|

市场调查报告书

商品编码

1851791

公司治理、风险与合规:市场占有率分析、产业趋势、统计数据与成长预测(2025-2030 年)Enterprise Governance, Risk And Compliance - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

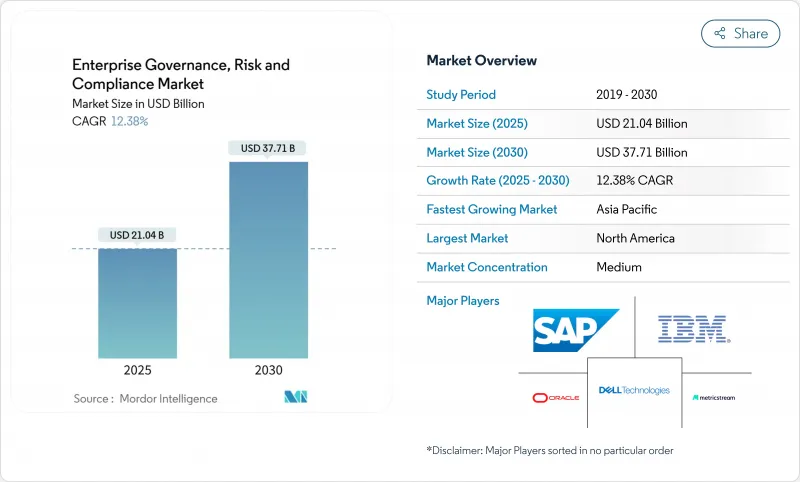

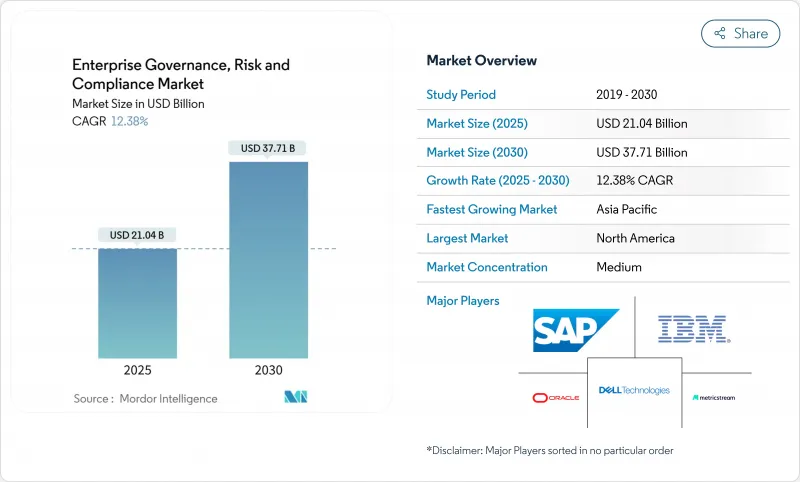

企业管治、风险和合规市场预计将在 2025 年达到 210.4 亿美元,到 2030 年达到 377.1 亿美元,在预测期内以 12.38% 的复合年增长率增长。

随着各组织面临监管要求激增,尤其是《数位营运弹性法案》(DORA) 的实施,同时积极采用人工智慧来自动化控制、解读快速变化的规则并即时检测异常情况,市场需求正在加速成长。整合套件将以往各自独立的审核、政策和网路安全工作流程整合到单一资料来源中,从而显着降低成本并加快问题解决速度,平台采用率也因此不断提高。早期采用者报告称,透过将人工智慧驱动的管治分析整合到安全远端检测中,误报率降低了高达 42%。此外,保险公司利用即时 GRC 指标来确定保费,将卓越的治理绩效与保费折扣和竞争优势挂钩,这进一步推动了市场发展。

全球公司治理、风险与合规市场趋势及洞察

严格的政府法规和指令推动平台整合

《资料保护条例》(DORA) 将于 2025 年 1 月生效,该条例要求欧盟金融机构纳入资讯通讯技术 (ICT) 风险框架,涵盖事件回应、弹性测试和第三方监控。目前,各机构每天要监控超过 250 项监理变更,速度远超过人工流程。机器学习模型能够解析新法规,评估其相关性,并在几分钟内将任务分配给相关负责人,使合规团队能够专注于策略风险分析。因此,提供多司法管辖区映射和自动更新引擎的供应商在各公司的候选名单中名列前茅。不合规不仅会面临巨额罚款,还会损害声誉,而儘早采取合规措施则能展现其营运的弹性,从而确保投资者信心。

日益严峻的网路安全威胁推动了GRC技术的整合

到2024年,网路安全事件将激增75%,迫使资讯安全长(CISO)将安全态势指标纳入核心管治仪表板,而不是孤立地看待它们。将策略检查与威胁远端检测迭加的单一主机可以减少重复工作,并加快混合环境中漏洞的修復速度。采用人工智慧赋能的GRC套件的医疗保健机构,其风险检测率提高了37%,误报率降低了42%,这充分证明了整合合规性和安全数据的价值。 70%的组织认为其目前的云端风险分配流程效率低下,因此对集中式、与云端无关的管理方案的需求日益增长。提供可操作仪表板而非原始警报的供应商,透过减少用户疲劳并使专家能够专注于高影响威胁,正逐渐赢得市场青睐。

对旧有系统进行现代化改造面临高昂的初始整合成本。

主流套件的年度订阅费用从 5 万美元到 50 万美元不等,但实施成本通常是许可费的两到六倍,这给使用老旧 ERP 系统的公司带来了沉重的预算负担。 SaaS 价格通膨率高达 11.3%,供应商甚至在员工人数保持不变的情况下仍将价格提高 25%,这进一步加剧了价格敏感度。将现代 GRC 工具与客製化的财务、人力资源和製造系统整合通常需要客製化 API 和变更管理程序,从而延长了专案週期。基于结果的许可和低程式码连接器正日益普及,它们将资本支出转化为营运支出,并透过可量化的风险降低指标来证明投资回报。

细分市场分析

解决方案将占2024年收入的67.30%,凸显了买家对端到端套件的偏好,这些套件将策略库、审核追踪、风险评分和事件回应整合到单一平台中。这种主导地位反映了企业在企业管治、风险和合规市场中对单一供应商课责和跨所有职能部门一致使用者体验的重视。咨询、整合和託管服务虽然绝对值较小,但预计到2030年将成长12.70%,因为企业会寻求外部专家进行监管解读和复杂系统部署。风险管理和审核管理模组的采用速度最快,因为它们取代了电子表格工作流程,并提供高阶主管可以透过行动应用程式追踪的即时分析。供应链衝击造成平均1.84亿美元的损失后,对业务永续营运能力的需求激增,促使企业将业务连续性计画与供应商评分卡直接关联起来。

银行和医院对本地储存敏感记录的需求将推动本地部署收入在2024年增长54.20%,但随着资讯长们青睐弹性运算能力以应对人工智慧工作负载,云端合约将在2030年前以每年13.50%的速度成长。云端平台能够自动升级、缩短引进週期并赋能远端团队,使其对中小企业和跨国公司都极具吸引力。监管机构透过资料流分析(DORA)对第三方弹性进行审查,将促使企业要求对外部云端供应商进行持续监督。混合模式将关键资料保留在企业内部,并将分析工作迁移到云端,使风险规避型企业能够在不违反资料驻留规则的情况下尝试云端服务。

服务供应商透过提供客户管理的加密金钥和经本地合规认证的主权云端区域来缓解安全漏洞。他们还利用基础设施即程式码范本简化部署,使用户能够在数小时内而非数週内建立完整的环境。由于人工智慧演算法需要庞大的训练资料集和可扩展的GPU,云端部署正成为配置合规分析的首选方案,这进一步巩固了云端在未来企业管治、风险和合规市场格局中的重要地位。

企业管治、风险与合规市场按组件(软体和服务)、部署模式(本地部署和云端部署)、组织规模(中小企业、大型企业)、最终用户行业垂直领域(银行、金融服务和保险、医疗保健和生命科学、製造业、IT和电信、能源和公共产业、其他)以及地区进行细分。市场预测以美元(USD)计价。

区域分析

北美地区拥有成熟的监管体系和雄厚的技术预算,预计2024年将贡献全球35.2%的收入。金融机构每年在合规方面支出610亿美元,99%的机构预计成本将会增加,这推动了对自动化解决方案的需求,以降低成本率。联邦指南鼓励企业进行自我报告和维持稳健的运营,促使企业将GRC(治理、风险和合规)投资视为竞争优势。 ServiceNow和Visa等机构的伙伴关係表明,技术供应商如何共同开发人工智慧工作流程,在确保合规性的同时,增强争议管理。

亚太地区预计将以13.1%的复合年增长率成为全球成长最快的地区。新加坡、澳洲和印度政府已推出与英国《反贿赂法》类似的法人责任法规,迫使企业投资现代化的合规架构。此外,亚太地区的银行业面临高达450亿美元的金融犯罪合规成本,其中70%的银行预计在2024年将增加软体支出。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 严格的政府法规和指令

- 数位转型带来了日益严峻的网路安全威胁

- 向整合风险管理平台过渡

- 环境、社会及公司治理(ESG)报告及非财务资讯揭露规则所面临的压力

- 采用人工智慧驱动的预测性合规分析

- 承保对即时 GRC 指标的依赖

- 市场限制

- 熟练的GRC专业人员短缺

- 整合到传统环境的初始成本很高

- 多重云端下资料驻留与主权的复杂性

- 组织治理、风险与合规疲劳与警报过载

- 供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场的宏观经济因素

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 政策合规管理

- 审核管理

- 风险管理

- 事件管理

- 业务永续营运和灾害復原

- 服务

- 咨询

- 整合与实施

- 培训和支持

- 解决方案

- 按部署模式

- 本地部署

- 云

- 按公司规模

- 小型企业

- 大公司

- 按最终用户行业划分

- BFSI

- 医疗保健和生命科学

- 製造业

- 资讯科技和电讯

- 能源与公共产业

- 零售和消费品

- 政府和公共部门

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Dell Technologies(incl. RSA Security)

- IBM Corporation

- SAP SE/GRC Suite

- Oracle Corporation

- MetricStream Inc.

- Wolters Kluwer/Enablon

- SAS Institute Inc.

- Software AG

- NAVEX Global

- Thomson Reuters Corp.

- ServiceNow Inc.

- Riskonnect Inc.

- LogicManager Inc.

- OneTrust LLC

- Galvanize(Diligent)

- Ideagen Plc

- SAI Global

- AxiomSL(Adenza)

- Cura Software

- BWise(SandP Global)

- FutureShield Inc.

- Maclear LLC

- RSA Archer Suite

第七章 市场机会与未来展望

The enterprise governance risk compliance market is valued at USD 21.04 billion in 2025 and is set to reach USD 37.71 billion by 2030, advancing at a 12.38% CAGR during the forecast period.

Demand accelerates as organizations confront a surge in regulatory obligations, most notably the Digital Operational Resilience Act (DORA), while adopting AI to automate controls, interpret fast-changing rules, and flag anomalies in real time. Platform uptake intensifies because integrated suites consolidate previously siloed audit, policy, and cybersecurity workflows into a single source of truth, producing measurable cost savings and faster issue resolution. Early adopters report efficiency gains of up to 42% in false-positive reduction after embedding AI-driven compliance analytics alongside security telemetry. Momentum is further reinforced by insurers that now price coverage using real-time GRC metrics, translating strong governance performance into premium discounts and competitive advantage.

Global Enterprise Governance, Risk And Compliance Market Trends and Insights

Stringent government regulations and mandates drive platform consolidation

Heightened rulemaking continues to swell the enterprise governance risk compliance market as DORA, effective January 2025, obliges EU financial entities to embed ICT risk frameworks covering incident response, resilience testing, and third-party oversight. Firms now monitor more than 250 regulatory changes each day, a pace that outstrips manual processes. Machine-learning models parse new statutes, rank their relevance, and route tasks to accountable owners within minutes, enabling compliance teams to redeploy effort toward strategic risk analysis. Vendors offering multijurisdictional mapping and automated update engines have therefore moved to the top of enterprise shortlists. Failure to comply risks both material penalties and reputational damage, whereas early movers secure investor confidence by demonstrating operational resilience.

Rising cybersecurity threats accelerate GRC technology integration

Cyber incidents spiked 75% in 2024, pushing CISOs to embed security posture metrics into core governance dashboards instead of handling them in isolation. A single console that overlays policy checks onto threat telemetry cuts duplication and shrinks time to remediate vulnerabilities across hybrid environments. Healthcare providers adopting AI-enabled GRC suites recorded 37% stronger risk detection rates and 42% fewer false positives, illustrating the value of unifying compliance and security data. Because 70% of organizations label current cloud-risk assignment processes ineffective, appetite for centralised, cloud-agnostic controls has intensified. Suppliers that deliver actionable dashboards-rather than raw alerts-win traction by easing user fatigue and freeing specialists to focus on high-impact threats.

High initial integration costs challenge legacy system modernization

Annual subscriptions for leading suites range from USD 50,000 to USD 500,000, while implementation often costs two to six times the license fees, straining budgets for firms running ageing ERP backbones. SaaS inflation running at 11.3% further heightens price sensitivity as vendors impose 25% hikes despite flat headcount. Integrating modern GRC tools with bespoke finance, HR, and manufacturing systems often demands custom APIs and change-management programmes that extend timelines. Outcome-based licensing and low-code connectors are gaining popularity by shifting capital expenditure to operating expense and demonstrating payback through quantifiable risk-reduction metrics.

Other drivers and restraints analyzed in the detailed report include:

- AI-powered predictive compliance analytics transform risk management

- ESG reporting pressure creates new compliance categories

- Organizational GRC-fatigue impedes platform adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions generated 67.30% of 2024 revenue, underscoring buyer preference for end-to-end suites that blend policy libraries, audit trails, risk scoring, and incident response into one stack. This dominance reflects how enterprises value single-vendor accountability and consistent user experience across all functions of the enterprise governance risk compliance market. Consulting, integration, and managed services, though smaller in absolute value, are set to grow 12.70% through 2030 as buyers turn to external experts for regulatory interpretation and complex system rollouts. Risk Management and Audit Management modules experience the fastest take-up because they replace spreadsheet workflows and provide real-time analytics that executives can track on mobile apps. Demand for Business Continuity features surged after supply-chain shocks averaged USD 184 million in losses, prompting firms to link continuity plans directly to supplier scorecards.

On-premise installations retained 54.20% of 2024 revenue because banks and hospitals must store sensitive records locally, but cloud subscriptions will expand 13.50% annually through 2030 as CIOs favor elastic compute for AI workloads. Cloud platforms automate upgrades, shorten implementation cycles, and empower remote teams, making them attractive to SMEs and multinationals alike. Regulatory scrutiny on third-party resilience through DORA pushes firms to demand continuous oversight of external cloud providers-a capability that cloud-native GRC suites embed by design. Hybrid models, which keep critical data on-site while shifting analytics to the cloud, enable risk-averse firms to test the waters without breaching residency rules.

Providers mitigate perceived security gaps by offering customer-managed encryption keys and sovereign-cloud regions certified for local compliance regimes. They also streamline deployment through infrastructure-as-code templates that stand up full environments in hours rather than weeks. As AI algorithms require large training sets and scalable GPUs, cloud deployments become the default choice for predictive compliance analytics-cementing their role in the future landscape of the enterprise governance risk compliance market.

Enterprise Governance Risk Compliance Market is Segmented by Component (Software and Services), Deployment Model (On-Premises and Cloud), Organisation Size (Small and Medium Enterprises, Large Enterprises), End-User Industry (BFSI, Healthcare and Life Sciences, Manufacturing, IT and Telecom, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 35.2% of global revenue in 2024, supported by mature regulatory ecosystems and robust technology budgets. Financial institutions spend USD 61 billion annually on compliance, and 99% expect costs to rise, reinforcing demand for automated solutions that lower expense ratios. Federal guidelines reward self-reporting and resilient operations, so firms treat GRC investment as a competitive edge. Partnerships such as ServiceNow-Visa illustrate how technology vendors co-create AI workflows that enhance dispute management while ensuring regulatory adherence.

Asia-Pacific is projected to log a 13.1% CAGR, the highest globally. Governments in Singapore, Australia, and India introduce corporate liability rules mirroring the UK Bribery Act, compelling companies to invest in modern compliance architecture. APAC banks also confront USD 45 billion in financial-crime compliance costs, with 70% citing higher software spend in 2024, driving cloud-native uptake that aligns with rapid digitalization.

- Dell Technologies (incl. RSA Security)

- IBM Corporation

- SAP SE / GRC Suite

- Oracle Corporation

- MetricStream Inc.

- Wolters Kluwer / Enablon

- SAS Institute Inc.

- Software AG

- NAVEX Global

- Thomson Reuters Corp.

- ServiceNow Inc.

- Riskonnect Inc.

- LogicManager Inc.

- OneTrust LLC

- Galvanize (Diligent)

- Ideagen Plc

- SAI Global

- AxiomSL (Adenza)

- Cura Software

- BWise (SandP Global)

- FutureShield Inc.

- Maclear LLC

- RSA Archer Suite

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent government regulations and mandates

- 4.2.2 Rising cybersecurity threats with digital transformation

- 4.2.3 Move toward integrated risk-management platforms

- 4.2.4 ESG reporting pressure and non-financial disclosure rules

- 4.2.5 AI-powered predictive compliance analytics adoption

- 4.2.6 Insurance underwriting dependencies on real-time GRC metrics

- 4.3 Market Restraints

- 4.3.1 Lack of skilled GRC professionals

- 4.3.2 High initial integration cost for legacy environments

- 4.3.3 Data-residency and sovereignty complexity in multi-cloud

- 4.3.4 Organisational GRC-fatigue and alert overload

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Policy and Compliance Management

- 5.1.1.2 Audit Management

- 5.1.1.3 Risk Management

- 5.1.1.4 Incident Management

- 5.1.1.5 Business Continuity and Disaster Recovery

- 5.1.2 Services

- 5.1.2.1 Consulting

- 5.1.2.2 Integration and Implementation

- 5.1.2.3 Training and Support

- 5.1.1 Solutions

- 5.2 By Deployment Model

- 5.2.1 On-premises

- 5.2.2 Cloud

- 5.3 By Organisation Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By End-user Industry

- 5.4.1 BFSI

- 5.4.2 Healthcare and Life Sciences

- 5.4.3 Manufacturing

- 5.4.4 IT and Telecom

- 5.4.5 Energy and Utilities

- 5.4.6 Retail and Consumer Goods

- 5.4.7 Government and Public Sector

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Dell Technologies (incl. RSA Security)

- 6.4.2 IBM Corporation

- 6.4.3 SAP SE / GRC Suite

- 6.4.4 Oracle Corporation

- 6.4.5 MetricStream Inc.

- 6.4.6 Wolters Kluwer / Enablon

- 6.4.7 SAS Institute Inc.

- 6.4.8 Software AG

- 6.4.9 NAVEX Global

- 6.4.10 Thomson Reuters Corp.

- 6.4.11 ServiceNow Inc.

- 6.4.12 Riskonnect Inc.

- 6.4.13 LogicManager Inc.

- 6.4.14 OneTrust LLC

- 6.4.15 Galvanize (Diligent)

- 6.4.16 Ideagen Plc

- 6.4.17 SAI Global

- 6.4.18 AxiomSL (Adenza)

- 6.4.19 Cura Software

- 6.4.20 BWise (SandP Global)

- 6.4.21 FutureShield Inc.

- 6.4.22 Maclear LLC

- 6.4.23 RSA Archer Suite

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment