|

市场调查报告书

商品编码

1906063

聚硅氧烷涂料:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Polysiloxane Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

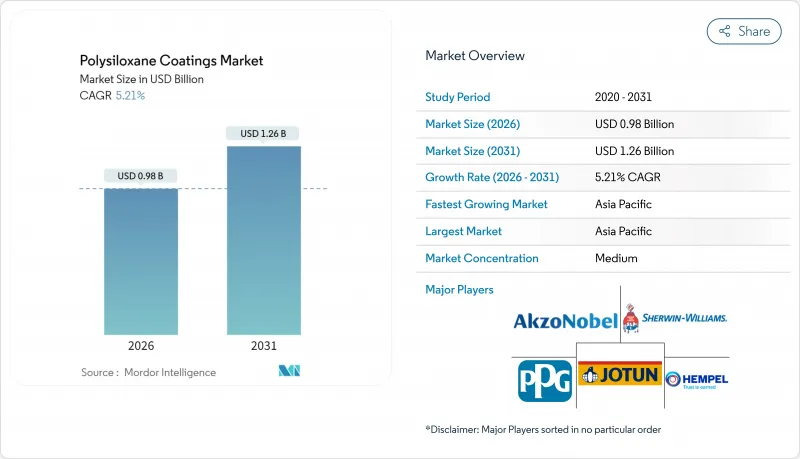

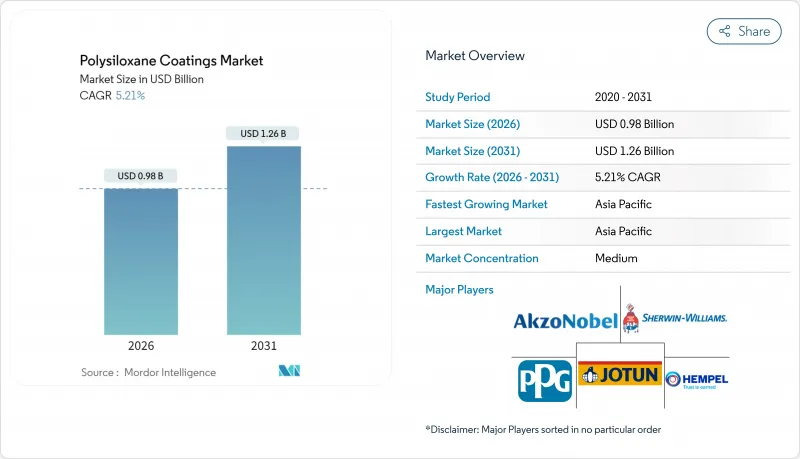

预计聚硅氧烷涂料市场将从 2025 年的 9.3 亿美元成长到 2026 年的 9.8 亿美元,到 2031 年将达到 12.6 亿美元,2026 年至 2031 年的复合年增长率为 5.21%。

在严苛的海洋和能源环境中,硅有机混合材料的使用日益增多;新兴国家基础设施投资不断增长;以及全球挥发性有机化合物(VOC)法规日趋严格,这些因素共同推动了市场需求的成长。规范制定者将聚硅氧烷基系统视为延长维护週期、降低生命週期成本以及满足不断变化的健康和安全标准的有效途径,从而为其高价策略奠定了基础。领先的供应商正大力推广双层环氧-聚硅氧烷基涂料,以取代三层富锌环氧-聚氨酯涂料体系,从而在熟练油漆工短缺的时代降低劳动力需求。同时,超高固态涂料可在不影响边缘覆盖率的前提下减少溶剂排放。竞争的重点正转向树脂创新、以收购为主导的产品组合建造以及确保订单重复购买的区域性技术服务项目。

全球聚硅氧烷涂料市场趋势及洞察

在腐蚀性环境中,海上和页岩油气资产的资本投资不断增长

全球上游业者正增加对深水和页岩油田的投资,这些油田的钢材会暴露在高浓度氯化物、二氧化碳和硫化氢的环境中。聚硅氧烷技术只需两层涂层即可提供必要的C5防护,从而缩短浮体式生产平台在日益狭窄的作业窗口期内的修整时间。与传统的环氧涂层相比,资产所有者也十分欣赏其减少底漆渗漏的优势,这一优势可以延缓飞溅区域高成本的维修工作。近期获得认证的系统已完成超过15,000小时的盐雾试验,并在3,000小时的QUV测试后仍保持85%以上的光泽度,证实了该技术的耐久性。因此,海上承包商正在将聚硅氧烷面漆纳入其导管架、甲板和火炬塔的标准维护规范中,作为其延寿计画的一部分。服务供应商强调,高涂层厚度只需一次交叉喷涂即可提供足够的边缘保护,从而缓解偏远水域劳动力短缺造成的生产力挑战。

亚洲和非洲的公私合营大型企划储备

中国、印度和非洲各国政府正在共同投资建造跨境管道和终端网络,这些网络必须能够承受湿度波动、沙漠沙砾的磨损以及紫外线照射。聚硅氧烷基涂料即使在-40°C至+120°C的温度循环中也能保持附着力和柔软性,从而减少了因地面重涂而导致的停工。工程、采购和施工 (EPC) 联合体普遍要求符合 ISO 12944 C4 或 C5 标准,而聚硅氧烷基混合涂料只需更少的涂层即可达到此标准。当地安装人员受益于更快的干燥速度,从而提高了工作效率——这对于每天施工路段移动数公里的线性计划至关重要。正如BASF与东方宇虹的合作所表明的那样,供应商正在深化区域伙伴关係,将全球树脂技术与现场培训相结合,以满足当地的品质标准。东非和东协地区领先的天然气管道走廊建设进度预示着未来几年防护领域聚硅氧烷基涂料的销售将持续成长。

熟练油漆工短缺推高了现场施工成本。

到2025年,美国经NACE认证的喷涂工的平均时薪将超过50美元,在季节性维护高峰期,加班费还会进一步上涨。德国和荷兰也面临类似的劳动力短缺问题,老员工的退休速度超过了新员工的入职速度。聚硅氧烷基涂料需要精确的混合比例和露点控制,这将进一步加剧劳动力短缺。仅人事费用一项,就导致船舶修理厂的竞标价格比去年同期上涨了15%,迫使一些船东推迟了重新喷漆的周期。製造商正在推出单组分和预混合料套装来应对这一问题,以减少现场操作,但这些产品的树脂成本往往更高。虽然涂料供应商和产业协会主导的培训计画旨在认证新的喷涂工,但由于招募新员工需要数年时间,预计短期内需求成长将会放缓。

细分市场分析

环氧树脂-聚硅氧烷混合涂料将在聚硅氧烷涂料市场占据最大份额,预计到2025年将占总收入的38.86%。其优点在于结合了环氧树脂的底漆级附着力和硅酮的紫外线稳定性,使得双层层级构造能够满足ISO 12944 C5-M性能标准。在海上平台导管架的现场测试证实,其维护週期可超过15年,进一步降低了劳动力短缺环境下的总拥有成本。这使得终端用户愿意接受更高的价格,并以此为基础签订了平台升级和舰艇维修等长期合约。

儘管市场规模较小,但由于丙烯酸聚硅氧烷杂化材料具有优异的保色性和低泛黄性,其复合年增长率高达5.62%,成为市场上成长最快的产品。邮轮、建筑建筑幕墙和桥樑梁体计划等领域对这类材料的需求日益增长。加州和欧洲经济区 (EEA) 严格的挥发性有机化合物 (VOC) 法规进一步推动了水性丙烯酸硅氧烷分散体的普及,这类分散体能够在不牺牲光泽度的前提下减少溶剂排放。聚酯改质产品利用酯键增强耐化学性,在易受酸碱侵蚀的化工厂中占有了一席之地。氟化聚硅氧烷混合物和陶瓷填充型产品分别针对极端温度环境和易受涂鸦的交通设施,凸显了树脂化学家致力于开发多功能性能替代方案以取代多层涂料的更广泛趋势。最近对室温固化、无乳化剂的硅酮黏合剂的研究证实了水解应力的降低,表明下一代产品将兼具零 VOC 特性和高机械强度。

区域分析

预计到2025年,亚太地区将占据聚硅氧烷涂料市场54.88%的份额,2026年至2031年的复合年增长率将达到6.55%。这主要得益于中国无可比拟的造船规模和韩国在液化天然气运输船建造领域的领先地位。北京大力推动国产海军舰艇建设,以及「十四五」规划中260吉瓦离岸风力发电装置容量的目标,进一步推动了国内需求。在日本,高规格化学品船和浮式储存再气化装置(FSRU)计划要求使用高硅面漆以防止货物洩漏,也促进了市场成长。印度的萨加尔马拉港口开发案以及东协地区模组化造船厂的兴起,正在扩大亚太地区的基本客群。

北美地区占据第二大市场份额,这主要得益于墨西哥湾浮体式生产设施的维修、加拿大油砂模组化以及桥樑和机场等联邦基础设施更新计划。美国环保署 (EPA) 将工业维护涂料中挥发性有机化合物 (VOC) 的含量限制在 275 克/公升或以下,这促使资产所有者转向使用超高固态聚硅氧烷涂料。区域电力公司正在排烟脱硫管中采用这些混合产品,因为其硅酮骨架能够承受酸性冷凝循环。美国墨加协定 (USMCA) 下的自由贸易物流正在简化树脂和颜料的跨境供应,并缩短墨西哥海上工程总承包 (EPC) 设施所需高固态聚硅氧烷产品的前置作业时间。

欧洲仍是一个具有重要战略意义的市场,并呈现出更稳定的成长态势。北海的拆船作业和离岸风力发电的升级改造带动了对维护涂料的需求,而北欧的造船厂正在建造需要低温固化聚硅氧烷底漆的冰级供应船。欧盟即将实施的环硅氧烷法规正推动市场朝向相容的水性分散体材料快速转型,该地区也因此成为下一代配方的试验场。德国高速公路桥樑升级改造工程需要25年的防腐蚀保护,而两层环氧-聚硅氧烷双层涂层系统即可实现这一目标,并减少车道封闭时间。中东、非洲和南美洲正在崛起为长期需求中心。巴西的盐盐层下FPSO订单和阿联酋的港口扩建计划预计将采用聚硅氧烷技术,以适应高盐度环境下的延长检测週期。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 增加对腐蚀性海上和页岩资产的油气资本投资

- 亚洲和非洲的公私合营大型企划储备

- 从溶剂型材料转向超高固态混合材料

- 模组化风力塔製造厂数量激增

- 液化天然气装运船隻船队迅速扩张

- 市场限制

- 由于熟练油漆工短缺,现场施工成本不断上涨

- 对环状硅氧烷产品的监管审查

- 高温循环下的边缘缺陷失效

- 来自氟聚合物面漆的竞争威胁

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品和服务的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依树脂类型

- 环氧-聚硅氧烷杂化物

- 丙烯酸-聚硅氧烷杂化物

- 聚酯改质聚硅氧烷

- 其他树脂类型

- 按最终用户行业划分

- 保护

- 石油和天然气

- 电力

- 基础设施

- 海洋

- 其他终端用户产业

- 保护

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Akzo Nobel NV

- Asian Paints Ltd.

- Hempel A/S

- Jotun

- KISHO Corporation Co.,Ltd

- Metcon Coatings & Chemicals India Private Limited.

- NCP Coatings LLC

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Thomas Industrial Coatings

- Tianjin Jinhai Special Coatings & Decoration Co., Ltd.

- Tikkurila

- Tnemec

- Yung Chi Paint & Varnish MFG. CO.,LTD

第七章 市场机会与未来展望

The Polysiloxane Coatings Market is expected to grow from USD 0.93 billion in 2025 to USD 0.98 billion in 2026 and is forecast to reach USD 1.26 billion by 2031 at 5.21% CAGR over 2026-2031.

The rising specification of these silicone-organic hybrids in harsh marine and energy settings, along with elevated infrastructure spending in emerging economies and tightening global VOC regulations, collectively underpin demand momentum. Specification engineers view polysiloxane systems as an effective path to extend maintenance cycles, cut life-cycle cost, and comply with evolving health and safety norms, an alignment that reinforces premium pricing power. Major suppliers highlight two-coat epoxy-polysiloxane alternatives that replace three-coat zinc-rich epoxy-polyurethane schemes, thereby reducing labor needs at a time of skilled painter scarcity. Meanwhile, ultra-high-solid variations reduce solvent release without sacrificing edge coverage. Competitive emphasis has therefore shifted to resin innovation, acquisition-led portfolio shaping, and region-specific technical service programs that secure repeat orders.

Global Polysiloxane Coatings Market Trends and Insights

Growing Oil and Gas CAPEX in Corrosive Offshore and Shale Assets

Global upstream operators are channeling new capital toward deep-water and shale prospects that expose steel to high concentrations of chloride, CO2, and H2S. Polysiloxane technology provides the required C5 protection in two coats, reducing trimming time on floating production platforms where weather windows narrow each year. Asset owners also cite lower under-film blistering versus conventional epoxies, a benefit that delays costly touch-ups in splash zones. Recent qualified systems have exceeded 15,000 hours of salt-spray testing while maintaining gloss retention above 85% after 3,000 hours of QUV, reinforcing the technology's durability credentials. Offshore contractors, therefore, embed polysiloxane topcoats in standard maintenance specifications for jackets, decks, and flare towers as part of life-extension programs. Service providers emphasize that high film-build capability enables adequate edge protection with one cross-spray pass, easing productivity hurdles created by labor shortages in remote basins.

Public-Private Megaproject Pipelines in Asia and Africa

Governments in China, India, and several African nations are co-funding cross-country pipelines and terminal networks that must withstand humidity swings, desert sand abrasion, and ultraviolet exposure. Polysiloxane systems retain adhesion and flexibility across -40°C to +120°C cycles, reducing the need for shutdowns to recoat above-ground sections. Engineering, procurement, and construction (EPC) consortia largely mandate ISO 12944 C4 or C5 compliance, a threshold that polysiloxane hybrids reach with fewer coats. Local applicators gain speed benefits from faster touch-dry times, a critical factor on linear projects where kilometer-long spreads move daily. Suppliers deepen regional partnerships-exemplified by BASF and Oriental Yuhong-to blend global resin expertise with on-site training that meets local quality standards. Forward schedules for gas pipeline corridors in East Africa and ASEAN suggest a multi-year tailwind for polysiloxane sales into protective segments.

Skilled-Painter Scarcity Inflating Field-Applied Costs

Average hourly wages for NACE-certified sprayers in the United States exceeded USD 50 in 2025, and overtime premiums escalate further during seasonal maintenance peaks. Similar shortages are also evident in Germany and the Netherlands, as an aging workforce retires faster than newcomers enter. Polysiloxane systems require accurate mix ratios and dew-point control, amplifying the impact of labor gaps. Ship-repair yards report bid prices up 15% year-on-year on labor alone, pushing some owners to postpone repaint cycles. Manufacturers counter with single-component or pre-blended kits that reduce on-site handling, but these variants often carry a higher resin cost. Training initiatives led by coating suppliers and trade associations aim to certify new applicators; however, the pipeline will take years to refill, which will mute near-term volume growth.

Other drivers and restraints analyzed in the detailed report include:

- Transition from Solvent-Borne to Ultra-High-Solid Hybrids

- Rapid Expansion of LNG Carrier Fleet

- Regulatory Scrutiny on Cyclic Siloxane By-Products

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Epoxy-polysiloxane hybrids accounted for the largest share of the polysiloxane coatings market, with a revenue share of 38.86% in 2025. Their dominance stems from the union of epoxy's primer-level adhesion with silicone's UV stability, which together allow a two-layer build to meet ISO 12944 C5-M performance. Field studies on offshore jackets confirm maintenance intervals above 15 years, a result that amplifies total cost-of-ownership savings when labor is scarce. End-users thus perceive price premiums as acceptable, anchoring long-term contracts for platform upgrades and naval refits.

Acrylic-polysiloxane hybrids, although having a smaller base, boast the quickest 5.62% CAGR due to their superior color retention and low yellowing, which appeal to cruise vessels, architectural facades, and bridge girder projects. Strict VOC limits in California and the European Economic Area further steer specifiers toward water-based acrylic-siloxane dispersions that release fewer solvents without sacrificing gloss. Polyester-modified grades carve a niche in chemical plants exposed to acids and alkalis, leveraging ester linkages to boost chemical resistance. Fluorinated polysiloxane blends and ceramic-filled variants target extreme-temperature units and graffiti-prone transit structures, respectively, underscoring a broader trend: resin chemists seek multi-attribute performance to replace multi-coat stacks. Recent lab work on room-temperature-curing emulsifier-free silicone binders reduces hydrolytic stress, suggesting next-generation offerings will merge zero-VOC status with higher mechanical strength.

The Polysiloxane Coatings Market Report is Segmented by Resin Type (Epoxy-Polysiloxane Hybrids, Acrylic-Polysiloxane Hybrids, Polyester-Modified Polysiloxane, and Other Resin Types), End-User Industry (Protective, Marine, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured a 54.88% share of the polysiloxane coatings market in 2025 and is set to log a 6.55% CAGR from 2026-2031, anchored by China's unrivaled shipbuilding scale and South Korea's dominance in LNG vessel construction. Beijing's push for locally built naval ships and the country's 14th Five-Year Plan, which targets 260 GW of offshore wind capacity, intensifies domestic demand for these products. Japan contributes through high-spec chemical carriers and FSRU projects that specify silicone-rich topcoats to resist cargo spillage. India's Sagarmala port upgrade and the growth of modular fabrication yards across ASEAN widen the regional customer pool.

North America holds the second-largest share, driven by the Gulf of Mexico's floating production unit refurbishment, the modularization of Canadian oil sands, and federal infrastructure renewal projects across bridges and airports. The US EPA's aim to clamp VOCs below 275 g/L in industrial maintenance coatings steers asset owners toward ultra-high-solid polysiloxane systems. Regional power-utilities adopt these hybrids for flue-gas desulfurization ducting because silicone backbones withstand acidic condensation cycles. Free-trade logistics under USMCA streamline cross-border resin and pigment supply, lowering lead times for high-build polysiloxane shipments into Mexican offshore EPC hubs.

Europe shows steadier growth yet stays strategically important. North Sea decommissioning and wind-farm repowering generate maintenance coatings work, while Nordic yards fabricate ice-class supply vessels requiring low-temperature cure polysiloxane primers. The upcoming EU cyclic-siloxane restriction drives early conversion to compliant water-based dispersions, making the region a test bed for next-generation formulations. Germany's autobahn bridge renewal program specifies 25-year anti-corrosion performance, a target that epoxy-polysiloxane duplex systems can meet in two layers, thereby curbing lane-closure days. Middle East & Africa and South America emerge as long-term demand centers. Brazil's pre-salt FPSO backlog and UAE's port expansions are likely to adopt polysiloxane technology to meet extended inspection cycles in hot saline environments.

- Akzo Nobel N.V.

- Asian Paints Ltd.

- Hempel A/S

- Jotun

- KISHO Corporation Co.,Ltd

- Metcon Coatings & Chemicals India Private Limited.

- NCP Coatings LLC

- PPG Industries, Inc.

- The Sherwin-Williams Company

- Thomas Industrial Coatings

- Tianjin Jinhai Special Coatings & Decoration Co., Ltd.

- Tikkurila

- Tnemec

- Yung Chi Paint & Varnish MFG. CO.,LTD

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing oil and gas CAPEX in corrosive offshore and shale asset

- 4.2.2 Public-private megaproject pipelines in Asia and Africa

- 4.2.3 Transition from solvent-borne to ultra-high-solid hybrids

- 4.2.4 Surge of modular wind-tower fabrication yards

- 4.2.5 Rapid expansion of LNG carrier fleet

- 4.3 Market Restraints

- 4.3.1 Skilled-painter scarcity inflating field-applied costs

- 4.3.2 Regulatory scrutiny on cyclic siloxane by-products

- 4.3.3 Edge-defect failures under high-temperature cycling

- 4.3.4 Competitive threat from fluoropolymer top-coats

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products & Services

- 4.5.5 Degree of Competition

5 Market Size & Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Epoxy-Polysiloxane Hybrids

- 5.1.2 Acrylic-Polysiloxane Hybrids

- 5.1.3 Polyester-Modified Polysiloxane

- 5.1.4 Other Resin Types

- 5.2 By End-user Industry

- 5.2.1 Protective

- 5.2.1.1 Oil and Gas

- 5.2.1.2 Power

- 5.2.1.3 Infrastructure

- 5.2.2 Marine

- 5.2.3 Other End-user Industries

- 5.2.1 Protective

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC Countries

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Asian Paints Ltd.

- 6.4.3 Hempel A/S

- 6.4.4 Jotun

- 6.4.5 KISHO Corporation Co.,Ltd

- 6.4.6 Metcon Coatings & Chemicals India Private Limited.

- 6.4.7 NCP Coatings LLC

- 6.4.8 PPG Industries, Inc.

- 6.4.9 The Sherwin-Williams Company

- 6.4.10 Thomas Industrial Coatings

- 6.4.11 Tianjin Jinhai Special Coatings & Decoration Co., Ltd.

- 6.4.12 Tikkurila

- 6.4.13 Tnemec

- 6.4.14 Yung Chi Paint & Varnish MFG. CO.,LTD

7 Market Opportunities & Future Outlook

- 7.1 White-space and Unmet-need Assessment