|

市场调查报告书

商品编码

1851904

门窗:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Windows And Doors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

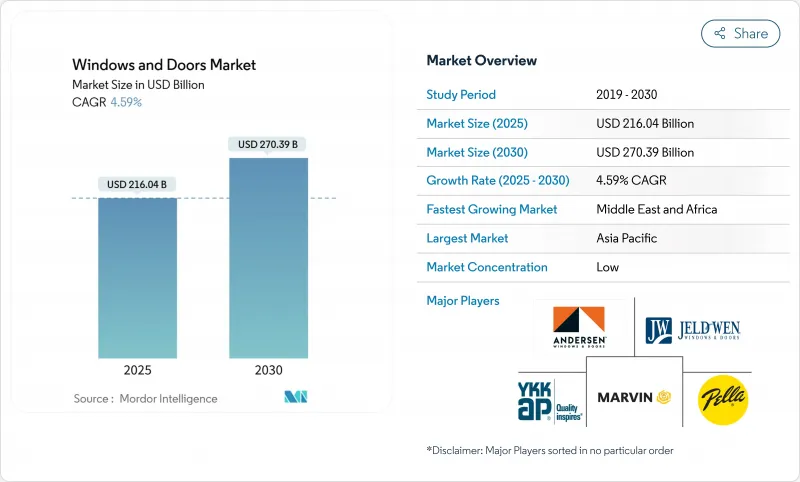

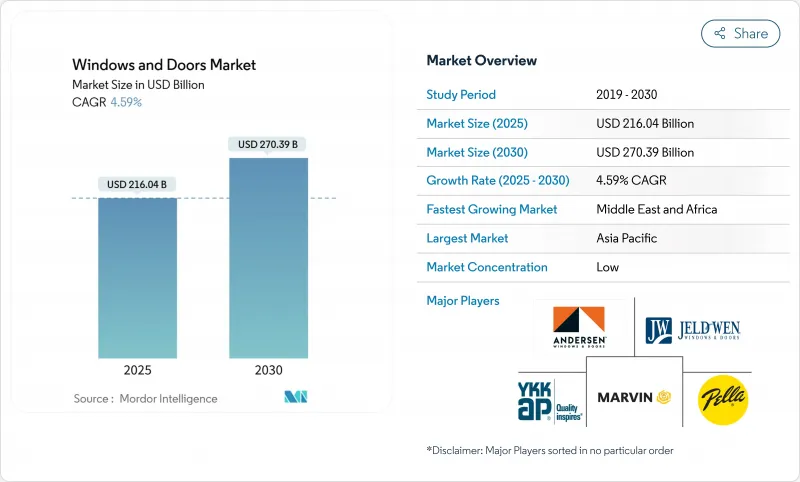

预计到 2025 年,门窗市场价值将达到 2,160.4 亿美元,到 2030 年将达到 2,703.9 亿美元,复合年增长率为 4.59%。

对节能建筑围护结构的强劲需求、日益严格的性能法规以及稳定的维修支出,共同支撑着这一成长。美国能源之星7.0版更新已将寒冷地区的U值上限提高至0.22,从而促进了三层玻璃和先进框架技术的应用。同时,欧盟《建筑能源性能指令》(EPBD)也在推动建筑规范朝着2030年实现零排放建筑的目标迈进,加速了高性能玻璃在住宅和商业计划的应用。儘管面临铝材和劳动力短缺的持续挑战,供应侧的转变,特别是轻质框架、模组化结构和智慧玻璃的升级,仍在不断拓展设计选择并缩短前置作业时间。能够将材料创新、自动化製造和在地化履约相结合的製造商,将更有利于掌握下一波规范主导的门窗市场需求浪潮。

全球门窗市场趋势与洞察

房屋翻新热潮及老旧住宅存量。

不断上涨的借贷成本锁定了有利的利率,促使大多数房主将可支配资金用于房屋升级而非搬迁。 2024年房屋翻新支出激增,预计2025年将维持5%的成长。这主要是由于北美和欧洲的住房基础设施老化,许多房屋的窗框使用年限在20至39年之间。美国沿海县近一半的飓风灾后重建计划都包括门窗维修,凸显了门窗兼具防护和节能功能的双重价值。翻新专家也注意到,「居家养老」的需求激增,人们倾向于选择更宽的开口、更低的门槛高度和符合人体工学的金属製品。这些使用模式使门窗市场与消费者对健康和适应性的重视紧密契合。

能源效率法规(能源之星 V7.0、欧盟 EPBD)

主要经济体正以协调一致的方式加强性能标准。在美国,能源之星V7.0将U值较上一版本降低了15%,有效实现了寒冷气候下三层玻璃结构的标准化。 2024年国际能源效率标准将空气洩漏上限设定为0.35立方英尺/分钟/平方英尺,并强制要求改善密封条和框架设计。在欧洲,建筑能源性能指令(EPBD)已修订,纳入了2030年起新建建筑的零排放要求,以及现有建筑的分阶段维修目标。税额扣抵和公用事业折扣等市场优惠政策可以抵消部分初始成本,加快投资回收期,并促进门窗市场的产品差异化。

原物料价格波动(铝、PVC)

能源成本上涨和冶炼厂停产导致铝供应减少,推高了平均溢价,延长了前置作业时间,而此时疫情后的需求刚开始復苏。聚氯乙烯(PVC)生产商也面临原材料成本上涨和更严格的氯气生产法规的双重压力,尤其是在环境监管严格的欧洲。为了避免价格波动,生产商开始转向使用回收铝坯、热塑性增强型材以及区域采购协议。轻质复合材料框架在不牺牲强度的前提下减少了金属用量,市占率持续成长。然而,价格波动正在挤压小型加工商的净利率,减缓计划订单,并限制门窗市场部分领域的成长。

细分市场分析

2024年,门将占据门窗销售额的58.56%,进一步巩固了其在各类建筑物中的基础性地位。安全门、防火组件和智慧锁具的持续高更换频率,即使在经济週期放缓期间也能保持相对稳定的需求。相较之下,窗户的年复合成长率将达到7.49%,这主要得益于严格的热增益限制以及建筑整合光伏技术的兴起——该技术可直接透过玻璃吸收太阳能。这种拉动效应使窗户在门窗市场中处于技术前沿。

儘管门窗製造商正大力投资多点锁、抗衝击面板和智慧家居无缝集成,但利润最高的净利率正转向结合电致变色涂层和太阳能收集夹层的先进窗户解决方案。劳伦斯柏克莱国家实验室表明,此类窗户安装可使整栋建筑的能源消耗降低高达15.9%,这项指标足以支撑其高价和较短的投资回收期。因此,预计窗户市场的细分规模将从2025年的890亿美元扩大到2030年的1,230亿美元。

金属框架,尤其是铝材,由于其优异的强度重量比、纤细的视觉效果和可回收性,预计到2024年将占销售额的46.62%。铝框架最常用于高层建筑、医院和交通枢纽的门窗和玻璃建筑幕墙。然而,在快速发展的郊区和近郊住宅区,塑胶/uPVC型材的成长速度最快,达到8.73%,这些地区的预算意识和快速施工至关重要。现代配方中嵌入了玻璃纤维或钢微增强材料,在不牺牲刚度的前提下实现了良好的隔热性能,解决了先前人们对PVC结构局限性的批评。

对产品生命週期的严格审查正促使生产商转向不含邻苯二甲酸酯和铅的稳定剂,并采用闭环回收方式,将型材边角料转化为新的挤出产品。同时,新兴的木塑复合材料和玻璃纤维框架兼具铝材的刚性和乙烯基的隔热性能。在此背景下,预计2025年至2030年间, 封闭式门窗市场规模将成长140亿美元,而由于原铝产能受限,金属市场的成长预计将会放缓。欧盟关于2030年后可能逐步淘汰PVC的监管讨论,既带来了战略风险,也推动了可回收和生物基聚合物混合物的创新。

门窗市场按产品类型(门、窗)、材料类型(木材、金属、塑胶/UPVC/复合材料)、应用方式(平开、推拉、其他)、最终用户(住宅和非住宅(商业、工业、机构))、安装类型(新建、更换/维修)以及地区进行细分。市场预测以价值(美元)和数量(台)为单位。

区域分析

亚太地区预计到2024年将占全球销售额的42.13%,这主要得益于快速的城市建设以及政府对节能环保建筑的政策奖励。中国、印度和印尼等国的国家建筑规范正逐步降低U值(传热係数),为抗热裂纹框架和低辐射隔热玻璃设定了有利的基准。当地製造商正越来越多地向周边市场出口单元式建筑幕墙,不仅加强了区域供应链,也降低了门窗市场的物流成本。

北美市场规模位居第二,这主要得益于强劲的房屋维修支出和日益成熟的异地住宅市场。儘管房屋开工量有所波动,但能源之星税额扣抵和州级雨水补贴政策仍支撑着强劲的需求。技术纯熟劳工短缺仍然是限製成长的主要瓶颈,但大型工厂自动化程度的提高和一体化安装专案的实施正在缓解週期放缓的问题。在加拿大和美国北部,三层玻璃窗正迅速成为多用户住宅计划的主流选择,以降低暖气负荷。

在欧洲,虽然绝对份额较小,但利润空间却很大,因为欧盟的《能源性能指令》(EPBD)规定,从2030年起,新建建筑必须达到零排放目标。最低能源效率标准也确保了维修工程的持续进行,届时,能源效率最差的16%的非住宅存量将完成升级改造。拥有检验的环境产品声明和循环经济框架的製造商可以获得优先采购评分。在巴黎和柏林等人口稠密的城市,门窗市场对隔音产品的需求旺盛,而自适应遮光系统在地中海度假胜地也逐渐成为标配。

到2030年,中东和非洲将以7.10%的复合年增长率实现最快增长,这主要得益于大规模的酒店、医疗保健和教育计划。炎热的气候需要采用太阳能控制嵌装玻璃,并配合可适应室内外混合居住模式的宽摇摆门系统。政府对绿建筑认证的强制性要求以及不断上涨的能源费用正在加速向低辐射涂层的转变。海湾国家的本地组装基地已开始为东非走廊提供服务,缩短了前置作业时间,并增强了门窗市场的区域韧性。

南美洲经济成长强劲,巴西、哥伦比亚和智利的都市化进程为其提供了有力支撑。高通膨限制了短期可自由支配支出,但长期基础建设的权益正在推动各项基础设施计划向前发展。智利和秘鲁已修订建筑性能规范,要求高海拔地区的新建筑必须使用双层玻璃,这进一步扩大了节能窗户的潜在市场。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 房屋翻新热潮及老旧住宅存量。

- 能源效率法规(能源之星 V7.0、欧盟 EPBD)

- 亚太地区的快速都市化和基础设施投资

- 模组化建筑促进了单元式建筑幕墙的采用

- 抗衝击玻璃窗的保险福利

- 建筑一体成型光伏(BIPV)窗的渗透率

- 市场限制

- 原物料价格波动(铝、PVC)

- 安装工人短缺,缺乏熟练劳动力

- 对黑胶唱片生命週期排放的ESG(环境、社会和治理)审查

- 高端商业建筑的智慧玻璃化

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 产业间竞争

第五章 市场规模与成长预测

- 依产品类型

- 门

- 视窗

- 材料

- 木头

- 金属

- 塑胶/PVC/复合材料

- 透过使用

- 摇摆

- 滑动

- 折迭式的

- 旋转和其他

- 最终用户

- 住宅

- 非住宅(商业、工业、机构)

- 按安装类型

- 新建工程

- 更换/改装

- 按地区

- 北美洲

- 加拿大

- 美国

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- Nordix(丹麦、芬兰、冰岛、挪威、瑞典)

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚(新加坡、马来西亚、泰国、印尼、越南、菲律宾)

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Andersen Corporation

- JELD-WEN Holding Inc.

- Pella Corporation

- YKK AP Inc.

- Marvin Windows & Doors

- Masonite International

- Cornerstone Building Brands/Ply Gem

- MI Windows and Doors

- LIXIL Corporation

- ASSA ABLOY Group

- Rehau Group

- VEKA AG

- Deceuninck NV

- Profine GmbH(Kommerling)

- Saint-Gobain Building Glass & Solutions

- Schuco International

- Aluplast GmbH

- Fenesta Building Systems(DCM Shriram)

- PGT Innovations

- Atrium Corporation

第七章 市场机会与未来展望

The windows and doors market was valued at USD 216.04 billion in 2025 and is forecast to reach USD 270.39 billion by 2030, posting a 4.59% CAGR.

Strong demand for energy-efficient building envelopes, tighter performance codes, and steady renovation spend underpin this growth. The ENERGY STAR Version 7.0 update is already pushing U-factor limits toward 0.22 in colder U.S. zones, motivating triple-pane glazing and advanced framing. Parallel momentum in the EU's Energy Performance of Buildings Directive (EPBD) is steering specifications toward zero-emission buildings by 2030, accelerating adoption of high-performance fenestration across both residential and commercial projects. Supply-side shifts-especially light-weight framing options, modular construction, and smart-glass upgrades-continue to widen design choices and shorten lead times, even as aluminum and labor shortages remain persistent headwinds. Manufacturers able to combine material innovation, automated fabrication, and regional fulfillment are positioned to capture the next wave of specification-driven demand in the windows and doors market.

Global Windows And Doors Market Trends and Insights

Residential renovation boom and aging housing stock

Elevated borrowing costs have locked most homeowners into favorable rates, channeling discretionary capital toward upgrades rather than relocation. Remodel spending grew sharply in 2024 and is projected to maintain 5% growth in 2025, supported by an aging North American and European housing base, much of which crosses the 20- to 39-year prime replacement window for fenestration. Nearly half of hurricane recovery projects in coastal U.S. counties now include window or door upgrades, highlighting the dual value of protective and energy-saving features. Remodeling professionals also note a surge in "aging-in-place" requests that favor wider clear openings, lower sill heights, and ergonomic hardware. These usage patterns keep the windows and doors market firmly aligned with consumer wellness and resilience priorities.

Energy-efficiency regulations (ENERGY STAR V7.0, EU EPBD)

Performance codes are tightening in a coordinated fashion across major economies. In the United States, ENERGY STAR V7.0 pushes U-factors down 15% from the previous cycle, practically standardizing triple-pane construction in cold climates. The 2024 International Energy Conservation Code now caps air leakage at 0.35 cfm/ft2, demanding improved weather-stripping and frame design. Europe's revised EPBD locks in zero-emission requirements for new buildings starting 2030, along with staged renovation targets for the existing stock. Attractive tax credits and utility rebates offset part of the upfront cost, fostering faster payback and heightening product differentiation within the windows and doors market.

Raw-material price volatility (aluminum, PVC)

Energy cost spikes and smelter curtailments have trimmed aluminum supply just as post-pandemic demand recovered, lifting average premiums and lengthening lead times. PVC producers also struggle with higher input costs and stricter chlorine-production rules, especially in Europe, where environmental scrutiny is intense. To hedge volatility, manufacturers are pivoting toward recycled billet, thermoplastic-reinforced profiles, and regional sourcing agreements. Lightweight composite frames, which reduce metal use without sacrificing strength, continue to gain share. Nonetheless, price swings squeeze smaller fabricators' margins, slowing project awards and tempering growth in parts of the windows and doors market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid urbanization and infrastructure spend in Asia-Pacific

- Modular construction driving unitized facades

- Skilled-labor shortage for installation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Doors generated the majority of 2024 revenue at 58.56%, confirming their foundational role in every building type. Security doors, fire-rated assemblies, and smart locks sustain a replacement cadence that keeps demand relatively stable even during cyclical slowdowns. Conversely, windows outpace in growth at a 7.49% CAGR thanks to stringent heat-gain limits and the rise of building-integrated photovoltaics, which capture solar energy directly through glass. This pull-through effect positions windows as the technological spearhead of the windows and doors market.

Door makers invest in multi-point locking, impact-rated panels, and seamless smart-home integration; however, the highest margins are migrating to advanced window solutions that fuse electro-chromic coatings with solar-harvesting interlayers. Lawrence Berkeley National Laboratory recorded up to 15.9% whole-building energy savings from such installations, a metric that drives premium pricing and short paybacks. As a result, the windows and doors market size for the window segment is projected to rise from USD 89 billion in 2025 to USD 123 billion by 2030, even though the door segment will still dominate on volume.

Metal frames, particularly aluminum, held 46.62% revenue in 2024 because of their favorable strength-to-weight ratio, slim sightlines, and recyclability. Curtain-wall high-rises, hospitals, and transport hubs nearly always specify aluminum frames for both doors and glazed facades. Yet plastic/uPVC profiles are capturing the fastest gains-8.73% CAGR-inside fast-growing suburban and peri-urban housing corridors where budget sensitivity and quick installation matter most. Updated formulations featuring embedded fiberglass or steel micro-reinforcements deliver thermal performance without compromising rigidity, answering earlier criticisms of PVC's structural limits.

Lifecycle scrutiny is pushing producers toward phthalate-free, lead-free stabilizers and closed-loop recycling commitments that turn profile off-cuts into new extrusions. Meanwhile, emerging wood-plastic composites and fiberglass frames offer a middle ground between aluminum's stiffness and vinyl's insulative edge. Against this backdrop, the windows and doors market size for PVC systems is projected to add USD 14 billion between 2025 and 2030, while metal growth moderates in line with primary-aluminum capacity constraints. Regulatory debates in the EU about potential PVC phase-downs beyond 2030 create strategic risk but also encourage innovation in recyclable and bio-based polymer blends.

The Windows and Doors Market is Segmented by Product Type (Doors, Windows), Material Type (Wood, Metal, Plastic / UPVC / Composite), Application (Swinging, Sliding, and More), End User (Residential and Non-Residential (Commercial, Industrial, Institutional)), Installation Type (New Construction, Replacement / Retrofit), Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 42.13% of 2024 revenue, anchored by rapid urban build-outs and policy incentives for energy-conserving, climate-resilient construction. National building codes in China, India, and Indonesia have progressively lowered allowable U-values, setting a lucrative baseline for thermally broken frames and low-e insulated glass. Indigenous fabricators increasingly export unitised facades to neighboring markets, strengthening intra-regional supply chains and shaving logistics costs for the windows and doors market.

North America ranks second in size, propelled by strong renovation expenditure and a maturing off-site housing segment. ENERGY STAR tax credits and state-level storm hardening grants keep demand solid despite fluctuating housing starts. Skilled-labor scarcity remains the main growth bottleneck; however, rising automation rates at major plants, plus integrated installation programs, are mitigating cycle delays. Across Canada and the northern United States, triple glazing is fast becoming the baseline for multi-family projects seeking lower heating loads.

Europe commands a smaller absolute slice but offers high margin potential because the EPBD mandates zero-emission targets for new builds from 2030. Minimum energy performance standards also force upgrades of the worst 16% of non-residential stock by that same year, ensuring a steady retrofit pipeline. Manufacturers with verifiable environmental product declarations and circular-economy frameworks stand to gain preferential procurement scores. The windows and doors market sees premium demand for noise-attenuating units in dense cities such as Paris and Berlin, while adaptive shading packages become standard in Mediterranean resorts.

Middle East & Africa records the fastest CAGR at 7.10% through 2030, underpinned by large-scale hospitality, healthcare, and education projects. Extreme heat zones require solar-control glazing paired with wide-swing door systems that accommodate mixed indoor-outdoor occupancy patterns. Government mandates for green-building certifications, plus rising energy tariffs, hasten the shift to low-emissivity coatings. Local assembly hubs in the Gulf are beginning to serve East African corridors, reducing lead times and bolstering regional resilience within the windows and doors market.

South America shows a steadier climb, supported by urban densification in Brazil, Colombia, and Chile. High inflation limits short-term discretionary spend, yet long-term infrastructure concessions keep institutional projects moving forward. Revised performance codes in Chile and Peru now prescribe double-glazing for new high-altitude construction, further enlarging the addressable market for energy-conscious fenestration.

- Andersen Corporation

- JELD-WEN Holding Inc.

- Pella Corporation

- YKK AP Inc.

- Marvin Windows & Doors

- Masonite International

- Cornerstone Building Brands / Ply Gem

- MI Windows and Doors

- LIXIL Corporation

- ASSA ABLOY Group

- Rehau Group

- VEKA AG

- Deceuninck NV

- Profine GmbH (Kommerling)

- Saint-Gobain Building Glass & Solutions

- Schuco International

- Aluplast GmbH

- Fenesta Building Systems (DCM Shriram)

- PGT Innovations

- Atrium Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Residential renovation boom and aging housing stock

- 4.2.2 Energy-efficiency regulations (ENERGY STAR V7.0, EU EPBD)

- 4.2.3 Rapid urbanisation and infra spend in APAC

- 4.2.4 Modular construction driving unitised facades

- 4.2.5 Insurance incentives for impact-rated fenestration

- 4.2.6 Building-integrated PV (BIPV) window uptake

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (aluminium, PVC)

- 4.3.2 Skilled-labour shortage for installation

- 4.3.3 ESG scrutiny on vinyl lifecycle emissions

- 4.3.4 Smart-glass shift in high-end commercial builds

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 Market Size and Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Doors

- 5.1.2 Windows

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic / uPVC / Composite

- 5.3 By Application

- 5.3.1 Swinging

- 5.3.2 Sliding

- 5.3.3 Folding

- 5.3.4 Revolving and Others

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.2 Non-Residential (Commercial, Industrial, Institutional)

- 5.5 By Installation Type

- 5.5.1 New Construction

- 5.5.2 Replacement / Retrofit

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 Canada

- 5.6.1.2 United States

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Peru

- 5.6.2.3 Chile

- 5.6.2.4 Argentina

- 5.6.2.5 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 BENELUX (Belgium, Netherlands, Luxembourg)

- 5.6.3.7 NORDICS (Denmark, Finland, Iceland, Norway, Sweden)

- 5.6.3.8 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 India

- 5.6.4.2 China

- 5.6.4.3 Japan

- 5.6.4.4 Australia

- 5.6.4.5 South Korea

- 5.6.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, Philippines)

- 5.6.4.7 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 United Arab Emirates

- 5.6.5.2 Saudi Arabia

- 5.6.5.3 South Africa

- 5.6.5.4 Nigeria

- 5.6.5.5 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Andersen Corporation

- 6.4.2 JELD-WEN Holding Inc.

- 6.4.3 Pella Corporation

- 6.4.4 YKK AP Inc.

- 6.4.5 Marvin Windows & Doors

- 6.4.6 Masonite International

- 6.4.7 Cornerstone Building Brands / Ply Gem

- 6.4.8 MI Windows and Doors

- 6.4.9 LIXIL Corporation

- 6.4.10 ASSA ABLOY Group

- 6.4.11 Rehau Group

- 6.4.12 VEKA AG

- 6.4.13 Deceuninck NV

- 6.4.14 Profine GmbH (Kommerling)

- 6.4.15 Saint-Gobain Building Glass & Solutions

- 6.4.16 Schuco International

- 6.4.17 Aluplast GmbH

- 6.4.18 Fenesta Building Systems (DCM Shriram)

- 6.4.19 PGT Innovations

- 6.4.20 Atrium Corporation

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment