|

市场调查报告书

商品编码

1851865

穿透测试:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Penetration Testing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

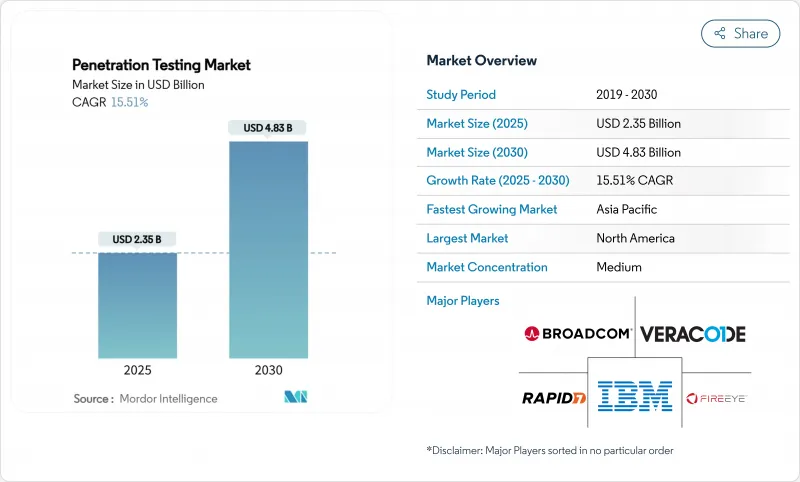

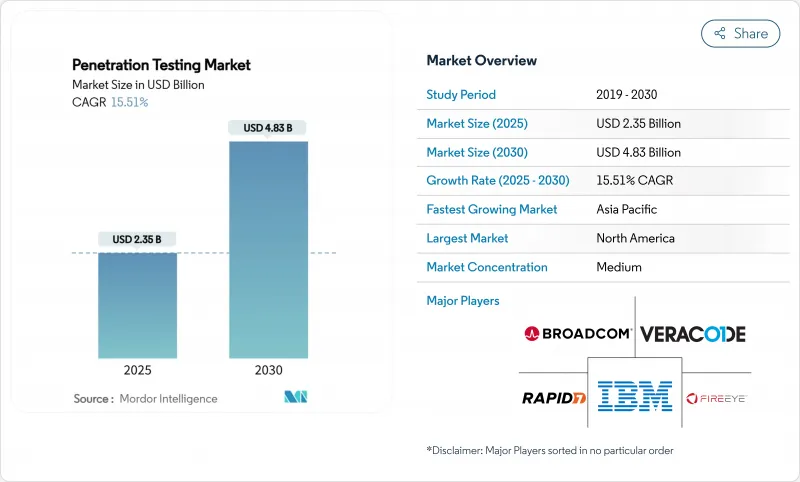

预计到 2025 年,穿透测试市场规模将达到 23.5 亿美元,到 2030 年将达到 48.3 亿美元,2025 年至 2030 年的复合年增长率为 15.51%。

网路攻击技术的日益复杂、隐私法律的不断完善以及网路保险需求的日益增长,推动了产业成长,使得独立的安全检验成为董事会层面的优先事项。 HIPAA、PCI DSS 4.0 和《数位营运弹性法案》等新规要求企业必须向监管机构证明其持续控制措施的有效性,从而扩大了可支配支出。投资正转向基于人工智慧和 API 的自动化测试,这缩短了测试週期,并为资源有限的团队提供了更多存取权限。云端技术的应用、DevSecOps 实践以及银行业、医疗保健业和製造业的积极数位化,为提供咨询、工具和管理服务的供应商创造了新的收入来源。竞争对手则透过平台收购、人才引进和资金筹措来应对,旨在扩大全球交付能力并加快价值实现速度。

全球穿透测试市场趋势与洞察

政府指令和特定产业法规

修订后的框架,例如 FedRAMP 的 2024 年指南和即将发布的 HIPAA 更新,强制要求进行年度或持续的穿透测试,并要求受监管实体和云端供应商将攻击性评估纳入其安全计画。仅 PCI DSS 4.0 就引入了 63 条新的控制声明,明确提及对持卡人资料环境进行更深入、基于情境的测试。欧盟金融机构在 DORA 下也面临类似的审查,为专业服务供应商带来了多年的发展机会。

人工智慧主导的自动化测试平台可降低成本和频率

这款现代测试平台内建的机器学习引擎能够以近乎即时的精度检测出可利用的攻击向量,从而减少人工操作,并帮助融资紧张的中小企业拓展市场。早期用户回馈,测试週期最多可缩短 70%,订阅门槛低于每月 100 美元,使供应商能够将一次性合约转化为持续的收入来源。

中小企业缺乏意识

儘管预算限制和人员短缺加剧了资料外洩的风险,但中小企业对穿透测试的采用率仍然很低。教育宣传活动、折扣捆绑保险和价格合理的自动化套件正在逐步缩小差距,但它们在成熟度指标方面仍然落后于大型企业。

细分市场分析

随着企业加大电子商务入口网站和SaaS工作负载的投入,预计到2024年,Web应用程式计划将占据穿透测试市场份额的36%。由于面向客户的服务堆迭越来越多地包含基于浏览器的介面,因此需要定期验证漏洞利用情况,市场需求保持稳定。同时,行动应用程式检验正以19.23%的复合年增长率快速成长,反映出银行业和零售业的互动正向Android和iOS通路转移。

应用商店安全隔离网闸和金融监管机构日益严格的审查迫使开发者整合行动端专属的威胁建模、会话管理检查和执行时间保护。云端和以 API 为中心的架构进一步扩大了攻击面,促使安全团队采用统一的平台,以便在单一的部署计划下扫描 Web、行动和微服务。

到 2024 年,本地部署方案仍将占据 61% 的收入份额,这反映了资料驻留要求的必要性以及企业内部测试编配的便利性。然而,云端基础订阅模式凭藉其能够即时启动代理并将测试结果即时传输到 DevSecOps 控制面板的功能,正以每年 20.27% 的速度成长。

为了让受监管的买家放心,服务提供者正在增加零信任连接器、匿名资料室和地理隔离的工作负载。混合交付模式(将本地测试工具与云端分析结合)正在成为企业平衡主权和效率的过渡状态。

区域分析

2024年,北美将占全球收入的39%,这主要得益于联邦政府的强制规定,例如针对云端供应商的FedRAMP测试指南和美国国税局的生产规则。光是医疗改革方案就可能带来46亿美元的新增安全支出。完善的供应商生态系统、成熟的网路保险市场以及集中的创业融资进一步巩固了该地区的领先地位。

亚太地区是成长最快的地区,年复合成长率高达17.04%,这主要得益于保险公司对检验的环境增加保费,以及各国政府对关键基础设施制定正式的审核计画。日本的「网路竞技场」培训体系、中国对自主型安全架构的推进以及印度金融科技的蓬勃发展,都在共同推动测试频率的需求。东协二线经济体也将管理服务外包,以弥补国内人才短缺。

在《一般资料保护规范》(GDPR) 和《数位营运弹性法案》的推动下,欧洲的业务稳步扩张,迫使银行和保险公司对跨境营业单位的控制措施进行检验。现有的电讯和製造业丛集正透过委託进行工业控制和5G网路测试来扩大规模。东欧企业由于面临邻近衝突带来的供应链衝击,正迅速转向持续参与丛集。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 各领域网路安全风险日益增加

- 安全评估和合规性审核的需求日益增长

- 政府和行业特定法规

- 人工智慧主导的自动化测试平台可降低成本和频率

- 您的DevSecOps管线需要整合持续渗透测试

- 网路保险承保需要第三方渗透测试

- 市场限制

- 中小企业缺乏意识

- 熟练测试人员短缺和高成本

- 工具滥用和误报疲劳会降低投资报酬率

- 在某些国家,主动攻击可能引发法律/责任问题。

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 评估市场宏观经济趋势

第五章 市场规模与成长预测

- 按测试类型

- 网路穿透测试

- Web应用程式穿透测试

- 行动应用穿透测试

- 社会工程穿透测试

- 无线网路穿透测试

- 云端穿透测试

- 其他类型

- 按部署模式

- 本地部署

- 云端基础的

- 按组织规模

- 大公司

- 小型企业

- 按服务类型

- 内部测试团队

- 第三方管理服务

- 按最终用户行业划分

- 政府/国防

- 银行、金融服务和保险(BFSI)

- 资讯科技和电信

- 医疗保健和生命科学

- 零售与电子商务

- 製造业

- 能源与公共产业

- 其他终端用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲和纽西兰

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 中东

- GCC

- 土耳其

- 以色列

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略性措施与资金筹措

- 市占率分析

- 公司简介

- IBM Corporation

- Rapid7, Inc.

- Synopsys, Inc.

- Checkmarx Ltd.

- Acunetix Ltd.(Invicti Security)

- Broadcom Inc.(Symantec Corporation)

- FireEye Inc.

- Veracode, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Palo Alto Networks, Inc.(Unit 42)

- Offensive Security, LLC

- Core Security(Fortra)

- Pentera Security Ltd.

- HackerOne, Inc.

- Trustwave Holdings, Inc.

- IOActive, Inc.

- NCC Group plc

- Cofense Inc.

- Bishop Fox, Inc.

第七章 市场机会与未来展望

The penetration testing market was valued at USD 2.35 billion in 2025 and is forecast to reach USD 4.83 billion in 2030, advancing at a 15.51% CAGR over 2025-2030.

Growth is propelled by sharper cyber-attack tactics, tighter privacy statutes, and rising cyber-insurance prerequisites that make independent security validation a board-level priority. New mandates under HIPAA, PCI DSS 4.0, and the Digital Operational Resilience Act are expanding the addressable spend as organizations must prove continuous control efficacy to regulators. Investment is shifting toward AI-enabled, API-driven test automation that cuts cycle time and broadens access for resource-constrained teams. Cloud adoption, embedded DevSecOps practices, and aggressive digitalization across banking, healthcare, and manufacturing create fresh revenue pools for providers willing to bundle consulting, tooling, and managed services. The competitive field is responding through platform acquisitions, talent roll-ups, and venture funding aimed at scaling global delivery and shortening time-to-value.

Global Penetration Testing Market Trends and Insights

Government Mandates and Industry-Specific Regulations

Revised frameworks such as FedRAMP's 2024 guidance and forthcoming HIPAA updates now specify annual or even continuous penetration tests, obliging covered entities and cloud vendors to hard-wire offensive assessments into security programs. PCI DSS 4.0 alone introduces 63 new control statements that explicitly reference deeper, scenario-based testing for cardholder data environments. Financial entities in the EU face similar scrutiny under DORA, guaranteeing a multi-year tailwind for specialist service providers.

AI-Driven Automated Testing Platforms Lower Cost and Frequency

Machine-learning engines embedded in modern testing platforms detect exploitable paths with near-real-time accuracy, trimming manual effort and widening market reach to cash-strapped SMEs. Early adopters report cycle-time reductions of up to 70% and subscription entry points under USD 100 per month, converting one-off engagements into recurring revenue streams for vendors.

Lack of Awareness Among SMEs

Budget limits and staffing shortages continue to dampen penetration testing uptake among smaller firms despite evidence of rising breach exposure. Education campaigns, bundled insurance discounts, and lower-priced automated suites are gradually narrowing the gap, but the segment still lags larger enterprises on maturity metrics.

Other drivers and restraints analyzed in the detailed report include:

- DevSecOps Pipelines Require Continuous Pen-Testing Integration

- Cyber-Insurance Underwriting Now Demands Third-Party Tests

- Shortage and High Cost of Skilled Testers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Web application projects generated 36% penetration testing market share in 2024 as companies fortified e-commerce portals and SaaS workloads. Demand stays stable because every customer-facing service stack now includes browser-based interfaces needing recurring exploit validation. Mobile application testing, however, is scaling at a 19.23% CAGR, reflecting the migration of banking and retail interactions to Android and iOS channels.

Intensifying scrutiny from app-store gatekeepers and financial supervisors forces developers to integrate mobile-specific threat modeling, session management checks, and runtime protections. Cloud and API-centric architectures further enlarge the attack surface, pushing security teams toward unified platforms that scan web, mobile, and micro-services in a single engagement cadence.

On-premise programs retained 61% of 2024 revenues, a testament to data-residency mandates and comfort with in-house test orchestration. Yet cloud-based subscriptions are growing 20.27% annually, buoyed by the ability to spin up agents instantly and stream findings back into DevSecOps dashboards.

Providers are adding zero-trust connectors, anonymized data chambers, and regionally segregated workloads to reassure highly regulated buyers. Hybrid delivery-local test harnesses coupled with cloud analytics-emerges as the transitional state for firms balancing sovereignty with efficiency.

The Penetration Testing Market Report is Segmented by Testing Type (Network Penetration Testing, and More), Deployment Mode (On-Premise, and Cloud), Organization Size (Large Enterprises, and SMEs), Service Delivery Mode (In-House Testing Teams, and Third-Party Managed Services), End-User Industry (Government and Defense, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 39% of 2024 revenues, supported by federal directives such as FedRAMP test guidance for cloud vendors and IRS production-environment rules. Healthcare overhaul proposals alone could inject USD 4.6 billion in fresh security outlays once finalized. An advanced vendor ecosystem, mature cyber-insurance market, and venture funding concentration reinforce regional leadership.

Asia-Pacific is the fastest-growing arena, charting a 17.04% CAGR as insurers premium-price untested environments and governments formalize critical-infrastructure audit schedules. Japan's Cyber Colosseo training pipeline, China's push for self-reliant security stacks, and India's fintech surge combine to elevate test frequency requirements. Tier-2 economies in ASEAN are also commissioning managed services to plug local talent gaps.

Europe records steady expansion under GDPR and the Digital Operational Resilience Act, compelling banks and insurers to validate controls across cross-border entities. Incumbent telecom and manufacturing clusters add depth by commissioning industrial-control and 5G-network test scopes. Eastern European firms, confronted with supply-chain spillovers from nearby conflicts, are moving quickly toward continuous engagement models.

- IBM Corporation

- Rapid7, Inc.

- Synopsys, Inc.

- Checkmarx Ltd.

- Acunetix Ltd. (Invicti Security)

- Broadcom Inc. (Symantec Corporation)

- FireEye Inc.

- Veracode, Inc.

- Qualys, Inc.

- Tenable Holdings, Inc.

- Palo Alto Networks, Inc. (Unit 42)

- Offensive Security, LLC

- Core Security (Fortra)

- Pentera Security Ltd.

- HackerOne, Inc.

- Trustwave Holdings, Inc.

- IOActive, Inc.

- NCC Group plc

- Cofense Inc.

- Bishop Fox, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising cybersecurity risks across sectors

- 4.2.2 Increasing demand for security assessments and compliance audits

- 4.2.3 Government mandates and industry-specific regulations

- 4.2.4 AI-driven automated testing platforms lower cost and frequency

- 4.2.5 DevSecOps pipelines require continuous pen-testing integration

- 4.2.6 Cyber-insurance underwriting now demands third-party pen tests

- 4.3 Market Restraints

- 4.3.1 Lack of awareness among SMEs

- 4.3.2 Shortage and high cost of skilled testers

- 4.3.3 Tool-sprawl and false-positive fatigue reduce ROI

- 4.3.4 Legal/liability concerns over active exploitation in some nations

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Testing Type

- 5.1.1 Network Penetration Testing

- 5.1.2 Web Application Penetration Testing

- 5.1.3 Mobile Application Penetration Testing

- 5.1.4 Social Engineering Penetration Testing

- 5.1.5 Wireless Network Penetration Testing

- 5.1.6 Cloud Penetration Testing

- 5.1.7 Other Types

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 Cloud-based

- 5.3 By Organization Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises (SMEs)

- 5.4 By Service Delivery Mode

- 5.4.1 In-house Testing Teams

- 5.4.2 Third-party Managed Services

- 5.5 By End-user Industry

- 5.5.1 Government and Defense

- 5.5.2 Banking, Financial Services and Insurance (BFSI)

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Retail and E-Commerce

- 5.5.6 Manufacturing

- 5.5.7 Energy and Utilities

- 5.5.8 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 GCC

- 5.6.5.1.2 Turkey

- 5.6.5.1.3 Israel

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Funding

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Rapid7, Inc.

- 6.4.3 Synopsys, Inc.

- 6.4.4 Checkmarx Ltd.

- 6.4.5 Acunetix Ltd. (Invicti Security)

- 6.4.6 Broadcom Inc. (Symantec Corporation)

- 6.4.7 FireEye Inc.

- 6.4.8 Veracode, Inc.

- 6.4.9 Qualys, Inc.

- 6.4.10 Tenable Holdings, Inc.

- 6.4.11 Palo Alto Networks, Inc. (Unit 42)

- 6.4.12 Offensive Security, LLC

- 6.4.13 Core Security (Fortra)

- 6.4.14 Pentera Security Ltd.

- 6.4.15 HackerOne, Inc.

- 6.4.16 Trustwave Holdings, Inc.

- 6.4.17 IOActive, Inc.

- 6.4.18 NCC Group plc

- 6.4.19 Cofense Inc.

- 6.4.20 Bishop Fox, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment