|

市场调查报告书

商品编码

1851786

客流统计系统:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)People Counting System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

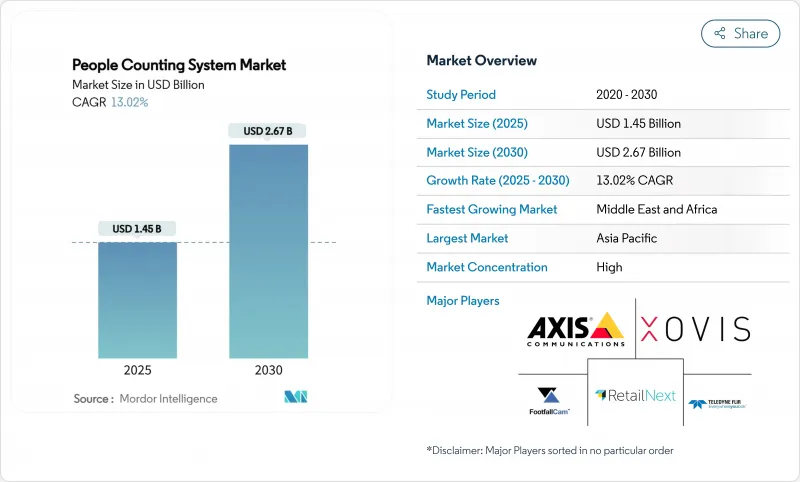

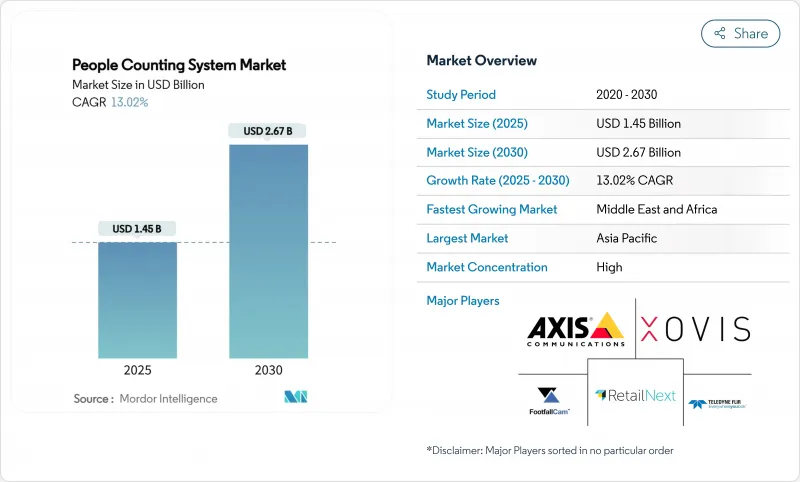

预计到 2025 年,客流统计系统市场规模将达到 14.5 亿美元,到 2030 年将达到 26.7 亿美元,预测期(2025-2030 年)复合年增长率为 13.02%。

强劲的需求源自于智慧城市建设支出、疫情后居住要求以及人工智慧感测器融合技术的持续发展,该技术旨在提高精度并降低营运成本。随着飞行时间(ToF) 感测器精度达到 99.8%,并整合隐私设计功能以帮助业主满足 GDPR 和 CCPA 的合规要求,其应用正在加速普及。与暖通空调 (HVAC) 系统的节能整合凸显了从点分析向整体优化的转变,一项商业建筑试点项目记录了 12.5% 的节能效果。亚太地区的智慧交通计划、中东的地铁扩建以及美国购物中心客流量的復苏,都为市场带来了多方面的成长动能。同时,半导体供应中断和不断上涨的合规成本正给中小型零售商带来定价压力。

全球客流统计系统市场趋势与洞察

北美和欧洲的智慧零售商对即时客流量分析的需求

美国购物中心在实施数据分析后,营收成长了5%至15%。 Link Retail的LinkVision摄影机软体利用现有CCTV,准确率超过95%,进而降低了欧洲连锁店的整修成本。 Telstra正在澳洲门市部署2024系统,该系统结合了超过95%的准确率和设备端处理技术,以应对隐私风险,凸显了其全球影响力。透过人口统计元资料增强客流量统计,零售商无需共用资料即可调整版面配置并进行精准促销活动。这些优势巩固了客流量统计系统的市场地位,而客流量统计系统是全通路策略的核心。

新冠疫情后租户合规要求强制安装加油设施(欧盟、美国)

修订后的建筑规范要求即时统计人数,以支援紧急疏散和室内空气品质监测,这促使医疗机构和政府办公大楼开始采用这项技术。美国总务奥克拉荷马市联邦大楼将居住感测器与其楼宇管理系统 (BMS) 连接,从而降低了 41% 的能源消耗,向政府采购方展示了投资回报率。 FootfallCam 符合 GDPR 标准的设计在晶片层面匿名化数据,防止储存个人影像,同时保持计数精度。美国国土国防安全保障部 2024 年的一项调查核准了15 种云分析工具,证实了该技术对公共准备的重要性。因此,日益严格的合规要求既是催化剂也是筛选器,它奖励那些拥有可靠隐私认证的供应商。

GDPR/CCPA隐私合规性阻碍了欧盟和加拿大基于摄影机的监控系统的应用。

严格的授权规则迫使供应商采用匿名化和本地处理技术。 AuraVision 的装置端分析技术可在不储存影像的情况下撷取方向计数,从而满足监管机构的要求。飞行时间 (ToF) 感测器无需可辨识的帧即可提供超过 95% 的精度,降低了认证门槛。能够检验端到端合规性的供应商在公共竞标中越来越具有优势,进而影响市场竞争动态。

细分市场分析

硬体仍将是客流统计系统市场收入的主导力量,到2024年将占据64%的市场。资本支出主要集中在安装在零售入口、机场航站大楼和公共场所的飞行时间(ToF)和雷射雷达(LiDAR)感测器上。同时,随着营运商寻求外包分析、合规性审核和持续校准等服务,託管服务正以13.7%的复合年增长率成长。从一次性安装模式转变为订阅模式的将改变收入的可见性,并支持永续成长。客流统计系统产业的参与者将利用交叉销售,将感测器升级和仪錶板培训相结合,签订多年合约。软体平台将转型为微服务架构,整合第三方数据,以支援预测性人员配置和能源优化等应用情境。

整合程度的提高增加了复杂性,使服务公司扮演起协调者的角色,负责统筹IT安全、设施管理和行销。运转率数据与暖通空调(HVAC)运行计划相结合的计划展现出切实的营运成本效益,促使业主将支出从固定资产转向基于结果的合约。因此,服务类别正在帮助客流统计系统市场摆脱硬体更新周期的限制,以实现多元化发展。

2024年,红外线光束感测器占据了36.5%的客流统计系统市场份额,这主要得益于其在狭窄门安装环境中的可靠性。然而,飞行时间(ToF)3D感测器预计将以14.4%的复合年增长率成长。 ToF感测器透过将光飞行时间转换为深度图,能够区分人、推车和宠物,即使在光照条件变化的情况下也能保持精确度。这种转变对拥有可整合符合GDPR要求的逻辑的专有ToF ASIC晶片的供应商来说是个好消息。基于视讯的方法将透过转向去除个人影像的边缘推理技术而继续生存,但一些买家仍然持谨慎态度。热感成像技术在医院占据独特的市场地位,因为医院的体温筛检和客流统计功能在此融合。随着组件成本的下降,预计到2030年,与ToF感测器相关的客流统计系统的市场规模将超过红外线感测器。

混合部署方案,例如在入口处使用飞行时间(ToF)感测器,在开放区域使用Wi-Fi探测器,显示人们对多模态精度的需求日益增长。高通公司可扩展深度估计专利清晰地表明了其对广泛技术栈的投入,旨在不断提升ToF的性能。随着应用范围的扩大,规模经济将进一步降低价格分布,进而进一步推动技术转型。

区域分析

亚太地区预计到2024年将占全球收入的31.4%,这主要得益于政府资助的智慧城市计画以及本地生产的降低单位成本的感测器硬体。新加坡地铁正在升级摄影机并利用车票资料推送拥塞预警,而香港则将雷射雷达(LiDAR)支援的边缘人工智慧技术应用于铁路安全。日本JR东日本公司正在处理约600个车站的Suica卡交易记录,以模拟通勤流量,用于交通规划和商店选址。中国二线城市的快速都市化推动了人群管理套件的大量订单,而东南亚的机场正在部署飞行时间计数器以加快安检速度。这些协调一致的基础设施建设目标正在巩固该地区在客流统计系统市场的长期主导地位。

中东是成长最快的地区,复合年增长率高达14.2%。 「2030愿景」计画正在沙乌地阿拉伯、阿联酋和卡达推动大规模感测器部署。 Bold Technologies公司向Ion Sentia的认知城市平台投资25亿美元,该平台将出行、医疗保健和能源数据整合到一个人工智慧层中。杜拜的目标是利用街道感测器建构全城数位孪生,这将为云端分析提供者带来更多机会。大量创业投资涌入中东和北非地区的分析新兴企业,预示着当地供给能力的提升。

在北美,零售业的更新换代週期和联邦政府的设施法规正在推动相关技术的应用。预计到2025年,消费者将重返美国购物中心,从而更加重视员工与消费者之间的差异化服务。欧洲的GDPR法规将推动以隐私为中心的飞行时间(ToF)技术和尖端视讯解决方案的发展,鼓励企业进行现有系统的升级而非全新部署。南美洲中小企业面临着技术成本的挑战,而非洲新兴的智慧城市规划则带来了更长远的成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲智慧零售业对客流量分析的需求

- 新冠疫情后入住率合规义务推动设施改造(欧盟、美国)

- 智慧城市交通枢纽在亚洲各地部署人流感测器

- 人工智慧驱动的视讯分析可降低整体拥有成本并提高准确性

- 透过商业建筑运转率整合实现暖通空调能源优化

- 创业投资中东和北非地区的客流量即服务平台

- 市场限制

- GDPR/CCPA隐私合规性阻碍了欧盟和加拿大基于摄影机的监控系统的应用。

- 开放区域(体育场)数量统计准确性的不足会降低买家信心。

- 新兴市场传统楼宇管理系统整合的复杂性

- 南美中小零售商的价格敏感度

- 监理与技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术概览

- 有线感应器

- 无线(Wi-Fi/BLE/LoRa)

- 热感成像感测器

- 飞行时间三维感测器

- 其他技术(压力垫、磁性、光达)

第五章 市场规模与成长预测

- 报价

- 硬体

- 软体

- 服务

- 透过感测器技术

- 红外线光束

- 热感成像(IR)

- 基于视讯的(单声道/立体/人工智慧)

- 飞行时间(3D)

- 压力和磁性

- Wi-Fi/BLE探针

- 透过部署模式

- 本地部署

- 云

- 连结性别

- 有线(乙太网路/PoE)

- 无线(Wi-Fi)

- LP-WAN(LoRa、Zigbee、BLE)

- 按行业

- 零售店

- 购物中心和大卖场

- 交通枢纽(机场/捷运/公车)

- 饭店及休閒(饭店、赌场、主题乐园)

- 体育和娱乐场所

- 银行和金融机构

- 企业及政府大楼

- 医疗机构

- 智慧城市与公共空间

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲国家

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 北欧国家(瑞典、挪威、丹麦、芬兰)

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- RetailNext Inc.

- Sensormatic Solutions(ShopperTrak)

- Axis Communications AB

- Teledyne FLIR Systems Inc.

- HELLA Aglaia Mobile Vision GmbH

- IEE SA

- InfraRed Integrated Systems Ltd.(IRISYS)

- Traf-Sys Inc.

- FootfallCam Ltd.

- V-Count Inc.

- Xovis AG

- iris-GmbH infrared and intelligent sensors

- DILAX Intelcom GmbH

- Eurotech SpA

- SensMax Ltd.

- Countlogic LLC

- Dor Technologies Inc.

- Density Inc.

- Cognimatics AB

- Megvii Technology Ltd.

第七章 市场机会与未来展望

The People Counting System Market size is estimated at USD 1.45 billion in 2025, and is expected to reach USD 2.67 billion by 2030, at a CAGR of 13.02% during the forecast period (2025-2030).

Steady demand comes from smart-city spending, post-pandemic occupancy requirements, and the continuing shift toward AI-enabled sensor fusion that raises accuracy while lowering operating costs. Adoption accelerates as Time-of-Flight (ToF) sensors deliver 99.8% accuracy and integrate privacy-by-design features that help owners meet GDPR and CCPA mandates. Energy-saving tie-ins with HVAC systems underline a move from point analytics to portfolio-wide optimization, with documented commercial-building pilots posting 12.5% energy reductions. Smart-transport projects across Asia Pacific, metro expansion in the Middle East, and mall traffic rebounds in the United States sustain multi-vertical momentum. At the same time, semiconductor supply disruption and heightened compliance costs create price tension that smaller retailers must navigate.

Global People Counting System Market Trends and Insights

Smart-retail demand for real-time footfall analytics in North America and Europe

Retailers rely on anonymized footfall data to raise conversion and calibrate staffing; evidence from U.S. malls shows 5-15% revenue uplift after analytics rollouts. Link Retail's LinkVision camera software leverages existing CCTV to surpass 95% accuracy, lowering retrofit costs for European chains. Telstra's 2024 deployment across Australian stores underscores global reach, pairing >95% accuracy with on-device processing that addresses privacy risk. By enriching traffic counts with demographic metadata, retailers adjust layouts and execute targeted promotions without data-sharing exposure. These traction points reinforce the People Counting System market as a core pillar of omnichannel strategy.

Post-COVID occupancy compliance mandates fueling installations (EU, US)

Revised building codes now require live head-counting to support emergency egress and indoor-air-quality monitoring, spurring adoption in health facilities and public offices. The GSA Oklahoma City Federal Building linked occupancy sensors to its BMS and cut energy use 41%, proving ROI to government buyers. GDPR-aligned designs from FootfallCam anonymize data at chip level, preventing storage of personal imagery while sustaining counting fidelity. Homeland Security's 2024 survey that endorsed 15 crowd-analysis tools confirms the technology's relevance to public-safety readiness. Heightened compliance requirements therefore work as both catalyst and filter, rewarding vendors with defensible privacy credentials.

GDPR/CCPA privacy compliance hindering camera-based adoption in EU and CA

Stringent consent rules compel vendors to embed anonymization and local processing, raising bill-of-materials and legal consultancy costs. Aura Vision's on-device analytics avoid image storage, satisfying regulators yet still capturing directional counts. ToF sensors emerge as a substitute, providing >95% accuracy without identifiable frames, easing certification hurdles. Vendors that can verify end-to-end compliance are increasingly favored in public tenders, which shapes competitive dynamics within the People Counting System market.

Other drivers and restraints analyzed in the detailed report include:

- Smart-city transportation hubs deploying crowd-flow sensors across Asia

- AI-enabled video analytics cutting TCO and boosting accuracy

- Accuracy gaps in open-area counting reducing buyer confidence (stadiums)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware continues to dominate People Counting System market revenue, holding 64% share in 2024. Capital outlays concentrate on ToF and LiDAR sensors installed across retail thresholds, airport terminals, and public facilities. Managed services, however, are climbing at a 13.7% CAGR as operators seek outsourced analytics, compliance auditing, and continuous calibration. The migration from one-off installs to subscription models transforms revenue visibility and underpins sustainable growth. People Counting System industry participants leverage cross-selling-pairing sensor upgrades with dashboard training-to lock in multi-year contracts. Software platforms move toward micro-services that ingest third-party data, supporting predictive staffing and energy-optimization use cases.

Integration depth raises complexity, positioning services firms as orchestrators that align IT security, facilities management, and marketing. Projects that join occupancy data with HVAC schedules demonstrate tangible opex gains, encouraging building owners to shift spending from fixed assets to outcome-based agreements. As a result, the services category helps diversify the People Counting System market beyond hardware refresh cycles.

Infrared beam sensors captured 36.5% of People Counting System market share in 2024 on the back of reliability in narrow-door installations. Yet ToF 3D sensors are set to expand at a 14.4% CAGR, catalyzed by privacy laws that favor non-imaging depth measurement. By converting light-flight time into depth maps, ToF differentiates people from carts and pets, sustaining accuracy under changing lighting. The shift bodes well for vendors with proprietary ToF ASICs that can embed GDPR-inclusive logic. Video-based approaches survive by pivoting to on-edge inference that strips personal imagery, but some buyers remain cautious. Thermal imaging occupies a niche in hospitals where temperature screening merges with head counts. The People Counting System market size tied to ToF sensors is projected to eclipse infrared revenues before 2030 as component cost curves decline.

Hybrid deployments that blend ToF at entry points with Wi-Fi probes in open zones demonstrate rising interest in multimodal precision. Qualcomm's patent work on scalable depth estimation underscores wider tech-stack investment that will keep ToF on a steep performance trajectory. As adoption broadens, economies of scale further compress price points, reinforcing switch-over momentum.

People Counting System Market Report is Segmented by Offering (Hardware, Software, Services), Sensor Technology (Infrared Beam, Thermal Imaging, Video-Based and More), Deployment Mode (On-Premise, Cloud), Connectivity (Wired, Wireless, LP-WAN), End-User Vertical (Retail, Malls, Transportation, Hospitality and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific holds a 31.4% revenue stake in 2024, propelled by government-funded smart-city frameworks and locally manufactured sensor hardware that compresses unit costs. Singapore's MRT applies camera upgrades and ticket data to push crowdedness alerts, while Hong Kong integrates LiDAR-backed edge AI for railway safety. Japan's JR East processes Suica transaction logs across ~600 stations to model commuter flow, feeding both transport planning and retail placement. China's tier-two city urbanization fuels bulk orders for crowd-management kits, and Southeast Asian airports deploy ToF counters to speed security lines. These coordinated infrastructure goals cement the region's long-term dominance within the People Counting System market.

The Middle East emerges as the fastest-growing geography at a 14.2% CAGR. Vision 2030 programs back large-scale sensor rollouts in Saudi Arabia, the UAE, and Qatar. Bold Technologies allocates USD 2.5 billion to the Aion Sentia cognitive-city platform that fuses mobility, healthcare, and energy data on one AI layer. Dubai targets a city-wide digital twin via street-level sensors, expanding opportunities for crowd analytics providers. Venture-capital flows into MENA analytics startups indicate rising local supply capacity.

North America sustains adoption through retail refresh cycles and federal facility mandates. The return of U.S. mall shoppers in 2025 renews appetite for staff-versus-shopper differentiation features. Europe's GDPR regime fosters privacy-centric ToF and on-edge video solutions, stimulating upgrades rather than greenfield sales. South America grapples with SMB affordability, while Africa's nascent smart-city schemes provide longer-dated upside.

- RetailNext Inc.

- Sensormatic Solutions (ShopperTrak)

- Axis Communications AB

- Teledyne FLIR Systems Inc.

- HELLA Aglaia Mobile Vision GmbH

- IEE S.A.

- InfraRed Integrated Systems Ltd. (IRISYS)

- Traf-Sys Inc.

- FootfallCam Ltd.

- V-Count Inc.

- Xovis AG

- iris-GmbH infrared and intelligent sensors

- DILAX Intelcom GmbH

- Eurotech S.p.A.

- SensMax Ltd.

- Countlogic LLC

- Dor Technologies Inc.

- Density Inc.

- Cognimatics AB

- Megvii Technology Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-Retail Demand for Real-Time Footfall Analytics in North America and Europe

- 4.2.2 Post-COVID Occupancy Compliance Mandates Fueling Installations (EU, US)

- 4.2.3 Smart-City Transportation Hubs Deploying Crowd-Flow Sensors Across Asia

- 4.2.4 AI-Enabled Video Analytics Cutting TCO and Boosting Accuracy

- 4.2.5 HVAC Energy-Optimization via Occupancy Integration in Commercial Buildings

- 4.2.6 Venture-Capital Surge into MENA Footfall-as-a-Service Platforms

- 4.3 Market Restraints

- 4.3.1 GDPR/CCPA Privacy Compliance Hindering Camera-Based Adoption in EU and CA

- 4.3.2 Accuracy Gaps in Open-Area Counting Reducing Buyer Confidence (Stadiums)

- 4.3.3 Legacy BMS Integration Complexity in Emerging Markets

- 4.3.4 Price Sensitivity of SMB Retailers in South America

- 4.4 Regulatory and Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Wired Sensors

- 4.6.2 Wireless (Wi-Fi / BLE / LoRa)

- 4.6.3 Thermal Imaging Sensors

- 4.6.4 Time-of-Flight 3-D Sensors

- 4.6.5 Other Technologies (Pressure Mats, Magnetic, LiDAR)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Sensor Technology

- 5.2.1 Infrared Beam

- 5.2.2 Thermal Imaging (IR)

- 5.2.3 Video-Based (Mono / Stereo / AI)

- 5.2.4 Time-of-Flight (3-D)

- 5.2.5 Pressure and Magnetic

- 5.2.6 Wi-Fi / BLE Probe

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Connectivity

- 5.4.1 Wired (Ethernet / PoE)

- 5.4.2 Wireless (Wi-Fi)

- 5.4.3 LP-WAN (LoRa, Zigbee, BLE)

- 5.5 By End-User Vertical

- 5.5.1 Retail Stores

- 5.5.2 Shopping Malls and Hypermarkets

- 5.5.3 Transportation Hubs (Airports / Metro / Bus)

- 5.5.4 Hospitality and Leisure (Hotels, Casinos, Theme Parks)

- 5.5.5 Sports and Entertainment Venues

- 5.5.6 Banks and Financial Institutions

- 5.5.7 Corporate and Government Buildings

- 5.5.8 Healthcare Facilities

- 5.5.9 Smart Cities and Public Spaces

- 5.5.10 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics (Sweden, Norway, Denmark, Finland)

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 RetailNext Inc.

- 6.4.2 Sensormatic Solutions (ShopperTrak)

- 6.4.3 Axis Communications AB

- 6.4.4 Teledyne FLIR Systems Inc.

- 6.4.5 HELLA Aglaia Mobile Vision GmbH

- 6.4.6 IEE S.A.

- 6.4.7 InfraRed Integrated Systems Ltd. (IRISYS)

- 6.4.8 Traf-Sys Inc.

- 6.4.9 FootfallCam Ltd.

- 6.4.10 V-Count Inc.

- 6.4.11 Xovis AG

- 6.4.12 iris-GmbH infrared and intelligent sensors

- 6.4.13 DILAX Intelcom GmbH

- 6.4.14 Eurotech S.p.A.

- 6.4.15 SensMax Ltd.

- 6.4.16 Countlogic LLC

- 6.4.17 Dor Technologies Inc.

- 6.4.18 Density Inc.

- 6.4.19 Cognimatics AB

- 6.4.20 Megvii Technology Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment