|

市场调查报告书

商品编码

1906077

脱模剂:市占率分析、产业趋势与统计、成长预测(2026-2031)Release Agents - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

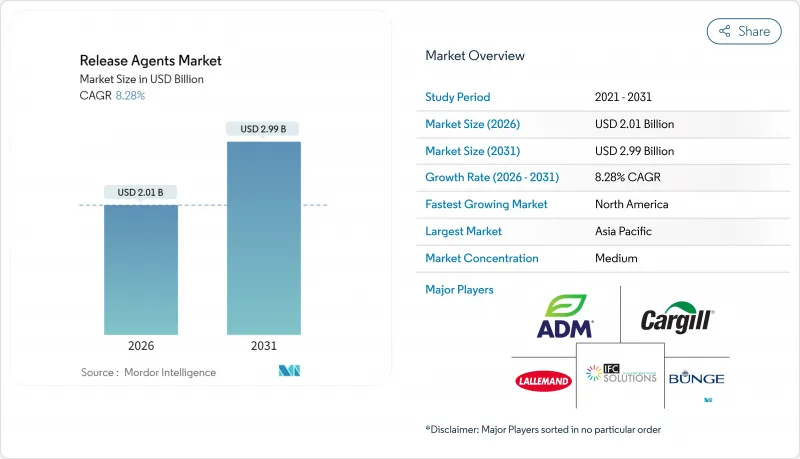

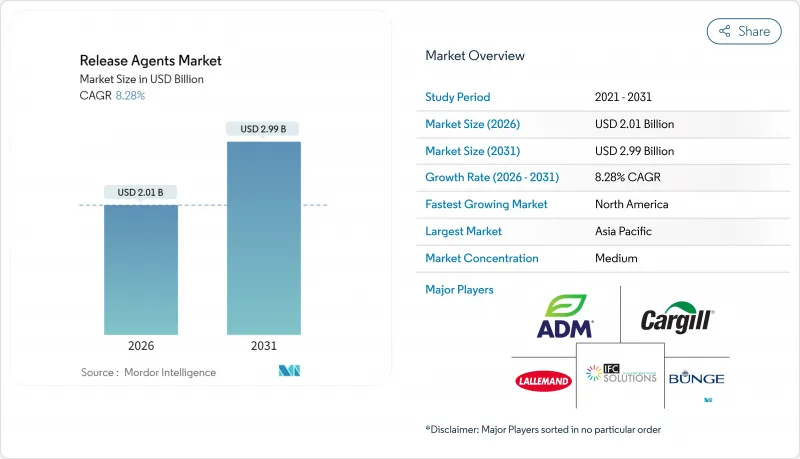

2025年,脱模剂市值为18.6亿美元,预计2031年将达到29.9亿美元,高于2026年的20.1亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 8.28%。

这一增长反映了製造商在严格的食品接触法规与自动化生产要求之间寻求平衡的努力。符合 NSF-H1 和欧盟 1935/2004 标准的组合药物日益普及,以及低 VOC 水基喷涂系统的引入,凸显了先进脱模剂在麵包房、肉类加工厂、糖果甜点生产线和冷冻甜点生产设施中的重要性。新兴经济体(尤其是亚太地区)的基础设施投资推动了市场扩张,该地区乳製品、肉类和简便食品业务的增长速度超过了当地在特种脱模技术方面的专业知识水平。各公司正致力于研发不含 PFAS 的配方、可生物降解的蜡酯和植物油,以在保持有效不黏性能的同时,满足永续性目标和消费者对透明度的需求。此外,大宗商品价格波动和区域迁移测试要求正在推动供应商整合,凸显了合规性和可靠的全球供应链的重要性。

全球脱模剂市场趋势与洞察

不断扩大的食品加工业

全球食品加工业的扩张,透过增加烘焙食品、糖果甜点、乳製品和加工肉品的产量,推动了脱模剂市场的成长。脱模剂对于在大生产过程中维持产品品质、减少废弃物和确保生产线效率至关重要。英国麵包和烘焙食品製造业正是这一趋势的典型代表,就公司数量而言,它是食品行业中最大的子部门。根据英国国家统计局 (ONS) 的数据,该子部门约有 2910 家公司,显示对烘焙相关脱模剂的需求庞大。这一趋势也正在蔓延至欧洲、北美和亚太地区,这些地区工业食品製造业的成长支撑了对脱模剂技术的需求。产业成长,加上消费者对预包装和已调理食品需求的不断增长,正在推动先进脱模剂配方的应用。製造商正在开发能够满足自动化生产系统、洁净标示要求以及全球加工商所期望的永续性标准的解决方案。

优先选择非氢化植物油

全球脱模剂市场正经历转型,非氢化植物油的日益普及是消费者健康意识增强和监管要求推动的结果。传统上,氢化油因其稳定性和功能性而被广泛用于脱模剂配方中。然而,研究显示反式脂肪酸与心血管疾病、肥胖和代谢障碍等健康问题有关,这促使全球加强监管并重新设计产品。加拿大卫生署核准植物二酰甘油油取代部分氢化油(PHO),显示监管机构对新型脂质技术的支持。这项核准可能会促使整个行业更广泛地采用替代解决方案。目前,烘焙、糖果和加工肉品行业的食品製造商正在将非氢化油(例如芥花籽油、葵花籽油、大豆油和菜籽油)添加到其脱模剂产品中。这些替代品具有可靠的脱模性能和较长的保质期等重要功能特性,同时符合洁净标示的要求,避免了反式脂肪酸带来的健康隐患。

原物料价格波动

商品价格波动对利润率造成压力,迫使企业在配方复杂性和成本竞争力之间寻求平衡。根据美国劳工统计局的数据,2020年至2024年间,食品加工应用领域的原料成本上涨了23.6%。这种通膨环境对特种脱模剂的影响尤其显着,因为这类产品需要高品质的原料,而价格敏感度限制了其在成本敏感应用领域的市场渗透。供应链中断加剧了价格波动的影响,为依赖特定原料等级和来源的脱模剂製造商带来了采购挑战。这种波动会影响直接材料成本、运输成本和能源投入,导致利润率面临多重压力,对于缺乏避险能力的中小型供应商而言,压力尤其严重。期货合约策略透过稳定价格和建立长期客户关係提供竞争优势,但规模较小的竞争对手在商品价格飙升期间会经历週期性的利润率压缩。

细分市场分析

截至2025年,乳化剂占了38.05%的市场份额,这表明它们在疏水性脱模剂和水性食品系统之间发挥着至关重要的桥樑作用。乳化剂在食品加工中的广泛应用,特别是在单甘油酯、双酸甘油酯、聚甘油酯和卵磷脂的配方中,确保了在各种生产条件下都能获得稳定的效果。这些乳化剂对于维持产品稳定性、改善质地和提升加工食品的整体品质至关重要,使其成为食品产业不可或缺的一部分。此外,乳化剂对各种加工环境的适应性和对不同生产条件的耐受性进一步巩固了其市场主导地位。

蜡和蜡酯是配方领域的热门细分市场,预计到2031年将以高达8.84%的复合年增长率成长。这一快速成长主要得益于可生物降解配方和不含PFAS替代品的创新,这些创新兼顾了性能与环境合规性。日益增长的永续性意识和对环保解决方案的需求进一步加速了这些配方的应用。同时,受非氢化植物油监管建议的推动,植物油的需求持续旺盛。这与消费者对更健康、更天然成分日益增长的偏好不谋而合。抗氧化剂在脂质基释放系统中发挥关键作用,它们能够延长保质期并抑制酸败,从而确保产品在各种应用中的品质和更长的保质期。此外,在这些系统中添加抗氧化剂不仅可以延长产品寿命,还有助于开发符合不断变化的消费者和行业标准的高品质、稳定配方。

区域分析

北美地区预计到2025年将占据34.10%的市场份额,这得益于其先进的食品加工基础设施和严格的法规环境进一步推动了先进脱模剂的应用,使北美成为市场主导。同时,亚太地区也呈现成长态势,预计2031年将以9.10%的复合年增长率成长。这一快速成长主要归功于食品加工产业的工业化程度不断提高以及监管标准的不断变化,这两方面都推动了对专用脱模剂的需求。该地区不断壮大的中产阶级以及消费者对加工食品和包装食品日益增长的需求,也促进了对高效脱模剂解决方案的需求。

欧洲拥有庞大的市场份额,并受欧盟法规1935/2004的监管。该法规对食品接触材料提出了具体要求,并影响脱模剂的选择。欧洲对环境保护的承诺推动了可生物降解和植物来源脱模剂的广泛应用。凭藉着完善的法规结构和对永续性的重视,欧洲已成为推动脱模剂配方持续创新的关键市场。此外,该地区对研发的高度重视,推动了满足监管要求和消费者需求的先进解决方案的开发,进一步巩固了其在全球市场的地位。

随着食品加工工业化程度的提高,南美洲和中东及非洲地区正崛起为极具潜力的市场。然而,由于法规结构和加工基础设施成熟度的差异,市场发展速度并不均衡。儘管这些地区食品加工用脱模剂的使用量显着增加,但成长速度高度依赖各国的产业成熟度和监管环境。在南美,需求成长主要得益于对食品加工设施现代化和食品安全标准提升的日益重视。同样,在中东及非洲,食品加工业投资的增加和法规结构的逐步完善也为市场扩张创造了机会。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 不断扩大的食品加工业

- 优先选择非氢化植物油

- 根据 NSF-H1 和欧盟 1935/2004 标准进行食品安全推广

- 脱模剂配方的技术进步

- 经济实惠的植物来源符合法规要求

- 用于工业烘焙中溶剂挥发性有机化合物(VOC)减少的水性喷雾技术

- 市场限制

- 原物料价格波动

- 新兴肉类加工丛集终端用户意识不足

- 严格的监管标准

- 过敏原和“不含”产品限制

- 供应链分析

- 监理与技术展望

- 五力分析

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 激烈的竞争

第五章 市场规模与成长预测

- 按成分

- 乳化剂

- 抗氧化剂

- 植物油

- 蜡和蜡酯

- 其他的

- 按形式

- 液体

- 固体的

- 透过使用

- 烘焙和糖果甜点

- 肉类及肉品

- 乳製品和冷冻甜点

- 其他用途

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 北美其他地区

- 欧洲

- 德国

- 英国

- 法国

- 俄罗斯

- 西班牙

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 阿拉伯聯合大公国

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 最活跃的公司

- 市场定位分析

- 公司简介

- Archer Daniels Midland(ADM)

- Cargill Inc.

- AAK AB

- Palsgaard A/S

- Dow Inc.

- IFC Solutions

- Lallemand Inc.

- Bunge Ltd.

- Masterol Foods Pty Ltd.

- Mallet & Company

- The Bakels Group

- Bundy Baking Solutions

- Avatar Corporation

- Chem-Trend(Lubrizol)

- Kerry Group plc

- PPG Silicones

- Henkel AG

- JAX Inc.

- ROCOL(ITW)

- Vegalene(R)/PLZ Corp.

第七章 市场机会与未来展望

The release agents market was valued at USD 1.86 billion in 2025 and estimated to grow from USD 2.01 billion in 2026 to reach USD 2.99 billion by 2031, at a CAGR of 8.28% during the forecast period (2026-2031).

This growth reflects manufacturers' efforts to balance strict food-contact regulations with automated production requirements. The increased use of NSF-H1 and EU 1935/2004-compliant formulations, combined with the implementation of low-VOC water-based spray systems, highlights the importance of advanced release agents in bakeries, meat processing plants, confectionery production lines, and frozen-dessert facilities. The market expansion is supported by infrastructure investments in emerging economies, particularly in Asia-Pacific region, where the growth of dairy, meat, and convenience food operations exceeds local expertise in specialized release technologies. Companies are focusing on PFAS-free formulations, biodegradable wax esters, and plant-based oils to meet sustainability goals and consumer transparency demands while maintaining effective anti-stick properties. Additionally, fluctuating commodity prices and regional migration testing requirements are driving supplier consolidation, emphasizing the importance of regulatory compliance and reliable global supply chains.

Global Release Agents Market Trends and Insights

Expanding food processing industry

The global food processing industry's expansion drives the release agents market growth through increased production of bakery, confectionery, dairy, and processed meat products. Release agents are essential for maintaining product quality, minimizing waste, and ensuring production line efficiency in high-volume processing operations. The United Kingdom's bread and bakery manufacturing sector exemplifies this trend, representing the food industry's largest subsector by number of companies. The Office for National Statistics (UK) reports approximately 2,910 enterprises operating in this subsector, demonstrating substantial bakery-related demand for release agents. This pattern extends across Europe, North America, and Asia-Pacific, where industrial food manufacturing growth sustains the demand for release technologies. The combination of industry growth and increasing consumer demand for packaged and ready-to-eat foods drives the adoption of advanced release agent formulations. Manufacturers are developing solutions that align with automated production systems, clean-label requirements, and sustainability standards required by global processors.

Preference for non-hydrogenated vegetable oils

The global release agents market is transforming due to the increasing adoption of non-hydrogenated vegetable oils, influenced by growing consumer health consciousness and regulatory requirements. While hydrogenated oils were previously common in release agent formulations due to their stability and functionality, research linking trans fats to health issues such as cardiovascular disease, obesity, and metabolic disorders has led to global regulatory restrictions and product reformulations. Health Canada's endorsement of vegetable diacylglycerol oil as an alternative to partially hydrogenated oils (PHOs) demonstrates regulatory support for new lipid technologies. This approval may increase the adoption of alternative solutions across the industry. Food manufacturers in the bakery, confectionery, and processed meat industries are now implementing non-hydrogenated oils, including canola, sunflower, soybean, and rapeseed oils, in their release agent products. These alternatives provide essential functional properties such as reliable release performance and longer shelf life while supporting clean-label initiatives without the health concerns linked to trans fats.

Raw-material price volatility

Commodity price fluctuations create margin pressure, forcing strategic decisions between formulation complexity and cost competitiveness. Food processing ingredient costs increased by 23.6% between 2020-2024, according to Bureau of Labor Statistics data. The inflationary environment significantly affects specialty release agents that require premium raw materials, as price sensitivity restricts their market penetration in cost-conscious applications. Supply chain disruptions intensify volatility effects, creating procurement challenges for release agent manufacturers who depend on specific raw material grades or sources. The volatility impacts direct material costs, transportation, and energy inputs, creating compound margin pressure that particularly affects smaller suppliers without hedging capabilities. Forward contracting strategies provide competitive advantages by enabling price stability and supporting long-term customer relationships, while smaller competitors experience periodic margin compression during commodity price spikes.

Other drivers and restraints analyzed in the detailed report include:

- Food safety push for NSF-H1 and EU 1935/2004-compliant release agents

- Technological advancements in release agent formulations

- Stringent regulatory standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, emulsifiers command a 38.05% share of the market, underscoring their pivotal role in bridging the gap between hydrophobic release agents and water-based food systems. Their widespread use in food processing, particularly with formulations like mono- and diglycerides, polyglycerol esters, and lecithin, ensures consistent results across diverse manufacturing conditions. These emulsifiers are critical in maintaining product stability, improving texture, and enhancing the overall quality of processed foods, making them indispensable in the industry. Additionally, their ability to adapt to various processing environments and withstand different manufacturing conditions further solidifies their dominance in the market.

Wax and wax esters are the composition segment to watch, boasting an impressive 8.84% CAGR through 2031. This surge is largely fueled by innovations in biodegradable formulations and PFAS-free alternatives, striking a balance between environmental compliance and performance. The growing emphasis on sustainability and the need for eco-friendly solutions have further accelerated the adoption of these compositions. Meanwhile, vegetable oils enjoy sustained demand, bolstered by regulatory endorsements for non-hydrogenated options, which align with the increasing consumer preference for healthier and more natural ingredients. Antioxidants play a crucial role, enhancing shelf life and curbing rancidity in lipid-based release systems, thereby ensuring product integrity and extending usability in various applications. Furthermore, the integration of antioxidants into these systems not only improves product longevity but also supports the development of high-quality, stable formulations that meet evolving consumer and industry standards.

The Release Agents Market Report Segments the Industry by Composition (Emulsifiers, Antioxidants, Vegetable Oils, Wax and Wax Esters, Others), by Form (Liquid, Solid), by Application (Bakery and Confectionery, Meat and Meat Products, More), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America commands a 34.10% share of the market, bolstered by its sophisticated food processing infrastructure and stringent regulations that demand top-tier release agent formulations. Years of advancement in industrial food processing have equipped the region with robust supply chains and deep technical expertise, ensuring the consistent application of release agent performance standards. The region's regulatory environment, which emphasizes food safety and quality, further drives the adoption of advanced release agents, making North America a dominant player in the market. Meanwhile, the Asia-Pacific region is on a growth trajectory, boasting a 9.10% CAGR through 2031. This surge is largely due to heightened industrialization in food processing and shifting regulatory standards, both of which amplify the demand for specialized release agents. The region's expanding middle-class population and increasing consumer demand for processed and packaged foods also contribute to the growing need for efficient release agent solutions.

Europe, with its significant market presence, is guided by EU Regulation 1935/2004. This regulation delineates specific requirements for food contact materials, influencing the selection of release agents. Europe's dedication to environmental stewardship has spurred the rise of biodegradable and plant-based release agents. Coupled with a robust regulatory framework and a sustainability focus, Europe stands out as a pivotal market, driving continuous innovation in release agent formulations. Additionally, the region's strong emphasis on research and development fosters the creation of advanced solutions that align with both regulatory and consumer demands, further solidifying its position in the global market.

As food processing industrialization gains momentum, South America and the Middle East, and Africa emerge as promising markets. Yet, the pace of market development is uneven, shaped by the nuances of regulatory frameworks and the maturity of processing infrastructure. While there's a noticeable uptick in the adoption of release agents for food processing in these regions, the speed of this growth is heavily influenced by each country's industrial maturity and regulatory landscape. In South America, the growing focus on modernizing food processing facilities and improving food safety standards is driving demand. Similarly, in the Middle East and Africa, increasing investments in food processing industries and the gradual establishment of regulatory frameworks are creating opportunities for market expansion.

- Archer Daniels Midland (ADM)

- Cargill Inc.

- AAK AB

- Palsgaard A/S

- Dow Inc.

- IFC Solutions

- Lallemand Inc.

- Bunge Ltd.

- Masterol Foods Pty Ltd.

- Mallet & Company

- The Bakels Group

- Bundy Baking Solutions

- Avatar Corporation

- Chem-Trend (Lubrizol)

- Kerry Group plc

- PPG Silicones

- Henkel AG

- JAX Inc.

- ROCOL (ITW)

- Vegalene(R) / PLZ Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and market definition

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expanding food processing industry

- 4.2.2 Preference for non-hydrogenated vegetable oils

- 4.2.3 Food safety push for NSF-H1 and EU 1935/2004-compliant release agents

- 4.2.4 Technological advancements in release agent formulations

- 4.2.5 Cost-effective plant-based formulations are gaining regulatory tailwinds

- 4.2.6 Water-based spray technologies cutting solvent VOCs in industrial bakeries

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility

- 4.3.2 Low end-user awareness in emerging meat-processing clusters

- 4.3.3 Stringent Regulatory Standards

- 4.3.4 Allergen and "free-from" limitations

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porters Five Force Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry Source

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Composition

- 5.1.1 Emulsifiers

- 5.1.2 Antioxidants

- 5.1.3 Vegetable Oils

- 5.1.4 Wax and Wax Esters

- 5.1.5 Others

- 5.2 By Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.3 By Application

- 5.3.1 Bakery and Confectionery

- 5.3.2 Meat and Meat Products

- 5.3.3 Dairy and Frozen Desserts

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Russia

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 India

- 5.4.3.2 China

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Active Companies

- 6.2 Market Positioning Analysis

- 6.3 Company Profiles

- 6.3.1 Archer Daniels Midland (ADM)

- 6.3.2 Cargill Inc.

- 6.3.3 AAK AB

- 6.3.4 Palsgaard A/S

- 6.3.5 Dow Inc.

- 6.3.6 IFC Solutions

- 6.3.7 Lallemand Inc.

- 6.3.8 Bunge Ltd.

- 6.3.9 Masterol Foods Pty Ltd.

- 6.3.10 Mallet & Company

- 6.3.11 The Bakels Group

- 6.3.12 Bundy Baking Solutions

- 6.3.13 Avatar Corporation

- 6.3.14 Chem-Trend (Lubrizol)

- 6.3.15 Kerry Group plc

- 6.3.16 PPG Silicones

- 6.3.17 Henkel AG

- 6.3.18 JAX Inc.

- 6.3.19 ROCOL (ITW)

- 6.3.20 Vegalene(R) / PLZ Corp.