|

市场调查报告书

商品编码

1906210

工业搅拌机:市占率分析、产业趋势与统计、成长预测(2026-2031)Industrial Mixers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

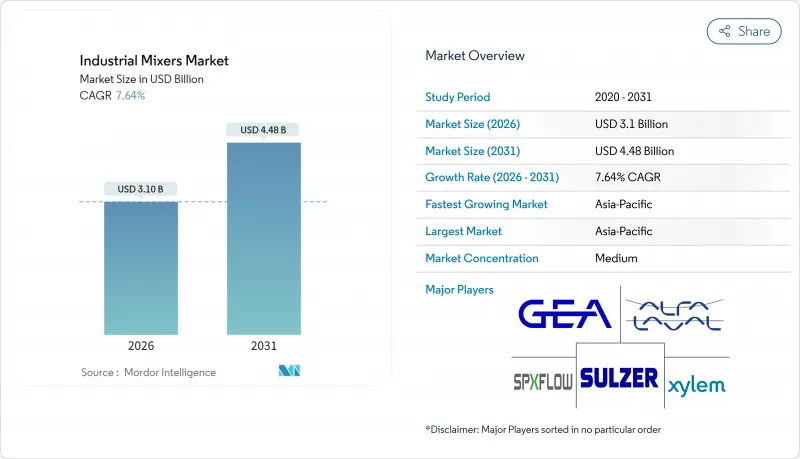

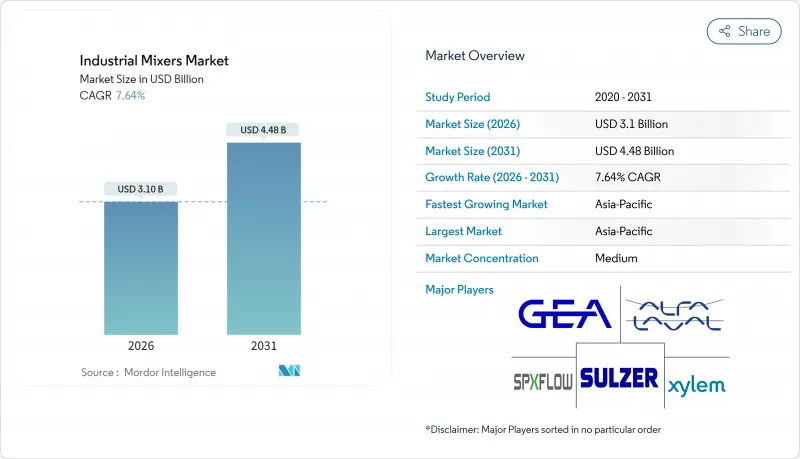

预计工业搅拌机市场将从 2025 年的 28.8 亿美元成长到 2026 年的 31 亿美元,到 2031 年将达到 44.8 亿美元,2026 年至 2031 年的复合年增长率为 7.64%。

食品和製药加工行业的严格监管、对高扭矩和高效率驱动装置日益增长的需求以及不断扩大的污水处理基础设施,是推动工业搅拌机市场稳步增长的关键因素。亚太地区的快速都市化、生命科学领域对连续生产的推动以及实现预测性维护的数位化维修,正在进一步促进工业搅拌机的应用。供应商正透过卫生设计、智慧控制系统和模组化撬装组件脱颖而出,这些产品能够缩短安装时间并提高製程可靠性。

全球工业搅拌机市场趋势与洞察

食品和製药业更严格的卫生标准

食品级和製药厂需要电解錶面、严密焊接和检验的CIP(原位清洗)通讯协定,以满足EHEDG 2024更新和FDA 21 CFR 110.35的要求。提供经认证的卫生级设备的供应商可以获得更高的价格,而小型製造商则面临更高的合规成本。在製药业,连续生产线依赖可记录的混合均匀性,这推动了对经过良好生产规范(GMP)审核检验的高剪切磁力驱动混合机的采购。传统混合机的改造往往无法通过检验,加速了设备的彻底更换。这种趋势强化了竞争壁垒,并巩固了以卫生设备为中心的长期服务合约。

引进高效率、高扭力电机

IE5同步磁阻马达与变频驱动装置结合,与传统感应马达相比,可将搅拌机能耗降低高达 20%,同时提供高黏度浆料所需的扭力。相关法规已规定功率超过 0.75 kW 的设备最低能源效率等级为 IE4,印度和巴西也正在考虑制定类似规定,这将加速设备改造。透过将驱动器与边缘分析技术集成,在低负载下降低转速,工厂工程师可以延长密封件寿命,并降低整个工业搅拌机市场的电力成本。将马达与数位控制面板捆绑销售的供应商能够获得更高的利润率,并创造数据驱动的业务收益。

原物料价格波动(不锈钢、合金)

2024年,镍价徘徊在每吨16,500美元至20,000美元之间,导致不銹钢价格波动15%至20%,挤压了搅拌机製造商的利润空间。哈氏合金C-276等特种合金也因航太需求而经历了类似的涨价,迫使原始设备製造商(OEM)重新谈判长期合约并对冲采购风险。大型供应商利用全球采购和库存池来缓衝成本衝击,而小规模的区域製造商则难以将价格上涨转嫁给消费者,限制了工业搅拌机产业的产能扩张。供应链多元化至印尼和美国或许有助于稳定价格,但这会增加基准成本,最终转嫁到设备价格上。

细分市场分析

截至2025年,搅拌器将占据工业混合器市场35.85%的份额,这得益于其在散装化学品、矿物加工和水处理领域数十年的卓越性能。其坚固的框架和模组化叶轮库可经济高效地定制,适用于100立方米以上的各种尺寸容器。随着卫生标准和能源法规的日益严格,设备更换週期加快,搅拌器市场预计将稳定成长。同时,受生物技术和先进材料领域乳化需求的推动,高剪切混合器预计将以8.05%的复合年增长率成长。在线连续转子-定子设计可实现微米级粒径减小,支援上游工程设备无法实现的连续湿磨和预分散操作。供应商正在整合即时扭力和温度感测器,数位双胞胎模型提供数据,从而提高放大精度,并缩短製药等受监管行业的验证时间。

数位化整合正在改变整个产品线。搅拌器供应商正在将振动感测器整合到齿轮箱机壳和轴中,并将数据传输到人工智慧模型,以预测轴承寿命。潜水式搅拌器製造商正在重新设计带有复合材料护罩的机壳,以减轻重量并抵抗海水淡化厂中的氯化物应力开裂。通常能耗为零的静态搅拌器和喷射式搅拌器现在标配差压变送器,使操作人员无需使用非侵入式探头即可检查混合强度。在各个领域,物联网框架正在推动「按混合收费」服务模式的实现,使原始设备製造商 (OEM) 能够按运作小时数而非按单位收费,从而扩大工业搅拌器市场的经常性收入来源。

区域分析

亚太地区将占全球营收的29.55%,到2031年将以8.18%的复合年增长率成长。这反映了中国和印度政府支持扩大化学品生产能力、药品出口不断增长以及对都市污水处理的大力投资。在中国,炼油厂废气氢气回收催生了对符合ATEX标准的喷射式搅拌器的需求,而超大型膜生物反应器计划则指定使用高效潜水式搅拌器。印度针对原料药的生产挂钩激励计画正在推动在线连续高剪切搅拌器的升级,而东南亚棕榈油下游丛集正在采用专用搅拌器进行脱臭製程。本地化生产有助于降低成本,但国际原始设备製造商(OEM)在高端市场主导,并要求书面检验。

在北美,我们拥有大规模的安装基础,主要集中在波士顿、圣地牙哥和多伦多等生技中心。卫生型高剪切混合机配备一次性流路,是连续生物生产线的必备设备;喷射式混合机则用于页岩气加工中的原油海水淡化。美国食品药物管理局 (FDA) 和美国环保署 (EPA) 的严格监管正在推动设备升级,并强调节能设计。墨西哥的化学和食品製造商正利用邻近的供应链网络,从美国进口模组化混合撬装设备,以缩短前置作业时间。美国《通膨控制法案》提供的数位化维修资金,正在推动工业混合机市场对现有设备进行预测性维护模组的投资。

在欧洲,欧盟绿色交易高度重视永续性和营运效率。工厂正在采用IE5马达、磁力耦合密封件以及获得环境产品声明(EPD)认证的低碳不銹钢合金。德国和荷兰的化学园区优先考虑能够与整个工厂数位双胞胎整合的搅拌机。氢电解的ATEX和IECEx法规增加了认证成本,但完善的文件管理系统也能保护现有供应商。循环经济倡议正在推动塑胶回收再利用、厌氧消化和有机肥料生产领域对搅拌机的需求。这些因素共同造就了欧洲工业搅拌机市场技术密集且平衡的格局。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 食品和製药业更严格的卫生标准

- 引进节能型高扭力电机

- 污水回收能力快速成长

- 培养肉先导工厂的生物反应器改造

- 现场化学混合製备电池级材料

- 适用于远端矿山管理的模组化「按需混合」撬装设备

- 市场限制

- 原物料价格波动(不锈钢、合金)

- 高额资本投入与替代性在线连续加药系统相比

- 氢能枢纽地区ATEX/IECEx认证成本不断上涨

- 大型搅拌机熟练操作人员短缺

- 供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素的影响

- 投资分析

第五章 市场规模与成长预测

- 依产品类型

- 搅拌器

- 专用搅拌机

- 潜水式搅拌器

- 高剪切混合器

- 静态混合器

- 喷射混合器

- 其他产品类型

- 按最终用户行业划分

- 化学品

- 用水和污水

- 食品/饮料

- 石油化学产品

- 製药

- 纸浆和造纸

- 能源(电力和可再生能源)

- 采矿和矿产资源

- 其他流程工业

- 额定功率

- 小于5千瓦

- 5~15kW

- 15~50kW

- 超过50千瓦

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 东南亚

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 中东

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- SPX FLOW Inc.

- Sulzer Ltd.

- Alfa Laval AB

- Xylem Inc.

- GEA Group AG

- EKATO HOLDING GmbH

- Philadelphia Mixing Solutions Ltd.

- Charles Ross & Son Company

- Silverson Machines Inc.

- IKA-Werke GmbH & Co. KG

- amixon GmbH

- Komax Systems Inc.

- Landia A/S

- Satake Chemical Equipment Mfg. Ltd.

- Dynamix Agitators Inc.

- Statiflo International Ltd.

- Scott Turbon Mixer Inc.

- INOXPA SAU

- Enviropax Inc.

- Arde Barinco Inc.

- ITT Bornemann GmbH

- Zhejiang Great Wall Mixers Co., Ltd.

第七章 市场机会与未来展望

The industrial mixers market is expected to grow from USD 2.88 billion in 2025 to USD 3.1 billion in 2026 and is forecast to reach USD 4.48 billion by 2031 at 7.64% CAGR over 2026-2031.

Strong regulatory oversight in food and pharmaceutical processing, rising demand for energy-efficient high-torque drives, and expanding wastewater treatment infrastructure are key factors driving steady gains for the industrial mixers market. Rapid urbanization in Asia-Pacific, the push for continuous manufacturing in life sciences, and digital retrofits that enable predictive maintenance further widen adoption. Vendors differentiate through hygienic design, intelligent control systems, and modular skid packages that shorten installation time while boosting process reliability.

Global Industrial Mixers Market Trends and Insights

Stricter Sanitary Mandates in Food and Pharma

Food-grade and pharmaceutical plants now specify electropolished surfaces, crevice-free welds, and validated clean-in-place protocols to satisfy EHEDG 2024 updates and FDA 21 CFR 110.35 requirements. Equipment suppliers that deliver certified hygienic designs secure premium pricing while smaller fabricators face rising compliance costs. In pharmaceuticals, continuous production lines rely on documented mixing uniformity, driving the procurement of high-shear and magnetically driven mixers that are validated under good manufacturing practice audits. Retrofits to legacy agitators often fail validation, accelerating outright replacement. This dynamic strengthens competitive barriers and cements long-term service contracts around sanitary assets.

Energy-Efficient High-Torque Motor Adoption

IE5 synchronous reluctance motors, paired with variable-frequency drives, reduce mixer energy draw by up to 20% compared to legacy induction units, while delivering the torque needed for high-viscosity slurries. Regulations already mandate IE4 minimum efficiency above 0.75 kW, and similar rules under discussion in India and Brazil will accelerate fleet renewal. Plant engineers link drives to edge analytics that reduce speed during low-load phases, extending seal life and lowering power bills across the industrial mixer market. Vendors that bundle motors with digital control panels command higher margins and cultivate data-driven service revenues.

Raw-Material Price Volatility (Stainless Steel, Alloys)

Stainless steel prices fluctuated by 15-20% in 2024 as nickel prices traded between USD 16,500 and USD 20,000 per metric ton, eroding margins for mixer fabricators. Specialty alloys, such as Hastelloy C-276, followed similar spikes tied to aerospace demand, forcing OEMs to renegotiate long-term frame contracts and hedge their purchases. Larger vendors leverage global procurement and inventory pooling to buffer cost shocks, but regional job shops struggle to pass increases through, curbing new capacity additions in the industrial mixers industry. Supply-chain diversification into Indonesia and the United States may stabilize pricing, but it introduces higher baseline costs that will be passed through to equipment prices.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Wastewater Recycling Capacity Additions

- Bioreactor Retrofits for Cultivated-Meat Pilots

- High Capex vs. Alternative Inline Dosing Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Agitators commanded a 35.85% share of the industrial mixers market in 2025, underpinned by decades of performance data in bulk chemical, mineral processing, and water treatment operations. Their robust frames and modular impeller libraries allow economical customization across vessel sizes exceeding 100 m3. The industrial mixers market size for agitators is expected to grow steadily as replacement cycles align with increasingly stringent sanitary and energy norms. High-shear mixers, however, are expected to grow at an 8.05% CAGR, driven by demand for emulsification in biotechnology and advanced materials. Inline rotor-stator designs deliver micron-level particle reduction, supporting continuous wet-milling and pre-dispersion tasks that upstream equipment cannot meet. Suppliers integrate real-time torque and temperature sensors that feed digital twins, thereby improving scale-up accuracy and reducing validation time in regulated segments, such as the pharmaceutical industry.

Digital integration reshapes every product line. Agitator vendors embed vibration sensors on gearbox housings and shafts, feeding AI models that forecast bearing life. Submersible mixer makers redesign housings with composite shrouds that cut weight while resisting chloride stress cracking in seawater desalination plants. Static and jet mixers, which are normally energy-neutral, now ship with differential-pressure transmitters that allow operators to verify mixing intensity without intrusive probes. Across categories, IoT frameworks enable pay-per-mix service models, where OEMs bill for uptime rather than equipment alone, thereby expanding recurring revenue streams within the industrial mixers market.

The Industrial Mixers Market Report is Segmented by Product Type (Agitators, Special Mixers, Submersible Mixers, and More), End-User Industry (Chemicals, Water and Wastewater, Food and Beverage, Petrochemicals, Pharmaceuticals, Energy, and More), Power Rating (< 5 KW, 5-15 KW, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds 29.55% of global revenue and is on track for an 8.18% CAGR through 2031, reflecting government-backed chemical capacity additions, expanding pharmaceutical exports, and aggressive municipal wastewater spending in China and India. In China, refinery off-gas hydrogen recycling creates demand for ATEX-compliant jet mixers, while mega-sized membrane bioreactor projects specify high-efficiency submersible units. India's production-linked incentive scheme for active pharmaceutical ingredients stimulates upgrades to inline high-shear mixers, and Southeast Asia's palm-oil downstream clusters adopt special agitators for deodorization stages. Local fabrication lowers cost, but international OEMs dominate premium tiers that demand documented validation.

North America commands a sizable installed base anchored by biotech clusters in Boston, San Diego, and Toronto. Continuous biologic manufacturing lines require sanitary high-shear mixers with single-use flow paths, while shale gas processing relies on jet mixers for crude desalting. Stringent FDA and EPA regulations promote replacement cycles that favor energy-efficient designs. Mexico's chemical and food manufacturing industries import modular mixing skids from the United States, utilizing near-shore supply chains to minimize lead times. Digital retrofits funded under the U.S. Inflation Reduction Act channel investment toward predictive maintenance modules across legacy fleets within the industrial mixers market.

Europe emphasizes sustainability and operational excellence, guided by the EU Green Deal. Plants adopt IE5 motors, magnetically coupled seals, and low-carbon stainless alloys certified under environmental product declarations. Chemical parks in Germany and the Netherlands prioritize mixers that integrate with plant-wide digital twins. ATEX and IECEx mandates for hydrogen electrolysis units increase certification costs, yet they also protect incumbent suppliers with robust documentation systems. Circular economy initiatives are expanding demand for mixers in plastic recycling, anaerobic digestion, and organic fertilizer production. Collectively, these drivers promote a balanced yet technologically intensive outlook for the industrial mixer market in Europe.

- SPX FLOW Inc.

- Sulzer Ltd.

- Alfa Laval AB

- Xylem Inc.

- GEA Group AG

- EKATO HOLDING GmbH

- Philadelphia Mixing Solutions Ltd.

- Charles Ross & Son Company

- Silverson Machines Inc.

- IKA-Werke GmbH & Co. KG

- amixon GmbH

- Komax Systems Inc.

- Landia A/S

- Satake Chemical Equipment Mfg. Ltd.

- Dynamix Agitators Inc.

- Statiflo International Ltd.

- Scott Turbon Mixer Inc.

- INOXPA S.A.U.

- Enviropax Inc.

- Arde Barinco Inc.

- ITT Bornemann GmbH

- Zhejiang Great Wall Mixers Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter sanitary mandates in food and pharma

- 4.2.2 Energy-efficient high-torque motor adoption

- 4.2.3 Surge in wastewater recycling capacity additions

- 4.2.4 Bioreactor retrofits for cultivated-meat pilots

- 4.2.5 On-site chemical blending for battery-grade materials

- 4.2.6 Modular "mix-on-demand" skids for remote mining camps

- 4.3 Market Restraints

- 4.3.1 Raw-material price volatility (stainless steel, alloys)

- 4.3.2 High capex vs. alternative inline dosing systems

- 4.3.3 Rising ATEX/IECEx certification costs for hydrogen hubs

- 4.3.4 Skilled-operator shortage for large-diameter agitators

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

- 4.9 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Agitators

- 5.1.2 Special Mixers

- 5.1.3 Submersible Mixers

- 5.1.4 High-shear Mixers

- 5.1.5 Static Mixers

- 5.1.6 Jet Mixers

- 5.1.7 Other Product Types

- 5.2 By End-User Industry

- 5.2.1 Chemicals

- 5.2.2 Water and Wastewater

- 5.2.3 Food and Beverage

- 5.2.4 Petrochemicals

- 5.2.5 Pharmaceuticals

- 5.2.6 Pulp and Paper

- 5.2.7 Energy (Power and Renewables)

- 5.2.8 Mining and Minerals

- 5.2.9 Other Process Industries

- 5.3 By Power Rating

- 5.3.1 < 5 kW

- 5.3.2 5 - 15 kW

- 5.3.3 15 - 50 kW

- 5.3.4 > 50 kW

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 SPX FLOW Inc.

- 6.4.2 Sulzer Ltd.

- 6.4.3 Alfa Laval AB

- 6.4.4 Xylem Inc.

- 6.4.5 GEA Group AG

- 6.4.6 EKATO HOLDING GmbH

- 6.4.7 Philadelphia Mixing Solutions Ltd.

- 6.4.8 Charles Ross & Son Company

- 6.4.9 Silverson Machines Inc.

- 6.4.10 IKA-Werke GmbH & Co. KG

- 6.4.11 amixon GmbH

- 6.4.12 Komax Systems Inc.

- 6.4.13 Landia A/S

- 6.4.14 Satake Chemical Equipment Mfg. Ltd.

- 6.4.15 Dynamix Agitators Inc.

- 6.4.16 Statiflo International Ltd.

- 6.4.17 Scott Turbon Mixer Inc.

- 6.4.18 INOXPA S.A.U.

- 6.4.19 Enviropax Inc.

- 6.4.20 Arde Barinco Inc.

- 6.4.21 ITT Bornemann GmbH

- 6.4.22 Zhejiang Great Wall Mixers Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment