|

市场调查报告书

商品编码

1851826

行动边缘运算:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Mobile Edge Computing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

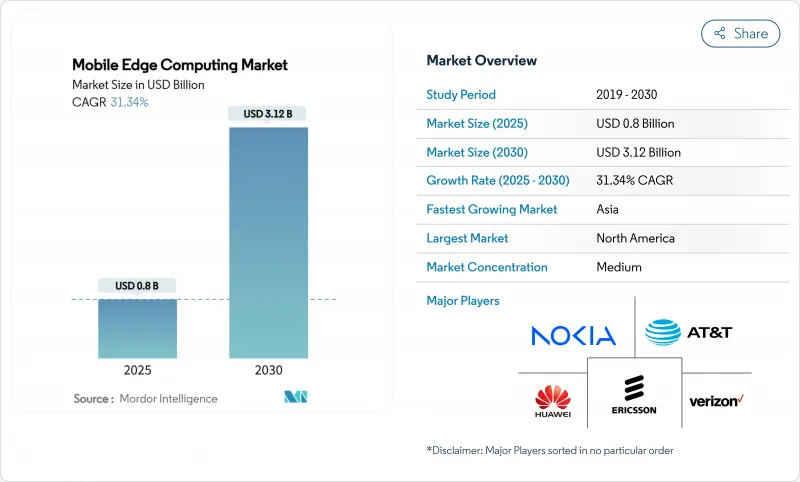

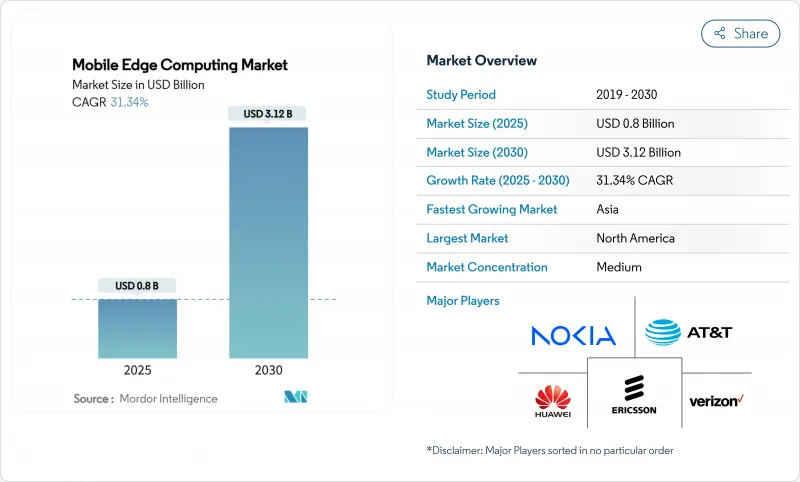

预计到 2025 年,行动边缘运算市场规模将达到 8 亿美元,到 2030 年将达到 31.2 亿美元,年复合成长率为 31.34%。

对低延迟服务日益增长的需求、5G独立组网(SA)网路的日益成熟,以及需要在更靠近终端用户的位置处理不断增长的资料量,都在加速边缘运算的普及。儘管硬体仍然是主要的支出驱动因素,但软体定义基础架构、容器编配和人工智慧推理的快速发展正在将重心转移到以服务为中心的收入流上。通讯业者、超大规模资料中心业者资料中心和专业新兴企业越来越将边缘运算能力视为核心差异化优势,以支援优质连接、新型企业服务和经济高效的人工智慧部署。监管机构对资料主权的关注,以及欧洲通讯标准协会(ETSI)主导的标准化工作,正在进一步影响市场架构和供应商策略。连接、云端运算和人工智慧的整合正在再形成竞争格局,迫使企业寻求跨领域伙伴关係和垂直行业专业化解决方案。

全球行动边缘运算市场趋势与洞察

对延迟要求极高的消费性应用(例如AR/VR游戏、直播等)在亚洲越来越受欢迎。

AR/VR游戏和直播对往返延迟的要求高达20毫秒或更低,持续重塑网路设计。爱立信的试验表明,将游戏伺服器迁移到边缘节点可将传输延迟降低75%,即使在讯号不稳定的情况下也能保持流畅的游戏体验。韩国通讯业者预计,到2024年,行动游戏收入将超过56亿美元。为了支援对延迟要求较高的游戏,他们已经在人口密集的都市区地区附近部署了多接入边缘运算丛集,以提供高级订阅服务。内容提供者可以从中受益,获得更高的用户留存率和每用户收入,而营运商则可以透过差异化的用户体验来实现盈利。随着5G SA覆盖范围的扩大和设备普及率的提高,类似的模式也在日本、中国和美国的特定市场出现。

快速部署5G独立组网(SA)释放北美MEC货币化潜力

到2024年中期,29个国家的49家通讯业者已推出5G SA,其中北美通讯业者在全国覆盖范围方面处于领先地位。 T-Mobile的全面SA部署实现了针对边缘工作负载客製化的确定性网路切片,并支援企业应用的新服务等级协定。 Verizon的目标是将边缘延迟降低到10毫秒以下,以支援虚拟实境、自动驾驶和即时分析。按需付费的网路API带来了新的商机,计量收费和基于位置的运算。与超大规模资料中心业者营运商的合作加速了应用程式上线,并缩短了开发者的产品上市时间。

缺乏全球统一的多接入边缘安全与信任框架

边缘基础设施由于工作负载、资料和编配跨越数千个无人值守节点,因此面临巨大的攻击面。学术研究表明,针对快取内容和编配API 的 DDoS 攻击和横向移动威胁急剧增加。在零信任参考模型、安全飞地支援和统一身分标准成熟之前,监管机构对迁移敏感工作负载持谨慎态度。儘管 ETSI MEC工作小组正在起草跨域信任规范,但距离达成完全共识仍需数年时间,这将延长整合週期并增加跨国部署的合规成本。

细分市场分析

到2024年,硬体部分将占行动边缘运算市场收入的61%,这主要得益于对伺服器、加强型机壳和专用网路卡的投资。儘管如此,软体部分预计将在2025年至2030年间以37.6%的复合年增长率成长,显着超过整体行动边缘运算市场的成长速度,因为编配、CI/CD管道和AI框架催生了灵活的配置模式。边缘编配套件现在结合了策略引擎和服务网格,可以将网路切片转换为运算和储存资源,使营运商能够在数小时内而非数月内推出新服务。

到 2025 年,软体定义能力将融合人工智慧驱动的资源调度器、预测性维护和零接触配置。 Akamai 采用 WebAssembly 和 Fermyon 展示了轻量级执行,将冷启动延迟降低到 10 毫秒以下,这是互动式工作负载的先决条件。因此,超大规模资料中心和通讯业者正在迎头赶上。对于营运混合私有/公有边缘网路的医疗保健和製造业客户而言,对多供应商蓝图的需求尤其旺盛。

区域分析

到2024年,北美将占据行动边缘运算市场41.2%的收入份额,这得益于其覆盖全国的5G SA连接、密集的骨干网路光纤网路以及强大的超大规模资料中心。 AWS Wavelength Zones和Microsoft Azure Edge Zones已在超过40个大都会圈部署,为消费者和工业应用开发者提供低于20毫秒的往返延迟。监管机构对云端服务集中度的审查促使营运商实现通讯业者多元化,并推动与基础设施公司和半导体供应商的合作。

亚太地区预计将在2025年至2030年间实现最快成长,复合年增长率将达到36.8%,这主要得益于数十亿美元的智慧城市投资、强大的製造地以及全球最高的行动游戏消费。中国移动和华为的试验表明,其在全国范围内部署边缘运算技术,支援扩增实境(AR)辅助的高铁维护。日本通讯业者正与主机游戏发行商合作,提供无需下载即可在线上畅玩3A级游戏的体验;而印度的Jio公司正在整合行动边缘运算(MEC)技术,以缓解回程传输拥塞并扩大农村地区的网路覆盖范围。

在欧洲,工业应用、隐私和资料本地化备受关注。 ETSI 的 MEC 标准确保了跨境服务的可移植性,沃达丰承诺到 2030 年在其 30% 的基地台部署开放式无线存取网 (Open RAN),这凸显了该地区对供应链韧性的重视。中东地区正在推进千兆计划,例如 NEOM,该项目融合了认知边缘基础设施;而非洲和南美洲则正在采用 MEC 来降低数位学习、远端医疗和远距采矿作业的延迟。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对延迟敏感的消费性应用(AR/VR游戏、直播)在亚洲越来越受欢迎。

- 快速部署5G独立组网(SA)释放北美MEC货币化潜力

- 通讯业者采用解耦式开放式无线存取网将推动欧洲对本地边缘运算的需求。

- 工业时间敏感网路(IEC/IEEE 60802)製造地强制要求

- 政府智慧城市大型企划(例如沙乌地阿拉伯的NEOM)都融入了MEC技术。

- 边缘人工智慧推理降低了超大规模云端营运商的云端出口成本

- 市场限制

- 缺乏全球统一的多接入边缘安全与信任框架

- 热带和沙漠气候地区缺乏性能可靠的微型资料中心硬件

- 二三级行动通讯业者边缘编配平台总拥有成本高

- 缺乏具备MEC技能的DevOps人才会延缓概念验证向生产环境的转换。

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

- 宏观经济因素如何影响市场

第五章 市场规模与成长预测

- 按组件

- 硬体

- 软体

- 服务

- 最终用户

- 银行和金融服务

- 零售

- 医疗保健和生命科学

- 工业生产

- 能源与公共产业

- 电讯

- 其他最终用户

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘鲁

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 澳洲

- 纽西兰

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 策略发展

- 供应商定位分析

- 公司简介

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- AT&T Inc.

- Verizon Communications Inc.

- Amazon Web Services Inc.

- Microsoft Corp.(Azure Edge Zones)

- Google LLC(Google Distributed Cloud Edge)

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- IBM Corp.

- ZTE Corp.

- EdgeConneX Inc.

- Cloudflare Inc.

- Fermyon Technologies

- Saguna Networks Ltd.

- ADLINK Technology Inc.

- ADVA Optical Networking SE

- Akamai Technologies

- CoreSite

第七章 市场机会与未来展望

The mobile edge computing market is valued at USD 0.80 billion in 2025 and is projected to reach USD 3.12 billion by 2030, advancing at a 31.34% CAGR.

Intensifying demand for low-latency services, the maturation of 5G standalone (SA) networks, and the need to process ever-rising data volumes closer to end users are accelerating adoption. Hardware continues to anchor spending, yet rapid progress in software-defined infrastructure, container orchestration, and AI inference is shifting the balance toward service-centric revenue streams. Telcos, hyperscalers, and specialist start-ups increasingly view edge capabilities as a core differentiator that underpins premium connectivity, new enterprise services, and cost-effective AI deployment. Regulatory interest in data sovereignty, coupled with standardization efforts led by the European Telecommunications Standards Institute (ETSI), is further influencing market architecture and vendor strategies. Convergence among connectivity, cloud, and AI domains is reshaping competitive boundaries, compelling players to pursue cross-domain partnerships and vertical-specific solutions.

Global Mobile Edge Computing Market Trends and Insights

Latency-critical consumer apps (AR/VR gaming, livestreaming) gaining traction in Asia

AR/VR gaming and livestreaming continue to reshape network design by demanding sub-20 millisecond round-trip latency. Ericsson's trials show that relocating game servers to edge nodes can cut transport latency by 75%, sustaining fluid gameplay under fluctuating radio conditions. . Telecom operators in South Korea, where mobile gaming revenue exceeded USD 5.6 billion in 2024, have already deployed multi-access edge computing clusters near dense urban zones, enabling premium subscription tiers for latency-sensitive titles. Content providers benefit from higher retention and revenue per user, while operators monetize differentiated quality of experience. Similar patterns are emerging in Japan, China, and select U.S. markets as 5G SA coverage expands and device adoption grows.

Rapid 5G standalone roll-outs unlocking MEC monetization in North America

Forty-nine operators in 29 countries had launched 5G SA by mid-2024, but North American carriers lead in national coverage. T-Mobile's full-scale SA deployment permits deterministic network slicing aligned with edge workloads and underpins new service-level agreements for enterprise applications. Verizon targets sub-10 millisecond edge latency to enable VR, autonomous mobility, and real-time analytics. Revenue opportunities stem from pay-as-you-go exposure of network APIs, including quality-on-demand and location-based compute. Collaboration with hyperscalers accelerates application onboarding and shortens time-to-market for developers.

Absence of globally harmonized security & trust framework for multi-access edge

Edge infrastructure widens the attack surface because workloads, data, and orchestration span thousands of unattended nodes. Academic studies show a surge in DDoS and lateral-movement threats targeting cached content and orchestration APIs. Regulated sectors hesitate to migrate sensitive workloads until zero-trust reference models, secure enclave support, and federated identity standards mature. ETSI MEC working groups are drafting inter-domain trust specifications, yet full consensus remains years away, prolonging integration cycles and increasing compliance costs for multinational deployments.

Other drivers and restraints analyzed in the detailed report include:

- Telco adoption of disaggregated Open RAN driving on-prem edge demand in Europe

- Industrial Time-Sensitive Networking mandates (IEC/IEEE 60802) in manufacturing hubs

- Scarcity of ruggedized micro-data-center hardware in extreme climates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024 the hardware segment accounted for 61% of mobile edge computing market revenue, anchored by investments in servers, rugged enclosures, and specialized network interface cards. Nevertheless, software is projected to grow at a 37.6% CAGR between 2025 and 2030-well above the overall mobile edge computing market growth rate-because orchestration, CI/CD pipelines, and AI frameworks unlock flexible deployment models. Edge orchestration suites now combine service meshes with policy engines that translate network slices into compute and storage reservations, enabling operators to launch new services in hours instead of months.

By 2025, software-defined functions will embed AI-powered resource schedulers, predictive maintenance, and zero-touch provisioning. Akamai's adoption of WebAssembly alongside Fermyon exemplifies lighter-weight execution that trims cold-start latency to sub-10 milliseconds, a prerequisite for interactive workloads. Consequently, hyperscalers and telcos are shifting R&D budgets toward platform software, even as they continue refreshing edge hardware every four to five years. Services-consulting, integration, and managed operations-are catching up as enterprises outsource complexity; demand for multi-vendor blueprints is particularly high among healthcare and manufacturing clients that operate hybrid private/public edge footprints.

The Mobile Edge Computing (MEC) Market is Segmented by Component (Hardware, Software, and More), End-User (Financial and Banking Industry, Retail, Healthcare and Life Sciences, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 41.2% of mobile edge computing market revenue in 2024, leveraged by nationwide 5G SA connectivity, dense fiber backbones, and strong hyperscaler presence. AWS Wavelength Zones and Microsoft Azure Edge Zones have been deployed in more than 40 metropolitan areas, offering developers sub-20 millisecond round-trip latency for consumer and industrial apps . Regulatory scrutiny of cloud concentration prompts carriers to diversify suppliers, spurring collaborative ventures with infrastructure companies and semiconductor vendors.

Asia-Pacific is expected to register the fastest growth, at a 36.8% CAGR during 2025-2030, driven by multi-billion-dollar smart-city investments, robust manufacturing bases, and the world's highest mobile-gaming spending. China Mobile's trials with Huawei illustrate nation-scale edge roll-outs supporting AR-assisted maintenance on high-speed rail. Japan's telcos partner with console publishers to stream AAA titles without downloads, whereas India's Jio integrates MEC to reduce backhaul congestion while expanding rural coverage.

Europe emphasizes industrial applications, privacy, and data localization. ETSI's MEC standards assure cross-border service portability, and Vodafone's commitment to deploy Open RAN across 30% of masts by 2030 underscores the region's focus on supply-chain resilience. The Middle East advances giga-projects such as NEOM that embed cognitive edge infrastructure, while Africa and South America adopt MEC to alleviate latency for e-learning, telemedicine, and mining operations in remote zones.

- Huawei Technologies Co. Ltd.

- Nokia Corporation

- Telefonaktiebolaget LM Ericsson

- AT&T Inc.

- Verizon Communications Inc.

- Amazon Web Services Inc.

- Microsoft Corp. (Azure Edge Zones)

- Google LLC (Google Distributed Cloud Edge)

- Cisco Systems Inc.

- Hewlett Packard Enterprise Co.

- IBM Corp.

- ZTE Corp.

- EdgeConneX Inc.

- Cloudflare Inc.

- Fermyon Technologies

- Saguna Networks Ltd.

- ADLINK Technology Inc.

- ADVA Optical Networking SE

- Akamai Technologies

- CoreSite

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Latency-critical consumer apps (AR/VR gaming, livestreaming) gaining traction in Asia

- 4.2.2 Rapid 5G standalone roll-outs unlocking MEC monetisation in North America

- 4.2.3 Telco adoption of disaggregated Open RAN driving on-prem edge demand in Europe

- 4.2.4 Industrial time-sensitive networking mandates (IEC/IEEE 60802) in manufacturing hubs

- 4.2.5 Government smart-city megaprojects (e.g., NEOM, Saudi Arabia) embedding MEC

- 4.2.6 AI-inferencing at the edge lowering cloud egress costs for hyperscalers

- 4.3 Market Restraints

- 4.3.1 Absence of globally harmonised security & trust framework for multi-access edge

- 4.3.2 Scarcity of ruggedised micro-data-centre hardware in tropical & desert climates

- 4.3.3 High TCO of edge orchestration platforms for Tier-2/3 mobile operators

- 4.3.4 Shortage of MEC-skilled DevOps talent delaying PoC-to-production conversions

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Investment Analysis

- 4.7 Impact of Macroeconomic Factors on Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By End-user

- 5.2.1 Banking and Financial Services

- 5.2.2 Retail

- 5.2.3 Healthcare and Life Sciences

- 5.2.4 Industrial Manufacturing

- 5.2.5 Energy and Utilities

- 5.2.6 Telecommunications

- 5.2.7 Other End-users

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.2 South America

- 5.3.2.1 Brazil

- 5.3.2.2 Argentina

- 5.3.2.3 Chile

- 5.3.2.4 Peru

- 5.3.2.5 Rest of South America

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 Asia-Pacific

- 5.3.4.1 China

- 5.3.4.2 Japan

- 5.3.4.3 South Korea

- 5.3.4.4 India

- 5.3.4.5 Australia

- 5.3.4.6 New Zealand

- 5.3.4.7 Rest of Asia-Pacific

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.3.1 Huawei Technologies Co. Ltd.

- 6.3.2 Nokia Corporation

- 6.3.3 Telefonaktiebolaget LM Ericsson

- 6.3.4 AT&T Inc.

- 6.3.5 Verizon Communications Inc.

- 6.3.6 Amazon Web Services Inc.

- 6.3.7 Microsoft Corp. (Azure Edge Zones)

- 6.3.8 Google LLC (Google Distributed Cloud Edge)

- 6.3.9 Cisco Systems Inc.

- 6.3.10 Hewlett Packard Enterprise Co.

- 6.3.11 IBM Corp.

- 6.3.12 ZTE Corp.

- 6.3.13 EdgeConneX Inc.

- 6.3.14 Cloudflare Inc.

- 6.3.15 Fermyon Technologies

- 6.3.16 Saguna Networks Ltd.

- 6.3.17 ADLINK Technology Inc.

- 6.3.18 ADVA Optical Networking SE

- 6.3.19 Akamai Technologies

- 6.3.20 CoreSite

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment