|

市场调查报告书

商品编码

1852192

氢氧化锂:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030)Lithium Hydroxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

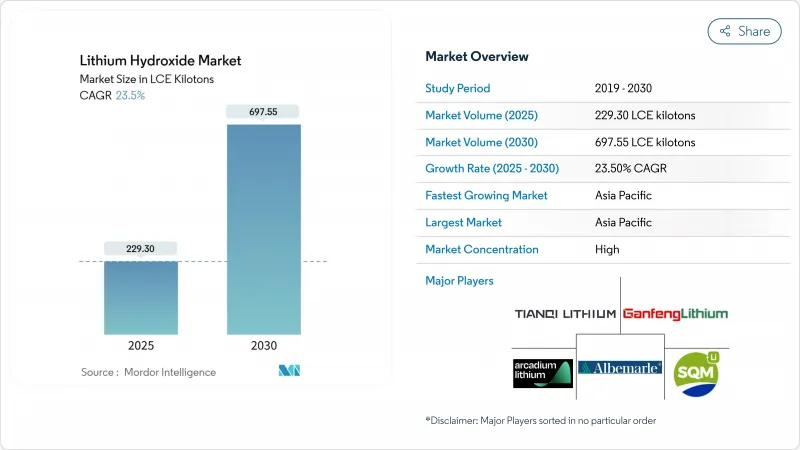

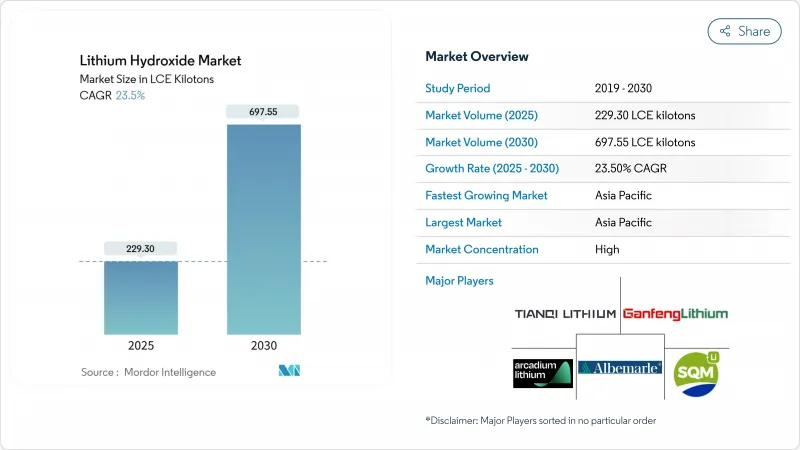

预计到 2025 年,氢氧化锂市场规模将达到 229.30 千吨 LCE,到 2030 年将达到 697.55 千吨 LCE,在预测期(2025-2030 年)内复合年增长率为 23.5%。

电池化学品市场竞争加剧、电动车销售激增以及直接锂提取(DLE)技术的快速规模化应用,正在重塑全球供应链格局。亚太地区是最大的消费区域,占全球消费量的40%,预计到2030年将以27.66%的年增长率成为成长最快的地区。汽车製造商已签署长期采购合同,有效期至2024年,以确保高纯度原料的供应;多家电池製造商也加快了垂直整合策略,以规避价格波动风险。同时,原物料价格的波动仍为计划融资模式带来挑战,预计到2023年,原物料价格将从每吨81,500美元跌至每吨22,500美元。

全球氢氧化锂市场趋势与洞察

电动工具的需求增加

在建筑和工业维护领域,无线电动工具正日益取代有线工具,因为锂离子电池组具有更长的运作时间和更高的功率重量比。製造商正在推出针对高放电循环次数优化的电池规格,并倾向于采用富含氢氧化锂的镍钴锰正极材料。北美和欧洲的专业承包商对无线工具的需求最为旺盛,因为劳动市场紧张,生产效率的提升至关重要。随着建筑资讯模型(BIM)工作流程的不断普及,工人们需要在工地上拥有不受束缚的移动性,无线工具的普及速度将进一步加快。虽然这一细分市场的需求量不如电动车,但对于供应特殊正极材料的氢氧化物製造商而言,其利润空间却高于平均水准。

直接锂萃取(DLE)的商业化释放低成本原料的潜力

在IBAT位于犹他州的工厂,采用模组化吸附柱的现场规模试验表明,锂的回收率在几小时内即可达到80-90%,而传统的池塘蒸发法则需要数月时间。位于加州的ATLiS计划获得了13.6亿美元的有条件贷款担保,用于每年从地热卤水中生产2万吨氢氧化锂,这印证了贷款方对DLE公司扩充性的信心。更高的产量降低了每吨产品的资本密集度,并使在缺水地区也能运作成为可能,因为许多离子交换和薄膜分离技术消费量的补充水量比池塘法更少。这些经济优势增强了氢氧化锂市场的长期供应前景,同时减少了对环境的影响。

高昂的生产成本

电池级氢氧化锂工厂需要精密的杂质控制和昂贵的结晶迴路。雅宝公司已取消位于澳洲凯默顿工厂的扩建计划,使其原计划产能减半,现场员工人数减少40%。多年的投资回收期、严格的环境授权以及有限的湿式冶金人才储备,都构成了高准入门槛,并减缓了新厂建设的步伐,尤其是在能源价格较高的地区。

细分市场分析

预计到2024年,锂离子电池将占氢氧化锂市场需求的63%,并在2030年之前以26.77%的复合年增长率成长。光是这一领域就占据了氢氧化锂市场规模的最大份额,预计也将是吨位成长最快的领域。镍钴锰(NCM)和镍钴铝(NCA)等以范围为导向的化学体系,由于其合成需要氢氧化锂而非碳酸盐,因此支撑了结构性需求。相较之下,润滑脂、空气净化系统和特殊合成预计将稳定贡献,但贡献幅度不大。欧盟日益严格的回收规定预计将在预测期后期建立二次供应管道,从而缓解而非取代原生需求。

储能部署是成长最快的子应用领域。大型电池电站与可再生能源资产结合,需要具有长循环寿命的化学材料。例如,加州的多吉瓦时储能装置等计划越来越多地采用富镍正极材料,从而增加了氢氧化锂的消耗量。随着成本的下降,规模较小的商业和工业用户电錶后端係统也加入了这一行列,确保氢氧化锂市场保持多元化成长,涵盖固定式和行动应用。

预计到2024年,电池级材料将占据70%的市场份额,复合年增长率(CAGR)为25.55%。对钠、钙和重金属杂质含量的严格监管,支撑了电池级材料与技术级材料之间的价格差异。像Livent这样的製造商正在加大对重结晶和离子交换模组的投资,以实现总杂质含量低于100 ppm的目标。这项投资增加了资本密集度,但也加剧了市场竞争。技术级材料主要面向对杂质含量阈值较为宽鬆的润滑脂和陶瓷市场,而工业级材料则主要面向水处理和特定合成过程。

随着OEM厂商规格的不断提高,电池级氢氧化锂的市占率将持续成长。新一代固态和高硅负极设计依赖精确的化学计量比和超低的含水量,从而提升了产品品质的溢价。拥有内部精炼能力的垂直整合型盐水或硬岩原料生产商最能掌握这项利润空间。

氢氧化锂市场报告按应用(锂离子电池、润滑脂、其他)、终端用户行业(汽车、家用电器、其他)、等级(电池级、技术级、工业级)、形态(一水合物、无水物)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行细分。

区域分析

亚太地区预计到2024年将占据40%的氢氧化锂市场份额,这得益于其无可比拟的电池製造能力以及下游正极、负极和电池组组装的密集丛集。中国目前的政策方针优先考虑国产化率,并鼓励大力开发内陆盐沼资源和吸引外资;而日本和韩国则凭藉其在材料科学领域的长期优势保持竞争力。印度也加入了竞争,在2025-2026财年联邦预算中推出了国家製造业发展计划,并对关键矿产实行关税豁免,从而刺激了本土氢氧化锂转化提案。

北美地区的扩张取决于一项重要的资金支持计划。美国能源部已向雅宝公司拨款1.5亿美元,用于支持其位于金斯山的锂辉石选矿厂建设,该选矿厂每年可供应160万辆电动车所需的锂辉石。现代汽车集团和SK安集团已核准在乔治亚建造一座价值50亿美元的电池工厂,以满足该地区对本地氢氧化物阴极材料的需求。这些倡议旨在减少对亚洲供应链的依赖,并符合美国《通膨控制法案》的采购标准。

南美洲仍然是重要的锂供应中心。智利的国家锂策略在维持国家监管的同时,吸引了私人企业的参与,新的地质勘测使蕴藏量估计值提高了28%。阿根廷吸引了力拓集团25亿美元的矿业投资,并获得了许多汽车製造商的订单。预计到2024年,巴西的电动车销量将激增85%,其中比亚迪占70%的市场份额,显示未来巴西国内对氢氧化物转化的需求日益增长。

欧洲正透过严格的二氧化碳排放法规和全面的回收强制措施来加速产能扩张。德国在下一代正极材料的研发方面处于领先地位,欧盟电池法规规定了自2025年起锂回收的最低配额。预计到2027年,芬兰、法国和葡萄牙将有多家待开发区的转化工厂运作,将丰富氢氧化锂市场的供应基础。追求战略自主的地区可能会重新调整贸易流向,尤其是在中国实施拟议的技术出口管制措施的情况下。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 电动车需求不断成长

- 电动工具的需求增加

- 直接锂萃取 (DLE) 的商业化释放了低成本氢氧化物原料的潜力

- 透过长期OEM合约降低拉丁美洲新增氢氧化物产能的风险

- 支持电池供应链的政府政策

- 市场限制

- 高昂的生产成本

- 原物料价格波动阻碍计划资金筹措

- 人们越来越关注毒性问题

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(数量与价值)

- 透过使用

- 锂离子电池

- 润滑脂

- 纯化

- 其他用途(聚合物、特殊化学合成)

- 按最终用途行业划分

- 车

- 消费性电子产品

- 能源储存系统

- 其他(工业机械/非道路机械)

- 按年级

- 电池等级(LiOH*H2O 含量 56.5% 或更高)

- 技术级

- 工业级

- 按形式

- 一水合物

- 无水

- 按地区

- 亚太地区

- 中国

- 日本

- 韩国

- 印度

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Albemarle Corporation

- Arcadium Lithium

- Chengxin Lithium

- Ganfeng Lithium Group Co. Ltd.

- IGO Limited

- LevertonHELM Limited

- Nemaska Lithium(Investissement Quebec)

- Piedmont Lithium Inc.

- Shandong Ruifu Lithium Co., Ltd.

- Sinomine Resource Group

- SQM SA

- Tianqi Lithium Corporation

- Yahua Industrial Group Co.

第七章 市场机会与未来展望

The Lithium Hydroxide Market size is estimated at 229.30 LCE kilotons in 2025, and is expected to reach 697.55 LCE kilotons by 2030, at a CAGR of 23.5% during the forecast period (2025-2030).

Intensifying competition for battery-grade chemicals, fast-rising electric vehicle (EV) sales, and the rapid scale-up of direct lithium extraction (DLE) technologies are reshaping supply networks worldwide. Asia-Pacific commands the largest regional position with 40% of global consumption, delivering the fastest growth rate of 27.66% through 2030. Automakers locked in long-term procurement contracts in 2024 to secure high-purity feedstock, and several battery manufacturers accelerated vertical-integration strategies to hedge price swings. At the same time, stark feedstock price volatility-from USD 81,500/t to USD 22,500/t during 2023-continues to challenge project finance models.

Global Lithium Hydroxide Market Trends and Insights

Increasing Demand for Power Tools

Cordless power tools are replacing corded alternatives in construction and industrial maintenance because lithium-ion packs deliver longer run-time and a superior power-to-weight ratio. Manufacturers have launched cell formats optimized for high-discharge cycles, a profile that favors lithium hydroxide-rich nickel-cobalt-manganese cathodes. Uptake is strongest among professional contractors in North America and Europe, where tight labor markets place a premium on productivity gains. Continuous adoption of building-information-modeling workflows further accelerates cordless tool penetration because crews require untethered mobility on-site. Though smaller than EV demand, this niche yields above-average price realization for hydroxide producers supplying specialty cathode blends.

Commercialization of Direct Lithium Extraction (DLE) Unlocking Low-Cost Feedstock

Field-scale success at IBAT's Utah plant, utilizing modular adsorption columns, demonstrated 80-90% lithium recovery in hours versus the months needed for conventional pond evaporation. Project ATLiS in California secured a USD 1.36 billion conditional loan guarantee to deliver 20,000 t/y of lithium hydroxide from geothermal brine, affirming lender confidence in DLE scalability. Higher yields cut capital intensity per ton and enable operations in water-stressed regions because many ion-exchange and membrane variants consume less make-up water than pond systems. These economics bolster the long-run supply outlook for the lithium hydroxide market while reducing environmental footprints.

High Production Costs

Battery-grade lithium hydroxide plants demand sophisticated impurity control and costly crystallization circuits. Albemarle halted expansion of its Kemerton facility in Australia, slicing planned nameplate capacity in half and reducing onsite headcount by 40%. Multiyear payback periods, strict environmental licensing, and a limited pool of hydro-metallurgical talent maintain high entry barriers and slow new-build momentum, especially in regions with elevated energy tariffs.

Other drivers and restraints analyzed in the detailed report include:

- OEM-Backed Long-Term Contracts De-Risking New Capacity in Latin America

- Government Policies Supporting Battery Supply Chains

- Feedstock Price Volatility Hindering Project Financing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lithium-ion batteries generated 63% of 2024 demand and are forecast to expand at 26.77% CAGR through 2030. This segment alone accounts for the largest slice of the lithium hydroxide market size and delivers the highest incremental tonnage. Range-oriented chemistries such as nickel-cobalt-manganese (NCM) and nickel-cobalt-aluminum (NCA) require lithium hydroxide for synthesis rather than carbonate, anchoring structural demand. In contrast, lubricating greases, purified-air systems, and specialty synthesis remain steady but modest contributors. Growing recycling mandates in the European Union are expected to generate a secondary supply channel later in the forecast period, tempering but not displacing primary demand.

Energy storage deployments form the fastest-rising sub-application. Large-scale battery farms linked to renewable assets need long cycle-life chemistries. Projects such as California's multi-gigawatt-hour installations increasingly specify nickel-rich cathodes, reinforcing hydroxide consumption. As costs decline, smaller commercial and industrial behind-the-meter systems join the opportunity set, ensuring the lithium hydroxide market retains a diversified growth engine across stationary and mobile domains.

Battery-grade material held a commanding 70% share in 2024 and posts a forecast 25.55% CAGR, the highest within this segmentation. Stringent impurity controls on sodium, calcium, and heavy metals underpin price differentials over technical grade. Manufacturers such as Livent have invested in additional recrystallization and ion-exchange modules to achieve less than 100 ppm aggregate impurity limits. That investment raises capital intensity but also deepens competitive moats. Technical grade serves grease and ceramic markets where tolerance thresholds are looser, while industrial grade addresses water treatment and select synthesis routes.

The lithium hydroxide market share for battery-grade will keep rising as OEM specification sheets lengthen. Next-generation solid-state and high-silicon-anode designs rely on precise stoichiometry and ultra-low moisture content, factors that amplify quality premiums. Producers with vertically integrated brine or hard-rock feedstock plus in-house purification are best placed to capture this margin pool.

The Lithium Hydroxide Market Report is Segmented by Application (Lithium-Ion Batteries, Lubricating Grease, and More), End-Use Industry (Automotive, Consumer Electronics, and More), Grade (Battery Grade, Technical Grade, and Industrial Grade), Form (Monohydrate and Anhydrous), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific, with a 40% lithium hydroxide market share in 2024, benefits from unrivaled cell-manufacturing capacity and a dense cluster of downstream cathode, anode, and pack assemblers. Chinese policy directives now favor domestic sourcing, prompting active development of inland salt-lake brine as well as overseas equity stakes, while Japan and South Korea leverage long-standing material science expertise to stay competitive. India entered the fray with a National Manufacturing Mission and duty exemptions for critical minerals under the 2025-26 Union Budget, stimulating local hydroxide conversion proposals.

North America's expansion rests on large-scale funding packages. The DOE's USD 150 million grant to Albemarle supports a spodumene concentrator at Kings Mountain capable of feeding 1.6 million EVs annually. Hyundai Motor Group and SK On approved a USD 5 billion battery cell plant in Georgia, anchoring regional cathode demand for locally produced hydroxide. These initiatives aim to cut reliance on Asian supply chains and meet US Inflation Reduction Act sourcing thresholds.

South America remains the primary feedstock hub. Chile's National Lithium Strategy invites private participation while safeguarding state oversight, and new geological surveys lifted estimated reserves by 28%. Argentina attracted Rio Tinto's USD 2.5 billion mine investment and multiple OEM offtakes. Brazil saw EV sales jump 85% in 2024, led by BYD with 70% share, hinting at future domestic hydroxide conversion requirements.

Europe accelerates capacity with stringent CO2 regulations and comprehensive recycling mandates. Germany spearheads R&D on next-generation cathodes, while the EU Battery Regulation sets minimum lithium recovery quotas from 2025 onward. Several greenfield conversion plants in Finland, France, and Portugal are scheduled for commissioning by 2027, adding diversity to the lithium hydroxide market supply base. The bloc's push for strategic autonomy may reshape trade flows, especially if China enacts proposed technology export restrictions.

- Albemarle Corporation

- Arcadium Lithium

- Chengxin Lithium

- Ganfeng Lithium Group Co. Ltd.

- IGO Limited

- LevertonHELM Limited

- Nemaska Lithium (Investissement Quebec)

- Piedmont Lithium Inc.

- Shandong Ruifu Lithium Co., Ltd.

- Sinomine Resource Group

- SQM S.A.

- Tianqi Lithium Corporation

- Yahua Industrial Group Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Electric Vehicles

- 4.2.2 Increasing Demand for Power Tools

- 4.2.3 Commercialisation of Direct Lithium Extraction (DLE) Unlocking Low-Cost Hydroxide Feedstock

- 4.2.4 OEM-Backed Long-Term Contracts De-Risking New Hydroxide Capacity in Latin America

- 4.2.5 Government Policies Supporting Battery Supply Chains

- 4.3 Market Restraints

- 4.3.1 High Production Costs

- 4.3.2 Feedstock Price Volatility Hindering Project Financing

- 4.3.3 Rising concern About the Toxicity

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume and Value)

- 5.1 By Application

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lubricating Greases

- 5.1.3 Purification

- 5.1.4 Other Application (Polymer and Specialty Chemical Synthesis)

- 5.2 By End-use Industry

- 5.2.1 Automotive

- 5.2.2 Consumer Electronics

- 5.2.3 Energy Storage Systems

- 5.2.4 Others (Industrial and Off-Road Machinery)

- 5.3 By Grade

- 5.3.1 Battery Grade (Greater than or equal to 56.5% LiOH*H2O)

- 5.3.2 Technical Grade

- 5.3.3 Industrial Grade

- 5.4 By Form

- 5.4.1 Monohydrate

- 5.4.2 Anhydrous

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 Japan

- 5.5.1.3 South Korea

- 5.5.1.4 India

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordics

- 5.5.3.7 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Chile

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arcadium Lithium

- 6.4.3 Chengxin Lithium

- 6.4.4 Ganfeng Lithium Group Co. Ltd.

- 6.4.5 IGO Limited

- 6.4.6 LevertonHELM Limited

- 6.4.7 Nemaska Lithium (Investissement Quebec)

- 6.4.8 Piedmont Lithium Inc.

- 6.4.9 Shandong Ruifu Lithium Co., Ltd.

- 6.4.10 Sinomine Resource Group

- 6.4.11 SQM S.A.

- 6.4.12 Tianqi Lithium Corporation

- 6.4.13 Yahua Industrial Group Co.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Rising Demand for Portable Electronic Devices