|

市场调查报告书

商品编码

1906192

母粒:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Masterbatch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

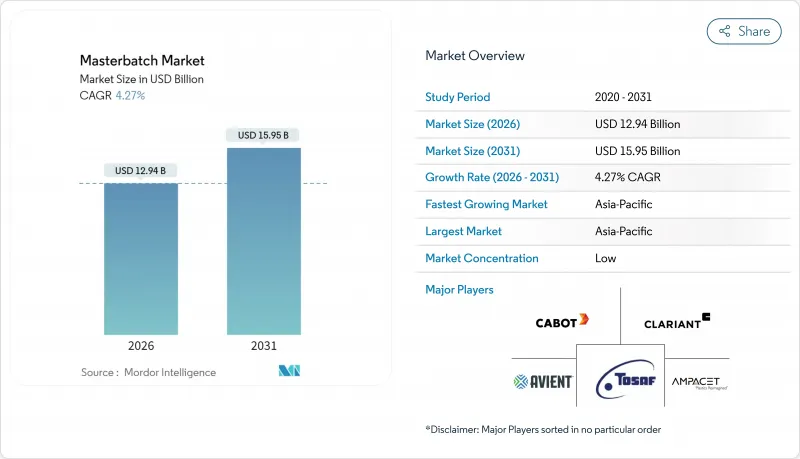

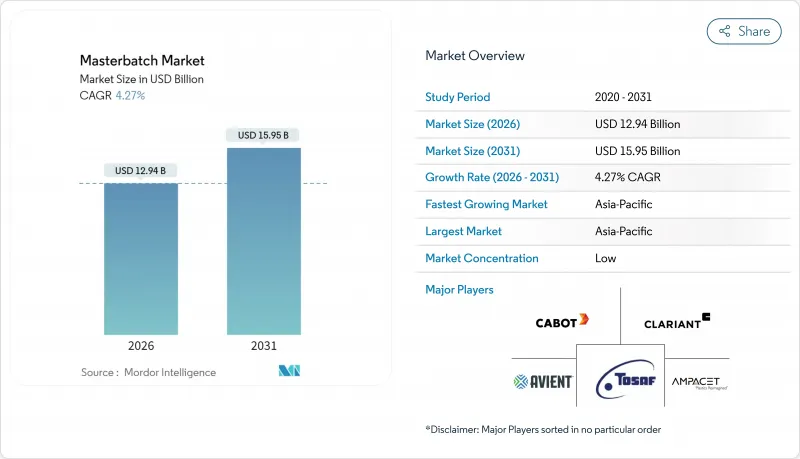

预计到 2026 年,母粒市场规模将达到 159.5 亿美元,2026 年至 2031 年的复合年增长率为 4.27%。

儘管原材料价格波动,但包装、汽车轻量化和通讯电缆护套领域的持续需求继续支撑着市场成长。亚太地区在母粒市场保持主导地位,占45%的市场份额,这主要得益于中国和印度不断增长的塑胶加工能力。白色配方占销售额的32%,因为二氧化钛基遮光性和紫外线防护仍然是关键。各公司正积极应对日益严格的全球废弃物法规,并将研发预算集中在生物基载体、抗菌添加剂以及能够提升再生聚丙烯性能的配方技术。由于跨国公司专注于永续创新,并试图抵御具有成本竞争力的区域供应商,市场竞争强度仍然适中。

全球母粒市场趋势与洞察

塑胶包装产业需求不断成长

在电子商务蓬勃发展和品牌商追求货架差异化的推动下,包装行业仍然是色母粒和添加剂浓缩物的最大消费领域。美国和欧盟的食品接触法规正促使加工商转向符合FDA和欧盟标准的等级产品,以确保色彩稳定性和加工效率。具有抗菌和阻隔性的产品有助于延长生鲜食品的保质期,而可回收的载体系统则有助于实现循环经济目标。科莱恩和安佩斯在母粒市场提供食品级解决方案,这些解决方案不仅满足迁移限制,还能在大批量生产线上提供一致的色彩。

汽车产业对塑胶的需求不断增长

为了减轻汽车平臺重量,聚丙烯化合物的应用日益普及,推动了对抗紫外线、耐刮擦和阻燃母粒的需求。 GRAFE 的基础黑系列产品提供深邃的黑色,无需多道调配工序即可实现经济高效的内装着色。此外,OEM 对产品耐久性和降低挥发性有机化合物 (VOC)排放的要求,也进一步推动了对专用添加剂的需求。

原料成本波动为母粒生产商带来挑战

二氧化钛和炭黑的价格受週期性波动的影响,导致浓缩物生产成本上升。这种波动是由于颜料产能中断、能源价格上涨以及週期性的出口限製造成的。製造商透过寻找多种关键颜料来源、签订与指数挂钩的合约以及配製高浓度浓缩物来降低单位使用成本,从而应对这一风险。

细分市场分析

白色浓缩液将在母粒市场占据最大份额,到2025年将占市场规模的31.40%,这主要得益于其在遮光性和紫外线防护方面的重要作用。高纯度二氧化钛为乳製品瓶、瓶盖和建筑幕墙提供了所需的亮度和耐热性。受高端包装、家用电器和汽车内部装潢建材对具有一致光泽的定制帘子的需求推动,预计到2031年,彩色母粒的复合年增长率将达到4.67%。黑色产品将继续保持强劲的需求,以满足导电性和耐候性产品的需求,同时,特效配方在高端化妆品领域也越来越受欢迎,珠光和金属颜料被用于提升产品的货架吸引力。

重新聚焦的永续性目标正推动基于生物基或回收材料的白色和彩色解决方案的发展。为应对颜料价格压力,供应商正在改进分散技术,以在保持遮盖力的同时减少二氧化钛的使用量。同时,色彩开发团队正在利用数位配色平台,以更低的稀释度重现品牌颜色,从而缩短新产品的认证週期。

区域分析

预计到2025年,亚太地区将占全球营收的44.60%,并在2031年之前以4.78%的复合年增长率成长。中国加工商正在推动薄膜、纺织品和汽车零件行业的消费量,而印度加工商则在扩大其在软包装和白色家电行业的产能。中国凭藉其庞大的製造基地和不断增长的国内需求,引领着区域母粒市场的发展,而印度则因其塑胶加工能力的扩张而崛起为重要的成长中心。 [2] 政府对电子製造业的激励措施正在促进着色剂的在地采购,从而提高区域自主性。可支配收入的成长持续推动对美观消费品的需求,而这些消费品依赖高性能着色剂。

北美是一个高价值但成熟的市场,其食品接触应用和汽车行业的标准极为严格。美国是该地区销售的主要驱动力,我们与复合材料生产商紧密合作,开发与化学回收树脂相容的浓缩液。加拿大包装製造商使用我们的抗菌配方生产肉类托盘,而墨西哥家电製造商则指定使用我们耐刮的黑色聚丙烯化合物作为外墙面板。

欧洲在先进功能性和环境友善性方面享有盛誉。德国和东欧汽车产业中心对紫外线稳定、低VOC组合药物的订单持续稳定。即将推出的欧盟再生材料含量强制令将有利于闭合迴路聚丙烯/聚乙烯体係用母粒。东地中海地区的加工商在利用中东原料优势的同时,也面临越来越大的碳边境调节机制合规压力。

中东和非洲虽然贡献较小,但受益于一体化石化联合企业以具有竞争力的成本供应树脂和颜料中间体。科莱恩位于沙乌地阿拉伯的工厂正在提高该地区管道、薄膜和纤维製造商所需的着色剂和添加剂浓缩物的供应量。波湾合作理事会(GCC)国家的基础设施计划正在刺激对用于电线导管和电缆护套的阻燃和耐候化合物的需求。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 塑胶包装产业需求不断成长

- 汽车产业对塑胶的需求不断增长

- 朝向更轻、更多再生材料含量更高的聚丙烯化合物的转变,正在推动白色和填充母粒的使用。

- 光纤电缆基础设施的发展推动了对阻燃母粒的需求。

- 在医疗和卫生产品中的使用量增加

- 市场限制

- 原料成本波动

- 严格的环境法规

- 与液体着色剂的竞争

- 价值链分析

- 波特五力模型

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按类型

- 白母粒

- 黑母粒

- 母粒

- 添加剂母粒

- 特效母粒

- 透过聚合物

- 聚乙烯

- 聚丙烯

- 高衝击聚苯乙烯

- 聚氯乙烯

- 聚对苯二甲酸乙二酯

- 其他的

- 最终用户

- 包装

- 建筑/施工

- 汽车/运输设备

- 电气和电子设备

- 消费品

- 农业

- 其他(医疗、纺织等)

- 按地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- ASEAN

- 亚太其他地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 其他中东和非洲地区

- 亚太地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Americhem

- Ampacet Corporation

- Astra Polymers

- Avient Corporation

- Scientific and Production Company "BARS-2"

- BASF

- Cabot Corporation

- Clariant

- Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- Gabriel-Chemie GmbH

- Heubach Group

- Hubron International

- JJPlastalloys

- Penn Color Inc. Masterbatch & Color Concentrates

- Plastiblends

- Plastika Kritis SA

- RTP Company

- Samplast Plast

- Shanghai Janton Industrial Co., Ltd

- Sukano

- Tosaf Compounds Ltd.

第七章 市场机会与未来展望

Masterbatch market size in 2026 is estimated at USD 12.94 billion, growing from 2025 value of USD 12.41 billion with 2031 projections showing USD 15.95 billion, growing at 4.27% CAGR over 2026-2031.

Growth is supported by sustained demand in packaging, automotive lightweighting, and telecom cable jacketing despite raw-material price swings. Asia Pacific retains leadership in the masterbatch market with a 45% revenue share, helped by rising plastic conversion capacity in China and India. White formulations account for 32% of sales because titanium-dioxide-based opacity and UV protection remain indispensable. Companies are directing R&D budgets toward bio-based carriers, antimicrobial additives, and formulations that improve the performance of recyclate-rich polypropylene, aligning with tightening global waste directives. Competitive intensity is moderate as multinationals focus on sustainable innovation to defend share against cost-driven regional suppliers.

Global Masterbatch Market Trends and Insights

Rising Demand in Plastic Packaging Industry

E-commerce growth and brand owners' quest for shelf differentiation keep packaging the single largest consumer of color and additive concentrates. Food contact regulations in the United States and the European Union are steering converters toward FDA- and EU-compliant grades that ensure color stability and processing efficiency. Antimicrobial and oxygen-barrier variants help extend product life in fresh-food formats, while recyclable carrier systems support circular-economy targets. Clariant and Ampacet offer food-grade solutions that allow processors to achieve consistent color across high-throughput lines while meeting migration limits in the masterbatch market.

Increasing Demand of Plastic in Automotive Industry

Vehicle platforms rely on polypropylene compounds to reduce weight, driving uptake of UV-, scratch- and flame-retardant masterbatches. GRAFE's Base Black series provides deep-black shades, enabling cost-effective interior trim coloration without multiple compounding steps. OEM directives for durability and lower volatile organic compound emissions further strengthen demand for purpose-built additive packages.

Feedstock Cost Volatility Challenges Masterbatch Manufacturers

Titanium dioxide and carbon black prices are prone to cyclical swings that inflate concentrate production costs. Volatility stems from pigment capacity outages, rising energy tariffs, and periodic export restrictions. Producers counter this exposure by dual-sourcing critical pigments, negotiating index-linked contracts, and formulating high-loading concentrates that lower cost per application dose.

Other drivers and restraints analyzed in the detailed report include:

- Fiber-Optic Cable Infrastructure Build-out

- Increased Use in Healthcare and Hygiene Products

- Strict Environmental Regulations Impact Product Development

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

White concentrates captured the largest 31.40% share of masterbatch market size in 2025, underpinned by their critical role in opacity and UV protection. High-purity titanium dioxide delivers brightness and heat stability needed in dairy bottles, caps, and facades. Color masterbatch is expected to post a 4.67% CAGR to 2031 due to premium packaging, consumer electronics, and automotive interiors seeking custom shades with consistent gloss. The black category retains strong demand in conductive and weatherable products, while special-effect formulations gain traction in luxury cosmetics, using pearlescent and metallic pigments for shelf appeal.

Renewed sustainability goals foster white and color solutions based on bio-sourced or recycled carriers. Suppliers are refining dispersion methods that lower titanium dioxide usage yet maintain opacity to manage pigment price pressure. Meanwhile, color developers exploit digital color-matching platforms to replicate brand hues at lower let-down ratios, shortening qualification cycles for new SKUs.

The Masterbatch Market Report Segments the Industry by Type (White Masterbatch, Black Masterbatch, Colour Masterbatch, Additive Masterbatch, and More), Polymer (Polypropylene, Polyethylene, High Impact Polystyrene, and More), End-User Industry (Building & Construction, Packaging, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific accounted for 44.60% of worldwide revenue in 2025 and is forecast to advance at 4.78% CAGR through 2031. Chinese processors lead volume consumption across film, fiber, and automotive parts, while Indian converters scale capacity in flexible packaging and white goods. China leads the regional masterbatch market due to its massive manufacturing base and growing domestic demand, while India is emerging as a significant growth center with expanding plastics processing capacity[2]. Government incentives for electronics manufacturing encourage local sourcing of color additives, increasing regional self-reliance. Rising disposable incomes continue to uplift demand for aesthetically appealing consumer products that rely on high-performance colorants.

North America represents a high-value but mature market characterized by stringent food-contact and automotive standards. The United States dominates regional sales, collaborating closely with compounders to develop concentrates compatible with chemically recycled resins. Canadian packaging firms adopt antimicrobial formulations for meat trays, and Mexican appliance producers specify scratch-resistant black PP compounds for exterior panels.

Europe maintains its reputation for advanced functionality and eco-compliance. Automotive hubs in Germany and Eastern Europe drive steady orders for UV-stable and low-VOC formulations. Upcoming recycled-content mandates in the European Union favor masterbatches designed for closed-loop polypropylene and polyethylene systems. Eastern Mediterranean processors tap into Middle-East feedstock advantages yet face rising pressure to comply with carbon-border adjustment mechanisms.

The Middle East and Africa, while still a smaller contributor, benefit from integrated petrochemical complexes supplying resin and pigment intermediates at competitive costs. Clariant's Saudi facility improves regional availability of color and additive concentrates for pipe, film, and fiber producers . Infrastructure projects in Gulf Cooperation Council countries stimulate demand for flame-retardant and weatherable compounds in electrical conduits and cable jacketing.

- Americhem

- Ampacet Corporation

- Astra Polymers

- Avient Corporation

- Scientific and Production Company "BARS-2"

- BASF

- Cabot Corporation

- Clariant

- Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- Gabriel-Chemie GmbH

- Heubach Group

- Hubron International

- JJPlastalloys

- Penn Color Inc. Masterbatch & Color Concentrates

- Plastiblends

- Plastika Kritis S.A.

- RTP Company

- Samplast Plast

- Shanghai Janton Industrial Co., Ltd

- Sukano

- Tosaf Compounds Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand in Plastic Packaging Industry

- 4.2.2 Increasing Demand of Plastic in Automotive Industry

- 4.2.3 Shift Toward Lightweight Recyclate Rich PP Compounds Boosting White and Filler Masterbatch Usage

- 4.2.4 Fiber Optic Cable Infrastructure Build out Propelling Flame Retardant Masterbatch Demand

- 4.2.5 Increased Use in Healthcare and Hygiene Products

- 4.3 Market Restraints

- 4.3.1 Feedstock Cost Volatility

- 4.3.2 Strict Environmental Regulations

- 4.3.3 Competition from Liquid Colorants

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 White Masterbatch

- 5.1.2 Black Masterbatch

- 5.1.3 Colour Masterbatch

- 5.1.4 Additive Masterbatch

- 5.1.5 Special Effect Masterbatch

- 5.2 By Polymer

- 5.2.1 Polyethylene

- 5.2.2 Polypropylene

- 5.2.3 High Impact Polystyrene

- 5.2.4 Polyvinyl Chloride

- 5.2.5 Polyethylene Terephthalate

- 5.2.6 Others

- 5.3 By End-User

- 5.3.1 Packaging

- 5.3.2 Building and Construction

- 5.3.3 Automotive and Transportation

- 5.3.4 Electrical and Electronics

- 5.3.5 Consumer Goods

- 5.3.6 Agriculture

- 5.3.7 Others (Healthcare, Textile, etc.)

- 5.4 By Geography

- 5.4.1 Asia Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Americhem

- 6.4.2 Ampacet Corporation

- 6.4.3 Astra Polymers

- 6.4.4 Avient Corporation

- 6.4.5 Scientific and Production Company "BARS-2"

- 6.4.6 BASF

- 6.4.7 Cabot Corporation

- 6.4.8 Clariant

- 6.4.9 Dainichiseika Color and Chemicals Mfg. Co. Ltd.

- 6.4.10 Gabriel-Chemie GmbH

- 6.4.11 Heubach Group

- 6.4.12 Hubron International

- 6.4.13 JJPlastalloys

- 6.4.14 Penn Color Inc. Masterbatch & Color Concentrates

- 6.4.15 Plastiblends

- 6.4.16 Plastika Kritis S.A.

- 6.4.17 RTP Company

- 6.4.18 Samplast Plast

- 6.4.19 Shanghai Janton Industrial Co., Ltd

- 6.4.20 Sukano

- 6.4.21 Tosaf Compounds Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Rising Demand for Biobased Masterbatch