|

市场调查报告书

商品编码

1851847

英国设施管理:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)United Kingdom (UK) Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

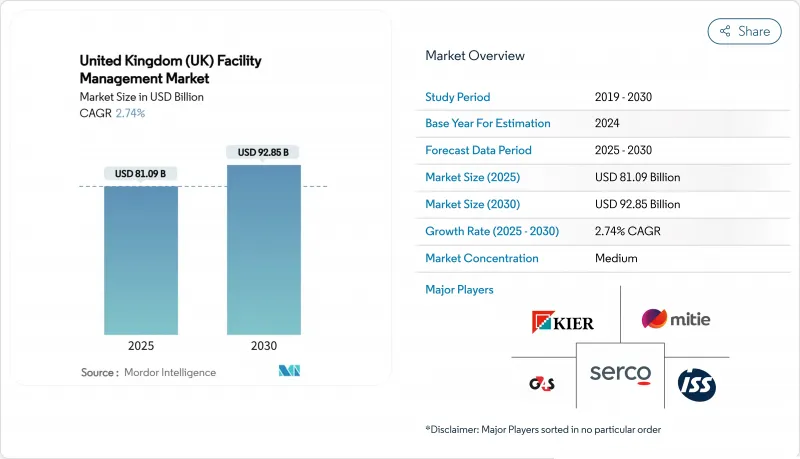

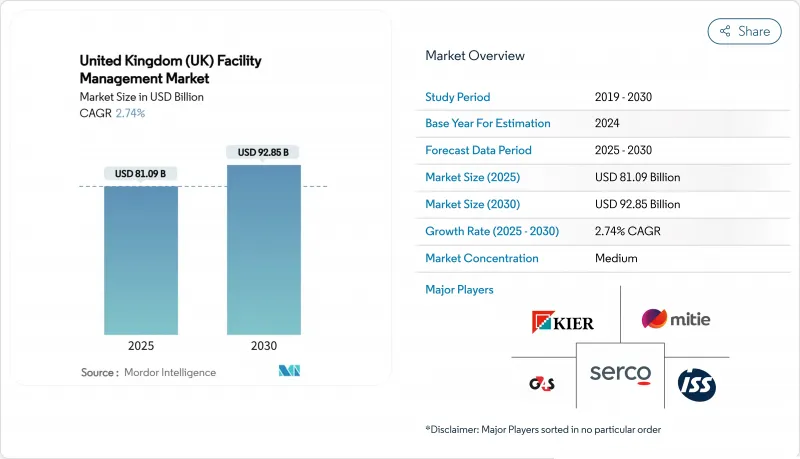

英国设施管理市场预计到 2025 年将达到 810.9 亿美元,到 2030 年将达到 928.5 亿美元,在此期间的复合年增长率为 2.74%。

这一市场规模标誌着一个成熟产业的演进,其驱动力包括能源效率的提高、数位转型以及对外包服务模式的持续偏好。硬性服务至关重要,因为老旧建筑需要严格的机械、电气和管道维护才能达到最低能源效率标准。从物联网感测器网路到人工智慧驱动的分析,技术整合能够加快响应速度、降低能耗,并支援基于绩效的合同,从而在不相应增加员工人数的情况下扩大收入规模。外包势头持续强劲,公共和私营客户都在寻求专业知识,以确保合规性并在投入价格波动的情况下提供成本确定性。英国脱欧相关的劳动力短缺和成本上涨正在压缩净利率,但公共部门维修资金的增加和灵活办公空间的普及为快速创新的服务提供者提供了扩张途径。

英国设施管理市场趋势与洞察

技术整合(物联网、人工智慧、自动化)

人工智慧驱动的楼宇管理平台正在重新定义服务交付方式。智慧财产局在推出数位化工单入口网站后,将维护回应时间从14天缩短至几秒钟。智慧感测器即时传输运作、温度和空气品质数据,使服务供应商能够从被动维护转向预测性维护,同时降低能源消耗并提升员工舒适度。世邦魏理仕进军超大规模资料中心设施管理领域,凸显了该领域24小时不间断分析监控的巨大获利潜力。医疗保健和教育行业的客户正在引领这一领域的应用,因为合规要求必须进行持续的环境监测。随着数位化仪錶板整合软体和硬体服务,服务提供者将清洁、保全、办公室支援和资产维护等服务打包到资料丰富的合约中,从而获得更高的价格。

商业不动产的快速扩张

根据英国英国特许测量师学会的数据,2025年第一季租户需求转正,预计到年底伦敦市中心黄金地段的办公大楼租金将上涨近5%。工业资产的投资热情最为强劲,受电子商务和近岸外包的推动,投资者需求净成长18%。新开发项目带动了对试运行、全生命週期资产管理和持续合规审核的需求。设施管理人员与开发商早期合作,透过整合ESG(环境、社会和治理)仪錶板的智慧建筑,确保了多年的稳定收入来源。物流的成长同样推动了客製化设施管理方案的需求,这些方案结合了库存追踪技术、码头管理和先进的消防安全维护,适用于高吞吐量的仓库。

劳动力短缺和技能差距

英国脱欧后,饭店、清洁和餐饮业面临13.2万个职缺,对设施管理人员数量造成压力。 2025年移民白皮书将技术纯熟劳工签证阈值提高至RQF 6级,限制了外籍员工进入入门设施管理职缺。自2005年以来,雇主对员工教育的投资下降了28%,导致技能短缺,同时,建筑物却在采用先进的数位系统。企业正透过诸如JPC by Samsic的12模组「下一代」专案等供电督导培训机构来应对这项挑战,该专案专注于领导力和技术发展。然而,高离职率和员工老化仍然是该行业产能的限制因素。

细分市场分析

到2024年,硬性服务将占英国设施管理市场份额的60.54%,这主要得益于英国国民医疗服务体系(NHS)高达116亿英镑(31.9亿美元)的维护积压以及积极的能源性能证书(EPC)升级时间表。由于28%的商业建筑的EPC评级仍为D级或以下,英国硬性服务合约的设施管理市场规模预计将会扩大,这迫使机械、电气和管道系统加快改造。机电和暖通空调(HVAC)产业受益于净零排放的监管路径,该路径要求到2035年将排放减少47%至62%。资产数位化将进一步推动对预测性维护分析的需求,使服务提供者能够在资产发生故障之前进行干预,同时满足合规报告要求。

目前规模较小的软性服务预计到2030年将以2.89%的复合年增长率成长,这主要得益于医院级清洁标准和职场体验创新。更严格的感染控制法规推高了机器人消毒系统和感测器检验卫生通讯协定的溢价。共享办公空间营运商需要智慧门禁系统,从而推动了保全服务的现代化。格伦费尔大厦火灾后的相关立法升级增加了对整合警报测试和疏散规划服务的需求。因此,服务提供者的产品正转向将卓越的软性服务与资料支援的合规性相结合的综合方案。

其他好处

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 目前运转率

- 主要FM玩家的获利能力

- 劳动指标 - 劳动参与率

- 按服务类型分類的设施管理市场占有率(%)

- 设施管理市场占有率(%):以硬体服务划分

- 按软体服务分類的设施管理市场占有率(%)

- 主要城市的都市化和人口成长

- 英国基础建设项目投资重点领域

- 与劳动和安全标准相关的监管因素

- 市场驱动因素

- 商业不动产的快速扩张

- 技术整合(物联网、人工智慧、自动化)

- 外包趋势日益成长

- 更重视工作场所体验和员工福祉

- 严格的节能和净零排放法规

- 灵活办公空间的兴起对灵活的设施管理合约提出了更高的要求。

- 市场限制

- 人手不足和技能差距

- 营运成本上升给利润率带来压力。

- 供应商生态系统分散阻碍了服务标准化。

- 智慧建筑系统中的资料安全问题

- 价值链分析

- PESTEL 分析

- 市场准入的监管和法律体制

- 宏观经济指标对FM需求的影响

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资与资金筹措分析

第五章 市场规模与成长预测

- 按服务类型

- 硬服务

- 资产管理

- 机电及暖通空调服务

- 消防系统与安全

- 其他硬体维修服务

- 软服务

- 办公室支援与安全

- 清洁服务

- 餐饮服务

- 其他软性调频服务

- 硬服务

- 按产品类型划分

- 内部

- 外包

- 单频调频

- Bundle FM

- 整合调频

- 按最终用户行业划分

- 商业(IT/通讯、零售、仓储等)

- 餐饮服务业(饭店、餐厅、大型餐厅)

- 设施和公共基础设施(政府、教育、交通)

- 医疗保健(公共和私立机构)

- 工业和流程(製造业、能源业、采矿业)

- 其他终端用户产业(多用户住宅、娱乐、运动和休閒)

第六章 竞争情势

- 市场集中度

- 策略转移与伙伴关係

- 市占率分析

- 公司简介

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

第七章 市场机会与未来展望

The United Kingdom facility management market size stands at USD 81.09 billion in 2025 and is forecast to reach USD 92.85 billion by 2030, reflecting a 2.74% CAGR over the period.

The measured trajectory signals a mature sector advancing under energy-efficiency mandates, digital transformation, and a sustained preference for outsourced service models. Hard services hold prime importance because ageing building stock demands strict mechanical, electrical, and plumbing upkeep to meet Minimum Energy Efficiency Standards, while soft services evolve quickly to address workplace well-being and stringent hygiene rules. Technology integration from IoT sensor grids to AI-powered analytics-cuts response times, trims energy consumption, and enables outcome-based contracts that grow revenue without proportionate head-count expansion. Outsourcing momentum continues as public and private clients seek specialist expertise that guarantees compliance and delivers cost certainty amid volatile input prices. Although Brexit-linked labour shortages and cost inflation compress margins, rising public-sector refurbishment funding and the spread of flexible workspaces offer expansion lanes for providers that innovate fast.

United Kingdom (UK) Facility Management Market Trends and Insights

Technology Integration (IoT, AI, Automation)

AI-driven building-management platforms are redefining service delivery, with the Intellectual Property Office cutting maintenance response times from 14 days to seconds after launching a digital work-order portal. Smart sensors relay live occupancy, temperature, and air-quality data, letting providers shift from reactive to predictive maintenance while lowering energy use and elevating employee comfort. CBRE's entry into hyperscale data-center facilities management underscores the high-margin potential in segments that demand 24-hour analytical monitoring. Healthcare and education clients lead adoption because compliance regimes mandate continuous environmental monitoring. As digital dashboards merge soft and hard services, providers package cleaning, security, office support, and asset maintenance into data-rich contracts that command price premiums.

Rapid Commercial Real Estate Expansion

Royal Institution of Chartered Surveyors data show occupier demand turned positive in Q1 2025, and prime office rents in Central London are projected to rise nearly 5% in the year. Industrial assets register the strongest investment appetite, with an +18% net balance in investor demand, propelled by e-commerce and near-shoring. New developments increase demand for commissioning, lifecycle asset management, and ongoing compliance auditing. Facility managers partnering early with developers secure multi-year revenue streams in smart-ready buildings that integrate ESG dashboards from day one. Logistics growth similarly drives tailored FM packages that combine inventory tracking technologies, dock management, and advanced fire-suppression maintenance for high-throughput warehouses.

Labor Shortages and Skill Gaps

Hospitality, cleaning, and catering units face 132,000 job vacancies post-Brexit, straining FM rosters. The 2025 Immigration White Paper raises the Skilled Worker visa threshold to RQF Level 6, curtailing access to international staff for entry-level FM roles. Employer training investment has fallen 28% since 2005, creating a skills deficit just as buildings adopt sophisticated digital systems. Firms counteract with supervisor academies such as JPC by Samsic's 12-module Next Gen programme focusing on leadership and technical upskilling. Nonetheless, high turnover and an aging workforce continue to limit sector capacity.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Outsourcing Trend

- Rising Focus on Workplace Experience and Employee Well-being

- Margin Pressure from Rising Operational Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services held 60.54% of United Kingdom facility management market share in 2024, anchored by the NHS's GBP 11.6 billion (USD 3.19 billion) maintenance backlog and stringent EPC upgrade timelines. The United Kingdom facility management market size for hard-service contracts is poised to expand as 28% of commercial properties still rate D or lower on EPC scale, forcing accelerated mechanical, electrical, and plumbing overhauls. MEP and HVAC segments benefit from regulatory pathways to net-zero that mandate 47%-62% emissions cuts by 2035. Asset digitization further lifts demand for predictive-maintenance analytics, letting providers intervene before asset failure while meeting compliance reporting needs.

Soft services, while smaller today, are forecast to grow 2.89% CAGR through 2030, propelled by hospital-grade cleaning standards and workplace-experience innovations. Heightened infection-control rules elevate the premium for robotic disinfection systems and sensor-verified hygiene protocols. Co-working operators require smart access control, driving security-service modernization. Fire-safety upgrades tied to post-Grenfell legislation amplify demand for integrated alarm testing and evacuation-planning services. Together, these forces shift provider offerings toward comprehensive packages that merge soft-service excellence with data-backed compliance.

The United Kingdom Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, Other End-User Industries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ISS UK

- Mitie Group PLC

- Serco Group PLC

- Kier Group PLC

- G4S Facilities Management UK Limited

- Sodexo Facilities Management Services

- Compass Group

- Equans

- VINCI Facilities Limited

- Aramark Facilities Services

- Andron Facilities Management

- CSM Facilities Management Group

- Orton Group

- Global Facilities.

- BGIS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%), by Service Type

- 4.1.5 Facility Management Market Share (%), by Hard Services

- 4.1.6 Facility Management Market Share (%), by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in United Kingdom's Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Drivers

- 4.2.1 Rapid Commercial Real Estate Expansion

- 4.2.2 Technology Integration (IoT, AI, Automation)

- 4.2.3 Increasing Outsourcing Trend

- 4.2.4 Rising Focus on Workplace Experience and Employee Well-being

- 4.2.5 Stringent Energy-Efficiency and Net-Zero Regulations

- 4.2.6 Rise of Flexible Workspaces Requiring Agile FM Contracts

- 4.3 Market Restraints

- 4.3.1 Labor Shortages and Skill Gaps

- 4.3.2 Margin Pressure from Rising Operational Costs

- 4.3.3 Fragmented Supplier Ecosystem Hindering Service Standardization

- 4.3.4 Data-Security Concerns in Smart Building Systems

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ISS UK

- 6.4.2 Mitie Group PLC

- 6.4.3 Serco Group PLC

- 6.4.4 Kier Group PLC

- 6.4.5 G4S Facilities Management UK Limited

- 6.4.6 Sodexo Facilities Management Services

- 6.4.7 Compass Group

- 6.4.8 Equans

- 6.4.9 VINCI Facilities Limited

- 6.4.10 Aramark Facilities Services

- 6.4.11 Andron Facilities Management

- 6.4.12 CSM Facilities Management Group

- 6.4.13 Orton Group

- 6.4.14 Global Facilities.

- 6.4.15 BGIS

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)