|

市场调查报告书

商品编码

1851933

美国农业机械:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)United States Agricultural Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

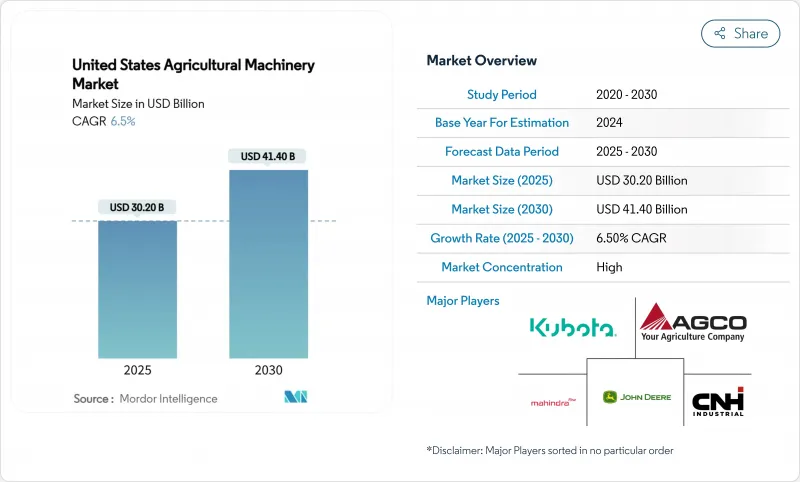

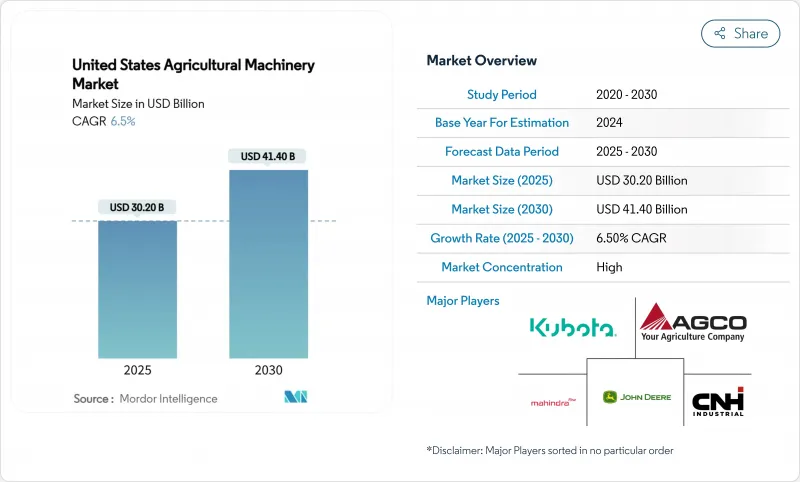

美国农业机械市场预计到 2025 年将达到 302 亿美元,到 2030 年将达到 414 亿美元,年复合成长率为 6.5%。

联邦政府对气候友善实践、精准维修和电气化投资的激励措施有助于抵消市场週期性波动。设备所有者正致力于功能升级以降低营运成本并实现永续性目标,推动了对远端资讯处理、预测性维护和自动驾驶系统的需求。经销商整合正在改善售后服务,而租赁和订阅方案则有助于缓解利率上升的影响。由于水资源日益短缺和排放气体法规日益严格,灌溉领域在美国农业机械市场中呈现高速成长态势。

美国农机市场趋势与洞察

精密农业改装套件的普及

改装方案使农民能够延长现有设备的使用寿命,并透过数据主导的改进,减少高达 30% 的化肥和农药用量。每台拖拉机 5 万美元的改装投资远低于购买新型自动驾驶设备所需的 40 万美元,且投资回收期通常不到三年。中型连续种植农户正越来越多地采用这些方案,以在不增加债务的情况下保持成本竞争力。设备经销商透过安装和校准改装套件获得额外的服务收入,从而加强客户关係并提高盈利。模组化升级的日益普及延长了设备的更换週期,促使目标商标产品製造商 (OEM) 将业务重心从设备销售转向软体和整合服务。

主要汽车製造商的电气化蓝图

迪尔公司计划于2026年推出首款全电动式自动驾驶拖拉机,并投资Krysel Electric公司以获取电池供应。 AGCO公司于2024年试运行了Fendt e100 Vario电动拖拉机,并为此增加了60%的研发投入,专注于研发电动动力传动系统。目前的电池能量密度限制了电动拖拉机的应用范围,使其功率只能达到120马力以下,足以满足蔬果农场和酪农的需求。美国自然资源保护局(NRCS)提供一项成本分摊计划,可以涵盖超过50%的购买成本,从而降低小型农场的经济负担。製造商希望未来电池技术的进步能推动更高功率的应用,但目前的进展也促使零件製造商扩大在美国的电池和逆变器生产规模。

经销商技术人员短缺

农机设备维修业正面临严重的劳动力短缺。服务整合导致实体服务网点数量减少,在关键的播种和收穫季节,反应时间延长。现代精密设备需要专业的诊断能力,而农村劳动力市场普遍缺乏这方面的技能,迫使目标商标产品製造商(OEM)扩展远端支援服务并引入模组化零件更换系统。这些劳动力限制导致农民不得不减少农机设备的购买。

细分市场分析

由于拖拉机在耕作、播种和物料输送中发挥关键作用,预计到2024年,拖拉机将在美国农业机械市场保持51%的份额。该细分市场的收入成长将主要来自大马力拖拉机,而小型拖拉机也越来越多地配备电动驱动系统,以满足特定农业应用的需求。灌溉设备虽然市占率较小,但预计将达到最高的成长率,到2030年复合年增长率将达到9.4%。现代灌溉系统,包括中心支轴式喷灌机、滴灌管和感测器控制阀,能够整合即时土壤湿度数据,进而减少高达25%的消费量。这一增长与西部各州的地下水法规以及联邦「节水智能」(WaterSMART)计划的奖励相契合。

在耕作系统中,製造商正将可变深度耕作技术应用于农机领域,以减少土壤扰动,从而在犁地农业兴起的背景下保持稳定增长。先进的播种和种植设备能够实现精准的单粒播种,提高收割效率,并支持精准施肥。虽然收割设备的需求与农作物价格的持续波动密切相关,但配备预测地面速度自动化功能的新型联合收割机提高了燃油效率和作业效率,更换。农民不再选择购买新设备,而是选择升级现有设备,例如加装自动导航和可变速率控制器,这使得零件和数位化服务的销售额超过了设备销售额。在各类设备中,感测器系统和ISOBUS相容控制器正在建立一个品牌无关的生态系统,降低了製造商的垄断程度,并迫使传统製造商提供开放的API接口,以维持其在拖拉机市场的地位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 精密农业改装套件的普及

- 主要汽车製造商的电气化蓝图

- 远端资讯处理预测性维护技术的日益普及

- 气候智慧型津贴奖励

- 客製化设备租赁模式的激增

- 一家由风险投资支持的机器人Start-Ups瞄准特种作物

- 市场限制

- 经销商技术人员短缺

- 农村地区连网机械的5G覆盖率差

- 不稳定的商品价格会抑制农业资本投资。

- 达到美国环保署第五阶段排放气体标准所需的时间

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 联结机

- 耕作和栽培机械

- 耕耘机

- 光环

- 耕耘机和耕耘机

- 其他耕作和土地清理机械

- 种植机

- 播种机

- 播种机

- 撒布器

- 其他播种机

- 收割机

- 联合收割机

- 饲料收割机

- 其他收割机

- 牧场和饲料机械

- 割草机

- 打包机

- 其他牧场和饲料机械

- 灌溉机械

- 喷水灌溉

- 滴灌

- 其他灌溉机械

- 其他农业机械

- 按农场规模

- 不到500英亩

- 500-2000英亩

- 超过2000英亩

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- KUHN SAS

- Same Deutz-Fahr SPA

- Kinze Manufacturing

- Horsch, LLC

- Ploeger Oxbo Group BV

- Argo Tractors SpA

- Netafim Limited(An Orbia Business)

- Valmont Industries, Inc.

- Yanmar Holdings Co., Ltd.

第七章 市场机会与未来展望

The United States agricultural machinery market size is valued at USD 30.2 billion in 2025 and is projected to grow at a CAGR of 6.5%, reaching USD 41.4 billion by 2030.

Federal incentives for climate-smart practices, precision technology retrofits, and electrification investments help counterbalance cyclical market fluctuations. Equipment owners focus on upgrading capabilities to reduce operational costs and achieve sustainability goals, increasing demand for telematics, predictive maintenance, and autonomous-ready systems. Dealer consolidation improves after-sales service networks, while leasing and subscription options help mitigate the impact of higher interest rates. The irrigation segments demonstrate higher growth rates in the United States agricultural machinery market, driven by increasing water scarcity and stricter emissions regulations.

United States Agricultural Machinery Market Trends and Insights

Widespread Adoption of Precision-Ag Retro-Fit Kits

Retro-fit solutions enable farmers to extend their existing fleet's lifespan while reducing fertilizer and pesticide usage by up to 30% through data-driven improvements. The investment of USD 50,000 per tractor for retrofitting is significantly lower than the USD 400,000 required for new autonomous-ready equipment, typically resulting in a return on investment within three years. Mid-scale row-crop farms increasingly adopt these solutions to maintain cost competitiveness without increasing debt. Equipment dealers benefit from additional service revenue through installation and calibration of retrofit kits, which strengthens customer relationships and improves profitability. The growing adoption of modular upgrades extends equipment replacement cycles, causing Original Equipment Manufacturers (OEMs) to shift their focus from unit sales to software and integration services.

Electrification Road-Maps by Major Original Equipment Manufacturers

Deere & Company plans to launch its first all-electric, autonomous-capable tractor in 2026 and has invested in Kreisel Electric for battery supply. AGCO introduced the Fendt e100 Vario to pilot fleets in 2024, supported by a 60% increase in research and development spending focused on electric powertrains. Current battery density limits electric tractors to under-120-horsepower applications, which align with the requirements of fruit, vegetable, and dairy farms. The Natural Resources Conservation Service (NRCS) offers cost-share programs that can cover over 50% of purchase costs, reducing financial barriers for small farms. While manufacturers expect future battery technology improvements to enable higher-horsepower applications, current progress has encouraged component suppliers to expand United States battery and inverter production.

Dealer Technician Shortage

The equipment service industry faces a significant labor shortage. The consolidation of service locations has reduced the number of physical stores, increasing response times during critical planting and harvest periods. Modern precision equipment requires specialized diagnostic capabilities that exceed the skills available in rural labor markets, compelling Original Equipment Manufacturers (OEMs) to expand remote support services and implement modular component replacement systems. These labor constraints have led farmers to restrict their purchases of agricultural machinery.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption of Telematics-Based Predictive Maintenance

- Climate-Smart Grant Incentives

- Lengthy Environmental Protection Agency Tier 5 Emission Compliance Lead-Times

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Tractors maintain a 51% share of the United States agricultural machinery market in 2024, demonstrating their essential role in tillage, seeding, and material handling. The segment's revenue growth stems from high-horsepower models, while compact tractors increasingly incorporate electric drivetrains for specialty farming applications. Irrigation equipment, though a smaller segment, is projected to achieve the highest growth rate at 9.4% CAGR through 2030. Modern irrigation systems, including center pivots, drip lines, and sensor-controlled valves, integrate real-time soil moisture data, reducing water consumption by up to 25%. This growth aligns with Western state groundwater regulations and federal WaterSMART program incentives.

In plowing and cultivating systems, manufacturers incorporate variable-depth tillage technology to reduce soil disruption, maintaining steady growth despite increasing no-till farming practices. Advanced seeding and planting equipment enable precise single-kernel placement, improving emergence rates and supporting precise nutrient application. While harvesting machinery demand correlates with row-crop prices, new combines featuring predictive ground-speed automation improve fuel efficiency and throughput, driving replacement demand. Farmers increasingly opt to upgrade existing equipment with autonomous guidance and variable-rate controllers instead of purchasing new machinery, resulting in parts and digital service revenue exceeding equipment sales. Across equipment categories, sensor systems and ISOBUS-compatible controllers establish brand-independent ecosystems, reducing manufacturer lock-in and requiring traditional manufacturers to provide open APIs to maintain tractor market position.

The United States Agricultural Machinery Market Report is Segmented by Product Type (Tractors, Plowing and Cultivating Machinery, and More), and by Farm Size (Less Than 500 Acres, 500-2, 000 Acres, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deere & Company

- CNH Industrial NV

- AGCO Corporation

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- CLAAS KGaA mbH

- KUHN SAS

- Same Deutz-Fahr S.P.A.

- Kinze Manufacturing

- Horsch, LLC

- Ploeger Oxbo Group B.V.

- Argo Tractors S.p.A.

- Netafim Limited (An Orbia Business)

- Valmont Industries, Inc.

- Yanmar Holdings Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Widespread Adoption of Precision-Ag Retro-Fit Kits

- 4.2.2 Electrification Road-Maps by Major Original Equipment Manufacturers

- 4.2.3 Rising Adoption of Telematics-Based Predictive Maintenance

- 4.2.4 Climate-Smart Grant Incentives

- 4.2.5 Surge in Bespoke Equipment Leasing Models

- 4.2.6 Venture-Backed Robotics Start-Ups Targeting Speciality Crops

- 4.3 Market Restraints

- 4.3.1 Dealer Technician Shortage

- 4.3.2 Patchy Rural 5G Coverage for Connected Machinery

- 4.3.3 Volatile Commodity-Price Swings Curbing Farm Capital Expenditure

- 4.3.4 Lengthy Environmental Protection Agency Tier 5 Emission Compliance Lead-times

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Tractors

- 5.1.2 Plowing and Cultivating Machinery

- 5.1.2.1 Plows

- 5.1.2.2 Harrows

- 5.1.2.3 Cultivators and Tillers

- 5.1.2.4 Other Plowing and Cultivating Machinery

- 5.1.3 Planting Machinery

- 5.1.3.1 Seed Drills

- 5.1.3.2 Planters

- 5.1.3.3 Spreaders

- 5.1.3.4 Other Planting Machinery

- 5.1.4 Harvesting Machinery

- 5.1.4.1 Combine Harvesters

- 5.1.4.2 Forage Harvesters

- 5.1.4.3 Other Harvesting Machinery

- 5.1.5 Haying and Forage Machinery

- 5.1.5.1 Mowers

- 5.1.5.2 Balers

- 5.1.5.3 Other Haying and Forage Machinery

- 5.1.6 Irrigation Machinery

- 5.1.6.1 Sprinkler Irrigation

- 5.1.6.2 Drip Irrigation

- 5.1.6.3 Other Irrigation Machinery

- 5.1.7 Other Agricultural Machinery

- 5.2 By Farm Size

- 5.2.1 Less Than 500 acres

- 5.2.2 500-2,000 acres

- 5.2.3 More Than 2,000 acres

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Deere & Company

- 6.4.2 CNH Industrial NV

- 6.4.3 AGCO Corporation

- 6.4.4 Kubota Corporation

- 6.4.5 Mahindra & Mahindra Ltd.

- 6.4.6 CLAAS KGaA mbH

- 6.4.7 KUHN SAS

- 6.4.8 Same Deutz-Fahr S.P.A.

- 6.4.9 Kinze Manufacturing

- 6.4.10 Horsch, LLC

- 6.4.11 Ploeger Oxbo Group B.V.

- 6.4.12 Argo Tractors S.p.A.

- 6.4.13 Netafim Limited (An Orbia Business)

- 6.4.14 Valmont Industries, Inc.

- 6.4.15 Yanmar Holdings Co., Ltd.