|

市场调查报告书

商品编码

1851815

互联物流:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Connected Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

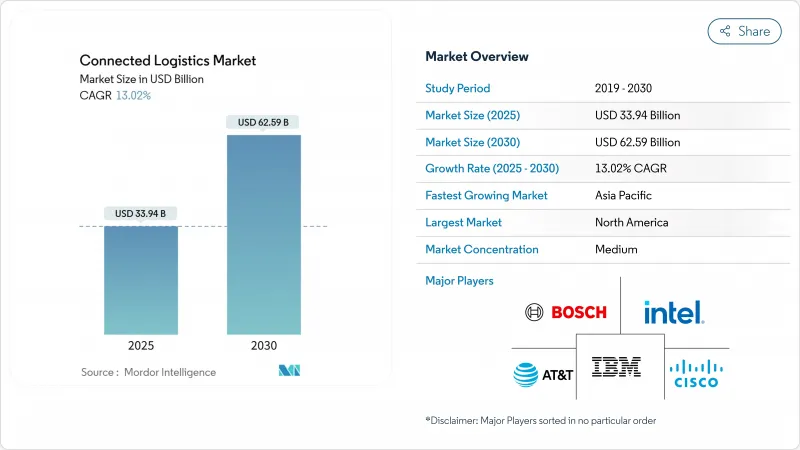

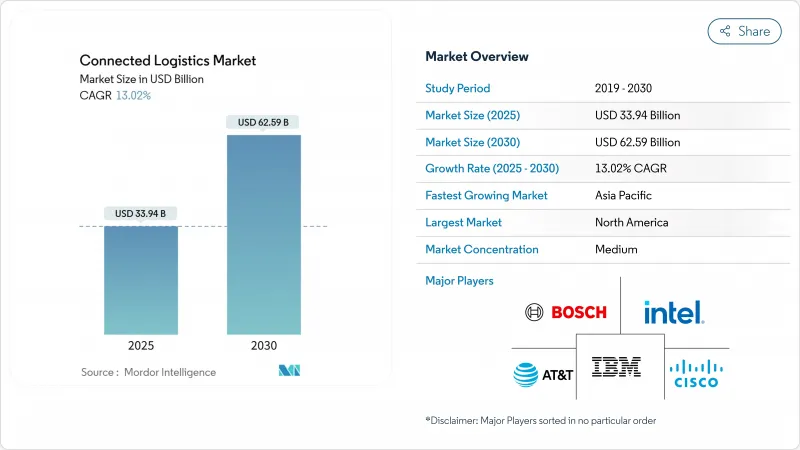

预计到 2025 年,互联物流市场规模将达到 339.4 亿美元,到 2030 年将达到 625.9 亿美元。

托运人对端到端货物透明度的坚持、物联网感测器的快速普及以及港口和堆场5G专用网路的兴起,都推动了这一领域的扩张。平台供应商提供整合的资产追踪、即时视觉化和预测分析套件,从而降低了承运人和托运人的整体拥有成本。网路安全韧性和资料主权合规性仍然是核心设计标准,促使供应商转向零信任架构和区域资料处理节点。透过数位孪生技术降低供应链风险的竞赛正在加速对人工智慧驱动的中断预测试点专案的投资,尤其是在製造地和出口导向经济体。

全球互联物流市场趋势与洞察

物联网赋能的资产追踪激增

低功耗感测器和全球低功耗广域网路 (LPWAN) 覆盖范围使企业能够即时监控位置、温度和衝击情况,在某些 LoRaWAN 部署中,电池寿命可延长至 10 年。 BMW利用蓝牙信标追踪仓库中的车辆,显着缩短了搜寻时间。康德乐 (Cardinal Health) 的智慧感测器试点计画改善了医院供应室的过期药品管理。人工智慧分析将历史数据转化为预测性维护警报,使车队从被动调整转变为主动调整。

托运人要求即时货物可视性

FourKites 收购 TrackX Yard Solutions,将堆场管理资料与路边视觉性结合,为托运人提供每小时更新的拖车位置资讯。汽车涂装中心的 RFID 部署可将即时状态传输至 OEM 的 ERP 系统,满足严格的准时制指标。生命科学领域的托运人部署多感测器标籤,以满足良好分销规范 (GDP) 中关于持续温度记录的规定。可视性驱动的生成式 AI 路线优化入口网站预计到 2028 年将处理四分之一的物流 KPI 报告。

多租户机房的网路安全责任

针对车队远端资讯处理和电子记录设备的勒索软体攻击将导致2024年报告的资料外洩事件增加181%。货物失窃造成的损失将达到4.55亿美元,通常涉及冒充仲介和重新安排整车货物的运输路线。物流(CISO)目前正计划将安全支出预算为两位数成长,这与马士基预测的到2037年达到366亿美元的目标相符。多租户SaaS平台使租户隔离更加复杂,并增加了横向移动的风险。

细分市场分析

到2024年,资产管理将占互联物流市场规模的41.0%,使企业能够透过减少閒置时间和周转率实现立竿见影的投资回报。企业正在将RFID、GNSS和环境感测器整合到统一的控制面板中,以即时标记运作拖车和高温情况。流式分析正以16.45%的复合年增长率成长。企业需要亚秒级的卡车预计到达时间偏差和停留时间热点讯息,从而推动预测性路线重排引擎的发展。

不断发展的仓库物联网迭加层扩展了应用场景,从拣货员引导到气候优化,从而降低低温运输SKU的损耗率。安全分析套件分析异常资料封包流,以侦测设备入侵的早期迹象。随着微软将其边缘AI套件扩展到物流网关,供应商将资产健康状况和流量预测整合到单一的推荐引擎中。

到2024年,设备管理市场份额将达到44.0%,反映出韧体修补和认证数千个卡车、托盘和堆场感测器的复杂性。零接触式入驻工具将缩短卡车装卸平台的启动时间,并支援大规模更新週期。随着专用5G和卫星连结的增加,需要针对每个资产进行编配的订阅模式也随之增加,连线管理正以15.67%的复合年增长率成长。

应用程式管理平台可在云端域和边缘网关之间迁移工作负载,从而满足延迟预算和资料保留限制。腾讯和三星的专利申请描述了新型流量优先权演算法,该演算法可根据车速调整无线电参数。支援区块链的设备将配备加密模组,从而带来更高水准的设备生命週期编配。

2024年,公路将占物流市场份额的38.5%,主要得益于最后一公里网路密集化和车载资讯科技的日益成熟。基于摄影机的ADAS(高级驾驶辅助系统)和ELD(电子记录设备)的强制实施将推动资料流,从而提升驾驶员安全性和合规性。海运预计将以15.10%的复合年增长率成长,这主要得益于智慧货柜遥测技术和自动化码头作业的普及。

铁路公司采用路边感测器阵列进行现代化改造,预测车轮爆胎,减少对线路运营的干扰;航空公司在货运枢纽部署ULD追踪器和人工智慧驱动的舱位管理工具;Eurotainer的槽式货柜遥测技术透过缩短加热週期,将供应链成本降低了40%;Aurora Innovation的达拉斯-休士顿汽车操作的达拉斯-12012012092009人驾驶货运操作的情况下行驶。

互联物流市场报告按软体解决方案(资产管理、安全、其他)、产品类型(设备管理、应用程式管理、其他)、运输方式(公路、铁路、其他)、最终用户行业(汽车、製造业、其他)、服务类型(託管服务、其他)、部署模式(云端、混合、其他)、组织规模(大型企业、其他)和地区进行细分。

区域分析

北美地区预计到2024年将保持35.2%的市场份额,这得益于其强大的高速公路网络和支持自动驾驶汽车试点项目的创新沙盒环境。亚马逊正投资40亿美元,将其次日达服务扩大至4,000个乡村社区,凸显了其基础建设投资的规模。 UPS收购Andlauer Healthcare Group进一步增强了其在该地区的低温运输技术实力。网路风险依然严峻,但资金筹措和公私合作试验平台正在加速技术的应用。

预计到2030年,亚太地区将以13.5%的复合年增长率引领成长。日本运输部省正在评估一条连接东京和大阪的500公里自动化货运线。澳洲在物流自动化领域的支出超过40亿美元,涵盖仓库机器人和集散中心自动化。 GEODIS正将GPS追踪公路走廊从新加坡延伸至中国,预计该地区物流市场规模将达到4.5兆美元。越南正透过举办2025年国际货运代理联合会(FIATA)世界大会,将自身定位为东协物流中心。

欧洲正努力在严格的资料保护规则与推动车队使用电动车和永续航空燃料的脱碳目标之间取得平衡。 CEVA新增23辆电动卡车,使其低碳车队规模超过1,100辆。详情请浏览cevalogistics.com。 DHL与Neste合作开发永续航空燃料(SAF)供应模式,以支持欧盟的净零排放运输目标。欧盟委员会估计区域物流经济规模达8,780亿欧元,并持续协调相关规则以减少跨国文书工作。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 物联网赋能的资产追踪激增

- 托运人要求即时掌握货物信息

- MandA主导的平台集成

- 码头和港口的5G专用网络

- 利用数位双胞胎规避供应链风险

- 市场限制

- 多租户机房的网路安全责任

- 数据主权法律体系碎片化的世界

- 棕地资产互通API的匮乏

- 「免运费」电商模式带来的获利压力

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过软体解决方案

- 资产管理

- 仓库物联网

- 安全

- 资料管理

- 网管

- 流分析

- 依产品类型

- 设备管理

- 应用程式管理

- 连线管理

- 透过运输方式

- 路

- 铁路

- 航空

- 海上运输

- 按最终用户行业划分

- 车

- 製造业

- 石油和天然气

- 资讯科技和电讯

- 卫生保健

- 零售与电子商务

- 饮食

- 其他行业

- 按服务类型

- 咨询与整合

- 託管服务

- 支援与维护

- 透过部署模式

- 云

- 本地部署

- 杂交种

- 按公司规模

- 大公司

- 中小企业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 中东和非洲

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达等)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- UPS Inc.

The connected logistics market reached USD 33.94 billion in 2025 and is forecast to climb to USD 62.59 billion by 2030, reflecting a solid 13.02% CAGR.

Shippers' insistence on end-to-end freight transparency, the rapid roll-out of IoT sensors, and the rise of 5G private networks in ports and yards underpin this expansion. Platform vendors are merging asset tracking, real-time visibility, and predictive analytics into unified suites that lower total cost of ownership for carriers and shippers alike. Cyber-resilience and data-sovereignty compliance remain central design criteria, nudging providers toward zero-trust architectures and regional data-processing nodes. The race to de-risk supply chains through digital twins accelerates pilot investments in AI-driven disruption forecasting, especially in manufacturing hubs and export-oriented economies.

Global Connected Logistics Market Trends and Insights

Surge in IoT-enabled asset tracking

Low-power sensors and global LPWAN coverage let companies monitor location, temperature, and shock in real time, extending battery life to a decade in some LoRaWAN deployments. BMW's use of Bluetooth beacons to trace vehicles across warehouses cut search times dramatically. Cardinal Health's smart-sensor pilots improve expiry management in hospital supply rooms. Converging AI analytics transform historical data into predictive maintenance alerts, shifting fleets from reactive to proactive coordination.

Real-time freight visibility mandates from shippers

FourKites' purchase of TrackX Yard Solutions pairs yard-management data with over-the-road visibility, giving shippers sub-hourly updates on trailer locations. RFID deployments in automotive finishing centers stream live status to OEM ERP systems, satisfying strict just-in-time metrics. Life-science consignors deploy multi-sensor tags to meet continuous-temperature logging rules under Good Distribution Practice. Visibility feeds generative-AI route optimization portals expected to handle one-quarter of logistics KPI reporting by 2028.

Cyber-security liabilities across multi-tenant fleets

Reported breaches in transport rose 181% in 2024, with ransomware targeting fleet telematics and electronic logging devices. Cargo theft hit USD 455 million, often via broker impersonation that reroutes entire truckloads. Logistics CISOs now budget double-digit growth in security spend, mirroring Maersk's forecast of USD 36.6 billion by 2037. Multi-tenant SaaS platforms complicate isolation-of-tenants, elevating lateral-movement risks

Other drivers and restraints analyzed in the detailed report include:

- M&A-driven platform consolidation

- 5G private networks in yards and ports

- Fragmented global data-sovereignty laws

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Asset Management represented 41.0% of the connected logistics market size in 2024 thanks to the immediate ROI firms gain by trimming idle time and improving container turns. Enterprises mesh RFID, GNSS, and environmental sensors into unified dashboards that flag under-utilized trailers and temperature excursions in real time. Streaming Analytics is advancing at 16.45% CAGR as organizations demand sub-second insight into truck ETA variance and dwell-time hot spots, fueling predictive rerouting engines.

Evolving warehouse IoT overlays expand use cases from picker guidance to climate optimization, cutting spoilage rates for cold-chain SKUs. Security analytics suites analyze atypical data-packet flows to detect early indicators of device compromise. As Microsoft extends edge AI toolkits into logistics gateways, providers stitch asset health and traffic forecasts into single recommendation engines.

Device Management captured 44.0% share in 2024, reflecting the complexity of patching firmware and certifying thousands of truck, pallet, and yard sensors. Zero-touch onboarding tools reduce truck-dock activation times, supporting large-scale refresh cycles. Connectivity Management is rising at a 15.67% CAGR as private 5G and satellite links multiply subscription profiles that must be orchestrated per asset.

Application Management platforms move workloads between cloud regions and edge gateways to honor latency budgets and data-residency constraints. Patent filings by Tencent and Samsung illustrate new traffic-prioritization algorithms that adapt radio parameters by vehicle speed. Blockchain-enabled devices now embed cryptographic modules, raising the bar for device-lifecycle orchestration

Roadways held 38.5% of the connected logistics market share in 2024 due to dense last-mile networks and mature telematics retrofits. Camera-based ADAS and ELD mandates fuel data flows that improve driver safety and regulatory compliance. Seaways is expected to post a 15.10% CAGR, propelled by smart-container telemetry and automated terminal operations.

Railways modernize with wayside-sensor arrays that predict wheel-flat defects, reducing line-haul interruptions. Airways integrate ULD trackers and AI-driven slot-management tools at cargo hubs. Eurotainer's tank-container telemetry cut supply-chain costs 40% by shrinking heating cycles. Aurora Innovation's driverless freight corridor between Dallas and Houston logged 1,200 miles without a human operator

The Connected Logistics Market Report is Segmented by Software Solution (Asset Management, Security, and More), Product Type (Device Management, Application Management, and More), Transportation Mode (Roadways, Railways, and More), End-User Industry (Automotive, Manufacturing and More), Service Type (Managed Services and More), Deployment Mode (Cloud, Hybrid, and More), Organization Size (Large Enterprises and More), and Geography.

Geography Analysis

North America retained 35.2% share in 2024, buoyed by robust highway networks and supportive innovation sandboxes for autonomous vehicle pilots. Amazon is investing USD 4 billion to extend next-day coverage to 4,000 rural communities, underscoring the scale of infrastructure spend. UPS's purchase of Andlauer Healthcare Group deepens cold-chain specialization in the region. Cyber-risk remains acute, yet venture funding and public-private testbeds accelerate technology diffusion.

Asia Pacific is projected to lead growth at a 13.5% CAGR through 2030. Japan's transport ministry is evaluating a 500-kilometer automated freight link between Tokyo and Osaka. Australia's logistics-automation outlays exceed USD 4 billion, spanning warehouse robotics and yard automation. GEODIS is extending GPS-tracked road corridors from Singapore to China in anticipation of a USD 4.5 trillion regional logistics sector. Vietnam positions itself as an ASEAN logistics pivot by hosting the 2025 FIATA World Congress.

Europe balances stringent data-protection rules with decarbonization mandates that push fleets toward EVs and sustainable aviation fuels. CEVA added 23 electric trucks, raising its low-carbon fleet beyond 1,100 vehicles cevalogistics.com. DHL collaborates with Neste on SAF supply models, supporting the EU's net-zero transport goal. The European Commission estimates the regional logistics economy at EUR 878 billion and continues harmonizing rules to cut cross-border paperwork

- Bosch Service Solutions GmbH

- Cisco Systems Inc.

- AT&T Inc.

- IBM Corporation

- Intel Corporation

- SAP SE

- Oracle Corporation

- Freightgate Inc.

- ORBCOMM Inc.

- HCL Technologies Ltd.

- Honeywell International Inc.

- Microsoft Corporation

- Siemens AG

- Zebra Technologies Corp.

- Trimble Inc.

- Descartes Systems Group

- Sensitech Inc.

- Project44 Inc.

- FourKites Inc.

- Huawei Technologies Co. Ltd.

- JD Logistics

- DHL Supply Chain

- FedEx Corp.

- UPS Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in IoT-enabled asset tracking

- 4.2.2 Real-time freight visibility mandates from shippers

- 4.2.3 MandA-driven platform consolidation

- 4.2.4 5G private networks in yards and ports

- 4.2.5 De-risking supply chains via digital twins

- 4.3 Market Restraints

- 4.3.1 Cyber-security liabilities across multi-tenant fleets

- 4.3.2 Fragmented global data-sovereignty laws

- 4.3.3 Scarcity of interoperable APIs for brown-field assets

- 4.3.4 Margin pressure from "ship-for-free" e-commerce models

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Software Solution

- 5.1.1 Asset Management

- 5.1.2 Warehouse IoT

- 5.1.3 Security

- 5.1.4 Data Management

- 5.1.5 Network Management

- 5.1.6 Streaming Analytics

- 5.2 By Product Type

- 5.2.1 Device Management

- 5.2.2 Application Management

- 5.2.3 Connectivity Management

- 5.3 By Transportation Mode

- 5.3.1 Roadways

- 5.3.2 Railways

- 5.3.3 Airways

- 5.3.4 Seaways

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Manufacturing

- 5.4.3 Oil and Gas

- 5.4.4 IT and Telecom

- 5.4.5 Healthcare

- 5.4.6 Retail and E-commerce

- 5.4.7 Food and Beverage

- 5.4.8 Other Industries

- 5.5 By Service Type

- 5.5.1 Consulting and Integration

- 5.5.2 Managed Services

- 5.5.3 Support and Maintenance

- 5.6 By Deployment Mode

- 5.6.1 Cloud

- 5.6.2 On-Premise

- 5.6.3 Hybrid

- 5.7 By Organisation Size

- 5.7.1 Large Enterprises

- 5.7.2 Small and Medium Enterprises (SMEs)

- 5.8 By Geography

- 5.8.1 North America

- 5.8.1.1 United States

- 5.8.1.2 Canada

- 5.8.1.3 Mexico

- 5.8.2 South America

- 5.8.2.1 Brazil

- 5.8.2.2 Argentina

- 5.8.2.3 Chile

- 5.8.2.4 Rest of South America

- 5.8.3 Europe

- 5.8.3.1 Germany

- 5.8.3.2 United Kingdom

- 5.8.3.3 France

- 5.8.3.4 Italy

- 5.8.3.5 Spain

- 5.8.3.6 Netherlands

- 5.8.3.7 Russia

- 5.8.3.8 Rest of Europe

- 5.8.4 Asia Pacific

- 5.8.4.1 China

- 5.8.4.2 India

- 5.8.4.3 Japan

- 5.8.4.4 South Korea

- 5.8.4.5 ASEAN

- 5.8.4.6 Rest of Asia Pacific

- 5.8.5 Middle East and Africa

- 5.8.5.1 Middle East

- 5.8.5.1.1 GCC (Saudi Arabia, UAE, Qatar, etc.)

- 5.8.5.1.2 Turkey

- 5.8.5.1.3 Rest of Middle East

- 5.8.5.2 Africa

- 5.8.5.2.1 South Africa

- 5.8.5.2.2 Rest of Africa

- 5.8.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Bosch Service Solutions GmbH

- 6.4.2 Cisco Systems Inc.

- 6.4.3 AT&T Inc.

- 6.4.4 IBM Corporation

- 6.4.5 Intel Corporation

- 6.4.6 SAP SE

- 6.4.7 Oracle Corporation

- 6.4.8 Freightgate Inc.

- 6.4.9 ORBCOMM Inc.

- 6.4.10 HCL Technologies Ltd.

- 6.4.11 Honeywell International Inc.

- 6.4.12 Microsoft Corporation

- 6.4.13 Siemens AG

- 6.4.14 Zebra Technologies Corp.

- 6.4.15 Trimble Inc.

- 6.4.16 Descartes Systems Group

- 6.4.17 Sensitech Inc.

- 6.4.18 Project44 Inc.

- 6.4.19 FourKites Inc.

- 6.4.20 Huawei Technologies Co. Ltd.

- 6.4.21 JD Logistics

- 6.4.22 DHL Supply Chain

- 6.4.23 FedEx Corp.

- 6.4.24 UPS Inc.