|

市场调查报告书

商品编码

1852179

包装黏合剂:市场份额分析、行业趋势、统计数据和成长预测(2025-2030 年)Packaging Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

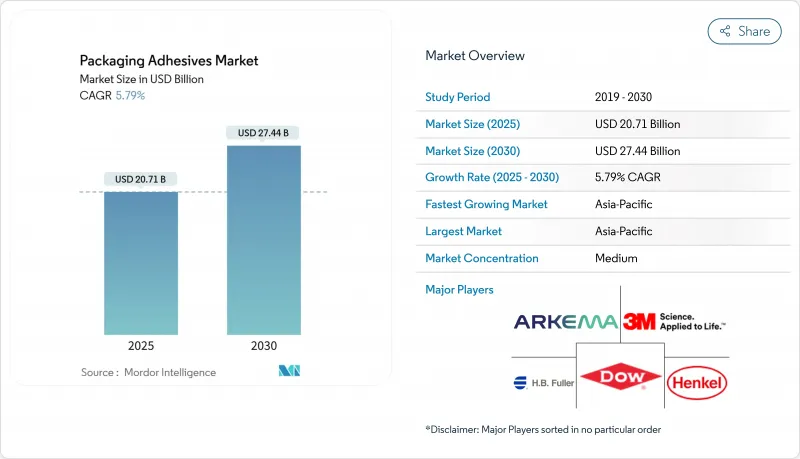

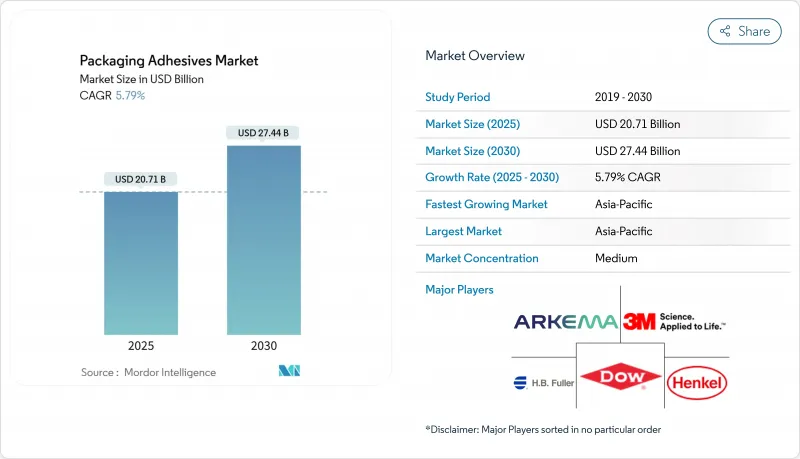

预计到 2025 年,包装黏合剂市场规模将达到 207.1 亿美元,到 2030 年将达到 274.4 亿美元,预测期(2025-2030 年)复合年增长率为 5.79%。

成长主要由四大支柱驱动:已调理食品销售不断增长、蓬勃发展的电子商务市场对防篡改密封的需求日益增长、挥发性有机化合物 (VOC)排放的监管压力以及生物基化学品的快速普及。水性配方占总销售量的一半以上,因为它们在满足日益严格的空气品质法规的同时,又不影响黏合强度。同时,热熔胶生产线在对生产线速度要求极高的自动化履约中心中持续扩大市场份额。从区域来看,亚太地区受益于生产规模的扩大和公共部门对回收基础设施的投资;北美地区致力于利用工艺创新;欧洲则推行循环经济规则,推动了对可重复使用或可堆肥等级产品的需求。由于主要化学品製造商在价格敏感的环境中寻求差异化竞争,并透过收购、合作研发和范围 3 碳排放目标来实现差异化,因此竞争格局依然较为温和。

全球包装黏合剂市场趋势与洞察

食品和饮料行业的需求不断增长

包装黏合剂市场受阻隔性和延长保质期需求的驱动,推动了饮料、乳製品和已调理食品等行业的新产品上市。生产商目前指定使用经过转型测试、符合多项地区法规且可在较低生产线温度下运作以节省能源的黏合剂等级。汉高生物基黏合剂 Technomelt Supra 079 Eco Cool 预计将于 2024 年上市,其可再生含量高达 49%,可将运行温度降低 40°C,从而减少 32% 的二氧化碳排放,并可与纸纤维无缝回收。类似的节能特性正帮助大型瓶装企业实现官方设定的气候变迁目标。

人们对食品安全的意识日益增强

世界各地的监管机构正在阻塞间接食品接触核准的漏洞。中国的GB 4806.15-2024标准引入了392种黏合剂物质的正面表列、标籤检视要求和迁移限量,该标准将于2025年2月8日生效。同时,美国食品药物管理局)将于2024年初逐步淘汰含全氟烷基和多氟烷基物质(PFAS)的防油化学品,迫使加工商对不含氟的替代品进行认证。由此带来的合规负担促使多区域黏合配方的出现,从而简化了出口市场的文件要求。

严格的政府法规

挥发性有机化合物(VOC)的监管力道持续收紧。新泽西州2024年的法律草案将消费性黏合剂中VOC的允许含量降低至7%,而加州的法规全面禁止了47种有害空气污染物。欧盟2024/3190号法规禁止在食品包装中使用双酚A,促使配方师转向水性或紫外线固化型替代品。合规成本上升,但早期采用者可以透过获得低排放认证标籤来获得定价权。

细分市场分析

到2024年,水性系统将占据包装黏合剂市场57.19%的份额(按以销售额为准),这反映了加工商为实现无溶剂生产目标而提出的需求。预计此主导地位将以6.04%的复合年增长率成长,显着超越溶剂型系统。快速干燥的丙烯酸分散体现在可在室温下黏合多层薄膜,从而缩短烘箱停留时间。同时,改良的流变改性剂在高速狭缝涂布机中保持轮胎边缘形状,无需添加稳定剂即可提高生产效率。热熔树脂紧随其后,这得益于仓库自动化系统可实现快速安装,而诸如可再生原料聚烯主炼等创新技术正在缩小其与水性树脂在碳排放方面的差距。

欧洲和北美严格的监管确保了市场需求的长期稳定。即将推出的经合组织指南将量化生命週期排放,迫使品牌所有者选择能够揭露工厂层级排放数据的供应商。因此,水性胶合剂生产线将能够同时供应大众市场瓦楞纸板和高端柔性复合材料,从而巩固技术领导者在2030年前包装胶合剂市场的主导地位。溶剂型胶黏剂仍将服务于一些特定的高温应用领域,但除非经过再加工製成超低VOC混合物,否则其市场份额可能会随着时间的推移而下降。

到2024年,EVA将占据包装胶合剂市场30.51%的份额,这主要得益于其优异的性价比和与多种基材的兼容性。 EVA的应用包括纸盒密封、杂誌封脊黏合和防篡改标籤,并且可以大规模生产。为了克服其热敏性缺点,供应商目前正将其与茂金属聚乙烯组分混合,以提高热黏性,并在树脂价格波动的情况下维持利润率。生物基EVA虽然目前销售仍较低,但随着甘蔗衍生单体的规模化生产,其复合年增长率可望达到6.71%。波士特(Bostik)的60%生物基氰基丙烯酸酯产品系列可快速黏合高价值包装,同时减少温室气体排放,其他主要公司也正在寻求效仿。

投资者对范围3揭露的审查正在加速这项转型。以科学为导向的跨国公司正在筛选供应商,要求其提供现场可再生能源和物料平衡认证,并将生产规模转向生物基创新企业。同时,丙烯酸酯和聚氨酯在对耐化学性和柔韧性要求极高的行业仍然至关重要,并保持中等个位数的成长。这种化学成分组合既维持了市场竞争,也促进了创新。

区域分析

亚太地区占包装胶合剂市场份额的40.19%,复合年增长率高达6.51%,位居全球之首。中国加工商正投资高速复合生产线,以满足单份饮料的上市需求;印度瓦楞纸板生产商则在增设水性涂布生产线,以发展区域履约。日本品牌商正致力于研发已烹调午餐盒的阻隔膜,从而催生了对室温固化的低迁移聚氨酯分散体的需求。各国包装废弃物法规,例如中国2023年对包装膜层数的限制,正迫使胶合剂供应商开发即使在较薄的基材上也不会剥落的胶合剂。电子商务的日益普及将进一步推动热熔胶棒和增强型胶带的市场成长。

北美在技术应用方面始终引领潮流。美国环保署的采购框架引用了40多个私人环保标籤,并指导联邦机构使用低挥发性有机化合物(VOC)和再生材料製成的包装。这促使信封封口和军用食材自煮包的需求转向水性及生物基产品。一家美国大型纸盒製造商目前正在试验使用妥尔油基物料平衡EVA,旨在透过客户评分卡展示可衡量的碳减排效果。加拿大2021-2028年VOC减量计画的下一个目标是工业黏合剂,敦促当地配方商加快溶剂替代。

欧洲在监管方面仍处于领先地位,2024/3190 号法规禁止在食品接触材料中使用双酚 A,为间接食品接触黏合剂设定了新标准。德国的 DIN CERTCO 认证可堆肥复合材料,法国的 AGEC 方法仍然推广需要超薄黏合层的单一材料软包装。东欧工厂正利用这项转变,在西方品牌精简产能之际,积极参与代工生产竞争。以巴西为首的南美洲市场呈现稳健的中个位数成长,各大连锁超市纷纷扩大自有品牌零食产品线,并使用热熔 EVA 混合物密封的包装袋。规模较小的中东和非洲市场,沙乌地阿拉伯的酪农产业和南非的水果出口业务需求不断增长,为湿固化聚氨酯热熔胶在低温运输物流领域的应用创造了空间。

总体而言,地域多元化正在缓衝包装黏合剂市场免受区域性经济衰退的影响。那些将全球监管资讯与本地技术服务相结合的供应商,透过为海湾市场配製符合清真标准的成分或针对赤道地区湿度水平定制黏合剂,正在创造显着价值。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 食品和饮料行业的需求不断增长

- 人们对食品安全的意识日益增强

- 黏合配方方面的技术进步

- 电子商务产业的需求不断增长

- 零售和消费品产业的扩张

- 市场限制

- 严格的政府法规

- 原物料价格波动

- VOC排放问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过技术

- 水溶液

- 溶剂型

- 热熔胶

- 通过树脂化学

- 丙烯酸纤维

- 聚氨酯

- 乙烯-醋酸乙烯酯共聚物(EVA)

- 苯乙烯基嵌段共聚物

- 天然/生物基

- 透过使用

- 软包装

- 折迭式纸盒和包装盒

- 标籤和胶带

- 密封

- 其他用途(纸巾及毛巾包装、印刷、特殊用途)

- 按最终用途行业划分

- 食品和饮料

- 製药和医疗保健

- 个人护理和化妆品

- 工业和消费品

- 电子商务与零售履约

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Dow

- Dymax

- Franklin International

- HB Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Paramelt

- Sonoco Products Company

- Synthomer plc

- Wacker Chemie AG

第七章 市场机会与未来展望

The Packaging Adhesives Market size is estimated at USD 20.71 billion in 2025, and is expected to reach USD 27.44 billion by 2030, at a CAGR of 5.79% during the forecast period (2025-2030).

Growth rests on four pillars: rising volumes of ready-to-eat food, an e-commerce boom that prioritizes tamper-evident sealing, regulatory pressure on volatile organic compound (VOC) emissions, and rapid uptake of bio-based chemistries. Water-based formulations command more than half of all revenue because they meet tightening air-quality rules without compromising bond strength, while hot-melt lines keep gaining share in automated fulfillment centers that demand quicker line speeds. Regionally, Asia-Pacific benefits from manufacturing scale and public-sector investment in recycling infrastructure, North America monetizes process innovation, and Europe enforces circular-economy rules that lift demand for repulpable or compostable grades. Competitive intensity stays moderate as large chemical producers use acquisitions, joint R&D, and scope-3 carbon targets to differentiate in an otherwise price-sensitive landscape.

Global Packaging Adhesives Market Trends and Insights

Growing Demand from the Food & Beverage Sector

Demand for barrier integrity and extended shelf life keeps the packaging adhesives market aligned with new product launches in beverages, dairy, and ready meals. Producers now specify migration-tested grades that pass multi-regional rules while running at lower line temperatures to save energy. Henkel's bio-based Technomelt Supra 079 Eco Cool, commercialized in 2024, contains 49% renewable content and cuts operating heat by 40 °C, which translates to 32% lower CO2 emissions and seamless recyclability with paper fibers. Similar energy-saving profiles help large bottlers achieve public climate milestones.

Increasing Awareness of Food Safety

Global regulators are closing loopholes in indirect-food-contact approvals. China's GB 4806.15-2024 introduces positive lists for 392 adhesive substances, mandatory labeling, and migration limits that apply on 8 February 2025. In parallel, the U.S. Food & Drug Administration phased out PFAS grease-proofing chemistries in early 2024, compelling converters to qualify non-fluorinated alternatives. The resulting compliance burden spurs multi-regional adhesive formulations that simplify documentation across export markets.

Stringent Government Regulations

VOC caps continue to tighten. New Jersey's 2024 draft lowers allowable VOCs in consumer adhesives to 7%, while California's rulebook bans 47 toxic air contaminants outright. European Union Regulation 2024/3190 removes Bisphenol A from food packaging, driving formulators to water-based or UV-cured alternatives. Compliance costs rise, yet early adopters gain pricing power through certified low-emission labels.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advances in Adhesive Chemistry

- E-Commerce Packaging Requirements

- Fluctuating Raw Material Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Water-based systems held a 57.19% share of the packaging adhesives market in 2024 on revenue terms, reflecting converters' need to meet zero-solvent production targets. This dominance will expand at a 6.04% CAGR, far ahead of solvent-borne analogues. Fast-drying acrylic dispersions now bond multilayer films at room temperature, lowering oven dwell times. In parallel, upgraded rheology modifiers preserve bead shape on high-speed slot coaters, elevating throughput without adding stabilizers. Hot-melt chemistries rank a close second because warehouse automation favors instant set-up; innovations such as renewable-sourced polyolefin backbones shrink the carbon gap with water-based peers.

Stringent rules across Europe and North America guarantee demand longevity. As upcoming OECD guidelines quantify life-cycle emissions, brand owners lock in suppliers that disclose plant-level emissions data. Consequently, water-based lines are positioned to supply both mass-market corrugate and premium flexible laminates, reinforcing the packaging adhesives market size advantage of technology leaders through 2030. Solvent-based players will still serve niche high-temperature applications but face gradual erosion unless they reformulate toward ultra-low VOC blends.

EVA accounted for 30.51% of the packaging adhesives market size in 2024, underpinned by favorable cost-to-performance ratios and compatibility with diverse substrates. Its role in carton sealing, magazine spine gluing, and tamper-evident labeling sustains high volumes. To counter thermal sensitivity drawbacks, suppliers now blend metallocene polyethylene segments for stronger hot-tack, safeguarding margins as resin prices swing. Bio-based grades, although smaller in volume, are on track for a 6.71% CAGR as sugar-cane-derived monomers scale. Bostik's 60% bio-content cyanoacrylate line brings instant adhesion to high-value packages while cutting greenhouse-gas footprints, a template other majors aim to replicate.

Investor scrutiny of scope-3 disclosures speeds the transition. Multinationals with science-based targets screen vendors for on-site renewable energy and mass-balance certification, reallocating volume toward bio-based innovators. In parallel, acrylics and polyurethanes remain indispensable where chemical resistance or flexibility is vital, maintaining mid-single-digit growth. Collectively, this chemistry mix ensures the packaging adhesives market remains both competitive and innovation-rich.

The Packaging Adhesives Market Report Segments the Industry by Technology (Water-Based, Solvent-Based, and Hot-Melt), Resin Chemistry (Acrylics, Polyurethanes, and More), Application (Flexible Packaging, Folding Cartons and Boxes, and More), End-Use Industry (Food and Beverage, Pharmaceuticals and Healthcare, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated 2024 revenue with a 40.19% stake in the packaging adhesives market and is set to advance at the highest 6.51% CAGR. Chinese converters invest in high-speed lamination to keep pace with single-serve beverage launches, while Indian corrugators add water-based coating lines to tap regional fulfilment hubs. Japan's brand owners innovate barrier films for ready-to-eat bento boxes, creating demand for low-migration polyurethane dispersions that cure at room temperature. National packaging waste rules-such as China's 2023 mandate capping excessive wrap layers-force adhesive suppliers to engineer bonds that survive thinner substrates without delamination. Growing adoption of e-commerce across ASEAN economies adds further upside for hot-melt sticks and reinforced gummed tapes.

North America remains a trendsetter in technology adoption. The Environmental Protection Agency's purchasing framework references over 40 private ecolabels, steering federal agencies toward low-VOC and recycled-content packs. This shifts demand toward water-based and bio-based grades across envelope closures and military meal kits. Large-scale carton makers in the United States now trial mass-balance EVA derived from tall-oil feedstocks, aiming to show measurable carbon reductions in customer scorecards. Canada's 2021-2028 VOC reduction agenda targets industrial adhesives next, pushing local formulators to accelerate solvent replacement.

Europe remains the regulatory bellwether, with the ban on Bisphenol A in food contact materials under Regulation 2024/3190 setting a new baseline for indirect-food-contact adhesives. Germany's DIN CERTCO certifies compostable laminates, while France's AGEC law drives mono-material flexible packs that still require ultra-thin tie layers. Eastern European plants leverage this shift to compete for contract manufacturing as Western brands rationalize capacity. South America, led by Brazil, exhibits solid mid-single-digit growth because grocery chains extend private-label snack lines that use sachets sealed with hot-melt EVA blends. Although smaller, the Middle East and Africa witness rising demand in Saudi Arabia's dairy sector and South Africa's fruit export operations, opening space for moisture-cure polyurethane hot melts that handle cold-chain logistics.

Collectively, geographic diversification cushions the packaging adhesives market from localized downturns. Suppliers blending global regulatory intelligence with localized technical service capture outsized value by formulating halal-compliant raw materials for Gulf markets or tuning tackifiers for sub-equatorial humidity levels.

- 3M

- Arkema

- Ashland

- Avery Dennison Corporation

- Dow

- Dymax

- Franklin International

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jowat SE

- Paramelt

- Sonoco Products Company

- Synthomer plc

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from the Food and Beverage Industry

- 4.2.2 Increasing Awareness for Food Safety

- 4.2.3 Technological Advancements in Adhesive Formulations

- 4.2.4 Growing Demand form the E-commerce industry

- 4.2.5 Expansion of Retail and Consumer Good Sector

- 4.3 Market Restraints

- 4.3.1 Stringent Government Regulations

- 4.3.2 Fluctiations in Raw Material Prices

- 4.3.3 Concerns of VOC Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Water-based

- 5.1.2 Solvent-based

- 5.1.3 Hot-Melt

- 5.2 By Resin Chemistry

- 5.2.1 Acrylics

- 5.2.2 Polyurethanes

- 5.2.3 Ethylene-Vinyl Acetate (EVA)

- 5.2.4 Styrenic Block Copolymers

- 5.2.5 Natural/Bio-based

- 5.3 By Application

- 5.3.1 Flexible Packaging

- 5.3.2 Folding Cartons and Boxes

- 5.3.3 Labels and Tapes

- 5.3.4 Sealing

- 5.3.5 Other Applications (Tissue and Towel Over-wrap, Graphics and Specialty)

- 5.4 By End-Use Industry

- 5.4.1 Food and Beverage

- 5.4.2 Pharmaceuticals and Healthcare

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Industrial and Consumer Goods

- 5.4.5 E-Commerce Retail Fulfilment

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 ASEAN Countries

- 5.5.1.6 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3M

- 6.4.2 Arkema

- 6.4.3 Ashland

- 6.4.4 Avery Dennison Corporation

- 6.4.5 Dow

- 6.4.6 Dymax

- 6.4.7 Franklin International

- 6.4.8 H.B. Fuller Company

- 6.4.9 Henkel AG & Co. KGaA

- 6.4.10 Jowat SE

- 6.4.11 Paramelt

- 6.4.12 Sonoco Products Company

- 6.4.13 Synthomer plc

- 6.4.14 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment