|

市场调查报告书

商品编码

1906045

环氧树脂:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Epoxy Resin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

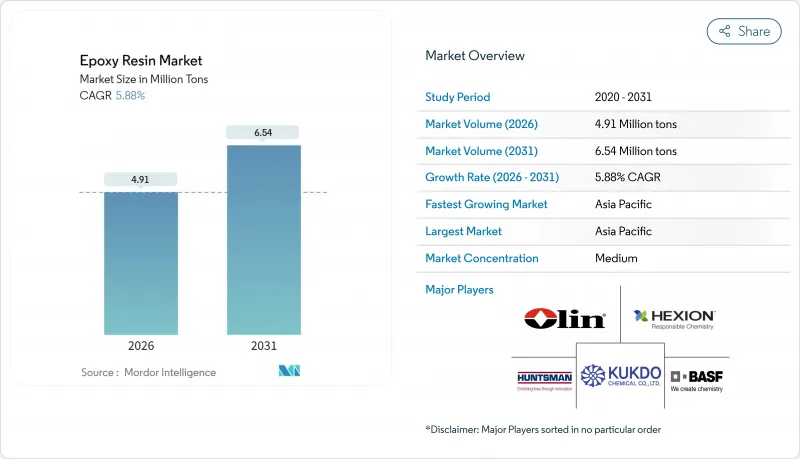

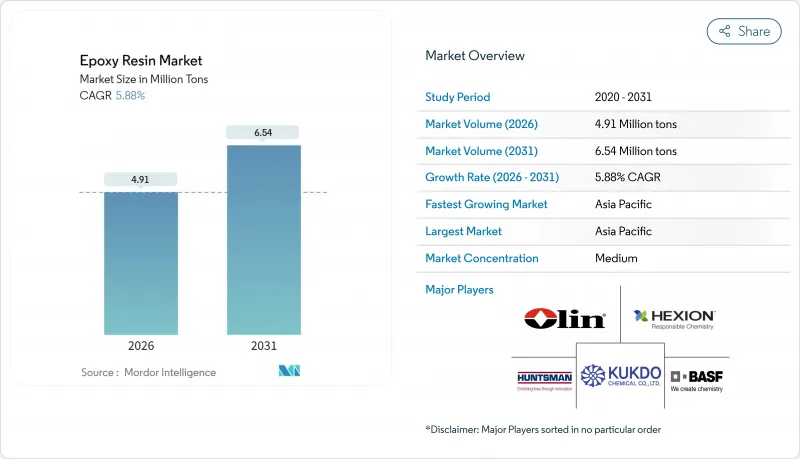

预计到 2026 年,环氧树脂市场规模将达到 491 万吨,高于 2025 年的 464 万吨。

预计到 2031 年将达到 654 万吨,2026 年至 2031 年的复合年增长率为 5.88%。

持续的需求源自于其卓越的机械、化学和热性能,这些性能支持从风力发电机叶片到半导体封装等关键应用。对双酚A (BPA) 和挥发性有机化合物 (VOC) 的监管日益严格,正在加速水基、生物可回收和低VOC化学技术的发展。新兴市场可再生能源基础设施的扩张、电气化趋势和基础设施投资正在推动需求成长,而不断上涨的贸易关税和原材料价格波动则为采购行业带来了短期不确定性。儘管环氧树脂市场集中度仍然适中,但对可再生和植物来源配方的突破性研发正在为现有企业和专业领域的新兴参与企业拓展机会。

全球环氧树脂市场趋势与洞察

油漆和涂料领域的需求不断增长

涂料产业仍将是环氧树脂的主要应用领域,预计到2024年将占环氧树脂市场份额的60.15%。东南亚和非洲基础设施项目以及船舶和包装应用对高阻隔阻隔性和耐腐蚀性涂料的特定需求正在推动市场成长。 Westlake公司计划于2025年推出的生物再生树脂EpoVIVE,正是供应商如何在永续性和性能之间取得平衡的典范。量子点催化光化学技术正在推动低VOC配方的普及,该技术无需使用昂贵的紫外线阻隔剂即可提高树脂的耐光稳定性。诸如Amerlock 400之类的船用级系统能够延长船舶的停靠间隔,并降低船队运营商的全生命週期成本。这使得涂料产业在整个环氧树脂市场中,无论在销量或创新方面,都将发挥关键作用,预计到2030年,其复合年增长率将达到6.51%。

扩大复合材料在风力发电机叶片中的应用

离岸风力发电的兴起、更大的转子直径以及碳纤维和玻璃纤维混合结构的设计,正在推动对环氧树脂性能的要求不断提高。全球风力发电理事会预测,新增装置容量将以每年8.8%的速度成长,这将支撑树脂的长期需求。到2025年,TPI Composites的基本客群将供应美国88%的陆上风力发电机叶片,凸显了製程技术在整合采购方面的重要性。西门子歌美飒已将可在弱酸性条件下剥离的可回收环氧树脂叶片商业化,从而缓解了处置难题。基于机器学习的叶片固化製程优化进一步减少了废弃物和能源消耗,巩固了环氧树脂作为风力发电价值链基材的主导地位。

原物料价格波动

2024年上半年,中国双酚A(BPA)产能成长12.31%,达到每年548万吨,但运转率下降,区域价格较上季下跌4.6%。国都化工厂爆炸等突发事件导致BPA价格一度翻倍,使下游复合材料生产商面临利润风险。极端天气引发的不可抗力声明进一步加剧了供应的不确定性。因此,多家大型环氧树脂生产商正在建造专用的环氧氯丙烷和BPA生产设施,以确保原料供应并对冲价格波动风险。

细分市场分析

作为风力涡轮机叶片和汽车复合材料的领先等级,DGBEA树脂预计在2025年将保持36.35%的环氧树脂市场份额。儘管仍是市场扩张的关键因素(复合年增长率达6.32%),但客户的审核正迫使生产商证明其BPA(双酚A)供应可追溯且低碳。为此,欧洲、美国和日本的供应商正在试行物料平衡会计和生物回收原料,以维持DGBEA在环氧树脂市场的地位。

特种树脂填补了不同的性能空白。 DGBEF树脂可实现低黏度,适用于船舶维护涂料;酚醛树脂则为炉衬提供耐热衝击性能;脂肪族环氧树脂具有建筑建筑幕墙所需的紫外线稳定性;缩水甘油胺类树脂在电子机壳中具有优异的金属黏合性。生物基和环脂族树脂(归类为其他原料)预计将成为成长最快的细分市场,到2031年将占据环氧树脂市场的重要份额,因为循环回收和碳核算正日益受到股东的关注。

环氧树脂市场报告按原料(双酚A和ECH、双酚F和ECH、酚醛树脂(甲醛和苯酚)、脂肪族(脂肪醇)、缩水甘油胺(芳香胺和ECH)、其他)、应用(油漆和涂料、黏合剂和密封剂、复合材料、电气和电子设备、北美、欧洲、其他地区进行分析。

区域分析

亚太地区仍将是环氧树脂市场的中心,预计到2025年将占全球需求的47.55%,并有望在2031年之前以6.08%的复合年增长率成长。由于美国对中国树脂出口征收高达354.99%的反倾销税,中国不得不转向地理上更加多元化的基本客群,其中包括DCM Shriram在印度新建的价值1.25亿美元的工厂。泰国和越南正在新增印刷基板(PCB)和风力涡轮机叶片的生产能力,而日本和韩国则在大力推进用于半导体和海上风电应用的超高玻璃化转变温度(Tg)和可再生化学品的研发。

北美正利用製造业回流、基础设施投资和可再生能源税额扣抵抵免来缓解进口树脂供应的波动。 1.01%至547.76%不等的反补贴税鼓励国内製造商运作暂停中反应器并投资新的原料资产。加拿大风电场开发商指定使用适用于北极环境的环氧树脂体系,美国的汽车产业丛集正在加速对结构性黏着剂的需求。美国国家再生能源实验室(NREL)的可再生植物来源环氧树脂研究进一步巩固了该地区在永续性。

欧洲正努力在严格的双酚A(BPA)法规与尖端研发之间寻求平衡。一家德国汽车供应商正与一家当地树脂生产商合作开发导热型EMC(电磁相容材料)。英国离岸风电的蓬勃发展推动了环氧涂层单桩25年使用寿命的要求,而法国核能产业则在推广耐辐射等级的产品。斯科特·巴德公司斥资3000万英镑扩建其在英国的生产能力,凸显了其在全球物流波动的情况下对本地供应的承诺。北欧地区在循环经济政策方面已领先,正在欧盟资助的计画下推动闭合迴路环氧树脂回收试验。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 油漆和涂料行业需求不断增长

- 复合材料在风力发电机叶片中的应用

- 电气和电子设备产业需求不断成长

- 基础建设主导黏合剂需求成长

- 采用环氧光敏聚合物进行3D列印

- 市场限制

- 原物料价格波动

- 加强对挥发性有机化合物(VOCs)和双酚A(BPA)的监管

- 反倾销税对贸易流量的影响

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章 市场规模和成长预测(价值和数量)

- 按原料

- DGBEA(双酚A和ECH)

- DGBEF(双酚F和ECH)

- 酚醛树脂(甲醛和苯酚)

- 脂肪族(脂肪醇)

- 缩水甘油胺(芳香胺和ECH)

- 其他原料(脂环族、生物基环氧树脂)

- 依实体形态

- 液体

- 固体的

- 解决方案

- 水性分散体

- 透过使用

- 油漆和涂料

- 黏合剂和密封剂

- 复合材料

- 电气和电子设备

- 风力发电机

- 海洋

- 其他用途(建筑、3D列印用光敏聚合物等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 马来西亚

- 泰国

- 印尼

- 越南

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 北欧国家

- 土耳其

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 奈及利亚

- 埃及

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)排名分析

- 公司简介

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production(SPOLCHEMIE)

- Westlake Corporation

第七章 市场机会与未来展望

Epoxy Resin Market size in 2026 is estimated at 4.91 Million tons, growing from 2025 value of 4.64 Million tons with 2031 projections showing 6.54 Million tons, growing at 5.88% CAGR over 2026-2031.

Sustained demand is rooted in the material's unmatched mechanical, chemical, and thermal performance that underpins critical uses ranging from wind-turbine blades to semiconductor packaging. Innovation is accelerating as stricter regulations on bisphenol A (BPA) and volatile organic compounds (VOCs) advance waterborne, bio-circular, and low-VOC chemistries. Expanding renewable-energy infrastructure, electrification trends, and infrastructure spending in emerging economies add positive volume momentum, while escalating trade duties and raw-material price swings present near-term uncertainties for procurement teams. The epoxy resins market remains moderately concentrated, yet breakthrough work on recyclable and plant-derived formulations is widening the opportunity set for both incumbents and specialist newcomers.

Global Epoxy Resin Market Trends and Insights

Increasing Demand from Paints and Coatings

Paints and coatings continued to dominate the epoxy resins market with a 60.15% revenue share in 2024. Growth is reinforced by infrastructure programs in Southeast Asia and Africa and by marine and packaging niches that depend on high-barrier, corrosion-resistant finishes. Westlake's 2025 launch of EpoVIVE bio-circular resins illustrates how suppliers are balancing sustainability with performance. The shift to low-VOC formulations is aided by quantum-dot-catalyzed photochemistry that improves sunlight stability without costly UV blockers Marine-grade systems such as Amerlock 400 lengthen dry-dock cycles, lowering total lifecycle cost for fleet operators.The resulting 6.51% CAGR to 2030 positions coatings as both volume and innovation anchors for the broader epoxy resins market.

Wind-Turbine Blade Composites Uptake

Growing offshore wind installations, larger rotor diameters, and hybrid carbon-glass designs are raising epoxy performance thresholds. The Global Wind Energy Council forecasts 8.8% annual growth in new capacity, which underpins long-run resin demand. TPI Composites' customer base supplied 88% of 2025 US onshore blades, underscoring how process know-how consolidates purchasing. Siemens Gamesa has already commercialized recyclable epoxy blades that de-bond under mild acidic conditions, easing end-of-life challenges. Machine-learning optimization of blade cure schedules further cuts waste and energy use, reinforcing epoxy's position as the matrix of choice in the wind energy value chain.

Raw-Material Price Volatility

China expanded BPA capacity by 12.31% in H1 2024 to 5.48 million t pa, yet utilization dipped and regional prices fell 4.6% quarter-on-quarter. Disruptions such as the Guodu Chemical plant explosion temporarily doubled BPA prices, exposing downstream formulators to margin risk. Force-majeure declarations following extreme weather events added further supply uncertainty. Several epoxy majors are therefore building captive epichlorohydrin and BPA units to secure feedstock and hedge volatility.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from Electrical and Electronics

- Growing Infrastructure-Led Adhesive Demand

- Stricter VOC and BPA Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DGBEA resins retained 36.35% epoxy resin market share in 2025 as the workhorse grade for wind-energy blades and automotive composites. At a 6.32% CAGR they remain integral to market expansion, yet customer audits are pushing producers to demonstrate traceable, lower-carbon BPA supply. In response, Western and Japanese suppliers are piloting mass-balance accounting and bio-circulating feedstocks to preserve DGBEA's position in the epoxy resins market.

Specialty resins fill clear performance gaps. DGBEF offers lower viscosity for marine maintenance coatings, while novolac chemistries withstand thermal shock inside furnace linings. Aliphatic epoxies deliver UV stability essential for architectural facades. Glycidylamine versions provide superior metal adhesion in electronics housings. Bio-based and cycloaliphatic chemistries, grouped under other raw materials, are projected to be the fastest movers and could capture a measurable slice of the epoxy resins market by 2031 as closed-loop recycling and carbon accounting gain shareholder focus.

The Epoxy Resin Market Report is Segmented by Raw Material (DGBEA (Bisphenol A and ECH), DGBEF (Bisphenol F and ECH), Novolac (Formaldehyde and Phenols), Aliphatic (Aliphatic Alcohols), Glycidylamine (Aromatic Amines and ECH), and More), Application (Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific remained the epicenter of the epoxy resin market, securing 47.55% of 2025 demand and pointing to a 6.08% CAGR through 2031. China's resin exports face US anti-dumping duties as high as 354.99%, prompting ventures like DCM Shriram's USD 125 million Indian greenfield unit to serve a more regionally diversified customer base. Thailand and Vietnam capture fresh PCB and wind-blade capacity, while Japan and South Korea push ultra-high-Tg and recyclable chemistries for semiconductors and offshore wind applications.

North America leverages reshoring, infrastructure investment, and renewable-energy tax credits to buffer volatility in imported resin flows. Countervailing duties ranging from 1.01% to 547.76% spur domestic producers to reactivate idled reactors and invest in new feedstock assets. Canadian wind-farm developers specify Arctic-grade epoxy systems, and Mexico's automotive clusters accelerate demand for structural adhesives. NREL's plant-derived epoxy research underscores the region's sustainability leadership.

Europe balances stringent BPA rules with cutting-edge R&D. German automotive suppliers co-engineer thermally conductive EMCs with local resin formulators. The United Kingdom's offshore wind boom sustains 25-year service life requirements for epoxy-primed monopiles, and France's nuclear sector pushes radiation-resistant grades. Scott Bader's GBP 30 million UK capacity addition highlights commitments to local supply amid global logistics flux. The Nordic region, already well advanced in circular-economy policy, pilots closed-loop epoxy recycling trials under EU-funded programs.

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Paints and Coatings

- 4.2.2 Wind-Turbine Blade Composites Uptake

- 4.2.3 Increasing Demand from Electrical and Electronics

- 4.2.4 Growing Infrastructure-Led Adhesive Demand

- 4.2.5 3-D Printed Epoxy Photopolymers Adoption

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Stricter VOC and BPA Regulations

- 4.3.3 Anti-Dumping Duties Disrupting Trade Flows

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenol)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials (Cycloaliphatic, Bio-based Epoxies)

- 5.2 By Physical Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.2.3 Solution

- 5.2.4 Waterborne Dispersion

- 5.3 By Application

- 5.3.1 Paints and Coatings

- 5.3.2 Adhesives and Sealants

- 5.3.3 Composites

- 5.3.4 Electrical and Electronics

- 5.3.5 Wind Turbines

- 5.3.6 Marine

- 5.3.7 Other Applications (Construction, 3-D Printing Photopolymers, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%) Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atul Ltd

- 6.4.2 Bodo Moller Chemie GmbH

- 6.4.3 Cardolite Corporation

- 6.4.4 Chang Chun Group

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Grasim Industries Limited

- 6.4.8 Hexion Inc.

- 6.4.9 Huntsman International LLC

- 6.4.10 Jiangsu Sanmu Group Co., Ltd.

- 6.4.11 Kolon Industries

- 6.4.12 Kukdo Chemical Co., Ltd

- 6.4.13 Mitsui Chemicals, Inc.

- 6.4.14 Nama

- 6.4.15 Nan Ya Plastics Corporation

- 6.4.16 Olin Corporation

- 6.4.17 Robnor ResinLab Ltd,

- 6.4.18 Sika AG

- 6.4.19 Sinochem Holdings Corporation Ltd.

- 6.4.20 Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment