|

市场调查报告书

商品编码

1906154

身分管治与管理:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Identity Governance And Administration - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

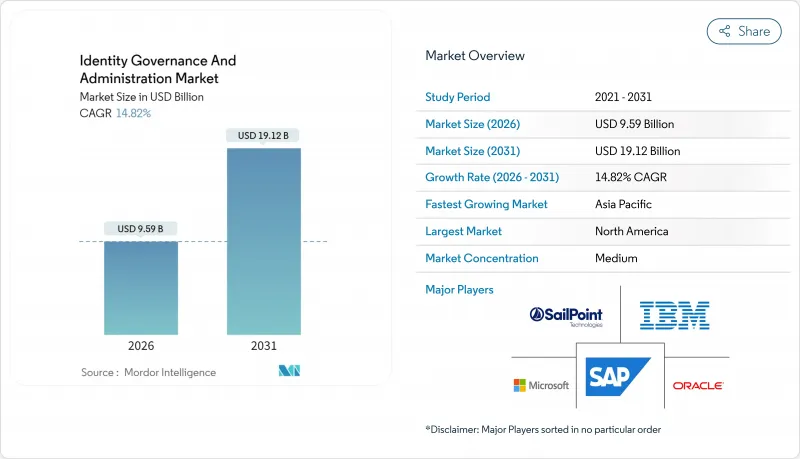

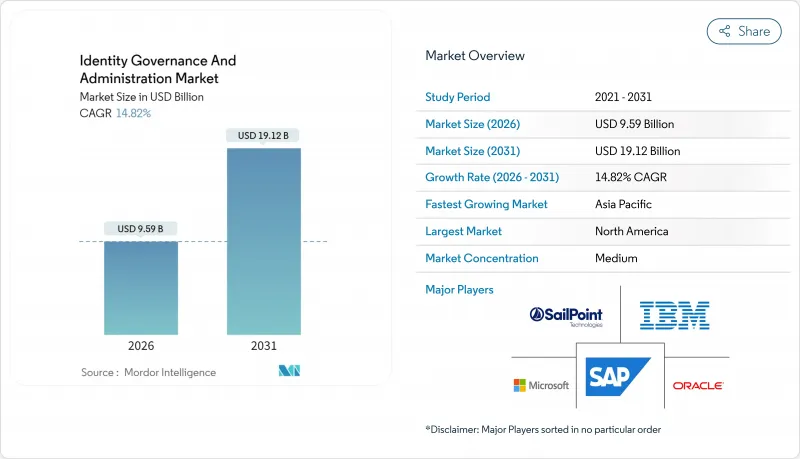

预计到 2026 年,身分管治和管理市场价值将达到 95.9 亿美元,高于 2025 年的 83.6 亿美元,预计到 2031 年将达到 191.2 亿美元。

预计2026年至2031年年复合成长率(CAGR)为14.82%。

对混合IT环境日益增长的依赖,加上身分盗窃诈骗激增82%,正推动安全支出转向以身分为中心的控制措施。云端交付模式目前为大多数新部署提供支持,这反映了弹性扩展和快速实现价值的需求。区域支出模式日益分散。北美凭藉着成熟的零信任计画引领着采用速度,而亚洲则凭藉着当地企业加速数位化和快速转向云端原生工具,推动了整体成长。服务仍然是最大的收入来源,这反映出技能差距阻碍了企业内部采用,以及对託管身分专业知识的需求不断增长。同时,供应商正越来越多地将机器学习融入身分验证工作流程,以实现权限审查自动化并提高侦测准确性。这种转变正在迅速改变竞争格局,并拓展特权存取和非人类身分等邻近领域的市场机会。

全球身分管治与管理市场趋势及洞察

AI驱动的IGA在持续存取认证的应用日益广泛

人工智慧驱动的工具现在可以近乎即时地检查使用者和非人类权限,透过识别高风险异常情况来最大限度地减少身份验证疲劳。采用这些功能的组织报告称,风险检测的准确性有所提高,管理成本降低,这种组合能够扩展管治,覆盖庞大的多重云端环境。生成式人工智慧还可以将复杂的权限说明说明为自然语言,从而提高业务经理的参与度并缩短服务台回应週期。金融服务和技术领域的早期应用表明,这种模式非常适合全球分散式办公环境,因为人工审核在这种环境下已变得不切实际。随着越来越多的组织对可解释的人工智慧审核引擎建立信任,预计成长动能将加速。

欧洲高度监管产业中 PAM 和 IGA 套件的融合

金融机构和关键基础设施营运商正透过将特权存取控制与更广泛的生命週期管治相结合,来简化工具的臃肿化问题。整合套件减少了管理员权限和普通使用者权限之间的重迭,从而堵住了攻击者的漏洞。领先的特权存取管理 (PAM) 供应商近期的收购凸显了整合管治模组并交付符合欧洲数位业务弹性法规的合规工作流程的竞争。早期采用者报告称,审核发现的问题更少,证据收集速度更快,这进一步增强了在全球子公司部署统一架构的商业价值。

身份工程人才短缺限制了复杂部署。

对精通目录架构、权限模型设计和法规映射的专家的需求持续超过供应。大多数公司都认为人才短缺是大规模部署的主要障碍。这种人才缺口导致更高的薪资和更长的计划週期,尤其是在网路安全人才稀缺的新兴市场。儘管供应商提供了标准化的模板和託管服务来应对这一需求,但由于缺乏内部专业知识,许多组织仍然迟迟不愿采用策略自动化等高级功能。

细分市场分析

到2025年,服务将占身分管治和管理市场收入的56.42%,这反映了整合各种应用环境所需的咨询和实施工作。跨本地部署、SaaS和操作技术层映射权限需要实施方面的负责人,尤其是在需要审核层级证据的受监管行业。 SaaS管治平台的出现正在将部分支出转向基于结果的託管服务,服务提供者将软体订阅和日常管理整合到固定费用模式中。

然而,软体订阅的成长速度超过了服务。人工智慧增强的使用者配置、持续身份验证和特权会话分析正推动软体订阅市场以 17.25% 的复合年增长率成长,从而吸引用户将预算从独立的存取管理工具中转移出来。透过将自动化融入每个工作流程并减少人工操作环节,供应商正在中端市场开闢新的机会,而复杂性历来是中端市场采用软体的障碍。随着客户寻求长期成本效益,这一趋势正为软体赢得市场份额铺平道路。

预计到2025年,云端采用将占身分管治和管理市场规模的60.74%,在所有细分市场中复合年增长率最高,达到16.02%。企业优先考虑快速上线、弹性扩充和即时取得功能版本。在多重云端环境中,跨IaaS、SaaS和平台服务的管治已成为必需,因此集中式架构成为首选。

在资料主权法规或空气间隙环境要求本地管理的情况下,本地部署仍然不可或缺。主权云端建置透过提供满足居住规则且不影响订阅经济性的专用区域实例,正在弥合这一差距。混合模式(策略引擎在云端运行,但敏感身分储存保留在本地)为拥有大规模传统环境的组织提供了一条迁移路径。

区域分析

北美地区将占2025年总收入的32.54%,这主要得益于日趋成熟的零信任计画以及众多平台供应商在人工智慧驱动分析领域持续创新。金融服务和医疗保健特定产业法规正在推动基础设施需求,而政府机构则在推动大规模的示范部署,从而帮助私人企业降低部署风险。

亚太地区预计将以16.75%的复合年增长率成长,这主要得益于中国、印度和东南亚国协积极的数位经济政策。通讯业者的整合、主权云端投资以及行动优先消费者服务的普及,正迫使企业快速实现身分管理的现代化。国内软体供应商正利用其在地化优势,积极拓展受国家技术发展指令影响的客户群,进而加剧市场竞争。

欧洲仍然是关键战场,GDPR(一般资料保护规则)、产业指令和ESG(环境、社会和管治)采购法规迫使企业实施符合审核要求的管治。北欧国家在供应商评估方面日益严格,并将道德身分验证纳入采购清单。同时,中东地区优先考虑符合居住法规的云端实例,将大规模电子化政府计划与资料主权要求相协调。在南美和非洲,市场准入正透过银行、电信和公共部门的试点计画实现,电子政府计画展现了快速的投资回报率,并鼓励更广泛地采用。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧驱动的IGA在持续存取认证的应用日益广泛

- PAM 和 IGA 套件在高度监管的欧洲产业的融合

- 零信任和无密码倡议加速了北美角色挖掘工具的普及

- 亚太地区通讯业者间的併购活动正在推动通讯业者采用IGA(集团政府协议)。

- 主权云端指令推动中东地区本土IGA平台发展

- 在北欧国家,与环境、社会及公司治理(ESG)相关的供应商评估要求推动了审核层级的验证。

- 市场限制

- 身分工程技能短缺限制了复杂部署的发展。

- 现有IT环境中API的蔓延会推高整合成本。

- 资料居住法的分散化阻碍了跨国公司的全球扩张

- 传统ERP环境中的角色为基础的进入许可权控制会降低投资报酬率。

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 投资分析

第五章 市场规模与成长预测

- 按组件

- 解决方案

- 存取授权和审查

- 使用者配置/取消配置

- 特权管治

- 密码管理

- 服务

- 专业服务

- 託管服务

- 解决方案

- 透过部署模式

- 本地部署

- 云

- 按公司规模

- 大公司

- 小型企业

- 按最终用户行业划分

- 银行、金融服务和保险

- 资讯科技和电信

- 医疗保健和生命科学

- 能源与公共产业

- 政府与公共国防

- 製造业

- 零售与电子商务

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 北欧国家(瑞典、挪威、丹麦、芬兰)

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 东协(新加坡、印尼、马来西亚、泰国、越南、菲律宾)

- 亚太其他地区

- 中东

- 海湾合作委员会(沙乌地阿拉伯、阿联酋、卡达、阿曼、科威特、巴林)

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SailPoint Technologies Holdings Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Broadcom Inc.(CA Technologies)

- SAP SE

- Okta Inc.

- One Identity LLC

- Saviynt Inc.

- CyberArk Software Ltd.

- Ping Identity Holding Corp.

- ForgeRock(Thales Group)

- Hitachi ID Systems

- Evidian(Atos)

- Quest Software Inc.

- Micro Focus(OpenText)

- RSA Security LLC

- Wipro Limited

- Cognizant Technology Solutions Corp.

- Omada Identity

- Zilla Security

- SecZetta

第七章 市场机会与未来展望

The identity governance and administration market size in 2026 is estimated at USD 9.59 billion, growing from 2025 value of USD 8.36 billion with 2031 projections showing USD 19.12 billion, growing at 14.82% CAGR over 2026-2031.

Heightened reliance on hybrid IT estates combined with an 82% surge in impersonation-led fraud is steering security spending toward identity-centric controls.Cloud delivery models now anchor most new deployments, reflecting the need for elastic scaling and quicker time-to-value. Regional spending patterns are fragmenting: North America sets the adoption pace through mature zero-trust programs, while Asia propels overall growth as local enterprises accelerate digitization and leapfrog to cloud-native tools. Services retain the largest revenue pool, mirroring the skills gap that hampers in-house roll-outs and drives demand for managed identity expertise. Meanwhile, vendors are embedding machine learning into certification workflows, automating entitlement reviews and raising detection accuracy, a shift that is rapidly altering competitive positioning and widening addressable opportunities in adjacent privileged access and non-human identity segments.

Global Identity Governance And Administration Market Trends and Insights

Rising Adoption of AI-Driven IGA for Continuous Access Certification

AI-enabled tools now inspect user and non-human entitlements in near real time, minimizing certification fatigue by spotlighting high-risk anomalies. Enterprises deploying these capabilities report sharper risk detection and administrative cost relief, a combination that scales governance to sprawling multicloud estates. Generative AI is also rewriting complex entitlement descriptions into natural language, widening participation among business managers and reducing help-desk cycles. Early roll-outs in financial services and tech verticals suggest the model is suited for globally dispersed workforces where manual reviews have become impractical. Growth momentum is therefore expected to intensify as more organizations build trust in explainable AI review engines.

Convergence of PAM & IGA Suites Among Highly-Regulated Sectors in Europe

Financial institutions and critical infrastructure operators are rationalizing tool sprawl by fusing privileged access controls with broader lifecycle governance. Unified suites reduce overlap between administrator and standard user entitlements, closing gaps that attackers target. Recent acquisitions by leading PAM providers underscore a race to integrate governance modules and to deliver compliance-ready workflows aligned with Europe's Digital Operational Resilience Act. Early adopters report fewer audit findings and faster evidence gathering, reinforcing the business case for integrated architectures across global subsidiaries.

Skill Shortage in Identity Engineering Limiting Complex Deployments

Demand for specialists versed in directory architecture, entitlement modelling, and regulatory mapping continues to outstrip supply. A majority of enterprises cite talent scarcity as the principal hurdle to large-scale implementations. The gap drives wage inflation and elongates project timelines, especially in emerging markets where cybersecurity skill pools remain shallow. Vendors are responding with prescriptive templates and managed offerings, yet many organizations still defer advanced features such as policy automation because internal expertise is absent.

Other drivers and restraints analyzed in the detailed report include:

- Zero-Trust & Passwordless Initiatives Accelerating Role Mining Tools in North America

- M&A Activity Among Telcos Driving Telco-Grade IGA Roll-Outs in APAC

- API-Sprawl Elevating Integration Cost for Brownfield IT Environments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services generated 56.42% of 2025 revenue in the identity governance and administration market, reflecting the consulting and integration effort needed to harmonize diverse application estates. Implementers remain indispensable for mapping entitlements across on-premises, SaaS, and operational technology layers, particularly in regulated sectors that demand audit-grade evidence. The arrival of SaaS-delivered governance platforms is shifting some expenditure toward outcome-based managed services, with providers bundling software subscriptions and day-to-day administration into fixed-fee models.

Software subscriptions are, however, outpacing services in growth terms. AI-enhanced user provisioning, continuous certification, and privileged session analytics underpin a 17.25% CAGR outlook, drawing budget from stand-alone access management tools. Vendors are weaving automation into every workflow, shrinking manual touchpoints, and opening mid-market opportunities where previous complexity deterred adoption. This dynamic positions software to capture incremental share as customers seek long-term cost efficiencies.

Cloud deployments accounted for 60.74% of the identity governance and administration market size in 2025 and are projected to register the segment's steepest 16.02% CAGR. Enterprises value rapid onboarding, elastic scaling, and instant access to feature releases. Multicloud realities now require governance that spans infrastructure-as-a-service, SaaS, and platform services, making centrally-hosted architectures the preferred option.

On-premises installations persist where data-sovereignty statutes or air-gapped environments dictate local control. Sovereign-cloud constructs are narrowing this divide by offering dedicated regional instances that satisfy residency rules without sacrificing subscription economics. Hybrid models, in which policy engines run in the cloud while sensitive identity stores remain on-site, provide transitional paths for organizations with large legacy footprints.

The Identity Governance and Administration Market Report is Segmented by Component (Solutions, Services), Deployment Mode (On Premise, Cloud), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End User Vertical (Banking, Financial Services, and Insurance, IT and Telecom, Energy and Utilities, Government and Public Defense, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 32.54% of 2025 revenue, underpinned by mature zero-trust initiatives and a concentration of platform vendors that continually innovate around AI-driven analytics. Sector-specific mandates in financial services and healthcare boost baseline demand, while government agencies sponsor large-scale reference deployments that de-risk adoption for private firms.

Asia-Pacific is projected to expand at a 16.75% CAGR, buoyed by aggressive digital-economy policies in China, India, and key ASEAN states. Telco consolidation, sovereign-cloud investments, and widespread mobile-first consumer services force enterprises to modernize identity controls rapidly. Domestic software suppliers leverage localisation advantages to penetrate accounts subject to national technology-development directives, amplifying competitive intensity.

Europe remains a pivotal battleground where GDPR, sectoral directives, and ESG-linked procurement rules compel organisations to adopt audit-ready governance. The Nordics push vendor assessment rigor even further, embedding ethical identity verification into sourcing checklists. Meanwhile, the Middle East prioritises residency-compliant cloud instances to harmonise expansive e-government projects with data-sovereignty imperatives. South America and Africa enter the market through banking, telecom, and public-sector pilots that demonstrate rapid ROI and spur broader adoption.

- SailPoint Technologies Holdings Inc.

- IBM Corporation

- Microsoft Corporation

- Oracle Corporation

- Broadcom Inc. (CA Technologies)

- SAP SE

- Okta Inc.

- One Identity LLC

- Saviynt Inc.

- CyberArk Software Ltd.

- Ping Identity Holding Corp.

- ForgeRock (Thales Group)

- Hitachi ID Systems

- Evidian (Atos)

- Quest Software Inc.

- Micro Focus (OpenText)

- RSA Security LLC

- Wipro Limited

- Cognizant Technology Solutions Corp.

- Omada Identity

- Zilla Security

- SecZetta

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption of AI-driven IGA for Continuous Access Certification

- 4.2.2 Convergence of PAM and IGA Suites Among Highly-Regulated Sectors in Europe

- 4.2.3 Zero-Trust and Passwordless Initiatives Accelerating Role Mining Tools in North America

- 4.2.4 MandA Activity Among Telcos Driving Telco-grade IGA Roll-outs in APAC

- 4.2.5 Sovereign-Cloud Mandates Fueling Domestic IGA Platforms in Middle East

- 4.2.6 ESG-Linked Vendor Assessment Requirements Pushing Audit-grade Identity Proof in Nordics

- 4.3 Market Restraints

- 4.3.1 Skill Shortage in Identity Engineering Limiting Complex Deployments

- 4.3.2 API-Sprawl Elevating Integration Cost for Brownfield IT Environments

- 4.3.3 Fragmented Data-Residency Laws Slowing Global Rollouts for Multinationals

- 4.3.4 Delayed ROI from Role-Based Access Clean-ups in Legacy ERP Estates

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Access Certification and Review

- 5.1.1.2 User Provisioning / De-provisioning

- 5.1.1.3 Privileged Governance

- 5.1.1.4 Password Management

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Solutions

- 5.2 By Deployment Mode

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By Enterprise Size

- 5.3.1 Large Enterprises

- 5.3.2 Small and Medium Enterprises

- 5.4 By End-user Vertical

- 5.4.1 Banking, Financial Services and Insurance

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Energy and Utilities

- 5.4.5 Government and Public Defense

- 5.4.6 Manufacturing

- 5.4.7 Retail and e-Commerce

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Nordics (Sweden, Norway, Denmark, Finland)

- 5.5.3.6 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN (Singapore, Indonesia, Malaysia, Thailand, Vietnam, Philippines)

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East

- 5.5.5.1 GCC (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain)

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 SailPoint Technologies Holdings Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 Oracle Corporation

- 6.4.5 Broadcom Inc. (CA Technologies)

- 6.4.6 SAP SE

- 6.4.7 Okta Inc.

- 6.4.8 One Identity LLC

- 6.4.9 Saviynt Inc.

- 6.4.10 CyberArk Software Ltd.

- 6.4.11 Ping Identity Holding Corp.

- 6.4.12 ForgeRock (Thales Group)

- 6.4.13 Hitachi ID Systems

- 6.4.14 Evidian (Atos)

- 6.4.15 Quest Software Inc.

- 6.4.16 Micro Focus (OpenText)

- 6.4.17 RSA Security LLC

- 6.4.18 Wipro Limited

- 6.4.19 Cognizant Technology Solutions Corp.

- 6.4.20 Omada Identity

- 6.4.21 Zilla Security

- 6.4.22 SecZetta

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment