|

市场调查报告书

商品编码

1852138

圆二色光谱:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Circular Dichroism Spectrometers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

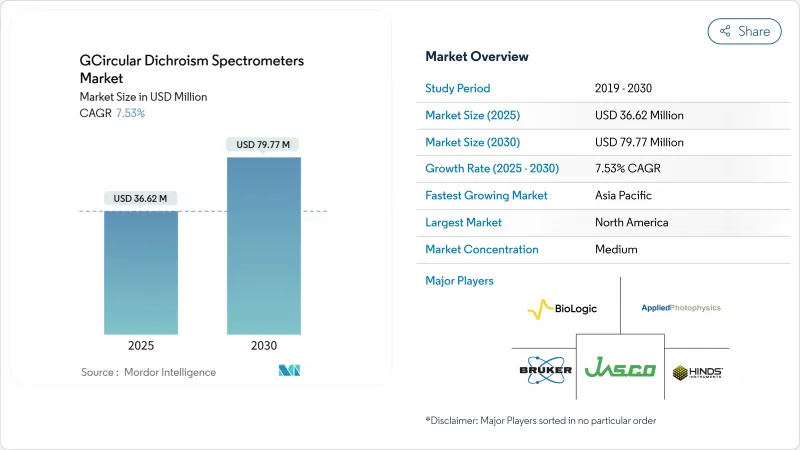

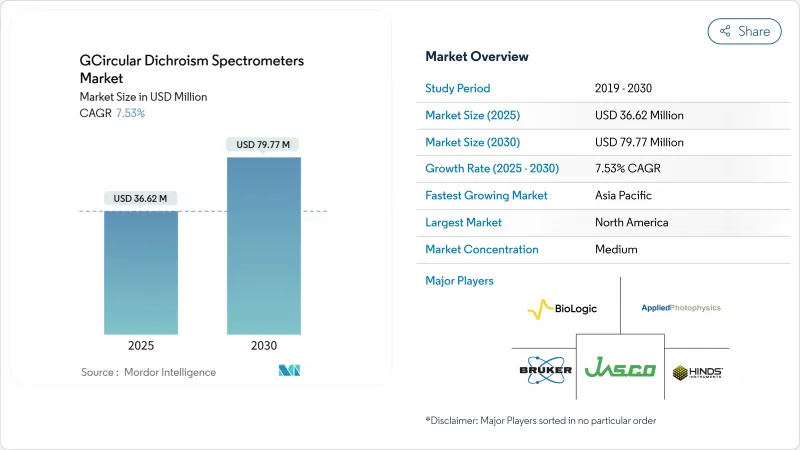

预计到 2025 年,圆二色光谱仪市场规模将达到 3,662 万美元,到 2030 年将达到 7,977 万美元,年复合成长率为 7.53%。

事实上,生物製药生产的规模化、生物相似药研发管线的不断拓展以及FDA和EMA对高阶蛋白质结构检验要求的提高,都推动了该领域的发展。此外,资金雄厚的学术核心设施也为市场需求提供了支撑,这些设施得到了NIH和NSF的资助。供应方面的进步,特别是台式自动化和量子级联雷射色谱技术,正在降低单次样品的成本并提高易用性。同时,中型委外研发机构(CRO)越来越多地采购多用户系统,并将资本支出转化为按服务收费的收入,从而推动了圆二色谱仪市场的新增长。以製程分析技术为中心的技术融合,透过将仪器直接整合到连续生技药品生产线中,进一步降低了供应商受常规研究预算波动的影响。

全球圆二色光谱仪市场趋势及洞察

全球生物製药生产扩张

生技药品向连续生产转型,将圆二色谱(CD)探头直接整合到生产线中,用于即时折迭式检验,从而提高了生产效率,并推动了落地架系统的普及。布鲁克公司2024年营收飙升至33.7亿美元,凸显了此类资本投资计划相关设备的广泛应用。供应商目前正将自动比色皿更换器与符合GMP规范的软体捆绑销售,以减少操作员干预时间,并符合美国联邦法规21 CFR Part 11的要求。更高的批次放行量也促使签订多年服务合同,从而获得稳定的收入。这些因素共同为圆二层析仪市场创造了强劲的合规性基础。

生命科学设备研发成本不断上涨

美国国立卫生研究院 (NIH) 2025 财政年度 501 亿美元的预算申请将与实验室升级改造的津贴需求保持同步,而美国国家科学基金会 (NSF) 4000 万美元的蛋白质设计倡议将支持对先进结构检验套件的需求。学术联盟正在增强其采购能力,并选择配备人工智慧驱动频谱解卷积功能的桌上型仪器来分析各种蛋白质库。在采购週期中,多检测器组件的需求日益增长,这有利于能够提供承包系统的製造商。这种经济实力正在稳定仪器的更新週期,并支撑着圆二色光谱仪市场的发展。

CD系统的高昂资本和营运成本

高阶系统加上GMP软体和服务合约后,价格可能超过25万美元,这会对首次购买者的资金预算造成压力。供应链关税可能会使美国光学组件进口商的到岸成本增加10-15%。营运成本,包括液态氮物流、灯泡更换和专用校准器,都会增加总拥有成本。共享设施模式可以减轻部分负担,但也会导致预约瓶颈,阻碍时间要求较高的实验。这些因素抑制了价格敏感地区圆二色光谱仪市场快速成长的乐观预期。

细分市场分析

到2024年,桌上型圆二色光谱仪将占据市场主导地位,市占率高达45.34%,满足学术实验室和中型生物技术公司常规蛋白质折迭筛检的需求。实验室倾向于选择占地面积小、扫描速度快且可选配自动盘式分析仪。落地式仪器虽然出货量较小,但由于其需要连续生产线运行,因此预计成长速度最快,因为这些仪器需要全天候可靠性和高信噪比。美国国家光源(NLS)安装的专用同步辐射圆二色光谱(SRCD)光束线可满足需要长波长的特殊膜蛋白研究计划。哈佛医学院安装的两台J-1500仪器表明,桌上型仪器仍然是高通量稳定性研究的核心。虽然桌上型仪器将继续主导更新换代週期,但落地架平台将吸引待开发区项目,从而在圆二色光谱仪市场中保持综合收益的平衡。

同时,产品升级正在模糊不同产品类别之间的界线。供应商正在将曾经仅用于大型系统的机器人自动自动取样器改装到桌上型设备上,使小型实验室能够在夜间处理96孔盘孔板。另一方面,落地架机型采用了模组化光学系统,使用者无需返厂即可在紫外线、可见光和中红外线探头之间进行切换。这种功能上的趋同性支持了围绕通量和稳定性的差异化价值提案,同时也缩小了以往的价格差异。最终,不断发展的实验室工作流程将确保这两类产品的扩张,从而增强整个圆二色光谱仪市场的广泛发展前景。

到2024年,电子圆二色谱(CD)仍将占据圆二色谱仪市场55.32%的份额。这主要归功于其在远紫外线区提供蛋白质科学家极为重视的α螺旋和β折迭的指纹图谱。此分析方法拥有成熟的验证指南,便于监管申报,并已成为批次放行检测的预设方法。同步辐射圆二色谱的复合年增长率(CAGR)最高,因为国家级设施虽然受限于光束线的使用,但缩短了工业的等待时间,并提供了传统光学系统无法企及的170 nm波长。振动圆二色谱(VCD)正逐步应用于掌性小分子的品质保证/品质控制(QA/QC)领域,目前的用户主要是愿意为量子级联雷射付费的药物立体化学研究团队。 JASCO公司的中红外线量子连锁桌上型系统表明,VCD能够将采集时间从数小时缩短至数分钟,从而从小众应用走向常规工作流程。

这些技术之间的交叉融合日益增加。如今,软体程式套件能够实现电子区和振动区的频谱迭加,从而提供蛋白质骨架和侧链手性的全景视图。可携式SRCD附加元件也在评估之中,但光束时间的可用性是一个关键因素。 SRCD和VCD具有较高的利润空间,维持了圆二色光谱仪市场的分级定价结构。

区域分析

2024年,北美将维持38.54%的圆二色光谱仪市场份额,这得益于成熟的生技药品管线、FDA对严格分析的要求以及资金雄厚的学术生态系统。美国国立卫生研究院(NIH)2025年501亿美元的预算确保了共用设施的设备更新速度稳定。关键光学组件可能征收10-15%的关税,短期内可能会推高价格,但保固折扣和租赁模式将缓解此影响。加拿大疫苗生产的加速推进了本地采购,尤其是针对符合GMP标准的落地式圆二色光谱仪生产线。

亚太地区是成长最快的区域,预计到2030年将以8.53%的复合年增长率成长,这主要得益于中国现代化的生技药品丛集、印度积极的生物相似药目标以及日本对再生医学品质工具的投资。中国圆二色谱仪供应商专注于成本优化型仪器,而全球企业则在跨国合资企业中赢得大批量订单,这些订单需要符合FDA标准的验证方案。印度的国有生物园区提供批量设备融资,以满足新兴企业的需求。这种区域成长动能将减少对二手二手设备的传统依赖,并加速高阶产品在整个圆二色谱仪市场的渗透。

欧洲市场整体平衡,但成长速度放缓,主要得益于大型製药公司的维修和「地平线欧洲」计画的研究招募工作。德国和瑞士继续投资高精度圆二色谱(CD)技术,用于膜蛋白药物的研究,但英国脱欧后的海关政策变化导致设备交付週期延长。东欧的合约研究组织(CRO)正崛起为价格具有竞争力的服务中心,它们购买中阶CD设备以吸引英国赞助商。拉丁美洲和中东地区取得了虽小但显着的成果,当地的疫苗计画推动了试点实验室的建设。然而,光谱学人才的匮乏和资金筹措週期的不稳定性限制了这些地区近期的成长潜力。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 全球生物製药生产扩张

- 生命科学设备研发成本不断上涨

- 圆二色性硬体的创新

- 药物研发中对蛋白质结构分析的需求日益增长

- 增加结构生物学研究的学术经费

- 用于製程分析技术的整合光谱平台的出现。

- 市场限制

- CD系统的高昂资本和营运成本

- 训练有素的光谱学专家数量有限

- 人们对高解析度替代方案的偏好日益增长

- 新型CD技术面临的监管验证挑战

- 监管情况(FDA、EMA、ICH Q5E、USP<781>)

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 桌上型圆二色光谱仪

- 落地式圆二色光谱仪

- SRCD光束线设备

- CD微分散仪

- 透过技术

- 电子光碟(ECD)

- 振动光碟(VCD)

- 同步辐射CD(SRCD)

- 透过使用

- 蛋白质二级结构测定

- 疫苗学与抗原构象研究

- 生物相似药与生物製药的比较评价

- 品管/批次放行测试

- 药物筛检和先导检验

- 最终用户

- 製药和生物技术公司

- 受託製造厂商(CRO/CMO)

- 学术和政府研究机构

- 医院和诊断实验室

- 地理

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 亚太其他地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 公司简介

- JASCO

- Bruker

- Applied Photophysics

- Bio-Logic Science Instruments

- Hinds Instruments

- Thermo Fisher Scientific

- Agilent Technologies

- Shimadzu

- CRAIC Technologies

- Aviv Biomedical

- ISS Inc.

- Ocean Insight

- Quantum Design International

- HORIBA Scientific

- SpectroPolaritek

第七章 市场机会与未来展望

The circular dichroism spectrometers market size sits at USD 36.62 million in 2025 and is forecast to expand to USD 79.77 million by 2030, reflecting a steady 7.53% CAGR.

In practice, the sector's momentum is anchored in biopharmaceutical manufacturing scale-up, rising biosimilar pipelines, and tighter FDA-EMA expectations for higher-order protein structure validation. Demand is additionally supported by NIH and NSF funding streams that keep academic core facilities well capitalized. Supply-side advances-most notably benchtop automation and quantum-cascade-laser vibrational CD-lower per-sample costs and broaden usability. Meanwhile, mid-sized contract research organizations (CROs) increasingly purchase multi-user systems and convert capital outlays into fee-for-service revenues, injecting new volume into the Circular Dichroism Spectrometers market. Technology convergence around process analytical technology further insulates vendors from routine research budget swings, embedding instruments directly into continuous biologics production lines.

Global Circular Dichroism Spectrometers Market Trends and Insights

Expansion of Global Biopharmaceutical Manufacturing

Biologic plants shifting toward continuous production embed CD probes directly into process lines for real-time folding validation, driving higher-throughput specifications and favoring floor-standing systems. Bruker's 2024 revenue spike of USD 3.37 billion underscores the instrumentation pull-through tied to these capital projects. Vendors now bundle automated cuvette changers and GMP-ready software, shortening operator intervention time and aligning with 21 CFR Part 11 expectations. Larger batch-release volumes encourage multi-year service contracts that lock in annuity revenue. Together, these factors add a sturdy compliance floor beneath the Circular Dichroism Spectrometers market.

Rising R&D Expenditure in Life Sciences Instrumentation

NIH's FY 2025 request of USD 50.1 billion keeps grant-backed lab upgrades on pace, while the NSF's USD 40 million protein-design initiative anchors demand for advanced structure-validation kits. Academic consortia consolidate purchasing power, opting for benchtop instruments equipped with AI-driven spectral deconvolution that handles diverse protein libraries. Procurement cycles increasingly specify multi-detector packages, rewarding manufacturers able to ship turn-key systems. These funding dynamics promote steady instrument refresh intervals, buttressing the Circular Dichroism Spectrometers market.

High Capital and Operational Costs of CD Systems

Premium systems can exceed USD 250,000 once GMP software and service agreements are added, straining capital budgets for first-time buyers. Supply-chain tariffs risk adding 10-15% to landed costs for U.S. importers of optics sub-assemblies. Operational expenses include liquid-nitrogen logistics, lamp replacements, and specialized calibrants, lifting total cost of ownership. Shared-facility models relieve part of that burden but produce reservation bottlenecks that deter time-sensitive experiments. These factors collectively temper high-growth optimism for the Circular Dichroism Spectrometers market in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Technological Innovations in Circular Dichroism Hardware

- Growing Demand for Protein Structure Analysis in Drug Discovery

- Limited Availability of Trained Spectroscopy Professionals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Benchtop units delivered a commanding 45.34% share of Circular Dichroism Spectrometers market size in 2024 by meeting everyday protein-fold screening needs of academic labs and mid-tier biotechs. Laboratories choose them for compact footprints, rapid scan modes, and optional automated plate readers. Floor-standing models, although fewer in absolute shipments, record the fastest unit growth because continuous-manufacturing lines require 24/7 reliability and higher s/n ratios. Specialty SRCD beamline configurations, housed at national light-sources, serve niche membrane-protein projects where extended wavelengths matter. The Harvard Medical School installation of dual J-1500s illustrates how benchtops remain central to high-throughput stability studies. Over the forecast, benchtops will continue to dominate replacement cycles, while floor-standing platforms capture green-field plants, keeping a balanced revenue mix inside the Circular Dichroism Spectrometers market.

In parallel, product upgrades blur lines between categories. Vendors now retrofit benchtops with robotic autosamplers once exclusive to large systems, letting smaller labs process 96-well plates overnight. Conversely, floor-standing models incorporate modular optics so users swap in UV, visible, or mid-IR heads without factory service visits. This feature parity compresses the historical price spread yet supports differentiated value propositions around throughput and robustness. Ultimately, evolving lab workflows ensure both product classes expand, reinforcing the broad opportunity base across the Circular Dichroism Spectrometers market.

Electronic CD still held 55.32% of Circular Dichroism Spectrometers market share in 2024 because its far-UV range delivers the alpha-helix and beta-sheet fingerprints prized by protein scientists. The method's mature validation guides ease regulatory submissions, making it the default for batch-release assays. Synchrotron Radiation CD, while confined to beamline access, posts the briskest CAGR as national facilities open industrial queue time and deliver wavelengths down to 170 nm unattainable on conventional optics. Vibrational CD elbows into chiral-small-molecule QA/QC, though current users remain pharma stereochemistry groups ready to pay for quantum-cascade-laser sources. JASCO's mid-IR quantum-cascade bench system demonstrates that VCD can migrate from niche to daily workflow by shortening acquisition times from hours to minutes.

Cross-pollination among these technologies is growing. Software packages increasingly allow spectral overlay across electronic and vibrational regimes, providing a single-view protein backbone plus side-chain chirality. Portable SRCD add-ons are under evaluation, but beamtime availability stays the gating factor. Over the outlook, Electronic CD will remain the workhorse while SRCD and VCD supply premium margins, preserving a tiered pricing architecture across the Circular Dichroism Spectrometers market.

The Circular Dichroism Spectrometers Market Report is Segmented by Product Type (Benchtop CD Spectrometers, and More), Technology (Electronic CD (ECD), and More), Application (Protein Secondary-Structure Determination, and More), End User (Pharmaceutical & Biotechnology Companies, and More), Geography (North America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 38.54% of Circular Dichroism Spectrometers market share in 2024, buoyed by mature biologics pipelines, FDA's rigorous analytical expectations, and a well-funded academic ecosystem. The NIH's 2025 appropriation of USD 50.1 billion guarantees consistent instrument refresh rates at shared facilities. A possible 10-15% tariff on critical optics assemblies could lift short-term prices, but warranty discounts and lease models cushion the blow. Canada's vaccine-manufacturing build-out amplifies regional procurement, particularly for floor-standing CD lines designed for GMP production floors.

Asia-Pacific is the fastest-expanding arena at an 8.53% CAGR through 2030, propelled by China's modern biologic clusters, India's aggressive biosimilar targets, and Japan's investment in regenerative medicine quality tools. Chinese CD vendors focus on cost-optimized benches, but global players win large-capacity orders at multinational joint-ventures needing FDA-ready validation packages. India's state-sponsored biotech parks bundle equipment financing, unlocking demand among start-ups. This regional momentum reduces historical dependency on imported second-hand gear and accelerates premium segment penetration across the Circular Dichroism Spectrometers market.

Europe exhibits balanced but slower growth, stabilizing around large pharma refurbishments and Horizon Europe research calls. Germany and Switzerland continue to invest in high-precision CD for membrane-protein drug work, while the UK's post-Brexit customs shifts require longer planning windows for instrument delivery. Eastern European CROs emerge as price-competitive service hubs, purchasing mid-tier CD units to attract western sponsors. Smaller but notable gains surface in Latin America and the Middle East, where local vaccine initiatives spur pilot lab construction. However, limited spectroscopy talent and sporadic funding cycle volatility temper near-term upside in those regions.

- Jasco

- Bruker

- Applied Photophysics

- Bio-Logic Science Instruments

- Hinds Instruments

- Thermo Fisher Scientific

- Agilent Technologies

- Shimadzu

- CRAIC Technologies

- Aviv Biomedical

- ISS

- Ocean Insight

- Quantum Design International

- HORIBA Scientific

- SpectroPolaritek

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope Of The Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Global Biopharmaceutical Manufacturing

- 4.2.2 Rising R&D Expenditure in Life Sciences Instrumentation

- 4.2.3 Technological Innovations in Circular Dichroism Hardware

- 4.2.4 Growing Demand for Protein Structure Analysis in Drug Discovery

- 4.2.5 Increasing Academic Funding for Structural Biology Research

- 4.2.6 Emergence of Integrated Spectroscopy Platforms For Process Analytical Technology

- 4.3 Market Restraints

- 4.3.1 High Capital and Operational Costs of CD Systems

- 4.3.2 Limited Availability of Trained Spectroscopy Professionals

- 4.3.3 Growing Preference for High-Resolution Alternative Methods

- 4.3.4 Regulatory Validation Challenges for New CD Technologies

- 4.4 Regulatory Landscape (FDA, EMA, ICH Q5E, USP <781>)

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat Of New Entrants

- 4.6.2 Bargaining Power Of Buyers

- 4.6.3 Bargaining Power Of Suppliers

- 4.6.4 Threat Of Substitutes

- 4.6.5 Intensity Of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product Type

- 5.1.1 Benchtop CD Spectrometers

- 5.1.2 Floor-Standing CD Spectrometers

- 5.1.3 SRCD Beamline Instruments

- 5.1.4 CD Microspectrometers

- 5.2 By Technology

- 5.2.1 Electronic CD (ECD)

- 5.2.2 Vibrational CD (VCD)

- 5.2.3 Synchrotron Radiation CD (SRCD)

- 5.3 By Application

- 5.3.1 Protein Secondary-Structure Determination

- 5.3.2 Vaccinology & Antigen Conformation Studies

- 5.3.3 Biosimilar & Biologic Comparability Assessments

- 5.3.4 Quality Control / Batch Release Testing

- 5.3.5 Drug Discovery Screening & Hit Validation

- 5.4 By End-User

- 5.4.1 Pharmaceutical & Biotechnology Companies

- 5.4.2 Contract Research / Manufacturing Organizations (CROs/CMOs)

- 5.4.3 Academic & Government Research Institutes

- 5.4.4 Hospital & Diagnostic Laboratories

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Australia

- 5.5.3.5 South Korea

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East & Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East & Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.3.1 JASCO

- 6.3.2 Bruker

- 6.3.3 Applied Photophysics

- 6.3.4 Bio-Logic Science Instruments

- 6.3.5 Hinds Instruments

- 6.3.6 Thermo Fisher Scientific

- 6.3.7 Agilent Technologies

- 6.3.8 Shimadzu

- 6.3.9 CRAIC Technologies

- 6.3.10 Aviv Biomedical

- 6.3.11 ISS Inc.

- 6.3.12 Ocean Insight

- 6.3.13 Quantum Design International

- 6.3.14 HORIBA Scientific

- 6.3.15 SpectroPolaritek

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment

![圆二色性 [CD] 光谱仪市场(产品:线偏振光源、圆偏振光源和多光源)- 2023-2031 年全球产业分析、规模、份额、成长、趋势和预测](/sample/img/cover/42/default_cover_6.png)