|

市场调查报告书

商品编码

1906082

绿石油焦和锻烧石油焦:市场份额分析、行业趋势和统计数据、成长预测(2026-2031)Green Petroleum Coke And Calcined Petroleum Coke - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

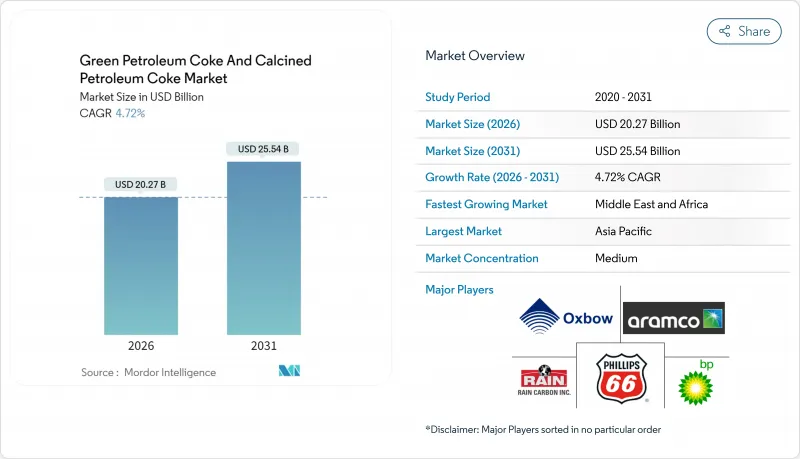

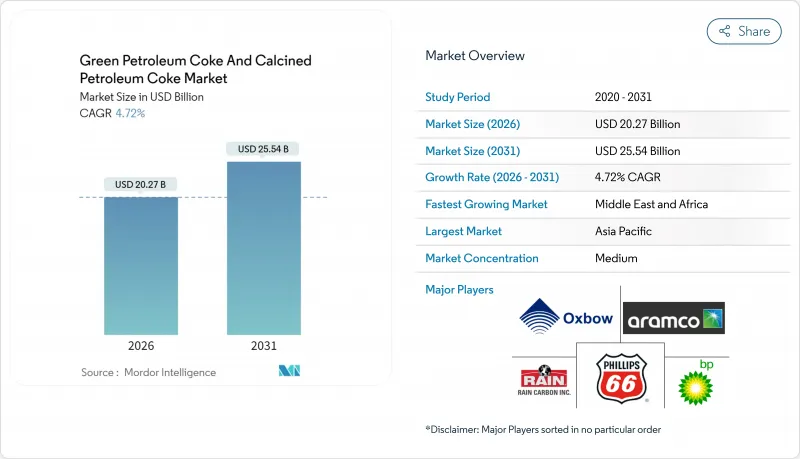

2025年,绿色石油焦和锻烧石油焦市场价值为193.6亿美元,预计从2026年的202.7亿美元成长到2031年的255.4亿美元,在预测期(2026-2031年)内复合年增长率为4.72%。

这一稳步增长反映了中东和亚太地区焦炭投资的延迟、中国阳极行业中硫含量限制的收紧,以及低硫焦炭和高硫焦炭之间价格差异的扩大。亚太地区保持需求主导,铝提炼和水泥厂正在消化不断增长的需求,而沙乌地阿拉伯、阿联酋和奈及利亚的新炼焦厂则增加了可出口的供应。欧盟和北美的环境法规正在重塑贸易路线,有利于低排放源和垂直整合的供应商。竞争格局显示,炼油厂对生焦原料的控制力增强,独立锻烧儘管面临利润压力,仍在提高产能,而超低硫焦等特殊焦作为锂离子电池负极材料,价格溢价较高。

全球绿色石油焦和锻烧石油焦市场趋势及洞察

扩大铝提炼产能

2024年,全球铝生产需要大量的锻烧焦。这项需求巩固了高品质、低硫原料的市场结构性基础。作为主导力量的中国消耗了其中很大一部分。然而,随着电价下跌和新建冶炼厂签订长期液化天然气合同,区域冶炼厂的成长重点转向了印度和波湾合作理事会(GCC)国家。阿曼和巴西新建的锻烧计划加剧了全球竞争,但其中许多设施仍依赖其他地区进口的低硫生焦。日益严格的品质标准,例如硫含量上限和钒含量限制,有利于能够自主管理原料流的综合炼厂,从而挤压了高硫焦生产商的利润空间。此外,冶炼厂目前已将范围1二氧化碳排放上限纳入长期承购合同,进一步提升了低排放焦炭的价值。

与煤炭相比,石油焦在水泥窑燃料使用上具有成本优势。

2025年,高硫石油焦与煤炭的价格差异显着,儘管运费波动,仍能支撑窑炉需求。印度降低了进口关税,土耳其取消了对美国石油焦的关税,扩大了需求基础。展望未来,飓风季期间价格差异可能会缩小,促使一些生产商签订多季合约。脱碳路线蓝图设想到2050年,窑炉燃料将过渡为石油焦、煤炭和生物质的组合,预计即使碳成本上升,石油焦在中期内仍将保持一定的市场地位。印度和美国港口强制实施的仓储设施将增加装卸成本,但在大多数价格情境下,石油焦在燃料成本方面仍优于煤炭。

欧盟更严格的硫氧化物/粒状物排放法规和碳边境调节机制

欧盟的碳边境调节机制正进入过渡性通报阶段,预计在未来几年内引入附加税。石油焦等残余产品预计将逐步纳入监管。进口商将被要求揭露直接和间接排放以及原产国的碳价格,这将降低高硫焦的成本优势。在美国,儘管单煅烧炉会产生大量的二氧化硫排放,但许多工厂仍缺乏脱硫设备。如果加强联邦法规以符合欧盟标准,维修固定成本的增加可能会促使贸易结构调整,转向低排放工厂。

细分市场分析

2025年,燃料级产品占生石油焦和锻烧石油焦市场份额的60.95%,主要受水泥窑和锅炉需求的驱动。儘管价格仍低于煤炭,但与历史水准相比,价格差距已缩小。许多炼油厂正在优化延时焦炉的运作条件,优先生产燃料级产品,以最大程度地提高真空残渣的产量而非品质。预计在预测期内,燃料级生石油焦和锻烧石油焦的市场规模将稳定成长。

锻烧焦的复合年增长率 (CAGR) 为 5.76%,主要受铝阳极市场扩张以及对二氧化钛、再碳化剂和石墨电极等特殊产品需求成长的推动。未来几年,全球锻烧焦产能可望大幅成长,主要得益于印度、阿曼和中国新增工厂的建设。然而,严格的硫含量限制了原料供应,迫使炼油厂添加脱硫添加剂并混合原料以满足其应用需求。儘管该领域因振动引起的堆积密度溢价和较低的金属杂质容忍度而享有较高的利润率,但短期内供应过剩的风险可能会对现货价格差构成压力。

区域分析

到2025年,亚太地区将占全球收入份额的47.90%,这主要得益于中国对石油焦和铝预焙设备的巨大需求。锻烧焦的进口量将逐年成长,主要来源国为美国、俄罗斯和沙乌地阿拉伯。日本和韩国拥有先进的针状焦技术,而东南亚国协则在液化天然气价格波动的情况下,在其水泥窑中使用高硫石油焦替代煤炭以控製成本。

受沙乌地阿拉伯、阿联酋、科威特、埃及和奈及利亚新建焦化装置带来的原料供应增加的推动,中东和非洲的绿色石油焦和锻烧石油焦市场预计到2031年将以5.62%的复合年增长率成长。像丹格特炼油厂这样的综合炼油厂正在逐步减少轻量产品的出口,转而将重质残渣油商业化。巴林和阿曼的铝冶炼厂接近性,缩短了供应链,而阿拉伯中质原油的低硫特性也有利于生产高品质的锻烧焦。

北美仍然是最大的出口地区,占全球绿焦产量的大部分。然而,由于美国西海岸和墨西哥湾沿岸港口的环境法规导致物流成本上升,一些炼油商已与亚洲签订长期的船上交货(FOB)合约。在欧洲,由于炼油厂产能下降,国内供应受到限制,对低硫焦炭的需求仍然强劲。欧盟的碳边境调节附加税(CBAM)将于2026年生效,预计将促使买方转向使用来自中东、范围1排放较低的原料。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 铝提炼产能扩张趋势

- 在水泥窑中,燃料石油焦比煤炭具有成本优势。

- 中东焦化产能扩充延迟

- 电炉炼钢石墨电极用针状焦的需求

- 用于锂离子电池的超低硫焦

- 市场限制

- 原油裂解价差的波动正在影响GPC的供应。

- 加强欧盟对硫氧化物(SOx)和颗粒物(PM)的监管以及碳边境调节措施

- 港口城市当地民众反对石油焦贸易

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按类型

- 燃油等级

- 锻烧焦

- 目的

- 绿色石油焦

- 铝

- 燃料

- 钢

- 金属硅

- 其他(砖块、玻璃、碳製品等)

- 锻烧石油焦

- 铝

- 二氧化钛

- 再碳化市场

- 其他(针状焦、碳製品等)

- 绿色石油焦

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Aluminium Bahrain BSC(Alba)

- BP plc

- Chevron Corp

- China Petroleum & Chemical Corporation(Sinopec)

- CNOOC Limited

- ELSID SA

- Exxon Mobil Corp

- Indian Oil Corporation

- Maniayargroup

- Marathon Petroleum

- Numaligarh Refinery Limited

- Oxbow Corporation

- Petrocoque

- Phillips 66 Company

- Rain Carbon Inc.

- Reliance Industries Ltd

- Rio Tinto

- Saudi Aramco

- Saudi Calcined Petroleum Coke Company(SCPC)

- Valero Energy Corp

- Zhenjiang Coking And Gas Group Co. Ltd

第七章 市场机会与未来展望

The Green Petroleum Coke And Calcined Petroleum Coke Market was valued at USD 19.36 billion in 2025 and estimated to grow from USD 20.27 billion in 2026 to reach USD 25.54 billion by 2031, at a CAGR of 4.72% during the forecast period (2026-2031).

This steady climb reflects delayed coking investments in the Middle East and Asia-Pacific, tightening sulfur limits in China's anode sector, and widening price spreads between low-sulfur and high-sulfur grades. The Asia-Pacific region retains its demand leadership as aluminium smelters and cement plants absorb growing volumes, while new complexes in Saudi Arabia, the United Arab Emirates, and Nigeria increase exportable supply. Environmental regulations in the European Union and North America are reshaping trade lanes, favoring low-emission origins and vertically integrated suppliers. Competitive dynamics reveal refiners tightening their control over green coke feedstock, independent calciners adding capacity despite margin pressure, and specialty grades, such as ultra-low-sulfur coke, capturing premiums for use in lithium-ion battery anodes.

Global Green Petroleum Coke And Calcined Petroleum Coke Market Trends and Insights

Rising Aluminium Smelting Capacity Expansions

In 2024, the global aluminium output necessitated a significant amount of calcined coke. This demand solidifies a structural floor for premium low-sulfur feedstocks. China, the dominant player, consumed a substantial share. However, as power prices decline and new smelters secure long-term LNG contracts, regional smelter growth is pivoting towards India and the Gulf Cooperation Council states. While new calcining projects in Oman and Brazil heighten global competition, many of these facilities still rely on imported low-sulfur green coke from other regions. Tightening quality standards-such as stricter sulfur caps and vanadium restrictions-benefit integrated refiners who can manage streams internally, thereby squeezing margins for high-sulfur producers. Additionally, smelters are now incorporating scope-1 CO2 intensity ceilings into long-term offtake contracts, further elevating the value of low-emission coke grades.

Fuel-Grade Petcoke Cost Advantage Over Coal in Cement Kilns

In 2025, high-sulfur petcoke maintained a significant discount to coal, sustaining kiln demand despite volatile freight. India reduced import duties, while Turkey removed tariffs on U.S. supplies, broadening accessible demand pools. Forward trends indicate that discounts are narrowing during hurricane season, prompting some producers to secure multi-quarter contracts. Decarbonization roadmaps envision a transitional kiln fuel split of petcoke, coal, and biomass by 2050, preserving a medium-term niche for petcoke even as carbon costs rise. Covered storage mandates at Indian and U.S. ports add handling costs, yet the net fuel advantage over coal remains intact under most price scenarios.

Stricter SOx/PM Limits and Carbon Border Adjustment in European Union

The EU Carbon Border Adjustment Mechanism has entered transitional reporting and will impose fees in the coming years, with residual products, such as petcoke, positioned for phased inclusion in the future. Importers must disclose direct and indirect emissions, as well as the carbon prices in their origin countries, narrowing the cost advantages for high-sulfur coke. In the United States, stand-alone calciners emitted significant levels of SO2, yet many still lack scrubbers. If federal limits tighten to match EU standards, retrofits could add fixed costs, reshaping trade toward lower-emission plants.

Other drivers and restraints analyzed in the detailed report include:

- Capacity Build-Out of Delayed Coking Units in Middle-East Refineries

- Ultra-Low-Sulfur Coke for Li-Ion Battery Anodes

- Community Opposition to Petcoke Handling in Port Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fuel-grade material held 60.95% of the Green Petroleum Coke and Calcined Petroleum Coke Market share in 2025, driven by demand from cement kilns and boilers. Prices are still undercutting coal, although the discount has narrowed against historical norms. Many refineries optimize delayed-coker operating severity to favor fuel-grade volumes, maximizing vacuum resid destruction over quality. The green petroleum coke and calcined petcoke market size for fuel-grade supply is expected to grow steadily during the forecast period.

Calcined coke is advancing at a 5.76% CAGR, stimulated by aluminium anode expansions and specialty demands in titanium dioxide, recarburizers, and graphite electrodes. Plant additions in India, Oman, and China could significantly increase global calcined capacity in the coming years. Yet sulfur tightening below 3% crimps effective feedstock, prompting refiners to apply desulfurizing additives and blend fit-for-purpose streams. The segment captures higher margins owing to vibrated bulk-density premiums and low metal impurity thresholds, although oversupply risk in the near future may pressure spot differentials.

The Green Petroleum Coke and Calcined Petroleum Coke Market Report is Segmented by Type (Fuel Grade and Calcined Coke), Application (Green Petroleum Coke: Aluminum, Fuel, Iron and Steel, Silicon Metal, and Others; Calcined Petroleum Coke: Aluminum, Titanium Dioxide, Re-Carburizing Market, and Others), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific captured 47.90% revenue share in 2025, anchored by China's substantial petcoke requirement and aluminium prebake capacity. Imports of uncalcined coke increased year over year, with the United States, Russia, and Saudi Arabia supplying the bulk. Japan and South Korea maintain advanced needle coke technology, while ASEAN cement kilns substitute high-sulfur pet coke for coal to manage costs amid volatile LNG prices.

The Middle East and Africa Green Petroleum Coke and Calcined Petroleum Coke Market is projected to grow at a 5.62% CAGR through 2031, driven by the introduction of new coking trains in Saudi Arabia, the UAE, Kuwait, Egypt, and Nigeria, which is expected to increase feedstock availability. Integrated complexes such as Dangote's refinery are moving beyond light-product exports to monetize heavy residue streams. Proximity to aluminium smelters in Bahrain and Oman shortens supply chains, while lower sulfur in Arabian medium crudes enables premium calcined output.

North America remains the largest exporter, accounting for a significant portion of the global green coke production. However, port-side environmental constraints on the U.S. West Coast and Gulf Coast increase logistics costs, prompting some refiners to enter long-term contracts for Asia-bound shipments delivered ex-ship. Europe's declining refinery slate curbs indigenous supply even as demand for low-sulfur CPC persists; EU CBAM fees, starting from 2026, will likely shift buyers toward Middle Eastern streams with lower scope-1 emissions profiles.

- Aluminium Bahrain B.S.C. (Alba)

- BP p.l.c

- Chevron Corp

- China Petroleum & Chemical Corporation (Sinopec)

- CNOOC Limited

- ELSID SA

- Exxon Mobil Corp

- Indian Oil Corporation

- Maniayargroup

- Marathon Petroleum

- Numaligarh Refinery Limited

- Oxbow Corporation

- Petrocoque

- Phillips 66 Company

- Rain Carbon Inc.

- Reliance Industries Ltd

- Rio Tinto

- Saudi Aramco

- Saudi Calcined Petroleum Coke Company (SCPC)

- Valero Energy Corp

- Zhenjiang Coking And Gas Group Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising aluminium smelting capacity expansions

- 4.2.2 Fuel-grade petcoke cost advantage over coal in cement kilns

- 4.2.3 Capacity build-out of delayed coking units in Middle-East refineries

- 4.2.4 Needle-grade CPC demand from graphite electrodes for EAF steel

- 4.2.5 Ultra-low-sulfur coke for Li-ion battery anodes

- 4.3 Market Restraints

- 4.3.1 Volatile crude-oil crack spreads impacting GPC availability

- 4.3.2 Stricter SOx/PM limits and Carbon Border Adjustment in European Union

- 4.3.3 Community opposition to petcoke handling in port cities

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 Type

- 5.1.1 Fuel Grade

- 5.1.2 Calcined Coke

- 5.2 Application

- 5.2.1 Green Petroleum Coke

- 5.2.1.1 Aluminum

- 5.2.1.2 Fuel

- 5.2.1.3 Iron and steel

- 5.2.1.4 Silicon Metal

- 5.2.1.5 Others (Bricks, Glass, Carbon Products, etc)

- 5.2.2 Calcined Petroleum Coke

- 5.2.2.1 Aluminum

- 5.2.2.2 Titanium Dioxide

- 5.2.2.3 Re-carburizing Market

- 5.2.2.4 Others (Needle Coke, Carbon Products, etc)

- 5.2.1 Green Petroleum Coke

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Aluminium Bahrain B.S.C. (Alba)

- 6.4.2 BP p.l.c

- 6.4.3 Chevron Corp

- 6.4.4 China Petroleum & Chemical Corporation (Sinopec)

- 6.4.5 CNOOC Limited

- 6.4.6 ELSID SA

- 6.4.7 Exxon Mobil Corp

- 6.4.8 Indian Oil Corporation

- 6.4.9 Maniayargroup

- 6.4.10 Marathon Petroleum

- 6.4.11 Numaligarh Refinery Limited

- 6.4.12 Oxbow Corporation

- 6.4.13 Petrocoque

- 6.4.14 Phillips 66 Company

- 6.4.15 Rain Carbon Inc.

- 6.4.16 Reliance Industries Ltd

- 6.4.17 Rio Tinto

- 6.4.18 Saudi Aramco

- 6.4.19 Saudi Calcined Petroleum Coke Company (SCPC)

- 6.4.20 Valero Energy Corp

- 6.4.21 Zhenjiang Coking And Gas Group Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment