|

市场调查报告书

商品编码

1851899

柔版印刷机:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Flexographic Printing Machine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

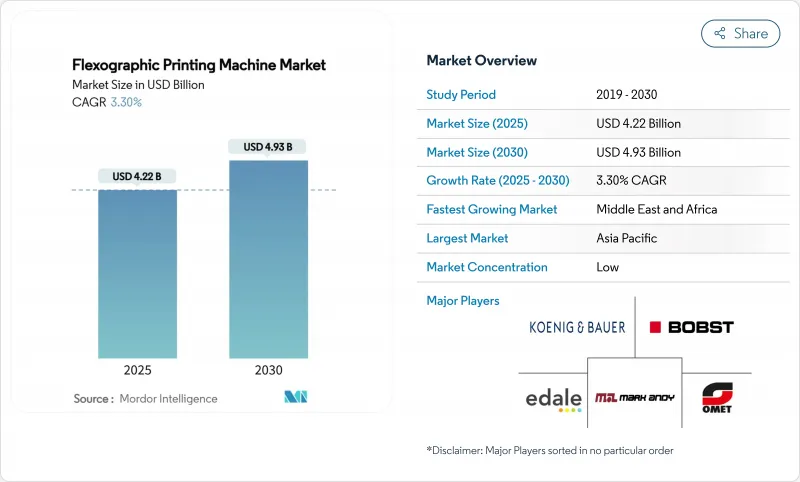

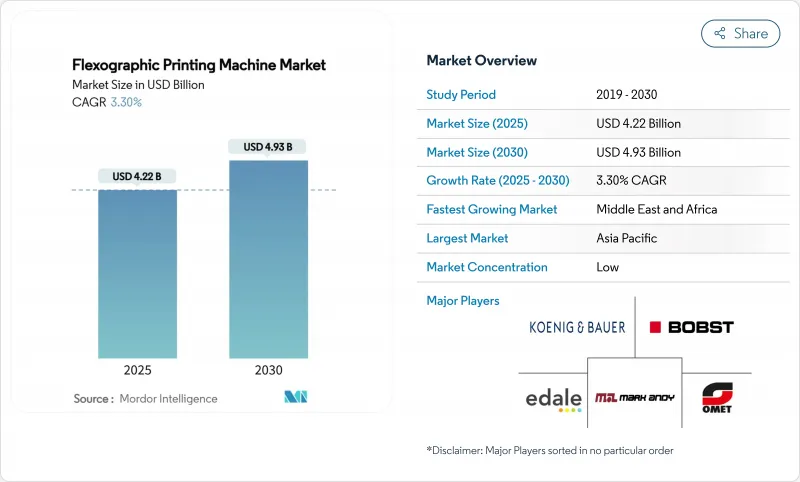

预计柔版印刷机市场规模将在 2025 年达到 42.2 亿美元,在 2030 年达到 49.3 亿美元,年复合成长率稳定在 3.3%。

如今,投资重点不再是单纯的产能扩张,而是更多地转向自动化、混合印刷能力以及满足日益严格的永续性法规。与电子商务相关的短版印刷、水性油墨的强制使用以及数位双胞胎维护平台正在重塑加工企业的采购标准。能够兼顾快速换版和低VOC性能的供应商正在赢得市场份额,而区域性补贴计划,例如中国的「绿色印刷2026」计划,正在改变竞争格局。同时,XSYS-MacDermid和INX-C&A等併购案例表明,製版和油墨专家正在透过整合来缩短前置作业时间并应对PFAS法规。

全球柔版印刷机市场趋势及洞察

经济高效的小批量包装能力

柔版印刷机製造商已将设定时间和盈利的最低印量从5000公尺缩短至近500公尺。更快的印刷週期使拥有季节性或区域性SKU的品牌能够以较低的成本推出定製图案。 MacDermid的LUX ITP印版现在只需8小时即可出版,而此前需要两天,这消除了加工商在隔天更换设计稿时面临的关键瓶颈。更快的印版速度和更便捷的换版流程使柔版印刷机能够重新获得先前转移到数位印刷的工作。因此,加工商正在投资于兼顾速度和灵活性的中阶模组化生产线,以满足整个柔版印刷机市场的设备需求。

食品级永续柔性包装的激增

欧洲和北美的法规正在逐步淘汰 PFAS,并强制要求完全可回收。 Cycaflex 计划在 2030 年实现 100% 可回收产品组合,其中 5% 为消费后回收材料 (PCR),这反映了压印加工商在循环经济方面必须达到的标准。 INX 的 GelFlex EB 墨水无需覆膜层,在保持阻隔性的同时,减轻了包装总重量。 inxinternational.com。与 Solenis Heidelberg 等公司合作的线上阻隔涂层伙伴关係进一步减少了二次加工工序。随着加工商竞相在欧盟 2026 年 8 月 PFAS 排放上限生效前完成新化学品的认证,能够以具有竞争力的速度运作水性油墨和 EB 固化油墨的印刷机需求激增,这将有利于柔版印刷市场的发展。

多色CI印刷机需要大量资金投入

一条配置齐全的1300毫米连续印刷生产线售价高达400万美元,远高于其模组化替代方案。因此,即使是全球性公司也在延后2024年的订单,博斯特的连续印刷订单量下降了24%。在平均运作下降的情况下,中型加工商不愿投资高阶印刷机,减缓了柔版印刷机市场的更新换代週期。

细分市场分析

到2024年,纸张和纸板将以45.56%的市场份额主导柔版印刷机市场,其中零售电商纸盒和再生牛皮纸是主要应用领域。加工商依靠纸张易于回收的特性来满足品牌法规要求,而改进的涂层则延长了常温食品的保质期。然而,塑胶薄膜将以6.57%的复合年增长率成为成长最快的市场,因为单一材料复合材料和PCR(再生塑胶)混合物能够满足循环利用和阻隔方面的需求。

INX的EB油墨能够去除薄膜结构中的层压层,从而在不影响阻隔性的前提下降低薄膜厚度,这加剧了对替代产品的竞争。 UFlex在埃及新建的PET树脂产能反映了全球树脂自给自足、缩短供应链的趋势。总体而言,纸张加工商正在扩大其瓦楞纸板生产线,而薄膜製造商则致力于生产高阻隔包装袋,这支撑了针对特定基材的柔版印刷机市场对设备的需求。

由于购置成本低廉且易于更换作业,深受自有品牌食品和独立化妆品企业的青睐,线上/模组化系统在2024年占据了39.34%的收入份额。而资本密集的中央压印机则以5.45%的复合年增长率成为成长最快的设备,这主要得益于品牌对收缩套标和宽幅捲筒零食等产品中精准套准的要求。

混合式设计打破了传统界限:Uteco 的 OnyxOMNIA 将喷墨列印头与八色柔印机结合,实现了可变数据列印,速度高达 400 公尺/分钟。随着 CI OEM 厂商推出自动化印版滚筒和数数位双胞胎诊断技术,24/6 轮班製版机正向高端市场转型,推动柔印机市场向更高规格的平台发展。

柔版印刷机市场按承印物(纸/纸板、塑胶薄膜、瓦楞纸板等)、印刷机类型(中央压印滚筒式、堆迭式、联线/模组化)、终端用户行业(食品/饮料、医药/医疗保健等)、自动化程度(传统型、智慧/物联网型)和地区进行细分。市场规模和预测以美元计价。

区域分析

到2024年,亚太地区将占全球销售额的40.56%,其中中国产能扩张和补贴主导的升级改造将有利于符合「绿色、智慧」标准的压机。日本高昂的人事费用将加速机器人物料输送的应用,而韩国和东协的加工商将投资建造软质包装线,以满足区域零食和个人护理品牌的需求。

中东和非洲是成长最快的地区,复合年增长率达6.14%。人口成长、低温运输改善以及快速消费品渗透率的提高,正推动着新型软包装工厂的建设,并吸引了诸如UFlex在埃及的PET晶片工厂等投资,该工厂有助于当地树脂供应。海湾国家也正在试验改造现有维修,采用水性油墨,以达成循环经济目标。

在日益成熟但日益严格的 PFAS 和 VOC 法规的背景下,北美和欧洲仍然是技术领导者。欧盟 25 ppb 的 PFAS 限值将于 2026 年 8 月生效,这将迫使加工商对其阻隔涂层进行全面升级。北美印刷商也面临各州溶剂法规的类似压力,促使他们升级到封闭式刮刀系统和热固型空气管理系统。因此,儘管这些地区的宏观销售成长放缓,但更换的需求仍保持着柔版印刷市场的活力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 经济高效的小批量包装能力

- 食品级永续柔性包装的激增

- 快速扩张瓦楞纸包装产能以履约

- 北美和欧盟强制要求使用水性低VOC油墨

- 将生产线数位双胞胎和人工智慧驱动的预测性维护相结合

- 中国2026年绿色印刷补贴政策(适用于CI柔版印刷设备)

- 市场限制

- 多色CI印刷机需要大量资金投入

- 欧洲和日本缺乏熟练的印刷操作员

- 超短期生产中前置作业时间的瓶颈

- 加强对阻隔涂层相容性的 PFAS 法规

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 材料

- 纸和纸板

- 塑胶薄膜

- 金属薄膜和箔

- 纸板

- 其他材料(生质塑胶、层压材料)

- 按压类型

- 中央广告曝光率(CI)

- 堆迭

- 内嵌/模组化

- 按最终用户行业划分

- 食品/饮料

- 製药和医疗保健

- 个人护理和化妆品

- 消费性电子产品

- 物流与电子商务

- 其他终端用户产业

- 按自动化级别

- 传统的

- 智慧/物联网相容

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 义大利

- 英国

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- ASEAN

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 肯亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Bobst Group SA

- Windmoller and Holscher KG

- Koenig and Bauer AG

- Mark Andy Inc.

- Uteco Group

- Heidelberger Druckmaschinen AG

- OMET Srl

- MPS Systems BV

- Nilpeter A/S

- Gallus Ferd. Ruesch AG

- Soma Engineering

- PCMC(Barry-Wehmiller)

- Star Flex International

- Orient Sogyo Co. Ltd.

- Taiyo Kikai Ltd.

- Comexi Group

- Rotatek SA

- Wolverine Flexographic LLC

- Zhejiang Weigang Machinery

- Edale Ltd.

第七章 市场机会与未来展望

The flexographic printing machine market size stands at USD 4.22 billion in 2025 and is on track to reach USD 4.93 billion by 2030, reflecting a steady 3.3% CAGR.

Investment priorities now revolve around automation, hybrid press capabilities, and compliance with tightening sustainability rules rather than simple capacity expansion. E-commerce-related short runs, water-based ink mandates, and digital-twin maintenance platforms are reshaping procurement criteria across converters. Suppliers that marry fast changeovers with low-VOC performance are gaining share, while regional subsidy programs, most notably China's 2026 "Green Press" policy, are altering the competitive map. At the same time, mergers such as XSYS-MacDermid and INX-C&A illustrate how plate-making and ink specialists are consolidating to cut lead times and navigate PFAS restrictions.

Global Flexographic Printing Machine Market Trends and Insights

Cost-effective short-run packaging capability

Flexographic press builders have slashed setup times, taking profitable minimum runs from 5,000 m to close to 500 m. Shorter cycles mean brands with seasonal or regional SKUs can deploy custom graphics without prohibitive costs. MacDermid's LUX ITP plates now leave the plate room in eight hours, down from two days, which removes a key bottleneck for converters targeting next-day art changes. Together, faster plates and rapid changeovers allow flexography to reclaim work that once defaulted to digital presses. Converters are therefore investing in mid-range modular lines that balance speed with flexibility, underpinning equipment demand across the flexographic printing machine market.

Surge in food-grade sustainable flexible packaging

European and North American regulations are eliminating PFAS while demanding full recyclability. Saica Flex plans a 100% recyclable portfolio by 2030 with 5% PCR content, showcasing the pressure on converters to prove circularity. INX's GelFlex EB inks remove lamination layers, cutting total pack weight yet maintaining barrier integrity inxinternational.com. Inline barrier-coating partnerships, such as Solenis-Heidelberg, further reduce secondary processes. As converters race to certify new chemistries before the EU's August 2026 PFAS cap, demand crescendos for presses that can run water-based or EB curing inks at competitive speeds benefiting the flexographic printing machine market.

Cap-ex intensive multi-color CI presses

A fully optioned 1,300 mm CI line can command USD 4 million, well above modular alternatives. As a result, even global accounts deferred orders in 2024, cutting Bobst CI bookings by 24%. Mid-market converters hesitate to finance premium presses when average run lengths are shrinking, slowing replacement cycles in the flexographic printing machine market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid corrugated capacity additions in e-commerce fulfillment

- Mandates on water-based low-VOC inks

- Skilled press-operator shortage in Europe and Japan

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Paper and paperboard led the flexographic printing machine market with 45.56% share in 2024, buoyed by retail e-commerce cartons and recycled kraft liners. Converters rely on paper's easy recyclability to satisfy brand mandates, while improved coatings are extending shelf life for ambient foods. Plastic films, however, chart the fastest 6.57% CAGR as mono-material laminates and PCR blends solve circularity and barrier needs.

The substitution battle intensifies as INX's EB inks allow film structures to drop a lamination layer, cutting gauge without compromising barrier. UFlex's new PET resin capacity in Egypt reflects global resin self-sufficiency moves to shorten supply chains. Overall, paper converters expand corrugator fleets, whereas film suppliers chase high-barrier pouches together sustaining equipment demand across the flexographic printing machine market size for substrate-specific presses.

In-line/modular systems held 39.34% revenue share in 2024 thanks to affordable acquisition costs and nimble job changes traits favored by private-label food and indie cosmetics. Central-impression presses, though capital-heavy, are gaining fastest at 5.45% CAGR, propelled by brand demands for tight color-to-color register on shrink sleeves and wide web snacks.

Hybrid designs blur former lines: Uteco's OnyxOMNIA stitches inkjet heads onto an eight-color flexo deck, delivering 400 m/min while enabling variable data . As CI OEMs roll out automatic plate cylinders and digital-twin diagnostics, converters with 24/6 shifts migrate upscale, driving the flexographic printing machine market toward higher-spec platforms.

Flexographic Printing Machine Market is Segmented by Material (Paper and Paperboard, Plastic Films, Corrugated Board, and More), Press Type (Central-Impression (CI), Stack, and In-Line / Modular), End-User Industry (Food and Beverage, Pharmaceutical and Healthcare, and More), Automation Level (Conventional, and Smart / IoT-Enabled), and Geography. The Market Sizes and Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 40.56% of global revenues in 2024, aided by China's capacity expansions and subsidy-driven equipment renewals that favor CI presses meeting "green, intelligent" criteria. Japan's high labor costs accelerate adoption of robotic material handling, while South Korean and ASEAN converters invest in flexible packaging lines to serve regional snack and personal-care brands.

Middle East & Africa is the fastest-growing territory at 6.14% CAGR. Population growth, cold-chain improvements, and rising FMCG penetration spur new flexible packaging plants, drawing investments like UFlex's PET chip facility in Egypt which anchors local resin supply. Gulf States are also piloting water-based ink retrofits to meet circular-economy targets.

North America and Europe, though mature, remain technology pacesetters as PFAS and VOC regulations tighten. The EU's 25 ppb PFAS ceiling effective August 2026 forces converters to overhaul barrier coatings. North American printers face similar pressure from state-level solvent rules, driving upgrades to enclosed-chamber doctor-blade systems and heat-set air management. Consequently, replacement demand keeps the flexographic printing machine market dynamic despite slower macro-volume growth in these regions.

- Bobst Group SA

- Windmoller and Holscher KG

- Koenig and Bauer AG

- Mark Andy Inc.

- Uteco Group

- Heidelberger Druckmaschinen AG

- OMET Srl

- MPS Systems BV

- Nilpeter A/S

- Gallus Ferd. Ruesch AG

- Soma Engineering

- PCMC (Barry-Wehmiller)

- Star Flex International

- Orient Sogyo Co. Ltd.

- Taiyo Kikai Ltd.

- Comexi Group

- Rotatek SA

- Wolverine Flexographic LLC

- Zhejiang Weigang Machinery

- Edale Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cost-effective short-run packaging capability

- 4.2.2 Surge in food-grade sustainable flexible packaging

- 4.2.3 Rapid corrugated capacity additions in e-commerce fulfilment

- 4.2.4 Mandates on water-based low-VOC inks in North America and EU

- 4.2.5 Converting-line digital twin and AI predictive-maintenance adoption

- 4.2.6 China 2026 Green Press subsidy for CI-flexo equipment

- 4.3 Market Restraints

- 4.3.1 Cap-ex intensive multi-colour CI presses

- 4.3.2 Skilled press-operator shortage in Europe and Japan

- 4.3.3 Plate-making lead-time bottlenecks for ultra-short runs

- 4.3.4 Tightening PFAS restrictions on barrier coating compatibility

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Paper and Paperboard

- 5.1.2 Plastic Films

- 5.1.3 Metallic Films and Foils

- 5.1.4 Corrugated Board

- 5.1.5 Others Material (Bioplastics, Laminates)

- 5.2 By Press Type

- 5.2.1 Central-Impression (CI)

- 5.2.2 Stack

- 5.2.3 In-Line / Modular

- 5.3 By End-User Industry

- 5.3.1 Food and Beverage

- 5.3.2 Pharmaceutical and Healthcare

- 5.3.3 Personal-Care and Cosmetics

- 5.3.4 Consumer Electronics

- 5.3.5 Logistics and E-commerce

- 5.3.6 Other End-user Industry

- 5.4 By Automation Level

- 5.4.1 Conventional

- 5.4.2 Smart / IoT-Enabled

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 Italy

- 5.5.2.4 United Kingdom

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 ASEAN

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Kenya

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Bobst Group SA

- 6.4.2 Windmoller and Holscher KG

- 6.4.3 Koenig and Bauer AG

- 6.4.4 Mark Andy Inc.

- 6.4.5 Uteco Group

- 6.4.6 Heidelberger Druckmaschinen AG

- 6.4.7 OMET Srl

- 6.4.8 MPS Systems BV

- 6.4.9 Nilpeter A/S

- 6.4.10 Gallus Ferd. Ruesch AG

- 6.4.11 Soma Engineering

- 6.4.12 PCMC (Barry-Wehmiller)

- 6.4.13 Star Flex International

- 6.4.14 Orient Sogyo Co. Ltd.

- 6.4.15 Taiyo Kikai Ltd.

- 6.4.16 Comexi Group

- 6.4.17 Rotatek SA

- 6.4.18 Wolverine Flexographic LLC

- 6.4.19 Zhejiang Weigang Machinery

- 6.4.20 Edale Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment