|

市场调查报告书

商品编码

1906180

实验室设备及耗材:全球市场份额分析、产业趋势及统计、成长预测(2026-2031)Global Laboratory Equipment And Disposables - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

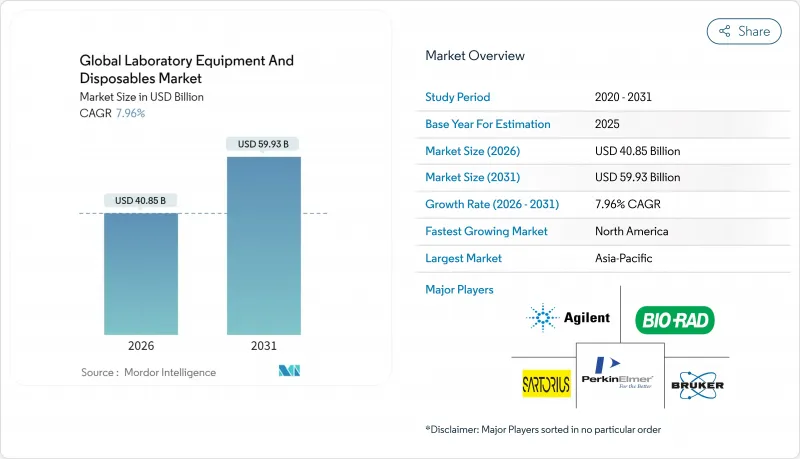

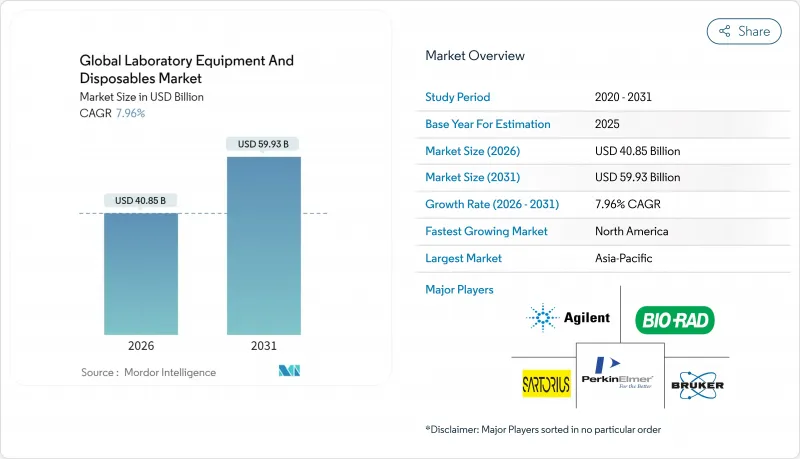

实验室设备和耗材市场预计到 2026 年价值 408.5 亿美元,高于 2025 年的 378.4 亿美元,预计到 2031 年将达到 599.3 亿美元。

预计2026年至2031年年复合成长率(CAGR)为7.96%。

生物製药研发投入的持续成长、基因组学工作流程的快速扩张(需要高通量自动化)以及严格的污染控制通讯协定(鼓励使用一次性耗材)推动了该产业的持续发展。供应商正在增加人工智慧驱动的预测性维护功能,以最大限度地延长仪器的运转率,而绿色实验室认证计画则促使实验室减少能源和材料废弃物。供应链韧性措施和回流政策持续影响采购决策,尤其是在北美和欧洲,而政府主导的生物技术投资在亚太地区也正在加速发展。日益激烈的竞争促使大型现有企业透过併购寻求规模经济,而新兴参与企业则透过模组化机器人和永续发展服务脱颖而出。

全球实验室设备及耗材市场趋势与洞察

不断扩大的医药品研究开发费用

预计到2024年,製药研发支出将达到2,880亿美元,到2030年将增加3,400亿美元,这将持续推动先进分析设备的强劲需求。美国创业融资的年投资额超过500亿美元,欧洲的研发管线依然强劲,为实验室基础设施的长期资本流入提供了支撑。 FDA对生物製药的核准增加,促进了设备利用率的提高和耗材的持续销售。随着研发管线扩展到包括细胞和基因疗法在内的多种治疗方式,实验室正在升级到封闭式隔离器和数位化文件平台,这将推动整合供应商的市场份额成长。

高通量定序设施的快速扩张

全球次世代定序设施的扩张正在加速对基因组样本製备、微流体晶片和云端资料管道的需求。生命科学工具市场预计将以10.9%的复合年增长率成长,其中定序工作流程是关键驱动因素。贝克曼库尔特的TruSight Oncology 500和凯杰即将推出的QIAsymphony Connect是自动化技术的典型代表,它们在减少人工工时的同时提高了通量。中国的「十四五」规划将加强基因组学能力建设列为优先事项,本土製造商正利用补贴政策部署台式定序仪。肿瘤研究人员正在将人工智慧演算法应用于突变检测,从而推动了对高容量伺服器和实验室资讯管理系统(LIMS)的需求。整体而言,定序实验室是重要的客户群,推动了各种耗材和资本设备的需求。

医用树脂价格波动

聚丙烯和聚四氟乙烯价格的快速波动正在挤压耗材製造商的利润空间,并迫使设备供应商重新谈判供货合约。地缘政治紧张局势导致的化学品供应瓶颈延长了前置作业时间,迫使买家建立安全库存,并增加了营运资金需求。伊士曼公司投资22.5亿美元用于分子回收,旨在确保原料可回收并降低投入成本风险。然而,现货价格波动依然存在,尤其对购买力有限的小规模实验室影响更大。预算的不确定性可能会推迟非必要设备升级,并促使实验室对玻璃器皿进行重新消毒,预计这将限制实验室设备和耗材市场一次性使用类别的短期增长。

细分市场分析

耗材将成为主导品类,2025年将占据实验室设备和耗材市场份额的51.62%,主要得益于一次性无菌性和工作流程效率的提升。预计到2031年,该品类将以8.53%的复合年增长率成长,实现持续的收入成长,超过原料成本的波动。生物製药和诊断实验室倾向于使用即用型微量吸管尖、过滤组件和微流体晶片,这些产品能够最大限度地减少交叉污染,并简化合规性文件。洁净室服装仍然是无菌生产必不可少的,而闭合迴路回收试点计画正在积极应对日益严格的环境、社会和治理(ESG)审查。

实验室设备,包括分析仪、光谱仪、离心机和培养箱等,持续为利用物联网连接实现基础设施现代化的机构带来稳定的资本投资需求。整合到高价值系统中的预测性维护模组可提供持续的服务收入,从而抵消较长的更换週期。供应商透过开放式架构软体、可扩展的机器人技术以及将耗材与设备使用挂钩的试剂租赁套餐来脱颖而出。在成熟的实验室中,分析即服务 (AaaS) 合约将预算从资本支出 (CapEx) 转移到营运支出 (OpEx),从而平滑收入波动,并支援实验室设备和耗材市场的整体成长。

区域分析

到2025年,北美将占据最大的收入份额,达到37.68%,这主要得益于持续的生物製药研发投入(超过1300亿美元)以及精准医疗的加速普及。该地区受益于美国食品药物管理局(FDA)明确的指导方针,降低了采购风险;此外,《晶片与科学法案》(CHIPS & Science Act)下的协调一致的回流激励措施,也增强了设备製造所需半导体元件的供应。临床检查室长期存在的13%的人才缺口,推动了自动化设备的采购,巩固了北美在实验室设备和耗材市场的核心地位。

亚太地区将成为成长最快的地区,到2031年复合年增长率将达到9.18%,这主要得益于中国「十四五」规划下慷慨的生物技术补贴以及预计到2027年将达到1380亿美元的医疗卫生基础设施计划。像安捷伦生工生物工程这样的战略合作伙伴关係正在根据国内需求调整核酸技术,而日本、韩国和澳洲则透过先进的临床研究倡议来维持需求。

在监管协调和永续性需求的推动下,欧洲市场维持了5%左右的稳定成长。德国占了21%的市场份额,并在绿色实验室实践方面引领创新。欧洲药品管理局(EMA)的药品短缺监测平台正在推动对合规性监测设备的需求。南美洲以及中东和非洲市场尚不成熟,但极具吸引力。巴西和海湾合作委员会(GCC)国家正在投资建造公共卫生实验室和学术中心,为其未来在实验室设备和耗材市场的发展奠定基础。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 生物製药领域研发成本增加

- 高通量定序实验室的快速扩张

- 一次性洁净室塑胶製品的需求激增

- 利用人工智慧进行医疗设备预测性维护(新)

- 过渡到“绿色实验室”认证(新增)

- 市场限制

- 医用树脂价格波动

- 新设备平台的检验週期越来越长。

- ESG(环境、社会和治理)对一次性塑胶製品的抵抗情绪日益高涨(新)

- 自动化和数据分析专家短缺(新增)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(以金额为准,2024-2030 年)

- 依产品类型

- 实验室设备

- 分析和测量设备

- 光谱分析仪

- 层析法系统

- 显微镜

- 其他的

- 通用实验室设备

- 离心机

- 培养箱

- 高压釜和消毒器

- 其他的

- 分析和测量设备

- 实验室耗材

- 塑胶和玻璃製品

- 移液管和吸头

- 培养皿

- 试管

- 其他的

- 过滤和分离材料

- 薄膜过滤器

- 注射器过滤器

- 洁净室耗材

- 手套

- 罩衣和口罩

- 塑胶和玻璃製品

- 实验室设备

- 透过使用

- 临床诊断

- 药物发现与开发

- 基因组学和蛋白质组学

- 学术和研究机构

- 工业和环境测试

- 最终用户

- 医院和诊所

- 製药和生物技术公司

- 学术和研究机构

- 合约研究机构

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地区

- 中东和非洲

- GCC

- 南非

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 市占率分析

- 公司简介

- Thermo Fisher Scientific Inc.

- Danaher Corporation

- Agilent Technologies Inc.

- Merck KGaA

- F. Hoffmann-La Roche Ltd

- Becton, Dickinson and Company

- Sartorius AG

- PerkinElmer Inc.

- Bio-Rad Laboratories Inc.

- Eppendorf SE

- Bruker Corporation

- Corning Incorporated

- 3M Company

- GE Healthcare(Cytiva)

- Waters Corporation

- Shimadzu Corporation

- Illumina Inc.

- Abbott Laboratories

- Mettler-Toledo International Inc.

- Tecan Group Ltd

第七章 市场机会与未来展望

The laboratory equipment and disposables market size in 2026 is estimated at USD 40.85 billion, growing from 2025 value of USD 37.84 billion with 2031 projections showing USD 59.93 billion, growing at 7.96% CAGR over 2026-2031.

Sustained growth stems from rising biopharma R&D outlays, fast-growing genomics workflows that require high-throughput automation, and tighter contamination-control protocols that favor single-use supplies. Vendors are adding AI-enabled predictive maintenance to maximize instrument uptime, while green-lab certification programs pressure laboratories to cut energy and material waste. Supply-chain resilience initiatives and reshoring policies continue to influence purchasing decisions, especially in North America and Europe, whereas Asia-Pacific gains momentum from government-backed biotech investments. Intensifying competition encourages large incumbents to pursue scale economies through M&A, while niche entrants differentiate on modular robotics and sustainability services.

Global Laboratory Equipment And Disposables Market Trends and Insights

Growing Biopharma R&D Expenditure

Pharmaceutical R&D spending reached USD 288 billion in 2024 and is projected to climb toward USD 340 billion by 2030, sustaining strong demand for advanced analytical instrumentation. Venture funding in biotech surpasses USD 50 billion annually in the United States, while Europe's pipeline remains robust, reinforcing long-term capital flows into laboratory infrastructure. Increased biologics approvals by the FDA validate greater instrument utilization and recurring consumables sales. As pipelines diversify into cell- and gene-therapy modalities, laboratories upgrade to closed-system isolators and digital documentation platforms, thereby deepening wallet share for integrated vendors.

Rapid Expansion of High-Throughput Sequencing Labs

Global build-out of next-generation sequencing facilities accelerates demand for genomic sample preparation, microfluidic chips, and cloud-based data pipelines. The life-science tools market is forecast at a 10.9% CAGR, with sequencing workflows as a primary catalyst. Beckman Coulter's TruSight Oncology 500 and QIAGEN's forthcoming QIAsymphony Connect exemplify automation aimed at reducing hands-on time while scaling throughput. China's 14th Five-Year Plan prioritizes genomic capabilities, and regional manufacturers leverage local subsidies to deploy bench-top sequencers. Oncology researchers integrate AI algorithms for variant calling, expanding concomitant demand for high-capacity servers and laboratory information management systems. Overall, sequencing labs act as anchor customers that pull through a broad basket of disposables and capital equipment.

Volatility in Medical-Grade Resin Prices

Sharp swings in polypropylene and PTFE pricing compress margins for consumables makers and force instrument vendors to renegotiate supplier contracts. Chemical-supply bottlenecks stemming from geopolitical tensions have extended lead times and compelled buyers to hold higher safety stocks, raising working-capital needs. Eastman's USD 2.25 billion molecular-recycling investment aims to secure circular feedstocks and mitigate input-cost risk. However, spot-price volatility persists and disproportionately impacts small-volume labs with limited purchasing clout. Budget uncertainty can delay discretionary equipment upgrades and prompt laboratories to re-sterilize glassware, tempering near-term growth in single-use categories of the laboratory equipment and disposables market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for Single-Use Clean-Room Plastics

- AI-Enabled Predictive Maintenance of Instruments

- Lengthy Validation Cycles for Novel Instrument Platforms

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Disposables represent the dominant 51.62% slice of the laboratory equipment and disposables market share in 2025, a position underpinned by their single-use sterility and workflow efficiency. The same category is forecast to grow at an 8.53% CAGR to 2031, ensuring sustained revenue momentum that outweighs raw-material cost volatility. Laboratories in biopharma and diagnostics favor ready-to-use pipette tips, filtration assemblies, and micro-fluidic plates that minimize cross-contamination and simplify compliance documentation. Clean-room apparel remains indispensable for aseptic manufacturing, while closed-loop recycling pilots address rising ESG scrutiny.

Laboratory equipment-including analyzers, spectrometers, centrifuges, and incubators-continues to generate steady capital orders as institutions modernize infrastructure with IoT connectivity. Predictive maintenance modules embedded in high-value systems offer recurring-service income streams that compensate for extended replacement cycles. Vendors differentiate through open-architecture software, scalable robotics, and reagent-rental bundles that tie consumables to instrument use. In mature labs, analytics-as-a-service contracts shift budgets from capex to opex, smoothing revenue and supporting the overarching growth trajectory of the laboratory equipment and disposables market.

The Laboratory Equipment and Disposables Market Report is Segmented by Product Type (Laboratory Equipment, Laboratory Disposables), Application (Clinical Diagnostics, Drug Discovery & Development, and More), End User (Hospitals & Clinics, Pharmaceutical & Biotechnology Companies, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America contributes the largest 37.68% revenue slice in 2025 due to sustained biopharma R&D exceeding USD 130 billion and accelerated precision-medicine adoption. The region benefits from clear FDA guidance that reduces procurement risk and from concerted reshoring incentives under the CHIPS & Science Act, which strengthen semiconductor component supply critical for instrument manufacturing. Persistent 13% staffing shortages in clinical labs catalyze automation purchases, solidifying North America's central role in the laboratory equipment and disposables market.

Asia-Pacific is the fastest-expanding territory with a 9.18% CAGR through 2031, propelled by China's generous biotech subsidies under its 14th Five-Year Plan and healthcare-infrastructure projects slated to hit USD 138 billion by 2027. Strategic alliances like Agilent-Sangon Biotech tailor nucleic-acid technologies to domestic requirements, while Japan, South Korea, and Australia sustain demand through advanced clinical research initiatives.

Europe delivers steady mid-single-digit growth amid regulatory harmonization and sustainability imperatives. Germany holds a 21% share and drives innovation in green-lab practices, while EMA's Shortages Monitoring Platform heightens demand for compliance-monitoring instruments. South America and Middle East & Africa remain nascent but attractive, with Brazil and GCC nations investing in public-health labs and academic centers, laying the groundwork for elevated future contributions to the laboratory equipment and disposables market.

- Thermo Fisher Scientific

- Danaher

- Agilent Technologies

- Merck

- Roche

- Beckton Dickinson

- Sartorius

- PerkinElmer

- Bio-Rad Laboratories

- Eppendorf

- Bruker

- Corning

- 3M

- GE Healthcare (Cytiva)

- Waters Corporation

- Shimadzu

- Illumina

- Abbott Laboratories

- Mettler Toledo

- Tecan Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing biopharma R&D expenditure

- 4.2.2 Rapid expansion of high-throughput sequencing labs

- 4.2.3 Surge in demand for single-use clean-room plastics

- 4.2.4 AI-enabled predictive maintenance of instruments (fresh)

- 4.2.5 Shift toward "green lab" certifications (fresh)

- 4.3 Market Restraints

- 4.3.1 Volatility in medical-grade resin prices

- 4.3.2 Lengthy validation cycles for novel instrument platforms

- 4.3.3 Growing ESG backlash against single-use plastics (fresh)

- 4.3.4 Talent crunch for automation & data-analytics specialists (fresh)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, 2024-2030)

- 5.1 By Product Type

- 5.1.1 Laboratory Equipment

- 5.1.1.1 Analyzers & Instruments

- 5.1.1.1.1 Spectroscopy Equipment

- 5.1.1.1.2 Chromatography Systems

- 5.1.1.1.3 Microscopes

- 5.1.1.1.4 Others

- 5.1.1.2 General Lab Equipment

- 5.1.1.2.1 Centrifuges

- 5.1.1.2.2 Incubators

- 5.1.1.2.3 Autoclaves & Sterilizers

- 5.1.1.2.4 Others

- 5.1.1.1 Analyzers & Instruments

- 5.1.2 Laboratory Disposables

- 5.1.2.1 Plasticware & Glassware

- 5.1.2.1.1 Pipettes & Tips

- 5.1.2.1.2 Petri Dishes

- 5.1.2.1.3 Test Tubes

- 5.1.2.1.4 Others

- 5.1.2.2 Filtration & Separation Supplies

- 5.1.2.2.1 Membrane Filters

- 5.1.2.2.2 Syringe Filters

- 5.1.2.3 Clean-room Consumables

- 5.1.2.3.1 Gloves

- 5.1.2.3.2 Gowns & Masks

- 5.1.2.1 Plasticware & Glassware

- 5.1.1 Laboratory Equipment

- 5.2 By Application

- 5.2.1 Clinical Diagnostics

- 5.2.2 Drug Discovery & Development

- 5.2.3 Genomics & Proteomics

- 5.2.4 Academic & Research

- 5.2.5 Industrial & Environmental Testing

- 5.3 By End User

- 5.3.1 Hospitals & Clinics

- 5.3.2 Pharmaceutical & Biotechnology Companies

- 5.3.3 Academic & Research Institutes

- 5.3.4 Contract Research Organizations

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Australia

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 GCC

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.3.1 Thermo Fisher Scientific Inc.

- 6.3.2 Danaher Corporation

- 6.3.3 Agilent Technologies Inc.

- 6.3.4 Merck KGaA

- 6.3.5 F. Hoffmann-La Roche Ltd

- 6.3.6 Becton, Dickinson and Company

- 6.3.7 Sartorius AG

- 6.3.8 PerkinElmer Inc.

- 6.3.9 Bio-Rad Laboratories Inc.

- 6.3.10 Eppendorf SE

- 6.3.11 Bruker Corporation

- 6.3.12 Corning Incorporated

- 6.3.13 3M Company

- 6.3.14 GE Healthcare (Cytiva)

- 6.3.15 Waters Corporation

- 6.3.16 Shimadzu Corporation

- 6.3.17 Illumina Inc.

- 6.3.18 Abbott Laboratories

- 6.3.19 Mettler-Toledo International Inc.

- 6.3.20 Tecan Group Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment