|

市场调查报告书

商品编码

1852171

发泡防火涂料:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Intumescent Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

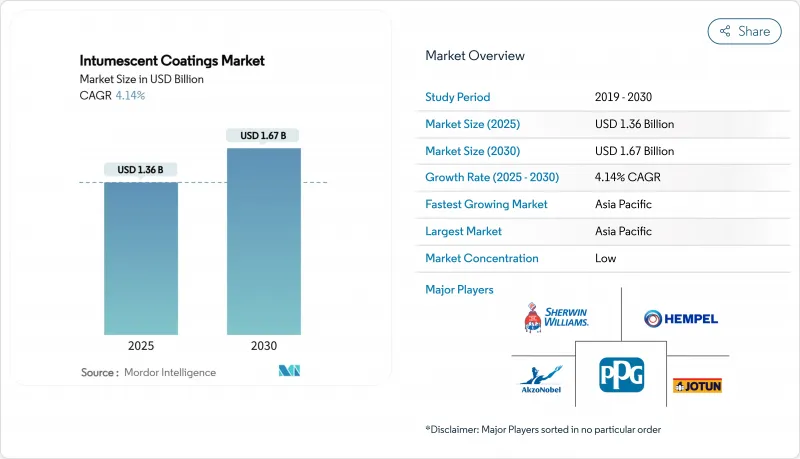

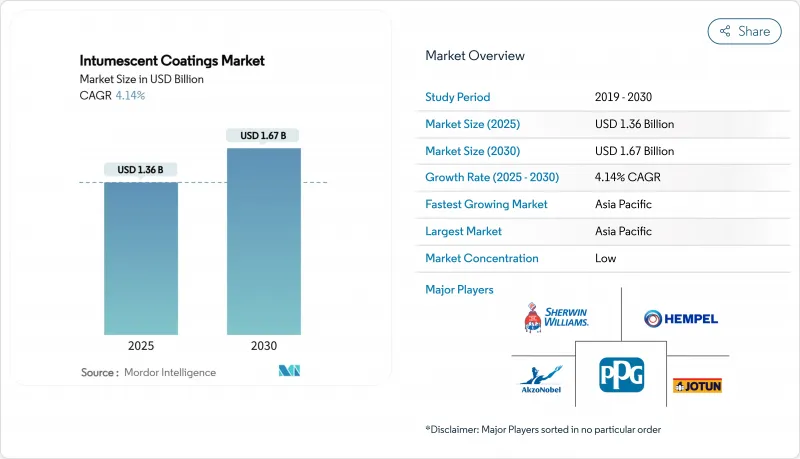

预计到 2025 年,发泡防火涂料市场规模将达到 13.6 亿美元,到 2030 年将达到 16.7 亿美元,在预测期(2025-2030 年)内,复合年增长率将达到 4.14%。

全球日益严格的消防安全标准、对更环保建筑材料的坚定支持,以及在不牺牲防护性能的前提下保持结构钢美观的需求,共同推动了膨胀型防火涂料的普及。需求成长并非爆发式成长,而是稳定上升,这种模式显示市场韧性源自于法规週期,而非投机性的建筑热潮。随着对挥发性有机化合物的监管限制促使投机者倾向于低气味解决方案,膨胀型防火涂料的市场份额可能会继续增长。在人口密集的城市、海上能源中心和模组化工厂,主动降低火灾风险的做法越来越受到重视,这推动了越来越多应用场景的出现,这些应用场景强调遇热炭化膨胀的薄膜。耐久性、快速固化和更薄涂层厚度等方面的技术进步,以及更长的产品使用寿命,正在推动发泡防火涂料市场的收入增长,这种增长反映的是每平方英尺使用寿命价值的提升,而非单纯的销售增长。

全球发泡防火涂料市场趋势及洞察

加速亚太地区高层建筑消防法规的製定

对于超过24公尺高的塔楼,新的建筑规范几乎强制要求使用薄膜涂层,这使得开发商能够在不增加结构重量的情况下获得两小时防火保护的产品。中国和印度的认证体系鼓励第三方测试,提高了进入门槛,使先驱者获得优势。随着摩天大楼数量的增加和逃生窗的加固,发泡防火涂料市场正蓬勃发展。符合当地规范的产品标籤供应商更容易进入竞标名单,而且核准通常涵盖多个计划阶段,从而提高了收入的可见性。

石油和天然气探勘活动成长

海上平台、液化天然气工厂和炼油厂必须应对超过1100°C的池火温度,这将推动碳氢化合物专用产品在2024年占据44.2%的市场份额。北美页岩气相关建设的蓬勃发展,使得涂料製造厂业务繁忙,并带动了环氧树脂填充薄膜的稳定订单。由于营运商重视单一合约的课责,供应和安装承包商的利润空间也随之扩大。一旦涂料通过UL1709等通讯协定测试,往往会在规范清单中保留多年,从而为发泡防火涂料市场带来持续的收入来源。

环氧树脂价格波动

原材料成本波动将对净利率构成压力,尤其是对于采购现货的亚洲生产商。多年期供应合约虽然能提供一定的缓衝,但无法完全消除原物料价格突然上涨所带来的风险。预算超支可能会延迟计划启动,或在规格允许的情况下导致产品替代,从而暂时减缓发泡防火涂料市场的成长。

细分市场分析

纤维素涂料将继续占据主导地位,占2024年收入的53%,即6.678亿美元,因为大量的商业和住宅钢材需要缓燃型防火保护。相对较低的价格使其适用于中高层建筑计划,而日益严格的法规并非唯一的驱动因素。建筑师认为,即使碳氢化合物的使用量快速成长,纤维素涂料的基准需求仍然强劲。相较之下,碳氢化合物标准化涂料累计将创造3.49亿美元的收入,到2030年以5.1%的复合年增长率成长,超过主要市场。这些产品必须经受喷射和池注试验,一旦EPC承包商批准了某个品牌,在计划进行过程中很少会更换。这种稳定性使得涂料可以进行更长的维护,并产生可预测的售后服务收入。因此,即使吨位较低,碳氢化合物涂料也能带来更高的单份合约收入,从而增强发泡防火涂料市场的价值集中度。

碳氢化合物薄膜的成长与墨西哥湾沿岸和中东地区的新建FPSO装置、LNG出口装置以及炼油厂升级改造直接相关。由于海上资产需要能够在热衝击下保持黏着性的涂层,环氧树脂系统仍然是首选平台。随着各国能源策略强调下游自给自足,发泡防火涂料在碳氢化合物应用领域的市场规模预计将会成长。同时,纤维素涂层生产线与日益密集的城市发展保持同步,裸露的钢材在城市中展现出现代美感。虽然这两种火灾场景的发展路径截然不同,但它们各自满足不同的安全需求,而非争夺同一市场空间,从而促进了整体应用。

至2024年,水性涂料将占总销售额的40%,年复合成长率达5.4%,引领低VOC建筑材料的发展趋势。水性涂料气味温和,可在租户居住期间进行涂装,简化了维修物流。这使得业主能够最大限度地减少停工成本,而停工成本往往被忽视,但却是促进重复购买的重要因素。溶剂型和混合型环氧树脂涂料具有优势,特别适用于需要在低温下快速固化的应用,例如海上和寒冷气候地区。然而,供应商正在不断优化溶剂配方,以确保VOC含量低于未来的监管基准值,这预示着溶剂型涂料的淘汰将是一个渐进的过程,而不是突然的变革。

随着监管限制的日益严格,规范制定者在评估技术时不仅关注其耐火性能,还关注其体积碳排放量。水性涂料在这两方面都获得了认可,促使计划工程师从传统的溶剂型涂料转向水性涂料。预计发泡防火涂料的市场规模将越来越受到生命週期评级的影响,该评级奖励从生产到应用过程中低排放的产品。混合环氧树脂除了具有机械强度外,其环境性能也日益受到认可,这表明性能和永续性目标正在逐步融合。

发泡防火涂料报告按应用领域(纤维素基、碳氢化合物基)、技术(溶剂型、水性、环氧基)、树脂类型(环氧树脂、丙烯酸树脂、聚氨酯等)、终端用户行业(建筑、汽车等)和地区(亚太地区、北美、欧洲等)对产业进行细分。市场预测以美元计价。

区域分析

预计亚太地区2024年的营收将达到4.41亿美元,占全球营收的35%,并预计到2030年将以5.8%的复合年增长率成长。中国在高层建筑安全和石化自给自足方面的双重目标,推动了纤维素和碳氢化合物两大类产品的强劲销售量。印度的智慧城市计画已将被动防火措施纳入市政竞标清单,实际上使其成为政府资助建造高层建筑的先决条件。在该地区建厂的製造商可以降低外汇风险,并享受有利于本土生产的税收优惠。

北美仍然是发泡防火涂料市场的核心。正如美国联邦公路管理局(FHWA)指南中所述,老旧桥樑需要进行不透水维修,而页岩气开采则推动了液化天然气(LNG)和管道建设等新项目的开发。以美元对冲的供应链降低了外汇风险,而广泛的现场服务网络则能够实现快速的检测和维修工作,从而抵消原材料价格波动的影响。模组化建筑的兴起也带来了新的需求,因为工厂喷涂工艺可以缩短工期。

在欧洲,源自《涂料指令》的强而有力法规鼓励水性涂料的创新。德国和斯堪地那维亚的绿色建筑标籤透过将原材料采购与隐含碳评分挂钩,进一步提升了市场需求。欧洲绿色新政的资金津贴木质素基添加剂的试点生产线,并鼓励供应商在其本地实验室测试生物基路线。因此,欧洲往往率先采用低碳涂料,随后这些涂料在全球推广,并进一步塑造市场竞争格局。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区高层建筑消防法规制定步伐加快

- 石油和天然气探勘活动成长

- 欧盟低VOC强制令促进水性配方的发展

- 北美模组化异地钢骨製造

- 改用环保涂料

- 市场限制

- 环氧树脂价格波动

- 发泡防火涂料高成本

- 来自其他消防方法的竞争

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过使用

- 纤维素

- 碳氢化合物

- 透过技术

- 溶剂型

- 水溶液

- 环氧树脂基

- 依树脂类型

- 环氧树脂

- 丙烯酸纤维

- 聚氨酯

- 醇酸

- 其他树脂

- 按最终用户行业划分

- 建造

- 石油和天然气

- 汽车与运输

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Akzo Nobel NV

- Albi Protective Coatings

- BASF

- Contego International Inc.

- Etex Group

- Flame-Stop Inc.

- Hempel A/S

- Hexion Inc.

- Huntsman International LLC

- Isolatek International

- Jotun

- No-Burn, Inc.

- PPG Industries, Inc.

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Co.

- Tremco Incorporated

第七章 市场机会与未来展望

The Intumescent Coatings Market size is estimated at USD 1.36 billion in 2025, and is expected to reach USD 1.67 billion by 2030, at a CAGR of 4.14% during the forecast period (2025-2030).

Adoption is anchored in stricter global fire-safety standards, a decisive shift toward greener building materials and the desire to keep structural steel visible without compromising protection. Demand increases are incremental rather than explosive, a pattern that hints at resilience built on code compliance cycles instead of speculative construction booms. Water-based chemistries already generate 40% of revenue, and regulatory limits on volatile organic compounds suggest this share will keep rising as specifiers prefer low-odor solutions. The growing preference for proactive fire-risk mitigation in high-density cities, offshore energy hubs and modular factories points to broad use cases that value thin films which expand into an insulating char when exposed to heat. Parallel innovation around durability, faster cure and lower applied thickness is extending product life, so revenue growth increasingly reflects a higher lifetime value per square foot rather than pure volume gains in the Intumescent coatings market.

Global Intumescent Coatings Market Trends and Insights

Accelerated High-Rise Fire Codes in Asia Pacific

New requirements for towers above 24 m make thin-film coatings nearly mandatory, giving developers products that deliver two-hour protection without adding structural weight. Certification regimes in China and India reward third-party testing, raising entry hurdles and giving early movers an edge. The Intumescent coatings market therefore enjoys a structural boost as skyline density grows and evacuation windows tighten. Suppliers that align product labels with local codes enter bid lists more easily, and approvals granted now often span multiple project phases, improving revenue visibility.

Growth in Oil and Gas Exploration Activities

Hydrocarbon-specialized products held 44.2% share in 2024 because offshore topsides, LNG plants and refineries must manage pool-fire temperatures above 1,100 °C. Shale-linked construction across North America keeps fabrication yards busy, sustaining a steady order flow of epoxy intumescent films. Contractors that bundle supply with installation achieve greater margin retention as operators value single-contract accountability. Once a coating wins protocol testing like UL 1709 it tends to remain on specification lists for years, supporting recurring income streams in the Intumescent coatings market.

Epoxy Resin Price Volatility

Fluctuations in raw material costs squeeze margins, especially for Asian producers that buy spot cargoes. Multi-year supply contracts provide partial insulation yet cannot eliminate exposure when feedstock prices spike quickly. Budget overruns may delay project starts or trigger product substitution where standards allow, temporarily slowing growth in the Intumescent coatings market.

Other drivers and restraints analyzed in the detailed report include:

- EU Low-VOC Mandate Boosting Water-Borne Formulations

- Modular Off-Site Steel Fabrication in North America

- High Cost of Intumescent Coatings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cellulosic coatings accounted for 53% of 2024 revenue equal to USD 667.8 million and continue to dominate because large volumes of commercial and residential steel require protection against slow-burn fires. Their relatively lower price broadens accessibility for mid-rise projects, so regulatory enforcement is not the sole driver. Architects see a clear cost-to-benefit ratio that supports repeat use, implying resilient baseline demand even if hydrocarbon volumes escalate faster. In contrast, hydrocarbon-rated lines generated USD 349 million yet are forecast to outpace the headline market with a 5.1% CAGR to 2030. These products must survive jet-fire and pool-fire testing, and once an EPC firm qualifies a brand it rarely changes mid-project. That stickiness locks in extended maintenance work, creating predictable after-sales income. The hydrocarbon subset therefore raises revenue per contract even if tonnage remains lower, reinforcing value concentration within the Intumescent coatings market.

The stronger growth rate in hydrocarbon films ties directly to new FPSO units, LNG export trains and refining upgrades in the Gulf Coast and Middle East. Offshore assets demand coatings that adhere under thermal shock, so epoxy systems remain the default platform. The Intumescent coatings market size for hydrocarbon applications is projected to climb as national energy strategies focus on downstream self-sufficiency. Cellulosic lines, meanwhile, keep pace with densifying cities where exposed steel delivers modern aesthetics. Together, the two fire scenarios carve distinct paths, but each strengthens overall penetration because they address separate safety imperatives rather than competing for the same square footage.

Water-borne solutions held 40% of 2024 revenue and are advancing at a 5.4% CAGR, leading the push toward low-VOC construction practices. Their absence of strong odor permits coating while tenants remain in place, a practical gain that simplifies refurbishment logistics. Building owners thus minimize downtime costs, an overlooked yet significant driver of repeat purchasing. Solvent-based and hybrid epoxy chemistries still account for the balance, favored where rapid cure at low temperature is mandatory, particularly offshore or in cold climates. Even so, suppliers tweak solvent blends to push VOC levels below future regulatory thresholds, signaling an evolutionary rather than abrupt phase-out.

As regulatory ceilings tighten, specifiers benchmark technologies not only on fire endurance but also on embodied carbon. Water-based films score well on both counts, encouraging project engineers to switch from older solvent types. The Intumescent coatings market size is expected to be increasingly influenced by lifecycle assessments that reward low emissions from manufacturing through application. Hybrid epoxies retain altitude by offering mechanical robustness plus improved environmental scores, illustrating a gradual convergence of performance and sustainability objectives.

The Intumescent Coatings Report Segments the Industry by Application (Cellulosic, Hydrocarbon), Technology (Solvent Based, Water Based, Epoxy Based), Resin Type (Epoxy, Acrylic, Polyurethane and More), End-User Industry (Construction, Automotive and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific generated USD 441 million or 35% of global revenue in 2024 and is forecast to climb at 5.8% CAGR through 2030. China enforces dual goals of high-rise safety and petrochemical self-reliance, underpinning steady volume in both cellulosic and hydrocarbon categories. India's Smart Cities program embeds passive fire protection into municipal tender checklists, effectively making intumescent supply a prerequisite for state-funded towers. Producers that localize factories in the region mitigate exchange-rate risk and capture tax incentives that favor domestic manufacturing.

North America remains a core pillar of the Intumescent coatings market. The shale play drives fresh LNG and pipeline assets while an aging bridge stock invites intumescent retrofits referenced in FHWA guidelines. Supply chains hedged in USD reduce currency exposure, and broad field-service networks enable rapid inspection and remedial work that offset raw-material swings. Modular construction adds a new demand layer, since factory spraying compresses build schedules.

Europe demonstrates strong regulatory pull derived from the Paints Directive, which rewards water-borne innovations. German and Scandinavian green-building labels amplify demand by linking procurement to embodied carbon scoring. Funding under the European Green Deal subsidizes pilot lines for lignin-based additives, encouraging suppliers to test bio-based routes inside regional labs. As a result, Europe often becomes the first adopter of low-carbon grades that later scale globally, further shaping the competitive direction of the Intumescent coatings market.

- Akzo Nobel N.V.

- Albi Protective Coatings

- BASF

- Contego International Inc.

- Etex Group

- Flame-Stop Inc.

- Hempel A/S

- Hexion Inc.

- Huntsman International LLC

- Isolatek International

- Jotun

- No-Burn, Inc.

- PPG Industries, Inc.

- RPM International Inc.

- Teknos Group

- The Sherwin-Williams Co.

- Tremco Incorporated

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated High-Rise Fire Codes in Asia Pacific

- 4.2.2 Growth in the Oil and Gas Exploration Activities

- 4.2.3 EU Low-VOC Mandate Boosting Water-Borne Formulations

- 4.2.4 Modular Off-Site Steel Fabrication in North America

- 4.2.5 Shift Toward Environmentally Friendly Coatings

- 4.3 Market Restraints

- 4.3.1 Epoxy Resin Price Volatility

- 4.3.2 High Cost of Intumescent Coatings

- 4.3.3 Competition from Alternative Fire Protection Methods

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Cellulosic

- 5.1.2 Hydrocarbon

- 5.2 By Technology

- 5.2.1 Solvent-Based

- 5.2.2 Water-Based

- 5.2.3 Epoxy Based

- 5.3 By Resin Type

- 5.3.1 Epoxy

- 5.3.2 Acrylic

- 5.3.3 Polyurethane

- 5.3.4 Alkyd

- 5.3.5 Other Resins

- 5.4 By End-user Industry

- 5.4.1 Construction

- 5.4.2 Oil and Gas

- 5.4.3 Automotive and Transportation

- 5.4.4 Other End-user Industries

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Albi Protective Coatings

- 6.4.3 BASF

- 6.4.4 Contego International Inc.

- 6.4.5 Etex Group

- 6.4.6 Flame-Stop Inc.

- 6.4.7 Hempel A/S

- 6.4.8 Hexion Inc.

- 6.4.9 Huntsman International LLC

- 6.4.10 Isolatek International

- 6.4.11 Jotun

- 6.4.12 No-Burn, Inc.

- 6.4.13 PPG Industries, Inc.

- 6.4.14 RPM International Inc.

- 6.4.15 Teknos Group

- 6.4.16 The Sherwin-Williams Co.

- 6.4.17 Tremco Incorporated

7 Market Opportunities & Future Outlook

- 7.1 White-Space and Unmet-Need Assessment