|

市场调查报告书

商品编码

1851912

扭力感测器:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Torque Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

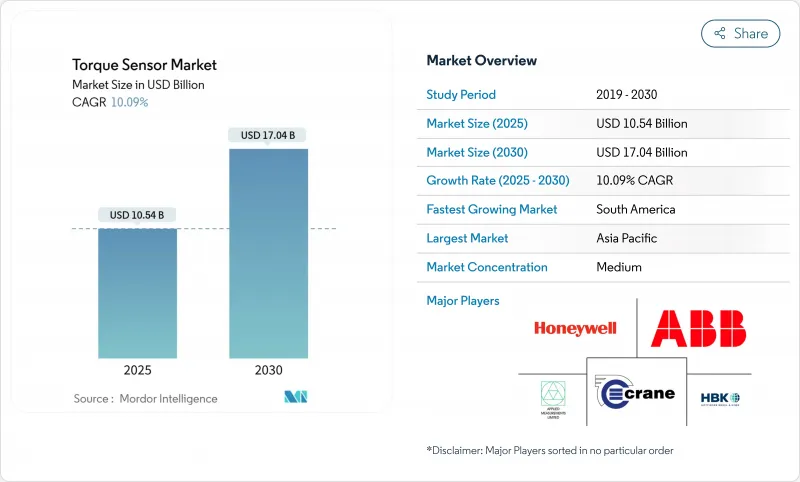

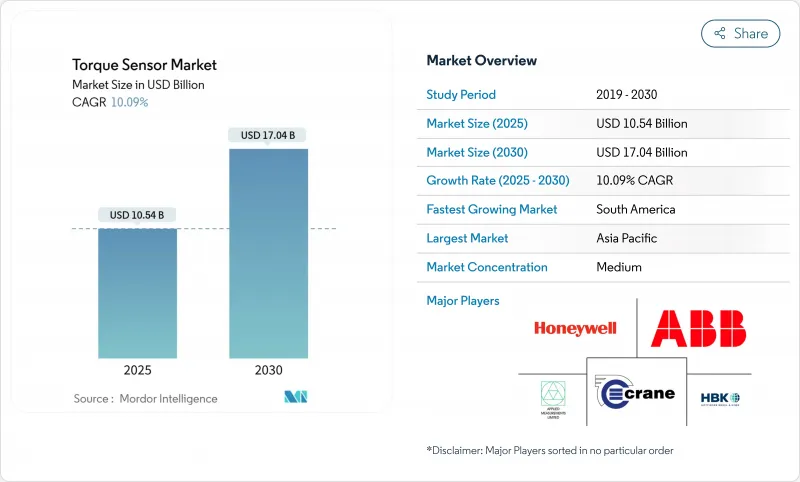

全球扭力感测器市场预计到 2025 年将达到 105.4 亿美元,到 2030 年将达到 170.4 亿美元,年复合成长率为 10.09%。

这一发展势头主要得益于汽车动力传动系统的快速电气化、工业自动化程度的不断提高,以及基础设施、能源和医疗设备领域日益严格的精密测量要求。随着扭力回馈成为电动方向盘、传动系统控制和进阶驾驶辅助功能的关键要素,车辆电气化持续支撑着市场需求。协作机器人的同步发展、单车感测器数量的增加,以及电动自行车和其他微型出行平台的普及,为大规模生产和降低成本创造了更多机会。供应商的差异化策略也从单纯的精度转向了抗电磁干扰能力、无线远端检测以及与预测分析平台的整合。印度和南美洲的区域采购倡议旨在降低对中国稀土的依赖,但供应链对高等级磁弹性合金的依赖仍然是一个限制。

全球扭力感测器市场趋势与洞察

电动动力方向盘转向系统(EPS)

即使在经济放缓时期,电动方向盘的强制性扭矩监测也提振了市场需求。将于2024年发布的欧洲法规强制要求持续提供转向扭矩回馈以支援自动驾驶,并要求所有电动辅助转向系统单元至少整合一个感测器。为了满足功能安全目标,原始设备製造商 (OEM) 采用了双冗余设计,有效地将每辆车的感测器数量增加了一倍。像Vitesco这样的供应商认为,电动辅助转向系统的扭矩感测是实现半自动车道维持和驾驶意图预测的核心技术。相同数据通道还可用于无线分析,从而提高了整合商的终身服务收入。随着传统液压转向平台的衰落,现有车辆的主流已不可逆转地转向电动辅助转向系统架构。

製造业自动化与协作机器人的崛起

协作机器人需要瞬时扭矩感测以符合 ISO 10218 安全限值,这使得协作机器人的出货量与感测器单元之间存在一一对应的关係。到 2024 年,协作机器人的全球销售将超过传统工业机器人,从而推动用于电子、食品和轻型组装的抗电磁干扰多轴扭矩感测器的快速成长。认证指南要求采用冗余感,这实际上提高了每个机器人的组件成本。预计到 2024 年,波兰中小企业的渗透率将仅为 26%,凸显了欧洲製造业的巨大潜力。长期影响不仅限于单一自动化设备,智慧工作单元在纺织和农产品加工厂的普及也将进一步扩大其影响范围。

汽车生产项目中的价格敏感性

原始设备製造商 (OEM) 的成本削减目标已将主要电动车平台上的感测器价格限制在每件近 50 美元,迫使供应商移除辅助功能。为了抵消电池组成本,所有动力传动系统零件都受到更严格的审查,而平台标准化则推动了规格的商品化。 2024 年稀土磁铁供应中断加剧了这一困境,迫使印度和南美的汽车製造商考虑使用替代材料,但代价是精度降低。供应商的应对措施是采用模组化电子元件,为高阶车型提供可选的调整板,同时为入门车型保留成本更低的核心零件。

细分市场分析

到2024年,旋转式扭力感测器将在传动系统、风力发电机和製程控制领域占据65.5%的扭力感测器市场。旋转式扭矩感测器可提供连续的现场测量,支援电动车和涡轮机的闭合迴路控制。反作用式扭力感测器的市占率从较小的基数成长至11.8%,这主要得益于机械加工和电池封装製程中自动化测试台的普及。数位遥测技术透过取消滑环改进了旋转式扭力感测器的设计,使其在严苛的工业环境中更加可靠。

旋转式感测器已发展成为边缘运算节点,将资料传输到云端仪錶盘,用于预测性维护。在线加工采用反作用单元来捕捉指示刀具磨损的扭矩峰值,从而推进航太结构铣削加工的零缺陷目标。随着原始设备製造商 (OEM) 对旧组装维修以符合可追溯性要求,扭力感测器市场也从中受益,确保这两类感测器能够持续同步成长。

应变计在成本优势和久经考验的可靠性的支撑下,预计2024年将维持48.3%的销售成长率。然而,声表面波(SAW)感测器将实现13.2%的复合年增长率,并在电磁干扰抑制和无线数据传输至关重要的领域占据市场份额。光纤感测器则主要面向实验室和航太校准应用,在这些领域,纳弧度级的分辨率足以支撑其更高的价格。

2024年,声表面波(SAW)技术的创新实现了1000°C的耐温性和10µm的位移解析度。这些优势为燃气涡轮机和深井钻探等极端环境应用领域开闢了市场。因此,扭矩感测器市场正经历技术分化:低成本应变计用于大众化的汽车转向系统应用,而高价值的SAW或光学单元则用于关键或任务关键型应用。

区域分析

亚太地区持续保持主导,预计2024年将占全球销售额的36.3%,主要得益于汽车组装、半导体製造和机器人领域的高密度封装需求。中国引领EPS生产,日本供应高精度应变计基板,韩国电子巨头则在电池和显示器生产线中引入了高解析度扭力回馈技术。印度大力推动稀土磁铁国产化,目标是到2026年实现年产500吨的产能,预计有助于降低全部区域的原料风险。

北美地区凭藉其高端市场地位,在航太和国防整合商采用高温光学感测器进行引擎测试方面占有一席之地。美国电动车新兴企业利用轴向电机,需要先进的扭矩控制迴路,从而推动了对錶面声波(SAW)和磁弹性元件的需求。墨西哥作为汽车出口中心的地位日益提升,带动了对成本敏感的中等批量转向和传动系统感测器件订单的增长。

在欧洲,监管机构逐步将扭力测量纳入协作机器人安全标准和自动驾驶车辆就绪规则。德国自动化供应商将感测器闸道整合到可程式逻辑控制器中,法国核能维护承包商则采用无线扭力头来加快停电期间的检修速度。在巴西的引领下,南美洲的扭力测量需求成长最为迅速,年复合成长率达到11.4%,这主要得益于原始设备製造商(OEM)安装了需要大量测试台仪器的新型冲压和动力传动系统线。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动动力方向盘转向系统(EPS)

- 製造业自动化和协作机器人的兴起

- 电动自行车和微型移动工俱生产激增

- 轴流式马达在电动车传动系统的应用日益广泛

- 智慧风力发电机的车载扭力监测

- 市场限制

- 汽车销售计划中的价格敏感性

- 电磁干扰下的可靠度问题

- 高等级磁弹性合金供应瓶颈

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

- 产业价值链分析

第五章 市场规模与成长预测

- 依产品类型

- 反应

- 旋转/迴转

- 透过技术

- 应变计

- 磁弹性

- 光学

- SAW(表面声波)

- 其他的

- 透过使用

- 车

- 航太/国防

- 工业製造与机器人

- 医疗保健

- 能源与电力

- 按最终用户行业划分

- OEM测试台和品质保证

- 流程监控

- 研究与开发

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ABB Ltd

- Honeywell International Inc.

- Hottinger Bruel & Kjaer(HBK-Spectris plc)

- TE Connectivity Ltd

- Kistler Instrumente AG

- Infineon Technologies AG

- Norbar Torque Tools Ltd

- Crane Electronics Ltd

- S. Himmelstein & Company Inc.

- Datum Electronics Ltd(Indutrade AB)

- Applied Measurements Ltd

- PCB Piezotronics Inc.(MTS)

- MagCanica Inc.

- Futek Advanced Sensor Technology Inc.

- Forsentek Co. Ltd

- Bota Systems AG

- ATI Industrial Automation(Novanta)

- Althen Sensors & Controls GmbH

- Sensor Technology Ltd(TorqSense)

- Burster Prazisionsmesstechnik GmbH

- Transense Technologies plc(SAWSense)

- Interface Inc.

- Mountz Inc.

- KTR Kupplungstechnik GmbH

- OPKON Optik Elektronik Kontrol San. AS

第七章 市场机会与未来展望

The global torque sensor market size stood at USD 10.54 billion in 2025 and is forecast to reach USD 17.04 billion by 2030, advancing at a 10.09% CAGR.

Momentum has been underpinned by the rapid electrification of vehicle powertrains, deepening industrial automation, and stricter precision-measurement requirements in infrastructure, energy and medical equipment. Automotive electrification continued to anchor demand as torque feedback became integral to electric power-steering, drivetrain control and advanced driver-assistance functions. Parallel growth in collaborative robots increased the sensor content per machine, while e-bike and other micromobility platforms multiplied high-volume, low-cost opportunities. Vendors shifted differentiation away from raw accuracy toward electromagnetic-interference resilience, wireless telemetry, and integration with predictive-analytics platforms. Supply chain exposure to high-grade magnetoelastic alloys remained a limiting factor, although regional sourcing initiatives in India and South America sought to ease dependence on Chinese rare-earth metals.

Global Torque Sensor Market Trends and Insights

Electrification of Power-Steering (EPS) Systems

Mandated torque monitoring for electric power-steering hardened demand even during economic slow-downs. European regulations issued in 2024 required continuous steering-torque feedback for autonomous-readiness, obligating every EPS unit to embed at least one sensor. OEMs adopted dual-redundant designs to satisfy functional-safety targets, effectively doubling sensor volumes per vehicle. Suppliers such as Vitesco cited EPS torque sensing as a core enabler for semi-autonomous lane-keeping and driver-intention prediction. The same data channel is reused in over-the-air analytics, increasing lifetime service revenue for integrators. As legacy hydraulic steering platforms sunset, the addressable automotive base shifted irreversibly toward EPS architectures.

Rising Automation and Cobots in Manufacturing

Collaborative robots required instantaneous torque detection to comply with ISO 10218 safety limits, creating a one-to-one relationship between cobot shipments and sensor units. Global cobot sales outpaced conventional industrial robots in 2024, inducing a steep ramp in EMI-resistant, multi-axis torque sensors destined for electronics, food and light-assembly lines. Certification guidelines enforced redundant sensing, effectively raising bill-of-materials value for each robot. Penetration remained only 26% among Polish SMEs in 2024, illustrating vast latent upside across European manufacturing. Long-term impact spans beyond discrete automation as smart work-cells propagate into textile and agri-processing plants.

Price Sensitivity in Volume Automotive Programs

OEM cost-down targets capped sensor pricing near USD 50 per unit in mainstream EV platforms, pressuring suppliers to strip auxiliary features. The need to offset battery-pack costs heightened scrutiny of every drivetrain component, with platform standardization further commoditizing specifications. Rare-earth magnet supply disruptions in 2024 exacerbated the dilemma, forcing Indian and South American automakers to weigh substitute materials that risked lower precision. Suppliers countered with modular electronics, allowing optional conditioning boards for premium trims while preserving a low-cost core for entry variants.

Other drivers and restraints analyzed in the detailed report include:

- Surge in E-Bike and Micromobility Production

- Growing Use in Axial-Flux Motors for EV Drivetrains

- Reliability Issues under Electromagnetic Interference

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rotational units captured 65.5% of torque sensor market share in 2024 on the strength of drivetrain, wind-turbine and process-control deployments. They offered continuous, in-situ measurement that supported closed-loop control in EVs and turbines. Reaction types, while smaller in base, posted an 11.8% CAGR as automated test-stands proliferated across machining and battery-cell wrap processes. Digital telemetry elevated rotational designs by removing slip rings, boosting reliability in harsh industrial settings.

Rotational sensors evolved into edge-computing nodes, streaming data to cloud dashboards for predictive maintenance. In-process machining adopted reaction units to catch torque spikes indicative of tool wear, advancing zero-defect programs in aerospace structural milling. The torque sensor market benefits as OEMs retrofit older assembly lines to meet traceability mandates, ensuring both sensor categories sustain parallel growth.

Strain-gauges retained 48.3% revenue in 2024, favored for cost and proven ruggedness. Yet, SAW sensors recorded a 13.2% CAGR and gained share where EMI immunity and wireless data mattered most. Magnetoelastic variants served sealed, non-contact duties in pump shafts, whereas optical fibers targeted lab and aerospace calibration where nano-radian resolution justified premium pricing.

SAW innovations in 2024 achieved temperature tolerance to 1,000 °C and 10 µm displacement resolution. Such capabilities unlocked extreme-environment markets like gas turbines and deep-well drilling. The torque sensor market thus witnessed technology bifurcation: low-cost strain-gauges for commoditized automotive steering, and high-value SAW or optical units for hazardous or mission-critical niches.

The Global Torque Sensor Market Report is Segmented by Product Type (Reaction Torque Sensors, Rotational/Rotary Torque Sensors), Technology (Strain-Gauge, Magnetoelastic, and More), Application (Automotive, Aerospace and Defense, and More), End-User Industry (OEM Test-Stand and QA, In-Process Monitoring, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 36.3% of 2024 revenue and sustained leadership through dense automotive assembly, semiconductor fabrication and robotics adoption. China led EPS volumes, Japan supplied precision strain-gauge substrates, and South Korea's electronics majors deployed high-resolution torque feedback in battery and display lines. India's push to localize rare-earth magnet production, with 500-tonne annual capacity targeted by 2026, promised to moderate raw-material risk across the region.

North America maintained its premium niche as aerospace and defense integrators employed high-temperature optical sensors for engine testing. US EV start-ups leveraged axial-flux motors requiring sophisticated torque control loops, bolstering demand for SAW and magnetoelastic devices. Mexico's growing role as an automotive export hub amplified mid-volume, cost-sensitive orders for steering and drivetrain sensing.

Europe advanced steadily on regulatory mandates that embedded torque measurement into collaborative robot safety standards and vehicle autonomous-readiness rules. Germany's automation vendors integrated sensor gateways into programmable-logic controllers, while France's nuclear maintenance contractors adopted wireless torque heads to accelerate outage turnarounds. South America, led by Brazil, posted the fastest 11.4% CAGR as OEMs installed new stamping and powertrain lines requiring extensive test-stand instrumentation.

- ABB Ltd

- Honeywell International Inc.

- Hottinger Bruel & Kjaer (HBK - Spectris plc)

- TE Connectivity Ltd

- Kistler Instrumente AG

- Infineon Technologies AG

- Norbar Torque Tools Ltd

- Crane Electronics Ltd

- S. Himmelstein & Company Inc.

- Datum Electronics Ltd (Indutrade AB)

- Applied Measurements Ltd

- PCB Piezotronics Inc. (MTS)

- MagCanica Inc.

- Futek Advanced Sensor Technology Inc.

- Forsentek Co. Ltd

- Bota Systems AG

- ATI Industrial Automation (Novanta)

- Althen Sensors & Controls GmbH

- Sensor Technology Ltd (TorqSense)

- Burster Prazisionsmesstechnik GmbH

- Transense Technologies plc (SAWSense)

- Interface Inc.

- Mountz Inc.

- KTR Kupplungstechnik GmbH

- OPKON Optik Elektronik Kontrol San. A.S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Electrification of Power-Steering (EPS) systems

- 4.2.2 Rising Automation and Cobots in Manufacturing

- 4.2.3 Surge in E-bike and Micromobility Production

- 4.2.4 Growing Use in Axial-Flux Motors for EV Drivetrains

- 4.2.5 On-board Torque Monitoring in Smart Wind Turbines

- 4.3 Market Restraints

- 4.3.1 Price Sensitivity in Volume Automotive Programs

- 4.3.2 Reliability Issues under Electromagnetic Interference

- 4.3.3 Supply Bottlenecks for High-Grade Magnetoelastic Alloys

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

- 4.9 Industry Value-Chain Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Reaction

- 5.1.2 Rotational / Rotary

- 5.2 By Technology

- 5.2.1 Strain-Gauge

- 5.2.2 Magnetoelastic

- 5.2.3 Optical

- 5.2.4 SAW (Surface Acoustic Wave)

- 5.2.5 Others

- 5.3 By Application

- 5.3.1 Automotive

- 5.3.2 Aerospace and Defense

- 5.3.3 Industrial Manufacturing and Robotics

- 5.3.4 Medical and Healthcare

- 5.3.5 Energy and Power

- 5.4 By End-User Industry

- 5.4.1 OEM Test-Stand and QA

- 5.4.2 In-Process Monitoring

- 5.4.3 Research and Development

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd

- 6.4.2 Honeywell International Inc.

- 6.4.3 Hottinger Bruel & Kjaer (HBK - Spectris plc)

- 6.4.4 TE Connectivity Ltd

- 6.4.5 Kistler Instrumente AG

- 6.4.6 Infineon Technologies AG

- 6.4.7 Norbar Torque Tools Ltd

- 6.4.8 Crane Electronics Ltd

- 6.4.9 S. Himmelstein & Company Inc.

- 6.4.10 Datum Electronics Ltd (Indutrade AB)

- 6.4.11 Applied Measurements Ltd

- 6.4.12 PCB Piezotronics Inc. (MTS)

- 6.4.13 MagCanica Inc.

- 6.4.14 Futek Advanced Sensor Technology Inc.

- 6.4.15 Forsentek Co. Ltd

- 6.4.16 Bota Systems AG

- 6.4.17 ATI Industrial Automation (Novanta)

- 6.4.18 Althen Sensors & Controls GmbH

- 6.4.19 Sensor Technology Ltd (TorqSense)

- 6.4.20 Burster Prazisionsmesstechnik GmbH

- 6.4.21 Transense Technologies plc (SAWSense)

- 6.4.22 Interface Inc.

- 6.4.23 Mountz Inc.

- 6.4.24 KTR Kupplungstechnik GmbH

- 6.4.25 OPKON Optik Elektronik Kontrol San. A.S.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment