|

市场调查报告书

商品编码

1852014

气雾剂涂料:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Aerosol Paints - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

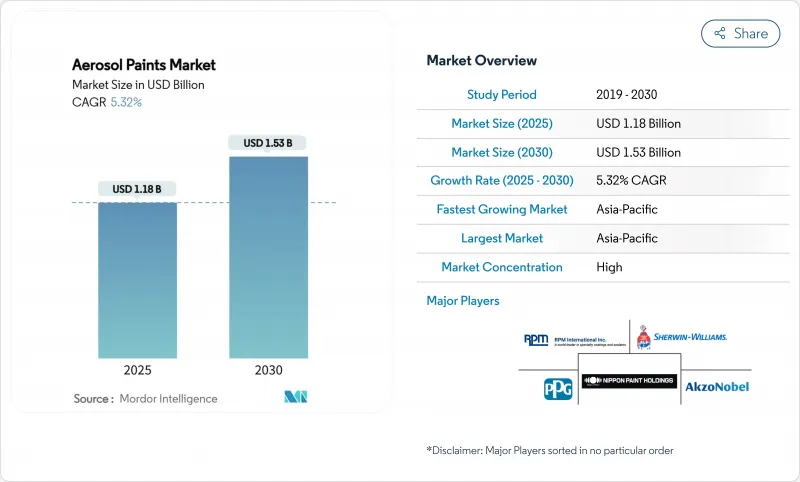

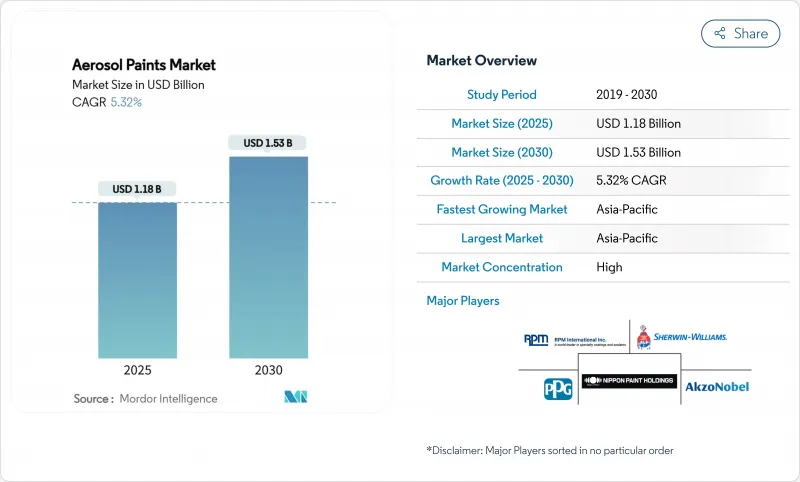

据估计,气雾剂涂料市场规模将在 2025 年达到 11.8 亿美元,到 2030 年达到 15.3 亿美元,在预测期(2025-2030 年)内复合年增长率为 5.32%。

建设业的復苏、汽车个人化的兴起以及DIY文化的兴起正在推动销售量成长,而树脂的持续创新和自动化点胶系统则支撑了高端定价。製造商正在加速向水性体系的转型,以满足更严格的VOC法规要求,同时又不牺牲涂装品质;特种双组分聚氨酯系统在无需喷漆室的修补领域也越来越受欢迎。技术整合、永续性认证以及旨在扩大地域覆盖范围和进入高利润细分市场的有针对性的併购活动,加剧了市场竞争。

全球气雾剂涂料市场趋势与洞察

住宅和商业建设活动增加

随着新建住宅和重建计划中对精准修补涂料的需求不断增长,气雾涂料市场正迅速渗透到初始施工和维护阶段。承包商倾向于使用气雾剂来匹配生活空间的颜色,并减少停工时间和过喷现象。製造商也积极回应,推出不同基材的专用涂料,兼具快速固化和耐磨性,确保在石材、复合材料和金属配件上都能保持稳定的性能。区域监管标准的统一正在简化产品核可,推广统一的标籤标准,并使跨境计划执行更加便捷。

汽车改装和重新喷漆文化的日益盛行

对第1151号规则的修订允许暂时放宽VOC(挥发性有机化合物)含量限制,从而确保高性能修补漆气雾剂的持续供应。科思创的透明涂层基准测试证明了奈米改性双组分聚氨酯的抗刮性。儘管北美和欧洲的汽车销售低迷,但由于汽车爱好者热衷于客製化轮毂、卡钳和装饰件,气雾剂的销售量依然保持稳定。在新兴市场,个人化是社会地位的象征,这催生了区域性的色彩搭配以及针对热带气候量身定制的抗紫外线配方。汽车製造商正与涂料生产商合作,推出经经销商认可的修补漆气雾剂套件,以保障保固范围并取得售后市场收入。

严格的挥发性有机化合物(VOC)含量规定

加州2023-2031年的规定将降低挥发性有机化合物(VOC)的允许含量并禁止使用芳香族溶剂,这将迫使企业进行成本高昂的再製造。美国环保署(EPA)已将合规期限延长至2027年1月,但产业测试週期仍很短。加拿大2024年的法规涵盖130种产品,每个司法管辖区都要求使用不同的SKU。配方变更增加了原料的复杂性,并可能降低光泽度和覆盖率,尤其是在冷喷涂环境下。然而,一旦性能达到同等水平,率先采用先进水性涂料化学技术的企业将在全球扩张中受益。

细分市场分析

至2024年,丙烯酸组合药物将占气雾涂料市场32.87%的份额,并在2030年之前以5.57%的复合年增长率成长。丙烯酸配方兼具良好的附着力、紫外线稳定性和低VOC相容性,因此在建筑和DIY领域广受欢迎。聚氨酯在汽车和工业领域占据了高端地位,双组分气雾剂套件可提供工厂级的耐久性。环氧树脂体系虽然成长放缓,但仍是重型防腐蚀的必备之选,而醇酸树脂体系则在偏好传统涂装製程的工匠中保持着一定的市场份额。其他类别中的混合奈米增强树脂有望实现红外线反射率和加速固化等目标,这促使供应商转向模组化配方平台,以简化客製化订单流程。

为了应对监管审查,丙烯酸树脂供应商正透过投资研发自交联乳化具有耐溶剂性,且可用水清洗。共用单体骨架使得气雾剂和散装喷涂剂型之间的快速转换成为可能,从而提高了规模经济效益。随着DIY用户寻求适用于各种表面的产品,多基材丙烯酸树脂因其与塑胶、金属和石材的兼容性而日益受到青睐。同时,聚氨酯开发商正在致力于改善延迟期管理,以延长活化后的适用期,从而扩大其对在偏远地区作业的车辆维修人员的吸引力。

气雾剂涂料市场报告按树脂类型(丙烯酸树脂、环氧树脂、聚氨酯树脂、醇酸树脂及其他树脂)、技术类型(溶剂型、水性)、终端用户行业类型(汽车、建筑、木材及包装、运输、DIY及其他终端用户行业)和地区类型(亚太地区、北美地区、欧洲及其他地区)进行细分。市场预测以美元计价。

区域分析

到2024年,亚太地区将占据全球45.42%的市场份额,年复合成长率达5.71%。中国的大型企划将支撑建筑需求,而印度中产阶级家庭对金属色和粉彩色系DIY计画的需求将推动成长。立邦涂料以23亿美元收购AOC并进军印度市场,标誌着其在该地区的战略布局。政府基础建设项目即使在消费週期性低迷时期也能提供稳定的销售管道。

北美强大的 DIY 文化为品牌和自有品牌商品带来了稳定的现金流,虽然通货膨胀对大型翻新工程造成了压力,但小型室内改造仍然强劲。

欧洲市场正透过合规联盟来促进技术领先地位,这些联盟规范测试方法并共用水基解决方案的最佳实践。公共资金鼓励使用低全球暖化潜值推进剂的试点计划,而消费者的生态标章则影响他们的购买选择。为加强供应链韧性,应对地缘政治动盪,製造商正将关键原料的生产转移到近岸地区,并巧妙地调整成本结构和区域产能分配。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 住宅和商业建设活动增加

- DIY整修和装饰计划的兴起

- 汽车改装和重新喷漆文化的日益盛行

- 新型双组分聚氨酯气雾剂系统可实现无需维修室的维修

- 用于老化基础设施的奈米陶瓷直接金属喷涂

- 市场限制

- 严格的挥发性有机化合物(VOC)含量规定

- 根据《基加利修正案》逐步淘汰氢氟碳化合物推进剂

- 消防法关于油漆加压储存的规定

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 树脂

- 丙烯酸纤维

- 环氧树脂

- 聚氨酯

- 醇酸

- 其他树脂

- 透过技术

- 溶剂型

- 水系统

- 按最终用户行业划分

- 车

- 建筑学

- 木材和包装

- 运输

- DIY(自己动手做)

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Aeroaids Corporation

- Akzo Nobel NV

- BASF

- Kobra Paint

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- RusTA

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Aerosol Paints Market size is estimated at USD 1.18 billion in 2025, and is expected to reach USD 1.53 billion by 2030, at a CAGR of 5.32% during the forecast period (2025-2030).

Construction recovery, automotive personalization, and a flourishing DIY culture fuel volume growth, while continuous resin innovation and automated dispensing systems support premium pricing. Manufacturers accelerate water-borne transitions to meet stricter VOC rules without sacrificing finish quality, and specialty 2-K polyurethane systems gain traction for booth-free repairs. Competitive intensity pivots around technology integration, sustainability credentials, and targeted mergers and acquisitions that broaden geographic footprints and boost access to high-margin niches.

Global Aerosol Paints Market Trends and Insights

Rising Residential and Commercial Construction Activities

Demand accelerates as new housing and renovation projects specify precision touch-up coatings, allowing the aerosol paints market to penetrate both initial build and maintenance phases. Contractors favor aerosols for color-matching occupied spaces, reducing downtime and overspray. Manufacturers respond with substrate-specific blends that combine rapid cure with abrasion resistance, ensuring consistent performance across masonry, composites, and metal fixtures. Regulatory alignment across regions is streamlining product approvals and driving uniform label standards that further ease cross-border project execution.

Growing Automotive Customisation and Refinishing Culture

Rule 1151 amendments grant temporary VOC leniency, enabling continued supply of high-performance refinishing aerosols. Covestro's clearcoat benchmarking validates nano-modified 2-K polyurethane dominance in scratch resistance. Enthusiasts in North America and Europe customize wheels, calipers, and trim, driving steady aerosol volumes despite plateauing vehicle sales. In emerging markets, personalization indicates social status, fostering localized color palettes and UV-stable formulations tailored to tropical climates. OEMs collaborate with paint suppliers to launch dealer-approved aerosol touch-up kits that protect warranty coverage and capture aftermarket revenue.

Stringent VOC-Content Regulations

California's 2023-2031 rules cut allowable VOC levels and ban aromatic solvents, compelling costly reformulations. The U.S. EPA deferred compliance to January 2027, yet industry testing cycles remain compressed. Canada's 2024 limits span 130 products, requiring distinct SKUs per jurisdiction. Reformulation increases raw-material complexity and may reduce gloss or coverage, particularly in cold-spray environments. However, early movers leveraging advanced water-borne chemistries anticipate global rollout efficiencies once performance parity is achieved.

Other drivers and restraints analyzed in the detailed report include:

- Emerging 2-K Polyurethane Aerosol Systems Enabling Booth-Free Repairs

- Nano-Ceramic Direct-to-Metal Sprays for Ageing Infrastructure

- Phase-Down of HFC Propellants Under Kigali Amendment

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations held the leading 32.87% share of the aerosol paints market in 2024, with a parallel 5.57% CAGR to 2030. Their balance of adhesion, UV stability, and low-VOC adaptability underpins widespread acceptance across architectural and DIY channels. Polyurethane earns premium positioning in automotive and industrial sectors, where two-component aerosol kits deliver factory-grade durability. Epoxy systems remain essential for heavy-duty anticorrosion protection despite slower growth, while alkyd retains niche loyalty among craftsmen who favor traditional finishes. Hybrid nano-enhanced resins in the "other" category promise targeted gains such as infrared reflectivity and accelerated cure, nudging suppliers toward modular formulation platforms that streamline custom orders.

In response to regulatory scrutiny, acrylic suppliers invest in self-crosslinking emulsions that deliver solvent-borne hardness with water clean-up, shrinking the environmental gap. Shared monomer backbones allow rapid pivoting between aerosol and bulk-spray formats, improving economies of scale. As DIY users demand all-surface products, multi-substrate acrylics compatible with plastics, metals, and masonry gain prominence. Concurrently, polyurethane developers tackle latency management to extend post-activation pot life, broadening appeal to fleet maintenance crews operating in remote locations.

The Aerosol Paints Report is Segmented by Resin (Acrylic, Epoxy, Polyurethane, Alkyd, and Other Resins), Technology (Solvent-Borne, Water-Borne), End-User Industry (Automotive, Architectural, Wood and Packaging, Transportation, Do-It-Yourself (DIY), and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 45.42% global share in 2024 and advances at 5.71% CAGR. China's mega-projects sustain architectural demand, while India's middle-class households spur growth in DIY metallic and pastel shades. Nippon Paint's USD 2.3 billion AOC acquisition and Indian expansions illustrate strategic anchoring in the region. Government infrastructure outlays infuse stable volume pipelines even during cyclical consumer dips.

North America benefits from an entrenched DIY culture, generating steady cash flow for branded lines and private labels alike. Although inflation weighs on big-ticket remodeling, smaller decor touch-ups remain resilient.

Europe's market fosters technology leadership through collaborative compliance consortia that standardize test methods and share best practices on water-borne conversion. Public funding incentivizes pilot projects employing low-GWP propellants, while consumer eco-labels sway purchase choices. Supply-chain resilience exercises following geopolitical disruptions push manufacturers to near-shore key raw materials, subtly reshaping cost structures and regional capacity allocation.

- Aeroaids Corporation

- Akzo Nobel N.V.

- BASF

- Kobra Paint

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- PPG Industries Inc.

- RPM International Inc.

- RusTA

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Residential and Commercial Construction Activities

- 4.2.2 Increasing DIY Refurbishment and Decor Projects

- 4.2.3 Growing Automotive Customisation and Refinishing Culture

- 4.2.4 Emerging 2-K Polyurethane Aerosol Systems Enabling Booth-Free Repairs

- 4.2.5 Nano-Ceramic Direct-to-Metal Sprays for Ageing Infrastructure

- 4.3 Market Restraints

- 4.3.1 Stringent VOC-Content Regulations

- 4.3.2 Phase-Down of HFC Propellants Under Kigali Amendment

- 4.3.3 Fire-Code Restrictions on Pressurised Paint Storage

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Acrylic

- 5.1.2 Epoxy

- 5.1.3 Polyurethane

- 5.1.4 Alkyd

- 5.1.5 Other Resins

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.3 By End-User Industry

- 5.3.1 Automotive

- 5.3.2 Architectural

- 5.3.3 Wood and Packaging

- 5.3.4 Transportation

- 5.3.5 Do-It-Yourself (DIY)

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aeroaids Corporation

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 BASF

- 6.4.4 Kobra Paint

- 6.4.5 Masco Corporation

- 6.4.6 Nippon Paint Holdings Co., Ltd.

- 6.4.7 PPG Industries Inc.

- 6.4.8 RPM International Inc.

- 6.4.9 RusTA

- 6.4.10 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment