|

市场调查报告书

商品编码

1905981

不织布:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Non-woven Fabric - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

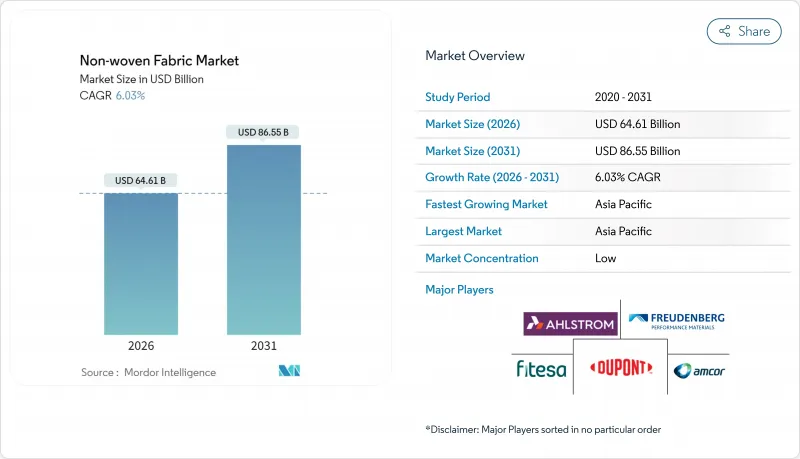

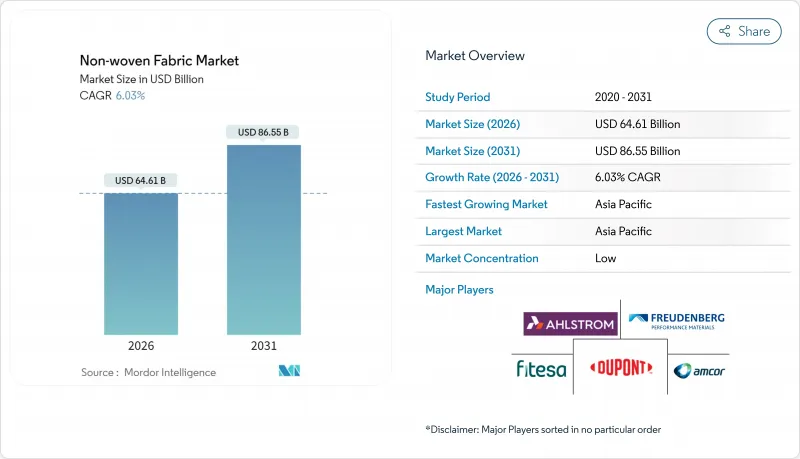

2025年,不织布市场价值为609.3亿美元,预计到2031年将达到865.5亿美元,而2026年为646.1亿美元。

预测期(2026-2031 年)的复合年增长率预计为 6.03%。

医疗、建筑和汽车行业的持续需求不断推动纺粘生产线的投资,而静电纺丝奈米纤维技术的进步则在创伤护理、过滤和固态电池隔膜等领域开闢了高端细分市场。儘管丙烯原料价格上涨,聚丙烯基产品仍比机织织物更具成本优势,有助于加工商维持利润。有关微塑胶洩漏和可回收包装的监管趋势正在重塑产品设计,使其朝着可生物降解或循环利用的方向发展,推动人造丝、Lyocell纤维和天然纤维混纺成为主流规格。

全球不织布市场趋势与洞察

一次性卫生用品需求激增

亚太地区部分地区出生率的快速增长以及北美和欧洲人口老化的持续加剧,推动了轻质高吸水性不织布一次性尿布、成人失禁垫片和女性用卫生用品的销量增长。采用可控蒸气渗透膜和高吸水性芯材的智慧创伤护理基材正从试验阶段走向大规模生产,有助于改善伤口癒合并减少换药次数。製造商正在采用结合纺粘层和熔喷层的结构,以优化液体处理性能,同时保持基材重量轻。这种结构使加工商能够在不牺牲性能的前提下满足价格要求。品牌所有者也倾向于使用无氯绒毛浆和生物基黏合剂,以满足零售商的永续发展标准。预计到2020年代中期,这些趋势将进一步推动不织布织布在卫生用品领域的市场成长。

医疗个人防护装备和创伤护理的快速应用

疫情期间,医院供应链面临供不应求,对具有认证阻隔性能的口罩、罩衣和手术铺巾的库存需求不断增长。美国国家职业安全与健康研究所 (NIOSH) 的 2020-2030 年目标强调美国紧急生产能力,鼓励投资于具有即时品质监控的高产量熔纺复合材料。基于聚酰亚胺和聚醚醚酮 (PEEK) 的静电纺丝奈米纤维具有高耐热性,适用于动力空气净化呼吸器和植入式医疗设备。含有银奈米颗粒和生长因子的多功能伤口敷料在临床前研究中显示超过 99.99% 的细菌减少率和促进上皮化的作用。评估住院时间缩短情况的保险报销制度改革将进一步推动对能够降低感染风险和缩短癒合时间的高级不织布的需求。

PP和PET价格波动

炼油厂意外停产和新丙烯产能运作延迟导致供应紧张,预计2025年初南亚聚丙烯合约价格将上涨每吨10-20美元。同时,由于需绕道红海运输,运费附加费增加,导致交付主要加工中心的成本上升。 PET市场也呈现类似趋势,由于价差为负,中国和欧洲生产商纷纷关闭老旧聚合物生产线。这些价格波动挤压了与卫生用品品牌商签订固定价格供应合约的加工商的利润空间,促使他们探索树脂避险和材料替代策略。

细分市场分析

到2025年,纺粘不织布将占不织布市场52.88%的份额,这反映了其高产能以及在卫生层压材料、医用罩衣和地工织物的卓越适用性。技术创新方面,引入了重量控制扫描器和封闭回路型空气循环系统,以降低能耗。超柔软面层和三层SMX复合材料也带来了成长机会,它们在不影响阻隔性能的前提下,显着提升了织物般的触感。

预计2031年,其他技术将以8.74%的复合年增长率成长,透过静电纺丝、离心纺丝和高密度针刺平台等技术,不断扩大其对不织布市场规模的贡献。这些技术可生产奈米纤维网、梯度密度毡和三维蓬鬆毡。采用PAN/PS/PMMA共混物的静电纺丝隔膜在150°C下可达到75.87%的孔隙率和低于3%的收缩率,这些特性对于高安全性电池组至关重要。熔喷製造商将驻极体充电与奈米颗粒掺杂相结合,可维持对0.3 μm气溶胶97%以上的捕获率,从而获得空气过滤和呼吸器领域的合约。

区域分析

预计到2025年,亚太地区将占据不织布市场48.10%的份额,并在2031年之前以7.50%的复合年增长率成长。这主要得益于中国、印度和印尼等国加工商的扩张,以满足日益增长的尿布和口罩需求。该地区的供应链将丙烯裂解装置、纤维纺丝和最终产品组装紧密整合,以最大限度地降低物流成本。中国正在增设专用针刺生产线,为国内电动车工厂生产隔音隔热材料;而印度则在扩建水针工厂,以供应擦拭巾出口商。

北美正受惠于关键医疗防护装备和电池防护工具等物资的恢復供应,例如金佰利公司斥资20亿美元扩建位于俄亥俄州和南卡罗来纳州的工厂,其中将包括一套由人工智慧驱动的物流系统。旭化成位于加拿大的薄膜工厂将于2027年开始为美国电动车生态系统供货。劳动力短缺正在推动高度自动化纺粘生产线的应用,这为设备供应商创造了机会。

欧洲严格的监管政策正在推动可生物降解纤维和闭合迴路回收试点计画的投资。弗罗伊登贝格收购海泰克斯公司,进一步巩固了在涂层技术纤维领域的地位;兰精公司扩大Lyocell纤维纤维产能,确保了生物基原料的长期供应。中东和非洲地区对本地生产的海岸防护和卫生用品的需求正在兴起,而拉丁美洲则利用近岸外包模式,向北美卫生品牌供应价格具有竞争力的复合材料。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 一次性卫生用品需求激增

- 医疗个人防护工具和创伤护理的快速应用

- 基础设施建设的扩张带动了对地工织物的需求。

- 与梭织和针织布料相比,具有成本优势

- 固体电动车电池隔膜

- 市场限制

- PP和PET价格波动

- 微塑胶/加强掩埋法规

- 与机织物相比,其拉伸强度和撕裂强度较差。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 透过技术

- 纺粘

- 湿法成网

- 空袭

- 其他技术

- 材料

- 聚酯纤维

- 聚丙烯

- 聚乙烯

- 人造丝(粘胶纤维)

- 其他的

- 按最终用户行业划分

- 建造

- 纺织品

- 卫生保健

- 车

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 土耳其

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 埃及

- 卡达

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Ahlstrom

- Amcor plc

- Asahi Kasei Advance Corporation

- Autotech Nonwovens Pvt Ltd

- Avgol Industries 1953 Ltd

- Cygnus Group

- DuPont

- Eximius Innovative Pvt. Ltd.

- Fibertex Nonwovens A/S

- Fitesa SA and Affiliates

- Freudenberg Performance Materials

- Hollingsworth & Vose

- Indorama Ventures Public Company Limited

- Johns Manville

- KCWW

- Lydall, Inc.

- Magnera

- Mitsui Chemicals, Inc.

- paramountnonwoven

- PFNonwovens Holding sro

- Toray Industries Inc.

- TWE GmbH & Co. KG

第七章 市场机会与未来展望

The Non-woven Fabric Market was valued at USD 60.93 billion in 2025 and estimated to grow from USD 64.61 billion in 2026 to reach USD 86.55 billion by 2031, at a CAGR of 6.03% during the forecast period (2026-2031).

Sustained demand from healthcare, construction, and automotive applications continues to accelerate investment in spun-bond manufacturing lines, while electrospun nanofiber breakthroughs open premium niches in wound care, filtration, and solid-state battery separators. Polypropylene-based grades preserve a cost edge over woven fabrics even as propylene feedstock prices rise, helping converters defend margins. Regulatory momentum around microplastic leakage and recyclable packaging is reshaping product design toward biodegradable or circular solutions, pushing rayon, lyocell, and natural-fiber blends into mainstream specifications.

Global Non-woven Fabric Market Trends and Insights

Exploding Demand for Disposable Hygiene Products

Soaring birth rates in parts of Asia-Pacific and steadily aging populations in North America and Europe are lifting unit sales of diapers, adult incontinence pads, and feminine hygiene articles that rely on lightweight, absorbent non-wovens. Smart wound-care substrates incorporating controlled vapor transmission films and super-absorbent cores are moving from pilot to high-volume production, improving healing environments and reducing dressing changes. Producers are pairing spun-bond and melt-blown layers to optimize fluid handling while keeping basis weight low, a configuration that helps converters meet price points without sacrificing performance. Brand owners also favor chlorine-free fluff pulps and bio-based binders to align with retailer sustainability scorecards. Together, these trends reinforce the non-woven fabric market trajectory in hygiene through mid-decade.

Rapid Adoption in Medical PPE and Wound-Care

Hospital supply chains that experienced shortages during the pandemic have expanded stocking requirements for masks, gowns, and drapes with certified barrier performance. NIOSH targets for 2020-2030 emphasize domestic surge capacity, prompting investment in high-output spun-melt composites equipped with real-time quality monitoring. Electrospun nanofibers based on polyimide or PEEK deliver elevated heat resistance, allowing their use in powered air-purifying respirators and implantable devices. Multifunctional wound dressings integrating silver nanoparticles or growth factors show more than 99.99% bacterial reduction and faster epithelialization in pre-clinical trials. Reimbursement reforms that reward shorter hospital stays further support demand for advanced non-wovens that cut infection risk and healing time.

PP and PET Price Volatility

Unplanned refinery outages and delayed new propylene capacities have tightened supply, lifting polypropylene contract prices in South Asia by USD 10-20 per ton in early 2025. At the same time, freight surcharges tied to Red Sea rerouting inflate delivered costs into key converting hubs. PET markets mirror the pattern as producers in China and Europe shut older polymer lines amid negative spreads. Such swings compress margins for converters locked into fixed-price supply contracts with hygiene brand owners, prompting them to explore resin hedging or material substitution strategies.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Boom Driving Geotextile Uptake

- Cost Advantage Over Woven and Knitted Fabrics

- Microplastic and Landfill Regulations Tightening

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The spun-bond segment accounted for 52.88% of the non-woven fabric market in 2025, reflecting its high throughput and proven suitability for hygiene laminates, medical gowns, and geotextiles. Generational upgrades now integrate weight-control scanners and closed-loop air recirculation to curb energy use. Growth opportunities emerge in ultra-soft topsheets and 3-layer SMX-based composites that enhance cloth-like feel without sacrificing barrier integrity.

Other technologies are set to expand at an 8.74% CAGR to 2031, lifting their contribution to the non-woven fabric market size through electrospinning, centrifugal spinning, and intense needling platforms that deliver nanofiber webs, gradient density mats, and 3D lofted felts. Electrospun separators using PAN/PS/PMMA blends achieve 75.87% porosity and less than 3% shrinkage at 150 °C, features valued in high-safety battery packs. Melt-blown producers combine electret charging with nanoparticle doping to maintain more than 97% capture of 0.3 µm aerosols, securing air-filtration and respirator contracts.

The Non-Woven Fabric Market Report is Segmented by Technology (Spun-Bond, Wet Laid, Dry Laid, and Other Technologies), Material (Polyester, Polypropylene, Polyethylene, Rayon (Viscose), and Others), End-User Industry (Construction, Textiles, Healthcare, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 48.10% of non-woven fabric market share in 2025 and is on course for a 7.50% CAGR to 2031 as converters expand in China, India, and Indonesia to serve growing diaper and mask consumption. Regional supply chains integrate propylene crackers, fiber spinning, and end-product assembly within close proximity, minimizing logistics cost. Chinese lines add needlepunch capacity dedicated to acoustic and thermal insulation for domestic EV factories, while Indian producers scale spun-lace installations to supply wipes exporters.

North America benefits from reshoring of critical medical-PPE and battery-separator supply, supported by Kimberly-Clark's USD 2 billion expansion across Ohio and South Carolina facilities that feature AI-enabled logistics. Canada's forthcoming separator plant from Asahi Kasei will feed the U.S. EV ecosystem beginning in 2027. Tight labor markets push the adoption of high-automation spun-bond lines, creating opportunities for equipment vendors.

Europe's stringent regulations spur investment in biodegradable fibers and closed-loop recycling pilots. Freudenberg's acquisition of Heytex deepens exposure to coated technical textiles, while Lenzing's lyocell upgrades secure long-term supply of bio-based inputs. Middle East and Africa show emerging demand linked to coastal protection and sanitary product localization, whereas Latin America leverages nearshoring to supply North American hygiene brands with competitively priced composites.

- Ahlstrom

- Amcor plc

- Asahi Kasei Advance Corporation

- Autotech Nonwovens Pvt Ltd

- Avgol Industries 1953 Ltd

- Cygnus Group

- DuPont

- Eximius Innovative Pvt. Ltd.

- Fibertex Nonwovens A/S

- Fitesa SA and Affiliates

- Freudenberg Performance Materials

- Hollingsworth & Vose

- Indorama Ventures Public Company Limited

- Johns Manville

- KCWW

- Lydall, Inc.

- Magnera

- Mitsui Chemicals, Inc.

- paramountnonwoven

- PFNonwovens Holding s.r.o.

- Toray Industries Inc.

- TWE GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Exploding demand for disposable hygiene products

- 4.2.2 Rapid adoption in medical PPE and wound-care

- 4.2.3 Infrastructure boom driving geotextile uptake

- 4.2.4 Cost-advantage over woven and knitted fabrics

- 4.2.5 Solid-state EV battery separators

- 4.3 Market Restraints

- 4.3.1 PP and PET price volatility

- 4.3.2 Micro-plastic / landfill regulations tightening

- 4.3.3 Inferior tensile and tear strength vs woven fabric

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Technology

- 5.1.1 Spun-bond

- 5.1.2 Wet Laid

- 5.1.3 Dry Laid

- 5.1.4 Other Technologies

- 5.2 By Material

- 5.2.1 Polyester

- 5.2.2 Polypropylene

- 5.2.3 Polyethylene

- 5.2.4 Rayon (Viscose)

- 5.2.5 Others

- 5.3 By End-user Industry

- 5.3.1 Construction

- 5.3.2 Textiles

- 5.3.3 Healthcare

- 5.3.4 Automotive

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Turkey

- 5.4.3.7 Russia

- 5.4.3.8 Nordic Countries

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Egypt

- 5.4.5.5 Qatar

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Ahlstrom

- 6.4.2 Amcor plc

- 6.4.3 Asahi Kasei Advance Corporation

- 6.4.4 Autotech Nonwovens Pvt Ltd

- 6.4.5 Avgol Industries 1953 Ltd

- 6.4.6 Cygnus Group

- 6.4.7 DuPont

- 6.4.8 Eximius Innovative Pvt. Ltd.

- 6.4.9 Fibertex Nonwovens A/S

- 6.4.10 Fitesa SA and Affiliates

- 6.4.11 Freudenberg Performance Materials

- 6.4.12 Hollingsworth & Vose

- 6.4.13 Indorama Ventures Public Company Limited

- 6.4.14 Johns Manville

- 6.4.15 KCWW

- 6.4.16 Lydall, Inc.

- 6.4.17 Magnera

- 6.4.18 Mitsui Chemicals, Inc.

- 6.4.19 paramountnonwoven

- 6.4.20 PFNonwovens Holding s.r.o.

- 6.4.21 Toray Industries Inc.

- 6.4.22 TWE GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment