|

市场调查报告书

商品编码

1851825

机器人领域的人工智慧:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Artificial Intelligence In Robotics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

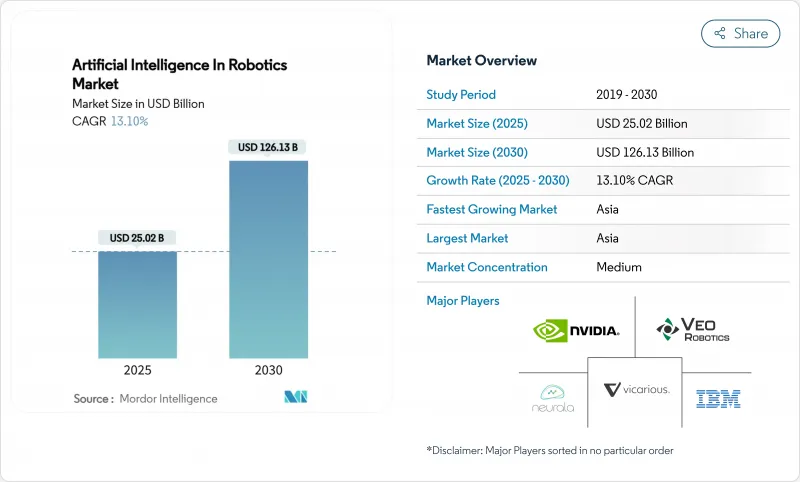

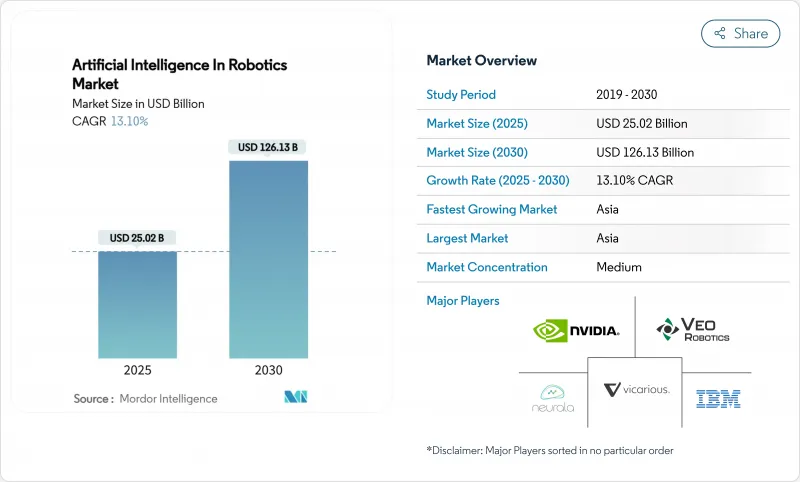

预计到 2025 年,机器人人工智慧市场规模将达到 250.2 亿美元,到 2030 年将达到 1,261.3 亿美元,预测期(2025-2030 年)复合年增长率为 13.10%。

这一发展势头得益于边缘运算、机器学习演算法和高解析度感测器的快速进步,这些技术使机器人能够在毫秒内解读周围环境并自主行动。製造业正从纯粹的机械升级转向以智慧为中心的改进,引入客製化的人工智慧处理器模组,以减少生产线和服务环境中的决策延迟。亚洲製造业的投资、北美电子商务的蓬勃发展以及欧洲的合作研究项目正在汇聚,从而拓展部署场景并加速价值实现。儘管硬体仍然是重要的成本驱动因素,但软体采用率的不断提高表明,价值创造正在转向感知、推理和自适应控制堆迭,使机器人成为互联工厂和物流系统中持续学习的资产。这些趋势的综合作用正在催生一个日益庞大的智慧机器用户群,这些机器是对人类操作员的补充而非取代,从而扩大了机器人人工智慧市场的潜在需求。

全球机器人人工智慧市场趋势与洞察

整合边缘人工智慧晶片以实现机器人即时决策

边缘AI处理器将决策延迟从秒级缩短至毫秒级,使自主移动机器人(AMR)无需依赖云端即可在动态生产车间中导航。研华科技在2025年的产品展示中,将NVIDIA Jetson Thor模组整合到其AMR丛集后,响应速度提升了75%。深圳和水原的电子产品製造商报告称,由于视觉和运动数据在本地进行处理,一次产量比率和节拍时间均得到了显着提升。更低的延迟也增强了预测性维护的回馈迴路,从而减少了精密组装的非计划性停机时间。随着边缘优化AI模型的日益成熟,处理器成本不断下降,这促使中端供应商对现有机器人进行改造升级,而不是购买新设备。因此,这项驱动力将推动不同类型工厂更广泛地采用边缘AI技术,从而积极促进机器人AI市场的发展。

人口快速老化将推动对老年护理机器人的需求。

由Panasonic、Softbank Corporation和日本政府支持的新兴企业正在部署行动社交陪伴机器人,这些机器人利用深度神经网路来侦测跌倒、提醒服药时间并进行自然对话。临床试验表明,这些机器人透过重新分配重复性的搬运和监测任务来提高医护人员的工作效率,使护理人员能够专注于与病人的直接互动。面临类似的人口结构挑战,韩国正透过其「2030年机器人产业愿景」计画投资人工智慧机器人护理员,为医院和家庭护理试验的部署津贴。这两个文化上的先驱的成功为欧洲的医疗保健提供者树立了标桿,欧洲人口老化加剧,未来机器人市场对人工智慧的需求也将不断增长。

针对特定机器人感知任务的高品质领域数据匮乏

《机器人与人工智慧前沿》指出,不一致和不完整的资料集导致人机协作的可靠性降低。例如,农业收割机难以准确判断不同作物的成熟度,限制了其在试点农场以外的商业性部署。资料缺失也阻碍了安全检验,迫使供应商过度设计感知系统,延长了产品上市时间。专有资料集为大型企业建构了竞争优势,使小型创新者难以达到效能基准。虽然合成资料生成和迁移学习正在缓解这一障碍,但资料短缺仍然阻碍着人工智慧在机器人市场的整体发展。

细分市场分析

到2024年,硬体将占机器人人工智慧市场份额的62%,这主要体现在赋予机器人物理形态的感测器、致动器、驱动装置和结构框架等方面。配备内置力传感器的资本密集型工业机械手臂仍然是焊接、喷漆和精密物料输送等作业的必备设备。供应商目前正在推出模组化设计,用户无需对整个系统进行全面改造即可更换夹爪、摄影机和人工智慧边缘模组,从而降低整体拥有成本并延长设备使用寿命。硬体蓝图强调节能伺服控制器和轻质复合材料关节,以实现更高的承重能力重量比,这对于在狭窄工厂通道中穿梭的机器人至关重要。

机器学习和深度学习软体正以24%的复合年增长率快速增长,并且通常以预训练感知和运动规划库的形式捆绑销售。这些技术堆迭无需外部编程即可实现缺陷检测、预测性维护和自适应抓取,从而从现有设备中挖掘更多价值。早期用户报告称,仅软体升级就能使整体设备效率提升两位数,这表明儘管基准较小,软体的成长速度仍然超过了硬体投入。随着客户对生命週期支援的需求不断增长,涵盖整合、远端监控和持续模型重训练等服务正在为供应商创造不断增长的收益。这种转变清晰地表明,在人工智慧机器人市场中,真正区分竞争者的是智能,而非机械。

到2024年,工业机器人将占据机器人人工智慧市场规模的68%,这主要得益于汽车和电子产品生产中应用的多关节臂。全球工厂中机器人的装置量已超过428万台,并以每年10%的速度成长,凸显了市场对机器人的强劲需求。人工智慧升级使这些系统能够处理各种几何形状的零件,无需停机重新示教,从而提高了资产利用率。虽然协作机器人目前出货量仍占少数,但随着灵活自动化在多品种、小批量生产环境中变得至关重要,它们正经历显着增长。

医疗和保健机器人是成长最快的类别,2025年至2030年的复合年增长率将达到26%。融合电脑视觉和力回馈技术的手术系统可辅助临床医师进行微创手术,从而减少术后併发症和缩短住院时间。医院物流机器人利用同步定位与地图建构(SLAM)技术,结合人工智慧决策引擎,可在拥挤的走廊中自主运送床单和药品。消费者对机器人的接受度也不断提高,例如,居家照护机器人可以帮助老年人完成日常生活任务。总而言之,这些趋势将透过多元化收入来源和缓解以汽车为中心的需求週期性波动,使机器人人工智慧市场受益。

机器人人工智慧市场按组件(硬体、其他)、机器人类型(工业机器人、服务机器人、其他)、应用(製造和组装、物流和仓储、医疗保健和手术、其他)、最终用户行业(汽车、电子、半导体、其他)和地区进行细分。

区域分析

亚太地区预计到2024年将占全球销售额的47%,这主要得益于中国、日本和韩国的大规模自动化项目。光是中国一国,2023年就将安装276,288台工业机器人,占全球出货量的51%。这得归功于地方政府提供税收优惠和低利率贷款,以提升製造业竞争力。韩国电子公司正在将边缘人工智慧视觉技术应用于贴片单元,以将晶圆级公差控制在微米级;而日本汽车製造商则正在部署人工智慧协作机器人,用于需要类似人类灵巧度的最终修整任务。该地区预计18%的复合年增长率不仅反映了其製造业的主导地位,也反映了医疗保健和服务机器人试点计画的快速发展。

北美排名第二,这主要得益于蓬勃发展的新兴企业和资金筹措,尤其是在美国,人工智慧软体领域的专业知识十分丰富。一家物流巨头正在对现有的输送机系统维修,引入人工智慧移动机器人,以实现两小时内送达的目标。汽车製造商正在利用人工智慧监控新型轻质材料的焊接质量,并随着工厂适应电池式电动车的生产,加速这些材料的应用。加拿大的采矿业正在试验使用自动驾驶卡车,这些卡车利用人工智慧感知系统在低GPS讯号环境的露天矿场中导航,从而将人工智慧机器人的应用范围扩展到工厂之外。墨西哥的工业园区也积极进行人工智慧维修,以保持竞争力,并符合美墨加协定(USMCA)的内容规则。

欧洲对符合伦理、安全可靠且值得信赖的人工智慧的重视,正在重塑技术发展和法律规范。德国在机器人密度方面处于领先地位,预计2023年将新增28,355台机器人。 「地平线欧洲」津贴鼓励在农业技术、医疗保健和绿色製造领域建立机器人-学术丛集。然而,对CE认证和人工智慧责任的不同解读减缓了跨境部署,尤其是协作机器人的部署。中欧和东欧仍然是一个充满潜力的成长区域,劳动力短缺推动了工厂投资。虽然南美、中东和非洲等规模较小的市场仍在发展中,但它们正受益于承包和机器人即服务合同,这些合约降低了前期投资门槛,有助于推动全球机器人人工智慧市场的扩张。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 将边缘人工智慧晶片整合到亚洲电子製造业中,以实现即时机器人决策

- 人口快速老化将推动日本和韩国对老年护理机器人的需求。

- 欧盟「地平线」计画的欧洲资助简化了人工智慧机器人合作研究联盟的运作。

- 电子商务物流的履约发展推动北美人工智慧仓库自动化

- 自主移动机器人在德国汽车组装线上迅速普及

- 随着视觉感测器成本的下降,用于改造传统机器人的 AI套件在全球范围内对中小企业越来越受欢迎。

- 市场限制

- 针对特定机器人感知任务的高品质领域数据匮乏

- 分散的安全标准阻碍了协作机器人跨国应用

- 食品加工业者使用的AI处理器模组初始成本高,利润率低。

- 网实整合安全问题限制了医院中云端连线服务机器人的应用。

- 市场驱动因素

- 价值/供应链分析

- 监理与标准展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 硬体

- 感应器

- 致动器

- 电力系统

- 控制系统

- 软体

- 机器学习和深度学习

- 电脑视觉

- 自然语言处理

- 情境感知/决策

- 服务

- 整合与部署

- 支援与维护

- 硬体

- 按机器人类型

- 工业机器人

- 关节机器人

- SCARA机器人

- 笛卡儿机器人

- 协作机器人(Cobots)

- 服务机器人

- 专业服务机器人

- 物流机器人

- 医疗和保健机器人

- 国防与安全机器人

- 田间机器人(农业和采矿)

- 个人/家用机器人

- 家用机器人

- 娱乐和陪伴机器人

- 工业机器人

- 透过使用

- 製造和组装

- 物流/仓储

- 医疗保健和外科手术

- 零售与电子商务业务

- 食品和饮料加工

- 检查和维护

- 其他用途

- 按最终用户行业划分

- 车

- 电子和半导体

- 零售与电子商务

- 卫生保健

- 饮食

- 航太/国防

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- ASEAN

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NVIDIA Corporation

- IBM Corporation

- Microsoft Corporation

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corp.

- Universal Robots A/S

- Hanson Robotics Ltd.

- Boston Dynamics, Inc.

- Brain Corporation

- Vicarious AI

- Neurala, Inc.

- Kindred AI

- Preferred Networks, Inc.

- Veo Robotics, Inc.

- Fetch Robotics, Inc.

- Blue River Technology(John Deere)

- UiPath Inc.

- SoftBank Robotics Group Corp.

第七章 市场机会与未来展望

The Artificial Intelligence In Robotics Market size is estimated at USD 25.02 billion in 2025, and is expected to reach USD 126.13 billion by 2030, at a CAGR of 13.10% during the forecast period (2025-2030).

Momentum is underpinned by rapid advances in edge computing, machine learning algorithms, and high-resolution sensor suites that allow robots to interpret their surroundings and act autonomously in milliseconds. Manufacturers are shifting from purely mechanical upgrades to intelligence-centric improvements, embedding custom AI processor modules that shorten decision latency on production lines and in service environments. Asia's manufacturing investments, North America's e-commerce boom, and Europe's coordinated research programs are converging to expand deployment scenarios and accelerate time-to-value. Hardware remains a large cost driver, yet rising software attach rates illustrate how value creation is migrating toward perception, reasoning, and adaptive-control stacks, turning robots into continuously learning assets within connected factory and logistics ecosystems. The combined effect of these trends is creating an ever-larger installed base of intelligent machines that complement, rather than displace, human operators, widening addressable demand for the AI in robotics market.

Global Artificial Intelligence In Robotics Market Trends and Insights

Integration of Edge-AI Chips Enabling Real-Time Robot Decision-Making

Edge-AI processors cut decision-making latency from seconds to milliseconds, enabling autonomous mobile robots (AMR) to navigate dynamic production floors without cloud dependence. Advantech's 2025 showcase highlighted 75% faster response times after integrating NVIDIA Jetson Thor modules into AMR fleets. Electronics manufacturers in Shenzhen and Suwon report measurable gains in first-pass yield and takt-time reduction when vision and motion data are processed locally. Lower latency also tightens feedback loops for predictive maintenance, decreasing unscheduled downtime in precision assembly lines. As edge-optimized AI models mature, processor costs are falling, encouraging mid-tier suppliers to retrofit existing robots instead of purchasing new units. The driver, therefore, widens adoption across diverse factory footprints and contributes positively to the AI in robotics market .

Rapid Aging Population Accelerating Demand for Elder-Care Robots

Japan's share of residents aged 65 plus exceeded 29% in 2025, amplifying a projected shortfall of 377,000 caregivers.Panasonic, SoftBank, and startups backed by the Japanese government are rolling out mobility and social-companion robots that use deep neural networks to detect falls, remind medication schedules, and interact through natural speech. Clinical pilots show robots increase staff efficiency by reallocating repetitive lifting or monitoring tasks, letting nurses focus on direct patient engagement. South Korea faces similar demographic headwinds and is investing in AI robotic caregivers through its "Robot Industry Vision 2030" plan, which subsidizes hospital deployments and homecare trials. Success in these two cultural early adopters sets benchmarks for healthcare providers in Europe as their populations age, broadening future addressable demand for AI in the robotics market.

Scarcity of High-Quality Domain Data for Niche Robot-Perception Tasks

Frontiers in Robotics and AI highlights that inconsistent, incomplete datasets reduce the reliability of human-robot collaboration, especially where robots must recognize uncommon objects. For example, agricultural harvesters struggle to gauge ripeness across diverse crop varieties, limiting commercial deployment beyond pilot farms. Data gaps also impede safety validation, forcing vendors to over-engineer perception stacks and prolong time-to-market. Proprietary datasets give large incumbents a moat, making it harder for smaller innovators to match performance benchmarks. While synthetic data generation and transfer learning mitigate the barrier, the shortage remains a drag on the overall expansion of AI in the robotics market.

Other drivers and restraints analyzed in the detailed report include:

- EU Horizon Europe Funding Streamlining Collaborative AI-Robot Research

- E-Commerce Fulfilment Boom Driving AI-Enabled Warehouse Automation

- Fragmented Safety Standards Hindering Cross-Border Cobot Deployment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware accounted for 62% of the AI in robotics market share in 2024, reflecting the sensors, actuators, drives, and structural frames that give robots their physical presence. Capital-intensive industrial arms with integrated force-torque sensors remain indispensable for welding, painting, and precision material handling. Vendors are now shipping modular designs that let manufacturers swap grippers, cameras, or AI edge modules without full system overhauls, lowering total cost of ownership and prolonging equipment life cycles. Hardware roadmaps emphasize power-efficient servo controllers and lightweight composite joints, enabling higher payload-to-weight ratios crucial for mobile robots in tight factory aisles.

Machine Learning & Deep Learning software is expanding at a 24% CAGR and is increasingly bundled as pre-trained perception and motion-planning libraries. These stacks extract more value from existing machines by enabling defect detection, predictive maintenance, and adaptive grasping without external programming. Early adopters report that software upgrades alone can raise overall equipment effectiveness by double digits, illustrating why software is outpacing physical spend despite its smaller baseline. Services covering integration, remote monitoring, and continuous model retraining form a rising annuity stream for vendors as customers seek lifecycle support. The shift underlines how intelligence rather than mechanics now differentiates competitors in the AI in robotics market.

Industrial robots commanded 68% of the AI in robotics market size in 2024, led by articulated arms deployed in automotive and electronics production. Their installed base surpassed 4.28 million units in factories worldwide, a 10% annual gain that highlights entrenched demand. AI upgrades are letting these systems handle variable part geometries without downtime for re-teaching, boosting asset utilization. Cobots, still a minority of shipments, enjoy outsized growth as flexible automation becomes essential for high-mix, low-volume environments.

Medical & healthcare robots represent the fastest-growing class at a 26% CAGR for 2025-2030. Surgical systems incorporating computer vision and force feedback assist clinicians in minimally invasive procedures, trimming post-operative complications and length of stay. Hospital logistics robots autonomously ferry linens and medications through crowded corridors using simultaneous localization and mapping (SLAM) fused with AI decision engines. Consumer acceptance is widening, evidenced by homecare robots that support daily living tasks for seniors. Altogether, these trends diversify revenue pools and mitigate cyclicality inherent in automotive-centric demand, benefiting the AI in robotics market.

The Artificial Intelligence in Robotics Market is Segmented by Component (Hardware and More), Robot Type (Industrial Robots, Service Robots and More), Application (Manufacturing and Assembly, Logistics and Warehousing, Healthcare and Surgery and More), End-User Industry (Automotive, Electronics, and Semiconductors, and More), and Geography.

Geography Analysis

Asia Pacific generated 47% of global revenue in 2024 driven by extensive automation programs in China, Japan, and South Korea. China alone installed 276,288 industrial robots in 2023, equal to 51% of world shipments, as local authorities provide tax incentives and low-interest loans to upgrade manufacturing competitiveness ifr.org. Korean electronics firms add edge-AI vision to pick-and-place cells to manage wafer-level tolerances measured in microns, while Japanese automakers deploy AI cobots for final trim operations that require human-like dexterity. The region's projected 18% CAGR reflects not only manufacturing dominance but also fast-emerging healthcare and service robotics pilots.

North America ranks second, anchored by the United States where AI software expertise seeds robust startup formation and venture funding. Logistics giants retrofit existing conveyor grids with AI mobile robots to meet two-hour delivery windows. Automakers accelerate adoption as factories retool for battery electric vehicles, using AI to monitor weld quality on new lightweight materials. Canada's mining sector pilots autonomous haulage trucks that leverage AI perception stacks to navigate open-pit sites in low-GPS conditions, extending AI in robotics market penetration beyond factory walls. Mexico's industrial corridors likewise embrace AI retrofits to stay competitive following USMCA content rules.

Europe emphasizes ethical, safe, and trustworthy AI, shaping both technology development and regulatory frameworks. Germany leads robot density with 28,355 new installations in 2023, aided by government subsidies for Mittelstand automation projects. Horizon Europe grants encourage academic-industry clusters in robotics for agri-tech, healthcare, and green manufacturing. Nonetheless, diverging interpretations of CE marking and AI liability delay cross-border deployments, particularly for cobots. Growth potential in Central and Eastern Europe remains high as labor shortages push factories to invest. Smaller markets in South America, the Middle East, and Africa are nascent but benefit from turnkey Robot-as-a-Service contracts that lower upfront capital barriers, nudging global uptake of the AI in robotics market.

- NVIDIA Corporation

- IBM Corporation

- Microsoft Corporation

- ABB Ltd.

- FANUC Corporation

- KUKA AG

- Yaskawa Electric Corp.

- Universal Robots A/S

- Hanson Robotics Ltd.

- Boston Dynamics, Inc.

- Brain Corporation

- Vicarious AI

- Neurala, Inc.

- Kindred AI

- Preferred Networks, Inc.

- Veo Robotics, Inc.

- Fetch Robotics, Inc.

- Blue River Technology (John Deere)

- UiPath Inc.

- SoftBank Robotics Group Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Market Drivers

- 4.1.1.1 Integration of Edge-AI Chips Enabling Real-Time Robot Decision-Making in Asia-s Electronics Manufacturing

- 4.1.1.2 Rapid Aging Population Accelerating Demand for Elder-Care Robots in Japan and South Korea

- 4.1.1.3 EU Horizon Europe Funding Streamlining Collaborative AI-Robot Research Consortia

- 4.1.1.4 E-Commerce Fulfilment Boom Driving AI-Enabled Warehouse Automation in North America

- 4.1.1.5 Surge in Autonomous Mobile Robots within German Automotive Final Assembly Lines

- 4.1.1.6 Falling Vision-Sensor Costs Allowing SMB AI-Retrofit Kits for Legacy Robots Globally

- 4.1.2 Market Restraints

- 4.1.2.1 Scarcity of High-Quality Domain Data for Niche Robot-Perception Tasks

- 4.1.2.2 Fragmented Safety Standards Hindering Cross-Border Cobot Deployment

- 4.1.2.3 High Up-Front Cost of AI Processor Modules for Low-Margin Food Processors

- 4.1.2.4 Cyber-Physical Security Concerns Limiting Cloud-Connected Service Robots in Hospitals

- 4.1.1 Market Drivers

- 4.2 Value / Supply-Chain Analysis

- 4.3 Regulatory and Standards Outlook

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Sensors

- 5.1.1.2 Actuators

- 5.1.1.3 Power Systems

- 5.1.1.4 Control Systems

- 5.1.2 Software

- 5.1.2.1 Machine Learning and Deep Learning

- 5.1.2.2 Computer Vision

- 5.1.2.3 Natural Language Processing

- 5.1.2.4 Context Awareness / Decision-Making

- 5.1.3 Services

- 5.1.3.1 Integration and Deployment

- 5.1.3.2 Support and Maintenance

- 5.1.1 Hardware

- 5.2 By Robot Type

- 5.2.1 Industrial Robots

- 5.2.1.1 Articulated Robots

- 5.2.1.2 SCARA Robots

- 5.2.1.3 Cartesian Robots

- 5.2.1.4 Collaborative Robots (Cobots)

- 5.2.2 Service Robots

- 5.2.2.1 Professional Service Robots

- 5.2.2.1.1 Logistics Robots

- 5.2.2.1.2 Medical and Healthcare Robots

- 5.2.2.1.3 Defense and Security Robots

- 5.2.2.1.4 Field Robots (Agriculture and Mining)

- 5.2.2.2 Personal and Domestic Robots

- 5.2.2.2.1 Household Robots

- 5.2.2.2.2 Entertainment and Companion Robots

- 5.2.1 Industrial Robots

- 5.3 By Application

- 5.3.1 Manufacturing and Assembly

- 5.3.2 Logistics and Warehousing

- 5.3.3 Healthcare and Surgery

- 5.3.4 Retail and E-Commerce Operations

- 5.3.5 Food and Beverage Processing

- 5.3.6 Inspection and Maintenance

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Electronics and Semiconductors

- 5.4.3 Retail and E-Commerce

- 5.4.4 Healthcare

- 5.4.5 Food and Beverage

- 5.4.6 Aerospace and Defense

- 5.4.7 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 United Arab Emirates

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 Turkey

- 5.5.4.4 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Egypt

- 5.5.5.4 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 Japan

- 5.5.6.3 South Korea

- 5.5.6.4 India

- 5.5.6.5 ASEAN

- 5.5.6.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 NVIDIA Corporation

- 6.4.2 IBM Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 ABB Ltd.

- 6.4.5 FANUC Corporation

- 6.4.6 KUKA AG

- 6.4.7 Yaskawa Electric Corp.

- 6.4.8 Universal Robots A/S

- 6.4.9 Hanson Robotics Ltd.

- 6.4.10 Boston Dynamics, Inc.

- 6.4.11 Brain Corporation

- 6.4.12 Vicarious AI

- 6.4.13 Neurala, Inc.

- 6.4.14 Kindred AI

- 6.4.15 Preferred Networks, Inc.

- 6.4.16 Veo Robotics, Inc.

- 6.4.17 Fetch Robotics, Inc.

- 6.4.18 Blue River Technology (John Deere)

- 6.4.19 UiPath Inc.

- 6.4.20 SoftBank Robotics Group Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment