|

市场调查报告书

商品编码

1851855

资料处理和託管服务:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Data Processing And Hosting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

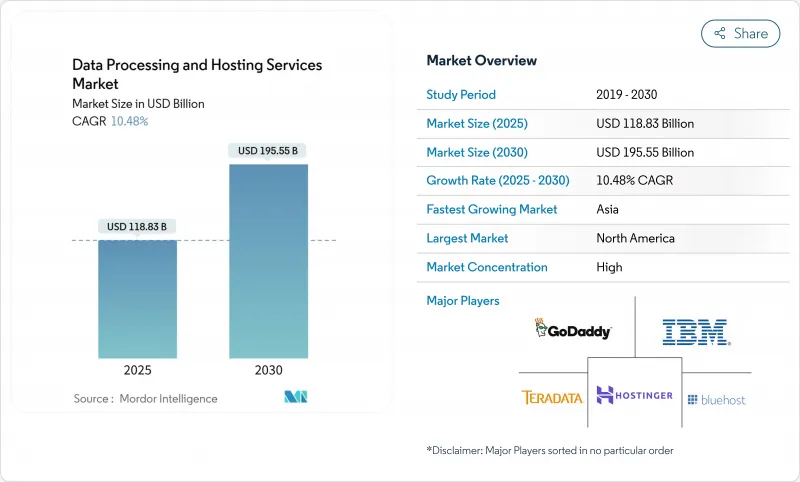

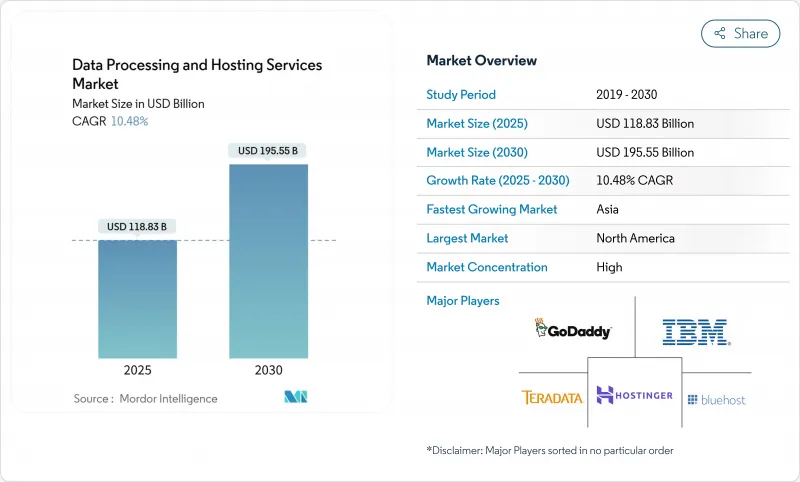

预计到 2025 年,资料处理和託管服务市场规模将达到 1,188.3 亿美元,到 2030 年将达到 1,955.5 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 10.48%。

企业大规模转向託管运算、加速向人工智慧赋能的基础设施转型以及持续的超大规模资本支出,是推动云端服务扩张的主要因素。企业正将预算从本地机架更新转向高GPU密度的云端实例、承包託管套件以及能够缩短资料到洞察週期的区域边缘节点。同时,欧洲和中东地区正在推行强制自主云端部署的政策,迫使全球企业将工作负载在地化,并在当地建立新的容量池。此外,三大公有云平台取消出口费用,降低了切换成本,并为那些在晶片技术、接近性或特定行业合规性方面脱颖而出的专业挑战者创造了机会。

关键技术和监管因素重塑了竞争格局。北美凭藉其深厚的光纤网路、可靠的电力供应和高密度超大规模丛集,目前占据了39%的收入份额。同时,亚洲正以13.4%的复合年增长率快速成长,这主要得益于5G的普及、人工智慧新兴企业的活跃以及政府的税收优惠政策,这些政策推动了新建资料中心的建设。託管服务继续主导资料处理和託管服务市场,占据64%的份额,但以IaaS、PaaS和SaaS为核心的云端原生产品正以14.1%的最高复合年增长率成长,因为客户越来越重视系统的弹性。混合云和多重云端策略正以12.5%的复合年增长率快速成长,显示企业正在将云端视为一个整体,而非单一架构。

全球数据处理及託管服务市场趋势及洞察

企业工作负载正越来越多地迁移到超大规模云端资料中心

企业正透过将关键业务系统迁移到超大规模资料中心来降低资本预算风险,预计到2030年,美国资料中心的电力需求将翻倍,达到35吉瓦。这一趋势日益受到容量驱动,其核心在于获取人工智慧加速器和主导保全服务,而这些服务在本地部署的成本仍然高得令人望而却步。预租协议使得企业能够在实际交付前数年就锁定所需容量,尤其是在电力资源紧张的城市,例如阿什本、凤凰城、都柏林和法兰克福。

人工智慧/机器学习工作负载的爆炸性增长推动了对高密度GPU託管的需求

到 2025 年,将有超过 4 万家公司在独立 GPU 上运行生产级 AI,这将提高运算密度并增加散热需求。 Lambda 和 CoreWeave 等专用 GPU 云端平台正经历三位数的成长,因为它们能够保证 H100 和 MI300 的资源,用于训练、微调和推理工作负载。

电网不稳定和能源价格上涨限制了资料中心的扩张。

南亚和非洲的电力供不应求和附加税阻碍了新建资料中心的建设。预计到2023年,美国资料中心将消耗176太瓦时(TWh)的电力,占全国电力需求的4.4%,凸显了不断增长的运算能力与电网容量之间的紧张关係。营运商正转向现场太阳能+电池储能和微电网解决方案,这增加了资本投入并延长了部署週期。

细分市场分析

大型企业将占2024年收入的71%,它们凭藉雄厚的资金实力,致力于大型主机现代化、容器编配和建构全球灾难復原副本。相较之下,中小企业正以11.7%的复合年增长率快速发展,这得益于简化的迁移工具、市场积分和託管式DevOps服务降低了技术壁垒。在非洲和拉丁美洲市场,超过90%的中小企业已采用数位支付,这表明数位支付的普及程度很高。政府对培训和云端服务券的补贴进一步推动了数位支付的普及。虽然预计2030年中小企业市场规模将翻倍,但由于大型企业持续扩张业务,中小企业的总支出占比将不足30%。

中小企业的云端服务日趋成熟,正催生一个全新的合作伙伴生态系统。经销商将销售点 (POS) 系统、分析工具和本地语言支援捆绑销售,并将计算成本计入服务费用。先进的可观测性技术堆迭能够发现异常情况并自动应用修復脚本,从而缓解了曾经阻碍中小企业发展的技能差距。这些效率的提升推动了订阅续约率和提升销售的成长,使中小企业成为更广泛的资料处理和託管服务市场中持续成长的引擎。

到2024年,由可靠的运算、储存和网路基础架构驱动的託管服务将占该行业收入的64%。云端託管(IaaS、PaaS、SaaS)细分市场到2030年将以14.1%的复合年增长率成长。客户越来越倾向于工作负载优化层、用于人工智慧的GPU丛集、用于Web层的ARM核心以及用于财务帐簿的z-parity CICS即服务。同时,随着越来越多的企业寻求云端原生重构、资料管道重构和FinOps管治,专业服务收入也在成长。边缘运算和託管服务供应商正在将类似云端的配置方式融入其入口网站,模糊了核心託管和分散式託管之间的界限。随着时间的推移,连接资料准备和运算的整合管道将削弱独立ETL供应商的竞争力,并将资料处理和託管服务市场的安全隔离网闸置于其核心地位。

财务灵活性依然具有吸引力。按秒收费和持续用电量抵扣降低了整体拥有成本。随着能源成本波动,工作负载会根据即时电力现货价格在各区域之间重新平衡。结果是,利用率结构性地提高,供应商利润率增加,租户成本更可预测。

区域分析

北美地区在2024年贡献了39%的收入,这主要得益于其广泛的光纤骨干网、丰厚的税收优惠以及高密度的超大规模丛集。光是维吉尼亚的劳登县就拥有超过3000万平方英尺的架空地板空间,并因变压器容量限製而面临电网互联禁令。为了应对永续性的审查,服务提供者正透过园区级微电网、全天候可再生能源购电协议(PPA)以及热能再生利用计画来应对挑战。 AWS、微软和Google已总合2025年在美国新建资料中心累计了超过2,550亿美元的资金,巩固了它们在该地区的容量领先地位。各州层级的隐私立法,例如加州的《消费者隐私法案》(CCPA)和德克萨斯州的《隐私法案》,要求资料副本必须保留在州内,这可能会潜移默化地再形成资料处理和託管服务市场的部署格局。

随着5G普及、数位银行和人工智慧Start-Ups生态系统的融合,亚洲将迎来13.4%的年复合成长率,成为全球成长最快的地区。新加坡暂停发放新的资料中心许可证将推动资本投资流向柔佛、巴淡岛、曼谷和海德拉巴。日本营运商将利用北海道尚未开发的地热能源,而中国的超大规模资料中心营运商将在东南亚复製国内的超级应用架构,将运算、支付和物流融合起来。智慧型手机的普及和即时翻译服务的兴起将增加数据流量,并支持持续的需求。

欧洲的主权议程正在引导采购趋势。欧盟的「数位欧洲」计画已拨款9亿欧元用于云端市场和安全中心,以提升国内能力。德国和法国将利用核能发电和水力发电结合的方式来建造人工智慧训练丛集。 Gaia-X已製定了互通性标准,儘管进度比最初预期的要慢。北欧国家正在利用廉价的水力发电,但光纤线路有限,难以覆盖。东欧国家正透过经济特区吸引投资者,但地缘政治风险仍是一大障碍。值得注意的是,英国脱欧后,放宽了资料中心设备的增值税,吸引了跨大西洋投资,并巩固了伦敦的领先地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 企业工作负载日益增长到超大规模云端资料中心(北美和欧洲)的迁移

- 边缘原生应用程式激增,需要分散式微託管(亚洲/大洋洲)

- 主权云端指令的出现将促进国内託管服务的发展(欧盟和中东地区)

- 零信任和资料驻留合规性驱动託管处理协议(银行、金融服务和医疗保健)

- 人工智慧/机器学习工作负载的爆炸性增长推动了对高密度GPU託管的需求(全球范围)

- 中小企业的数位化优先策略推动主机套餐捆绑式处理(南美和非洲)

- 市场限制

- 不稳定的电网和不断上涨的能源价格限制了资料中心的扩张(非洲和南亚)

- 云端使用费用不断上涨引发了人们对供应商锁定问题的担忧(全球)

- 资料主权衝突阻碍跨境託管(欧洲与美国)

- 缺乏认证的云端技术人才导致迁移计划延期(北欧和海湾合作委员会国家)

- 价值/供应链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 技术展望

- 容器原生託管和 Kubernetes 自动化

- 无伺服器资料处理平台

- 硅晶片专用化(DPU/G晶片)

- 投资分析

- 监理展望

第五章 市场规模与成长预测

- 按公司规模

- 大公司

- 中小企业

- 报价

- 资料处理服务

- 资料输入服务

- 资料探勘服务

- 资料清洗和格式化

- 资料扫描和索引

- 管理 ETL 和分析

- 託管服务

- 共用(经销商)主机

- 虚拟专用伺服器 (VPS) 主机

- 专用伺服器託管

- 云端託管

- IaaS

- PaaS

- SaaS

- 託管式 WordPress 主机

- 应用程式託管

- 託管和裸机

- 资料处理服务

- 按部署模式

- 公共云端

- 私有云端

- 混合云和多重云端

- 按最终用户行业划分

- 资讯科技/通讯

- BFSI

- 零售与电子商务

- 製造业

- 医疗保健和生命科学

- 媒体与娱乐

- 政府/公共部门

- 其他(教育、饭店等)

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲地区

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性倡议(MandA、伙伴关係、资金筹措)

- 市占率分析

- 公司简介

- Amazon Web Services Inc.

- Microsoft Corporation(Azure)

- Alphabet Inc.(Google Cloud Platform)

- International Business Machines Corporation

- Alibaba Cloud

- Oracle Corporation

- SAP SE

- Teradata Corporation

- Hewlett Packard Enterprise Development LP

- GoDaddy Operating Company LLC

- Bluehost(Newfold Digital Inc.)

- HostGator.com LLC

- Hostinger International Ltd.

- SiteGround Hosting Ltd.

- A2 Hosting Inc.

- DreamHost LLC

- GreenGeeks LLC

- DigitalOcean Holdings Inc.

- OVHcloud

- Equinix Inc.

- Hetzner Online GmbH

- Cloudflare Inc.

- Salesforce.com Inc.

- Alteryx Inc.

- Cloudera Inc.

第七章 市场机会与未来展望

The Data Processing And Hosting Services Market size is estimated at USD 118.83 billion in 2025, and is expected to reach USD 195.55 billion by 2030, at a CAGR of 10.48% during the forecast period (2025-2030).

Expansion is propelled by large-scale enterprise migrations to managed compute, an accelerating shift toward AI-ready infrastructure, and unrelenting hyperscale capital expenditure. Enterprises are diverting budgets from refreshed on-prem racks to GPU-dense cloud instances, turnkey colocation suites, and regional edge nodes that compress data-to-insight cycles. Parallel policy shifts in Europe and the Middle East mandate sovereign-cloud deployments, prompting global corporations to localize workloads and create fresh pools of in-country capacity. Meanwhile, the removal of egress fees by the three largest public clouds has lowered switching costs, opening opportunities for specialist challengers that differentiate on stacked silicon, proximity, or sector-specific compliance.

Key technology and regulatory catalysts have reshaped the competitive balance. North America currently commands a 39% revenue share, underpinned by deep fiber networks, reliable power, and dense hyperscale clusters. Asia, in contrast, is expanding the fastest at a 13.4% CAGR as 5G penetration, AI start-up activity, and government tax incentives converge to boost new datacenter builds. Hosting services continue to dominate the data processing and hosting services market with a 64% share, yet cloud-native offerings within that category, especially IaaS, PaaS, and SaaS, post the strongest 14.1% CAGR as customers prioritize elasticity. Hybrid and multi-cloud strategies are surging at 12.5% CAGR, signaling that enterprises now view cloud as a portfolio rather than a monolith.

Global Data Processing And Hosting Services Market Trends and Insights

Growing Migration of Enterprise Workloads to Hyperscale Cloud Data-Centers

Enterprises continue to de-risk capital budgets by shifting mission-critical systems to hyperscale regions, with U.S. datacenter power demand expected to double to 35 GW by 2030. The move is increasingly capability-driven, anchored in access to AI accelerators and managed security services that remain prohibitively expensive on-prem. Pre-lease agreements now secure capacity years ahead of physical handover, particularly in Ashburn, Phoenix, Dublin, and Frankfurt, where power allotments are constrained.

AI/ML Workload Explosion Elevating Demand for High-Density GPU Hosting

By 2025, over 40,000 companies will run production AI on discrete GPUs, raising computational density and cooling requirements. Dedicated GPU clouds such as Lambda and CoreWeave post triple-digit growth as they guarantee H100 and MI300 inventory for training, fine-tuning, and inference workloads.

Power-Grid Instability and Rising Energy Tariffs Limiting Data-Center Expansion

Electricity supply shortfalls and surcharges in South Asia and Africa throttle new builds. Data centers consumed 176 TWh of U.S. power in 2023, or 4.4% of national demand, underscoring the tension between compute growth and grid capacity. Operators pivot to onsite solar-plus-battery and micro-grid solutions, inflating capital requirements and elongating deployment schedules.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Edge-Native Applications Requiring Distributed Micro-Hosting

- Emergence of Sovereign-Cloud Mandates Boosting In-Country Hosting

- Data-Sovereignty Conflicts Hindering Cross-Border Hosting

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises controlled 71% of 2024 revenue, leveraging deep coffers to modernize mainframes, adopt container orchestration, and spin up global DR replicas. In contrast, SMEs are the fastest movers, accelerating at 11.7% CAGR as simplified migration tooling, marketplace credits, and managed DevOps services flatten technical barriers. In African and Latin American markets, more than 90% of SMEs have adopted digital payments, underscoring widespread digital adoption. Governments subsidize training and cloud vouchers, further broadening reach. The absolute data processing and hosting services market size for SMEs is projected to double by 2030, while their slice of overall spending remains under 30% because large-enterprise estates also keep expanding.

SME cloud maturation creates new partner ecosystems. Resellers bundle point-of-sale, analytics, and local-language support, embedding compute costs into service fees. Advanced observability stacks surface anomalies and auto-apply remediation scripts, mitigating the skill gap that once stymied smaller firms. Those efficiencies, in turn, reinforce subscription renewals and incremental upsell, positioning the SME segment as a durable growth flywheel within the broader data processing and hosting services market.

Hosting services delivered 64% of sector revenue in 2024, anchored by reliable compute, storage, and network primitives. The sub-segment of cloud hosting (IaaS, PaaS, SaaS) commands a 14.1% CAGR to 2030, fueled by elastic scaling, bundled APIs, and declining unit pricing as hyperscalers aggregate demand. Customers increasingly favor workload-optimized tiers, GPU clusters for AI, ARM cores for web tier, and z-parity CICS as a service for financial ledgers. Concurrently, professional services revenue grows as firms seek cloud-native redesign, data pipeline refactor, and FinOps governance. Edge and colocation providers embed cloud-like provisioning into portals, blurring the lines between core and distributed hosting. Over time, integrated pipelines that marry data preparation with compute will erode standalone ETL vendors, folding their economics into the data processing and hosting services market gatekeepers.

Financial flexibility remains a draw. Pay-by-the-second billing and sustained-usage credits lower the total cost of ownership. As energy costs fluctuate, workloads re-balance across regions based on real-time power spot prices, a capability accessible only through cloud automation. The result is a structurally higher utilization rate, translating to margin expansion for providers and cost predictability for tenants.

The Data Processing and Hosting Services Market Report is Segmented by Organisation (Large Enterprise and Small and Medium Enterprises [SME]), Offering (Data Processing Services and Hosting Services), Deployment Model (Public Cloud, Private Cloud, and Hybrid and Multi-Cloud), End-User Industry (IT and Telecommunication, BFSI, Retail and E-Commerce, Manufacturing, Healthcare and Life Sciences, and More), and Geography

Geography Analysis

North America claimed 39% of 2024 revenue on the back of vast fiber backbones, generous tax incentives, and dense hyperscale clusters. Loudoun County, Virginia, alone hosts over 30 million square feet of raised floor and is now facing grid-interconnection pauses due to transformer constraints. Providers respond with campus-scale micro-grids, 24X7 renewable PPAs, and reclaimed-heat reuse programs to counter sustainability scrutiny. AWS, Microsoft, and Google collectively earmarked more than USD 255 billion for new U.S. halls in 2025, ensuring the region's capacity lead. Privacy legislation at the state level, such as California CCPA and Texas privacy bills, could demand that data copies remain in-state, subtly reshaping deployment footprints inside the data processing and hosting services market.

Asia records the fastest 13.4% CAGR as 5G proliferation, digital banking, and AI start-up ecosystems converge. Singapore's moratorium on new datacenter permits diverts cap-ex toward Johor, Batam, Bangkok, and Hyderabad, all vying to become the region's latency hubs. Japanese operators exploit underused geothermal in Hokkaido while Chinese hyperscalers replicate domestic super-app stacks to Southeast Asia, blending compute with payments and logistics. Smartphone saturation and real-time translation services multiply data flows, anchoring durable demand.

Europe's sovereignty agenda steers procurement trends. The EU's Digital Europe Programme has allocated EUR 900 million to cloud marketplaces and security centers, catalysing domestic capacity. Germany and France vie for AI training clusters by touting nuclear and hydro power mixes. Gaia-X lays interoperability standards, albeit slower than first envisioned. Nordic states leverage cheap hydroelectricity yet grapple with limited fiber routes; Eastern European states woo investors through special economic zones, though geopolitical risk remains a hurdle. Notably, post-Brexit UK relaxes VAT on datacenter gear, attracting trans-Atlantic investment and reinforcing London's pole position.

- Amazon Web Services Inc.

- Microsoft Corporation (Azure)

- Alphabet Inc. (Google Cloud Platform)

- International Business Machines Corporation

- Alibaba Cloud

- Oracle Corporation

- SAP SE

- Teradata Corporation

- Hewlett Packard Enterprise Development LP

- GoDaddy Operating Company LLC

- Bluehost (Newfold Digital Inc.)

- HostGator.com LLC

- Hostinger International Ltd.

- SiteGround Hosting Ltd.

- A2 Hosting Inc.

- DreamHost LLC

- GreenGeeks LLC

- DigitalOcean Holdings Inc.

- OVHcloud

- Equinix Inc.

- Hetzner Online GmbH

- Cloudflare Inc.

- Salesforce.com Inc.

- Alteryx Inc.

- Cloudera Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Migration of Enterprise Workloads to Hyperscale Cloud Data-Centers (North America and Europe)

- 4.2.2 Proliferation of Edge-Native Applications Requiring Distributed Micro-Hosting (Asia and Oceania)

- 4.2.3 Emergence of Sovereign Cloud Mandates Boosting In-Country Hosting (EU and Middle-East)

- 4.2.4 Zero-Trust and Data-Residency Compliance Driving Managed Processing Contracts (BFSI and Healthcare)

- 4.2.5 AI/ML Workload Explosion Elevating Demand for High-Density GPU Hosting (Global)

- 4.2.6 SME Digital-First Strategies Fueling Bundled Processing?Hosting Packages (South America and Africa)

- 4.3 Market Restraints

- 4.3.1 Power-Grid Instability and Rising Energy Tariffs Limiting Data-Center Expansion (Africa and South Asia)

- 4.3.2 Escalating Cloud Egress Fees Creating Vendor-Lock Concerns (Global)

- 4.3.3 Data-Sovereignty Conflicts Hindering Cross-Border Hosting (Europe vs US)

- 4.3.4 Shortage of Certified Cloud Talent Delaying Migration Projects (Nordics and GCC)

- 4.4 Value/Supply-Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Technological Outlook

- 4.6.1 Container-Native Hosting and Kubernetes Automation

- 4.6.2 Serverless Data-Processing Platforms

- 4.6.3 Silicon Specialisation (DPUs/G-chips)

- 4.7 Investment Analysis

- 4.8 Regulatory Outlook

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organisation Size

- 5.1.1 Large Enterprises

- 5.1.2 Small and Medium Enterprises (SME)

- 5.2 By Offering

- 5.2.1 Data Processing Services

- 5.2.1.1 Data Entry Services

- 5.2.1.2 Data Mining Services

- 5.2.1.3 Data Cleansing and Formatting

- 5.2.1.4 Data Scanning and Indexing

- 5.2.1.5 Managed ETL and Analytics

- 5.2.2 Hosting Services

- 5.2.2.1 Shared (Reseller) Hosting

- 5.2.2.2 Virtual Private Server (VPS) Hosting

- 5.2.2.3 Dedicated Server Hosting

- 5.2.2.4 Cloud Hosting

- 5.2.2.4.1 IaaS

- 5.2.2.4.2 PaaS

- 5.2.2.4.3 SaaS

- 5.2.2.5 Managed WordPress Hosting

- 5.2.2.6 Application Hosting

- 5.2.2.7 Colocation and Bare-Metal

- 5.2.1 Data Processing Services

- 5.3 By Deployment Model

- 5.3.1 Public Cloud

- 5.3.2 Private Cloud

- 5.3.3 Hybrid and Multi-Cloud

- 5.4 By End-user Industry

- 5.4.1 IT and Telecommunication

- 5.4.2 BFSI

- 5.4.3 Retail and E-commerce

- 5.4.4 Manufacturing

- 5.4.5 Healthcare and Life Sciences

- 5.4.6 Media and Entertainment

- 5.4.7 Government and Public Sector

- 5.4.8 Others (Education, Hospitality, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Rest of Europe

- 5.5.4 Middle East

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 UAE

- 5.5.4.3 Turkey

- 5.5.4.4 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Nigeria

- 5.5.5.3 Rest of Africa

- 5.5.6 Asia Pacific

- 5.5.6.1 China

- 5.5.6.2 India

- 5.5.6.3 Japan

- 5.5.6.4 South Korea

- 5.5.6.5 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, Partnerships, Funding)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amazon Web Services Inc.

- 6.4.2 Microsoft Corporation (Azure)

- 6.4.3 Alphabet Inc. (Google Cloud Platform)

- 6.4.4 International Business Machines Corporation

- 6.4.5 Alibaba Cloud

- 6.4.6 Oracle Corporation

- 6.4.7 SAP SE

- 6.4.8 Teradata Corporation

- 6.4.9 Hewlett Packard Enterprise Development LP

- 6.4.10 GoDaddy Operating Company LLC

- 6.4.11 Bluehost (Newfold Digital Inc.)

- 6.4.12 HostGator.com LLC

- 6.4.13 Hostinger International Ltd.

- 6.4.14 SiteGround Hosting Ltd.

- 6.4.15 A2 Hosting Inc.

- 6.4.16 DreamHost LLC

- 6.4.17 GreenGeeks LLC

- 6.4.18 DigitalOcean Holdings Inc.

- 6.4.19 OVHcloud

- 6.4.20 Equinix Inc.

- 6.4.21 Hetzner Online GmbH

- 6.4.22 Cloudflare Inc.

- 6.4.23 Salesforce.com Inc.

- 6.4.24 Alteryx Inc.

- 6.4.25 Cloudera Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment