|

市场调查报告书

商品编码

1852108

空胶囊:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)Empty Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

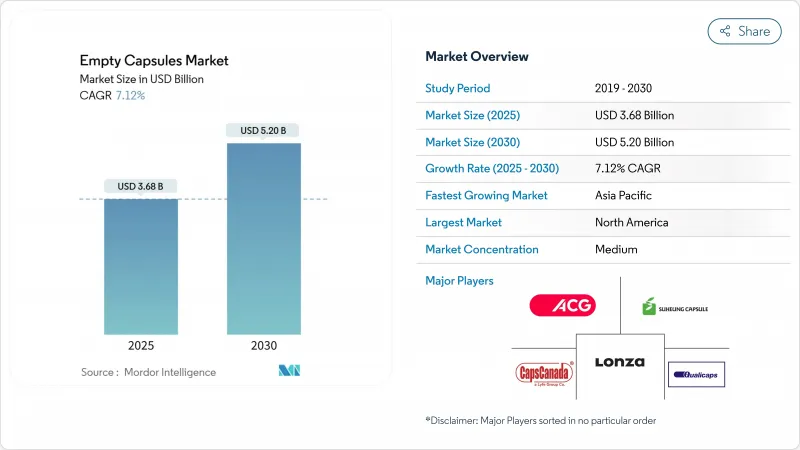

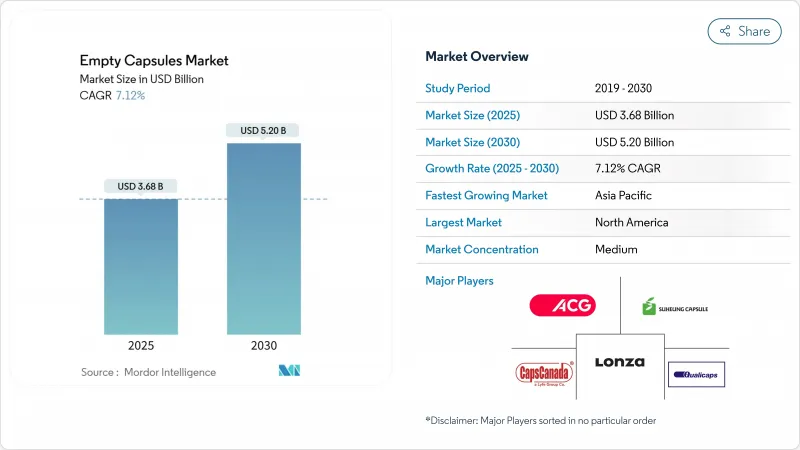

预计到 2025 年,空胶囊市场规模将达到 36.8 亿美元,到 2030 年将达到 52 亿美元,年复合成长率为 7.12%。

成长的驱动力来自药品产量的扩大、胶囊剂型治疗方法的广泛应用以及高速填充设备的快速改进。尤其是在北美和欧洲,对单剂量包装的需求不断增长,这需要符合严格监管要求和以患者为中心的优质胶囊。整合机器视觉和物联网感测器的技术升级提高了一次产量比率率,降低了单位成本,并促进了产能扩张。同时,膳食补充品品牌也开始采用胶囊来保护敏感成分,这为市场需求增添了新的多样性。随着主要供应商在印度和中国扩大产能,同时探索剥离业务和成立合资企业以期获得更清晰的策略方向,市场竞争日益激烈。

全球空胶囊市场趋势与洞察

增加药品产量

人口老化和保险覆盖范围的扩大正在推动药品生产扩张,从而维持对高精度空胶囊市场供应链的需求。龙沙公司斥资8,500万瑞士法郎进行升级改造,使其年产能增加300亿粒,体现了其致力于透过扩大产能来确保供应连续性的承诺。连续生产线需要原材料的均一性和即时品质数据,这对高端胶囊的生产至关重要。生技药品产量的增加推动了对无污染胶囊壳的需求。灵活的生产模式,例如工厂持有更多安全库存以实现快速换线,进一步推动了各地区胶囊的消费量成长。

膳食补充剂摄取量增加

预防性健康措施正促使消费者转向益生菌、适应原和定製配方产品,而这些产品通常采用胶囊包装以保护敏感的活性成分。配方生产商正在摒弃动物性成分,转而选择植物来源丙甲纤维素(HPMC)外壳,以实现「洁净标示」的宣传。这一趋势在美国和德国尤为明显,益生菌胶囊的销售量正呈现两位数的成长。小批量生产以满足个性化营养需求,也为特定规格的胶囊创造了新的订单。品牌拥有者也开始使用透明或彩色外壳,并采用透明标籤,进一步强化了胶囊作为高端递送载体的形象。

明胶原料供应不稳定

牛和猪的供应趋紧,以及药用级明胶可能被征收10-25%的进口关税,将给空胶囊市场带来短期成本压力。中国工厂的季节性停工将进一步加剧供应短缺,使依赖单一供应商合约的公司面临风险。製药采购商正采取双重采购和预购策略来应对,但这种策略会消耗大量营运资金。天气导致的畜牧业中断可能会持续,这将促使配方师转向植物来源胶囊壳,儘管其单位成本更高。因此,明胶持续不稳定可能会加速羟丙基(HPMC)胶囊的普及。

细分市场分析

2024年,明胶胶囊壳占了空胶囊市场84.34%的份额。然而,非明胶胶囊预计将以10.32%的复合年增长率增长,这表明在洁净标示偏好和多宗教合规要求的推动下,市场结构正在转变。硬明胶胶囊在大容量口服固体製剂中占据主导地位,而软明胶胶囊则用于脂溶性製剂。纤维素化学的创新使得羟丙基甲基纤维素(HPMC)胶囊壳具备了以往只有明胶才能拥有的溶解性和机械性能。普鲁兰胶胶囊和淀粉胶囊则占据了高端市场,它们宣称具有优异的氧气阻隔性能或特定的素食相容性。

HPMC的应用在营养补充剂领域中成长最为迅速,尤其适用于封装对水分敏感的益生菌和草本萃取物。生产商正透过优化干燥过程中的水分含量来克服以往HPMC易碎的问题。普鲁兰胶多醣优异的耐氧性使其成为高效价植物萃取物的理想选择。新型肠溶HPMC胶囊,例如Enprotect,无需二次包衣即可实现98%的缓衝剂释放效率,从而减少了加工步骤,并检验了其高端定位。淀粉类HPMC胶囊目前仍仅限于对成本较为敏感的领域,但如果其转化率能够进一步提高,则有望从中受益。

到2024年,即时释胶囊壳将占据空胶囊市场72.45%的份额,这主要得益于其成熟的标准。然而,随着製药公司致力于开发每日一次给药方案以提高患者用药依从性,缓释性胶囊预计将以9.84%的复合年增长率成长。延迟释放胶囊正透过聚合物层层包裹技术不断发展,以实现特异性溶出,填补了酸不稳定原料药这一虽小但具有战略意义的市场空白。顺序包衣技术能够实现更均匀的聚合物分布,从而提高批次均一性并简化监管申报流程。

这种双层壳将速释和缓释特性结合于一体,无需片剂-胶囊混合製剂。其pH值非依赖性基质能够适应不同患者胃部环境的差异。连续生产线内建的即时分析系统使操作人员能够直接控制包衣增重,从而减少偏差。随着数位疗法将药物释放数据整合到患者资讯平台中,预计在预测期内,对客製化释放曲线的需求将日益增长。

区域分析

北美在空胶囊市场保持主导,2024年市占率达38.54%,这得益于先进的GMP设施和FDA的严格监管,后者尤其註重文件记录和批次一致性。美国的连续生产测试要求供应商满足严格的规格范围和即时放行测试。加拿大学名药的生产以及墨西哥的契约製造基地也增加了该地区对胶囊的需求。能够获得FDA、加拿大卫生署和USP认证的工厂正在获得优先供应商地位。

到2030年,亚太地区将以8.72%的复合年增长率保持最高成长,再形成全球药品流通格局。中国正在升级其医药基础设施,但一项针对低成本胶囊出口的反倾销调查迫使其调整筹资策略。印度正利用其成本优势和熟练劳动力,投资2.5亿卢比扩大天然胶囊业务,显示对出口交易充满信心。日本则瞄准老年人专用製剂,这些製剂需要易于吞嚥的胶囊壳,因此倾向于较小的胶囊尺寸和增强润滑剂。随着全民健保扩大了口服药物的覆盖范围,东南亚国家也正在跟进。

欧洲依然是一个成熟且充满创新活力的市场。德国的生物技术中心需要先进的胶囊技术来生产特殊药品,而英国脱欧后的政策调整也刺激了英国的投资。欧盟的环境指令鼓励转向植物来源胶囊壳,羟丙基甲基纤维素(HPMC)的应用也日益普及。生产商正大力宣传其低碳足迹和无溶剂生产工艺,以契合企业的永续性目标。在欧盟范围内,个人化医疗试点计画正在使用电子处方平台,这使得能够快速小批量交付的胶囊供应商获得了竞争优势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加药品产量

- 膳食补充剂摄取量增加

- 胶囊填充技术的进步

- 转向独立剂量包装

- 整合数位健康技术

- 扩大常规生产基础设施

- 市场限制

- 明胶原料供应的波动性

- 严格遵守宗教和饮食规定

- 药用级羟丙基甲基纤维素(HPMC)供应有限。

- 气候相关稳定性挑战对供应链的影响

- 监管环境

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 副产品

- 明胶胶囊

- 硬明胶胶囊

- 软胶囊

- 非明胶胶囊

- HPMC胶囊

- 普鲁兰胶胶囊

- 淀粉基胶囊

- 明胶胶囊

- 功能

- 即时释胶囊

- 延迟释放胶囊

- 缓释性胶囊

- 治疗用途

- 抗生素和抗菌剂

- 维生素和营养补充剂

- 制酸剂和肠道调节剂

- 心血管治疗

- 其他治疗用途

- 最终用户

- 製药业

- 营养保健品产业

- 化妆品和个人护理

- 研究和学术机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 公司简介

- ACG Worldwide

- Lonza Group(Capsugel)

- Qualicaps

- Suheung Capsule Co. Ltd

- CapsCanada Corporation

- Bright Pharma Caps Inc.

- Medi-Caps Ltd

- HealthCaps India Ltd

- Sunil Healthcare Ltd

- Fujifilm Corp.(Fujicaps)

- Roxlor LLC

- Farmacapsulas SA

- Patheon(Thermo Fisher)

- Sirio Pharma Co., Ltd.

- Er-Kang Pharmaceutical Co. Ltd

- Qingdao Yiqing Medicinal Capsules Co. Ltd

- Shanxi Guangsheng Medicinal Capsules Co. Ltd

- Shanxi JC Biological Technology Co. Ltd

- Natural Capsules Ltd

- Zhejiang Huangyan Gelatin Capsule Co. Ltd

- Zhejiang Ruixin Capsules Co. Ltd

第七章 市场机会与未来展望

The empty capsules market size is valued at USD 3.68 billion in 2025 and is forecast to reach USD 5.20 billion by 2030, expanding at a 7.12% CAGR.

Growth springs from larger pharmaceutical production runs, wider acceptance of capsule-based therapies and rapid improvements in high-speed filling equipment. Rising demand for personalized dose packaging, especially in North America and Europe, lifts premium capsule grades that meet strict regulatory and patient-centric requirements. Technology upgrades that integrate machine vision and IoT sensors are raising first-pass yield rates and lowering unit costs, encouraging producers to scale capacity. Simultaneously, nutraceutical brands are shifting to capsules to protect delicate ingredients, which adds a fresh layer of demand diversity. Competitive intensity is sharpening as leading suppliers expand output in India and China while exploring divestitures or joint ventures that promise sharper strategic focus.

Global Empty Capsules Market Trends and Insights

Growing Pharmaceutical Manufacturing Volume

Expanding drug output, propelled by aging populations and wider insurance coverage, creates sustained demand for high-precision empty capsules market supply chains. Lonza's CHF 85 million upgrade that adds 30 billion units a year shows how producers scale capacity to secure continuity of supply. Continuous production lines need feedstock uniformity and real-time quality data, which favors premium capsule grades. Heightened biologics output intensifies requirements for contamination-free shells. Flexible manufacturing models, where plants hold larger safety stocks to enable rapid changeovers, further lift unit consumption across regions.

Rising Nutraceutical Consumption

Preventive-health habits are steering consumers toward probiotics, adaptogens and bespoke blends that rely on capsules to protect sensitive actives. Formulators pick plant-based HPMC shells for clean-label claims because they avoid animal derivatives. Double-digit sales growth of probiotic capsules in the United States and Germany demonstrates the trend. Smaller batch runs for personalized nutrition create fresh orders for niche capsule sizes. Brand owners also use clear or tinted shells to signal transparent labeling, which reinforces the capsule format as a premium delivery vehicle.

Volatility in Gelatin Raw-Material Supply

Tighter bovine and porcine supply and potential 10-25% import tariffs on pharmaceutical-grade gelatin raise short-term cost pressure on the empty capsules market. Seasonal plant shutdowns in China compound scarcity, exposing firms that rely on single-source contracts. Pharmaceutical buyers respond by dual-sourcing and pre-booking volumes, but that strategy ties up working capital. Climate-driven livestock disruptions may persist, nudging formulators toward plant-based shells despite higher unit prices. Broader adoption of HPMC capsules could therefore accelerate if gelatin volatility persists.

Other drivers and restraints analyzed in the detailed report include:

- Advancements in Capsule Filling Technology

- Shift Toward Personalized Dose Packaging

- Stringent Religious and Dietary Compliance

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Gelatin shells retained 84.34% of empty capsules market share in 2024, thanks to entrenched cost advantages and proven functionality. Yet non-gelatin capsules are moving at a 10.32% CAGR, signaling a structural pivot driven by clean-label preferences and multi-faith compliance requirements. Hard gelatin variants dominate high-volume oral solids, while soft gelatin capsules support lipid-soluble formulations. Innovation in cellulose chemistry equips HPMC shells with dissolution and mechanical properties once exclusive to gelatin. Pullulan and starch capsules occupy premium niches where oxygen barrier performance or specific vegetarian claims hold sway.

HPMC adoption rises fastest in nutraceutical lines that encapsulate moisture-sensitive probiotics or herbal extracts. Producers overcome previous brittleness by optimizing moisture content during drying. Pullulan's superior oxygen resistance makes it ideal for high-potency botanicals. Emerging enteric HPMC capsules such as Enprotect reach 98% buffer-conditioned release efficiency without secondary coating, cutting process steps and validating the premium positioning. Starch variants remain limited to cost-sensitive segments but stand to benefit if conversion economics further improve.

Immediate-release shells held 72.45% share of the empty capsules market size in 2024, favored for their established compendial standards. However, sustained-release uses are growing at 9.84% CAGR as pharma companies chase once-daily regimens that lift adherence. Delayed-release capsules fill a smaller yet strategic niche for acid-labile APIs, evolving through polymer layering that triggers site-specific dissolution. Continuous coating methods yield tighter polymer distribution, enhancing batch uniformity and easing regulatory filings.

Bi-layer shells merge immediate and sustained profiles in a single unit, eliminating the need for tablet-capsule hybrids. pH-independent matrices counter patient-to-patient variability in gastric conditions. Real-time analytics embedded in continuous lines give operators direct control over coating weight gain, reducing deviations. As digital therapeutics integrate drug release data into patient dashboards, demand for bespoke release profiles is poised to strengthen over the forecast horizon.

The Empty Capsules Market Report is Segmented by Product (Gelatin Capsules and Non-Gelatin Capsules), Functionality (Immediate-Release Capsules, and More), Therapeutic Application (Antibiotic & Antibacterial, and More), End User (Pharmaceutical Industry, and More), Geography (North America, Europe, Asia-Pacific, The Middle East and Africa, and South America). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained leadership with a 38.54% stake in the empty capsules market in 2024, backed by advanced GMP facilities and FDA oversight that prizes documentation and batch consistency. Continuous manufacturing pilots in the United States push suppliers to meet tight specification ranges and real-time release testing. Canada's generics production and Mexico's contract-manufacturing base add depth to regional capsule demand. Plants that can certify for FDA, Health Canada and USP standards thus win preferred-supplier status.

Asia-Pacific records the highest 8.72% CAGR through 2030 and is set to re-shape global volume flows. China upgrades its pharmaceutical infrastructure while antidumping probes into low-cost capsule exports force realignment of sourcing strategies. India leverages cost advantages and a skilled workforce; Natural Capsules' INR 250 million expansion indicates confidence in export contracts. Japan targets geriatric formulations that demand easy-to-swallow shells, favoring smaller sizes and enhanced glidants. Southeast Asian economies follow suit as universal healthcare programs expand access to oral therapies.

Europe maintains a mature yet innovative landscape. German biotechnology hubs require advanced capsule technologies for specialty drugs, while post-Brexit policy tweaks stimulate United Kingdom-based investments. EU environmental directives encourage a pivot to plant-based shells, with HPMC uptake gathering momentum. Producers market low-carbon footprints and solvent-free processes to align with corporate sustainability targets. Across the bloc, personalized medicine pilots tap into e-prescription platforms, and capsule suppliers that can provide rapid small-lot deliveries gain competitive edges.

- ACG Worldwide

- Lonza Group

- Qualicaps

- Suheung Capsule

- CapsCanada Corporation

- Bright Pharma Caps

- Medi-Caps

- HealthCaps India Ltd

- Sunil Healthcare Ltd

- Fujifilm Corp. (Fujicaps)

- Roxlor LLC

- Farmacapsulas S.A.

- Patheon (Thermo Fisher)

- Sirio Pharma Co., Ltd.

- Er-Kang Pharmaceutical Co. Ltd

- Qingdao Yiqing Medicinal Capsules

- Shanxi Guangsheng Medicinal Capsules

- Shanxi JC Biological Technology

- Natural Capsules Ltd

- Zhejiang Huangyan Gelatin Capsule Co. Ltd

- Zhejiang Ruixin Capsules Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Pharmaceutical Manufacturing Volume

- 4.2.2 Rising Nutraceutical Consumption

- 4.2.3 Advancements in Capsule Filling Technology

- 4.2.4 Shift Toward Personalized Dose Packaging

- 4.2.5 Integration of Digital Health Technologies

- 4.2.6 Expansion of Continuous Manufacturing Infrastructure

- 4.3 Market Restraints

- 4.3.1 Volatility In Gelatin Raw Material Supply

- 4.3.2 Stringent Religious and Dietary Compliance

- 4.3.3 Limited Availability of Pharmaceutical-Grade HPMC

- 4.3.4 Climate-Induced Stability Challenges In Supply Chain

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Gelatin Capsules

- 5.1.1.1 Hard Gelatin Capsules

- 5.1.1.2 Soft Gelatin Capsules

- 5.1.2 Non-Gelatin Capsules

- 5.1.2.1 HPMC Capsules

- 5.1.2.2 Pullulan Capsules

- 5.1.2.3 Starch-Based Capsules

- 5.1.1 Gelatin Capsules

- 5.2 By Functionality

- 5.2.1 Immediate-Release Capsules

- 5.2.2 Delayed-Release Capsules

- 5.2.3 Sustained/Extended-Release Capsules

- 5.3 By Therapeutic Application

- 5.3.1 Antibiotic & Antibacterial

- 5.3.2 Vitamins & Dietary Supplements

- 5.3.3 Antacid & Antiflatulent

- 5.3.4 Cardiovascular Therapy

- 5.3.5 Other Therapeutic Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical Industry

- 5.4.2 Nutraceutical Industry

- 5.4.3 Cosmetic & Personal-Care

- 5.4.4 Research & Academic Laboratories

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 ACG Worldwide

- 6.3.2 Lonza Group (Capsugel)

- 6.3.3 Qualicaps

- 6.3.4 Suheung Capsule Co. Ltd

- 6.3.5 CapsCanada Corporation

- 6.3.6 Bright Pharma Caps Inc.

- 6.3.7 Medi-Caps Ltd

- 6.3.8 HealthCaps India Ltd

- 6.3.9 Sunil Healthcare Ltd

- 6.3.10 Fujifilm Corp. (Fujicaps)

- 6.3.11 Roxlor LLC

- 6.3.12 Farmacapsulas S.A.

- 6.3.13 Patheon (Thermo Fisher)

- 6.3.14 Sirio Pharma Co., Ltd.

- 6.3.15 Er-Kang Pharmaceutical Co. Ltd

- 6.3.16 Qingdao Yiqing Medicinal Capsules Co. Ltd

- 6.3.17 Shanxi Guangsheng Medicinal Capsules Co. Ltd

- 6.3.18 Shanxi JC Biological Technology Co. Ltd

- 6.3.19 Natural Capsules Ltd

- 6.3.20 Zhejiang Huangyan Gelatin Capsule Co. Ltd

- 6.3.21 Zhejiang Ruixin Capsules Co. Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment