|

市场调查报告书

商品编码

1906132

高岭土:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Kaolin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

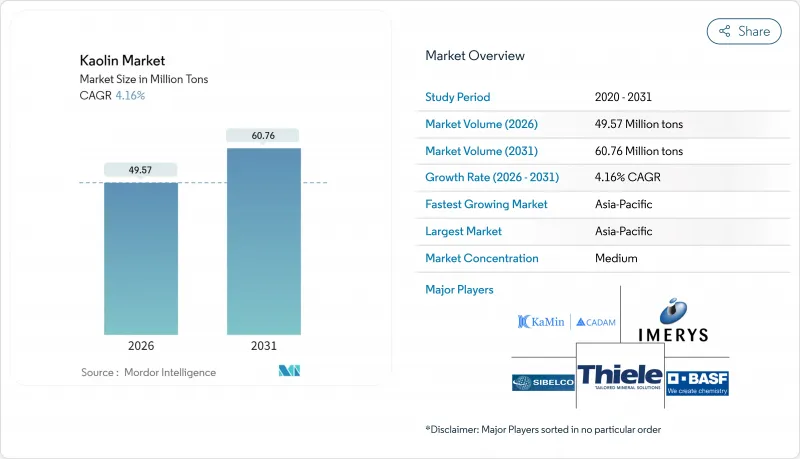

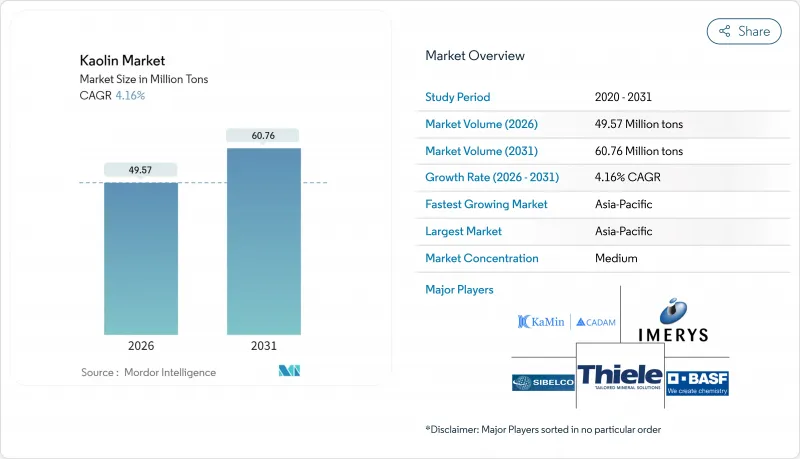

预计高岭土市场将从 2025 年的 4,759 万吨增长到 2026 年的 4,957 万吨,预计到 2031 年将达到 6,076 万吨,2026 年至 2031 年的复合年增长率为 4.16%。

需求正从传统的陶瓷应用扩展到电池隔膜、特殊纸张和洁净标示化妆品等领域,这些领域都重视高岭土的洁白度、化学惰性和低导电性。亚太地区的产能扩张、北美和欧洲对优质包装级高岭土需求的成长,以及对电动车电池的煅烧产品的投资,都推动了这一积极的市场前景。拥有综合采矿、高效煅烧和特定应用加工技术的生产商已签订了多年供应协议。儘管燃料价格上涨和成熟地区复杂的采矿许可程序带来的短期成本压力抑制了整体成长势头,但在大多数终端应用领域,高岭土凭藉其明显的性能优势,正日益被替代。

全球高岭土市场趋势及展望

亚太地区卫浴设备和瓷砖製造业快速成长

受都市化和住宅升级的推动,中国、印度、越南和印尼的瓷砖和卫浴设备生产显着增长。国内製造商正在扩大窑炉产能,以烧製大型瓷板,这需要高亮度高岭土来达到一致的美学标准。区域製造商也优先发展本地供应链,以控制投入成本并缩短交货时间,并与广西、福建和古吉拉突邦的高岭土矿山签订长期供应协议。现代隧道窑设计提高了烧製均匀性,同时对流变性能和热稳定性的要求不断提高,推动了高岭土品种的优质化。政府支持的住宅开工和公共基础设施建设进一步巩固了陶瓷供应基础,确保了高岭土市场需求的持续稳定。

北美和欧洲转向使用高亮度包装纸

品牌拥有者正透过将未漂白牛皮纸外层与亮白色或粉彩色内衬搭配,来打造差异化的电商包装,并提升开箱体验。这种设计趋势推动了超细高岭土作为涂料颜料的消费量成长,以在不影响可回收性的前提下实现高遮盖力。造纸厂正透过优化刮刀涂布环节和升级分散系统来解决颗粒分布更细的问题。产业整合,例如国际纸业收购DS Smith,标誌着包装产业策略向高附加价值方向转变,并加强了与特种高岭土生产商的紧密供应关係。无法稳定获得高亮度高岭土的造纸厂将面临产量比率下降和涂层缺陷的风险,这进一步凸显了高岭土在高檔纸板生产中的重要性。

烘焙过程能耗高、成本不断上涨

煅烧过程需要650°C至1200°C的温度,因此燃料成本是主要的成本驱动因素。预计2024年至2025年欧洲天然气价格将大幅上涨,这将使区域生产商的现金成本曲线出现两位数的成长。闪式煅烧和旋转式煅烧设计可将停留时间缩短高达30%,并回收显热,但每条生产线近1500万美元的资本预算限制了其应用,只有大型综合企业才能采用。 Calix公司已试行一种电力驱动的间接煅烧初步试验,该工艺可将二氧化碳排放强度降低30%,但其商业规模应用能力仍在评估中。缺乏低成本燃料或製程创新的小型矿业公司面临利润率压缩的风险,这可能会推动高岭土市场的整合。

细分市场分析

到2025年,加工高岭土将占高岭土市场的69.35%,巩固了其在高端陶瓷、高光纸和工程聚合物领域的关键地位。选矿製程(筛分、磁选、浮选和化学漂白)可使高岭土的白度达到ISO 90以上,并去除二氧化钛和铁等杂质。终端用户愿意为这些优异的性能支付更高的价格,这反映了其优于原土的性能标准。由于加工高岭土在电池隔膜涂层和节能建筑用绝缘砂浆中的应用日益广泛,预计其市场规模将持续成长。

预计到2031年,原土市场将以4.72%的复合年增长率成长,这主要得益于亚洲陶瓷丛集将修整和研磨工序外包给当地的代工加工商。泰国和马来西亚的生产商正在矿床附近建造简易洗选厂,以降低物流成本。随着区域加工商投资柱式浮选和高梯度磁选设备,部分原料供应预计将逐步转向半成品和成品,从而推动高岭土市场价值链向上游转移。

本高岭土市场报告按类型(原高岭土/加工高岭土)、等级(水合高岭土、煅烧高岭土、膨胀高岭土及其他)、应用领域(陶瓷、水泥、造纸、耐火材料、油漆涂料、塑胶及其他)和地区(亚太地区、北美、欧洲、南美、中东和非洲)进行分析。市场预测以吨为单位。

区域分析

预计到2025年,亚太地区将占全球高岭土市场份额的42.55%,并在2031年之前以4.70%的复合年增长率成长。中国广东和山东两省的瓷砖产业走廊支撑着区域需求,而印度正在莫尔比和拉贾斯坦邦扩大其卫浴设备丛集。政府基础设施项目和稳定的出口订单维持了窑炉的运转率,并有力地支撑了对水合高岭土和煅烧高岭土的需求。东南亚,特别是越南和印尼的产能扩张,正在深化区域内贸易,并巩固亚洲的主导地位。

北美是一个成熟且技术先进的产业中心。 2025年,美国将开采711万吨高岭土,其中大部分来自乔治亚的白垩纪矿藏。对电池煅烧高岭土工厂的投资生产国内超级工厂,这些工厂利用现有的铁路和港口基础设施,快速实现关键矿产资源的本地化供应。环境法规提高了基本营运成本,促使生产商安装再生式热氧化器和封闭回路型水循环系统,以维持其营运许可证。

在欧洲,捷克和英国拥有高品位矿床。排放交易体系下更严格的碳政策正加速低能耗加工方法的研发。生产商正在探索干燥机的部分电气化以及在燃烧器生产线中使用生物质燃料。特种应用(先进耐火材料、过滤介质、环保水泥)正在抵消传统纸张需求放缓的影响。

以巴西为首的南美洲正崛起为重要的出口枢纽。政府对关键矿产开采的支持以及接近性大西洋航线的地理优势,都促进了高岭土在巴西国家矿业生产中的贡献。巴伊亚州正在建造的世界最大活性黏土厂之一,将利用当地的高岭土原料生产低碳水泥添加剂。对北美和欧洲具有竞争力的交付成本进一步巩固了巴西的战略地位。

中东和非洲地区持续成长,儘管规模较小。沙乌地阿拉伯的「2030愿景」旨在向重工业多元化发展,南非计划扩大其陶瓷砖产业,这些都是推动需求成长的关键因素。摩洛哥和埃及正在评估高岭土资源,用于耐火材料,这表明未来上游开发具有潜力。由于国内选矿能力有限,高岭土中间产品和成品仍需持续进口,从而维持了高岭土市场的国际贸易流量。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 亚太地区卫浴设备和瓷砖製造业快速成长

- 北美和欧洲转向使用高亮度包装纸

- 煅烧高岭土在锂离子电池隔膜涂层中的快速应用

- 造纸和橡胶产业的需求不断增长

- 化妆品和个人护理行业的成长

- 市场限制

- 烘焙过程能耗高、成本不断上涨

- 欧洲和北美对矿场有严格的环境许可要求

- 以其他替代品替代

- 价值链分析

- 波特五力分析

- 买方的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 按形式

- 生高岭土

- 加工高岭土

- 按年级

- 水合高岭土

- 煅烧高岭土

- 前往角质高岭土

- 其他的

- 透过使用

- 陶瓷

- 水泥

- 纸

- 耐火材料

- 油漆和涂料

- 塑胶

- 其他的

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- 20 Microns

- Active Minerals International LLC(JM Huber Corporation)

- Ashapura Group

- BASF SE

- Burgess Pigment Company

- EICL

- Gebruder Dorfner GmbH & Co.

- Imerys

- I-Minerals Inc.

- KaMin LLC./CADAM

- Kaolin AD

- Keramost as

- LASSELSBERGER Group GmbH

- LB MINERALS, Ltd.

- Quarzwerke GmbH

- Sibelco

- Thiele Kaolin Company

- Tokai Clay Industry Co., Ltd.

第七章 市场机会与未来展望

The Kaolin Market market is expected to grow from 47.59 Million tons in 2025 to 49.57 Million tons in 2026 and is forecast to reach 60.76 Million tons by 2031 at 4.16% CAGR over 2026-2031.

Demand is widening from traditional ceramics into battery separators, specialty papers, and clean-label cosmetics, all of which prize kaolin's brightness, chemical inertness, and low electrical conductivity. Capacity additions in Asia Pacific, a push for premium packaging grades in North America and Europe, and investments in calcined products for electric-vehicle batteries are reinforcing the positive outlook. Producers with integrated mining, energy-efficient calcination, and application-specific processing technologies are securing multi-year supply agreements. Short-term cost pressure from rising fuel prices and complex mine-site permitting in mature regions is tempering the overall growth trajectory, yet most end-use segments continue to substitute toward kaolin where it offers demonstrable performance advantages.

Global Kaolin Market Trends and Insights

Booming Sanitary-ware & Tile Manufacturing in Asia Pacific

Rising urbanization and residential upgrades are stimulating vast new tile and sanitary-ware output across China, India, Vietnam, and Indonesia. Domestic producers are scaling kilns capable of firing large-format porcelain panels that require high-whiteness kaolin to achieve consistent aesthetic standards. Regional manufacturers also favor local supply chains to limit input costs and shorten delivery cycles, spurring long-term offtake pacts with kaolin mines in Guangxi, Fujian, and Gujarat. Modern tunnel-kiln designs improve firing uniformity but raise specification thresholds for rheology and thermal stability, supporting the premiumization of kaolin grades. Governments encouraging housing starts and public infrastructure are further underpinning the ceramics pipeline, ensuring steady pull-through demand across the kaolin market.

Shift to High-Brightness Packaging Paper in North America & Europe

Brand owners are differentiating e-commerce parcels with unbleached kraft outers paired with bright white or pastel inner liners that elevate the unboxing experience. This design trend increases the consumption of ultra-fine kaolin as a coating pigment that delivers high opacity without impairing recyclability. Paper mills are debottlenecking blade-coater sections and upgrading dispersion systems to handle finer particle distributions. Consolidation activities-such as International Paper's agreement to acquire DS Smith-demonstrate a strategic pivot toward value-added packaging niches and reinforce tight supply relationships with specialty kaolin producers. Mills unable to source consistent high-brightness grades risk yield losses and coating defects, cementing kaolin's central role in premium board production.

High Energy Intensity & Cost Inflation in Calcination Operations

Calcination requires temperatures from 650 °C to 1 200 °C, making fuel costs a major input. European natural gas prices surged in 2024-2025, swelling cash-cost curves for regional producers by double digits. FlashCalx and RotaCalx firing designs cut residence time by up to 30% and recover sensible heat, yet capital budgets near USD 15 million per line limit adoption to integrated majors. Calix Limited has piloted electric-powered indirect calcination that reduces CO2 intensity by 30%, but commercial throughput remains under evaluation. Smaller miners without low-cost fuel or process innovation risk margin compression, encouraging consolidation within the kaolin market.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- Growing Demand from Paper and Rubber Industries

- Stringent Mine-Site Environmental Permitting in Europe and North America

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Processed kaolin captured 69.35% of the kaolin market in 2025, underpinning its indispensability in premium ceramics, high-gloss papers, and engineered polymers. Beneficiation stages-screening, magnetic separation, flotation, and chemical bleaching-lift brightness above 90 ISO and pare down titania and iron impurities. End-users pay a premium for these attributes, reflecting the superior performance threshold relative to crude clay. The kaolin market size for processed grades is forecast to climb alongside deeper penetration in battery separator coatings and in thermal-insulation mortars used in energy-efficient construction.

Crude/unprocessed clay is projected to advance at 4.72% CAGR through 2031 thanks to ceramic clusters in Asia outsourcing trimming and micronizing to local toll processors. Producers in Thailand and Malaysia are co-locating rudimentary washing plants near deposits to control logistics costs. As regional processors invest in column flotation and high-gradient magnetic separators, a share of crude supply will progressively shift to semi-finished and finished material, reinforcing a gradual migration up the value chain within the kaolin market.

The Kaolin Market Report is Segmented by Form (Crude/Unprocessed Kaolin and Processed Kaolin), Grade (Hydrous Kaolin, Calcined Kaolin, Delaminated Kaolin, and Others), Application (Ceramics, Cement, Paper, Refractories, Paints and Coatings, Plastics, and Others) and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (tons).

Geography Analysis

Asia Pacific commanded 42.55% of the kaolin market in 2025 and is on track for 4.70% CAGR through 2031. China anchors regional demand with its integrated tile corridors in Guangdong and Shandong, while India scales sanitary-ware clusters in Morbi and Rajasthan. Government infrastructure programs and steady export orders sustain kiln utilization rates, ensuring consistent pull for hydrous and calcined grades. Southeast Asian capacity additions, notably in Vietnam and Indonesia, deepen intra-regional trade and reinforce Asia's leading position.

North America constitutes a mature yet technologically advanced hub. The United States mined 7.11 million tons of kaolin in 2025, largely from Georgia's Cretaceous deposits. Investments in battery-grade calcined kaolin plants leverage existing rail and port infrastructure, targeting domestic gigafactories eager to localize critical mineral supply. Environmental regulations elevate baseline operating costs, prompting producers to adopt regenerative thermal oxidizers and closed-loop water circuits to safeguard operating permits.

Europe offers high-purity reserves in the Czech Republic and United Kingdom. Tightening carbon policy under the EU Emissions Trading System accelerates the search for low-energy processing methods. Producers explore partial electrification of dryers and the use of biomass in burner lines. Specialty applications-advanced refractories, filtration media, and green cement-offset headwinds from conventional paper demand.

South America, led by Brazil, is emerging as a pivotal export base. Government incentives for critical mineral extraction and proximity to Atlantic shipping lanes underpin kaolin's contribution to national mining output. The world's largest activated clay plant under construction in Bahia will tap local kaolin feedstock to produce low-carbon cement additives. Competitive delivered-cost positions into North America and Europe reinforce Brazil's strategic relevance.

The Middle East and Africa remain smaller but growing. Saudi Arabia's Vision 2030 heavy-industrial diversification and South Africa's ceramic tile ambitions underpin incremental demand. Morocco and Egypt evaluate kaolin resources for white cement and refractories, hinting at future upstream development. Limited domestic beneficiation drives imports of intermediate or finished grades, sustaining global trade flows within the kaolin market.

- 20 Microns

- Active Minerals International LLC (J.M. Huber Corporation)

- Ashapura Group

- BASF SE

- Burgess Pigment Company

- EICL

- Gebruder Dorfner GmbH & Co.

- Imerys

- I-Minerals Inc.

- KaMin LLC. / CADAM

- Kaolin AD

- Keramost a.s.

- LASSELSBERGER Group GmbH

- LB MINERALS, Ltd.

- Quarzwerke GmbH

- Sibelco

- Thiele Kaolin Company

- Tokai Clay Industry Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Booming Sanitary-ware and Tile Manufacturing in Asia Pacific

- 4.2.2 Shift to High-Brightness Packaging Paper in North America and Europe

- 4.2.3 Rapid Adoption of Calcined Kaolin in Li-ion Battery Separator Coatings

- 4.2.4 Growing Demand from Paper and Rubber Industries

- 4.2.5 Cosmetics and Personal Care Industry Growth

- 4.3 Market Restraints

- 4.3.1 High Energy Intensity and Cost Inflation in Calcination Operations

- 4.3.2 Stringent Mine-Site Environmental Permitting in Europe and North America

- 4.3.3 Replacement by Other Subsitutes

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Form

- 5.1.1 Crude/Unprocessed Kaolin

- 5.1.2 Processed Kaolin

- 5.2 By Grade

- 5.2.1 Hydrous Kaolin

- 5.2.2 Calcined Kaolin

- 5.2.3 Delaminated Kaolin

- 5.2.4 Others

- 5.3 By Application

- 5.3.1 Ceramics

- 5.3.2 Cement

- 5.3.3 Paper

- 5.3.4 Refractories

- 5.3.5 Paints and Coatings

- 5.3.6 Plastics

- 5.3.7 Others

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 20 Microns

- 6.4.2 Active Minerals International LLC (J.M. Huber Corporation)

- 6.4.3 Ashapura Group

- 6.4.4 BASF SE

- 6.4.5 Burgess Pigment Company

- 6.4.6 EICL

- 6.4.7 Gebruder Dorfner GmbH & Co.

- 6.4.8 Imerys

- 6.4.9 I-Minerals Inc.

- 6.4.10 KaMin LLC. / CADAM

- 6.4.11 Kaolin AD

- 6.4.12 Keramost a.s.

- 6.4.13 LASSELSBERGER Group GmbH

- 6.4.14 LB MINERALS, Ltd.

- 6.4.15 Quarzwerke GmbH

- 6.4.16 Sibelco

- 6.4.17 Thiele Kaolin Company

- 6.4.18 Tokai Clay Industry Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Growing Demand for Sanitary Ceramics