|

市场调查报告书

商品编码

1852147

奈米碳管:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Carbon Nanotubes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

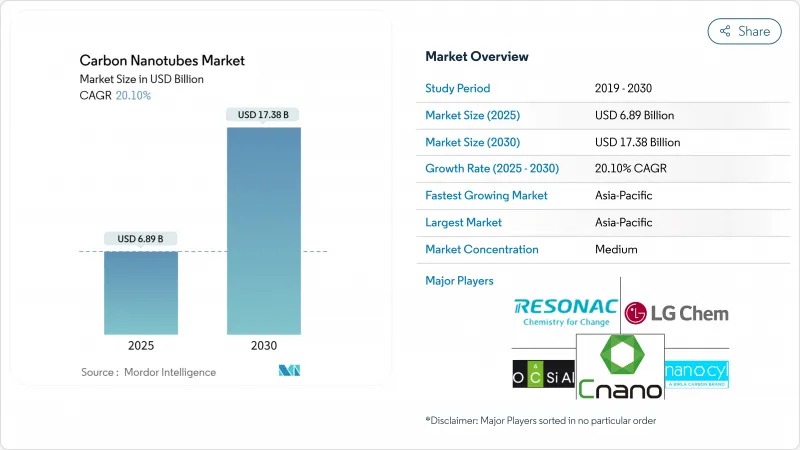

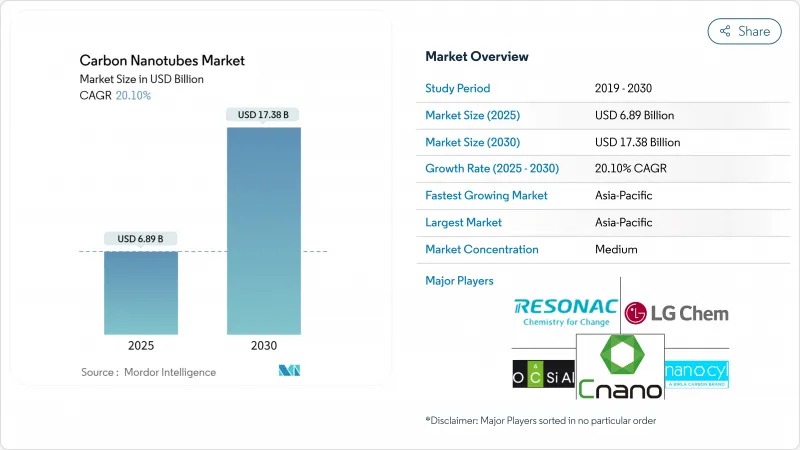

预计到 2025 年,奈米碳管市场规模将达到 68.9 亿美元,到 2030 年将达到 173.8 亿美元,预测期(2025-2030 年)的复合年增长率为 20.10%。

积极的市场前景反映了该材料在电池、航太复合材料、医疗器材和水溶液等领域的快速应用。多壁奈米碳管仍具有成本效益,促使生产商在追求更高纯度和均匀性的同时,扩大生产规模。亚太地区在需求和产能方面持续占据主导地位,这主要得益于电动车和电子产业丛集的发展。 OCSiAl收购Zyvex Technologies增强了其在单壁奈米碳管领域的规模和智慧财产权实力。

全球奈米碳管市场趋势与洞察

电动交通的蓬勃发展推动了对碳奈米管的需求

奈米碳管即使在硅含量接近 20% 的情况下也能确保导电性和机械稳定性,从而实现 300Wh/kg 的锂离子电池组,有效缓解里程焦虑。汽车製造商也指定使用填充碳奈米管的热感垫片来散发电力电子设备产生的热量,陶氏化学和 Carby 公司在 2024 年的合作正是为了满足这一需求。同样的导电优势也为汇流排和电池组屏蔽层的应用开启了新的可能性。生产硅-碳奈米管复合阳极的新兴企业正在吸引创业投资资金,凸显了它们的商业性信心。随着电池製造商供应链的本地化,更多的碳奈米管产能正被安置在超级工厂附近,进一步将材料与电池生产整合起来。

高能量密度储存推动技术进步

电网储能和航太应用需要更轻、更安全的电池。采用奈米碳管管支架的锂硫电池能够固定硫并抑制多硫化物穿梭效应。扭曲的单壁奈米碳管绳可储存2.1 MJ/kg的机械能,其能量密度超过锂离子电池,同时避免了使用易燃电解液。超级电容製造商正在采用多层电极来实现低等效串联电阻,这对于快速充放电至关重要。这些进步带来了对高导电等级电池和分散式服务的稳定订单。

职业毒理学和监管强化

由于其纤维状形态与石棉类似,西方当局正在製定吸入暴露限值。学术团体正在改进剂量测定方法,以建立空气中颗粒质量和长宽比与肺部反应之间的关係。合规性要求推动了对全封闭式反应器和自动化包装线的投资,从而增加了新参与企业的资本支出。拥有安全加工记录的公司正在汽车和航太项目中赢得合同,这些项目非常重视企业永续性指标。

细分市场分析

到2024年,多壁奈米碳管将占据90%的市场份额,这反映出化学气相沉积生产过程的成熟以及其与块状添加剂相同的价格分布。预计到2030年,该细分市场将以20.51%的复合年增长率成长,占奈米碳管市场成长的三分之二以上。颗粒工程师正在提高外径公差,并将金属催化剂的含量降低到100 ppm以下,以满足电子和医疗设备的阈值。这些改进将推动导电浆料、行动电话扬声器和超级电容器电极等领域的应用,从而巩固其市场领先地位。

单壁奈米碳管的市占率仍不足10%,但在量子和半导体等特定应用领域仍维持较高的溢价。静电催化技术目前已能製备出直径0.95奈米、纯度高达99.92%的半导体,因此可在软式电路板上製造薄膜电晶体。对受限碳炔的研究预示着未来可用于光电的一维导体的发展前景。随着特定元件的商业化,奈米碳管市场可望在不挤压多层碳奈米管整体需求的前提下,逐步获得更高的效益。

区域分析

亚太地区将持续维持主导,到2024年将占全球需求的54%,复合年增长率达21.51%。中国完善的电池供应链生态系统正推动本土奈米管製造商根据长期合约向超级工厂供货。日本企业正专注于生产用于显示器的超洁净单层奈米管,充分利用「超高速生长」製程的高长宽比和高取向品质。韩国和印度的政府奖励措施将进一步扩大产能,直到2027年,进而巩固该地区的成本优势。

北美市场对总销售额贡献显着。在美国,诸如能源部向卡博特公司(Cabot Corporation)拨款5000万美元用于其在密西根州的生产等倡议,正使国内电池和国防客户的供应更加安全。航太复合材料和高频连接器是关键的需求支柱,这得益于国家实验室强大的研发实力。在加拿大,一座专注于利用奈米管产品差异化进行甲烷-氢气热解的试点工厂已投入运作,将气候政策与製造业政策紧密结合。

欧洲也占据了全球汽车销售的相当大份额。德国和法国的汽车製造商要求严格的材料可追溯性,并敦促供应商证明其从摇篮到大门的排放符合标准。在英国奈米製造中心的支持下,英国的大学正在孵化专注于半导体互连技术的企业。同时,中东的海水淡化机构和非洲的通讯塔安装商正在评估奈米管薄膜和导电涂层,以应对水资源和能源挑战,从而释放新的市场需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动交通的蓬勃发展将加速碳奈米管的需求。

- 在高能量密度锂离子电池和超级电容生产方面取得飞跃式发展

- 推动航太领域超轻型结构复合材料的发展

- 在中东、非洲和亚洲推广海水淡化和环境感测器

- 导电丝的增材製造集成

- 市场限制

- 欧洲和美国的职业毒理学和奈米技术监管

- 石墨烯和氮化硼奈米管在热应用领域竞争

- 专利陷阱,授权成本集中于此。

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

- 专利分析

第五章 市场规模及成长预测(价值及数量)

- 按类型

- 多壁奈米碳管市场

- 单壁奈米碳管市场

- 其他类型(扶手椅式、之字形、双层墙式)

- 透过製造方法

- 化学气相沉积(CVD)

- 高压一氧化碳(HiPco)

- 电弧闪光

- 雷射消熔

- 按最终用途行业划分

- 电气和电子

- 活力

- 车

- 航太/国防

- 卫生保健

- 其他行业(纺织、建筑、塑胶、复合材料)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Applied Nanostructures, Inc.

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Chengdu Organic Chemicals Co., Ltd.

- CNT Co., Ltd.

- FutureCarbon GmbH

- Hanwha Group

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon Co.,Ltd

- Nano-C

- Nanocyl SA

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Thomas Swan & Co., Ltd.

- Toray Industries, Inc.

- Zyvex Technologies

第七章 市场机会与未来展望

The Carbon Nanotubes Market size is estimated at USD 6.89 billion in 2025, and is expected to reach USD 17.38 billion by 2030, at a CAGR of 20.10% during the forecast period (2025-2030).

The strong outlook reflects the material's rapid adoption in batteries, aerospace composites, healthcare devices and water solutions. Multi-walled variants remain cost-efficient, so producers are scaling output while pursuing higher purity and uniformity. Asia-Pacific continues to dominate both demand and production capacity, helped by the region's electric-vehicle and electronics clusters. Consolidation among leading suppliers is gathering pace, illustrated by OCSiAl's purchase of Zyvex Technologies, which strengthened single-walled carbon nanotube scale and intellectual-property depth.

Global Carbon Nanotubes Market Trends and Insights

E-mobility boom accelerating CNT demand

Rising electric-vehicle output is lifting graphite anode silicon content, and carbon nanotubes ensure conductivity and mechanical stability at silicon loads near 20%, enabling 300 Wh/kg lithium-ion packs that reduce range anxiety. Automakers also specify nanotube-filled thermal interface pads that dissipate heat generated by power electronics, a need addressed by Dow and Carbice's 2024 alliance. The same conductivity advantage opens opportunities in busbars and battery-pack shielding. Start-ups producing silicon-CNT composite anodes have attracted venture funding, underscoring commercial confidence. As cell makers localize supply chains, nanotube capacity additions are being colocated near gigafactories, tightening integration between materials and battery production.

High-energy-density storage pushing technical frontiers

Grid storage and aerospace sectors require lighter, safer cells. Lithium-sulfur batteries using carbon-nanotube scaffolds anchor sulfur and suppress polysulfide shuttling, which is central to Lyten's 200 MWh plant targeted for 2025 ramp-up. Twisted single-walled carbon nanotube ropes store 2.1 MJ/kg as mechanical energy, exceeding lithium-ion energy density while avoiding flammable electrolytes. Supercapacitor makers employ multi-walled electrodes to deliver low equivalent-series resistance, ideal for rapid charge-discharge duty. Together, these advances translate to steady orders for high-conductivity grades and dispersion services.

Occupational toxicology and tightening regulation

European and U.S. agencies are drafting inhalation-exposure limits, citing fiber-like dimensions comparable with asbestos. Academic groups are refining dosimetry to link airborne mass and aspect ratio to pulmonary response. Compliance drives investment in fully enclosed reactors and automated bagging lines, raising capex for newcomers. Companies with documented safe-handling records secure contracts in automotive and aerospace programs where corporate sustainability metrics weigh heavily.

Other drivers and restraints analyzed in the detailed report include:

- Aerospace composites raising performance bar

- Desalination & sensor innovations aiding water-stressed regions

- Competition from graphene and boron-nitride nanotubes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-walled carbon nanotubes accounted for 90% of 2024 share, reflecting mature chemical vapor deposition output and price points aligned with bulk additives. The segment is forecast to log a 20.51% CAGR, underpinning more than two-thirds of the carbon nanotubes market size expansion through 2030. Particle engineers are narrowing outer-diameter tolerance and reducing metal catalysts below 100 ppm, meeting electronics and medical-device thresholds. These improvements encourage adoption in conductive pastes, cell-phone speakers and supercapacitor electrodes, reinforcing volume leadership.

Single-walled carbon nanotubes remain under 10% by share yet command premium pricing in quantum and semiconductor niches. Electrostatic catalysis now yields 99.92% semiconducting purity at 0.95 nm diameter, enabling thin-film transistors on flexible substrates. Research on confined carbyne suggests future one-dimensional conductors for photonics. As niche devices commercialize, the carbon nanotubes market will capture incremental high-margin revenue without displacing multi-walled bulk demand.

The Carbon Nanotubes Market Report Segments the Industry by Type (Multi-Walled Carbon Nanotubes, Single-Walled Carbon Nanotubes, and Other Types), Manufacturing Method (Chemical Vapor Deposition (CVD), High-Pressure Carbon Monoxide (HiPco), and More), End-Use Industry (Electrical and Electronics, Energy, and More), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific held 54% of global demand in 2024, and its 21.51% CAGR will sustain leadership. China's integrated battery-supply ecosystem catalyzes local nanotube manufacturers that supply gigafactories under long-term contracts. Japanese firms specialize in ultra-clean single-walled grades for displays, leveraging the "super-growth" method's high aspect ratios and alignment quality. Government incentives across South Korea and India further expand capacity through 2027, widening the regional cost advantage.

North America contributed a significant share to the total revenue. U.S. initiatives, including a USD 50 million Department of Energy grant to Cabot Corporation for Michigan production, shift supply security closer to domestic battery and defense customers. Aerospace composites and high-frequency connectors are key demand pillars, drawing on national labs' R&D strengths. Canada hosts pilot plants focused on methane-to-hydrogen pyrolysis with nanotube coproducts, linking climate and manufacturing policies.

Europe also contributed a significant share to the overall sales. German and French automakers require stringent material traceability, pushing suppliers to certify cradle-to-gate emissions. British universities spin out ventures targeting semiconductor interconnects, supported by national nanofabrication hubs. At the periphery, Middle East desalination agencies and African telecom tower installers evaluate nanotube-coated membranes and conductive coatings to tackle water and energy challenges, fostering pockets of emerging demand.

- Applied Nanostructures, Inc.

- Arkema

- Cabot Corporation

- Carbon Solutions, Inc.

- CHASM

- Cheap Tubes

- Chengdu Organic Chemicals Co., Ltd.

- CNT Co., Ltd.

- FutureCarbon GmbH

- Hanwha Group

- Hyperion Catalysis International

- Jiangsu Cnano Technology Co., Ltd.

- Kumho Petrochemical

- LG Chem

- Meijo Nano Carbon Co.,Ltd

- Nano-C

- Nanocyl SA

- OCSiAl

- Raymor Industries Inc.

- Resonac Holdings Corporation

- Thomas Swan & Co., Ltd.

- Toray Industries, Inc.

- Zyvex Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-mobility Boom Accelerating CNT Demand

- 4.2.2 Leap in High-Energy-Density Li-ion and Supercapacitor Production

- 4.2.3 Aerospace Push for Ultra-light Structural Composites

- 4.2.4 Desalination and Environmental Sensors Adoption in MEA and Asia

- 4.2.5 Additive Manufacturing Integration for Conductive Filaments

- 4.3 Market Restraints

- 4.3.1 Occupational Toxicology and Nano-regulation in Europe and United States

- 4.3.2 Competition from Graphene and Boron-Nitride Nanotubes in Thermal Apps

- 4.3.3 Patent Thickets Concentrating Licensing Costs

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Patent Analysis

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Type

- 5.1.1 Multi-Walled Carbon Nanotubes

- 5.1.2 Single-Walled Carbon Nanotubes

- 5.1.3 Other Types (Armchair, Zigzag, Double-Walled)

- 5.2 By Manufacturing Method

- 5.2.1 Chemical Vapor Deposition (CVD)

- 5.2.2 High-Pressure Carbon Monoxide (HiPco)

- 5.2.3 Arc Discharge

- 5.2.4 Laser Ablation

- 5.3 By End-Use Industry

- 5.3.1 Electrical and Electronics

- 5.3.2 Energy

- 5.3.3 Automotive

- 5.3.4 Aerospace and Defense

- 5.3.5 Healthcare

- 5.3.6 Other Industries (Textiles, Construction, Plastics and Composites)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Applied Nanostructures, Inc.

- 6.4.2 Arkema

- 6.4.3 Cabot Corporation

- 6.4.4 Carbon Solutions, Inc.

- 6.4.5 CHASM

- 6.4.6 Cheap Tubes

- 6.4.7 Chengdu Organic Chemicals Co., Ltd.

- 6.4.8 CNT Co., Ltd.

- 6.4.9 FutureCarbon GmbH

- 6.4.10 Hanwha Group

- 6.4.11 Hyperion Catalysis International

- 6.4.12 Jiangsu Cnano Technology Co., Ltd.

- 6.4.13 Kumho Petrochemical

- 6.4.14 LG Chem

- 6.4.15 Meijo Nano Carbon Co.,Ltd

- 6.4.16 Nano-C

- 6.4.17 Nanocyl SA

- 6.4.18 OCSiAl

- 6.4.19 Raymor Industries Inc.

- 6.4.20 Resonac Holdings Corporation

- 6.4.21 Thomas Swan & Co., Ltd.

- 6.4.22 Toray Industries, Inc.

- 6.4.23 Zyvex Technologies

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Increasing Demand for Energy Storage Devices