|

市场调查报告书

商品编码

1852204

分子育种:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Molecular Breeding - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

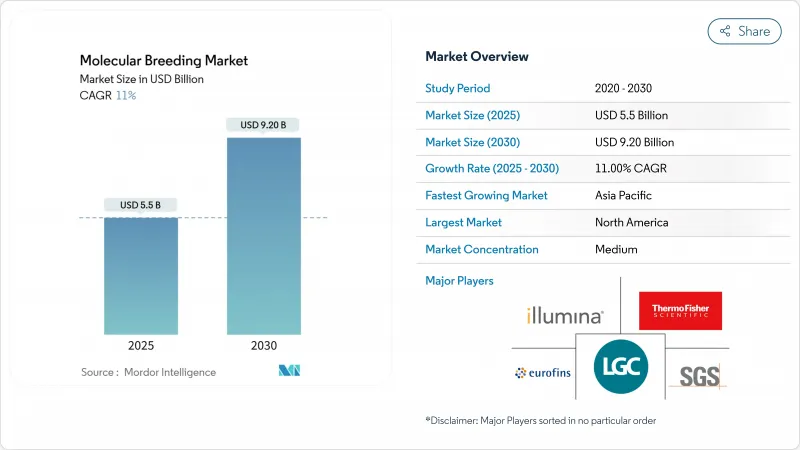

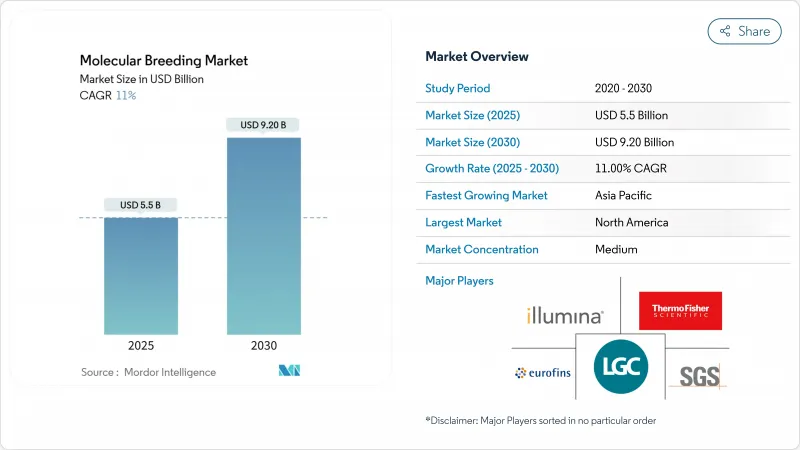

预计到 2025 年分子育种市场规模将达到 55 亿美元,到 2030 年将达到 92 亿美元,年复合成长率为 11.0%。

将人工智慧应用于基因组选择,可将育种週期从数年缩短至数月,进而提高产品开发效率。美国「适应性作物与土壤愿景」和印度「国家粮食安全行动计画」等政府倡议,正在推动对气候适应作物的需求。高通量表型分析、定序成本降低以及基因分型服务的普及,将进一步促进市场扩张。儘管北美在研究基础设施方面仍保持优势,但亚太地区由于监管改革和粮食安全需求,展现出巨大的成长潜力。

全球分子育种市场趋势与洞察

扩大生物技术研发资金

该市场的公共和私人支出正在迅速增长。赛默飞世尔科技公司在2023年投资13亿美元研发,推动次世代定序仪和试剂的创新,以降低中型育种者的进入门槛。美国的数据标准化计画正在协调基因组数据集,避免重复测试,并缩短产品上市时间。此类资本投资降低了中小企业的合规门槛,并使新型性状的开发者能够规避监管要求。此外,诸如国际农业研究咨询组织(CGIAR)4亿美元的营养重点项目等多边倡议正在调动捐助资金,以加速生物强化工作。

对产量、抗气候变迁作物的需求日益增长

在印度,一种能够抵御创纪录高温、百日成熟期的小麦品种已经上市,耐热耐旱基因型也正从试验阶段走向商业化种植。日本的研究中心正在开发适应盐碱和水分胁迫条件的藜麦和大豆品种,以维持易受气候变迁影响国家的产量水准。如今,植物育种的重点已不再局限于产量优化,而是扩展到多重胁迫耐受性,这就需要使用能够整合生产力和环境适应性的多重分子标记。极端天气事件目前每季造成的作物损失高达数十亿美元,也带来了巨大的经济影响,因此,投资气候适应种子组合的回报也随之提高。

监管核准繁琐且缓慢

每项新性状的合规成本可能高达1,500万美元,约占整体研发预算的一半,限制了小型创新者的参与。欧盟对生物技术作物的限制促使企业将目光转向监管环境较为宽鬆的市场,例如美国和巴西。儘管阿根廷、乌拉圭和泰国已于2024年更新了相关法规并简化了核准,但监管方面的不确定性仍然会延长审批时间并增加资金筹措成本。

细分市场分析

到2024年,植物应用将占分子育种市场63%的份额,这主要得益于基因组选择技术在玉米、小麦和大豆育种计画的应用。畜牧业正以13.1%的复合年增长率成长,这主要得益于基因组育种值在乳牛优于传统评估方法,以及基于CRISPR技术的抗病猪的培育。诸如Angus SteerSELECT之类的工具,在预测重要胴体性状方面展现出超过0.72的准确率,从而提高了育肥场的盈利并吸引了投资。

家禽业正在利用精准编辑技术对繁殖和生长基因进行编辑,以缩短世代间隔。此外,儘管目前猪育种中整合代谢组学和基因组学模型的效果有限,但在提高日均增重方面展现出潜力。这些市场发展趋势表明,到2030年,畜牧业有望显着提升其在分子育种市场中的份额。

到2024年,单核苷酸多态性(SNP)将占分子育种市场规模的42%,并保持13.2%的复合年增长率,这主要得益于其与高通量平台的兼容性以及全基因组关联分析(GWAS)输出的提升。单位成本的下降正在消除先前简单序列重复所具有的价格优势,从而鼓励开发中国家的专案直接采用SNP解决方案。 RNA-seq和ATAC-seq资料的功能性变异面板的引入,已使酪农蛋白性状的育种准确率提高了3个百分点,证明了该技术的可靠性。

随着SNP工作流程的标准化,表达序列标籤和其他传统标记主要用于表达谱分析等特定应用。 SNP的日益普及将提升资料互通性,这对于人工智慧育种系统的发展至关重要。

区域分析

2024年,北美将占据分子育种市场36%的份额,这得益于其先进的研究基础设施和高效的法律规范。累计2024年营收将达43.3亿美元的Illumina公司已与LGC Biosearch Technologies公司合作,以增强其针对作物和畜牧业的标靶基因分型定序能力。美国SECURE规则简化了基因编辑产品的核准流程,巩固了Illumina在该地区的市场领先地位。

亚太地区拥有最高的成长潜力,预计到2030年将以12.1%的复合年增长率成长。中国将于2024年核准抗病基因编辑小麦,印度的监管更新将简化某些基因组编辑的核准,并加速私人育种倡议。日本分级监管体系和对作物逆境研究的重视使其成为该地区的重要枢纽。政府资金和私人创业投资的共同作用正在加强该地区的育种基础设施,以满足粮食安全需求。

儘管受到监管限制,欧洲仍保持着重要的市场份额。欧盟环境委员会于2024年底核准了新的基因组技术立法,这标誌着欧盟正朝着基于风险的评估方向发展。英国的《精准育种法案》已正式生效,该法案建立了两级安全审查体系,旨在加速基因编辑作物的测试。瑞士也在实施类似的监管改革。市场发展将取决于政策走向,市场对符合欧洲绿色新政永续性要求的品种需求强劲。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 扩大生物技术研发资金

- 对产量、抗气候变迁作物的需求日益增长

- 快速采用精准育种及表型分析平台

- 政府支持的粮食安全措施

- 结合人工智慧和基因组选择

- 低投入品种的碳信用奖励

- 市场限制

- 监管核准繁琐且缓慢

- 定序和基因型鉴定基础设施的高资本成本

- 育种者取得可互通资料平台的管道有限

- 社会对「分子改造」种子的担忧

- 监管环境

- 技术展望

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 透过使用

- 植物

- 家畜

- 其他用途

- 按标记类型

- 简单序列重复(SSR)

- 单核苷酸多态性(SNP)

- 表达序列标籤(EST)

- 其他标记

- 透过育种过程

- 标记辅助选择(MAS)

- 数量性状基因(QTL)定位

- 标记辅助回交

- 基因组选择

- 按目标特征

- 产量增加

- 抗虫害

- 生物压力耐受性

- 品质和营养特性

- 最终用户

- 种子和作物保护公司

- 畜牧公司

- 学术和政府研究机构

- 独立繁殖服务提供者

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲国家

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- LGC Limited(Cinven)

- Eurofins Scientific

- SGS SA

- Agilent Technologies, Inc.

- DanBred P/S

- LemnaTec GmbH(Nynomic AG)

- Charles River Laboratories

- Intertek Group plc

- KeyGene NV

- Syngenta AG

- Corteva Agriscience

- Bayer AG

- BASF SE

- Sequentia Biotech SL

- Hudson Alpha

第七章 市场机会与未来展望

The molecular breeding market attained USD 5.5 billion in 2025 and is projected to reach USD 9.2 billion by 2030, registering a CAGR of 11.0%.

The incorporation of artificial intelligence with genomic selection has reduced breeding cycles from years to months, enhancing product development efficiency. Government initiatives, including the U.S. Vision for Adapted Crops and Soils and India's National Action Plan on Food Security, are driving demand for climate-resilient crop varieties. Market expansion is facilitated by high-throughput phenotyping, decreased sequencing costs, and accessible genotyping services. While North America retains its advantage in research infrastructure, the Asia-Pacific region demonstrates substantial growth potential due to regulatory reforms and food security requirements.

Global Molecular Breeding Market Trends and Insights

Expanding Biotechnology Research and Development Funding

Private and public spending in the market is increasing rapidly. Thermo Fisher invested USD 1.3 billion in research and development in 2023 to advance next-generation sequencing and reagent innovation, reducing entry costs for midsized breeders. The U.S. Department of Agriculture's data-standards programs are harmonizing genomic datasets, preventing redundant trials, and reducing time-to-market. These capital investments have decreased compliance barriers for smaller firms, enabling novel trait developers to navigate regulatory requirements. Additionally, multilateral initiatives, such as CGIAR's USD 400 million nutrition-focused portfolio, are attracting donor funds and accelerating biofortification outcomes.

Growing Demand for High-Yield, Climate-Resilient Crops

India's release of 100-day wheat varieties capable of withstanding record temperatures has enabled heat- and drought-tolerant genotypes to advance from pilot to commercial scale. Japanese research centers are developing quinoa and soybean varieties adapted to saline and water-stress conditions to maintain production levels in climate-vulnerable countries. Plant breeding priorities now extend beyond yield optimization to include multistress tolerance, necessitating the use of multiplexed molecular markers that integrate productivity with environmental resilience. The financial implications are significant, as extreme weather events currently cause crop losses worth billions of USD per season, increasing the return on investment for climate-resilient seed portfolios.

Stringent, Slow-Moving Regulatory Approvals

The compliance cost per new trait can reach USD 15 million, consuming approximately half of the total development budgets and deterring smaller innovators. The European Union's regulation of gene-edited crops under GMO legislation drives companies to focus on markets with favorable regulations, such as the United States and Brazil. While Argentina, Uruguay, and Thailand updated their regulations in 2024 to simplify approvals, regulatory uncertainty continues to extend timelines and increase financing costs.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Precision Breeding and Phenotyping Platforms

- Government-Backed Food Security Initiatives

- High Capital Cost of Sequencing and Genotyping Infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plant applications accounted for 63% of the molecular breeding market in 2024, primarily through genomic selection implementation in maize, wheat, and soybean breeding programs. The livestock segment is experiencing growth at a 13.1% CAGR, driven by genomic breeding values that demonstrate superior performance compared to traditional estimates in dairy cattle and CRISPR-based disease-resistant pig development. Tools such as Angus SteerSELECT have demonstrated prediction accuracies exceeding 0.72 for critical carcass traits, enhancing feedlot profitability and attracting investment.

The poultry sector is implementing precision editing of fertility and growth genes to reduce generation intervals. Furthermore, integrated metabolomic and genomic models in swine breeding demonstrate potential for improving average daily gain, despite current modest outcomes. These developments indicate that the livestock segment may substantially increase its contribution to the molecular breeding market by 2030.

Single nucleotide polymorphisms (SNPs) accounted for 42% of the molecular breeding market size in 2024 and maintain a 13.2% CAGR due to their compatibility with high-throughput platforms and enhanced genome-wide association outputs. The reduction in unit costs has diminished the price advantage previously held by simple sequence repeats, prompting developing-country programs to adopt SNP solutions directly. The implementation of functional-variant panels from RNA-seq and ATAC-seq data has improved breeding accuracies by 3 percentage points in dairy-protein traits, demonstrating the technology's reliability.

The standardization of SNP workflows has positioned express sequence tags and other traditional markers primarily in specialized applications such as expression profiling. The increased adoption of SNPs enhances data interoperability, which is fundamental for developing AI-enabled breeding systems.

The Molecular Breeding Market Report is Segmented by Application (Plant, Livestock, and More), by Marker Type (Simple Sequence Repeats (SSR), and More), by Breeding Process (Marker-Assisted Selection (MAS), and More), by Trait Target (Yield Enhancement, and More), by End-User (Seed and Crop-Protection Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 36% of the molecular breeding market share in 2024, supported by advanced research infrastructure and efficient regulatory frameworks. Illumina reported USD 4.33 billion revenue in 2024 and has partnered with LGC Biosearch Technologies to increase targeted genotyping-by-sequencing capabilities for row-crop and livestock segments. The USDA's SECURE rule streamlines the approval process for gene-edited products, maintaining the region's market leadership.

Asia-Pacific demonstrates the highest growth potential with a projected 12.1% CAGR through 2030. China approved disease-resistant gene-edited wheat in 2024, while India's regulatory updates streamline approvals for specific genome edits, accelerating private breeding initiatives. Japan's tiered regulatory system and focus on crop-stress research establishes it as a key regional hub. The combination of government funding and private venture capital is strengthening the region's breeding infrastructure to address food security needs.

Europe maintains significant market presence despite regulatory constraints. The EU Environment Committee's approval of new genomic technology legislation in late 2024 indicates movement toward risk-based assessment. The UK implemented the Precision Breeding Act, establishing a two-tier safety review system to expedite gene-edited crop trials. Switzerland is implementing similar regulatory changes. Market growth depends on policy developments, with substantial demand for varieties meeting European Green Deal sustainability requirements.

- Illumina, Inc.

- Thermo Fisher Scientific Inc.

- LGC Limited (Cinven)

- Eurofins Scientific

- SGS SA

- Agilent Technologies, Inc.

- DanBred P/S

- LemnaTec GmbH (Nynomic AG)

- Charles River Laboratories

- Intertek Group plc

- KeyGene NV

- Syngenta AG

- Corteva Agriscience

- Bayer AG

- BASF SE

- Sequentia Biotech SL

- Hudson Alpha

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding Biotechnology Research and Development Funding

- 4.2.2 Growing Demand for High-Yield, Climate-Resilient Crops

- 4.2.3 Rapid Adoption of Precision Breeding and Phenotyping Platforms

- 4.2.4 Government-Backed Food Security Initiatives

- 4.2.5 Convergence of AI and Genomic Selection

- 4.2.6 Carbon-Credit Incentives for Low-Input Cultivars

- 4.3 Market Restraints

- 4.3.1 Stringent, Slow-Moving Regulatory Approvals

- 4.3.2 High Capital Cost of Sequencing and Genotyping Infrastructure

- 4.3.3 Limited Breeder Access to Interoperable Data Platforms

- 4.3.4 Public Perception Concerns Over "Molecular-Modified" Seeds

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Application

- 5.1.1 Plant

- 5.1.2 Livestock

- 5.1.3 Other Application

- 5.2 By Marker Type

- 5.2.1 Simple Sequence Repeats (SSR)

- 5.2.2 Single Nucleotide Polymorphisms (SNP)

- 5.2.3 Expressed Sequence Tags (EST)

- 5.2.4 Other Markers

- 5.3 By Breeding Process

- 5.3.1 Marker-Assisted Selection (MAS)

- 5.3.2 Quantitative Trait Loci (QTL) Mapping

- 5.3.3 Marker-Assisted Back-Crossing

- 5.3.4 Genomic Selection

- 5.4 By Trait Target

- 5.4.1 Yield Enhancement

- 5.4.2 Disease and Pest Resistance

- 5.4.3 Abiotic Stress Tolerance

- 5.4.4 Quality and Nutritional Traits

- 5.5 By End-User

- 5.5.1 Seed and Crop-Protection Companies

- 5.5.2 Livestock Breeding Firms

- 5.5.3 Academic and Government Research Institutes

- 5.5.4 Independent Breeding Service Providers

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Russia

- 5.6.2.5 Spain

- 5.6.2.6 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Illumina, Inc.

- 6.4.2 Thermo Fisher Scientific Inc.

- 6.4.3 LGC Limited (Cinven)

- 6.4.4 Eurofins Scientific

- 6.4.5 SGS SA

- 6.4.6 Agilent Technologies, Inc.

- 6.4.7 DanBred P/S

- 6.4.8 LemnaTec GmbH (Nynomic AG)

- 6.4.9 Charles River Laboratories

- 6.4.10 Intertek Group plc

- 6.4.11 KeyGene NV

- 6.4.12 Syngenta AG

- 6.4.13 Corteva Agriscience

- 6.4.14 Bayer AG

- 6.4.15 BASF SE

- 6.4.16 Sequentia Biotech SL

- 6.4.17 Hudson Alpha