|

市场调查报告书

商品编码

1852156

丙烯腈-丁二烯-苯乙烯(ABS)树脂:市场份额分析、产业趋势、统计数据和成长预测(2025-2030)Acrylonitrile Butadiene Styrene (ABS) Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

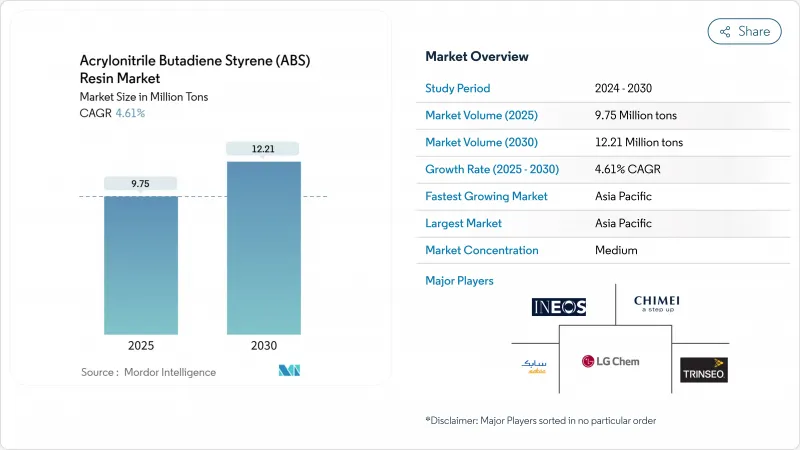

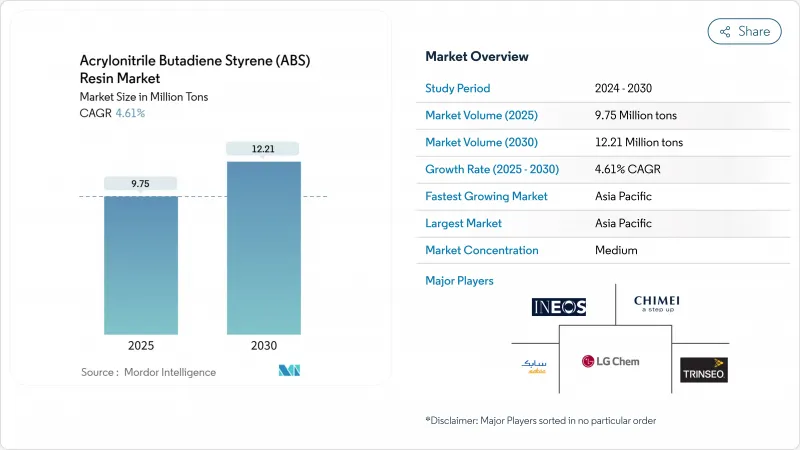

预计到 2025 年,丙烯腈丁二烯苯乙烯市场将达到 975 万吨,到 2030 年将达到 1,221 万吨,年复合成长率为 4.61%。

该树脂的强度重量比、耐化学腐蚀性和易加工性推动了其稳定的市场需求,并持续吸引汽车、电子和建筑等行业的大量用户。电动车平台目前指定使用增强型ABS树脂取代铝製支架和外壳,在保持结构完整性的前提下,重量最多可减轻40%,成本最多可降低20%。此外,该树脂与5G基础设施建设的紧密联繫,以及用于天线外壳的电镀型ABS树脂的应用,进一步拓展了其市场机会。

全球丙烯腈-丁二烯-苯乙烯(ABS)树脂市场趋势及洞察

电动交通平台的轻量化与金属替代

随着电动车设计师致力于减轻车重以增加续航里程,增强型ABS树脂正在大规模取代金属支架、管道和外壳。玻璃纤维增强型ABS树脂的抗拉强度超过75兆帕,重量却比铝轻40%,这与美国能源局提出的到2030年将轻型汽车重量减轻25%的目标相符。汽车製造商也指出,增强型ABS树脂可以降低模具成本并缩短生产週期,从而缩短专案推出时间。随着电池组製造商指定使用具有整合式紧固件和冷却通道的树脂外壳,丙烯腈-丁二烯-苯乙烯(ABS)市场也直接受益。

智慧家庭设备需要高光泽度和耐热等级

连网家庭设备必须机壳,并能承受接近 100 度C 的持续高温。家电製造商青睐光泽度高、耐热性强的 ABS 配方,这种配方能够保持尺寸精度,并在多年使用后仍能保持不变色。此外,该聚合物也适用于雷射蚀刻压印,无需二次加工即可实现无缝背光标识。较短的产品更新周期保证了较高的基准需求,使配方师能够加快配色服务。

电子元件中生物基聚合物的替代

家电品牌正越来越多地采用符合UL-94 V-0标准的无卤生物聚合物混合物,但其碳足迹却是ABS的七倍。欧洲的「永续性化学品策略」正在加强对石化衍生材料的审查,并引导采购指南朝着可再生材料的方向发展。美国品牌正在努力提升其ESG(环境、社会和治理)评分,提高了传统ABS的准入门槛,除非其含有再生材料。丙烯腈-丁二烯-苯乙烯(ABS)市场在成本、加工性和供应可靠性方面仍保持优势,但在高端市场份额正逐渐下降。

细分市场分析

至2024年,射出吹塑成型将占总产量的48%,并持续维持5.15%的年增长率。薄壁成型技术使品牌商能够在不影响性能的前提下减少树脂用量,从而提升其永续发展绩效。即时型腔压力回馈和随形冷却插件可将生产週期缩短高达18%,进而提高生产线运转率。

区域分析

到 2024 年,亚太地区将占丙烯腈-丁二烯-苯乙烯市场的 75%,预计到 2030 年将以每年 5.17% 的速度成长。中国拥有世界一流的裂解装置、丰富的混炼技术以及接近性高成长消费性电子中心的地理优势,这些因素共同支撑着供需。

北美市场需求稳定,但正转向高端产品。到2025年,平均每辆汽车将使用426磅塑料,其中ABS将用于内装、边框和尾灯模组。在欧洲,永续性政策正在提高汽车聚合物的回收目标,引导汽车製造商实现ABS的循环利用。同时,日益严格的排放法规也促使北欧加工厂更加重视合规性。

巴西的家电和汽车产业将支撑该地区的消费,而阿根廷和哥伦比亚正在探索将电子组装外包到近岸地区。波湾合作理事会国家将利用其原料优势和93%的产能运转率,从出口级原料转向本地化的片材和复合材料生产。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场驱动因素

- 电动交通平台的轻量化与金属替代

- 需要高光泽度和耐热性的智慧家庭设备

- 桌上型3D列印机在教育领域的快速普及

- 强制阻燃驾驶座部件

- 5G基础设施推动电涂装ABS的需求

- 市场限制

- 挥发性丙烯腈原料价格

- 电子元件中生物基聚合物的替代

- 北欧对加工厂的挥发性有机化合物(VOC)排放有严格的规定。

- 价值链分析

- 价格趋势

- 监理展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过加工技术

- 注塑吹塑成型

- 挤出吹塑成型

- 拉伸吹塑成型

- 按ABS等级

- 一般

- 高影响力

- 电镀

- 阻燃剂

- 耐热性

- 按最终用户行业划分

- 汽车与运输

- 电子学

- 消费品/家用电器

- 建造

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 泰国

- 越南

- 马来西亚

- 印尼

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 土耳其

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 埃及

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- BEPL

- CHIMEI

- ELIX POLYMERS

- Eni SpA

- Formosa Plastics Group

- INEOS

- JSR Corporation

- KUMHO PETROCHEMICAL

- LG Chem

- LOTTE Chemical Corporation

- NIPPON A&L INC.

- PetroChina Company Limited

- SABIC

- Shandong INEOS-YPC

- Techno-UMG Co., Ltd.

- TORAY INDUSTRIES, INC.

- TotalEnergies

- Trinseo

第七章 市场机会与未来展望

The acrylonitrile butadiene styrene market stood at 9.75 million tons in 2025 and is forecast to reach 12.21 million tons by 2030, advancing at a 4.61% CAGR.

Consistent demand stems from the resin's strength-to-weight ratio, chemical resistance, and ease of processing, qualities that continue to attract high-volume users in automotive, electronics, and construction. Electric-vehicle platforms now specify reinforced ABS grades to replace aluminum brackets and housings, saving up to 40% in weight and 20% in cost while preserving structural integrity. Tight coupling between 5 G infrastructure build-outs and electroplatable ABS grades for antenna housings further widens the resin's opportunity set.

Global Acrylonitrile Butadiene Styrene (ABS) Resin Market Trends and Insights

Lightweighting and Metal Replacement in E-Mobility Platforms

Electric-vehicle designers target mass reduction to extend driving range, and reinforced ABS grades are replacing metal brackets, ducts, and enclosures at scale. Glass-fiber-modified grades achieve tensile strengths above 75 MPa yet weigh 40% less than aluminum, aligning with the U.S. Department of Energy's goal of trimming 25% off light-duty vehicle curb weight by 2030. Automakers also cite lower tooling costs and faster cycle times, which compress program launch schedules. The acrylonitrile butadiene styrene market benefits directly as battery-pack makers specify resin housings that integrate fasteners and cooling channels.

Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

Connected home devices pack advanced processors into sleek casings that must withstand sustained temperatures near 100 °C. Appliance OEMs validate glossy, heat-stabilized ABS formulations that retain dimensional accuracy and resist discoloration over multi-year duty cycles. Brand owners also cite the polymer's compatibility with laser-etch debossing, enabling seamless back-lit logos without secondary operations. Short product-refresh cycles maintain high baseline demand and encourage formulators to accelerate color-match services.

Substitution by Bio-Based Polymers in Electronics

Consumer-electronics brands increasingly trial halogen-free biopolymer blends with carbon footprints seven times lower than ABS while still achieving UL-94 V-0 ratings. Europe's Chemicals Strategy for Sustainability tightens scrutiny on petrochemical-derived materials, nudging procurement guidelines toward renewable content. American brands pursue ESG scorecard improvements that raise evaluation hurdles for traditional ABS unless accompanied by recycled content. The acrylonitrile butadiene styrene market retains incumbency where cost, processability, and supply reliability still dominate, yet faces gradual displacement in premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Desktop 3-D Printers in Education

- Mandatory Flame-Retardant Cockpit Components

- Stringent Nordic VOC Limits on Processing Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Injection Blow Molding secured 48% of 2024 production volume and is growing 5.15% annually, reflecting its efficiency in turning pellets into complex parts with minimal post-processing. Thin-wall capability enables brand owners to cut resin usage without performance loss, supporting sustainability scorecards. Real-time cavity-pressure feedback and conformal-cooling inserts shave cycle times by up to 18%, translating into higher line uptime.

The Acrylonitrile Butadiene Styrene (ABS) Market Report Segments the Industry by Processing Technology (Injection Blow Molding, Extrusion Blow Molding, and More), ABS Grade (General-Purpose, High Impact, and More), End-User Industry (Automotive and Transportation, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific dominated the acrylonitrile butadiene styrene market with 75% volume in 2024 and will grow 5.17% annually through 2030. China anchors supply and demand by combining world-scale crackers, extensive compounding expertise, and proximity to high-growth consumer-electronics hubs.

North American demand is stable yet shifts toward premium grades. The average car built in 2025 contains 426 lb of plastics, with ABS supplying interior trims, bezels, and taillight modules. In Europe, policy-driven sustainability triggers higher recycled-content targets for automotive polymers, nudging OEMs toward circular ABS streams. Simultaneously, stricter emission controls in Nordic processing plants raise compliance.

Brazil's appliance and automotive sectors underpin regional consumption, while Argentina and Colombia explore near-shoring of electronics assembly. Gulf Cooperation Council states leverage feedstock advantage and a 93% capacity-utilization rate to pivot from export-grade feedstock to local sheet and compound production

- BEPL

- CHIMEI

- ELIX POLYMERS

- Eni S.p.A.

- Formosa Plastics Group

- INEOS

- JSR Corporation

- KUMHO PETROCHEMICAL

- LG Chem

- LOTTE Chemical Corporation

- NIPPON A&L INC.

- PetroChina Company Limited

- SABIC

- Shandong INEOS-YPC

- Techno-UMG Co., Ltd.

- TORAY INDUSTRIES, INC.

- TotalEnergies

- Trinseo

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Lightweighting and Metal Replacement in E-Mobility Platforms

- 4.1.2 Smart-Home Appliances Requiring High-Gloss Heat-Resistant Grades

- 4.1.3 Rapid Adoption of Desktop 3-D Printers in Education

- 4.1.4 Mandatory Flame-Retardant Cockpit Components

- 4.1.5 5G Infrastructure Driving Electroplatable ABS Demand

- 4.2 Market Restraints

- 4.2.1 Volatile Acrylonitrile Feedstock Prices

- 4.2.2 Substitution by Bio-based Polymers in Electronics

- 4.2.3 Stringent Nordic VOC Limits on Processing Plants

- 4.3 Value Chain Analysis

- 4.4 Pricing Trends

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Processing Technology

- 5.1.1 Injection Blow Molding

- 5.1.2 Extrusion Blow Molding

- 5.1.3 Injection Stretch Blow Molding

- 5.2 By ABS Grade

- 5.2.1 General-Purpose

- 5.2.2 High-Impact

- 5.2.3 Electro-plating

- 5.2.4 Flame-Retardant

- 5.2.5 Heat-Resistant

- 5.3 By End-user Industry

- 5.3.1 Automotive and Transportation

- 5.3.2 Electronics

- 5.3.3 Consumer Goods and Appliances

- 5.3.4 Construction

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Thailand

- 5.4.1.6 Vietnam

- 5.4.1.7 Malaysia

- 5.4.1.8 Indonesia

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Turkey

- 5.4.3.8 Nordics

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Qatar

- 5.4.5.4 Egypt

- 5.4.5.5 South Africa

- 5.4.5.6 Nigeria

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BEPL

- 6.4.2 CHIMEI

- 6.4.3 ELIX POLYMERS

- 6.4.4 Eni S.p.A.

- 6.4.5 Formosa Plastics Group

- 6.4.6 INEOS

- 6.4.7 JSR Corporation

- 6.4.8 KUMHO PETROCHEMICAL

- 6.4.9 LG Chem

- 6.4.10 LOTTE Chemical Corporation

- 6.4.11 NIPPON A&L INC.

- 6.4.12 PetroChina Company Limited

- 6.4.13 SABIC

- 6.4.14 Shandong INEOS-YPC

- 6.4.15 Techno-UMG Co., Ltd.

- 6.4.16 TORAY INDUSTRIES, INC.

- 6.4.17 TotalEnergies

- 6.4.18 Trinseo

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing usage of PC-ABS Resin in Industrial Applications