|

市场调查报告书

商品编码

1906121

押出成型聚苯乙烯:市占率分析、产业趋势与统计、成长预测(2026-2031)Extruded Polystyrene - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

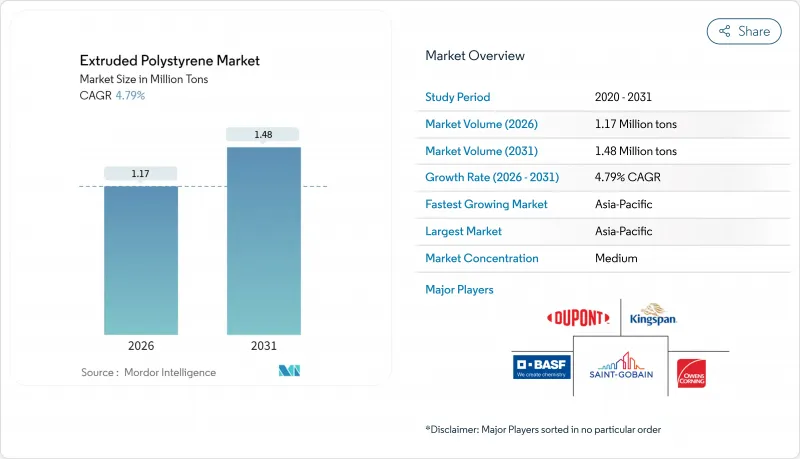

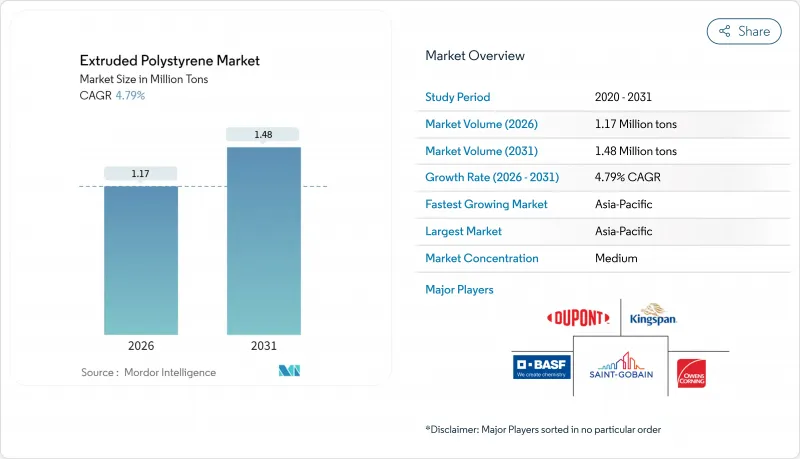

2025年押出成型聚苯乙烯市场价值为112万吨,预计到2031年将达到148万吨,高于2026年的117万吨。

预计在预测期(2026-2031 年)内,复合年增长率将达到 4.79%。

这种增长主要得益于该材料的闭孔结构,与其它发泡体相比,它具有更优异的耐热性和防潮性。销售成长则受到全球建设活动加速、能源效率法规日益严格以及老旧建筑维修需求不断增长的推动。此外,该产品还具备许多优势,例如可支撑屋顶安装的抗压强度和可减少长期能源损失的尺寸稳定性,这些特性也为其带来了竞争优势。而且,策略性地采用低全球暖化潜势发泡有望增强长期需求的可持续性,即使在气候法规日益严格的背景下也是如此。

全球押出成型聚苯乙烯市场趋势及洞察

节能建筑的需求日益增长

政府和公共产业的奖励提高了高性能(高R值)隔热材料的投资回报率,促使建筑师在墙体、屋顶和地基中更倾向于使用押出成型聚苯乙烯板。国际节能规范(IECC)对连续隔热材料的要求推动了其在商业建筑围护结构中的应用,因为商业建筑围护结构必须最大限度地减少热桥效应。业主将较高的初始成本与建筑使用寿命期间可靠的暖气、通风和空调(HVAC)系统所带来的节能效益连结起来。优异的防水和抗水蒸气扩散性能确保保温材料即使在潮湿气候下也能在安装后保持其性能。 LEED v4等认证项目透过将整栋建筑的能源性能与材料选择挂钩,支持了长期需求。随着能源网路日益脱碳,隔热材料仍然是一项关键的低成本节能措施,推动了大规模的维修。

快速的都市化和基础设施扩张

亚太地区的城市人口每年持续成长数百万,推动了高层住宅、大型交通枢纽和商业区的建设,这些都需要强大的围护结构隔热材料。中国和印度的基础设施项目正在支撑区域消费,而东南亚的智慧城市计划也日益吸引押出成型聚苯乙烯市场参与企业采用其设计。中产阶级消费者对热舒适性的需求促使建筑规范制定者提高最低保温性能值(R值)。印尼和菲律宾的公共住宅项目正在采用此前仅适用于豪华计划的保温标准。这些长期趋势正在将押出成型聚苯乙烯市场拓展到正在经历快速建设热潮的区域性城市。

环保隔热材料材料市占率不断扩大

基于生命週期影响的绿建筑计划正在指定使用木纤维板和再生纤维素隔热材料。欧洲日益严格的塑胶废弃物法规推动了对生物基解决方案的需求,并促使一些建筑师放弃化石基泡沫材料。循环经济政策鼓励材料再利用,并优先选择具有成熟可回收性的隔热系统。这些变化目前主要集中在高端市场,但随着生产规模的扩大,成本曲线正在改善。押出成型聚苯乙烯供应商正透过投资回收计画和生物基发泡来提升其环保资质。

细分市场分析

预计到2025年,板材将占押出成型聚苯乙烯市场份额的61.50%,这充分体现了其在屋顶、墙体和地基结构中的多功能性,在这些应用中,结构强度和可行走性至关重要。随着建商越来越重视透过闭孔结构来提高抗压性和防潮性,发泡聚苯乙烯板材的市场规模持续扩大。同时,受预製装配工艺的推动,面板预计到2031年将以4.86%的复合年增长率增长,预製装配组装能够简化现场施工。

在周边基础和地下室防水领域,砌块仍是一种小众应用,因为这些领域对厚度的要求超过了传统板材的极限。管材则用于机房和加工行业的隔热材料,随着低温运输的扩展,其应用前景也日益广阔。目前,产品创新主要集中在边缘轮廓设计上,以提高黏合力;同时,也致力于改进表面纹理,以增强多层屋顶系统的黏合性。

押出成型聚苯乙烯市场报告按产品类型(板材、面板、块材、管材)、应用领域(屋顶隔热、墙体隔热材料、其他)、终端用户行业(住宅、商业、基础设施)和地区(亚太、北美、欧洲、南美、中东和非洲)进行细分。市场预测以吨为单位。

区域分析

预计到2025年,亚太地区将占全球总量的44.20%,并在2031年之前以4.93%的复合年增长率增长,这主要得益于强劲的都市化、大规模计划以及政府的住宅政策。中国的「一带一路」倡议正在参与国带动需求外溢效应,而印度的「智慧城市」计画则纳入了节能标准,提高了隔热性能要求。

在北美,加拿大和美国的建筑规范变更要求新建筑必须提高屋顶和墙体的隔热性能(R值)。公共工程部门扩大了建筑外围护结构改造的补贴计划,从而推动了维修活动的增加。电子商务食品宅配的兴起刺激了冷藏仓库的建设,进而带动了工业地产对冷藏产品的需求。该地区的押出成型聚苯乙烯市场正在经历整合,这主要得益于那些能够承受苯乙烯价格波动的垂直整合製造商。

儘管欧洲建筑业成长放缓,但由于严格的能源性能法规和政府对大型维修计划的资助,押出成型聚苯乙烯仍占据相当大的市场份额。虽然其他隔热材料的普及正在逐渐蚕食其市场份额,但由于其防水性能,挤塑聚苯乙烯在地下结构和反坡屋顶应用中仍然占据主导地位。製造商经营符合当地回收规定的循环经济回收计划,这有助于其继续成为永续性的建筑商的首选材料。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 节能建筑的需求日益增长

- 快速的都市化和基础设施扩张

- 严格的建筑规范要求隔热材料

- 生技药品和电商生鲜对低温运输仓库的需求激增

- 异地模组化建筑系统的兴起

- 市场限制

- 环保隔热材料材料市占率不断扩大

- 原物料(苯乙烯)价格波动

- 《基加利协议》下的氢氟碳化合物发泡法规

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 依产品类型

- 木板

- 控制板

- 堵塞

- 管段

- 透过使用

- 屋顶隔热

- 墙体隔热材料

- 其他(地板下、地下室、模腔、周围区域)

- 按最终用户行业划分

- 住宅

- 商业

- 基础设施

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Austrotherm

- BASF

- DuPont

- Emirates Extruded Polystyrene LLC

- JACKON Insulation GmbH

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Polyfoam XPS

- Saint-Gobain

- Soprema Group

- Supreme Petrochem Ltd.

- Synthos

- TECHNONICOL

- URSA

第七章 市场机会与未来展望

The Extruded Polystyrene Market was valued at 1.12 million tons in 2025 and estimated to grow from 1.17 million tons in 2026 to reach 1.48 million tons by 2031, at a CAGR of 4.79% during the forecast period (2026-2031).

This growth rests on the material's closed-cell structure, which delivers superior thermal resistance and moisture tolerance compared with alternative foams. Volume gains track the acceleration of global construction activity, the hardening of energy-efficiency mandates, and mounting renovation demand in mature building stocks. Competitive advantages also stem from the product's compressive strength, which supports rooftop equipment, and from its dimensional stability, which reduces long-term energy loss. Strategic focus on low-global-warming-potential blowing agents further reinforces long-range demand resilience under tightening climate regulations.

Global Extruded Polystyrene Market Trends and Insights

Growing Demand for Energy-Efficient Buildings

Government and utility incentives amplify the payback of high-R-value insulation, steering architects toward extruded polystyrene boards for walls, roofs, and foundations. Continuous insulation requirements in the International Energy Conservation Code elevate adoption in commercial envelopes where thermal bridging must be minimized. Building owners associate the material's higher upfront cost with reliable HVAC savings over building life. Resilience to bulk water and vapor diffusion protects installed R-value in humid climates. Certification schemes such as LEED v4 link whole-building energy performance to material selection, sustaining long-term demand. As energy grids decarbonize, insulation remains a primary low-cost efficiency measure, encouraging deeper retrofit scopes.

Rapid Urbanization and Infrastructure Expansion

Asia-Pacific's urban population adds millions of residents each year, driving high-rise housing, mass-transit stations, and commercial districts that specify robust envelope insulation. China's and India's infrastructure programs anchor regional consumption, while Southeast Asian smart-city projects multiply design wins for extruded polystyrene market participants. Middle-class consumer expectations for thermal comfort encourage code writers to raise minimum R-values. Public housing schemes in Indonesia and the Philippines adopt insulation guidelines that previously applied only to premium projects. These secular forces extend the extruded polystyrene market footprint into second-tier cities that are experiencing rapid construction booms.

Eco-Friendly Insulation Substitutes Gaining Share

Wood-fiber boards and recycled cellulose insulation win specifications in green building projects that benchmark lifecycle impacts. European regulatory pressure on plastic waste bolsters demand for bio-based solutions, nudging some architects away from fossil-derived foams. Circular-economy policies promote material reuse, which favors insulation systems with demonstrated recyclability. These shifts are still concentrated in premium segments, yet cost curves are improving as production scales. Extruded polystyrene suppliers counteract by investing in take-back programs and bio-sourced blowing agents to shore up environmental credentials.

Other drivers and restraints analyzed in the detailed report include:

- Stringent Building Codes Mandating Thermal Insulation

- Cold-Chain Warehousing Boom for Biologics and E-Grocery

- Kigali-Driven HFC Blowing-Agent Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Boards accounted for 61.50% of the extruded polystyrene market share in 2025, underscoring their versatility across roofs, walls, and foundations, where structural integrity and walkability are critical. The extruded polystyrene market size tied to boards continues to rise as builders prioritize compressive strength and closed-cell moisture resistance in exposed conditions. Panels, meanwhile, are projected to register a 4.86% CAGR to 2031, benefiting from their suitability for prefabricated assemblies that streamline onsite labor.

Blocks remain a niche for perimeter foundations and below-grade waterproofing where thickness needs exceed conventional board limits. Pipe sections serve mechanical room and process-industry insulation, capturing emerging opportunities in cold-chain expansion. Product innovation now centers on edge profiles that promote tight interlocks and on surface textures that improve adhesion in multi-layer roof systems.

The Extruded Polystyrene Report is Segmented by Product Type (Boards, Panels, Blocks, and Pipe Sections), Application (Roof Insulation, Wall Insulation, and Others), End-User Industry (Residential, Commercial, and Infrastructure), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa, ). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific held 44.20% of global volume in 2025, and the region is projected to log a 4.93% CAGR through 2031 on the back of robust urbanization, infrastructure megaprojects, and government housing programs. China's Belt and Road Initiative generates spill-over demand in participating nations, while India's Smart Cities Mission embeds energy-efficiency standards that elevate insulation specifications.

North America is buoyed with code updates in Canada and the United States mandating higher R-values for roofs and walls in new builds. Renovation activity picks up as utilities expand rebate programs targeting envelope improvements. Cold-storage construction accelerates due to strong e-grocery adoption, reinforcing product pull-through in industrial real estate. The extruded polystyrene market in this region remains consolidated around vertically integrated producers able to navigate styrene price swings.

Europe maintains a sizable base despite slower construction volume growth, supported by strict energy-performance legislation and public funding for deep-renovation projects. Adoption of alternative insulation materials exerts gradual share pressure; however, extruded polystyrene still dominates below-grade and inverted-roof applications because of its water-resistance profile. Manufacturers operate circular-economy take-back programs to align with regional recycling mandates, which helps preserve specification preference among sustainability-conscious builders.

- Austrotherm

- BASF

- DuPont

- Emirates Extruded Polystyrene L.L.C.

- JACKON Insulation GmbH

- Kingspan Group

- Knauf Insulation

- Owens Corning

- Polyfoam XPS

- Saint-Gobain

- Soprema Group

- Supreme Petrochem Ltd.

- Synthos

- TECHNONICOL

- URSA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for energy-efficient buildings

- 4.2.2 Rapid urbanization and infrastructure expansion

- 4.2.3 Stringent building codes mandating thermal insulation

- 4.2.4 Cold-chain warehousing boom for biologics and e-grocery

- 4.2.5 Uptake of off-site modular construction systems

- 4.3 Market Restraints

- 4.3.1 Eco-friendly insulation substitutes gaining share

- 4.3.2 Raw-material (styrene) price volatility

- 4.3.3 Kigali-driven HFC blowing-agent restrictions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Boards

- 5.1.2 Panels

- 5.1.3 Blocks

- 5.1.4 Pipe Sections

- 5.2 By Application

- 5.2.1 Roof Insulation

- 5.2.2 Wall Insulation

- 5.2.3 Others (Floor, Basement, Cavity and Perimeter)

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Infrastruture

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Austrotherm

- 6.4.2 BASF

- 6.4.3 DuPont

- 6.4.4 Emirates Extruded Polystyrene L.L.C.

- 6.4.5 JACKON Insulation GmbH

- 6.4.6 Kingspan Group

- 6.4.7 Knauf Insulation

- 6.4.8 Owens Corning

- 6.4.9 Polyfoam XPS

- 6.4.10 Saint-Gobain

- 6.4.11 Soprema Group

- 6.4.12 Supreme Petrochem Ltd.

- 6.4.13 Synthos

- 6.4.14 TECHNONICOL

- 6.4.15 URSA

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Innovations in Extruded Polystyrene Manufacturing