|

市场调查报告书

商品编码

1906111

教育娱乐:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Edutainment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

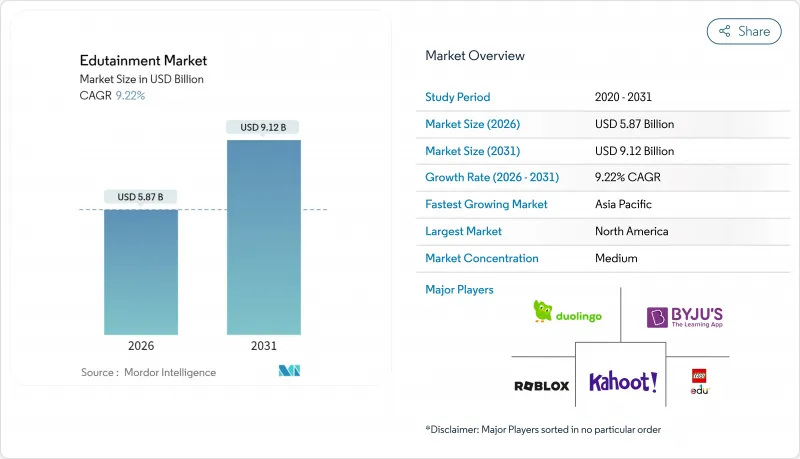

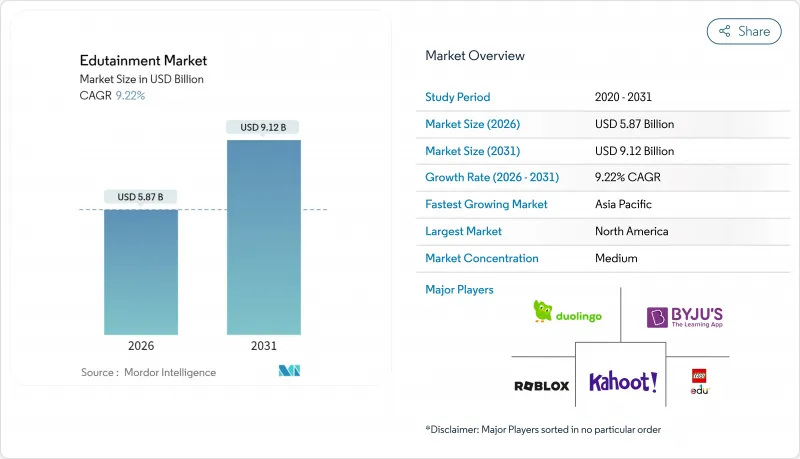

2025年,教育娱乐市场价值53.7亿美元,预计2031年将达到91.2亿美元,高于2026年的58.7亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 9.22%。

这种稳定成长反映了市场环境的日趋成熟,成熟平台巩固了其用户基础,而5G和扩增实境(AR)等新兴技术则正在改变内容传送。儘管互动产品仍然拥有最多的每日有效用户,但融合游戏机制和结构化教学的混合形式正在迅速发展。由于5G的全球普及,行动应用在分发管道占据主导地位,实现了即时多人学习。同时,企业采购部门正在增加对身临其境型软性技能发展模组的投入。儿童资料隐私监管力度的加大也影响教育娱乐市场,这使得那些能够平衡用户参与和合规性的公司更具优势。此外,由生成式人工智慧编写工具带来的内容製作成本降低,也为利基供应商和区域专家开闢了新的发展道路。

全球教育娱乐市场趋势与洞察

5G将促进行动微学习

超低延迟网路正在变革教育内容传送,使以往需要桌上型电脑处理能力才能实现的即时协作体验成为可能。 2024年,主要都会地区的5G基础设施覆盖率将达到85%,进而减少内容缓衝延迟,提升身临其境型学习体验。这项技术的影响远不止于更快的下载速度:它还支援扩增实境(AR)应用,可以将情境资讯迭加到实体环境中,在博物馆、零售店和户外场所创造基于位置的学习机会。企业培训计画也越来越多地利用支援5G的行动装置进行「即时」技能提升。员工现在可以在工作中随时取得操作指南,而无需参加单独的培训课程。这种向「环境学习」融合的转变标誌着教育模式从预定的课时活动转向融入日常工作流程的持续技能提升的根本性转变。

游戏化的语言学习应用程式正变得越来越受欢迎。

行为心理学研究表明,游戏化应用中采用可变奖励机制比传统教育软体能带来更高的用户留存率。整合竞争和社交功能可使每日活跃用户数提升40%至60%。多邻国的持续学习追踪系统和联赛功能在2024年使每日有效用户增加了51%,这表明游戏设计原则如何在最初的新鲜感过后维持用户的长期参与。语言学习应用的成功也为其他领域的应用创造了机会,例如数学和科学教育,这些领域正越来越多地采用类似的进度系统、成就徽章和同侪比较功能。这种用户参与模式也对获利模式产生正面影响,因为持续的每日活跃用户数提高了免费用户转换为付费用户的率,同时也创造了广告空间,从而带来额外的收入来源。

课程标准碎片化导致采购延迟。

教育内容必须符合各州、地方和国家不同的课程框架,随着地理市场的扩张,开发成本呈指数级增长。美国有50个不同的州教育标准,此外,各州对「共同核心标准」(Common Core)的采用也存在差异;欧盟则有27个国家课程体系,难以实现统一。内容在地化的要求不仅限于语言翻译,还包括文化参考、历史观点以及反映区域教育理念的教学方法。这种碎片化阻碍了内容创作的规模经济,迫使企业在通用材料覆盖广泛市场和客製化产品深度渗透市场之间做出选择,而这限制了其扩充性。

细分市场分析

到2025年,互动产品将维持47.05%的市场份额,这反映出市场对融合娱乐机制与教育目标的趣味化学习体验的持续需求。混合解决方案将以18.11%的复合年增长率(CAGR)实现最快成长,直至2031年。内容创作者将互动元素与传统教学影片和评估工具结合,以最大限度地满足不同学习偏好,从而提升用户参与度。混合方案透过精心平衡的内容构建,既能满足教育机构对限制萤幕时间的担忧,又能维持游戏化学习的激励作用。虽然非互动产品在需要结构化资讯呈现以满足课程要求的正规教育环境中仍然有用,但与动态方案相比,其静态特性限制了使用者的参与度。

探究式产品带来了新的机会,虚拟实地考察和模拟学习正日益受到教育者的青睐,他们希望在不受后勤限制的情况下获得真实、体验式的学习。新冠疫情加速了虚拟实验室体验和历史遗址参观的普及,为超越物理限制的身临其境型教育内容树立了先例。生成式人工智慧工具透过自动调整不同互动模式的内容,在降低製作成本的同时,维持了在各种学习环境中的教育效果,从而日益支持混合产品的开发。

区域分析

北美地区在2025年之前将维持33.10%的市场份额,这得益于其完善的教育科技基础设施和优先投资于员工发展的企业培训预算。亚太地区将以10.21%的复合年增长率实现最快增长,这主要得益于政府主导的数位化倡议、不断壮大的中产阶级以及绕过传统运算基础设施的行动优先技术应用模式。欧洲市场对资料隐私合规性和教育研究验证的重视,虽然设定了较高的进入门槛,但也为符合严格监管要求的解决方案创造了溢价机会。

在中东和非洲地区,网路连线的改善和政府对教育投入的增加正在创造新的成长机会。然而,经济波动和基础设施的限制限制了近期的成长潜力。在南美洲,全球平台正日益将西班牙语和葡萄牙语内容在地化,而本地内容创作者则在开发符合当地课程要求和学习偏好的文化相关资料。这种地理分布反映的是数位转型的不同阶段,而非市场规模的固有限制,这表明随着新兴经济体基础设施的完善,未来可能会出现融合趋势。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 5G赋能的行动微学习快速发展

- 游戏化语言学习应用程式的迅速普及

- 政府强制要求在K-12课程中进行STEM教育

- 企业身临其境型软性技能培训的技能提升预算

- 娱乐工作室扩大教育娱乐娱乐智慧财产权

- 生成式人工智慧工具可大幅降低内容製作成本。

- 市场限制

- 课程标准碎片化导致采购延迟。

- 萤幕时间对健康的担忧引发监管审查

- 新兴市场AR/VR硬体前期成本高昂

- 教师缺乏互动式教学方法的培训

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 互动的

- 非互动式

- 杂交种

- 探索性的

- 按最终用途分類的年龄组

- 孩子们

- 青少年

- 青年人

- 成人

- 按平台

- 行动应用

- PC/主机

- 基于网路的

- AR/VR

- 电视/串流媒体

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 秘鲁

- 智利

- 阿根廷

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟

- 比利时

- 荷兰

- 卢森堡

- 北欧国家

- 丹麦

- 芬兰

- 冰岛

- 挪威

- 瑞典

- 其他欧洲地区

- 亚太地区

- 印度

- 中国

- 日本

- 澳洲

- 韩国

- 东南亚

- 新加坡

- 马来西亚

- 泰国

- 印尼

- 越南

- 菲律宾

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Duolingo

- BYJU'S

- Kahoot!

- Roblox Corporation

- LEGO Education

- Coursera

- Osmo(Tangible Play)

- Adventure Academy(Age of Learning)

- Code.org

- Prodigy Education

- BBC Bitesize

- Sesame Workshop

- KidZania

- Disney Imagicademy

- Quizizz

- Kahoot DragonBox

- Labster

- Google for Education

- Microsoft Minecraft Education

- GooseChase

第七章 市场机会与未来展望

The edutainment market was valued at USD 5.37 billion in 2025 and estimated to grow from USD 5.87 billion in 2026 to reach USD 9.12 billion by 2031, at a CAGR of 9.22% during the forecast period (2026-2031).

This measured growth reflects a maturing landscape in which established platforms consolidate user bases while emerging technologies such as 5G and augmented reality transform content delivery. Interactive products continue to attract the largest daily active user pools, yet hybrid formats that meld game mechanics with structured instruction are scaling rapidly. Mobile apps dominate distribution thanks to global 5G roll-outs that enable real-time, multiplayer learning sessions, while corporate purchasers expand spending on immersive soft-skill up-skilling modules. The edutainment market is also shaped by intensifying regulatory scrutiny over children's data privacy, favoring companies that can balance engagement with compliance. Meanwhile, falling content-production costs from generative-AI authoring tools widen entry paths for niche providers and regional specialists.

Global Edutainment Market Trends and Insights

5G-Enabled Mobile Micro-Learning Boom

Ultra-low latency networks transform educational content delivery by enabling real-time collaborative experiences that previously required desktop computing power. 5G infrastructure deployment reached 85% population coverage across major metropolitan areas in 2024, reducing content buffering delays that historically disrupted immersive learning sessions . The technology's impact extends beyond faster downloads to support augmented reality applications that overlay contextual information onto physical environments, creating location-based learning opportunities in museums, retail spaces, and outdoor settings. Corporate training programs increasingly leverage 5G-enabled mobile devices for just-in-time skill development, allowing employees to access procedural guidance during actual work tasks rather than separate training sessions. This shift toward ambient learning integration represents a fundamental departure from scheduled educational activities toward continuous capability enhancement embedded within daily workflows.

Rapid Adoption of Gamified Language-Learning Apps

Behavioral psychology research demonstrates that variable reward schedules in gamified applications generate higher user retention rates than traditional educational software, with daily active usage increasing 40-60% when competitive elements and social features are integrated. Duolingo's streak mechanics and league competitions drove 51% growth in daily active users during 2024, demonstrating how game design principles sustain long-term engagement beyond initial novelty periods . The success of language learning applications creates template opportunities for other subject areas, as mathematics and science educators adopt similar progression systems, achievement badges, and peer comparison features. Revenue models benefit from this engagement pattern, as sustained daily usage increases conversion rates from free to premium subscriptions while generating advertising inventory for supplementary monetization streams.

Fragmented Curriculum Standards Slowing Procurement

Educational content must align with diverse state, provincial, and national curriculum frameworks, creating development costs that scale exponentially with geographic market expansion. The United States maintains 50 different state education standards alongside Common Core adoption variations, while European Union countries implement 27 distinct national curricula that resist harmonization efforts. Content localization requirements extend beyond language translation to encompass cultural references, historical perspectives, and pedagogical approaches that reflect regional educational philosophies. This fragmentation prevents economies of scale in content production and forces companies to choose between broad market coverage with generic materials or deep market penetration with customized offerings that limit scalability potential.

Other drivers and restraints analyzed in the detailed report include:

- Government STEM Mandates in K-12 Curricula

- Corporate Up-Skilling Budgets for Immersive Soft-Skills

- High Upfront AR/VR Hardware Costs in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Interactive products maintain a 47.05% market share in 2025, reflecting sustained demand for gamified learning experiences that combine entertainment mechanics with educational objectives. Hybrid solutions demonstrate the fastest growth at 18.11% CAGR through 2031, as content creators blend interactive elements with traditional instructional videos and assessment tools to maximize engagement across diverse learning preferences. The hybrid approach addresses institutional concerns about screen time limitations while preserving the motivational benefits of game-based learning through carefully balanced content portfolios. Non-interactive products retain relevance in formal educational settings where curriculum compliance requires structured presentation of information, though their static nature limits user engagement compared to dynamic alternatives.

Explorative products represent emerging opportunities as virtual field trips and simulation-based learning gain acceptance among educators seeking authentic experiential learning without logistical constraints. The COVID-19 pandemic accelerated the adoption of virtual laboratory experiences and historical site tours, creating precedents for immersive educational content that transcends physical limitations. Generative AI tools increasingly support hybrid product development by automating content adaptation across different interaction modes, reducing production costs while maintaining pedagogical effectiveness across varied learning contexts.

The Edutainment Market Report is Segmented by Product Type (Interactive, Non-Interactive, Hybrid, Explorative), End-Use Age Group (Children, Teenagers, Young Adults, Adults), Platform (Mobile Apps, PC/Console, Web-Based, AR/VR, TV/Streaming), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America maintains 33.10% market share in 2025, supported by established educational technology infrastructure and corporate training budgets that prioritize employee development investments. Asia-Pacific demonstrates the fastest regional growth at 10.21% CAGR, driven by government digitization initiatives, expanding middle-class populations, and mobile-first technology adoption patterns that bypass traditional computing infrastructure. European markets emphasize data privacy compliance and pedagogical research validation, creating higher barriers to entry but also premium pricing opportunities for solutions that meet stringent regulatory requirements.

Middle East and Africa represent emerging opportunities as internet connectivity improves and government education investments increase, though economic volatility and infrastructure limitations constrain near-term growth potential. South America benefits from Spanish and Portuguese language content localization efforts by global platforms, while regional content creators develop culturally relevant educational materials that address local curriculum requirements and learning preferences. The geographic distribution reflects varying stages of digital transformation rather than inherent market size limitations, suggesting convergence potential as infrastructure development progresses across emerging economies.

- Duolingo

- BYJU'S

- Kahoot!

- Roblox Corporation

- LEGO Education

- Coursera

- Osmo (Tangible Play)

- Adventure Academy (Age of Learning)

- Code.org

- Prodigy Education

- BBC Bitesize

- Sesame Workshop

- KidZania

- Disney Imagicademy

- Quizizz

- Kahoot DragonBox

- Labster

- Google for Education

- Microsoft Minecraft Education

- GooseChase

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G-enabled mobile micro-learning boom

- 4.2.2 Rapid adoption of gamified language-learning apps

- 4.2.3 Government STEM mandates in K-12 curricula

- 4.2.4 Corporate up-skilling budgets for immersive soft-skills

- 4.2.5 Edutainment IP extensions by global entertainment studios

- 4.2.6 Generative-AI tools slashing content-production costs

- 4.3 Market Restraints

- 4.3.1 Fragmented curriculum standards slowing procurement

- 4.3.2 Screen-time health concerns prompting regulatory scrutiny

- 4.3.3 High upfront AR/VR hardware costs in emerging markets

- 4.3.4 Teacher training gaps for interactive pedagogy

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Product Type

- 5.1.1 Interactive

- 5.1.2 Non-Interactive

- 5.1.3 Hybrid

- 5.1.4 Explorative

- 5.2 By End-Use Age Group

- 5.2.1 Children

- 5.2.2 Teenagers

- 5.2.3 Young Adults

- 5.2.4 Adults

- 5.3 By Platform

- 5.3.1 Mobile Apps

- 5.3.2 PC / Console

- 5.3.3 Web-based

- 5.3.4 AR / VR

- 5.3.5 TV / Streaming

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Peru

- 5.4.2.3 Chile

- 5.4.2.4 Argentina

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 BENELUX

- 5.4.3.6.1 Belgium

- 5.4.3.6.2 Netherlands

- 5.4.3.6.3 Luxembourg

- 5.4.3.7 NORDICS

- 5.4.3.7.1 Denmark

- 5.4.3.7.2 Finland

- 5.4.3.7.3 Iceland

- 5.4.3.7.4 Norway

- 5.4.3.7.5 Sweden

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 India

- 5.4.4.2 China

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 South East Asia

- 5.4.4.6.1 Singapore

- 5.4.4.6.2 Malaysia

- 5.4.4.6.3 Thailand

- 5.4.4.6.4 Indonesia

- 5.4.4.6.5 Vietnam

- 5.4.4.6.6 Philippines

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Duolingo

- 6.4.2 BYJU'S

- 6.4.3 Kahoot!

- 6.4.4 Roblox Corporation

- 6.4.5 LEGO Education

- 6.4.6 Coursera

- 6.4.7 Osmo (Tangible Play)

- 6.4.8 Adventure Academy (Age of Learning)

- 6.4.9 Code.org

- 6.4.10 Prodigy Education

- 6.4.11 BBC Bitesize

- 6.4.12 Sesame Workshop

- 6.4.13 KidZania

- 6.4.14 Disney Imagicademy

- 6.4.15 Quizizz

- 6.4.16 Kahoot DragonBox

- 6.4.17 Labster

- 6.4.18 Google for Education

- 6.4.19 Microsoft Minecraft Education

- 6.4.20 GooseChase

7 Market Opportunities & Future Outlook

- 7.1 AI-generated adaptive story-worlds for language immersion

- 7.2 Location-based XR learning arcs in shopping-mall FECs