|

市场调查报告书

商品编码

1851860

托盘:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Pallets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

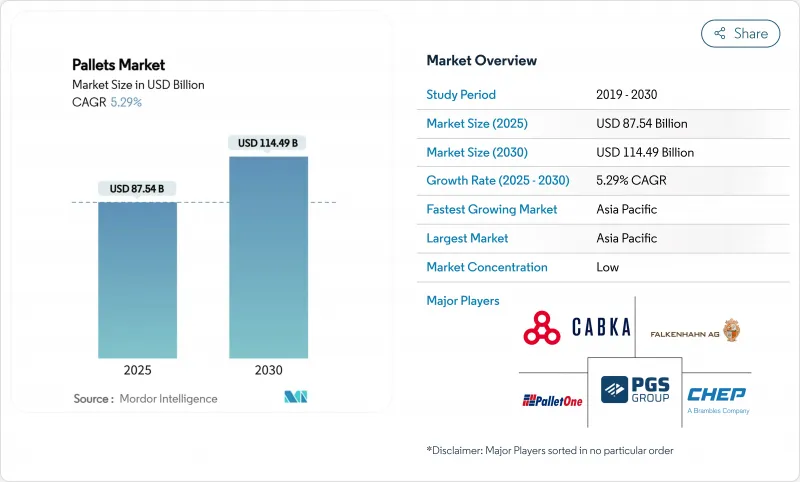

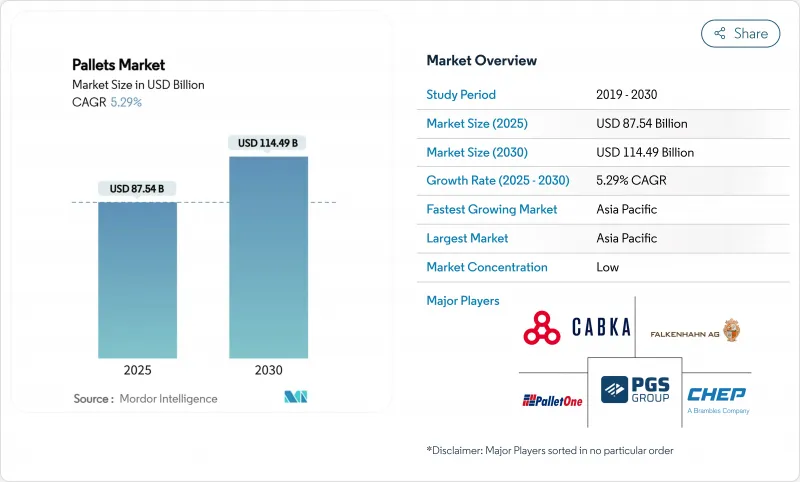

预计到 2025 年,托盘市场规模将达到 875.4 亿美元,到 2030 年将达到 1,144.9 亿美元,在此期间的复合年增长率为 5.29%。

蓬勃发展的电子商务、便于自动化的仓库设计以及全球范围内对ISPM-15标准的遵循,都在支持市场需求。企业优先选择块状托盘,以避免对自动化储存和搜寻系统进行昂贵的重新校准;塑胶在食品、饮料和製药等需要无孔接触面的产业链中占据越来越大的份额。在亚太地区,区域共享模式正在迅速扩张,这得归功于有利于认证和可追溯资产的跨境贸易倡议。同时,木材价格波动和塑胶逆向物流的滞后,导致南美和非洲部分地区的成长低于预期。儘管存在这些摩擦,但技术驱动的共享模式和生物复合材料的创新仍在不断为用户提供经济高效且永续。

全球托盘市场趋势与洞察

电子商务履约中心推广使用块状托盘

高速全通路仓库采用标准化的模组格式,以确保四向存取和结构完整性。偏离参考模组规格可能导致每个仓库5万至20万美元的校验成本,从而限制操作人员使用尺寸一致的模组。机器人混合箱码垛技术已实现高达30%的吞吐量提升和288%的效益,进一步强化了模组式设计的吸引力。

更严格的ISPM-15托盘法规促进亚太地区的托盘共享

ISPM-15框架目前涵盖182个国家,每年罚款约4,500万美元,迫使托运人使用经认证的共享网络,为热处理设备投保。由于将合规数据与每个托盘关联起来的数位化追溯设备,亚太地区的共享运输量预计将从2024年起增加23%。

美国和加拿大关税导致木材价格波动

对加拿大软木征收14.54%的关税导致木材投入成本每季波动高达40%,迫使製造商对冲采购风险并压缩利润空间。这种风险促使製造商投资替代纤维,例如玉米秸秆板材,目前这些板材正处于试生产阶段。

细分市场分析

到2024年,木材将占据托盘市场69.45%的份额,这主要得益于其单价8-12美元的优势。然而,关税主导的成本上涨、ISPM-15热处理费用以及客户的脱碳目标正在削弱这一优势。 Brambles公司购买的木材中有78%是经过认证的,并且每砍伐一棵树就种植两棵树以维持其木材资源,但用户仍在寻找更轻、可回收的托盘替代品。

预计到2030年,塑胶托盘的复合年增长率将达到7.2%,尤其是在医药和食品产业。这些行业受到严格的接触材料法规约束,其整体拥有成本足以抵销较高的购置价格。由稻壳和玉米秸秆製成的生物复合材料可在两个月内生物降解,符合监管机构和企业的碳排放目标。这些优势在亚太地区越来越受欢迎,因为该地区农业废弃物丰富,且大力推行减少废弃物的政策。

由于其四向存取和与机器人相容的特性,块状托盘预计在2024年将占据托盘市场55.34%的份额。据报道,自动化履约楼层的速度比桁架式托盘快15-20%。

客製化托盘正以7.5%的复合年增长率成长,因为营运商需要配备RFID插件、感测器插槽以及根据特定输送机係数客製化的托盘表面。混合结构,即木质托盘与塑胶滑轨的结合,兼顾了摩擦力优化和成本控制,从而支持了食品杂货和服装配送领域不断增长的自动化装机量。

区域分析

预计到2024年,亚太地区将以45.12%的市占率引领托盘市场,复合年增长率达6.4%。中国和印度的製造地整合以及东南亚电子商务的加速发展持续推动托盘销售的成长。 Roscam的托盘池扩张表明,跨境资产轮换可以减少重新部署里程并缓解市场不平衡。

北美排名第二,自动化维修和近岸外包政策推动了托盘升级。木材关税加剧了市场波动,但也促进了替代纤维和塑胶的采用。墨西哥与美国供应链的深度融合,催生了对符合ISPM-15认证标准的托盘的新需求,为国内和出口通路提供产品。

欧洲市场受益于循环经济法规、碳定价以及有利于自动化的高人事费用。可重复使用托盘方案的引入正在减少废弃物,德国和斯堪的纳维亚半岛的生物复合材料试点计画正在测试下一代材料。中东/非洲和南美洲市场潜力巨大,但受到逆向物流和标准分散的限制。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 北美和欧洲的电子商务履约中心推动了托盘式仓储的普及。

- ISPM15类型的监管收紧将鼓励亚太地区的资源整合。

- 食品饮料工厂对符合 FSMA 和欧盟 1935/2004 法规要求的卫生塑胶製品的需求

- 大洋洲和印度医药低温运输物流中RTP的使用率

- 仓库机器人托盘市场需要尺寸一致的复合复合材料

- 生物复合稻壳加速中国和东南亚实现净零排放目标

- 市场限制

- 美加关税导致木材价格波动

- 南美洲和非洲塑胶製品逆向物流薄弱

- 金属製品在欧洲、中东和非洲地区的空运中高成本且有重量限制。

- 东协标准碎片化阻碍了资源共享的扩充性

- 供应链分析

- 监理展望

- 托盘永续性和可回收/可重复使用托盘市场

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 地缘政治影响分析

第五章 市场规模与成长预测

- 依材料类型

- 木头

- 塑胶

- 金属

- 纸板/复合材料

- 有意为之

- 堵塞

- 弦乐

- 客製化

- 按托盘类型

- 可嵌套

- 可携带的

- 可堆迭

- 其他托盘类型

- 按载重能力

- 轻型托盘

- 中型托盘

- 重型托盘

- 按最终用户行业划分

- 食品和饮料

- 化学品

- 製药和医疗保健

- 零售与电子商务

- 物流/仓储

- 车

- 其他行业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲、纽西兰

- 亚太其他地区

- 中东和非洲

- 中东

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Brambles Ltd(CHEP)

- PalletOne Inc.

- CABKA Group GmbH

- Craemer Holding GmbH

- Schoeller Allibert

- Rehrig Pacific Co.

- Loscam International Holdings

- UFP Industries Inc.

- ORBIS Corporation(Menasha)

- Pallet Logistics of America

- PECO Pallet LLC

- Falkenhahn AG

- World Steel Pallet Co. Ltd.

- Millwood Inc.

- PGS Group(Palettes Gestion Services)

- Euroblock Pallets

- Beijing LuckyStar Logistics

- Interpak Pallets

- Palletways Group

- Polymer Logistics

第七章 市场机会与未来展望

The pallets market size stood at USD 87.54 billion in 2025 and is forecast to reach USD 114.49 billion by 2030, reflecting a 5.29% CAGR during the period.

Robust e-commerce activity, automation-ready warehouse design and global alignment with ISPM-15 standards underpin demand. Companies are prioritizing block pallets to avoid costly recalibration of automated storage and retrieval systems, while plastics gain share in food, beverage and pharmaceutical chains that require non-porous contact surfaces. Regional pooling models are scaling rapidly in Asia-Pacific, helped by cross-border trade initiatives that favor certified, track-and-trace assets. At the same time, lumber price volatility and weak reverse-logistics for plastics in parts of South America and Africa hold growth below potential. Despite these frictions, technology-enabled pooling and bio-composite innovations continue to open cost-efficient and sustainable pathways for users.

Global Pallets Market Trends and Insights

E-commerce fulfilment centres driving block-pallet adoption

High-velocity omnichannel warehouses are standardising on block formats to secure four-way access and structural integrity. Deviation from the reference block specification can trigger USD 50,000-200,000 recalibration costs per site, locking operators into dimensionally consistent units.Throughput improvements of up to 30% and robotic mixed-case palletising gains of 288% have been recorded, reinforcing the preference for block designs.

Regulatory push for ISPM-15 pallets fuelling pooling in Asia-Pacific

The ISPM-15 framework now spans 182 countries and levies roughly USD 45 million in annual penalties, forcing shippers toward certified pooling networks that guarantee heat-treated assets. Pooling volumes in Asia-Pacific have risen 23% since 2024, aided by digital traceability devices that keep compliance data linked to each pallet.

Volatile lumber prices from US-Canada tariffs

A 14.54% duty on Canadian softwood swings wood input costs by as much as 40% per quarter, forcing manufacturers to hedge purchases and compress margins. The exposure encourages investment in alternative fibres such as corn stover panels now in pilot production.

Other drivers and restraints analyzed in the detailed report include:

- Hygienic plastic pallets demand from FSMA and EU 1935/2004 compliance

- RTP uptake in pharma cold-chain logistics across Oceania and India

- Weak reverse-logistics for plastic pallets in South America and Africa

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wood retained 69.45% of pallets market share in 2024, underpinned by a USD 8-12 unit price advantage. However, tariff-driven cost inflation, ISPM-15 heat-treatment fees and customer decarbonisation targets are eroding this lead. Brambles sources 78% certified timber and plants two trees for each harvested one to sustain its pool, yet users still seek lighter, recyclable options.

Plastic pallets are tracking a 7.2% CAGR through 2030 as hygiene and reusability requirements mount. Adoption accelerates where total cost of ownership offsets higher acquisition prices, especially in pharma and food sectors bound by strict contact-material rules. Bio-composites derived from rice husk and corn stover offer biodegradability within two months, meeting both regulatory and corporate carbon objectives. These attributes are gaining traction across Asia-Pacific, where agricultural residues are abundant and waste-reduction policies supportive.

Block formats commanded 55.34% of the pallets market in 2024 due to four-way access and robotic compatibility. Automated fulfilment floors report 15-20% faster handling relative to stringer alternatives.

Customized pallets are growing 7.5% CAGR as operators demand RFID inserts, sensor slots and deck surfaces tailored to specific conveyor coefficients. Hybrid builds that marry wooden decks to plastic runners balance friction optimisation with cost, supporting the rising automation installed base in grocery and apparel distribution.

The Pallets Market Report is Segmented by Material Type (Wood, Plastic, and More), Design (Block, Stringer, Customized), Pallet Type (Nestable, Rackable, Stackable, Other Pallet Types), Load Capacity (Light-Duty, and More, End-User Industry (Food and Beverage, Chemical, Pharmaceutical and Healthcare, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 45.12% of pallets market share in 2024 and is expected to post a 6.4% CAGR. Manufacturing hub consolidation in China and India, plus e-commerce acceleration in Southeast Asia, continue to lift volume. Loscam's pool expansion illustrates how cross-border asset rotation lowers repositioning miles and reduces imbalances.

North America ranks second as automation retrofits and near-shoring policy drive pallet upgrades. Lumber tariffs inject volatility but also promote alternative fibres and plastic adoption. Mexico's deeper integration into US supply chains generates fresh demand for ISPM-15-certified pallets serving both domestic and export lanes.

Europe's market benefits from circular-economy law, carbon pricing and high labour costs that favour automation. Implementation of reusable pallet schemes compresses waste, while bio-composite pilots in Germany and the Nordics test next-generation materials. Middle East, Africa and South America exhibit high latent potential yet remain constrained by reverse-logistics and standards fragmentation, although national logistics plans in Saudi Arabia and Brazil point to upside beyond 2027.

- Brambles Ltd (CHEP)

- PalletOne Inc.

- CABKA Group GmbH

- Craemer Holding GmbH

- Schoeller Allibert

- Rehrig Pacific Co.

- Loscam International Holdings

- UFP Industries Inc.

- ORBIS Corporation (Menasha)

- Pallet Logistics of America

- PECO Pallet LLC

- Falkenhahn AG

- World Steel Pallet Co. Ltd.

- Millwood Inc.

- PGS Group (Palettes Gestion Services)

- Euroblock Pallets

- Beijing LuckyStar Logistics

- Interpak Pallets

- Palletways Group

- Polymer Logistics

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce Fulfilment Centres Driving Block-Pallet Adoption in North America and Europe

- 4.2.2 Regulatory Push for ISPM-15 Pallets Fuelling Pooling in Asia-Pacific

- 4.2.3 Hygienic Plastic Pallets Demand from FSMA and EU 1935/2004-Compliant FandB Plants

- 4.2.4 RTP Uptake in Pharma Cold-Chain Logistics across Oceania and India

- 4.2.5 Warehouse Robotics Requiring Dimensionally Consistent Composite Pallets

- 4.2.6 Net-Zero Targets Accelerating Bio-Composite Rice-Husk Pallets in China and SE-Asia

- 4.3 Market Restraints

- 4.3.1 Volatile Lumber Prices from US-Canada Tariffs

- 4.3.2 Weak Reverse-Logistics for Plastic Pallets in South America and Africa

- 4.3.3 High Cost and Weight Limiting Metal Pallets in EMEA Air-Freight

- 4.3.4 Fragmented ASEAN Standards Hindering Pooling Scalability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Sustainability and Recycling/Reusability of Pallets

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Geopolitical Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Wood

- 5.1.2 Plastic

- 5.1.3 Metal

- 5.1.4 Corrugated Paper/Composite

- 5.2 By Design

- 5.2.1 Block

- 5.2.2 Stringer

- 5.2.3 Customized

- 5.3 By Pallet Type

- 5.3.1 Nestable

- 5.3.2 Rackable

- 5.3.3 Stackable

- 5.3.4 Other Pallet Types

- 5.4 By Load Capacity

- 5.4.1 Light - Duty Pallets

- 5.4.2 Medium - Duty Pallets

- 5.4.3 High - Duty Pallets

- 5.5 By End-User Industry

- 5.5.1 Food and Beverage

- 5.5.2 Chemical

- 5.5.3 Pharmaceutical and Healthcare

- 5.5.4 Retail and E-Commerce

- 5.5.5 Logistics and Warehousing

- 5.5.6 Automotive

- 5.5.7 Other Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Brambles Ltd (CHEP)

- 6.4.2 PalletOne Inc.

- 6.4.3 CABKA Group GmbH

- 6.4.4 Craemer Holding GmbH

- 6.4.5 Schoeller Allibert

- 6.4.6 Rehrig Pacific Co.

- 6.4.7 Loscam International Holdings

- 6.4.8 UFP Industries Inc.

- 6.4.9 ORBIS Corporation (Menasha)

- 6.4.10 Pallet Logistics of America

- 6.4.11 PECO Pallet LLC

- 6.4.12 Falkenhahn AG

- 6.4.13 World Steel Pallet Co. Ltd.

- 6.4.14 Millwood Inc.

- 6.4.15 PGS Group (Palettes Gestion Services)

- 6.4.16 Euroblock Pallets

- 6.4.17 Beijing LuckyStar Logistics

- 6.4.18 Interpak Pallets

- 6.4.19 Palletways Group

- 6.4.20 Polymer Logistics

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment