|

市场调查报告书

商品编码

1906211

工业轴承:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Industrial Bearings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

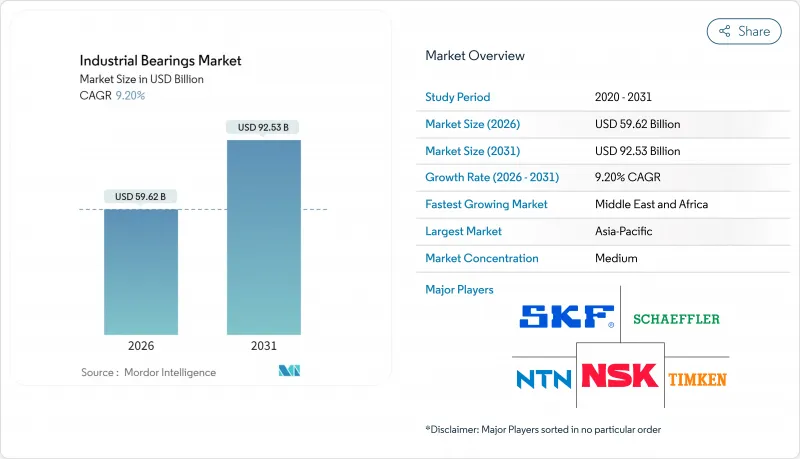

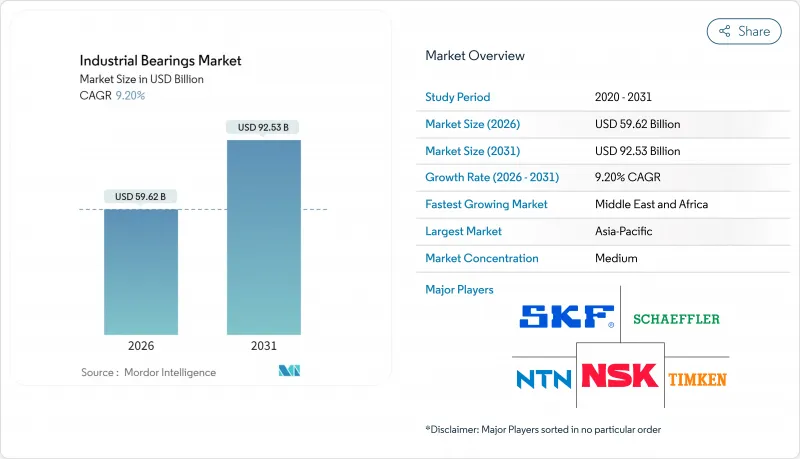

预计工业轴承市场将从 2025 年的 546 亿美元成长到 2026 年的 596.2 亿美元,到 2031 年将达到 925.3 亿美元,2026 年至 2031 年的复合年增长率为 9.2%。

这一增长反映了交通运输和工厂设备的电气化程度不断提高、自动化进程加速以及基础设施升级对高性能机械部件的需求日益增长。配备感测器、微型电子元件和无线连接功能的智慧轴承正在将维护方式从被动式转变为预测式,从而提高资产运转率并减少非计画性停机时间。製造商也积极研发轻量化材料和低摩擦设计,以提高电动车和工业机器人的能源效率。对风能、氢能和半导体计划的持续资本投资进一步增加了对专用、高负载、高精度轴承的需求,这些轴承需在全球严苛、高速和洁净的环境中运作。

全球工业轴承市场趋势与洞察

汽车和电动车生产呈现復苏迹象

预计到2025年,全球轻型车产量将成长至8,960万辆,其中电动车预计将占总销量的25%。电动车牵引马达需要使用电绝缘轴承来减少杂讯电流造成的腐蚀。杜邦Vespel聚酰亚胺嵌件能够承受高温,且成本低于全陶瓷混合型轴承。能够同时生产内燃机(ICE)和电动车轴承的双产能生产线製造商,既可以维持其稳定的现有需求,又能抓住电动动力传动系统领域不断增长的需求。

智慧轴承在预测性维护中的快速普及

整合于外壳内的无线感测器组件可实现对振动、温度和润滑状况的持续监测。舍弗勒的OPTIME生态系统体现了这项变革,它透过限制对旋转设备的物理接触,减少了人工检查并提高了安全性。结合人工智慧分析,工厂报告称,引入协作机器人后,组装时间缩短了30%,品质提高了15%。向数据密集型产品的转变不仅带来了持续的业务收益,也提高了低成本假冒产品製造商的准入门槛。

合金和能源价格波动对利润率造成压力。

镍价飙升和能源附加费波动加剧了投入成本的波动,并侵蚀了毛利率,即便附加费已降至四年来的最低点。对华进口货柜附加费推高了运费,而美国钢铁关税则限制了现货采购选择,并延长了钢厂的前置作业时间。拥有多供应商合约和能源供应避险策略的公司,其业绩优于单一供应商的竞争对手。

细分市场分析

到2025年,滚珠轴承将占据工业轴承市场41.55%的份额,这主要归功于其在汽车零件、工业马达和家用电器等领域的广泛应用。滚轮轴承仍然是矿山和施工机械的首选,因为这些领域承受着巨大的衝击负荷。滑动轴承则用于腐蚀性海洋和化学应用。磁轴承是成长最快的细分市场,年复合成长率高达17.85%,其无油运转消除了磨损,并实现了氢气压缩机和电动垂直起降飞行器(eVTOL)涡轮机的高速旋转。 NSK面向城市空中运输的燃气涡轮机发电机解决方案已在航太领域初见成效(nsks.com)。 Upwing Energy的被动式磁径向设计透过消除金属间的直接接触,延长了地下泵浦的使用寿命,展现了其跨产业的适用性。

对无摩擦系统日益增长的需求推动了磁性元件领域收入的快速增长,但材料成本和对先进控制电子设备的要求仍然限制了其在高端应用之外的广泛部署。随着原始设备製造商 (OEM) 将状态监控感测器整合到磁性元件中,磁性元件能够将电流、温度和振动数据直接整合到设备控制迴路中,而同时掌握机械和电子技术的供应商则有望实现高利润率。

截至2025年,合金钢将占据工业轴承市场67.10%的份额,这主要得益于其全球熔炼能力、良好的加工性能和优异的抗疲劳性能,且成本具有竞争力。陶瓷工业轴承市场虽然目前规模较小,但在电动车绝缘和高速主轴需求的推动下,预计到2031年将以13.85%的复合年增长率持续成长。研究表明,先进的金属基复合材料静压轴承具有优异的导热性能,既可实现轻量化应用,又能支援超精密加工。

混合钢-陶瓷轴承设计将氮化硅滚动体与硬化钢滚道相结合,兼顾成本和性能,在风力发电机需要关注电偶腐蚀问题。聚合物和复合材料保持架因其能够耐受化学清洗且无需外部润滑,在符合卫生标准的食品级泵浦和製药搅拌机中也越来越受欢迎。

区域分析

亚太地区预计2025年将维持46.60%的工业轴承市场份额,这主要得益于中国大规模的OEM厂商群体和印度不断发展的基础设施。 SKF的在地化策略,包括扩大宁波工厂和建立研发中心,正在缩短前置作业时间并根据区域标准量身设计。日本在电子组装和手术机器人所需的微型高精度轴承领域保持主导,而韩国和台湾则透过对半导体大型晶圆厂的投资扩大了需求。随着企业利用具有成本竞争力的劳动力和新达成的区域贸易协定,东协地区的成长正在加速。

北美地区的经济成长高于全球平均水平,这得益于1.4兆美元的资金回流以及公共部门的支持,例如《CHIPS法案》和《基础设施法案》。儘管国内生产商正在扩张,但熟练工人的短缺延长了生产扩张的周期。目前,墨西哥的进口产品填补了供应缺口。在欧洲,永续性和高效机械是优先考虑的因素,但德国工业订单的下降将限制短期生产。欧盟的政策正在推广循环经济轴承,SKF的雷射重涂层循环性能係列就是一个例证。

预计中东和非洲地区将以12.45%的复合年增长率成长,海湾国家正积极向石化、铝和可再生能源领域多元化发展。阿联酋自由区的经销商是区域整合的枢纽,而沙乌地阿拉伯的本土化目标则为合资企业创造了机会。南美洲的需求主要局部采矿业主导,但货币波动和政治风险要求弹性价格设定和信贷条款。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 汽车和电动车(EV)生产正在復苏

- 智慧轴承在预测性维护中的快速普及

- 亚太和欧洲陆上风力发电机扩张

- 北美工业设备供应链回流

- 氢气压缩机用磁轴承和陶瓷轴承的利基需求(被低估了)

- 机器人和协作机器人的普及,需要低摩擦微型轴承(被低估了)。

- 市场限制

- 合金和能源价格的波动给利润率带来了压力。

- 汽车产业从内燃机(ICE)向电动车(EV)的转变正在降低对引擎相关轴承的需求。

- 美国和欧盟基于智慧财产权(缺乏保障)对中国製造的轴承实施进口限制

- 增材製造的衬套可取代航太的小型滚轮轴承(报道不足)

- 价值/供应链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 按轴承类型

- 滚珠轴承

- 滚轮轴承

- 滑动轴承

- 磁轴承

- 其他轴承

- 材料

- 合金钢

- 陶瓷製品

- 聚合物/复合材料

- 杂交种

- 按最终用户行业划分

- 车

- 航太

- 能源(风能、石油与天然气、水力)

- 采矿和金属

- 建筑和重型设备

- 食品/饮料

- 物料输送与物流

- 其他行业

- 透过使用

- 旋转设备(马达、帮浦)

- 直线运动系统

- 引擎、变速箱和传动系统

- 底盘和轮毂

- 精密仪器和测量仪器

- 按销售管道

- OEM

- 售后市场/MRO

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 亚太其他地区

- 中东

- 以色列

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 埃及

- 其他非洲地区

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- AB SKF

- NSK Ltd.

- NTN Corporation

- The Timken Company

- JTEKT Corporation

- MinebeaMitsumi Inc.

- Regal Rexnord Corporation

- RBC Bearings Inc.

- THB Bearings Co., Ltd.

- HKT Bearings Ltd.

- Schaeffler AG

- Nachi-Fujikoshi Corp.

- CandU Group Co., Ltd.

- Federal-Mogul LLC(DRiV)

- THK Co., Ltd.

- SKF Motion Technologies

- Harbin HRB Bearing Group Co., Ltd.

- LYC Bearing Corporation

- KG International FZCO

- Others(validated)

第七章 市场机会与未来展望

The industrial bearings market is expected to grow from USD 54.6 billion in 2025 to USD 59.62 billion in 2026 and is forecast to reach USD 92.53 billion by 2031 at 9.2% CAGR over 2026-2031.

Growth reflects rising electrification across transport and factory equipment, accelerating automation adoption, and infrastructure upgrades that demand higher-performance mechanical components. Smart bearings equipped with sensors, miniaturised electronics and wireless connectivity shift maintenance from reactive to predictive, raising asset uptime and reducing unplanned downtime. Manufacturers also pursue lightweight materials and low-friction designs to improve energy efficiency in electric vehicles and industrial robots. Sustained capital expenditure in wind, hydrogen and semiconductor projects further increases demand for specialised, high-load and high-precision bearings that operate in harsher, faster and cleaner environments worldwide.

Global Industrial Bearings Market Trends and Insights

Rising Automotive & EV Production Rebound

Global light-vehicle output is forecast to edge up to 89.6 million units in 2025, with electric models accounting for 25% of sales. EV traction motors require electrically insulated bearings that mitigate stray-current erosion; DuPont's Vespel polyimide inserts lower cost versus full ceramic hybrids while tolerating high temperatures. Producers that build dual-capability lines for ICE and EV bearings benefit from steady legacy demand while capturing new e-powertrain volumes.

Rapid Adoption of Predictive-Maintenance-Ready Smart Bearings

Wireless sensor packages integrated into housings now monitor vibration, temperature and lubrication regimes continuously. Schaeffler's OPTIME ecosystem illustrates the shift, cutting manual inspection and raising safety by limiting physical access to rotating assets. When paired with AI analytics, factories report 30% assembly-time reduction and 15% quality gains from collaborative-robot deployments. The move to data-rich products creates recurring service revenue while raising qualification hurdles for low-cost imitators.

Volatile Alloy & Energy Prices Squeezing Margins

Nickel price spikes and energy-surcharge swings push input-cost volatility that erodes gross margins despite surcharges peaking at four-year lows. Container surcharges on inbound Chinese shipments inflate freight costs, while US steel tariffs limit spot options and lengthen mill lead times. Firms with multi-sourcing contracts and hedged energy supply outperform single-source competitors.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of On-Shore Wind Turbines

- Re-shoring of Industrial Equipment Supply Chains

- Automotive ICE-to-EV Transition Reducing Engine-Related Bearing Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ball bearings held 41.55% of the industrial bearings market in 2025 thanks to broad suitability for automotive accessories, industrial motors and consumer appliances. Roller bearings remain preferred in mining and construction machinery where shock loads dominate. Plain bearings serve corrosive marine and chemical duties. Magnetic bearings represent the fastest-growing niche at 17.85% CAGR as oil-free operation eliminates wear and enables higher rotational speeds in hydrogen compressors and eVTOL turbines. NSK's gas-turbine generator solution for urban air mobility highlights early aerospace traction nsk.com. Upwing Energy's passive magnetic radial design extends downhole pump life by removing metal-to-metal contact, illustrating cross-industry adoption potential.

Growing demand for friction-less systems underpins the magnetic segment's revenue leap, although material cost and sophisticated control-electronics requirements still limit widespread deployment beyond premium applications. As OEMs integrate condition-monitoring sensors, magnetic units can embed current, temperature and vibration data directly into equipment control loops, positioning suppliers that master both mechanics and electronics for higher margins.

Alloy steel comprised 67.10% of the industrial bearings market in 2025, benefiting from global melt capacity, machinability and fatigue resistance at competitive cost. The industrial bearings market size for ceramic products remains smaller but climbs at 13.85% CAGR through 2031 on the back of EV insulation needs and high-speed spindle requirements. Research shows advanced metal-matrix-composite hydrostatic bearings deliver superior thermal conductivity, supporting ultraprecision machining at reduced weight.

Hybrid steel-ceramic designs blend silicon-nitride rolling elements with hardened-steel races to balance cost and performance, accelerating uptake in wind-turbine generators where electrical corrosion is problematic. Polymer and composite cages gain share in food-grade pumps and pharmaceutical mixers because they endure chemical washdowns and eliminate external lubrication, complying with hygiene codes.

The Industrial Bearings Market Report is Segmented by Bearing Type (Ball Bearings, Roller Bearings, Plain Bearings, and More), Material (Alloy Steel, Ceramic, Polymer/Composite, Hybrid), End-User Industry (Automotive, Aerospace, Energy, and More), Application (Rotating Equipment, Linear Motion Systems, Engine/Transmission/Driveline, and More), Sales Channel, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained 46.60% industrial bearings market share in 2025, propelled by China's large-scale OEM base and India's infrastructure build-out. Localization strategies such as SKF's expanded Ningbo plant and R&D hub shorten lead times and customise designs for regional standards. Japan sustains leadership in miniaturised and high-accuracy bearings needed for electronics assembly and surgical robotics, while South Korea and Taiwan boost demand via semiconductor megafab investments. ASEAN growth accelerates as companies leverage cost-competitive labour and newly inked regional trade pacts.

North America grows above global average on the back of USD 1.4 trillion reshoring commitments and public-sector incentives like the CHIPS and Infrastructure acts. Domestic producers scale up, yet skill shortages lengthen ramp-up schedules; meantime, imports from Mexico fill interim supply gaps. Europe prioritises sustainability and high-efficiency machinery, but industrial order softness in Germany tempers near-term volume. EU policy pushes circular-economy bearings, evidenced by SKF's laser-reclad circular performance series.

The Middle East & Africa present 12.45% CAGR prospects as Gulf nations diversify into petrochemical, aluminium and renewable projects. Free-zone distributors in UAE serve as regional consolidation hubs, while localisation goals in Saudi Arabia open joint-venture opportunities. South America offers mining-driven pockets of demand, although currency volatility and political risk require flexible pricing and credit terms.

- AB SKF

- NSK Ltd.

- NTN Corporation

- The Timken Company

- JTEKT Corporation

- MinebeaMitsumi Inc.

- Regal Rexnord Corporation

- RBC Bearings Inc.

- THB Bearings Co., Ltd.

- HKT Bearings Ltd.

- Schaeffler AG

- Nachi-Fujikoshi Corp.

- CandU Group Co., Ltd.

- Federal-Mogul LLC (DRiV)

- THK Co., Ltd.

- SKF Motion Technologies

- Harbin HRB Bearing Group Co., Ltd.

- LYC Bearing Corporation

- KG International FZCO

- Others (validated)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising automotive and EV production rebound

- 4.2.2 Rapid adoption of predictive-maintenance?ready smart bearings

- 4.2.3 Expansion of on-shore wind turbines in APAC and Europe

- 4.2.4 Re-shoring of industrial equipment supply chains in North America

- 4.2.5 Niche demand for magnetic and ceramic bearings in hydrogen compressors (under-reported)

- 4.2.6 Surge in robotics and cobots requiring low-friction miniature bearings (under-reported)

- 4.3 Market Restraints

- 4.3.1 Volatile alloy and energy prices squeezing margins

- 4.3.2 Automotive ICE-to-EV transition reducing engine-related bearing volumes

- 4.3.3 IP-driven import restrictions on Chinese bearings in U.S. and EU (under-reported)

- 4.3.4 Additive-manufactured bushings replacing small roller bearings in aerospace (under-reported)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Bearing Type

- 5.1.1 Ball Bearings

- 5.1.2 Roller Bearings

- 5.1.3 Plain Bearings

- 5.1.4 Magnetic Bearings

- 5.1.5 Other Bearings

- 5.2 By Material

- 5.2.1 Alloy Steel

- 5.2.2 Ceramic

- 5.2.3 Polymer / Composite

- 5.2.4 Hybrid

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Aerospace

- 5.3.3 Energy (Wind, Oil and Gas, Hydro)

- 5.3.4 Mining and Metals

- 5.3.5 Construction and Heavy Equipment

- 5.3.6 Food and Beverage

- 5.3.7 Material Handling and Logistics

- 5.3.8 Other Industries

- 5.4 By Application

- 5.4.1 Rotating Equipment (Motors, Pumps)

- 5.4.2 Linear Motion Systems

- 5.4.3 Engine, Transmission and Driveline

- 5.4.4 Chassis and Wheel Hubs

- 5.4.5 Precision and Instrumentation

- 5.5 By Sales Channel

- 5.5.1 OEM

- 5.5.2 Aftermarket / MRO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 United Kingdom

- 5.6.2.2 Germany

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 Japan

- 5.6.3.3 India

- 5.6.3.4 South Korea

- 5.6.3.5 Rest of Asia-Pacific

- 5.6.4 Middle East

- 5.6.4.1 Israel

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 United Arab Emirates

- 5.6.4.4 Turkey

- 5.6.4.5 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 South America

- 5.6.6.1 Brazil

- 5.6.6.2 Argentina

- 5.6.6.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AB SKF

- 6.4.2 NSK Ltd.

- 6.4.3 NTN Corporation

- 6.4.4 The Timken Company

- 6.4.5 JTEKT Corporation

- 6.4.6 MinebeaMitsumi Inc.

- 6.4.7 Regal Rexnord Corporation

- 6.4.8 RBC Bearings Inc.

- 6.4.9 THB Bearings Co., Ltd.

- 6.4.10 HKT Bearings Ltd.

- 6.4.11 Schaeffler AG

- 6.4.12 Nachi-Fujikoshi Corp.

- 6.4.13 CandU Group Co., Ltd.

- 6.4.14 Federal-Mogul LLC (DRiV)

- 6.4.15 THK Co., Ltd.

- 6.4.16 SKF Motion Technologies

- 6.4.17 Harbin HRB Bearing Group Co., Ltd.

- 6.4.18 LYC Bearing Corporation

- 6.4.19 KG International FZCO

- 6.4.20 Others (validated)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment