|

市场调查报告书

商品编码

1851909

醇醚:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Alcohol Ethoxylates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

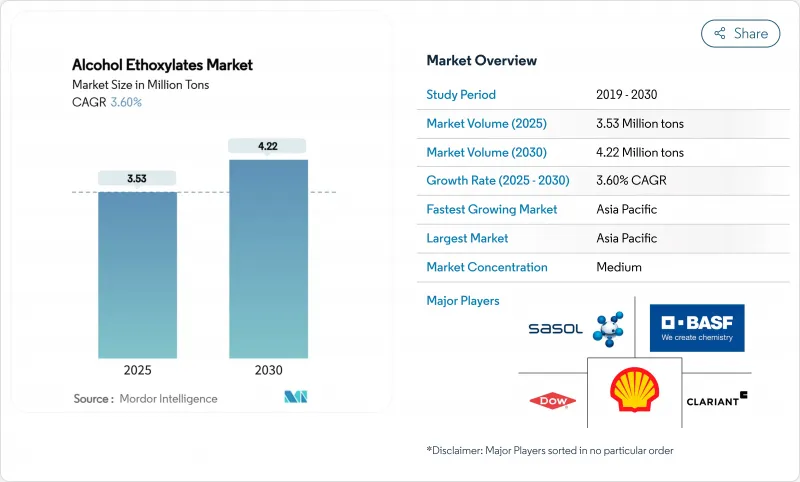

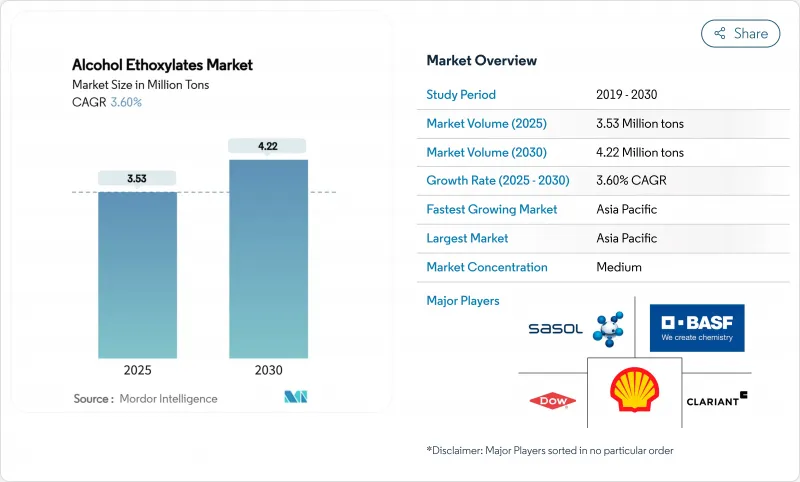

预计到 2025 年,醇醚市场规模将达到 353 万吨,到 2030 年将达到 422 万吨,预测期(2025-2030 年)复合年增长率为 3.60%。

这种温和的成长反映了在新的、日益严格的环氧乙烷排放永续性法规的背景下,市场需求曲线日益成熟。生产商正透过生物基原料专案和更窄范围的乙氧基化技术来应对,这些技术可以降低能源强度并提高生物降解性。高成长的亚洲经济体对个人护理和商用清洁应用的强劲需求,正在推动印尼和巴西下游油脂化学品产能的扩张。同时,北美和欧洲的监管压力迫使製造商提高排放标准,这推高了成本,并加速了向低碳界面活性剂等级的创新。这些趋势表明,技术差异化和检验的永续性比单纯的规模经济更为重要。

全球醇醚市场趋势与洞察

亚太地区对个人和家庭护理的需求不断增长

中国、印度和东南亚地区持续的都市化和收入成长继续推动高端个人护理产品的消费。负责人青睐醇醚类化合物,其温和的特性和冷水清洁能力与这些市场流行的浓缩型液体清洁剂相得益彰。跨国公司正在扩大其通过生物质平衡认证的永续产品组合,这标誌着其正向低碳界面活性剂供应链转型。零售商向电商平台的转型进一步推动了产品差异化,供应商也面临着在提供感官性能声明的同时,提供透明的永续性数据的压力。

在工业和机构清洁产品中的使用日益增多

即使在疫情高峰过后,医疗保健、食品服务和交通枢纽的强化卫生通讯协定仍将持续实施。醇醚类界面活性剂可在各种 pH 值和温度范围内有效去除污渍,即使在硬水条件下也能保持稳定的性能,使配方师无需使用磷酸盐或溶剂即可满足严格的消毒标准。北美和西欧市场成长最为强劲,这些地区的工业卫生法规正在推动对温和、易生物降解界面活性剂的需求。

原物料价格波动

环氧乙烷和脂醇类价格的波动正在挤压没有避险或垂直整合的小型生产商的利润空间。一家北美主要供应商近期宣布的乙二醇醚价格上涨,进一步证实了乙氧基化成本的上涨压力。依赖南亚进口的製剂生产商由于外汇风险和运费额外费用,面临最大的风险。

细分市场分析

至2024年,油脂化学品级产品将占醇醚市场份额的58.19%,其复合年增长率(CAGR)为3.91%,增速将超过石化产品。东南亚的垂直整合确保了原料供应的稳定性,并减少了物流排放。企业采购政策强制要求可再生碳含量,这进一步推动了向生物基供应的转型。欧洲和北美生产商已通过ISCC PLUS认证工厂并增加绿色环氧乙烷产量来应对这一挑战,缓解了石化产品的不利影响,但这一趋势并未逆转。

油脂化学产业受益于雅加达和吉隆坡附近棕榈油和椰子油蒸馏丛集,这些集群以低成本向当地的乙氧基化装置供应原料。采用窄范围技术的製造商能够提供个人护理乳化所需的等级一致性,从而获得溢价。儘管如此,石化产品正在对成本敏感的通用清洁剂市场站稳脚跟,而碳排放资讯揭露在这些市场仍然是可选的。

到2024年,C12-C14馏分将占醇醚市场规模的41.55%,年增率达4.08%。其兼具清洁力和生物降解性,符合不断变化的区域法规。较短的C9-C11同系物在对快速润湿性要求较高的工业清洁剂中越来越受欢迎,而较长的C15-C18链则用于高端个人保健产品和油田化学品。

配方师们正越来越多地采用窄范围的C12-C14乙氧基化物,以最大限度地减少游离醇含量,并改善气味和产品稳定性。他们也正在研究在低温下不易结晶的支链类似物,以扩大其在冬季洗车液的应用。

区域分析

到2024年,亚太地区将占据全球醇醚市场52.18%的份额,并在2030年之前以4.76%的复合年增长率引领成长。可支配收入的成长、零售清洁剂渗透率的提高以及充足的油脂化学品原料供应,正吸引着本土独立企业和跨国巨头的目光。印尼新建的脂醇类联合装置将为新加坡和泰国的区域个人护理中心提供醇醚化产品,从而加强亚洲内部贸易循环,并降低对欧洲的进口依赖。

北美是一个成熟且创新主导的市场环境,环境、健康和安全法规在采购决策中占据主导地位。美国环保署对乙氧基化丙氧基化C12-C15醇类化合物用于农药的耐受性豁免,凸显了此技术在作物保护领域公认的安全性。种植者正优先考虑绿色化学升级数位化供应链追踪,以符合品牌所有者的透明度计划。

在欧洲,相关法规和政策正在修订,推出了更严格的政策,例如数位产品护照和更高的生物降解性阈值。儘管需求成长缓慢,但供应商仍能从获得永续性认证的产品中获得溢价。在拉丁美洲,一家大型石化集团收购了巴西最大的乙氧基化物生产商,从而增强了供应,并使区域客户能够获得价格更低的产品。在中东和非洲,儘管销售量较低,但市场对高效能液体清洁剂的需求仍然强劲。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区对个人和家庭护理的需求不断增长

- 在工业和机构清洁产品中的使用日益增多

- 扩大下游油脂化学品生产能力

- 人们卫生和清洁意识的提高

- 增加农药使用以保护农作物

- 市场限制

- 原物料价格波动

- 日益增长的环境问题

- 是否有合适的替代方案

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按原产地

- 油脂化学品

- 石油化工衍生性商品

- 按碳炼长度

- C9-C11

- C12-C14

- C15-C18 和支链

- 按形式

- 液体

- 糊状/固态

- 透过使用

- 个人护理

- 肥皂和清洁剂

- 工业和设施清洁

- 农业化学品

- 油漆和涂料

- 纺织加工

- 其他应用(石油和天然气(提高采收率、钻井液))

- 地理

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- BASF

- Clariant

- Croda International plc

- Dow

- Evonik Industries AG

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Kao Chemicals Europe, SLU

- Kemipex

- Mitsui Chemicals Inc.

- Nouryon

- Procter & Gamble

- SABIC

- Sasol Ltd

- Shell plc

- Stepan Company

- Syensqo

- Thai Ethoxylate Co., Ltd.(TEX)

第七章 市场机会与未来展望

The Alcohol Ethoxylates Market size is estimated at 3.53 Million tons in 2025, and is expected to reach 4.22 Million tons by 2030, at a CAGR of 3.60% during the forecast period (2025-2030).

The moderate expansion reflects a maturing demand curve even as new sustainability rules tighten around ethylene oxide emissions. Producers are responding with bio-based feedstock programs and narrower-range ethoxylation technologies that cut energy intensity and improve biodegradability. Strong personal-care and institutional cleaning demand in high-growth Asian economies, plus the build-out of downstream oleochemical capacity in Indonesia and Brazil, underpin steady volume gains. At the same time, regulatory pressure in North America and Europe forces manufacturers to upgrade emission controls, adding cost yet accelerating innovation toward low-carbon surfactant grades. These cross-currents define a competitive arena where technical differentiation and verified sustainability credentials outweigh pure scale economies.

Global Alcohol Ethoxylates Market Trends and Insights

Growing Personal-Care & Home-Care Demand in Asia-Pacific

Sustained urbanization and income growth in China, India, and Southeast Asia continue to lift premium personal-care consumption. Formulators favor alcohol ethoxylates for their mildness and cold-water detergency, traits well matched to concentrated liquid detergents popular in these markets. Multinationals expand sustainable portfolios certified under biomass balance schemes, signaling a pivot toward lower-carbon surfactant supply chains. Retail migration to e-commerce platforms further amplifies product differentiation, pushing suppliers to deliver transparent sustainability data alongside sensory performance claims.

Rising Use in Industrial & Institutional Cleaning Formulations

Elevated hygiene protocols across healthcare, food service, and transport hubs remain in force even after the pandemic peak. Alcohol ethoxylates provide effective soil removal over broad pH and temperature bands and deliver stable performance in hard-water conditions, enabling formulators to meet tightened disinfection standards without phosphates or solvents. Growth is strongest in North America and Western Europe, where regulatory mandates for occupational health drive demand for low-irritancy, readily biodegradable surfactants.

Feedstock Price Volatility

Swing pricing for ethylene oxide and fatty alcohols compresses margins for smaller producers lacking hedging programs or vertical integration. Recent glycol ether increases announced by a major North American supplier underscore the upward pressure on ethoxylation costs. Import-reliant formulators in South Asia face the greatest exposure due to currency risk and freight surcharges.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Downstream Oleochemical Capacity

- Rising Awareness Regarding Hygiene and Cleanliness

- Growing Environmental Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Oleochemical grades captured 58.19% of alcohol ethoxylates market share in 2024 and will grow faster than petrochemical peers at a 3.91% CAGR. Vertical integration in Southeast Asia assures feedstock certainty and lowers logistics emissions. Corporate procurement policies that mandate renewable carbon content continue to migrate volumes toward bio-based supply. Producers in Europe and North America respond by certifying plants under ISCC PLUS and ramping green ethylene oxide output, which moderates the petrochemical retreat but does not reverse the trend.

The oleochemical segment benefits from palm and coconut oil distillation clusters near Jakarta and Kuala Lumpur that feed local ethoxylation units at lower cost. Producers marketing narrow-range technology achieve premium pricing by offering grade consistency required in personal-care emulsions. Nevertheless, petrochemical variants retain a foothold in cost-sensitive commodity detergents where carbon disclosure remains voluntary.

The C12-C14 cut constituted 41.55% of the alcohol ethoxylates market size in 2024, enjoying a 4.08% growth trajectory. Its balance of detergency and ready biodegradation meets evolving regional regulations. Shorter C9-C11 homologues gain traction in industrial cleaning where rapid wetting is prized, while longer C15-C18 chains serve premium personal-care and oilfield chemistries.

Formulators increasingly request narrow-range C12-C14 ethoxylates that minimize free alcohol content, improving odor and product stability. Research has also explored branched analogues that resist crystallization at low temperature, broadening usage in winter-grade vehicle washes.

The Alcohol Ethoxylates Market Report Segments the Industry by Origin Type (Oleochemical and Petrochemical), Carbon Chain Length (C9-C11 (Linear Alcohol Ethoxylates), C12-C14 (Lauryl Alcohol Ethoxylates), and More), Form (Liquid and Paste/Solid), Application (Personal Care, Soap and Detergents, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific anchored 52.18% of alcohol ethoxylates market size in 2024 and leads growth at 4.76% CAGR through 2030. Rising disposable income, expanding retail detergent penetration, and robust oleochemical feedstock supplies attract both local independents and multinational majors. Indonesia's new fatty alcohol complexes supply ethoxylation units that serve regional personal-care hubs in Singapore and Thailand, tightening intra-Asian trade loops and curbing import reliance on Europe.

North America presents a mature, innovation-led environment where environmental health and safety regulations dominate procurement decisions. The US Environmental Protection Agency's tolerance exemption for ethoxylated propoxylated C12-C15 alcohols in agrochemical use underscores the technology's accepted safety profile in crop protection. Producers emphasize green chemistry upgrades and digitalized supply tracking to comply with brand-owner transparency programs.

Europe faces a stricter policy backdrop as the revision of Regulation 648/2004 rolls in digital product passports and enhanced biodegradability thresholds. While demand growth is modest, suppliers enjoy premium pricing for verified sustainable grades. Latin America benefits from an enhanced supply position following a major petrochemical group's acquisition of Brazil's largest ethoxylate producer, ensuring regional customers receive local, lower-freight product. The Middle East and Africa record smaller volumes but exhibit keen interest in concentrated liquid detergents, a format that favors high-actives alcohol ethoxylates.

List of Companies Covered in this Report:

- BASF

- Clariant

- Croda International plc

- Dow

- Evonik Industries AG

- Huntsman International LLC

- India Glycols Limited

- Indorama Ventures Public Company Limited

- Kao Chemicals Europe, S.L.U.

- Kemipex

- Mitsui Chemicals Inc.

- Nouryon

- Procter & Gamble

- SABIC

- Sasol Ltd

- Shell plc

- Stepan Company

- Syensqo

- Thai Ethoxylate Co., Ltd. (TEX)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing personal-care & home-care demand in Asia-Pacific

- 4.2.2 Rising use in industrial & institutional cleaning formulations

- 4.2.3 Expanding downstream oleochemical capacity

- 4.2.4 Rising awareness regarding hygiene and cleanliness

- 4.2.5 Growing usage in agrochemicals for crop protection

- 4.3 Market Restraints

- 4.3.1 Feedstock price volatility

- 4.3.2 Growing environmental concerns

- 4.3.3 Availability of suitable alternatives

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Volume)

- 5.1 By Origin Type

- 5.1.1 Oleochemical-derived

- 5.1.2 Petrochemical-derived

- 5.2 By Carbon Chain Length

- 5.2.1 C9-C11

- 5.2.2 C12-C14

- 5.2.3 C15-C18 & Branched

- 5.3 By Form

- 5.3.1 Liquid

- 5.3.2 Paste / Solid

- 5.4 By Application

- 5.4.1 Personal Care

- 5.4.2 Soaps and Detergents

- 5.4.3 Industrial and Institutional Cleaning

- 5.4.4 Agricultural Chemicals

- 5.4.5 Paints and Coatings

- 5.4.6 Textile Processing

- 5.4.7 Other Applications (Oil & Gas (EOR, drilling fluids))

- 5.5 Geography

- 5.5.1 Asia-Pacifc

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacifc

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)}

- 6.4.1 BASF

- 6.4.2 Clariant

- 6.4.3 Croda International plc

- 6.4.4 Dow

- 6.4.5 Evonik Industries AG

- 6.4.6 Huntsman International LLC

- 6.4.7 India Glycols Limited

- 6.4.8 Indorama Ventures Public Company Limited

- 6.4.9 Kao Chemicals Europe, S.L.U.

- 6.4.10 Kemipex

- 6.4.11 Mitsui Chemicals Inc.

- 6.4.12 Nouryon

- 6.4.13 Procter & Gamble

- 6.4.14 SABIC

- 6.4.15 Sasol Ltd

- 6.4.16 Shell plc

- 6.4.17 Stepan Company

- 6.4.18 Syensqo

- 6.4.19 Thai Ethoxylate Co., Ltd. (TEX)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment