|

市场调查报告书

商品编码

1906066

奈米多孔膜:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Nanoporous Membranes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

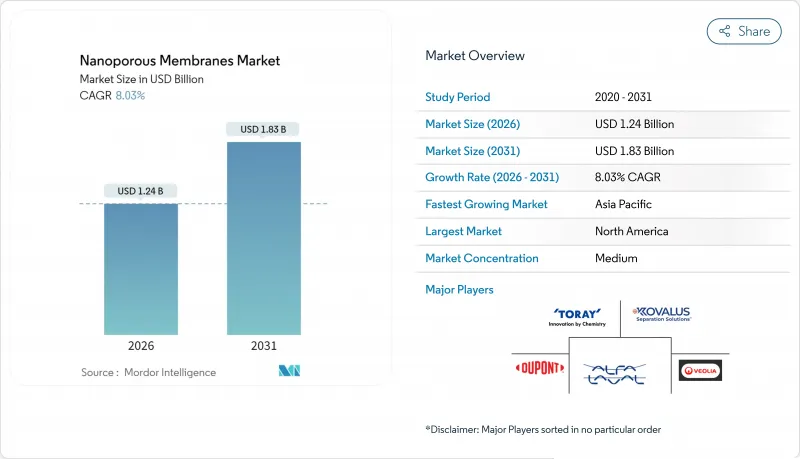

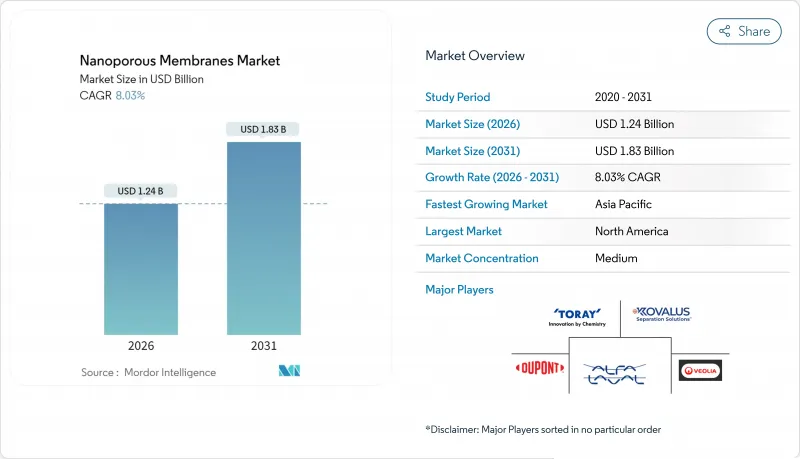

奈米多孔膜市场在 2025 年的价值为 11.5 亿美元,预计到 2031 年将达到 18.3 亿美元,而 2026 年为 12.4 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 8.03%。

水处理、燃料电池和生物医学製程对高性能分离技术的需求不断增长,是推动这一成长的关键因素。日益严格的工业污水法规、全球范围内海水淡化厂的大规模建设以及不断提升的生物处理能力,共同推动了先进膜平台的快速普及。技术供应商正致力于有机-无机混合设计和人工智慧驱动的效能建模,以降低能耗、减少膜污染并缩短企业发展週期。随着现有企业收购利基创新者以扩大生产规模和应用范围,竞争日益激烈。

全球奈米多孔膜市场趋势及洞察

废弃物和污水再利用的需求日益增长

市政当局和工业业者正在扩大薄膜生物反应器生产线和奈米过滤过滤最终处理流程的规模,以完善水循环,达到饮用水水资源再利用目标,并遵守严格的排放法规。香港大学以丝素蛋白为基础的过滤平台将水质净化率提高了10倍,同时降低了80%的能耗,展现了目前可实现的显着效率提升。公共产业优先选择兼具高污染物去除率和抗污染性能的薄膜材料,推动了对结合生物预处理和奈米级过滤的混合系统的资本投资。随着资产所有者采用基于绩效的合同,对提供预测性维护和低压设计的供应商的需求日益增长。这正在加速对模组化工厂的投资,这些工厂可以快速部署到缺水的都市区走廊。

提高缺水地区的海水淡化能力

埃及、阿尔及利亚和海湾地区的大规模咸水和海水淡化中心正推动超高压逆渗透膜元件的需求达到历史新高。埃及新建的日处理量达750万立方公尺的工厂,充分展现了埃及政府目前水安全计画的规模。欧盟的设施(2,178座工厂,每日处理量686万立方公尺)正在将可再生能源和能源回收技术融入薄膜处理生产线,以显着降低营业成本。为此,供应商正在研发能够处理浓度高达25万ppm的进水、使用寿命更长且能耐受强效预处理化学品的薄膜材料。地下水开采和卤水开采的先导计画对薄膜的耐久性提出了更高的要求,凸显了复合材料和陶瓷基材在高盐环境细分市场中的价值。

价格敏感型开发中国家的普及速度缓慢

儘管安全饮用水的需求迫切,但资金限制和熟练劳动力短缺阻碍了膜技术的普及应用。阿尔及利亚的海水淡化蓝图凸显了资金筹措方面的障碍,即便计划存量不断增加。对进口组件的依赖推高了生命週期成本,而本地有限的製造能力又减缓了备件的供应。发展融资倡议正试图弥补融资缺口,但与需求相比,部署速度仍然缓慢。如果组件製造成本和服务模式无法降低,薄膜技术在农村和郊区的普及应用将仍然有限。

细分市场分析

有机膜占奈米多孔膜市场规模的63.44%,预计到2031年将以8.47%的复合年增长率成长。其主导地位主要得益于成本效益高的捲对卷生产方式和优异的脱盐性能。聚酰胺薄膜复合片材兼具高选择性和可扩展的生产技术,正逐渐成为海水淡化和工业污水处理的主流材料。磺酸盐聚醚醚酮(PEC)的最新进展为燃料电池提供了一种低成本的质子交换方案,对目前由昂贵的含氟聚合物製成的产品构成了挑战。

将氧化石墨烯或氧化锆等无机填料融入聚合物基体的混合型奈米多孔膜设计,是奈米多孔膜市场成长最快的细分领域,它兼具有机械材料的易加工性和陶瓷的耐久性。几丁聚醣衍生的薄膜采用可再生原料,在维持机械强度的同时,也具有生物降解性,因此深受追求循环经济概念的顾客青睐。虽然在大批量专案中,纯有机系统的製造成本仍然更具优势,但在高温、高溶剂环境下,陶瓷膜和混合膜正逐渐占据一席之地,因为其较高的初始成本可以透过更长的组件使用寿命来弥补。

奈米多孔膜市场报告按材料类型(有机、无机、混合)、应用领域(水处理、燃料电池、生物医学、食品加工及其他)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以美元计价。

区域分析

北美地区在严格的环境法规和大规模的水利基础设施预算的推动下,预计到2025年将保持37.20%的收入份额。光是德克萨斯州运作60座市政海水淡化厂,日产量达1.72亿加仑。沿海海水淡化计划的可行性研究也正在进行中。该地区也是锂卤水纯化中心,杜邦公司的FilmTec LiNE-XD奈米过滤线具有高锂渗透性和二价金属去除率,专为直接锂提取製程而设计。

亚太地区预计将以9.22%的复合年增长率成为成长最快的地区,这主要得益于中国庞大的膜製造基地、印度城市水处理设施的扩张以及日本燃料电池供应链的不断完善。中国企业,例如国初科技,正在将膜技术应用于工业、製药和市政设施,这反映了该地区作为生产国和消费国的双重角色。新加坡的新生水策略正在推动对抗污染奈米过滤技术的持续研发投入,而东南亚国家则正在采用低压系统来满足农村地区的卫生需求。

欧洲是一个成熟而又充满创新活力的中心,运作2178座海水淡化厂,并且与可再生能源的联繫日益紧密。一个德国研究联盟正在测试可降低压力需求的原子膜,地中海沿岸国家正在试验使用浓缩盐水以提高计划经济效益。中东和非洲地区,以埃及的世界级海水淡化厂为首,提供了大规模供水的机会,但资金筹措复杂性也随之增加。在南美洲,巴西和阿根廷的海水淡化建设正在加速推进,儘管仍处于早期阶段,但此时正值水资源短缺威胁水力发电可靠性之际。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对废弃物和污水回收的需求不断增长

- 提高缺水地区的海水淡化能力

- 更严格的工业污水排放标准

- 生物加工中对高纯度过滤的需求

- 利用奈米级膜的实验室晶片实验室诊断技术

- 市场限制

- 价格敏感型开发中国家的采用率较低

- 堵塞和清洁循环带来的成本增加

- 特种奈米材料的供应和价格波动;

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依材料类型

- 有机的

- 无机物

- 杂交种

- 透过使用

- 水处理

- 燃料电池

- 生物医学

- 食品加工

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 义大利

- 法国

- 西班牙

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Alfa Laval

- Applied Membranes Inc.

- AXEON Water Technologies Inc.

- BASF

- DuPont

- Hunan Keensen Technology Co. Ltd

- Hydranautics-A Nitto Group Company

- inopor GmbH

- InRedox LLC

- Kovalus Separation Solutions

- MICRODYN-NADIR GmbH

- Osmotech Membranes Pvt Ltd

- Pure-Pro Water Corporation

- SiMPore Inc.

- SmartMembranes GmbH

- Synder Filtration Inc.

- TORAY INDUSTRIES, INC.

- Veolia

第七章 市场机会与未来展望

The Nanoporous Membranes Market was valued at USD 1.15 billion in 2025 and estimated to grow from USD 1.24 billion in 2026 to reach USD 1.83 billion by 2031, at a CAGR of 8.03% during the forecast period (2026-2031).

Growing demand for high-performance separation in water treatment, fuel cells, and biomedical processes is the primary engine behind this expansion. Regulatory tightening on industrial effluents, aggressive global desalination build-outs, and rising bioprocessing throughput needs all favor the rapid adoption of advanced membrane platforms. Technology suppliers are positioning around hybrid organic-inorganic designs and AI-enabled performance modeling to reduce energy use, tackle fouling, and shorten development cycles. Competitive intensity is rising as incumbents acquire niche innovators to secure scale advantages in manufacturing and broaden application coverage.

Global Nanoporous Membranes Market Trends and Insights

Growing Need for Waste- and Waste-Water Re-Use

Municipal and industrial operators are scaling membrane bioreactor lines and nanofiltration polishing steps to close water loops, achieve potable-reuse goals, and meet stringent discharge caps. A silk-based nanofiltration platform from the University of Hong Kong purifies water 10 times faster while cutting energy use by 80%, illustrating the step-change efficiency gains now possible. Utilities prioritize membranes that balance high contaminant rejection with fouling resistance, driving capital spending toward hybrid systems that pair biological pretreatment with nano-scale filtration. As asset owners adopt performance-based contracts, suppliers offering predictive maintenance and low-pressure designs gain traction. The result is accelerating investment in modular plants that can be deployed rapidly in water-scarce urban corridors.

Desalination Capacity Additions in Water-Scarce Regions

Mega-scale brackish and seawater desalination hubs in Egypt, Algeria, and Gulf states are catalyzing record demand for ultra-high-pressure reverse-osmosis elements. Egypt's newly completed 7.5 million m3/day station underscores the volumetric scale now targeted by government water-security programs. EU facilities, 2,178 plants producing 6.86 million m3/day, are layering renewable power and energy-recovery devices onto membrane trains to slash operating costs. Suppliers are, in turn, engineering membranes rated for 250,000 ppm feed, longer lifespans, and harsh pretreatment chemistries. Subsurface intakes and brine-mining pilots add further durability requirements, elevating the value of composite and ceramic substrates in niche high-salinity settings.

Low Adoption in Price-Sensitive Developing Countries

Capital constraints and limited skilled labor curb membrane roll-outs, despite urgent needs for safe water. Algeria's desalination roadmap highlights financing hurdles even as project pipelines swell. Dependence on imported modules inflates life-cycle costs, while sparse local manufacturing capacity delays spare-part deliveries. Development-finance initiatives attempt to bridge funding gaps, yet scaling remains slow relative to demand. Without cost-down advances in module fabrication and service models, adoption in rural and peri-urban centers will remain muted.

Other drivers and restraints analyzed in the detailed report include:

- Stricter Industrial Effluent Discharge Norms

- Bioprocessing Demand for High-Purity Filtration

- Fouling and Cleaning-Cycle Cost Penalties

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic membranes command 63.44% of the nanoporous membranes market size and are projected for an 8.47% CAGR through 2031, sustaining their lead via cost-effective roll-to-roll production and strong salt-rejection performance. Polyamide thin-film-composite sheets dominate desalination and industrial wastewater service because they marry high selectivity with scalable fabrication. Recent advances in sulfonated poly(ether ether ketone) provide low-cost proton-exchange options for fuel cells, challenging premium fluoropolymer incumbents.

Hybrid designs blending polymer matrices with inorganic fillers such as graphene oxide or zirconia are expanding fastest within the nanoporous membranes market, pairing the processability of organics with ceramic durability. Chitosan-derived membranes highlight renewable feedstocks that add biodegradability while maintaining mechanical integrity, appealing to customers pursuing circular-economy metrics. Manufacturing cost curves still favor pure organics for high-volume bids, yet ceramics and hybrids are gaining footholds in high-temperature, solvent-rich environments where extended module life offsets up-front premiums.

The Nanoporous Membranes Report is Segmented by Material Type (Organic, Inorganic, and Hybrid), Application (Water Treatment, Fuel Cell, Biomedical, Food Processing, and Others), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained a 37.20% revenue lead in 2025 on the back of rigorous environmental oversight and expansive water-infrastructure budgets. Texas alone operates 60 municipal desalination units producing 172 million gallons daily, with coastal seawater projects in feasibility review. The region is also a hotbed for lithium-brine purification, where DuPont's FilmTec LiNE-XD nanofiltration line targets direct-lithium-extraction flows with high lithium passage and divalent-metal rejection.

Asia-Pacific is forecast to register the fastest 9.22% CAGR, buoyed by China's massive membrane manufacturing base, India's urban water-treatment build-out, and Japan's fuel-cell supply-chain expansion. Chinese firms such as Guochu Technology integrate membranes across industrial, pharma, and municipal installations, underscoring the region's dual role as producer and consumer. Singapore's NEWater strategy drives sustained research and development spend on fouling-resistant nanofiltration, while South-East Asian nations adopt low-pressure systems to address rural sanitation needs.

Europe remains a mature yet innovative hub, running 2,178 desalination plants and increasingly pairing them with renewable-energy inputs. German research consortia trial atomically thin membranes to trim pressure requirements, and Mediterranean states are implementing brine-valorization pilots to enhance project economics. The Middle East and Africa, led by Egypt's world-scale desal plant, offer high-volume opportunities balanced against financing complexities. South America's build-outs in Brazil and Argentina are nascent but accelerating as water scarcity dents hydro-power reliability.

- Alfa Laval

- Applied Membranes Inc.

- AXEON Water Technologies Inc.

- BASF

- DuPont

- Hunan Keensen Technology Co. Ltd

- Hydranautics - A Nitto Group Company

- inopor GmbH

- InRedox LLC

- Kovalus Separation Solutions

- MICRODYN-NADIR GmbH

- Osmotech Membranes Pvt Ltd

- Pure-Pro Water Corporation

- SiMPore Inc.

- SmartMembranes GmbH

- Synder Filtration Inc.

- TORAY INDUSTRIES, INC.

- Veolia

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Need for Waste- and Waste-Water Re-Use

- 4.2.2 Desalination Capacity Additions in Water-Scarce Regions

- 4.2.3 Stricter Industrial Effluent Discharge Norms

- 4.2.4 Bioprocessing Demand for High-Purity Filtration

- 4.2.5 Lab-on-Chip Diagnostics Adopting Nano-Scale Membranes

- 4.3 Market Restraints

- 4.3.1 Low Adoption in Price-Sensitive Developing Countries

- 4.3.2 Fouling and Cleaning-Cycle Cost Penalties

- 4.3.3 Volatile Supply and Pricing of Specialty Nanomaterials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Material Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.1.3 Hybrid

- 5.2 By Application

- 5.2.1 Water Treatment

- 5.2.2 Fuel Cell

- 5.2.3 Biomedical

- 5.2.4 Food Processing

- 5.2.5 Others

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Overview, Market-level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alfa Laval

- 6.4.2 Applied Membranes Inc.

- 6.4.3 AXEON Water Technologies Inc.

- 6.4.4 BASF

- 6.4.5 DuPont

- 6.4.6 Hunan Keensen Technology Co. Ltd

- 6.4.7 Hydranautics - A Nitto Group Company

- 6.4.8 inopor GmbH

- 6.4.9 InRedox LLC

- 6.4.10 Kovalus Separation Solutions

- 6.4.11 MICRODYN-NADIR GmbH

- 6.4.12 Osmotech Membranes Pvt Ltd

- 6.4.13 Pure-Pro Water Corporation

- 6.4.14 SiMPore Inc.

- 6.4.15 SmartMembranes GmbH

- 6.4.16 Synder Filtration Inc.

- 6.4.17 TORAY INDUSTRIES, INC.

- 6.4.18 Veolia

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment