|

市场调查报告书

商品编码

1851762

资料仓储即服务:市场占有率分析、产业趋势、统计资料和成长预测(2025-2030 年)Data Warehouse As A Service - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

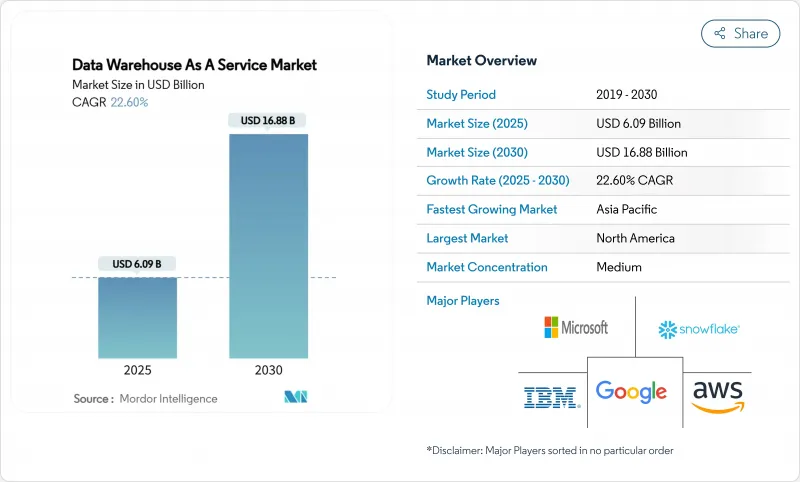

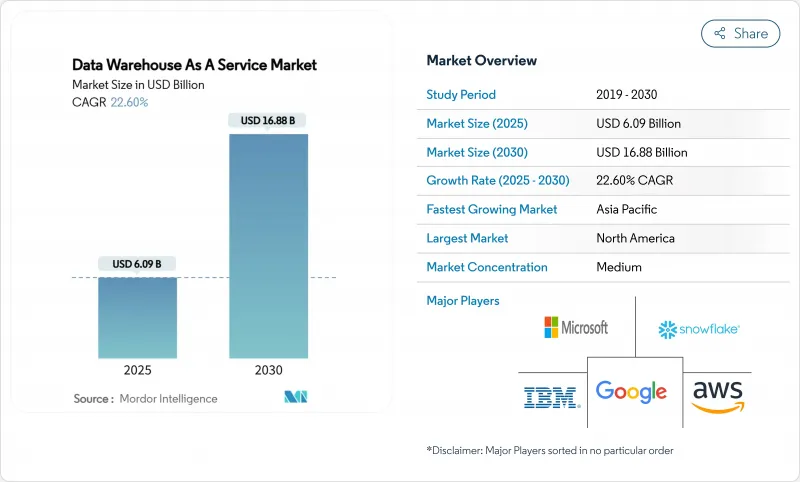

预计到 2025 年,资料仓储即服务市场规模将达到 60.9 亿美元,到 2030 年将达到 168.8 亿美元,预测期内复合年增长率将达到 22.6%。

对现代云端原生分析的强劲需求、不断增长的企业人工智慧工作负载以及计量收费的成本效益是关键的成长要素。虽然目前公共云端平台占据了大部分市场份额,但随着企业优化工作负载部署并避免被厂商锁定,多重云端和混合架构的成长速度正在超越整体水平。儘管大型企业仍然占据大部分支出,但随着自助服务工具降低了准入门槛,以及无伺服器扩展消除了容量规划的需求,中小企业 (SME) 的采用率也在迅速提高。从业界来看,金融服务业正在加速采用云端原生分析,而医疗保健和生命科学领域的采用速度最快,因为临床和研究数据的整合加速了精准医疗计画的发展。超大规模云端服务供应商利用整合生态系统,而专业云端服务供应商则透过多重云端可移植性和内建机器学习功能来脱颖而出。

全球资料仓储即服务市场趋势与洞察

云端迁移与即时分析热潮

企业正从週期性批次报告转向串流架构,以亚秒速度产生仪表板和预测模型。 ABB 将来自 40 个不同 ERP 系统的资料整合到单一 Snowflake 实例中,透过即时生产可视性节省了数百万美元。边缘网关在生产线附近过滤对时间敏感的遥测数据,而云端资料仓储则可执行复杂的连接和历史趋势分析,而不会出现容量瓶颈。这些低延迟管道支援自主资产优化、动态定价和即时欺诈管理。随着连网设备的日益普及,即时分析将继续成为一项重要的支出项目,从而推动对弹性 DWaaS 容量的需求,这种容量能够随资料摄取速率扩展,而不是采用固定节点。

人工智慧/机器学习主导的仓储需求

现代资料仓储层融合了结构化表和非结构化文件,从而可以在储存层内进行模型训练。 Snowflake 与 NVIDIA 合作,将专用 GPU 整合到运算丛集中,确保资料在推理加速过程中始终位于安全边界内。 Databricks 正在整合 Lakehouse 储存格式,使资料科学家能够使用与仪表板相同的 SQL 端点,在Petabyte级日誌上建立特征。由大规模语言模型驱动的自然语言查询助手,使业务用户能够更便捷地存取分析功能,从而推动更广泛的组织采用该技术,并提升资料仓储即服务市场的计算消耗。

网路安全和隐私风险

欧洲的《一般资料保护规则)和亚洲的新在地化法规限制了跨国资料传输,并使跨国企业的云端策略变得更加复杂。将敏感资产集中在第三方云端对威胁行为者极具吸引力,迫使企业采用普遍加密、零信任存取和持续态势监控。安全责任共担模式本身可能会模糊责任范围、延长采购週期并减缓采用速度,尤其对于缺乏专业云端安全人才的团队而言更是如此。

细分市场分析

到2024年,随着企业优先考虑承包的可扩展性和全球可用性,公共云端平台将占据资料仓储即服务市场规模的65.5%。 AWS凭藉其深度服务集成,将占据全球约34%的收入份额,而微软Azure在Office 365领域的稳固地位将使采购更加便捷。当主权法规禁止外部託管时,私有云端实例仍将继续存在,但高昂的营运成本限制了其成长。

预计到 2030 年,混合云端和多重云端的采用率将以 24.6% 的复合年增长率成长,这主要得益于企业透过将分析资源分散到不同的云端服务供应商,避免被单一供应商锁定,利用区域成本差异,并将敏感资料集放置在首选的自主平台上。 Google云端的 BigQuery Omni 支援跨云端查询,无需实体资料移动,展现了强大的互通性,可降低出口费用和延迟损失。 Snowflake 的开放式 Polaris Catalog 透过标准化 AWS、Azure 和Google云端之间的元资料,进一步简化了迁移过程。

受复杂管治需求和跨部门分析设施的驱动,大型企业将在 2024 年占据资料仓储即服务市场份额的 62.2%。这些企业部署了高阶安全层,支援数千个同时上线用户,并将他们的资料仓储与传统的 ERP、CRM 和风险引擎整合。

同时,中小企业将成为营收成长的最大驱动力,到2030年将以26.4%的复合年增长率成长,这主要得益于无伺服器引擎消除了容量规划的障碍。低程式码资料导入连接器和自然语言查询介面将使业务分析师无需专门的资料科学团队即可启动预测模型,从而缩小与大型企业的能力差距。学术研究表明,文化变革而非硬体预算是中小企业分析计画成功的关键因素。

区域分析

2024年,北美将占全球收入的39.6%,这得益于其丰富的资料中心容量、有利的云端采购政策以及在技术、金融和医疗保健领域深厚的技能基础。超大规模资料中心业者持续推出区域性人工智慧加速器和主权云端区域,以满足市场对高端分析服务的需求。以缅因州云端迁移为例,联邦和州政府机构正在进一步检验云端仓库在公共部门工作负载的可行性。

亚太地区是成长最快的地区,预计到2030年将以24.8%的复合年增长率成长,这得益于大规模超大规模资料中心建设和政府数位经济蓝图的推动。新加坡政府科技局(GovTech)等公共部门的最佳实践表明,明确的监管政策和政府支持的云端培训能够缩短企业引进週期。

欧洲正努力在对分析技术的高需求与严格的主权法律之间寻求平衡。供应商正透过推出仅限欧盟用户的区域、保密运算飞地和主权元资料服务来应对这项挑战。跨国金融机构正在采用分散式资料网格架构,以便在遵守当地居住规定的同时,维持跨境风险分析。南美洲以及中东和非洲地区则提供了规模较小但不断增长的机会,这些机会与电子商务和智慧城市计划的扩展密切相关。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 市场定义与研究假设

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 云端迁移与即时分析热潮

- 人工智慧/机器学习驱动仓储需求

- 金融服务业数位化优先蓝图

- 转向基于消费的定价

- 边缘到云端的低延迟仓库

- 绿色仓储和碳排放彙报重点

- 市场限制

- 网路安全和隐私风险

- 不可预测的云端成本

- 对供应商锁定问题的担忧

- 财务营运/数据可观测性技能短缺

- 价值链分析

- 关键法规结构评估

- 关键相关人员影响评估

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 按部署模式

- 公有云

- 私有云端

- 混合/多重云端

- 按最终用户公司规模划分

- 大公司

- 小型企业

- 按最终用户行业划分

- BFSI

- 政府和公共部门

- 医疗保健和生命科学

- 零售与电子商务

- 电讯和资讯技术

- 媒体与娱乐

- 製造业

- 按服务类型

- 企业资料仓储即服务 (DWaaS)

- 营运资料储存即服务

- 数据湖屋即服务

- 分析加速服务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- Snowflake Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Teradata Corp.

- Cloudera Inc.

- Databricks Inc.

- Micro Focus International plc

- Yellowbrick Data

- ClickHouse Inc.

- Dremio Corporation

- Alibaba Cloud

- Huawei Cloud

- Firebolt Analytics Ltd.

- Vertica(Micro Focus)

- Exasol AG

- Actian Corp.

第七章 市场机会与未来趋势

- 閒置频段与未满足需求评估

The data warehouse as a service market size reached USD 6.09 billion in 2025 and is projected to climb to USD 16.88 billion by 2030, translating into a 22.6% CAGR over the forecast period.

Strong demand for modern, cloud-native analytics, rising enterprise artificial-intelligence workloads, and the cost efficiencies of pay-as-you-go pricing are the principal growth engines. Public-cloud platforms dominate current deployments, yet multi-cloud and hybrid architectures are outpacing overall expansion as firms hedge against lock-in while optimizing workload placement. Large enterprises still account for a majority of spending, but small and medium enterprises (SMEs) are increasing adoption rapidly as self-service tooling lowers entry barriers and serverless scaling eliminates capacity planning. Vertically, financial services set the adoption pace, whereas healthcare and life sciences log the fastest gains because unified clinical and research data accelerates precision-medicine programs. Competitive intensity remains moderate; hyperscale providers leverage integrated ecosystems while specialists differentiate through multi-cloud portability and built-in machine-learning features.

Global Data Warehouse As A Service Market Trends and Insights

Cloud Migration and Real-Time Analytics Boom

Enterprises are shifting from periodic batch reporting to streaming architectures that feed sub-second dashboards and predictive models. ABB consolidated data from 40 disparate ERP systems into a single Snowflake instance and unlocked multimillion-dollar savings through real-time production visibility . Edge gateways now filter time-sensitive telemetry close to manufacturing lines, while cloud data warehouses execute complex joins and historical trend analyses without capacity bottlenecks. These low-latency pipelines support autonomous-equipment optimization, dynamic pricing, and instantaneous fraud controls. As more connected devices proliferate, real-time analytics will remain a top spending priority, reinforcing demand for elastic DWaaS capacity that scales on ingestion rates rather than fixed nodes.

AI/ML-Driven Warehousing Demand

Modern data-warehouse layers blend structured tables with unstructured files, enabling model training inside the storage tier. Snowflake's collaboration with NVIDIA embeds specialized GPUs alongside compute clusters so data never leaves the security perimeter during inference acceleration . Databricks integrates lakehouse storage formats that let data scientists build features over petabyte-scale logs using the same SQL endpoints powering dashboards. Natural-language query assistants driven by large language models democratize analytics access for business users, fueling broader organizational adoption and increasing overall compute consumption across the data warehouse as a service market.

Cyber-Security and Privacy Risks

General Data Protection Regulation requirements in Europe and new localization statutes in Asia restrict cross-border data movement, complicating multinational cloud strategies. Consolidating sensitive assets inside third-party clouds heightens the appeal for threat actors, forcing enterprises to deploy pervasive encryption, zero-trust access and continuous posture monitoring. The shared-responsibility security model itself can blur accountability lines, especially for teams lacking dedicated cloud-security talent, thereby extending procurement cycles and slowing adoption.

Other drivers and restraints analyzed in the detailed report include:

- BFSI Digital-First Road-Maps

- Shift to Consumption-Based Pricing

- Unpredictable Cloud Cost Sprawl

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Public-cloud platforms held 65.5% of the data warehouse as a service market size in 2024 as enterprises prioritized turnkey scalability and global availability. AWS captured roughly 34% of worldwide revenue thanks to deep service integration, while Microsoft Azure benefited from established Office 365 footprints that eased procurement. Private-cloud instances persist where sovereignty mandates preclude external hosting, but higher operational overhead tempers growth.

Hybrid and multi-cloud deployments are projected to record a 24.6% CAGR through 2030 as firms distribute analytics across providers to avoid lock-in, exploit regional cost differentials and place sensitive datasets on preferred sovereign platforms. Google Cloud's BigQuery Omni allows cross-cloud querying without physical data moves, showing how interoperability features reduce egress fees and latency penalties . Snowflake's open Polaris Catalog further eases migration by standardizing metadata across AWS, Azure and Google Cloud.

Large organizations controlled 62.2% of the 2024 data warehouse as a service market share due to complex governance needs and multi-department analytics estates. They deploy advanced security layers, support thousands of concurrent users and integrate warehouses with legacy ERP, CRM and risk engines.

In contrast, SMEs will drive the highest incremental revenue, expanding at a 26.4% CAGR through 2030 as serverless engines remove capacity-planning hurdles. Low-code ingestion connectors and natural-language query interfaces allow business analysts to launch predictive models without dedicated data-science teams, narrowing capability gaps versus larger peers. Academic studies highlight cultural change as the primary success factor for SME analytics programs, not hardware budgets.

The Data Warehouse As A Service Market Report is Segmented by Deployment Model (Public Cloud, Private Cloud, Hybrid/Multi-cloud), End-User Enterprise Size (Large Enterprises, Small and Medium Enterprises), End-User Industry (BFSI, Government and Public Sector, and More), Service Type (Enterprise DWaaS, Operational Data-Store As A Service, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 39.6% of global revenue in 2024, buoyed by abundant data-center capacity, favorable cloud procurement policies and a deep skills base across technology, finance and healthcare verticals. Hyperscalers continuously launch region-specific AI accelerators and sovereign-cloud zones, sustaining demand for premium analytics tiers. Federal and state agencies, exemplified by the State of Maine's cloud migration, further validate cloud warehouses for public-sector workloads .

Asia-Pacific is the fastest-growing region with a 24.8% CAGR through 2030, supported by massive hyperscale build-outs and government digital-economy roadmaps. Public-sector exemplars such as Singapore's GovTech highlight how regulatory clarity and state-sponsored cloud training shorten enterprise adoption cycles.

Europe balances high analytics demand with stringent sovereignty legislation. Vendors respond by launching EU-only regions, confidential computing enclaves and sovereign-metadata services. Multinational financial institutions implement distributed data-mesh architectures to comply with local residency rules while preserving cross-border risk analytics. South America plus the Middle East & Africa exhibit growing, albeit smaller, opportunity pools linked to e-commerce expansion and smart-city initiatives; however, infrastructure gaps and macro-economic volatility moderate near-term uptake.

- Amazon Web Services Inc.

- Microsoft Corporation

- Google LLC

- Snowflake Inc.

- IBM Corporation

- Oracle Corporation

- SAP SE

- Teradata Corp.

- Cloudera Inc.

- Databricks Inc.

- Micro Focus International plc

- Yellowbrick Data

- ClickHouse Inc.

- Dremio Corporation

- Alibaba Cloud

- Huawei Cloud

- Firebolt Analytics Ltd.

- Vertica (Micro Focus)

- Exasol AG

- Actian Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Market Definition and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud migration and real-time analytics boom

- 4.2.2 AI/ML-driven warehousing demand

- 4.2.3 BFSI digital-first road-maps

- 4.2.4 Shift to consumption-based pricing

- 4.2.5 Edge-to-cloud low-latency warehousing

- 4.2.6 Green warehousing and carbon reporting focus

- 4.3 Market Restraints

- 4.3.1 Cyber-security and privacy risks

- 4.3.2 Unpredictable cloud cost sprawl

- 4.3.3 Vendor lock-in concerns

- 4.3.4 Shortage of FinOps / data-observability skills

- 4.4 Value Chain Analysis

- 4.5 Evaluation of Critical Regulatory Framework

- 4.6 Impact Assessment of Key Stakeholders

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Impact of Macro-economic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid / Multi-cloud

- 5.2 By End-user Enterprise Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises

- 5.3 By End-user Industry

- 5.3.1 BFSI

- 5.3.2 Government and Public Sector

- 5.3.3 Healthcare and Life Sciences

- 5.3.4 Retail and E-commerce

- 5.3.5 Telecom and IT

- 5.3.6 Media and Entertainment

- 5.3.7 Manufacturing

- 5.4 By Service Type

- 5.4.1 Enterprise DWaaS

- 5.4.2 Operational Data-store as a Service

- 5.4.3 Data Lakehouse as a Service

- 5.4.4 Analytics Acceleration Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation

- 6.4.3 Google LLC

- 6.4.4 Snowflake Inc.

- 6.4.5 IBM Corporation

- 6.4.6 Oracle Corporation

- 6.4.7 SAP SE

- 6.4.8 Teradata Corp.

- 6.4.9 Cloudera Inc.

- 6.4.10 Databricks Inc.

- 6.4.11 Micro Focus International plc

- 6.4.12 Yellowbrick Data

- 6.4.13 ClickHouse Inc.

- 6.4.14 Dremio Corporation

- 6.4.15 Alibaba Cloud

- 6.4.16 Huawei Cloud

- 6.4.17 Firebolt Analytics Ltd.

- 6.4.18 Vertica (Micro Focus)

- 6.4.19 Exasol AG

- 6.4.20 Actian Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-need Assessment