|

市场调查报告书

商品编码

1906135

邻苯二甲酸二异壬酯 (DINP):市场占有率分析、产业趋势与统计、成长预测 (2026-2031)Diisononyl Phthalate (DINP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

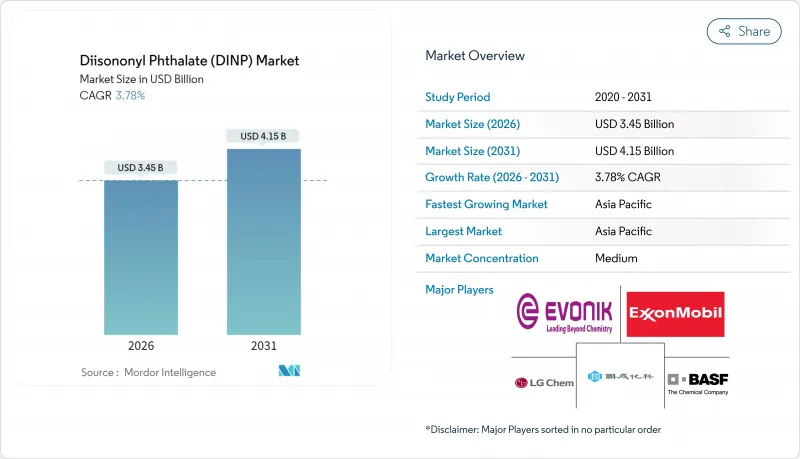

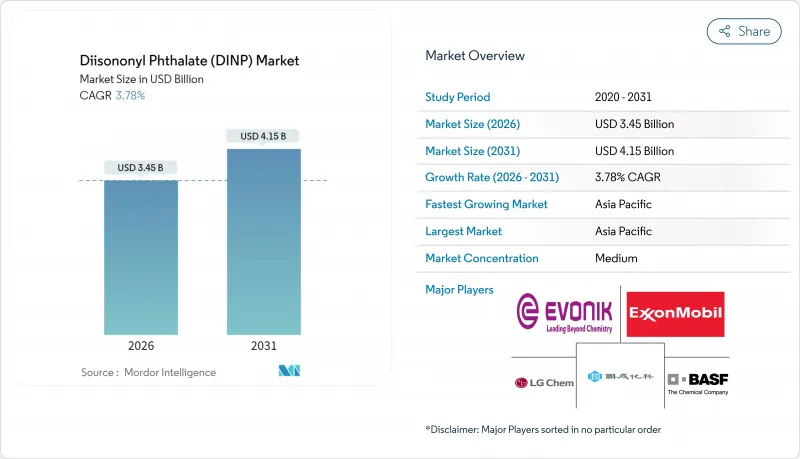

2025 年邻苯二甲酸二异壬酯 (DINP) 市值为 33.2 亿美元,预计到 2031 年将达到 41.5 亿美元,高于 2026 年的 34.5 亿美元。

预计在预测期(2026-2031 年)内,复合年增长率将达到 3.78%。

主要消费地区日益严格的监管措施被稳定的基础设施支出、对柔软性PVC的强劲需求以及现有供应链的韧性所抵消。製造商正转向更安全的应用部署和可追溯的原材料以确保产量,而建筑和电气行业注重成本的买家则继续看重DINP优异的成本绩效。亚太地区保持着需求主导地位,其增速高于全球平均水平,这得益于大规模的石化投资,这些投资确保了树脂的长期供应。在北美和欧洲,美国环保署(EPA)将于2025年1月发布的风险评估报告正促使企业加快永续产品的部署,并投资于以合规为导向的流程改善。

全球邻苯二甲酸二异壬酯 (DINP) 市场趋势及洞察

对柔软性PVC的需求不断成长

2025年,全球PVC消费量将以5.96%的复合年增长率成长,从而确保中期内邻苯二甲酸二异壬酯(DINP)的稳定需求。 DINP在地板材料和电缆应用中长达5至30年的使用寿命,使其更换需求可预测。同时,再生PVC技术的进步(利用热解衍生原料,可将二氧化碳排放减少50%)正促使生产商在不牺牲规模的前提下提供报废解决方案。这些发展使得邻苯二甲酸二异壬酯市场能够在维持产量的同时,提升永续性能力。

建筑和建设产业的扩张

建筑需求的復苏推动了邻苯二甲酸二异壬酯(DINP)在乙烯基(PVC)地板材料、壁材和屋顶防水卷材中的应用,这些材料需要具备柔软性和耐候性。北美地区住宅维修活动的活性化和亚洲都市化的加快支撑了这一需求,而台塑和信达近期产能的扩张也有助于抑制PVC价格的上涨压力。从柔软性LVT(层压乙烯基瓷砖)到刚性SPC(石塑复合材料)的转变增加了加工的复杂性,促使生产商开发耐热性更高的DINP产品。邻苯二甲酸二异壬酯市场正受益于此专业化趋势,但利润率取决于能否在每平方英尺的价格上与低成本进口产品保持竞争力。

监理监督与健康风险评估

美国环保署 (EPA) 于 2025 年 1 月发布的一项风险评估得出结论:邻苯二甲酸二异壬酯 (DINP) 在某些喷涂产品和消费地板材料中构成不合理的风险,因此触发了强制性风险控制措施,这些措施可能会限制其某些用途。加州 65 号提案将其列入禁用物质清单,以及美国消费品安全委员会 (CPSC) 禁止将其用于玩具,进一步增加了限制。这些法规导致市场需求分散,迫使製造商更改配方,并增加了合规成本。鑑于欧盟持续的审查以及其他司法管辖区计划实施类似 REACH 法规,监管风险仍然是邻苯二甲酸二异壬酯市场参与企业的首要关注点。

细分市场分析

预计到2025年,聚氯乙烯树脂(PVC)将占总收入的86.62%,并在2031年之前以3.96%的复合年增长率成长。这一规模确保了对邻苯二甲酸二异壬酯(DINP)原材料的持续需求,使一体化生产商能够利用现有资产保持成本优势。新兴的再生PVC树脂有助于维持产量并确保未来的合规性,从而将邻苯二甲酸二异壬酯(DINP)市场牢牢地建立在这一基材之上。

丙烯酸和聚氨酯的细分市场将占据剩余的收入。丙烯酸涂料利用DINP的溶解性来提高薄膜在恶劣天气条件下的柔软性,而一些聚氨酯泡棉製造商则选择DINP来增强座椅的回弹寿命,从而提升舒适度。非异氰酸酯聚氨酯的研发存在未来被替代的风险,但预计在预测期内商业性应用将受到限制。

区域分析

预计到2025年,亚太地区将占全球营收的58.83%,并在2031年之前以4.07%的复合年增长率成长。中国在全球PVC产量中占比高达50%,这得益于BASF对一体化生产系统的100亿欧元投资,也构成了该地区的供应基础;而印度的建筑业蓬勃发展则推动了新增需求。诸如中国对部分美国进口产品征收43.5%的反倾销税等贸易措施,造成了暂时的价格扭曲,而本土DINP生产商正利用这些扭曲来保护其国内市场。

在北美,美国环保署 (EPA) 的风险评估促成了政策主导的转变,加速了涂料生产商向更安全涂料的转型,并促使他们儘早采用国际标准认证委员会 (ISCC) 认证的等级产品。受页岩原料主导地位的推动,预计美国国内化工产业在 2023 年将保持低迷,并在 2024 年小幅成长 1.5%。在欧洲,REACH 法规和强制回收目标正在推动循环经济的发展,同时对韩国产 DOTP 征收的反倾销税也在重塑竞争格局。预计这将间接支撑对符合不断发展标准的本地生产的 DINP 等级产品的需求。

南美洲和中东及非洲的基本客群小规模但成长迅速,这主要得益于产业多元化计划和较低的监管阻力。然而,薄弱的回收系统和较低的回收率也带来了未来可能受到干预的风险,这与经合组织(OECD)的调查结果相呼应:2019年有2,200万吨塑胶被排放到环境中。面向这些地区的生产商正优先研发价格合理的DINP配方,同时也为最终与经合组织标准接轨做准备。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 对柔软性PVC的需求不断成长

- 建筑和建设产业的扩张

- 对电线电缆绝缘材料的需求不断增长

- 汽车生产和轻量化内部装潢建材的恢復

- 可作为5G通信电缆的绝缘材料

- 市场限制

- 监理监督与健康风险评估

- 加速向生物基/非邻苯二甲酸酯塑化剂的过渡

- 溶剂型PVC回收技术的进步减少了原生DINP的使用。

- 价值链分析

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按聚合物类型

- PVC

- 丙烯酸纤维

- 聚氨酯

- 透过使用

- 地板材料和墙壁材料

- 涂层织物

- 消费品

- 薄膜和片材

- 电线电缆

- 其他用途

- 按最终用户行业划分

- 建筑/施工

- 电气和电子设备

- 汽车/运输设备

- 包装和食品接触材料

- 医疗和医疗设备

- 其他终端用户产业

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 南非

- 埃及

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Azelis Group NV

- BASF SE

- Evonik Industries AG

- Exxon Mobil Corporation

- GM Chemie Pvt Ltd

- Hanwha Solutions Chemical Division Corporation

- KLJ Group

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- Polynt SpA

- Shandong Qilu Plasticizers Co Ltd

- UPC Group

第七章 市场机会与未来展望

The Diisononyl Phthalate Market was valued at USD 3.32 billion in 2025 and estimated to grow from USD 3.45 billion in 2026 to reach USD 4.15 billion by 2031, at a CAGR of 3.78% during the forecast period (2026-2031).

Steady infrastructure spending, entrenched demand for flexible PVC, and the resilience of established supply chains offset rising regulatory scrutiny in key consuming regions. Manufacturers are pivoting toward safer application routes and traceable feedstocks to safeguard volume, while cost-focused buyers in construction and electrical sectors continue to value DINP's proven price-performance balance. Asia-Pacific maintains demand leadership and posts faster growth than the global average, helped by large-scale petrochemical investments that secure long-term resin availability. In North America and Europe, the January 2025 EPA risk evaluation forces companies to speed up sustainable product rollouts and invest in compliance-centric process upgrades.

Global Diisononyl Phthalate (DINP) Market Trends and Insights

Growing Demand for Flexible PVC

DINP remains indispensable because about 95% of global output plasticizes flexible PVC products that serve construction, automotive, and wire markets. Global PVC consumption is advancing at a 5.96% CAGR to 2025, ensuring a steady pull for DINP over the medium term. Long service lives of between 5 and 30 years in flooring and cable applications add predictable replacement demand. Parallel progress in circular PVC, where pyrolysis-sourced feedstocks cut CO2 emissions by 50%, pushes producers to demonstrate end-of-life solutions without sacrificing scale. Such developments allow the Diisononyl Phthalate market to preserve volume while improving sustainability credentials.

Expanding Building and Construction Industry

Construction rebound drives elevated use of vinyl flooring, wall cladding, and roofing membranes that require DINP for flexibility and weather resistance. Residential renovation levels in North America and ongoing urbanization in Asia sustain demand, even as recent capacity additions by Formosa and Shintech temper PVC pricing power. The shift from flexible LVT to rigid SPC formats increases processing complexity and encourages producers to refine DINP grades for higher heat stability. The Diisononyl Phthalate market benefits from this specialization, yet margins hinge on keeping cost-per-square-foot competitive with low-cost imports.

Regulatory Scrutiny and Health-Risk Assessments

The January 2025 EPA risk evaluation concluded that DINP presents unreasonable risks for certain spray-applied products and consumer floor coverings, triggering mandatory risk management that may limit specific uses. California's Proposition 65 listing and the CPSC ban in toys add further constraints. These rules fragment demand, force manufacturer reformulation, and increase compliance costs. Persistent oversight in the EU and forthcoming reach-style legislation in other jurisdictions keep regulatory risk at the forefront for participants in the Diisononyl Phthalate market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand in Electrical Wire and Cable Insulation

- Recovery in Automotive Production and Lightweight Interiors

- Accelerating Switch to Bio-/Non-Phthalate Plasticizers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PVC commanded 86.62% of revenue in 2025 and is forecast to grow at a 3.96% CAGR through 2031. This scale secures continuous feedstock offtake for DINP while integrated producers leverage existing assets for cost leadership. Emerging circular PVC resins help maintain volume and future-proof compliance, keeping the Diisononyl Phthalate market anchored in this substrate.

Acrylic and polyurethane niches together occupy the balance of revenue. Acrylic coatings exploit DINP's solvency to enhance film flexibility in demanding climatic conditions, whereas select polyurethane foam producers choose DINP to improve rebound life in seating. Non-isocyanate polyurethane R&D introduces future substitution risk, although commercial adoption remains limited through the forecast horizon.

The Diisononyl Phthalate (DINP) Market Report is Segmented by Polymer Type (PVC, Acrylic, and Polyurethane), Application (Floor and Wall Coverings, Coated Fabrics, and More), End-User Industry (Building and Construction, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 58.83% of 2025 revenue and is forecast to expand at a 4.07% CAGR to 2031. China's 50% global share in PVC output, supported by BASF's EUR 10 billion Verbund investment, anchors supply while India's construction boom pulls incremental tonnage. Trade actions, such as China's 43.5% anti-dumping duties on select U.S. imports, create episodic price distortions that local DINP producers exploit to defend home markets.

North America experiences policy-driven transitions following the EPA risk verdict, prompting formulators to shift toward safer coatings and to fast-track ISCC-certified grades. The domestic chemical sector ekes out a 1.5% gain in 2024 after a subdued 2023, aided by shale-advantaged feedstocks. Europe pushes circularity through REACH and mandatory recycling targets; anti-dumping duties on Korean DOTP also shape the competitive field, indirectly sustaining demand for locally made DINP grades that remain compliant with evolving standards.

South America, the Middle East, and Africa together provide a small but rising customer base driven by industrial diversification projects and limited regulatory friction. Weak collection systems and low recycling rates, however, risk future intervention, echoing the OECD finding that 22 million t of plastics leaked into the environment in 2019. Producers eyeing these regions emphasize affordable DINP formulations while preparing for eventual policy convergence with OECD norms.

- Azelis Group NV

- BASF SE

- Evonik Industries AG

- Exxon Mobil Corporation

- GM Chemie Pvt Ltd

- Hanwha Solutions Chemical Division Corporation

- KLJ Group

- LG Chem Ltd

- Mitsubishi Chemical Group Corporation

- NAN YA PLASTICS CORPORATION

- Polynt SpA

- Shandong Qilu Plasticizers Co Ltd

- UPC Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand for Flexible PVC

- 4.2.2 Expanding Building and Construction Industry

- 4.2.3 Rising Demand in Electrical Wire and Cable Insulation

- 4.2.4 Recovery in Automotive Production and Lightweight Interiors

- 4.2.5 Adoption in 5G Telecom Cable Insulation

- 4.3 Market Restraints

- 4.3.1 Regulatory Scrutiny and Health-Risk Assessments

- 4.3.2 Accelerating Switch to Bio-/Non-Phthalate Plasticizers

- 4.3.3 Emerging Solvent-Based PVC Recycling Cuts Virgin DINP Use

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Polymer Type

- 5.1.1 PVC

- 5.1.2 Acrylic

- 5.1.3 Polyurethane

- 5.2 By Application

- 5.2.1 Floor and Wall Coverings

- 5.2.2 Coated Fabrics

- 5.2.3 Consumer Goods

- 5.2.4 Films and Sheets

- 5.2.5 Wires and Cables

- 5.2.6 Other Applications

- 5.3 By End-User Industry

- 5.3.1 Building and Construction

- 5.3.2 Electrical and Electronics

- 5.3.3 Automotive and Transportation

- 5.3.4 Packaging and Food Contact Materials

- 5.3.5 Healthcare and Medical Devices

- 5.3.6 Other End-Use Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 South Africa

- 5.4.5.4 Egypt

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Azelis Group NV

- 6.4.2 BASF SE

- 6.4.3 Evonik Industries AG

- 6.4.4 Exxon Mobil Corporation

- 6.4.5 GM Chemie Pvt Ltd

- 6.4.6 Hanwha Solutions Chemical Division Corporation

- 6.4.7 KLJ Group

- 6.4.8 LG Chem Ltd

- 6.4.9 Mitsubishi Chemical Group Corporation

- 6.4.10 NAN YA PLASTICS CORPORATION

- 6.4.11 Polynt SpA

- 6.4.12 Shandong Qilu Plasticizers Co Ltd

- 6.4.13 UPC Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment