|

市场调查报告书

商品编码

1906125

衝击改质剂:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Impact Modifier - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

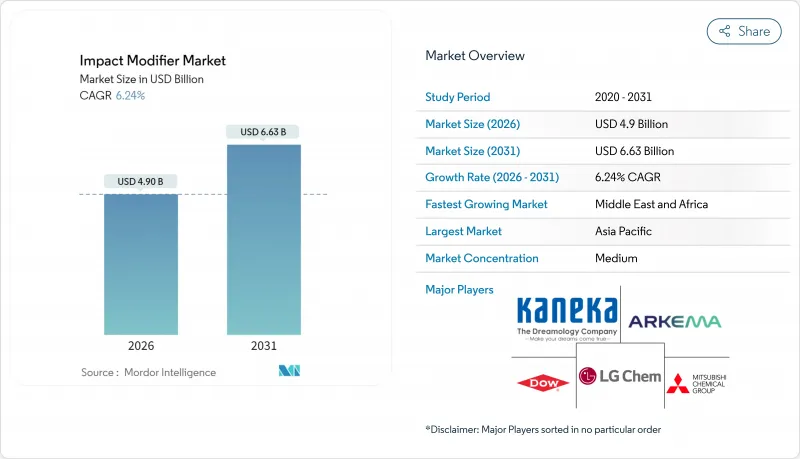

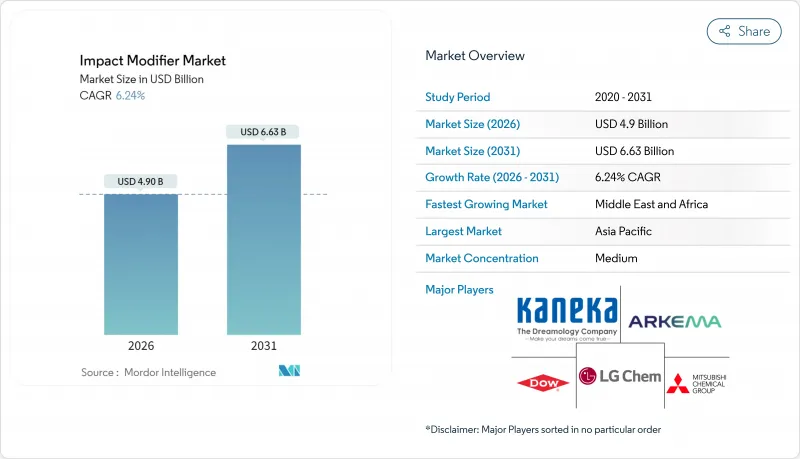

预计到 2026 年,衝击改质剂市场价值将达到 49 亿美元,从 2025 年的 46.1 亿美元成长到 2031 年的 66.3 亿美元。

预计2026年至2031年年复合成长率(CAGR)为6.24%。

聚合物的应用增强能力是推动成长的主要因素,它可用于製造轻量化汽车零件、抗衝击建筑材料和更薄的包装薄膜。亚太地区的建筑业蓬勃发展将支撑需求,预计到2024年,其市占率将达到47.26%。同时,随着汽车製造商积极实施轻量化策略,汽车应用预计将以6.45%的复合年增长率成长。丙烯腈-丁二烯-苯乙烯共聚物(ABS)仍将是最大的产品类型,到2024年将占据33.48%的市场份额;而丙烯酸类抗衝击改质剂(AIM)将以6.42%的复合年增长率成为增长最快的产品,主要用于需要耐候化合物的户外应用。聚氯乙烯(PVC)将在管道和型材的强劲需求推动下,于2024年占据主导地位,市场份额将达到42.67%;而随着汽车製造商采用抗衝击复合复合材料製造碰撞相关部件,工程塑料的复合年增长率将达到6.63%。

全球衝击改质剂市场趋势及洞察

包装需求不断成长

包装加工商正在采用抗衝击改质化合物,以实现更薄的壁厚,从而能够承受电商配送中的跌落测试,满足FDA食品接触标准,同时减少树脂用量。硬质包装配方师正在添加改质剂以降低厚度,同时保持结构完整性,尤其适用于循环利用项目中的可重复使用容器。随着品牌拥有者优先考虑与回收流程的兼容性,对兼具透明度和韧性的混合改质剂/相容剂系统的需求日益增长。材料供应商正在透过调整熔体流动性能来满足高速薄膜生产线的需求。向单一材料形式的持续转变进一步推动了对能够在更薄的包装中平衡刚度和抗衝击性的改质剂的需求。

PVC管材和型材的需求不断成长

亚太地区的基建计划正在采用添加了改质剂的大口径PVC管材,以增强其在安装过程中的抗损伤能力和抗压循环能力。颱风多发地区的建筑规范规定使用抗衝击改质PVC窗框型材,以承受风荷载和热应力。随着城市地下管网的扩展,承包商要求使用经久耐用、数十年不开裂的管道。 ASTM D1784和ISO 4422等标准规定了最低衝击阈值,迫使复合材料生产商优化改质剂配方。海湾合作委员会(GCC)国家也采用了类似的规范,加速了PVC在中东地区计划的应用。

原物料价格波动(苯乙烯、丙烯酸酯)

苯乙烯和丙烯酸酯单体价格波动挤压了生产商的利润空间,并透过促使现货交易和短期合约的签订,为加工商带来了不确定性。由于裂解装置计划外停产造成的供应中断导致交付成本飙升,迫使复合材料生产商限製配额。买家正透过多源策略进行避险,但当原物料供应中断波及整个供应链时,差异化策略难以实施。一些原始设备製造商 (OEM) 正在签署代工加工协议以降低价格波动,但也因此承担了更高的库存风险。亚洲原料供应中心的能源成本波动进一步加剧了改质剂交付价格的不确定性。

细分市场分析

到2025年,ABS将维持32.92%的衝击改质剂市场份额,主要用于家电机壳和汽车内装。同时,AIM凭藉其卓越的抗紫外线性能,将应用于车身外板和窗框型材,推动市场以6.36%的复合年增长率成长。受AIM驱动的衝击改质剂市场规模预计将稳定扩大,这主要得益于在恶劣气候条件下对更耐用建筑建筑幕墙的需求。 ASA将服务于需要耐化学腐蚀的燃料接触部件这一细分市场,而MBS则可用于製造兼具透明度和抗跌落性能的透明PVC包装。 EPDM和CPE则适用于对阻燃性和弹性性能要求极高的领域。对于所有类型的材料而言,与回收材料的兼容性都是至关重要的采购因素,因为循环经济的目标正日益实现。

AIM技术的持续应用也受到汽车造型设计严格要求的推动,这些要求需要使用能够防止光亮表面出现应力泛白的材料。 ABS材料因其兼具刚性、耐热性和色彩柔软性,仍是仪表板和立柱区域的重要材料。从长远来看,製造商正在探索将丙烯酸芯材与弹性体外壳材料结合的混合解决方案,以满足更严格的碰撞能量吸收标准。随着区域法规强制要求在新车和建筑中使用再生聚烯树脂,改质剂的化学性质及其与再生聚烯原料的相互作用已成为一项重要的研究主题。

区域分析

到2025年,亚太地区将以46.78%的市场份额主导全球市场,这主要得益于中国的大规模计划规划和印度不断扩大的汽车生产。抗衝击改质PVC管道系统是新型城市供水网路的主干,而工程塑胶在亚太地区的汽车製造商中正被广泛应用于仪表板、立柱和电池等领域。日本汽车製造商正在采用改质PP和PC/ABS共混物来减轻车身重量,同时又不影响侧面碰撞性能。受益于供应链变化的东协製造商正在扩大家用电器的出口,这些家用电器依赖ABS改质剂来提升光泽度和韧性。

由于石油化学原料产地接近性,改质剂生产成本降低,中东和非洲地区的复合年增长率达6.50%。沙乌地阿拉伯的一个计划指定使用抗衝击型材製作帷幕墙,以抵御沙尘暴和强烈紫外线辐射。南非汽车组装正在采用改质剂来减轻零件重量,同时满足当地的碰撞安全法规。在北美,促进国内电池工厂建设的政策刺激了对改性聚酰胺屏蔽材料的需求,而联邦基础设施基金支持的新开工项目也推动了PVC导管的消费。在欧洲,严格的REACH法规加速了低VOC改质剂在地板材料和电缆管道中的应用。在南美,由AIM增强PVC製成的大直径压力管道正被用于多边银行资助的高速公路建设。同时,巴西汽车製造商正在试验使用EPDM接枝改质剂製作引擎室管道,以适应高乙醇混合燃料。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 包装需求不断成长

- PVC管材和型材的需求不断成长

- 亚太地区建筑业主导树脂需求成长

- 重点发展轻量化和安全型汽车

- 再生塑胶需要相容剂—IM混合物

- 市场限制

- 原物料价格波动(苯乙烯、丙烯酸酯树脂)

- 更严格的VOC和PVC法规

- 高回收率树脂流的处理挑战

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模及成长预测(金额)

- 按类型

- 丙烯腈丁二烯苯乙烯(ABS)

- 丙烯酸衝击改质剂(AIM)

- 丙烯腈苯乙烯丙烯酸酯(ASA)

- 甲基丙烯酸丁二烯苯乙烯(MBS)

- 乙丙橡胶 (EPDM)

- 氯化聚乙烯(CPE)

- 其他类型

- 透过使用

- 聚氯乙烯(PVC)

- 尼龙

- 聚丁烯对苯二甲酸酯(PBT)

- 工程塑料

- 其他用途

- 按最终用户行业划分

- 包装

- 建造

- 车

- 消费品

- 电气和电子设备

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东南亚国协

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 俄罗斯

- 北欧国家

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率/排名分析

- 公司简介

- Akdeniz Kimya

- Arkema

- BASF

- CLARIANT

- Dow

- Evonik Industries

- Formosa Plastics Corporation

- INEOS Styrolution Group GmbH

- Kaneka Corporation

- LANXESS

- LG Chem

- Mitsubishi Chemical Corporation

- Plastics Color Corporation

- Shandong Novista Chemicals Co.,Ltd.

- Shandong Ruifeng Chemical Cp.Ltd

- SI Group, Inc.

- SONGWON

- Sundow Polymers Co., Ltd.

- Wacker Chemie AG

第七章 市场机会与未来展望

Impact Modifier market size in 2026 is estimated at USD 4.9 billion, growing from 2025 value of USD 4.61 billion with 2031 projections showing USD 6.63 billion, growing at 6.24% CAGR over 2026-2031.

Growth rests on the material's ability to toughen polymers that enable lightweight automotive parts, resilient construction components and downgauged packaging films. Asia-Pacific's building boom anchors demand, accounting for a 47.26% volume share in 2024, while automotive applications increase at a 6.45% CAGR as vehicle makers pursue aggressive weight-reduction strategies. Acrylonitrile Butadiene Styrene (ABS) remains the largest product type with 33.48% share in 2024, but Acrylic Impact Modifiers (AIM) deliver the fastest 6.42% CAGR as outdoor applications require weatherable compounds. Polyvinyl Chloride (PVC) dominates usage with 42.67% share in 2024 on the strength of pipe and profile demand, whereas engineering plastics climb at 6.63% CAGR as automakers adopt impact-modified composites for crash-relevant parts.

Global Impact Modifier Market Trends and Insights

Growing Packaging Demand

Packaging converters deploy impact-modified compounds so thinner walls survive drop tests encountered in e-commerce distribution, meeting FDA food-contact requirements while reducing resin mass. Rigid packaging formulators add modifiers to downgrade thickness and keep structural integrity, especially in reusable containers targeted at closed-loop programs. Brand owners prioritize compatibility with recycled streams, spurring demand for hybrid modifier-compatibilizer systems that maintain clarity and toughness. Material suppliers respond by tailoring melt-flow characteristics that suit high-speed film lines. The ongoing shift toward mono-material formats intensifies the need for modifiers that balance stiffness and impact for downgauged packages.

PVC Pipe and Profile Boom

Asia-Pacific infrastructure projects favor large-diameter PVC pipes where modifiers raise resistance to installation damage and pressure cycling. Building codes in typhoon-prone regions specify impact-modified PVC window profiles to withstand wind loads and thermal stress. As cities expand underground utility grids, contractors require rugged conduits that last decades without cracking. Standards such as ASTM D1784 and ISO 4422 dictate minimum impact thresholds, pushing compounders to optimize modifier loading. GCC countries replicate these specifications, accelerating penetration into Middle Eastern water projects.

Raw-Material Price Volatility (Styrene, Acrylates)

Styrene and acrylate monomer swings compress producer margins, prompting spot-pricing and shorter contracts that unsettle converters. Supply interruptions tied to unplanned cracker outages can lift delivered costs sharply, forcing compounders to ration allocations. Buyers hedge through multi-source strategies, yet differentiation remains difficult when feedstock disruptions cascade through the chain. Some OEMs lock in tolling deals to cushion volatility but accept higher inventory risk. Volatile energy costs in Asia's feedstock centers compound unpredictability in delivered modifier prices.

Other drivers and restraints analyzed in the detailed report include:

- Construction-Led Resin Uptake in Asia-Pacific

- Automotive Lightweighting and Safety Focus

- Tightening VOC and PVC Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

ABS retained 32.92% of impact modifier market share in 2025, anchoring appliance housings and interior automotive trim. AIM, however, leads growth with a 6.36% CAGR as its superior UV durability supports exterior body panels and window profiles. The impact modifier market size attributable to AIM is projected to expand steadily as building facades demand longer service life under harsh climates. ASA serves niche fuel-contact parts needing chemical resistance, while MBS enables clear PVC packaging that combines transparency with drop-test integrity. EPDM and CPE round out the suite where flame-retardant or elastomeric performance is paramount. Across all types, recyclate compatibility becomes a decisive purchase factor as manufacturers align with circular-economy targets.

Continued AIM uptake also reflects tight automotive styling gaps that require materials to keep glossy surfaces free from stress-whitening. ABS remains indispensable in dashboard and pillar areas thanks to its balance of rigidity, heat resistance and coloring flexibility. Long-term, producers anticipate hybrid solutions blending acrylic cores with elastomeric shells to satisfy stricter crash-energy dissipation metrics. The interplay between modifier chemistry and recycled polyolefin streams is a research priority because regional mandates now require post-consumer resin thresholds in new cars and buildings.

The Impact Modifier Market Report is Segmented by Type (Acrylonitrile Butadiene Styrene, Acrylic Impact Modifiers, Acrylonitrile Styrene Acrylate, and More), Application (Polyvinyl Chloride, Nylon, Polybutylene Terephthalate, and More), End-User Industry (Packaging, Construction, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's commanding 46.78% share in 2025 stems from China's megaproject pipeline and India's swelling auto output. Impact-modified PVC pipe systems form the backbone of new municipal water grids, and engineering plastics capture dashboard, pillar, and battery applications across regional OEM plants. Japanese automakers deploy modified PP and PC/ABS blends to cut vehicle weight without compromising side-impact scores. ASEAN manufacturers-benefiting from shifts in supply chains-expand appliance exports that rely on ABS modifiers for gloss and toughness.

The Middle East & Africa enjoys a 6.50% CAGR as petrochemical feedstock proximity lowers modifier production cost. Saudi Arabia's giga-projects specify impact-resistant profiles for curtain walls that withstand sandstorms and high UV exposure. South Africa's auto assemblers adopt modifiers to meet local crash regulations while reducing part weight. North America's policy push for domestic battery plants stimulates demand for modified polyamide shields, and construction starts supported by federal infrastructure funds lift PVC conduit consumption. Europe's stringent REACH rules spur the rollout of low-VOC modifiers in flooring and cable ducts. South America's highways, financed by multilateral banks, absorb large-diameter pressure pipes made from AIM-enhanced PVC; meanwhile Brazilian automakers trial EPDM-grafted modifiers in under-hood ducts to handle ethanol-rich fuel blends.

- Akdeniz Kimya

- Arkema

- BASF

- CLARIANT

- Dow

- Evonik Industries

- Formosa Plastics Corporation

- INEOS Styrolution Group GmbH

- Kaneka Corporation

- LANXESS

- LG Chem

- Mitsubishi Chemical Corporation

- Plastics Color Corporation

- Shandong Novista Chemicals Co.,Ltd.

- Shandong Ruifeng Chemical Cp.Ltd

- SI Group, Inc.

- SONGWON

- Sundow Polymers Co., Ltd.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing packaging demand

- 4.2.2 PVC pipe and profile boom

- 4.2.3 Construction-led resin uptake in Asi-Pacific

- 4.2.4 Automotive lightweighting and safety focus

- 4.2.5 Recycled-content plastics need compatibilizer-IM hybrids

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (styrene, acrylates)

- 4.3.2 Tightening VOC and PVC regulations

- 4.3.3 Processing issues with high-recycle resin streams

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value )

- 5.1 By Type

- 5.1.1 Acrylonitrile Butadiene Styrene (ABS)

- 5.1.2 Acrylic Impact Modifiers (AIM)

- 5.1.3 Acrylonitrile Styrene Acrylate (ASA)

- 5.1.4 Methacrylate-Butadiene- Styrene (MBS)

- 5.1.5 Ethylene Propylene Diene Monomer (EPDM)

- 5.1.6 Chlorinated Polyethylene (CPE)

- 5.1.7 Other Types

- 5.2 By Application

- 5.2.1 Polyvinyl Chloride (PVC)

- 5.2.2 Nylon

- 5.2.3 Polybutylene Terephthalate (PBT)

- 5.2.4 Engineering Plastics

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Packaging

- 5.3.2 Construction

- 5.3.3 Automotive

- 5.3.4 Consumer Goods

- 5.3.5 Electrical and Electronics

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akdeniz Kimya

- 6.4.2 Arkema

- 6.4.3 BASF

- 6.4.4 CLARIANT

- 6.4.5 Dow

- 6.4.6 Evonik Industries

- 6.4.7 Formosa Plastics Corporation

- 6.4.8 INEOS Styrolution Group GmbH

- 6.4.9 Kaneka Corporation

- 6.4.10 LANXESS

- 6.4.11 LG Chem

- 6.4.12 Mitsubishi Chemical Corporation

- 6.4.13 Plastics Color Corporation

- 6.4.14 Shandong Novista Chemicals Co.,Ltd.

- 6.4.15 Shandong Ruifeng Chemical Cp.Ltd

- 6.4.16 SI Group, Inc.

- 6.4.17 SONGWON

- 6.4.18 Sundow Polymers Co., Ltd.

- 6.4.19 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment