材料技术的供应商更具优势。像TechnipFMC的iEPCI这样的系统级承包模式可以将工期缩短高达20%,从而进一步推动了对整合式柔性解决方案的需求。

用复合材料取代腐蚀的钢管

海上腐蚀造成的年损失高达25亿美元,因此,避免使用阴极保护的复合材料正变得越来越经济。 Saipem公司的塑胶衬里管道技术可在保持1000巴耐压性能的同时,降低40%的成本。北海业者面临长达1万公里、建于1990年以前的老旧管网。柔性管道系统无需重型起重设备即可插入现有管道,从而减少维修的停机时间。贝克休斯公司将感测器整合到非金属产品中,提供完整性分析,取代了耗时且耗力的巡检工作。

原油价格波动抑制了资本支出。

每桶70-90美元的价格波动会延缓最终的投资决策。利率上升会提高审核阈值,进一步拖延许可核准。成熟的北海和墨西哥湾油田尤其容易受到影响,因为柔性管道的成本占计划总资本支出的20%之多,使得专案的经济效益对价格非常敏感。

细分市场分析

预计到2024年,高密度聚乙烯(HDPE)柔性管道市场规模将达到4.5亿美元,占总营收的35.75%。操作员看重HDPE的挤出成本低、化学惰性以及无需焊接的连接方式。然而,其他材料,主要是碳纤维和先进聚合物,预计将以8.42%的复合年增长率增长,超过现有材料,因为浮体式生产系统为了便于上部模组装载,正在寻求减轻重量。雪梨大学预测,到2030年,碳纤维增强复合材料(CFRP)废弃物将达到50万吨,这将增加对循环经济的需求,并可能促使研发方向转向可回收树脂。

材料创新推动柔性管市场份额成长,提升了其疲劳寿命和工作温度范围。先进的PA和PVDF层可实现130°C的工作温度,从而扩大了柔性管在高温高压井中的应用。热塑性复合管(TCP)结合了碳纤维拉伸套管和PA12内衬,实现了零腐蚀和低摩擦流动特性。随着深水作业的扩展,复合材料的应用日益普及,预计2030年,其他材料将占据柔性管市场三分之一的份额。

采用多层铠装结构、可有效分离环向和轴向载荷的非黏结式结构,预计2024年将占全球销售额的45.65%。其可修復性使其非常适合动态立管应用。然而,随着操作员追求防腐蚀性能和更轻的平台载重,无金属汽车胎体的增强型热塑性管的年复合成长率将达到7.34%。 FlexSteel的可捲绕式RTP解决方案无需阳极氧化和涂层宣传活动,从而降低了现有棕地连接的运作成本。

柔性管道市场中的结构选择取决于疲劳、压力和化学腐蚀。黏结管道在超高压输油管线领域占有一席之地,但其缺点在于现场维修选择有限且成本高昂。芳香聚酰胺和玻璃纤维缠绕技术的创新,以及能够追踪疲劳累积的数位双胞胎技术,有望使RTP(快速技术管道)突破强度限制,进入此前因强度限製而无法涉足的立管作业领域。

区域分析

预计2024年,亚太地区将维持38.23%的总收入份额,主要得益于南海深水区块和澳洲液化天然气回填计画。该地区柔性管材市场规模预计将占据主导地位,年复合成长率达8.35%。这推动了区域製造中心的建设,例如TechnipFMC在东南亚的工厂,该工厂缩短了中国和印度营运商的捲筒铺设前置作业时间。在日本和韩国,离岸风力发电的扩张带动了对海底电力电缆和动态供应连系管的需求,进一步促进了复合材料的交叉融合。

北美是第二大市场,这主要得益于墨西哥湾超深水油气勘探开发的限制,该限制要求使用20ksi的柔性连接管。阿纳达科盆地集气管线和二迭纪盆地氢气示范计划正在推动陆上可捲绕式连接管的应用。然而,亚太地区的复合年增长率落后,因为墨西哥湾的替代浪潮被停滞不前的油气发现速度所抵消。

欧洲呈现均衡成长,这主要得益于北海延寿计划以及挪威和英国早期氢能骨干网试点计画的推动。严格的除役法规将加速老旧钢结构的拆除,为回接方案中的灵活管线更换提供改装机会。然而,强制回收的要求将促使供应商提案聚合物回收的闭合迴路模式,这可能会增加总资本成本。

在中东和非洲,卡达能源公司的诺斯菲尔德压缩计画和西非的FPSO宣传活动对耐腐蚀复合材料的需求日益增长,推动了其快速普及。赛佩姆公司在卡达签订的价值40亿美元的EPC订单,印证了该地区对高规格输油管线和光纤供应连系管的强劲需求。土耳其的萨卡里亚二期工程将铺设158公里长、额定通径2,200公尺的管道,标誌着黑海盆地的成熟。拉丁美洲,以巴西的盐层下油田和圭亚那的斯塔夫罗克区块为中心,占据了全球SURF管道积压订单的很大一部分,促使製造商决定在里约热内卢附近设立一个捲绕终端。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 深海与超深海开发扩张

- 用复合材料取代腐蚀的钢管

- 巴西和圭亚那的SURF大型企划储备

- 碳纤维铠装管道减轻了FPSO的重量

- 嵌入式光纤健康监测

- 对灵活氢气和二氧化碳运输的需求

- 市场限制

- 原油价格波动抑制了资本投资。

- 与刚性钢材相比,初始成本较高

- 消费后聚合物管道回收的缺口

- 适用于额定压力为 20k psi 管道的紧凑型容器

- 供应链分析

- 监理展望

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依材料类型

- 高密度聚苯乙烯(HDPE)

- 聚酰胺(PA)

- 聚二氟亚乙烯(PVDF)

- 其他材料类型

- 依管道结构类型

- 非黏合柔性管

- 黏性软管

- 增强型热塑性管道(RTP)

- 按功能用途

- 流线

- 立管

- 跳线和繫带

- 出口/装载软管

- 透过安装环境

- 离岸

- 浅水区(水深小于500公尺)

- 深海(500-1500公尺)

- 超深海(超过1500公尺)

- 陆上

- 离岸

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- TechnipFMC plc

- National Oilwell Varco(NOV)

- Saipem SpA

- Prysmian Group

- Shawcor Ltd

- Strohm(formerly Airborne Oil & Gas)

- Magma Global Ltd

- SoluForce BV

- ContiTech AG

- Chevron Phillips Chemical Co.

- FlexSteel Pipeline Technologies Inc.

- GE Oil & Gas(Baker Hughes)

- Aker Solutions ASA

- Wellstream Processing(NOV)

- Subsea 7 SA

- Oceaneering International

- Hunan Great Steel Pipe Co.

- JDR Cable Systems Ltd

- Polyflow LLC

- Cosmoplast Industrial Co.

第七章 市场机会与未来展望

The flexible pipe market size stands at USD 1.26 billion in 2025 and is projected to climb to USD 1.63 billion by 2030, representing a 5.34% CAGR through the forecast period.

This growth is traced to deep- and ultra-deepwater exploration programs, rapid material innovation that mitigates corrosion, and expansion in pre-salt developments in Brazil and Guyana. Industry leaders are embedding fiber-optic sensors that deliver real-time integrity data, reducing downtime while lengthening asset life. Asia-Pacific holds the pre-eminent position, propelled by offshore programs in China, India, and Australia and supported by domestic manufacturing that lowers logistics costs. On the materials front, High-Density Polyethylene (HDPE) remains the default choice for operators, yet carbon-fiber and other composite solutions are gaining traction as weight-saving imperatives intensify. Accelerating vertical-integration strategies, such as the proposed Saipem-Subsea7 merger, are redrawing competitive lines by aligning engineering, procurement, construction, and installation (EPCI) capabilities inside one corporate umbrella.

Global Flexible Pipe Market Trends and Insights

Growing Deep- and Ultra-Deepwater Developments

Operators are sanctioning projects beyond 1,500 m as rigid steel systems become uneconomic in complex seabed topography. Chevron's Anchor field inaugurated 20 ksi subsea hardware that sets a new performance bar for the flexible pipe market. Brazil's pre-salt reservoirs impose CO2-driven corrosion stresses at 2,900 m depth, favoring suppliers with proven composite technology. System-level contracting models such as TechnipFMC's iEPCI compress schedules by up to 20%, reinforcing demand for integrated flexible solutions.

Replacement of Corroded Steel Lines with Composites

Annual offshore corrosion expenses reach USD 2.5 billion, elevating the economics of composite retrofits that sidestep cathodic protection. Saipem's plastic-lined pipeline technology trims costs by 40% while sustaining 1,000 bar ratings. North Sea operators confront a 10,000 km legacy grid dating back pre-1990; flexible pipe systems slot into existing corridors without heavy-lift spreads, cutting retrofit downtime. Embedded sensors inside Baker Hughes' non-metallic products feed integrity analytics that replace labor-intensive inspection rounds.

Crude-Oil Price Volatility Curbs CAPEX

Price swings in the USD 70-90 per-barrel band delay final investment decisions as boards now demand 18-24 months' price stability before greenlighting offshore projects. Higher interest rates lift hurdle thresholds, further deferring sanctioning. Mature North Sea and Gulf of Mexico fields are particularly vulnerable because flexible pipes constitute up to 20% of total project CAPEX, rendering economics price sensitive.

Other drivers and restraints analyzed in the detailed report include:

- SURF Megaproject Pipeline in Brazil and Guyana

- Embedded Fibre-Optic Health Monitoring

- Higher Upfront Cost Versus Rigid Steel

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible pipe market size for HDPE reached USD 0.45 billion in 2024, translating into 35.75% revenue dominance. Operators value HDPE for cost-efficient extrusion, chemical inertia, and weld-free joints. Still, Other Materials-chiefly carbon-fiber and advanced polymers-record an 8.42% CAGR, outstripping incumbents as floating production systems chase mass savings to ease topside loading. University of Sydney forecasts CFRP waste streams hitting 500,000 t by 2030, intensifying circular-economy pressures that could redirect R&D toward recyclable resins.

Material innovators push flexible pipe market share gains by enhancing fatigue life and temperature windows. Advanced PA and PVDF layers deliver 130 °C service, expanding flexible deployment into high-HTHP wells. Thermoplastic composite pipes (TCP) marry carbon-fiber tensile casing with a PA12 liner to achieve zero corrosion and low-friction flow profiles. As deepwater activity scales, composite uptake is expected to raise Other Materials' contribution to one-third of the flexible pipe market by 2030.

Unbonded architectures accounted for 45.65% of global revenue in 2024, capitalizing on multilayered armor that decouples hoop and axial loads. Their repairability underpins preference in dynamic riser applications. Yet Reinforced Thermoplastic Pipes, devoid of metallic carcasses, expand 7.34% CAGR as operators target corrosion-free performance and lighter deck loads. FlexSteel's spoolable RTP solutions eliminate anodes and coating campaigns, lowering OPEX in brownfield tie-ins.

Structural choice in the flexible pipe market hinges on fatigue, pressure, and chemical exposure profiles. Bonded pipes serve niche ultra-high-pressure flowlines but are handicapped by limited field repair options and higher cost. Innovations in aramid and glass-fiber winding, coupled with digital twins tracking fatigue accumulation, will allow RTP to penetrate riser duty where strength limits once blocked entry.

The Flexible Pipes Market Report is Segmented by Material Type (High-Density Polyethylene, Polyamide, and More), Pipe Structure Type (Unbonded Flexible Pipe, Bonded Flexible Pipe, Reinforced Thermoplastic Pipe), Functional Application (Flowlines, Risers, Jumpers and Tie-Ins, Export/Loading Hoses), Installation Environment (Offshore, Onshore), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 38.23% of 2024 revenue on the back of South China Sea deepwater blocks and Australian LNG backfill programs. The region's flexible pipe market size is forecast to rise at an 8.35% CAGR, outpacing all others. Government policy favoring local content spurs construction of regional manufacturing hubs, such as TechnipFMC's plant in Southeast Asia that shortens reel-lay lead times for Chinese and Indian operators. Growing offshore wind deployment in Japan and Korea creates spill-over demand for subsea power cables and dynamic umbilicals, further nurturing composite capability cross-fertilization.

North America follows as the second-largest region, underpinned by Gulf of Mexico ultra-deepwater sanctions that require 20 ksi flexible jumpers. Anadarko basin gathering lines and Permian hydrogen demonstration projects drive onshore spoolable adoption. Yet regional CAGR lags Asia-Pacific because the replacement wave in the Gulf is offset by plateauing discovery rates.

Europe shows balanced growth built on North Sea life-extension projects and nascent hydrogen backbone pilots across Norway and the United Kingdom. Strict decommissioning legislation accelerates removal of ageing steel, offering retrofit openings for flexible line substitution in tie-back schemes. Recycling mandates, however, require suppliers to propose closed-loop models for polymer recovery, potentially elevating total installed cost.

Middle East and Africa register rapid adoption as QatarEnergy's North Field Compression Program and West Africa's FPSO campaigns solicit corrosion-immune composites. Saipem's USD 4 billion EPC award in Qatar confirms regional appetite for high-specification flowlines and optic-fiber-infused umbilicals. Turkey's Sakarya Phase 2 calls for 158 km of 2,200 m-rated pipe, signalling Black Sea basin maturation. South America, anchored by Brazil's pre-salt and Guyana's Stabroek block, remains a central pillar, accounting for the bulk of global SURF backlogs and reinforcing manufacturers' decision to co-locate spool-bases near Rio.

- TechnipFMC plc

- National Oilwell Varco (NOV)

- Saipem S.p.A.

- Prysmian Group

- Shawcor Ltd

- Strohm (formerly Airborne Oil & Gas)

- Magma Global Ltd

- SoluForce BV

- ContiTech AG

- Chevron Phillips Chemical Co.

- FlexSteel Pipeline Technologies Inc.

- GE Oil & Gas (Baker Hughes)

- Aker Solutions ASA

- Wellstream Processing (NOV)

- Subsea 7 S.A.

- Oceaneering International

- Hunan Great Steel Pipe Co.

- JDR Cable Systems Ltd

- Polyflow LLC

- Cosmoplast Industrial Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing deep- and ultra-deepwater developments

- 4.2.2 Replacement of corroded steel lines with composites

- 4.2.3 SURF megaproject pipeline in Brazil and Guyana

- 4.2.4 Carbon-fibre armoured pipes lighten FPSOs

- 4.2.5 Embedded fibre-optic health monitoring

- 4.2.6 Hydrogen and CO2 transport demand for flexibles

- 4.3 Market Restraints

- 4.3.1 Crude-oil price volatility curbs CAPEX

- 4.3.2 Higher upfront cost versus rigid steel

- 4.3.3 Polymer-pipe end-of-life recycling gaps

- 4.3.4 Tight capacity for 20 k-psi rated pipes

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 High-Density Polyethylene (HDPE)

- 5.1.2 Polyamide (PA)

- 5.1.3 Polyvinylidene Fluoride (PVDF)

- 5.1.4 Others Material Type

- 5.2 By Pipe Structure Type

- 5.2.1 Unbonded Flexible Pipe

- 5.2.2 Bonded Flexible Pipe

- 5.2.3 Reinforced Thermoplastic Pipe (RTP)

- 5.3 By Functional Application

- 5.3.1 Flowlines

- 5.3.2 Risers

- 5.3.3 Jumpers and Tie-ins

- 5.3.4 Export / Loading Hoses

- 5.4 By Installation Environment

- 5.4.1 Offshore

- 5.4.1.1 Shallow Water (Less than 500 m)

- 5.4.1.2 Deepwater (500-1500 m)

- 5.4.1.3 Ultra-deepwater (More than 1500 m)

- 5.4.2 Onshore

- 5.4.1 Offshore

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 TechnipFMC plc

- 6.4.2 National Oilwell Varco (NOV)

- 6.4.3 Saipem S.p.A.

- 6.4.4 Prysmian Group

- 6.4.5 Shawcor Ltd

- 6.4.6 Strohm (formerly Airborne Oil & Gas)

- 6.4.7 Magma Global Ltd

- 6.4.8 SoluForce BV

- 6.4.9 ContiTech AG

- 6.4.10 Chevron Phillips Chemical Co.

- 6.4.11 FlexSteel Pipeline Technologies Inc.

- 6.4.12 GE Oil & Gas (Baker Hughes)

- 6.4.13 Aker Solutions ASA

- 6.4.14 Wellstream Processing (NOV)

- 6.4.15 Subsea 7 S.A.

- 6.4.16 Oceaneering International

- 6.4.17 Hunan Great Steel Pipe Co.

- 6.4.18 JDR Cable Systems Ltd

- 6.4.19 Polyflow LLC

- 6.4.20 Cosmoplast Industrial Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment