|

市场调查报告书

商品编码

1851765

区块链在能源领域的应用:市场份额分析、产业趋势、统计数据和成长预测(2025-2030 年)Blockchain In Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

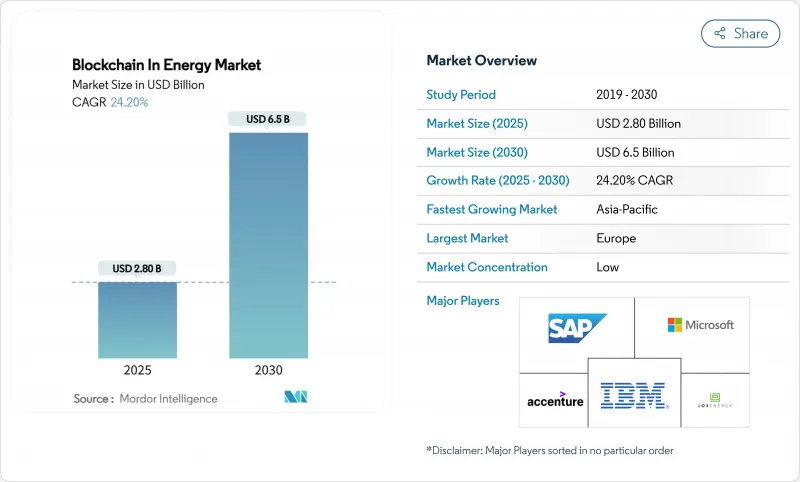

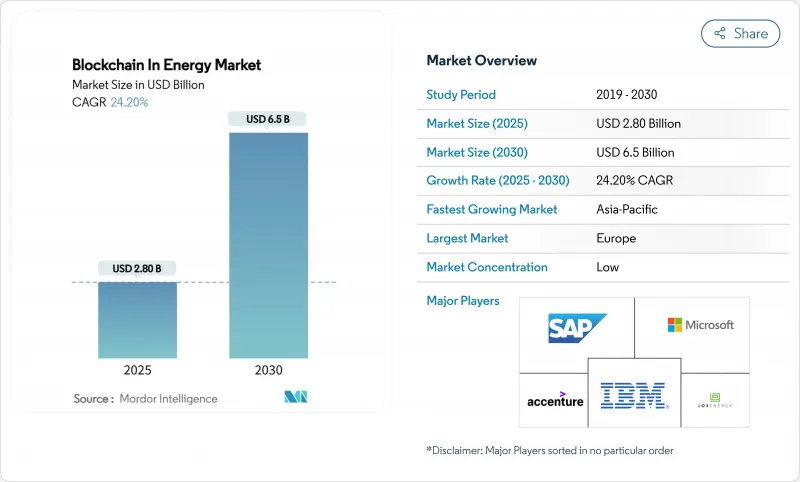

据估计,2025 年能源市场的区块链价值为 28 亿美元,预计到 2030 年将达到 65 亿美元,在预测期(2025-2030 年)内复合年增长率为 24.20%。

欧洲强有力的法规结构、亚太地区创业投资的刺激以及企业对全天候无碳能源证书日益增长的需求,共同推动了能源区块链市场的快速扩张。公用事业公司支持的试点计画正在向商业平台转型,这些平台实现了P2P(P2P) 交易的自动化,将分散式能源 (DER) 的灵活性货币化,并整合了反映即时电网状况的浮动电价机制。节能型权益证明通讯协定的出现,例如 Solana 实现了 69% 的能耗降低,降低了交易成本,并消除了规模化发展的关键障碍。基于代币的分散式能源部署获得的风险资金筹措提振了投资者信心,而智慧合约则使电动车 (EV) 车队和固定式电池能够获得电网服务收入。这些动态共同推动能源区块链市场在 2030 年前保持两位数的持续成长。

全球能源区块链市场趋势与洞察

可变定价与P2P交易的出现

浮动定价正在取代固定费率,取而代之的是反映供需失衡的即时定价,为产消者创造了套利机会。奥地利的smartCOMMUNITY平台允许家庭用户客製化购电协议,并以具有竞争力的价格交易多余的太阳能电力,这与该国到2030年实现100%可再生能源的目标一致。日本关西电力公司预计透过取消上网电价补贴节省185亿美元,这显示市场主导的定价如何重塑一个国家的能源经济。与传统的净计量相比,农村微电网中联盟区块链的部署实现了更高的投资报酬率,凸显了去中心化市场的商业性潜力。随着更多参与企业市场,网路效应将增强流动性,并加速区块链在能源市场的整体应用。

公共产业区块链认证计划

为了履行可再生能源义务并维持市场影响力,公共产业正在推出区块链证书方案。韩国电力公司(KEPCO)的伙伴关係正在基于区块链建立国家可再生能源证书(REC)标准,确保在法律规范下实现透明的发行和交易。在加拿大,Alectra 的 GridExchange 专案正在展示公用事业公司营运的市场如何在不放弃控制权的情况下向分散式能源(DER)所有者支付电网支援费用。德克萨斯州电力可靠性委员会(ERCOT)的 REC 专案提供了一种成熟的交易机制,区块链可以增强而非取代该机制,这表明最具扩展性的部署方案将与现有企业合作,而不是颠覆它们。

扩充性和交易成本限制

传统的基于工作量证明(PoW)的区块链无法处理即时电网平衡所需的微交易。基于SNARK并行执行的研究表明,吞吐量可提升10,000倍,这为实现公用事业规模化应用提供了一条切实可行的途径。 Solana的权益证明(PoS)网路每笔交易仅消耗0.00412瓦时(Wh)的电量,相当于2024年833个美国家庭的总用电量,证明节能共识机制可以同时降低排放和费用。一种针对电动车能源交易进行测试的混合区块链,结合了工作量证明的安全性和权益证明的效率,为区块链在能源领域的应用提供了一个切实可行的解决方案。

细分市场分析

用于分散式能源弹性的智慧合约预计在2025年将达到6.5亿美元,并在2030年之前以30%的复合年增长率成长。此细分市场可自动调度电动车队和家用电池,最大限度地减少人为干预,并在尖峰时段支援电网稳定性。到2024年,支付和P2P能源交易将占据能源区块链市场38%的最大份额,证明了自动计费和结算的即时商业性可行性。随着企业采购中按小时匹配可再生能源成为常态,管治、风险和合规解决方案也正在蓬勃发展,这印证了能源区块链市场目前涵盖的广泛应用情境。

人工智慧与区块链智能合约的融合正在提升营运效率。微软和Flexidao将离岸风力发电与资料中心用电量进行逐小时匹配,消费量表明,不可篡改的帐本能够防止重复计算,而先进的演算法则能最大限度地提高同步性得分。基于零知识证明的数位身分框架在电动车与智慧电网互动时保护用户隐私,而能源效率奖励机制则为参与需量反应的用户提供代币奖励。这些不断发展的应用共同拓展了区块链在能源产业套件中的地位,从而为整个电网创造长期价值。

能源市场的区块链按应用(支付、智慧合约、数位身分、管治、风险和合规 (GRC) 以及其他应用)和地区进行细分。

区域分析

到2024年,欧洲将占全球销售额的32%,凭藉协调一致的政策工具和大量的公共支出,巩固其领先地位。欧盟委员会斥资2,250万欧元在汉堡启动的「供热转型」计画利用区块链技术检验热源来源,彰显了各国致力于建构透明能源体系的决心。监管沙盒,例如曾对Enoda的ENSEMBLE平台进行审查的欧洲区块链沙盒,降低了创新者的合规成本,并加速了商业化进程。奥地利P2P交易的推出也印证了持续的政策支援能够促进商业性应用,并为能源领域的区块链市场奠定基础。

亚太地区是成长最快的地区,预计年复合成长率将达到28%。日本修改了基金规则,允许有限伙伴关係持有加密货币。根据tokenpost.kr通报,韩国一家公共产业财团正在部长级监督下建立一个基于区块链的再生能源证书(REC)市场,这将使其获得合法性,从而吸引更多投资。澳洲的Vehicle-to-Grid)电价研究强调了自适应电价设计如何最大限度地节省客户成本并支援电网运行,为未来的区块链平台提供了一个可复製的蓝图。

北美正在经历大规模的整合。美国能源局发布的十年「Vehicle-to-Grid蓝图将网路安全和智慧充电列为优先事项。加州的快速充电试点计画表明,透过分散式帐本优化可再生能源併网和电网服务可以显着降低成本。加拿大的Alectra GridExchange为公用事业营运的市场提供了一个试验平台,在保留现有功能的同时,采用了新的交易架构。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 浮动定价与P2P交易的出现

- 公共事业支持的区块链认证计划

- 创投涌入能源代币新兴企业

- 凭证式能源部署资金筹措(报道不足)

- 全天候追踪无碳能源需求(数据低估)

- 将电网服务货币化应用于电动汽车车队(报告不足)

- 市场限制

- 可扩充性和交易成本限制

- 能源数据标准碎片化

- 代币价格波动对经营模式的影响(未充分通报)

- 能源代币证券监管方面的不确定性(瞒报)

- 价值/供应链分析

- 监管环境

- 技术展望(分散式帐本技术堆迭、POS、POA)

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

第五章 市场规模与成长预测

- 透过使用

- 沉淀

- 智能合约

- 数位身分

- 管治、风险和合规 (GRC)

- 其他用途

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 荷兰

- 其他欧洲地区

- 亚太地区

- 日本

- 澳洲

- 纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 墨西哥

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 以色列

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SAP SE

- Electron

- Accenture

- IBM

- LO3 Energy

- GREENEUM

- Drift Marketplace

- IOTA Foundation

- BTL Group

- Power Ledger

- ImpactPPA

第七章 市场机会与未来展望

The Blockchain In Energy Market size is estimated at USD 2.80 billion in 2025, and is expected to reach USD 6.5 billion by 2030, at a CAGR of 24.20% during the forecast period (2025-2030).

The rapid expansion is supported by Europe's strong regulatory frameworks, Asia-Pacific's venture-capital stimulus and rising corporate demand for 24/7 carbon-free energy certificates. Utility-backed pilots are graduating to commercial platforms that automate peer-to-peer (P2P) trading, monetize distributed energy resource (DER) flexibility and integrate variable tariffs that mirror real-time grid conditions. The emergence of energy-efficient proof-of-stake protocols, exemplified by Solana's 69% energy-consumption reduction, lowers transaction costs and removes a key barrier to scale. Venture funding into token-based DER roll-outs validates investor confidence, while smart contracts enable electric-vehicle (EV) fleets and stationary batteries to earn grid-service revenues. Combined, these dynamics position the blockchain in energy sector market for sustained double-digit growth through 2030.

Global Blockchain In Energy Market Trends and Insights

Emergence of Variable Tariffs & P2P Trading

Variable tariffs are replacing flat rates with real-time pricing that reflects supply-demand imbalances, creating arbitrage opportunities for prosumers. Austria's smartCOMMUNITY platform lets households customize power-purchase agreements and trade surplus solar at competitive rates, aligning with the nation's 100% renewable goal by 2030. Japan's KEPCO trial projected USD 18.5 billion in savings from abandoning fixed feed-in tariffs, showing how market-driven pricing can reshape national energy economics. Consortium blockchains deployed in rural microgrids deliver superior paybacks versus traditional net-metering, highlighting the commercial viability of distributed marketplaces. As participation rises, network effects deepen liquidity, accelerating adoption across the blockchain in the energy sector market.

Utility-Backed Blockchain Certificate Programs

Utilities are launching blockchain certificate schemes to comply with renewable mandates while retaining market influence. South Korea's KEPCO partnership is building a national renewable-energy certificate (REC) standard on blockchain, ensuring transparent issuance and trade under regulatory supervision. In Canada, Alectra's GridExchange demonstrates how a utility-operated marketplace pays DER owners for grid support without ceding control. Texas's ERCOT REC program offers a proven trading mechanism that blockchain can enhance rather than replace, signaling that the most scalable deployments will collaborate with, not disrupt, incumbent operators

Scalability & Transaction-Cost Constraints

Legacy proof-of-work chains cannot process the micro-transactions needed for real-time grid balancing. Research on SNARK-based parallel execution shows 10,000-fold throughput gains, hinting at a viable path to utility scale. Solana's proof-of-stake network consumes only 0.00412 Wh per transaction, with total 2024 usage equal to 833 US homes, proving that energy-efficient consensus can cut both emissions and fees. Hybrid blockchains tested for EV energy trading blend proof-of-work security with proof-of-stake efficiency, demonstrating practical solutions for the blockchain in the energy sector market.

Other drivers and restraints analyzed in the detailed report include:

- VC Funding Surge into Energy-Token Start-ups

- Token-Based Financing for DER Roll-Outs

- Fragmented Energy-Data Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart contracts for DER flexibility accounted for USD 0.65 billion in 2025 and are poised to grow at a 30% CAGR to 2030. This sub-segment automates the dispatch of EV fleets and household batteries, minimizing human intervention and supporting grid stability during peak demand. Payments and P2P energy trading maintained the largest 38% share of the blockchain in the energy sector market size in 2024, proving immediate commercial viability for automated billing and settlement. Governance, risk, and compliance solutions are gaining momentum as hourly renewable-energy matching becomes standard in corporate procurement, underscoring the breadth of use cases now captured by the blockchain in the energy sector market.

Integrating AI with blockchain smart contracts is elevating operational efficiency. Microsoft and Flexidao's hourly matching of offshore wind output with data center consumption shows how immutable ledgers prevent double-counting while advanced algorithms maximize synchronicity scores. Digital-identity frameworks relying on zero-knowledge proofs safeguard user privacy as EVs interact with smart grids, and energy-efficiency incentive schemes deliver token rewards for demand-response participation. Together, these evolving applications expand the blockchain in the energy sector industry toolkit and anchor long-term value creation across the grid.

The Blockchain in the Energy Market is Segmented by Application (Payments, Smart Contracts, Digital Identities, Governance, Risk and Compliance (GRC), Other Applications) and Geography

Geography Analysis

Europe contributed 32% of 2024 revenue, cementing its lead through cohesive policy instruments and sizable public outlays. The European Commission's EUR 22.5 million Hamburg heating transition leverages blockchain to verify heat-source provenance, emphasizing state-level commitment to transparent energy systems. Regulatory sandboxes, such as the European Blockchain Sandbox that vetted Enoda's ENSEMBLE platform, lower the compliance cost for innovators and accelerate commercialization. Austria's P2P trading roll-out confirms that consistent policy support translates to commercial adoption and underpins the blockchain in the energy sector market.

Asia-Pacific is the fastest-growing geography, projected at 28% CAGR. Japan's revised fund rules allow limited partnerships to hold crypto, channeling domestic capital toward Web3 energy ventures. South Korea's utility consortium is establishing blockchain-based REC markets under ministerial oversight, granting legitimacy that draws additional investment, tokenpost.kr. Australia's vehicle-to-grid tariff research highlights how adaptive rate design maximizes both customer savings and grid support, offering a replicable blueprint for future blockchain platforms.

North America's market advances on large-scale integration. The US Department of Energy's 10-year vehicle-to-grid roadmap prioritizes cybersecurity and smart charging-the foundational layers for blockchain interoperability. California's fast-charging pilots demonstrate cost reductions when renewable integration and grid services are optimized through distributed ledgers. Canada's Alectra GridExchange provides a proof point for utility-operated marketplaces, preserving incumbent roles while embracing new transactional architectures.

- SAP SE

- Electron

- Accenture

- IBM

- LO3 Energy

- GREENEUM

- Drift Marketplace

- IOTA Foundation

- BTL Group

- Power Ledger

- ImpactPPA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of variable tariffs and P2P trading

- 4.2.2 Utility-backed blockchain certificate programs

- 4.2.3 VC funding surge into energy-token start-ups

- 4.2.4 Token-based financing for DER roll-outs (under-reported)

- 4.2.5 24/7 carbon-free energy tracking demand (under-reported)

- 4.2.6 Grid-service monetisation for EV fleets (under-reported)

- 4.3 Market Restraints

- 4.3.1 Scalability and transaction-cost constraints

- 4.3.2 Fragmented energy-data standards

- 4.3.3 Token-price volatility impacting business models (under-reported)

- 4.3.4 Regulatory uncertainty on energy-token securities (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (DLT stacks, PoS, PoA)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Payments

- 5.1.2 Smart Contracts

- 5.1.3 Digital Identities

- 5.1.4 Governance, Risk and Compliance (GRC)

- 5.1.5 Other Applications

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 Germany

- 5.2.2.3 Netherlands

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 Japan

- 5.2.3.2 Australia

- 5.2.3.3 New Zealand

- 5.2.3.4 Rest of APAC

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Mexico

- 5.2.4.3 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Israel

- 5.2.5.3 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview)}

- 6.4.1 SAP SE

- 6.4.2 Electron

- 6.4.3 Accenture

- 6.4.4 IBM

- 6.4.5 LO3 Energy

- 6.4.6 GREENEUM

- 6.4.7 Drift Marketplace

- 6.4.8 IOTA Foundation

- 6.4.9 BTL Group

- 6.4.10 Power Ledger

- 6.4.11 ImpactPPA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment