|

市场调查报告书

商品编码

1851769

自动化液体处理系统:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Automated Liquid Handlers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

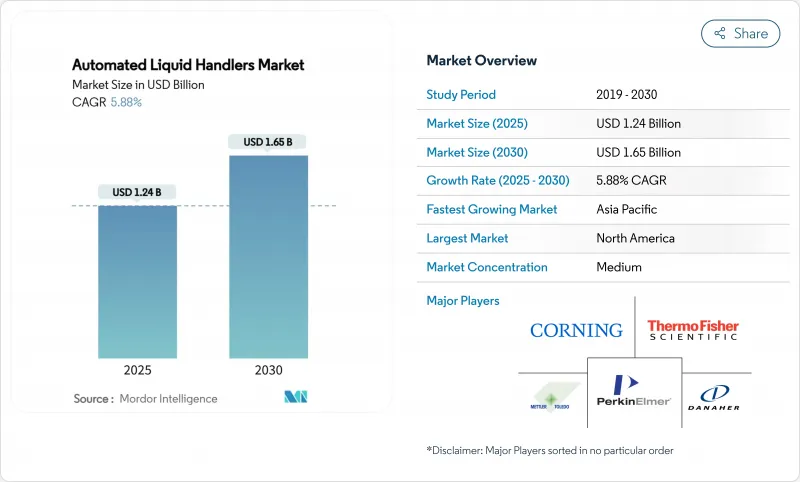

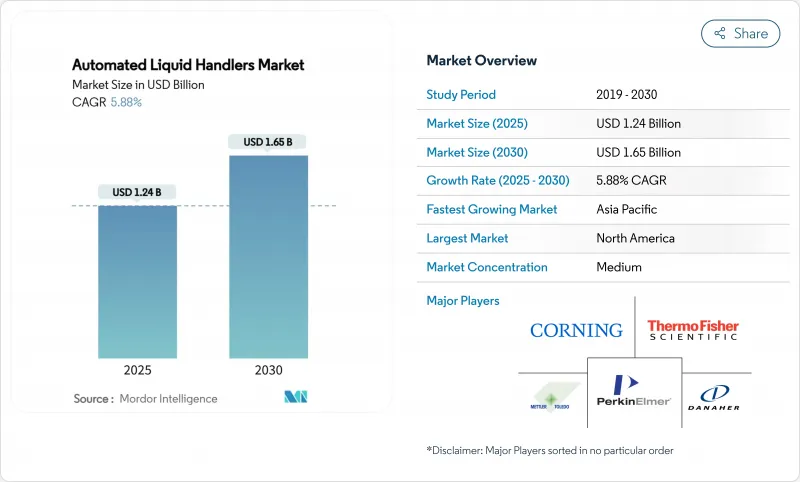

预计到 2025 年,自动化液体处理市场价值将达到 12.4 亿美元,到 2030 年将达到 16.5 亿美元,年复合成长率为 5.88%。

这一稳步增长反映了对大规模分子诊断能力的需求、人工智慧主导的实验室平台的快速普及以及从手动移液到精密机器人移液的转变。高通量基因组工作流程的推进得益于硬体升级,将文库製备时间从数小时缩短至数分钟。中等通量系统也推动了市场需求,这些系统能够满足大多数临床和研究实验室的日常样本量,从而为自动化液体处理市场耗材销售提供了稳定的基准。亚太地区政府的资助以及北美地区稳定的设备更换週期,都保证了该市场的长期前景良好。

全球自动化液体处理市场趋势与洞察

与人工智慧主导的药物发现平台集成,可加快从发现先导化合物到获得前置作业时间。

自动化工作站结合机器学习演算法,如今无需人工干预即可执行迭代式设计-执行-分析循环。配备<sup>19</sup>F NMR感测器的机器人可并行评估21种反应,使药物研发团队能够将先导化合物的发现週期缩短75%。Astra Zeneca和威尔康奈尔医学院的案例研究表明,这些闭合迴路系统提高了协同化合物预测的准确性,同时还能捕捉详细的分析元资料,为深度学习模型提供数据。节省的时间和更丰富的数据直接转化为更快的专利申请速度和更高的临床成功率,这使得自动化液体处理市场在製药数位数位化中占据了有利地位。

大规模基因组筛检(北美)对处理容量要求不断提高

疫情期间迅速扩大规模的美国参考实验室,如今每天处理数千份临床基因组样本。像 Biomek Echo One 这样的机器人移液解决方案,可以将样本製备时间从两小时缩短到十分钟——这只有全自动工作流程才能实现。随着保险公司扩大次世代定序仪的报销范围,大容量系统正成为首选,进一步巩固了北美在自动化液体处理市场的领先地位。

新兴市场灵活办公空间的初始资本投入较高

进口关税和多层分销导致标价上涨高达116%,在非洲部分地区,一套原价35万美元的系统价格飙升至75万美元以上。津贴很少涵盖培训或维护,迫使实验室签订他们无法负担的服务合约。结果是能力差距不断扩大,这有可能将新兴市场排除在全球基因组学联盟之外,从而削弱这些地区的自动化液体处理市场。

细分市场分析

机器人工作站占据自动化液体处理市场最大份额,预计2024年将占46%的市场份额。然而,随着人工智慧模组能够安排点胶流程并预测吸头使用情况,软体和服务预计将以7.7%的复合年增长率成长,从而立即降低成本。机器人安装量的增加确保了耗材的稳定供应,而润滑吸头则减少了黏稠样本中的残留。

产品组合正转向平台许可,以解锁工作流程库和云端分析功能。供应商现在将订阅仪表板捆绑销售,这些仪表板可以监控执行时间并在出现异常情况时发出警报,从而进一步推动软体收入成长。这种转变正在改变竞争动态,促进生态系统伙伴关係,并使程式码库成为自动化液体处理市场的核心差异化因素。

中型通量系统(每次运行处理 100 至 1000 个样本)将在 2024 年占据自动化液体处理市场 53.5% 的份额。这类系统兼顾速度和价格,能够满足临床实验室和中型生物技术公司典型的大量处理需求。高通量系统(每次运行处理超过 1000 个样本)将以 6.3% 的复合年增长率 (CAGR) 实现最快增长,这主要得益于药物研发领域大规模筛检宣传活动(每天进行超过 10 万次检测)的推动。

随着每日处理量超过 5000 个培养皿,单位经济效益显着提升,促使合约研究组织 (CRO) 在产能瓶颈领先进行设备升级。这一趋势推高了多臂配置和加长吸头架的机器人平台的价格。同时,这也拓展了预测性维护的服务机会,为自动化液体处理市场的收入来源提供了稳定性。

区域分析

北美地区凭藉其完善的分子诊断基础设施和集中的製药产业丛集,预计到2024年将占据自动化液体处理设备市场38.5%的份额。总部位于美国的赛默飞世尔科技公司已投资20亿美元用于本土生产,以确保短供应链和合规支援。加拿大在基因组研究领域实力雄厚,墨西哥则在农业基因体学领域应用自动化技术。该地区受益于创投对人工智慧主导的实验室技术新兴企业的资助,但机器人程式设计人员的短缺仍然是限制其规模化发展的瓶颈。

亚太地区是成长最快的地区,预计到2030年将以6.9%的复合年增长率成长,这主要得益于中国万亿元人民币的机器人计画和韩国1.28亿美元的智慧机器人计画。日本正充分利用数十年的自动化传统,而澳洲则利用联邦政府补贴建造符合GMP标准的生物加工设施。本地化服务中心克服了以往对进口技术人员的依赖,并减少了停机时间。政府有利于国内供应商的采购政策将加速装机量的扩张,巩固亚太地区作为自动化液体处理市场主要收入来源的地位。

欧洲凭藉德国、英国和法国强大的製药产品线,在自动化液体处理设备市场中占有稳固地位。欧盟内部的监管协调促进了跨境技术转让,而永续性要求则青睐经过检验的低碳排放机器人。南欧的实验室正在食品和环境检测领域采用自动化技术,扩大了潜在市场需求。与设备供应商合作的学徒计画有效弥补了技能缺口,确保了设备的稳定运作并降低了服务成本。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 大规模基因组筛检(北美)对通量需求的不断增长

- 采用紧凑型检测方法可降低试剂成本

- 与人工智慧主导的药物发现平台整合可加快先导化合物发现速度

- 个人化医疗的扩展推动了高精准度液体处理技术的发展(欧洲和美国)

- 新冠疫情后永久性分子诊断能力(全球参考实验室)

- 亚太地区政府对自动化生物加工的资助

- 市场限制

- 新兴市场灵活办公空间的初始资本投入较高

- 机器人系统编程和维护方面的技能差距

- 高黏度液体中存在样品交叉污染的风险

- 大型製药企业实验室传统LIMS系统整合面临的挑战

- 生态系分析

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 机器人液体处理工作站

- 移液系统

- 试剂分配器

- 耗材(晶片、培养板、试剂)

- 软体和服务

- 按吞吐能力

- 低通量(每次运行少于100个样本)

- 中等通量(每次运行 100-1000 个样本)

- 高通量(每次运行超过1000个样本)

- 按平台配置

- 独立式桌上型系统

- 整合模组化平台

- 透过使用

- 药物发现及先导药物最适化

- 基因组学和蛋白质组学

- 临床诊断

- 细胞生物学和干细胞研究

- 合成生物学和生物製程开发

- 其他用途

- 最终用户

- 製药和生物技术公司

- 合约研究组织 (CRO) 和合约生产组织 (CMO)

- 学术研究机构

- 临床检测与诊断实验室

- 法医学与环境检测实验室

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 东南亚

- 亚太其他地区

- 南美洲

- 巴西

- 其他南美洲

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Thermo Fisher Scientific Inc.

- Danaher Corp.(Beckman Coulter Life Sciences)

- Tecan Group Ltd.

- Hamilton Company

- PerkinElmer Inc.(Revvity)

- Agilent Technologies Inc.

- Mettler-Toledo International Inc.

- Becton, Dickinson and Company

- Eppendorf AG

- Formulatrix Inc.

- Aurora Biomed Inc.

- Sartorius AG(Biohit)

- Synchron Lab Automation

- Hudson Robotics Inc.

- Analytik Jena AG(Endress+Hauser)

- Opentrons Labworks Inc.

- Biosero Inc.(BICO Group)

- Gilson Inc.

- Lab Services BV

- Andrew Alliance SA(Waters)

- Integra Biosciences AG

- Corning Incorporated

- SPT Labtech Ltd.

- Festo AG and Co. KG

- Starlab International GmbH

第七章 市场机会与未来展望

The automated liquid handlers market size is estimated at USD 1.24 billion in 2025 and is projected to reach USD 1.65 billion by 2030, expanding at a 5.88% CAGR.

The steady rise reflects the push for large-scale molecular diagnostics capacities, rapid uptake of AI-driven laboratory platforms, and the shift from manual pipetting to robotic precision. Hardware upgrades that shorten library-prep from hours to minutes in high-throughput genomic workflows add further momentum. Demand is also supported by mid-sized throughput systems that fit the daily sample volume of most clinical and research laboratories, giving the automated liquid handlers market a resilient baseline of recurring consumable sales. Emerging government funding in Asia-Pacific and steady replacement cycles in North America keep long-term visibility high.

Global Automated Liquid Handlers Market Trends and Insights

Integration with AI-Driven Drug-Discovery Platforms Accelerating Hit-to-Lead Timelines

Automated workstations that pair with machine-learning algorithms now run iterative design-execute-analyse loops without human intervention. Robots equipped with 19F NMR sensors can evaluate 21 reactions in parallel, enabling discovery teams to compress hit-to-lead cycles by 75%. Case studies at AstraZeneca and Weill Cornell show these closed-loop systems improving predictive accuracy for synergistic compounds while capturing granular assay metadata that feeds deep-learning models. The time savings and data richness directly translate into earlier patent filings and a better probability of clinical success, keeping the automated liquid handlers market firmly aligned with pharmaceutical digitalization.

Growing Throughput Requirements in High-Volume Genomic Screening (North America)

US reference labs that scaled up during the pandemic now process thousands of clinical genomes daily. Robotic pipetting solutions like the Biomek Echo One trim sample-prep from two hours to 10 minutes. The underlying economics reward laboratories able to push the cost per sequence below USD 100, which is only feasible when workflows are fully automated. As insurers broaden reimbursement for next-generation sequencing, high-capacity systems become default purchases, reinforcing North American leadership in the automated liquid handlers market.

High Initial CapEx for Flexible Deck Workstations in Emerging Markets

Import duties and multi-layer distribution inflate list prices by up to 116%, pushing a USD 350,000 system above USD 750,000 in parts of Africa. Grants rarely cover training or maintenance, leaving labs with unaffordable service contracts. The result is a widening capability gap that risks excluding emerging markets from global genomics consortia, dampening the automated liquid handlers market in these regions.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Miniaturized Assay Formats Reducing Reagent Costs

- Expansion of Personalized Medicine Driving High-Accuracy Liquid Handling

- Skill Gap in Programming and Maintenance of Robotic Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Robotic workstations represent the largest slice of the automated liquid handlers market, holding 46% market share in 2024, because laboratories still prioritize mechanical precision for repeatable pipetting. Software and services, however, are forecast to grow at 7.7% CAGR as AI modules that schedule runs and predict tip usage deliver immediate cost savings. A growing installed base of robots ensures a recurring stream of consumables, and lubricant-infused tips reduce carry-over in viscous samples.

The product mix is shifting toward platform licences that unlock workflow libraries and cloud analytics. Vendors now bundle subscription dashboards that monitor uptime and flag anomalies, which further elevate software revenue. This pivot transforms competitive dynamics, encouraging ecosystem partnerships and making code libraries a core differentiator in the automated liquid handlers market.

Medium-throughput systems processing 100-1,000 samples per run accounted for 53.5% of the automated liquid handlers market size in 2024. They match typical batch volumes at clinical labs and mid-sized biotechs, offering balanced speed and price. High-throughput units that exceed 1,000 samples log the fastest 6.3% CAGR, thanks to large screening campaigns in drug discovery that surpass 100,000 assays a day.

Unit economics improve sharply once workflows cross 5,000 daily plates, prompting CROs to upgrade ahead of capacity bottlenecks. This trend anchors price premiums for robotic decks with multi-arm configurations and expanded tip racks. It also widens service opportunities in predictive maintenance, adding stability to revenue streams within the automated liquid handlers market.

The Automated Liquid Handlers Market Report is Segmented by Product Type (Robotic Liquid-Handling Workstations, and More), Throughput Capability (Low, Medium, and High), Platform Configuration (Stand-Alone Benchtop Systems, and Integrated Modular Platforms), Application (Drug Discovery, Genomics, and More), End User (CROs and CMOs, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.5% share of the automated liquid handlers market in 2024 on the back of permanent molecular diagnostic infrastructure and concentrated pharmaceutical clusters. US-based Thermo Fisher invested USD 2 billion in domestic manufacturing, ensuring short supply chains and compliance support. Canada adds strength in genomics research, while Mexico adopts automation for agrigenomics. The region benefits from venture capital that funds AI-driven lab-tech start-ups, though staffing shortages in robot programming still constrain scale.

Asia-Pacific is the fastest-growing region with a 6.9% CAGR through 2030, boosted by China's 1 trillion yuan robotics initiative and Korea's USD 128 million intelligent-robot program. Japan leverages decades of automation heritage, and Australia uses federal grants to build GMP-grade bioprocessing sites. Localized service centers cut downtime, overcoming historic reliance on imported technicians. Government procurement policies that favor domestic suppliers accelerate installed-base expansion, cementing Asia-Pacific as the primary incremental revenue source for the automated liquid handlers market.

Europe maintains a firm foothold in the automated liquid handlers market through stable pharma pipelines in Germany, the United Kingdom, and France. Regulatory alignment across the EU smooths cross-border tech transfer, while sustainability mandates drive preference for robots with validated CO2 footprints. Southern European labs deploy automation in food and environmental testing, enlarging the addressable demand. Skills gaps are mitigated by apprenticeship programs tied to equipment suppliers, enabling consistent uptime and moderating service costs.

- Thermo Fisher Scientific Inc.

- Danaher Corp. (Beckman Coulter Life Sciences)

- Tecan Group Ltd.

- Hamilton Company

- PerkinElmer Inc. (Revvity)

- Agilent Technologies Inc.

- Mettler-Toledo International Inc.

- Becton, Dickinson and Company

- Eppendorf AG

- Formulatrix Inc.

- Aurora Biomed Inc.

- Sartorius AG (Biohit)

- Synchron Lab Automation

- Hudson Robotics Inc.

- Analytik Jena AG (Endress + Hauser)

- Opentrons Labworks Inc.

- Biosero Inc. (BICO Group)

- Gilson Inc.

- Lab Services B.V.

- Andrew Alliance S.A. (Waters)

- Integra Biosciences AG

- Corning Incorporated

- SPT Labtech Ltd.

- Festo AG and Co. KG

- Starlab International GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Throughput Requirements in High-Volume Genomic Screening (North America)

- 4.2.2 Adoption of Miniaturized Assay Formats Reducing Reagent Costs

- 4.2.3 Integration with AI-Driven Drug-Discovery Platforms Accelerating Hit-to-Lead Timelines

- 4.2.4 Expansion of Personalized Medicine Driving High-Accuracy Liquid Handling (Europe and US)

- 4.2.5 Permanent Molecular-Diagnostic capacity Post-COVID-19 (Global Reference Labs)

- 4.2.6 Government Funding for Automated Bioprocessing (Asia-Pacific)

- 4.3 Market Restraints

- 4.3.1 High Initial CapEx for Flexible Deck Workstations in Emerging Markets

- 4.3.2 Skill Gap in Programming and Maintenance of Robotic Systems

- 4.3.3 Sample Cross-Contamination Risks in High-Viscosity Liquids

- 4.3.4 Legacy LIMS Integration Challenges in Big-Pharma Labs

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Robotic Liquid-Handling Workstations

- 5.1.2 Pipetting Systems

- 5.1.3 Reagent Dispensers

- 5.1.4 Consumables (Tips, Plates, Reagents)

- 5.1.5 Software and Services

- 5.2 By Throughput Capability

- 5.2.1 Low Throughput (Less than 100 samples/run)

- 5.2.2 Medium Throughput (100-1000 samples/run)

- 5.2.3 High Throughput (Above 1 000 samples/run)

- 5.3 By Platform Configuration

- 5.3.1 Stand-Alone Benchtop Systems

- 5.3.2 Integrated Modular Platforms

- 5.4 By Application

- 5.4.1 Drug Discovery and Lead Optimization

- 5.4.2 Genomics and Proteomics

- 5.4.3 Clinical Diagnostics

- 5.4.4 Cell Biology and Stem-Cell Research

- 5.4.5 Synthetic Biology and Bioprocess Development

- 5.4.6 Other Applications

- 5.5 By End User

- 5.5.1 Pharmaceutical and Biotechnology Companies

- 5.5.2 CROs and CMOs

- 5.5.3 Academic and Research Institutes

- 5.5.4 Clinical and Diagnostic Laboratories

- 5.5.5 Forensic and Environmental Testing Labs

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 South Korea

- 5.6.3.4 India

- 5.6.3.5 South East Asia

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Thermo Fisher Scientific Inc.

- 6.4.2 Danaher Corp. (Beckman Coulter Life Sciences)

- 6.4.3 Tecan Group Ltd.

- 6.4.4 Hamilton Company

- 6.4.5 PerkinElmer Inc. (Revvity)

- 6.4.6 Agilent Technologies Inc.

- 6.4.7 Mettler-Toledo International Inc.

- 6.4.8 Becton, Dickinson and Company

- 6.4.9 Eppendorf AG

- 6.4.10 Formulatrix Inc.

- 6.4.11 Aurora Biomed Inc.

- 6.4.12 Sartorius AG (Biohit)

- 6.4.13 Synchron Lab Automation

- 6.4.14 Hudson Robotics Inc.

- 6.4.15 Analytik Jena AG (Endress + Hauser)

- 6.4.16 Opentrons Labworks Inc.

- 6.4.17 Biosero Inc. (BICO Group)

- 6.4.18 Gilson Inc.

- 6.4.19 Lab Services B.V.

- 6.4.20 Andrew Alliance S.A. (Waters)

- 6.4.21 Integra Biosciences AG

- 6.4.22 Corning Incorporated

- 6.4.23 SPT Labtech Ltd.

- 6.4.24 Festo AG and Co. KG

- 6.4.25 Starlab International GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment