|

市场调查报告书

商品编码

1851802

LTE物联网:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030年)LTE IoT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

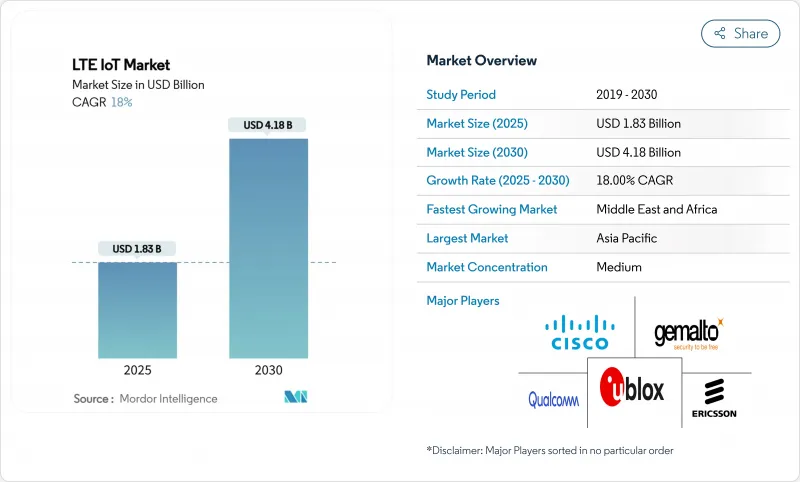

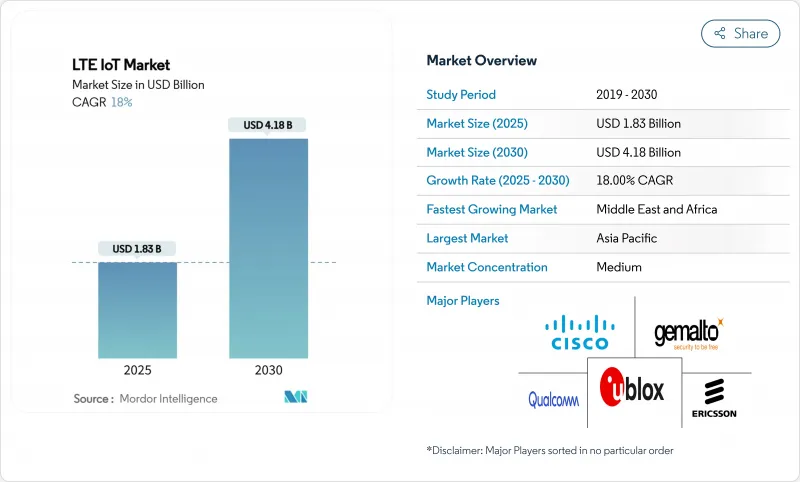

预计到 2025 年,LTE 物联网市场规模将达到 18.3 亿美元,到 2030 年将达到 41.8 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 18%。

这种快速成长反映了2G和3G网路的加速淘汰、低功耗蜂窝模组成本的下降,以及政府强制推行智慧电錶将公用事业公司锁定在授权频谱连接上的趋势。亚太地区目前以55%的收入份额领先其他地区的5G市场,这主要得益于中国通讯部署的170万个5G基地台和5.95亿条蜂巢式物联网电路。中东地区智慧城市建设的同步成长,例如卡达斥资6,000万美元建设的卢赛尔城项目,推动该地区以19.8%的复合年增长率成为成长最快的地区。企业正在从自有连接转向託管连接,随着营运商实现网路切片和自动化配置的商业化,託管服务的复合年增长率将达到15.4%。虽然工业自动化目前的需求最高,但医疗保健领域的成长速度最快,这得益于利用蜂巢式低功耗广域网路(LPWA)骨干网路的远端患者监护计画。

全球LTE物联网市场趋势与洞察

低功耗蜂窝LPWA模组价格跌破4美元

Nordic Semiconductor 的 nRF9151 晶片,凭藉其 64MHz 的 Arm Cortex-M33 处理器和集成的多模调製解调器,展示瞭如何降低物料清单成本,使产品价格接近 4 美元以下,从而推动农业、物流和环境感测领域的部署,这些领域此前依赖于免许可的 LPWAN 网路。中国供应商已开始以 3 美元的价格提供用于公用事业收费计量表的 NB-IoT 模组,进一步推动了成本下降的趋势。儘管大多数全球产品目录中的组件价格仍为 10-15 美元,但欧洲和亚太地区的通讯业者已开始补贴硬件,以加速 LTE 物联网市场的普及并提高网路利用率。

智慧电錶强制令提升蜂窝网路连接

超过60个地区的燃气、电力和公共已颁布法规,强制安装可远端升级的通讯电錶。 Telia在瑞典部署了200万个采用NB-IoT和LTE-M技术的电錶,降低了上门服务成本,并建立了5G就绪的配电网。 Netinium的SIM卡设定檔编配和Telit Cinterion实现了远端配置,打破了以往阻碍公用事业公司使用广域蜂窝链路的厂商锁定机制。这些项目能够提供对LTE物联网市场多年的可视性,并取代专有网状网路。

Sub-GHz频段拥塞限制了容量

目前,多种低功耗广域网路(LPWAN)协定在有限的700-960MHz频段内竞争。占空比限制和功率上限制约了小区密度,推高了网路侧干扰管理成本。儘管美国联邦通讯委员会(FCC)在2024年开放了新的6GHz室内频段分配,但对于地下和农村物联网而言,Sub-GHz频段的传播至关重要。这迫使营运商投资于动态频谱存取和窄带滤波技术,从而推高成本并减缓市场动态。

细分市场分析

至2024年,专业服务将透过咨询、设备认证和边缘云端整合计划,贡献LTE物联网市场61%的收入。随着企业将从SIM卡物流到安全修补程式等生命週期任务转移给专业服务供应商,託管服务预计将以15.4%的复合年增长率加速成长。德国电信的B2B部门正在将连接和分析与基于结果的合约捆绑在一起,将资本预算转化为营运支出。随着时间的推移,人工智慧赋能的编配平台将减少人工工程工时。

标准化的存取API和eUICC配置已经缩短了试点阶段,但棕地工业仍需要客製化的无线电方案和通讯协定转换。因此,虽然新建计划大多倾向于采用託管式服务包,但对于需要多年时间的维修而言,专家参与仍然至关重要。

LTE IoT 市场按服务类型(专业、主机)、产品类型(NB-IoT、LTE-M)、最终用户产业(IT 和通讯、消费性电子、零售(数位电子商务)、医疗保健、工业、其他行业)和地区进行细分。

区域分析

中国通讯累计, 2024年前三季通讯收入将达到7,235亿元人民币(约1,012亿美元),凸显了其对频谱和资本投资的持续投入。日本和韩国正优先推动智慧工厂维修,而东南亚国协正在试办利用共用的LTE骨干网基础设施建设交通管理和洪水预警系统。

中东是成长最快的次区域,预计到2030年将以19.8%的复合年增长率成长。卡达的卢赛尔城计画将利用NB-IoT和LTE-M感测器进行照明、废弃物和交通运输,并将45万居民整合到即时营运中心。沙乌地阿拉伯的「2030愿景」计画将石油盈余转化为农业物联网,将温室气候控制和无人机灌溉与蜂巢式低功耗广域网路(LPWA)技术相结合,以应对粮食安全风险。

在欧洲和北美,受更严格的碳计量和3G网路关闭的推动,传统仪錶和工业设备的更新换代正稳步推进。 O2 Telefónica的德国分公司报告称,2025年第一季其M2M用户增132.4%,其中大部分来自公共。非洲和拉丁美洲仍在发展中,但LTE物联网在资产追踪和农业领域的直接应用正在推动固网。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 主流

- 低功耗蜂窝广域网路(LPWA)标准(NB-IoT、LTE-M)的模组成本低于4美元。

- 目前,超过60个国家强制要求使用公用事业收费电錶。

- 2G/3G时代终将结束,设备将被迫升级到下一代网路。

- 低调行事

- 3GPP Rel-17 RedCap 将 LTE-M 的功耗降低了一半

- 基于网路切片的QoS层级结构提升物联网平均ARPU值

- 主流

- 市场限制

- 主流

- Sub-GHz频段壅塞

- 模组价格溢价与 LoRaWAN/BLE 替代方案相比

- 低调行事

- NB-IoT漫游故障导致韧体分叉

- 碳排放报告推动企业转向超低能耗低功耗广域网

- 主流

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过服务

- 专业的

- 管理

- 依产品类型

- NB-IoT(Cat-NB1)

- LTE-M(eMTC Cat-M1)

- 按最终用户行业划分

- 资讯科技和电信

- 消费性电子产品

- 零售(数位商务)

- 卫生保健

- 工业的

- 其他行业

- 按地区

- 北美洲

- 南美洲

- 欧洲

- 亚太地区

- 中东

- 非洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Qualcomm Technologies

- Gemalto(Thales DIS)

- u-blox AG

- Ericsson

- Cisco(Jasper)

- Cradlepoint

- Sequans Communications

- PureSoftware

- TELUS

- MediaTek

- Verizon

- ATandT

- Vodafone

- China Mobile

- Deutsche Telekom

- Quectel

- Fibocom

- Telit Cinterion

- Semtech

- Sierra Wireless

第七章 市场机会与未来展望

The LTE IoT Market size is estimated at USD 1.83 billion in 2025, and is expected to reach USD 4.18 billion by 2030, at a CAGR of 18% during the forecast period (2025-2030).

This rapid growth reflects accelerating 2G and 3G network sunsets, falling low-power cellular module costs, and government smart-meter mandates that lock utilities into licensed-spectrum connectivity. Asia-Pacific (APAC) leads current adoption with 55% revenue share, propelled by China Mobile's deployment of 1.7 million 5G base stations and 595 million cellular IoT lines. Parallel smart-city spending in the Middle East, exemplified by Qatar's USD 60 million Lusail City contract, positions the region as the fastest climber at 19.8% CAGR. Enterprises are shifting from outright ownership toward managed connectivity, lifting the managed-services CAGR to 15.4% as operators monetize network slicing and automated provisioning. Demand is strongest in industrial automation today, yet healthcare registers the sharpest upswing thanks to remote patient-monitoring programs riding cellular LPWA backbones.

Global LTE IoT Market Trends and Insights

Low-power cellular LPWA modules fall below USD 4

Nordic Semiconductor's nRF9151 shows how a 64 MHz Arm Cortex-M33 and integrated multimode modem can cut bill-of-materials and approach a sub-USD 4 headline price, encouraging agriculture, logistics, and environmental-sensing deployments that once relied on unlicensed LPWAN. Chinese vendors already quote USD 3 NB-IoT modules for utility meters, reinforcing cost-down momentum . While most global catalogs still list USD 10-15 parts, operators in Europe and APAC have begun subsidizing hardware to accelerate LTE IoT market uptake and lift network utilization.

Smart-meter mandates reinforce cellular connectivity

Over 60 jurisdictions have enacted regulations that oblige gas, electricity, or water utilities to install communicating meters able to upgrade remotely. Telia's rollout of 2 million Swedish electric meters on NB-IoT and LTE-M cut truck-roll costs and established a 5G-ready distribution grid. Netinium's SIM-profile orchestration with Telit Cinterion allows remote provisioning, solving the historic lock-in that deterred utilities from wide-area cellular links. These programs create multiyear visibility for the LTE IoT market while displacing proprietary mesh networks.

Sub-GHz spectrum congestion limits capacity

Multiple LPWAN formats now compete inside finite 700-960 MHz slices. Duty-cycle rules and power caps curb cell density, and network-side interference management costs rise sharply. The FCC opened new 6 GHz indoor allocations in 2024, yet sub-GHz propagation remains critical for underground or rural IoT reach. Operators,, therefore,, invest in dynamic-spectrum access and narrowband filtering, adding expense and slowing LTE IoT market rollouts imegacitiess.

Other drivers and restraints analyzed in the detailed report include:

- Legacy network sunsets stimulate immediate migration

- RedCap improves LTE-M energy profile

- Carbon-footprint rules favor ultra-low-energy designs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Professional services generated 61% of LTE IoT market revenue in 2024 through consulting, device certification, and edge-cloud integration projects. Managed-service uptake is forecast to accelerate at 15.4% CAGR as enterprises transfer lifecycle tasks, from SIM logistics to security patching, to specialist providers. Deutsche Telekom's business-to-business arm bundles connectivity with analytics in outcome-based contracts that shift capital budgets into operating fees. Over time, AI-enabled orchestration platforms will trim manual engineering hours, yet the transition itself fuels recurring revenue for managed-service vendors.

Standardized \onboarding APIs and eUICC provisioning already shorten pilot phases, but brownfield industrial estates still need bespoke radio-planning and protocol translation. As a result, professional engagements remain pivotal for multiyear retrofits even while new-build projects lean more heavily on managed packages. The LTE IoT market size for managed services is projected to reach USD X million by 2030, outgrowing professional income streams beyond 2028, though both categories together reinforce operator stickiness.

LTE IoT Market Market is Segmented by Service (Professional, Managed), Product Type (NB-IoT, LTE-M), End-User Industry (IT and Telecommunication, Consumer Electronics, Retail (Digital Ecommerce), Healthcare, Industrial and Other Industries), and Geography.

Geography Analysis

APAC contributed 55% of global revenue in 2024 as China scaled NB-IoT coverage to 100,000 connections per sector and subsidized module production below USD 3. China Mobile booked CNY 723.5 billion (USD 101.2 billion) telecom income in the first three quarters of 2024, underscoring sustained spectrum and capex commitments. Japan and Korea emphasize smart-factory retrofits, while ASEAN nations pilot traffic management and flood-alert systems riding shared LTE backbone infrastructure.

The Middle East is the fastest-expanding sub-region, projected at 19.8% CAGR to 2030. Qatar's Lusail City program integrates 450,000 residents into a real-time operations center using NB-IoT and LTE-M sensors for lighting, waste, and transport. Saudi Vision 2030 channels petro surplus into agricultural IoT that combats food-security risks, with cellular LPWA linking greenhouse climate controls and drone irrigation.

Europe and North America display steady renewal of legacy meters and industrial gear, aided by stricter carbon accounting and 3G shutdowns. Telia's conversion of Swedish meters shows the blueprint: swap proprietary PLC for licensed LTE radios, enable eUICC, and guarantee 15-year contracts. o2 Telefonica's German footprint reported 132.4% year-over-year M2M subscriber growth in Q1 2025, mostly utility driven . Africa and Latin America remain nascent but are leapfrogging fixed lines with direct LTE IoT adoption in asset-tracking and agriculture.

- Qualcomm Technologies

- Gemalto (Thales DIS)

- u-blox AG

- Ericsson

- Cisco (Jasper)

- Cradlepoint

- Sequans Communications

- PureSoftware

- TELUS

- MediaTek

- Verizon

- ATandT

- Vodafone

- China Mobile

- Deutsche Telekom

- Quectel

- Fibocom

- Telit Cinterion

- Semtech

- Sierra Wireless

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 MAINSTREAM

- 4.2.1.1 Low-power cellular LPWA standards (NB-IoT, LTE-M) reach sub-USD 4 module cost

- 4.2.1.2 Smart utility-meter mandates in more than 60 countries

- 4.2.1.3 2G/3G sunsets forcing device migration to LTE IoT

- 4.2.2 UNDER-THE-RADAR

- 4.2.2.1 3GPP Rel-17 RedCap halves LTE-M power draw

- 4.2.2.2 Network-slicing-based QoS tiers lift average IoT ARPU

- 4.2.1 MAINSTREAM

- 4.3 Market Restraints

- 4.3.1 MAINSTREAM

- 4.3.1.1 Sub-GHz spectrum congestion

- 4.3.1.2 Module price premium vs LoRaWAN/BLE alternatives

- 4.3.2 UNDER-THE-RADAR

- 4.3.2.1 Patchy NB-IoT roaming causing firmware forks

- 4.3.2.2 Carbon-emission reporting pushes firms toward ultra-low-energy LPWAN

- 4.3.1 MAINSTREAM

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysi

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service

- 5.1.1 Professional

- 5.1.2 Managed

- 5.2 By Product Type

- 5.2.1 NB-IoT (Cat-NB1)

- 5.2.2 LTE-M (eMTC Cat-M1)

- 5.3 By End-user Industry

- 5.3.1 IT and Telecom

- 5.3.2 Consumer Electronics

- 5.3.3 Retail (Digital Commerce)

- 5.3.4 Healthcare

- 5.3.5 Industrial

- 5.3.6 Other Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 South America

- 5.4.3 Europe

- 5.4.4 Asia-Pacific

- 5.4.5 Middle East

- 5.4.6 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Qualcomm Technologies

- 6.4.2 Gemalto (Thales DIS)

- 6.4.3 u-blox AG

- 6.4.4 Ericsson

- 6.4.5 Cisco (Jasper)

- 6.4.6 Cradlepoint

- 6.4.7 Sequans Communications

- 6.4.8 PureSoftware

- 6.4.9 TELUS

- 6.4.10 MediaTek

- 6.4.11 Verizon

- 6.4.12 ATandT

- 6.4.13 Vodafone

- 6.4.14 China Mobile

- 6.4.15 Deutsche Telekom

- 6.4.16 Quectel

- 6.4.17 Fibocom

- 6.4.18 Telit Cinterion

- 6.4.19 Semtech

- 6.4.20 Sierra Wireless

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment